What is sub-appointment of an heir?

According to Art. 1121 of the Civil Code of the Russian Federation, in addition to the main heirs, additional legal successors are sometimes indicated in the will - sub-appointments are carried out. “Spare” successors replace the main ones in the following cases:

- after the death of a specific heir or his death simultaneously with the testator - before the opening of a specific inheritance;

- when opening a certain inheritance case after the funeral of a successor or abandonment of inherited property;

- in the absence of the legal rights of the successor to inherit or if he is recognized as unworthy.

Attention! The posthumous disposition reflects one or more additional successors. For example, a father indicates his son as the main applicant for an apartment in this document, and his daughter and brother as “spare” ones.

Article 1121 of the Civil Code of the Russian Federation “Appointment and sub-appointment of an heir in a will”

Legislative regulation

The specifics of drawing up a will and accepting an inheritance according to it are reflected in the following articles of the Civil Code of the Russian Federation (Civil Code of the Russian Federation):

- Art. 1121 - upon the death of the main successor before the opening of the inheritance, the inherited car, apartment or other property, according to the last will of the testator, is assigned to the “spare” successor;

- Art. 1122 - if property shares are not specified in the posthumous disposition of the testator, then the property is divided into equal inheritance shares;

- Art. 1130 - at the will of the testator, the text of the testamentary act is changed or canceled at any time and without specifying reasons;

- Art. 1131 - the posthumous order of the testator is declared invalid in court;

- Art. 1149 - incapacitated or minor children, wife, husband and parents of the testator receive a compulsory inheritance share.

Important! Sub-appointment of successors is carried out only when drawing up an open or closed will.

If inheritance is carried out according to the law, then the inherited apartment or other property is distributed in equal specific shares among all heirs of the first stage, and in the absence of any, heirs of the 2nd-8th stage.

Who has the right to inheritance by law

Article 1122 of the Civil Code of the Russian Federation “Shares of heirs in bequeathed property”

Article 1130 of the Civil Code of the Russian Federation “Cancellation and amendment of a will”

Article 1131 of the Civil Code of the Russian Federation “Invalidity of a will”

Article 1149 of the Civil Code of the Russian Federation “The right to an obligatory share in the inheritance”

What does a will give to the testator?

Sometimes successors give up an apartment, car or other inherited property. In addition, according to Art. 1117 of the Civil Code of the Russian Federation, in some cases such persons are considered unworthy or these citizens of the Russian Federation die before officially entering into inheritance. In these and other situations mentioned above, the institution of subassignment is used.

Read also: How to inherit a garage

In case of sub-appointment, the will reflects the spare heir. When carrying out such a legal procedure, such situations are prevented when the ownership rights to a specific inherited property are transferred to hostile or other similar undesirable persons.

Article 1117 of the Civil Code of the Russian Federation “Unworthy heirs”

What should you think about before registration?

Before you undertake the steps of making a will, you need to prepare your estate for this purpose. If you are going to submit documents for real estate, you must be 100% sure that it can be included in the transaction. Be sure to pay off all debts and remove encumbrances from him.

You must be the rightful owner, and bequeath to your heirs the property that has no encumbrance. Think about this in advance.

Next, we'll tell you more about writing a document.

In what situations do they not enter into inheritance during subassignment?

A will with a sub-designation of an additional legal successor is drawn up so that an apartment, car or other inheritance does not become the property of hostile persons or to a long-forgotten relative. For example, in such a document they indicate information about the inheritance of specific property to their close friend. However, after the sudden death of a friend before entering into an inheritance, the inherited property is assigned, for example, to the testator’s wife, with whom the testator was in a quarrel during the last years of his life.

To prevent the situation described above, a “spare” heir is indicated in the will. In this way, the will of the testator is further extended.

However, there are situations in which the “spare” successor does not enter into the inheritance. This happens when:

- indication in the posthumous testamentary disposition of not all legal grounds on which an apartment or other property is bequeathed;

- acceptance of a specific inheritance by the main legal successor;

- death of the designated successor. In this situation, various property is inherited by right of representation or transmission. It depends on who dies faster - the testator or the successor.

On a note! In all other cases, the rights to accept and formalize the inheritance are retained by the “spare” successor.

Contents of the will and sample

As the samples of wills for all property show, such documents, regardless of the form they are drawn up, must contain mandatory details and elements.

Use the Sample Will for All Property to draw up such an administrative act yourself.

Among them:

- place, date of compilation;

- Full name, address of the testator, where he is registered and lives;

- Full name, address of the heirs who are appointed (except for those cases when the heir has not yet been born);

- information about witnesses and the attacker;

- special orders of the property owner.

When considering the contents and how a will for property is drawn up, it should be taken into account that the composition and individual parameters of the property that is bequeathed do not have to be indicated.

Determination of inheritance shares in a will

The size and content of shares of the inheritance, when there are several heirs at once, are also not considered mandatory information when drawing up a document. The will of the testator may manifest itself in other ways. In particular, in an effort to disinherit a specific successor, assign responsibilities for receiving the inheritance, or indicate the recipients of the inheritance.

As the example of a will for property shows, if the size of the shares of the estate is not indicated, then it is distributed among certain legal successors in equal amounts.

