In this article we will tell you about the key tools for tax-free (low-tax) transfer of property in business. Each of them has its own characteristics and limitations.

Why might a tax-free transfer of property be required? A change in the ownership of property by concluding a purchase and sale agreement is recognized as a sale and entails the need to pay VAT and income tax (if the general taxation system is applied). In the event that property is transferred within a single group of companies, the occurrence of tax obligations is extremely undesirable: in fact, the property remains the property of the same beneficiary, and taxes must be paid. In addition, a tax-free transfer (change of ownership) of property in a group may be required:

- To increase the level of property security. Obviously, assets that are “vital” to a business should not be located in the operating sector.

- To launch an investment project. It is more logical to start a new promising direction with a clean slate; it should not be subject to the risks and obligations of an existing business. In addition, partners who are not involved in your main business may participate in the implementation of the investment project. In this case, filling the new project with property (including money) should also occur with the most beneficial tax consequences for both the transferring and receiving parties.

- When refinancing in a group: redistribution of financial flows between related companies (entities) also requires the exclusion of unnecessary tax liabilities.

How to make a tax-free transfer of property?

- Capital contribution

- Contributions to property on the basis of subclause 3.7 and subclause 11 of clause 1 of Article 251 of the Tax Code of the Russian Federation, including “daughter gift”

- Reorganization in the form of spin-off

We have recorded the key points for you in a separate table.

| Nuances | Capital contribution | Contribution to property on the basis of subclause 3.7 clause 1 of article 251 of the Tax Code of the Russian Federation | Gratuitous transfer of property on the basis of subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation | Selection procedure |

| Organizational and legal form of the company receiving the property | Any | Only business companies and partnerships | Any one that has an authorized/share capital or fund (JSC, LLC, business partnership/partnership) | Any |

| The size of shares/shares of the transferring party in the authorized capital of the recipient company | Any | Any | 50% or more. Not only direct but also indirect participation is taken into account | Any |

| Does the size of the transferring party’s share in the management company change? | Yes | No | No | No |

| Tax obligations | For organizations on OSN:

| For organizations on OSN:

| For organizations on OSN:

| For organizations on OSN:

|

| What can be conveyed | Cash, securities, other property, property and other rights that have a monetary value. This list should be in the charter | Property, property/non-property rights | Property and property rights. According to the Civil Code of the Russian Federation, non-cash money refers to property rights. From 01/01/2019 to 22/11/2020, their transfer under this item was impossible. | Cash, securities, other property, property and other rights having a monetary value |

| Restrictions | Mandatory independent assessment of non-monetary contributions | Property cannot be transferred to third parties during the year, including under a lease agreement (except for cash) |

Capital contribution

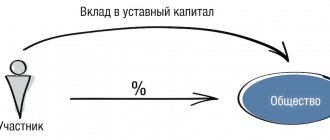

This is the most well-known way of providing a company with property and property rights by its participants. A participant in any commercial organization (JSC, LLC, etc.) can make a contribution to the authorized capital (AC), both at the stage of registration of the company and during its activities.

In addition, a third party can make a contribution to the authorized capital of an LLC upon joining the company’s members. In a joint stock company, a third party can purchase shares during an additional issue, and this will constitute a contribution to the management company. Money, securities, other property or property rights can be contributed to pay for the authorized capital.

Tax consequences

A contribution to the authorized capital of a commercial organization is exempt from income tax (clause 3, clause 1, article 251 of the Tax Code). As for VAT, in a situation where the share in the management company is paid for with property, the transferring party to the OSN is obliged to restore the VAT previously accepted for deduction (clause 3 of Article 170 of the Tax Code of the Russian Federation) in an amount proportional to the residual (book) value without taking into account revaluation (in regarding fixed assets and intangible assets).

However, the receiving party, if it is also on the general taxation system, takes into account the same amount of tax as part of deductions after accepting the property for registration (clause 8 of Article 172, clause 11 of Article 171 of the Tax Code of the Russian Federation). As a result, the balance of VAT amounts paid and accepted for deduction is maintained, which actually means the absence of tax consequences for the business owner of the contribution of property to the authorized capital.

Naturally, if we make a contribution to the capital of a commercial organization under a special tax regime, it will not be possible to take VAT into account as expenses.

Additional expenses

To transfer property to the authorized capital, the law requires an independent monetary assessment of its value (clause 2 of Article 66.2 of the Civil Code).

Risks

The guaranteed amount of liability of a legal entity for its obligations to creditors is equal to the amount of the authorized capital. Also, a large management company can make the company attractive to unscrupulous third parties (for example, raiders).

