Responsibility of the parties to the transaction

Liability under a supply contract is a voluntary measure. That is, the parties have the right not to include such provisions in the agreement and not to apply sanctions. But this is unreasonable: in the absence of possible negative consequences, an unscrupulous counterparty is not interested in strict compliance with accepted obligations.

IMPORTANT!

The liability of the parties for violation of the supply contract is usually expressed in the need to pay a penalty or compensate for losses. Interest is also calculated under Art. 395 of the Civil Code of the Russian Federation (clause 3 of Article 486 and clause 4 of Article 487 of the Civil Code of the Russian Federation).

Another feature of liability under such an agreement is the possibility of applying sanctions even in the absence of the counterparty’s fault. For example, a supplier violated the furniture delivery deadline due to a failure to deliver accessories to his address. Objectively, he is not to blame for missing the deadline, but he will have to bear responsibility. Or the buyer was unable to pay for the selected products on time due to financial difficulties. There is no guilt, but sanctions are applicable.

Accounting for penalties under a supply agreement

Let's look at accounting for accrual and payment of penalties using a specific example.

Continent LLC received goods worth 300,000 rubles (including VAT) from Vesta LLC. The company uses OSN. According to the agreement, payment for the goods is set on November 25, 2021, and the penalty for each day of delay is equal to 0.1% of the debt amount. Payment from Continent LLC was received only on December 20, 2021, that is, the delay was 24 days. Let's make the calculation:

300,000 x 24 x 0.1 = 7,200 rubles.

Continent LLC recognized the penalty under the contract and paid.

Let's consider the postings that the organization LLC "Continent" must make:

D91.2 K76.2 – penalty accrued under the contract;

D76.2 K51 – penalty paid.

In addition, Continent LLC pays income tax on a monthly basis; the company uses the accrual method. The organization has the right to include a penalty in the amount of 7,200 rubles as part of non-operating expenses.

Violations and liability of the supplier

Typical cases:

- violation of the shipment deadline;

- non-delivery;

- low-quality products;

- inconsistent assortment;

- incompleteness.

As part of liability for violation of the supply contract, it is advisable to provide for the accrual of a penalty for the first two points. The amount of the contractual penalty is determined by the parties in the agreement. This is usually a percentage of the price of a batch of products.

For the last three points, you can demand compensation for losses, the limit of which is specified in the contract. This could be real damage or lost profits. The product itself can be returned to the supplier or replaced, with all additional costs incurred being reimbursed by the unscrupulous party.

Item supplied and why it is so important

As mentioned above, the subject of the supply contract is exclusively goods, works or services intended for commercial use. However, the legislation does not further stipulate the nature of these goods, works and services. The role of the supplier in such an agreement is important. It is he who is responsible for correctly determining the nature of the subject of the contract. The fact is that such a sale is always recognized as a wholesale sale, even if only one unit of goods was supplied under the contract. Therefore, the seller does not have the right to apply such special taxation regimes as the patent system or the unified tax on imputed income (UTII). At the same time, neither the supplier nor other persons should control exactly how the buyer will use the goods purchased under the agreement: for personal purposes or in business activities.

Violations and liability of the customer

Buyers usually violate the payment terms. But there are other situations:

- did not prepare the site for unloading (when the contract provides for delivery);

- late collection or refusal to receive;

- did not issue a power of attorney for the representative, which excludes the possibility of actual transfer of the goods.

The first example involves vehicle downtime, which allows you to recover damages in the amount of expenses incurred, based on the hourly payment for the work of the vehicle.

Failure to pay will result in the accrual of a contractual penalty (if provided for in the terms and conditions). Untimely sampling or lack of proper registration of the representative’s powers may result in the accrual of a penalty, but it is possible to additionally provide for a fee for storage over a certain number of days.

Normative base

The possibility of recovering lost profits is stipulated by such regulations as:

- Civil Code of the Russian Federation.

- Order of the Ministry of Emergency Situations No. 482.

- Order of Gosgortekhnadzor No. 175a.

- Government Decree No. 262 of May 7, 2003.

- Federal Law No. 35 of March 26, 2003.

- Federal Law No. 7 of January 10, 2002.

- Order of the State Committee for Ecology No. 81 of February 11, 1998.

- Letter from the State Tax Service dated February 22, 1996.

- Letter from the State Tax Service dated June 25, 1997.

- Federal Law No. 108 of July 18, 1995.

Each of the regulations regulates a separate area, for example, compensation for lost profits in transactions with land participants. The definition of lost profit is contained in Article 15 of the Civil Code of the Russian Federation. This, on the basis of paragraph 2, is lost income that would have been received by the plaintiff under ordinary turnover conditions. Ordinary conditions mean a situation in which no illegal actions occurred.

