The concepts of “dependents” and “dependency”

Dependents are persons who are on long-term or permanent material or monetary support from other persons.

Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B. “Modern economic dictionary. — 6th ed., revised. and additional - M." (INFRA-M, 2011)

Dependency is a disabled person being fully supported by one of the family members or receiving assistance from one of the family members, which was a permanent and main source of livelihood for the disabled person.

Explanations of the Constitutional Court of the Russian Federation on dependency in the form of full or main content

The concept of “dependency” implies both the full maintenance of a person by the deceased breadwinner, and the receipt from him of maintenance, which was for this person the main, but not the only source of livelihood, i.e. does not exclude the possibility that the person (family member) of the deceased breadwinner may have any own income.

Thus, disabled family members of a deceased breadwinner who may be assigned a survivor's pension include, among others, his spouse who has reached the age of 60 and 55 years (for men and women, respectively) or who is disabled (paragraph 2 Article 9 of the Law “On Labor Pensions in the Russian Federation”), i.e. recipient of an old-age or disability pension.

..At the same time, the fact of being dependent or receiving significant assistance from the deceased can be established both extrajudicially and in court by determining the ratio between the amount of assistance provided to the deceased and his own income, and such assistance can be recognized as permanent and basic the source of his livelihood (Determination of the Constitutional Court of the Russian Federation dated September 30, 2010 N 1260-О-О).

Thus, the mere fact that a person has, for example, an old-age pension does not exclude the possibility of recognizing this person as a dependent of the deceased.

The concept of the main source of livelihood implies that the support of the breadwinner should constitute the bulk of the funds on which family members lived. It must be of such size that without it the family members who received it would not be able to provide themselves with the necessary means of life.

A dependent is a relative of the deceased

The procedure for applying for additional payment to a pension It should be noted that subordinates on maternity leave cannot be laid off. As already stated earlier, if a representative of the stronger sex decides to go on maternity leave, then he may be fired when he returns to his previous position. This is explained by the fact that many employers do not take such an initiative from subordinates very well.

For example, the testator bequeathed an apartment to his common-law wife. He left behind a disabled daughter, who by law would have become the only heir to the apartment. In this case, the daughter is entitled to ½ of the apartment as a mandatory share in the inheritance, regardless of the will of the testator.

What documents can confirm the fact of being a dependent?

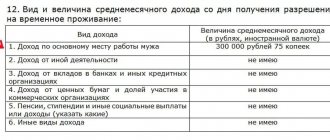

Documents confirming the fact of being dependent, that is, being fully supported by the deceased breadwinner or receiving assistance from him, which was a constant and main source of livelihood, are:

- certificates issued by housing authorities or local governments,

- certificates of income of all family members and other documents containing the required information,

- if necessary, a court decision establishing this legal fact.

Explanations of the Supreme Court of the Russian Federation on establishing the fact of dependency

Courts must keep in mind that establishing the fact that a person is dependent on the deceased is important for obtaining an inheritance, assigning a pension or compensation for damage if the assistance provided was a permanent and main source of livelihood for the applicant. In cases where the applicant had earnings, received a pension, scholarship, etc., it is necessary to find out whether assistance from the person providing the maintenance was a permanent and main source of livelihood for the applicant (clause 4 of the Resolution of the Plenum of the Supreme Court of the USSR dated 06.21.1985 N 9 “On judicial practice in cases of establishing facts of legal significance”).

The presence of an independent source of income for members of the family of the deceased does not, by force of law, prevent persons from being classified as dependents of the deceased (breadwinner), if assistance in the form of earnings (income) of the latter was a constant and main source of livelihood for the persons who were dependent on him (Definition of the Supreme Court RF dated November 12, 2010 N 4-B10-35).

Is it possible to register dependency on the parents of pensioners?

In principle, this is quite possible. The only point is that you will have to collect evidence to recognize the fact of dependency. Because It is not required by law only when applied to minor children. All other situations need to be confirmed.

If you receive a positive decision from the district court, you will be able to apply for benefits and receive additional payments. Dependency on parents without disabilities is formalized only when they reach retirement age. There are several important aspects to consider:

- The arrival of retirement age, according to the gradation of the Pension Reform, and the year of registration of dependency.

- Regular receipt of financial assistance by parents from children, which will be recorded and confirmed by payment receipts.

- Funds sent from children are the main source of income.

The position of the Pension Fund on this issue is quite clear. After all, pensioners have as income a pension benefit paid from the Pension Fund. Another question is that its size may be minimal.

Recognition as a dependent for the purposes of receiving a survivor's pension

If the right of disabled dependents to compensation for damage in the event of the loss of a breadwinner is not made dependent on whether they are in any degree related or related to the deceased breadwinner (see below), then the law “On Insurance Pensions” defines the circle of persons who are recognized as disabled members of the family of the deceased breadwinner and the list of these persons is exhaustive.

Thus, according to Article 10 of the Law of December 28, 2013 N 400-FZ “On Insurance Pensions”, disabled members of the family of the deceased breadwinner who were dependent on him have the right to an insurance pension in the event of the loss of a breadwinner...