However, a participant has the right to make a contribution to the management company in an amount exceeding the nominal value of his share. For example, to pay for a share in the authorized capital of an LLC of 10 thousand rubles, a participant may well contribute, for example, 15 million rubles. In this case, the nominal value of his share will be 10,000 rubles. This is exactly what will be indicated in the Unified State Register of Legal Entities. And this contribution (including in terms of the excess of the real amount of the contribution over the nominal value of the share) is not included in the tax base of the receiving party (paragraph 3, paragraph 1, paragraph 3, Article 170, paragraph 11, Article 171, paragraph 8 Article 172 of the Tax Code; paragraph 3, paragraph 1 of Article 251 of the Tax Code).

You can read more here.

Tax consequences upon subsequent sale of a share or exit from the company

It is important not only to provide the company with property without taxes, but also to take into account the costs of its acquisition or creation during the further alienation of the share in the company.

In this case, income will arise (from the sale of the share, in the form of the actual value of the share upon leaving the LLC, or in the form of property remaining after liquidation), which can be reduced for tax purposes:

- when selling a share - for expenses associated with its acquisition (for legal entities - clause 2.1, clause 1, article 268 of the Tax Code of the Russian Federation, for individuals - clause 2, clause 2, article 220 of the Tax Code of the Russian Federation);

- upon exit - for the amount of the contribution to the authorized capital (clause 4, clause 1, article 251 of the Tax Code of the Russian Federation for legal entities, clause 2, clause 2, article 220 of the Tax Code of the Russian Federation for individuals);

- upon liquidation - in the amount of the actually paid cost of the share (clause 2 of Article 277 of the Tax Code of the Russian Federation for legal entities, clause 2 of clause 2 of Article 220 of the Tax Code of the Russian Federation for individuals).

If the owner has made a contribution to the company's management company that exceeds the nominal value of his share, the income received upon sale (exit, liquidation) can also be reduced by the amount of expenses for acquiring the share in full. If the payment was in property - for the amount of expenses for acquiring the property.

If you or your organization has continuously owned shares in the company for more than 5 years, then the entire amount of income from the sale of such shares will be:

- be exempt from personal income tax for individuals (clause 17.2, article 217 of the Tax Code of the Russian Federation);

- subject to a tax rate of 0% for income tax for legal entities (Article 284.2 of the Tax Code of the Russian Federation).

You are the only founder or owner of a share greater than 50%: donate money to the organization

When the founder's share in the authorized capital is more than 50%, he can transfer any amount of money to the organization. Draw up a gift agreement and write that the organization receives assistance free of charge. Transfer the amount in cash or transfer to the organization's account. LLCs confirm each action with documents, so issue a cash receipt order or save the payment.

This method is not suitable for founders whose share is 50% or less. In this case, the organization will pay tax to the simplified tax system on the amount of the gift.

Template: agreement for donating money to an organization

Indirect share of participation

Subclause 11, clause 1, Article 251 of the Tax Code of the Russian Federation makes it possible to make a contribution to property not only from a direct participant, but also from a person who has an indirect share of participation through an intermediate company. For a contribution to be exempt from taxation, the share of indirect participation must also be at least 50%.

To calculate the share of indirect participation, it is necessary to multiply the shares of direct participation in each organization along the ownership chain. For example:

In this case, the share of indirect participation of the Participant in Organization No. 3 will be 63%. Accordingly, he can directly, bypassing the intermediate Organization, transfer funds, other property or property rights. When it comes to real estate, this saves time on registration activities and compliance with corporate procedures.

The rules for determining the share of indirect participation are spelled out in detail in clause 3 of Art. 105.2 of the Tax Code of the Russian Federation.

"Daughter's Gift"

At the same time, according to paragraphs. 11 clause 1 art. 251 of the Tax Code, not only the parent company can contribute to the property. The opposite situation is possible - the “daughter” transfers the property to the “mother” (the so-called “Daughter’s gift”). And even “grandmother” - taking into account the rules on indirect participation.

Is it possible for a founder to leave an LLC without paying out a share?

Withdrawal from the membership of an LLC always equals the alienation of a share.

In this case, the exiting founder may decide to leave the share to the company. If this method of exit is not limited by the charter of the LLC, then the law does not require the exit to be coordinated with other participants (Article 26 of the Law “On Limited Liability Companies”). The charters of most LLCs do not contain such restrictions, but if they do, you will have to obtain the consent of all founders.

Important! Another condition under which the law limits the right of a founder to withdraw from an LLC without paying a share is the case when he is its only participant. In this case, the company must be subject to liquidation.