Question: Can an organization create a reserve for doubtful debts in tax accounting based on a court decision on compensation for losses, including actual damage and lost profits? The receivables arose due to the failure of the counterparty (attorney) to fulfill obligations under the agency agreement, and the legal process lasts more than a year. View answer

Government contracts

The adverse consequences are greater. Main sanctions:

- compensation for losses;

- interest;

- penalty or fine;

- forced payment for unselected goods;

- return of defective products.

The period for compensation of losses is established by law and is 30 days. The amount of fines is also regulated: when selling defective products - 20% of the price of such a batch (Clause 5, Article 16 79-FZ “On State Material Reserves”), when evading the conclusion of a government contract, the fine is equal to the cost of the goods (Clause 2, Art. 5 No. 60-FZ “On the supply of products for federal state needs”).

What is lost profit?

Lost profits are funds that a person should have received, but did not receive due to the illegal actions of third parties. Lost profits are different from actual damages. In the second case, the person expects real costs associated with damage to his property. Real damage presupposes a deterioration in the present financial situation. Lost profits imply that a situation does not improve when it should have improved. This is lost income. The definition is contained in Article 15 of the Civil Code of the Russian Federation. Let's look at examples of lost profits:

- A person plans to rent out an apartment. Neighbors flooded their home. For this reason, the landlord cannot rent out the apartment, meaning he misses out on the expected profit. The costs of restoring the home will be considered actual damage.

- The company ordered a batch of products. The supplier failed to deliver the goods on time. For this reason, the organization did not receive the profit that it could have received from selling a batch of products.

- The taxi driver got into an accident through no fault of his own. The vehicle is damaged. Consequently, the taxi driver did not receive the funds that he could have received from his work. These funds are lost profits. The cost of restoring the car will be considered real damage.

Cases involving the recovery of lost profits are considered the most difficult because it is extremely difficult to prove the amount of income that could have been received. In addition, it is difficult to prove that the person should have received any funds at all.

Question: Is it possible to recover lost profits if the equipment installed by the contractor breaks down, but the warranty period has not passed? View answer

When does it make sense to hire a lawyer?

The plaintiff can seek help from a law firm. This increases the chance of winning the case. It makes sense to see a lawyer if the following circumstances exist:

- The amount of lost profits is large. If it is small, then the amount of the expected compensation will not cover the associated costs.

- There is a high probability of winning the case. If the plaintiff does not win the case, he will not receive any reimbursement for the services of lawyers and appraisers.

The plaintiff does not have to order a full range of legal services. It is recommended to entrust a lawyer with drawing up a statement of claim, since the outcome of the case depends on the correctness of the plaintiff’s arguments. You can also contact a professional for advice. The lawyer will assess the likelihood of the outcome of the case and tell you what documents will need to be prepared. However, if there is irrefutable evidence of lost profits and the defendant’s guilt, the plaintiff can handle the case himself.

Is it possible to recover lost profits from an employee?

Sometimes there is a need to recover lost profits from an employee. For example, an employee unlawfully provided a discount to customers. In this case, the store does not receive part of the markup. That is, there is a fact of lost profits. However, it is almost impossible to collect it from the employee. Based on Article 238 of the Labor Code of the Russian Federation, only compensation for direct actual damage can be demanded from an employee. This form of damage assumes that the company's condition has worsened as a result of culpable actions.

Question: A dismissed employee (driver) refuses to return his company car for three months. What damages can the former employer recover from him (damage, lost profits, depreciation, etc.)? Will this be a labor or civil dispute? View answer

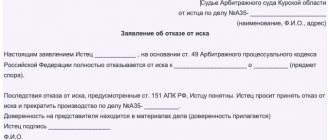

Features of filing a claim

The claim for recovery must include the following information:

- Information (telephone, name of the legal entity) about the plaintiff and defendant.

- Title of the paper.

- The name of the security on the basis of which the lost profit arose.

- The main terms of the contract of this document.

- The condition that the defendant violated (for example, unilateral termination of the contract).

- Illegal acts committed by the defendant.

- Justification of the amount of lost profits.

- Justification of the cause-and-effect relationship.

- Requirements, exact amount of compensation.

The claim must also contain an annex that lists the documents attached to the claim.

IMPORTANT! A receipt for payment of the state duty is attached to the claim.

Calculation of lost profits

There is no single formula for calculating lost profits. The specific method of calculation is determined depending on the reasons that led to the loss and the form of relations between the plaintiff and the defendant. When calculating, reasonable expenses are taken into account that the plaintiff would have incurred if no offense had been committed against him.

Let's look at an example. The defendant did not deliver consumables on time, which resulted in lost profits. In this case, the lost profit will be calculated based on the cost of the finished product, for the manufacture of which consumables were needed. In this case, the costs of delivering these materials are deducted.