For example, in the ruling of the Supreme Court of the Russian Federation dated July 25, 2016 N 18-KG16-53, the following was stated:

On January 1, 2015, Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions” came into force.

According to Part 1 of Article 10 of the Federal Law “On Insurance Pensions”, the right to an insurance pension in the event of the loss of a breadwinner is granted to disabled family members of the deceased breadwinner who were his dependents (with the exception of persons who have committed a criminal act that resulted in the death of the breadwinner and was established in pre-trial okay).

Part 2 of Article 10 of the Federal Law “On Insurance Pensions” defines the circle of persons who are recognized as disabled members of the family of the deceased breadwinner, including the parents and spouse of the deceased breadwinner, if they have reached the age of 60 and 55 years (men and women, respectively) or are disabled (clause 3 of part 2 of article 10 of the Federal Law “On Insurance Pensions”).

Family members of a deceased breadwinner are considered dependent on him if they were fully supported by him or received assistance from him, which was their constant and main source of livelihood (Part 3 of Article 10 of the Federal Law “On Insurance Pensions”).

Thus, the legislator has established a circle of persons who are subject to compulsory pension insurance in connection with the loss of a breadwinner, the list of which is exhaustive, not subject to broad interpretation and includes persons whose personal and property relations are inextricably linked with their status in marriage or kinship.

Recognition as a dependent for the purposes of compensation for harm in case of loss of a breadwinner

Who has the right to compensation for damages in the event of the loss of a breadwinner?

The circle of persons entitled to compensation for harm in the event of the loss of a breadwinner (victim) is established in paragraph 1 of Article 1088 of the Civil Code of the Russian Federation.

Please note that in the event of the death of the victim (breadwinner), first of all, disabled persons who were dependent on the deceased or who had the right to receive maintenance from him on the day of his death have the right to compensation for harm.

That is, the right to compensation for harm in the event of the loss of a breadwinner arises not only from the spouse of the breadwinner or his relatives, but also from any other persons dependent on the deceased. The Supreme Court of the Russian Federation also drew attention to this in Resolution 33 of the Plenum of the Supreme Court of the Russian Federation dated January 26, 2010 No. 1:

“..the right of disabled dependents to compensation for damages in the event of the loss of a breadwinner does not depend on whether they are in any degree related or related to the deceased breadwinner. The fundamental legal facts in this case are the fact of dependent status and the fact of incapacity for work.”

Who are considered disabled dependents for the purposes of survivor compensation?

Dependency of children under 18 years of age is assumed and does not require proof. The right to compensation for damage caused in connection with the death of the breadwinner is also enjoyed by adult children of the deceased who were dependent on him until they reached the age of 23, if they are studying full-time in educational institutions;

Dependency of persons of retirement age . Achieving the generally established retirement age in itself is an unconditional basis for recognizing such a person as disabled, regardless of the actual state of his ability to work (women over 55 years of age and men over 60 years of age are recognized as disabled with respect to the right to receive compensation for harm in the event of the death of a breadwinner).

people are also recognized as incapable of work with respect to the right to receive compensation for harm in the event of the death of the breadwinner, regardless of what disability group they are assigned to - I, II or III.

At the same time, the right of disabled dependents to compensation for damage in the event of the loss of a breadwinner does not depend on whether they are in any degree related or related to the deceased breadwinner. The fundamental legal facts in this case are the fact of being dependent and the fact of incapacity for work (clause 33 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 26, 2010 N 1 “On the application by courts of civil legislation regulating relations under obligations resulting from harm to the life or health of a citizen”)

Recommended publications:

- Compensation for damage caused by the death of the breadwinner. Who is a dependent and how to calculate the amount of damage?

- Compensation for harm to an employee’s health in the event of an industrial accident, recovery of insurance payment from the Social Insurance Fund

- Statements to establish facts of legal significance

- Samples of claims for compensation for damages in connection with the death of a breadwinner

- Claims for compensation for damage to health caused as a result of an accident at work (occupational disease)

Dependents' rights to inheritance

Dependency means living at the expense of a breadwinner when you are unable to support yourself due to various reasons - old age, disability, childhood, etc.

Dependents of the deceased testator can be divided into two categories:

- relatives of the deceased;

- persons who are not relatives of the deceased.

Relatives of the deceased have the right to accept inherited property if the fact of dependency is established, regardless of the fact of living with the deceased in the same living space.

Persons who are not relatives of the deceased can claim an inheritance only if they lived together with the deceased during the last year before death (Clause 2 of Article 1148 of the Civil Code of the Russian Federation).

In addition, these persons must live off the income of the deceased during the last year before death.

Dependents of the deceased can claim his property simultaneously with the main line of heirs accepting the inheritance. Regardless of the testamentary will, such dependents receive the right to half of the property that would be due to them upon receipt of the inherited property by law.

For example, the deceased testator left two sons and one citizen who lived with the deceased, who was not a relative and was a dependent for the last two years before the death of the testator. In this case, if the deceased did not make a will, the dependent and sons belonging to the first line of heirs will each receive 33% of the inheritance.

If there is a will dividing all the property of the deceased in half between the sons, the dependent has the right to challenge up to half of the property due to him, in which case he will receive 16.5% of the inheritance, two sons - 41.5% each.