Reorganization in the form of spin-off

Reorganization in the form of separation (Article 57 of the Civil Code; clause 8 of Article 50 of the Tax Code of the Russian Federation) is the most universal method of transferring property that does not have organizational and legal restrictions (applicable to both JSC, LLC, and partnerships).

During the spin-off, a second legal entity is formed, which is not the legal successor of the reorganized organization in terms of its tax obligations, except in cases where the tax authority proves that the sole purpose of the spin-off was to evade repayment of debt to the budget (clause 8 of Article 50 of the Tax Code).

Tax consequences

Income tax

A spin-off involves the “spinning off” of an old company into a new company. The property is transferred under a transfer deed and its value is not an expense for the old legal entity and is not income for the new company. That is, there are no income tax consequences.

VAT

The transfer of property within the framework of the allocation is not a sale; the company on the OSN does not have the obligation to charge VAT.

If the legal successor switches to UTII or the simplified tax system, then he is obliged to restore the VAT previously accepted for deduction by the reorganized organization in proportion to the residual (book) value. Clause 3.1 of Article 170 of the Tax Code of the Russian Federation This obligation has been in effect since 2020.

Who can become a participant in the spun-off company?

During the procedure of separation from an LLC, the participants of the new legal entity may become:

- reorganized company;

- participants of the reorganized company in the same composition and in the same proportions;

- part of the participants of the reorganized company (in other proportions) or other third parties.

The main condition is that this third party independently pays for the authorized capital, at least in the minimum amount of 10 thousand rubles.

In the case of a joint stock company, only the first two options are possible during the spin-off. Either the new company becomes a 100% subsidiary of the reorganized company, or the same shareholders in the same proportions become participants in the spun-off company.

In addition, mixed reorganizations in the form of spin-off are allowed, when it is possible to spin off an LLC from a JSC or vice versa.

Risks

The separation must be carried out in strict accordance with the principle of fair distribution of rights and obligations between the old and new legal entity. It means that:

- The assets of the spun-off company must be balanced by liabilities. In other words, it is impossible to transfer fixed assets without transferring the debt on the loans with which these fixed assets were acquired. If the old company has a large amount of accounts payable, then it is fair to transfer to the spun-off company part of such debt associated with the transferred property;

- the spin-off must meet the criteria of the business purpose concept (transfer of part of the assets to organize a new line of activity, business restructuring with the aim of creating several independent business units on the basis of former divisions, etc.).

When separating, the transfer of property and/or obligations to the new organization occurs under a transfer deed.

Selection with appendix

Within the framework of one reorganization, the law allows you to combine two procedures at once (Article 57 of the Civil Code of the Russian Federation): separation and merger, which can significantly save time and costs for reorganization. First there is separation, then attachment. The intermediate company resulting from the spin-off is virtual in nature, as it is used solely to transfer assets and liabilities to the acquiring company. The period of existence of this legal entity is not defined by law, but we can say that it tends to zero.

Documents are drawn up first for the separation of the company. According to the transfer deed, part of the assets and liabilities of the reorganized company is transferred to it, which are then added to the balance sheet of another legal entity (“Company 2” in the diagram above).

Of course, real life cannot always be “shoved” into the framework of the above-described methods of transferring property. There are a great many options for property consolidation; most often they are a combination of tax-free and low-tax methods of property redistribution, the set of which is always unique.

A database of other business tools and comprehensive developments of the taxCOACH Center - at the seminar “STAY ALIVE-2021” in Yekaterinburg, December 10-12.

Documentation of the transfer of the share of the withdrawing participant

- The co-owner of the company sends an application to the executive body to resign from the founders. From the moment this application is received, the share of the withdrawing founder is automatically transferred free of charge, as a result of which the voting results are determined without taking it into account, i.e. all decisions are made only by the remaining participants.

- Provisions of Art. 24 of the LLC Law provide for the need to notify the registration authority of the transfer of a share to the company and its subsequent redistribution. To do this, you must send an application to the Unified State Register of Legal Entities, to which is attached a document indicating the existence of grounds for transfer of the share. Such a document is a statement of the founder’s intention to leave the company.

- To make changes to the Unified State Register of Legal Entities, the following documents are required:

- application in form P14001;

- statement of the participant's intention to leave the society;

- minutes of the meeting of participants at which a decision was made to redistribute the share.

Note! From 08/11/2020, a participant is considered to have left the moment an entry is made about his withdrawal from the LLC in the Unified State Register of Legal Entities (Clause 2 of Article 94 of the Civil Code of the Russian Federation as amended by the Law “On Amendments...” dated 07/31/2020 No. 251-FZ).