Let's consider the average type formula:

HC = DRNP – IR – NI

The formula uses these values:

- LP – lost profit.

- DRNP – funds received from the sale of unproduced goods.

- IR – selling costs.

- NI – tax costs.

When calculating, these components are taken into account:

- Income lost due to illegal actions.

- Damage (means needed to eliminate the damage).

- Various costs: lawyer services, appraisal company.

IMPORTANT! It is extremely difficult to independently determine the amount of lost profits. If the calculations are not justified, the court will not take them into account. It is recommended to contact an appraisal company. The specialist not only determines the amount of lost profits, but also describes all the components of the calculations. Appraisal firms must provide all official documentation. Who should pay for the services of appraisers? If the plaintiff wins the case, all associated costs (including attorneys' fees) are borne by the defendant.

Filing claims and jurisdiction

In 2021, amendments were made to the Arbitration Procedural Code of the Russian Federation regarding the mandatory claims procedure.

If the contract does not contain this condition, then it is still necessary to submit a claim and only after 30 calendar days can you go to court. We recommend that the contract specify the procedure for submitting and the deadline for responding to complaints, for example, 14 calendar days. If it is impossible to resolve the dispute pre-trial, the dispute is referred to the arbitration court (if the parties to the agreement are legal entities). If counterparties are located in different constituent entities of the Russian Federation, we recommend indicating the Arbitration Court of the constituent entity in which your company is registered. For example, the buyer is registered in Moscow, the supplier is registered in Yekaterinburg. The buyer, acting as a plaintiff in the process, is obliged to file a statement of claim at the location of the defendant, i.e. to the Arbitration Court of the Sverdlovsk Region. In this case, when considering a dispute, the buyer will have additional expenses associated with representing his interests in another constituent entity of the Russian Federation.

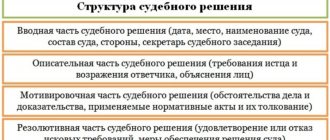

The court's position regarding cases of lost profits

The court is very careful in cases of recovery of lost profits. Previously, judicial authorities often refused to satisfy claims due to the fact that the plaintiff’s lost profits were exemplary in nature. In this regard, changes were made to the Civil Code stating that lost profits can be approximate. This cannot be a reason for refusal. Let's consider special cases from which we can understand the position of the courts:

- Due to the unlawful actions of the defendant, the plaintiff was unable to continue renting out the premises. In this case, the landlord can recover rent from the person at fault.

- The plaintiff's land plot was seized for state needs. The amount of lost profits is determined based on the nature of the use of the site before the seizure.

- If the debtor terminates the agreement with the creditor unilaterally, he must compensate for lost income. At the same time, the creditor must not illegally enrich himself. Lost profits are determined based on the interest on the loan.

It can be said that at the moment more and more claims of plaintiffs regarding compensation are being satisfied.

Nuances that need to be taken into account when calculating

When making calculations, you need to take into account the following features:

- Sometimes lost profits result from the guilty actions of several persons. In this case, it is necessary to calculate the amount of damage caused by each participant. In the event that the calculation cannot be made, the amount of lost profit is divided among all participants.

- The amount of compensation sought includes expenses that the plaintiff incurred as a result of proving the existence of lost profits. These are expenses for the services of an appraisal company, a lawyer, expenses for sending notices, registered letters.

- In order to recover compensation for expenses, the plaintiff must retain all receipts and receipts. This will allow you to prove the existence of all expenses.

- To assess the amount of lost profits, you need to study all the nuances of the enterprise. The assessment is made on the basis of documents.

- If, due to the defendant's culpable actions, products are not produced in sufficient quantities, lost profits will include the cost of the unreleased goods.

- If, as a result of guilty actions, the quality of the product has deteriorated, the cost of the product is reduced. In this case, the defendant must pay the difference between the potential and actual value.

The only way to recover lost profits is to go to court.

How to prove the existence of lost profits

Going to court to recover funds involves collecting evidence in support of your claims. You need to prove these facts:

- Lack of income.

- There is a violation of rights.

- There is a connection between the illegal act and lost profits.

Documents and witness statements can be presented as evidence.

Question: Are demands for recovery of lost profits legal if, as a result of the issuance of an act of a state body, the obligation has ceased in whole or in part? View answer

Presence of violation of rights

Lost profits arise due to the following cases of violation of rights:

- Failure to fulfill obligations stipulated in a written agreement.

- Causing damage to the plaintiff's property.

- Causing harm to health.

Violation of rights in itself does not indicate anything. It must entail the non-receipt of funds that the person could actually receive.

Causal relationship

There must be a cause-and-effect relationship between the violation of the right and lost profits. Its presence is determined by the following criteria:

- The person's right was violated before the loss occurred.