Drawing up a document

When drawing up and state registration of a will with a sub-designation of an heir, they go to a local notary. Upon receipt of the necessary documentation from the testator, the notary office performs the following actions:

- They study documents from the testator.

- They establish the identity of the citizen, check his legal capacity and explain the various rights and responsibilities of the testator.

- They listen to the oral expression of the will of the testator and clarify the list of applicants for the inherited apartment or other property.

- A testamentary posthumous disposition is drawn up and executed.

- Leaves a notarized certification inscription and enters information about this in a separate Accounting Book.

- Enter information into the state register.

One sample of the posthumous order is given to the testator, and the second is left with the notary. If the testator lives in a city or other locality where there is a notary, then in this situation a notarization must be carried out.

Important! According to Art. 1127 of the Civil Code of the Russian Federation, when the testator is on a long voyage or undergoing treatment in a hospital, the will is certified not by a notary, but by another authorized specific person (ship captain, head physician in a hospital, etc.).

As soon as possible, such a document is transferred to a local notary’s office (at the place of registration of the testator).

Article 1127 of the Civil Code of the Russian Federation “Wills equated to notarized wills”

Content

A will with a sub-appointment can only be made in writing. This document provides the following information:

- Name, city and date of registration.

- Information about the testator and the heir (full name, date and place of birth, registration, information from the passport).

- List of inherited property.

- The last will of the testator.

- A separate line about familiarization with Art. 1149 of the Civil Code of the Russian Federation.

- Link to pay state duty in the amount of 100 rubles. (Article 333.24 of the Tax Code of the Russian Federation).

- State form number.

- Certifying notarial inscription.

- Number of copies of the document.

- Signature of the testator.

On a note! A testamentary posthumous disposition is drawn up according to a standard template, which is taken from a notary. By law, sometimes the content of such a document is further changed, expanded, or new information is added to it.

Article 333.24 of the Tax Code of the Russian Federation “Amount of state duty for performing notarial acts”

Read also: Car valuation for a notary by inheritance

Sample

When inheriting specific property by posthumous testamentary disposition, within 6 months from the date of death of the testator, they go to a local notary's office and declare their decision to accept a certain inheritance. In this case, they draw up a separate application and show the title document.

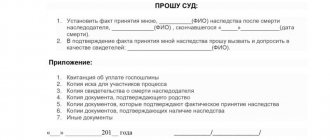

A sample of an official will with a sub-designation of an heir is presented below.

Sample will with sub-designation of heir

What are the requirements for a testator?

The main requirement for a testator is to have full legal capacity. That is, the testator must be mentally healthy and of age. Emancipated persons, as well as persons married before reaching the age of 18, are considered adults. A citizen of at least 16 years of age who, with the consent of parents, guardians and social security authorities, is engaged in business or works under an employment contract is recognized as emancipated. If the parents do not agree to such work or running a business, then the child can apply to the court for recognition of his full legal capacity.

Confirmation of legal capacity for a notary is the following documents:

- passport confirming the age of majority of the testator;

- certificate confirming marriage;

- a court decision or consent of the guardianship and trusteeship authorities to declare a minor to have reached full legal capacity.

ATTENTION !!! If a will leaves a person stateless, then he must be legally capable under the law of the Russian Federation. But the rules are different for foreigners. The rules on the legal capacity of those states of which they are citizens apply to them.

In this regard, notaries have appropriate methodological recommendations “The age of attainment of civil capacity in different states.”

Special testamentary dispositions of the testator

Sometimes specific instructions to the heir are added to the text of the will (clause 2 of Article 1152 of the Civil Code of the Russian Federation).

If the testator refuses to comply with such wishes, the successor is refused to receive part or all of the inheritance. In this document you can indicate the following special instructions of the testator:

- testamentary official refusal. In this situation, 1 or more legal successors are entrusted with fulfilling, at the expense of specific inherited property, specific obligations in favor of the legatee (Article 1137 of the Civil Code of the Russian Federation);

- testamentary assignment for the execution of various affairs by the legal successor (Article 1139 of the Civil Code of the Russian Federation). This could be a contribution to a specific shelter, care for a cat or other pet of the deceased, etc.

Attention! The main heir does not have the right to refuse to officially accept the inheritance if another legal successor is appointed instead.

It is also impossible to do this when inheriting a mandatory specific share or when indicating in a posthumous testamentary disposition the responsibility of the successor to fulfill various property obligations at the expense of the inherited property.

Article 1137 of the Civil Code of the Russian Federation “Testamentary refusal”

Article 1139 of the Civil Code of the Russian Federation “Testamentary assignment”

Article 1152 of the Civil Code of the Russian Federation “Acceptance of inheritance”

What are the features of this type of inheritance?

A will is a person's specific instructions regarding the distribution of his or her belongings after death. This document is drawn up during your lifetime. The person who gives instructions in the event of death is called the testator. These instructions regarding property are given in person only. Testamentary dispositions through a representative are completely unacceptable from the point of view of law. And no power of attorney in this regard is valid.

A will is a personal document. Collectivity is not envisaged here. A document containing testamentary dispositions of several citizens is declared invalid.

The transaction in question is a deferred one, because the rights and obligations of the heirs arise only after the death of the owner of the property.