- Violation of the law caused loss of income.

Moreover, the plaintiff needs to prove in court that he has taken all measures to reduce the amount of losses. If it was impossible to take these measures, this impossibility must be proven.

FOR YOUR INFORMATION! Measures to reduce lost profits must be reasonable. Otherwise, the court will not take them into account. However, the law does not specify a list of measures that must be taken. Therefore, the person must independently determine the procedure for reducing the size. Let's look at an example of the plaintiff's actions. The person was supposed to repair the car, but did not do so, which resulted in lost profits. In this case, the plaintiff may require the car mechanic to pay for consumables and related expenses.

Penalty

The most common measure of civil liability is the collection of penalties. These sanctions can be applied to both the supplier and the buyer.

Let me remind you that, according to paragraph 1 of Article 330 of the Civil Code of the Russian Federation, a penalty is understood as a sum of money established by an agreement or law and paid by a party that has not fulfilled or improperly fulfilled its obligations under the agreement. In Russian practice, there are several types of penalties, in particular, there are legal, that is, provided for by law and applied against the will of the counterparties, and contractual, which acquires its legal force directly when it is included in the agreement. Today, in relation to the supply agreement, there is no legal penalty, so we can only talk about a contractual penalty.

An agreement on a penalty must be concluded by the parties in writing, in accordance with paragraph 1 of Article 331 of the Civil Code of the Russian Federation. Please note that if there is no written agreement regarding the penalty, its collection will be denied. This development of the situation is confirmed by numerous judicial practices, for example, the ruling of the Supreme Court of the Russian Federation dated March 30, 2021 No. 306-ES16-3369 in case No. A55-10985/2015. In addition, the claim for the collection of a penalty under the contract may be refused if it is impossible to determine its amount from the agreement of the parties. This position was expressed by the Arbitration Court of the Moscow District in Resolution No. F05-7389/2017 dated July 16, 2021 in case No. A40-111339/2016. Therefore, the content of the contract on penalties must be clear, specific and unambiguous.

note

When including a provision for payment of penalties in the contract, it is necessary to determine its amount accrued for the corresponding period of delay. If the contract does not stipulate that a fine is charged for each day of delay or another period, such a condition may be regarded by the court as a one-time fine.

The amount of the penalty in the contract should be differentiated depending on the nature of the defect in the goods supplied. Compared to other “penalties”, the penalty has a number of advantages: to collect it, it is enough to prove only the fact of violation of the obligation by the counterparty, in turn, the amount of the penalty does not need to be proven. On the other hand, it should be remembered that the penalty can be reduced by the court if it is disproportionate to the consequences of violation of the obligation (clause 1 of Article 333 of the Civil Code of the Russian Federation). Criteria for disproportionality may include an excessively high interest rate, a significant excess of the amount of the penalty over the amount of possible losses and/or the duration of non-fulfillment of the obligation. The degree of proportionality of the penalty declared by the party to the consequences of violation of the obligation is an evaluative category, therefore the court assesses this criterion based on its internal conviction and the circumstances of a particular case.

To protect the interests of both parties to the contract, it is recommended to provide in this contract the maximum amount of the penalty that can be collected, for example, no more than 10 percent of the unpaid amount or undelivered goods. If the obligation is violated by a person carrying out entrepreneurial activities, then the court has the right to reduce the penalty only if the debtor requests such a reduction. However, the debtor is obliged to prove to the arbitrators that collecting a penalty from him may lead to the creditor receiving unjustified benefits (clause 2 of article 333 of the Civil Code of the Russian Federation, clause 77 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of March 24, 2021 No. 7). In accordance with established judicial practice, if a party to a trial does not object to the high amount of the penalty, then the court has the right not to reduce it and collect it in the stated amount (Resolution of the Arbitration Court of the East Siberian District dated June 28, 2021 No. F02-2605/2017 in case No. A19-17240/2016).

Contract price

More often there are contracts in which the price is indicated not in the document itself, but, for example, in the specification or an appendix to it.

This approach is beneficial to those buyers who plan to purchase various goods from one supplier on an ongoing basis. At this point, it is important to pay attention to the payment procedure. It will be more convenient for buyers to pay after delivery of the goods and signing the delivery note. Please note which days will be indicated for payment - working days or calendar days. We recommend avoiding the inclusion of the concept of “banking” day in the contract, since there is no interpretation of such a concept in the current legislation. If the definition of terms in “banking” days is used in contractual relations, then the parties can attach their own meaning to this concept, which should be clarified when interpreting the terms of the contract, if the description of this concept is not stated literally in the contract.

We advise suppliers of goods to add an advance payment to their payment terms. It can be indicated either in a fixed monetary amount or as a percentage of the total delivery price.