The act of acceptance and transfer of an apartment is not an independent document. It is formed as an annex to the contract of sale or lease of an apartment. By themselves, both documents - the deed and the agreement - do not have legal force. The act records the fact of transfer of an object from the seller to the buyer or from the lessor to the lessee. The parties to the transaction can be both individuals and legal entities. Let's consider how to correctly draw up an act of acceptance and transfer of an apartment to legal entities.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

General information, function of the act

The purchase, sale and rental process are regulated by the Civil Code. In Art. 556 and art. 655 states that the transfer of real estate must be carried out by signing a transfer deed or other similar document. That is, the law obliges the parties to draw up such a document.

The reason is that the agreement only indicates the intention of the parties to the transaction to complete it, and the act is, as it were, the final stage in the transaction. In addition, by signing this document, the tenant or buyer declares that he knows the condition of the apartment and has no claims against the seller or landlord.

The act of purchase and sale of an apartment is the primary accounting document. Based on it, the accountant of one organization writes off the object from accounting, and the other - accepts it on the balance sheet.

Important! The completed form is stored along with the agreement and payment papers, information about it is recorded in the journal for registering incoming documents, if the company maintains such a document.

What documents can replace the transfer and acceptance certificate?

The transfer and acceptance certificate records these provisions:

- Availability of agreement between the parties.

- Rights and obligations of participants.

- The procedure for pre-trial regulation.

That is, the document replacing the act must contain the same information. The consignment note performs similar functions. It also contains information about the parties to the transaction and the product. Dates are also recorded there.

That is, when transferring goods, either an act or an invoice can be used. However, in some cases, it is necessary to draw up an act. It is required when it is necessary to record consumer claims or their absence. For example, it is needed when transferring expensive equipment.

Features of compilation

When drawing up the act, you must remember the following:

- The preparation is entrusted to any employee of the selling company (or lessor) who understands the intricacies of document preparation and descriptions of real estate. This could be a legal adviser, an accountant, or a clerk. Employees can draft a document together.

- It is necessary to describe the condition of the apartment as accurately as possible. Usually they indicate the condition of the plumbing, electrical, type of repair, heating. List the defects found during the inspection.

- There is no unified form. The document is drawn up randomly, on company letterhead. It is possible to fill out the form by hand, but the typewritten version is more convenient to read. The company can develop the form of the act independently, the main thing is that it meets all the requirements for such documents.

Important! Along with the deed, it is required to hand over to the buyer the keys to the apartment and all documents related to it.

When is the acceptance certificate drawn up?

The act is required when receiving products by one person and transferring them to another person. The document accompanies almost any operation related to reception and transmission. For example, an act is needed in the presence of these circumstances:

- The goods are transferred from the seller to the buyer. The document confirms that the item was accurately received by the consumer.

- The products are sent to the warehouse. In these conditions, it is necessary to draw up an act in 3 copies for all participants in the operation. The act is supplemented by an agreement on the storage of valuables.

- Valuables are sent for safekeeping. In this case, the act must also be supplemented with an agreement on responsible storage.

In most cases, the act is drawn up upon the sale of products. But the need for it also arises during internal movements of values. For example, when placing an object in a warehouse.

Compiling a document

The act has a three-part structure, which includes the header, the main part and the final part.

A cap

This part contains the following information:

- that the document is an annex to the contract, contract number, date;

- title of the act;

- place (city or other locality) and date of signing.

Main part

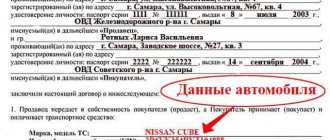

The text of this section begins with information about the seller and buyer or lessor and lessee (names of companies, positions and full names of the persons representing them), followed by the number of the purchase and sale or lease agreement, the number and date of its creation.

Then comes the description of the apartment:

- Name;

- address;

- common and living area;

- number of rooms;

- appearance of the apartment (condition of the ceiling, windows, walls, floor, etc.);

- an indication that all communications are normal: plumbing, electrical, heating, etc.;

- indication of the presence of the Internet, fire alarm (if any);

- a list of defects and shortcomings found during the inspection (it is recommended to describe them in detail so that later after signing the document the buyer and the tenant have no complaints);

- a list of documents that the parties to the transaction want to attach to the act.

Conclusion

This part contains information that all data on the transferred apartment has been verified, the buyer or tenant has no complaints about the condition of the property, the funds have been given to the seller or paid to the company’s cash desk. In turn, the seller or lessor has no claims against the buyer or lessee regarding payments for the transferred property. In addition, you can write that this act is drawn up in two copies and both of them have the same legal force.

After this paragraph, the parties to the transaction put their signatures.

For your information! There is no need to notarize the deed; the fact that both parties have signed the document is sufficient.

Responsibility of the parties

The responsibilities of the parties are specified in detail in the rental agreement itself. Usually it is indicated there that from the moment the contract is signed, the tenant bears full responsibility for the safety of the landlord’s property, therefore, after signing the act, the condition of things and the apartment documented in it passes into the tenant’s area of responsibility . If, at the end of the contract, damage or loss of the property specified in the deed is discovered, the tenant is obliged to compensate the owner of the property.

Who cooks it

Typically, the preparation is carried out by the transferring entity: seller, lessor, employer, etc. It must be signed by both parties: both the transferor and the recipient. Commission transfer and acceptance are acceptable - with the participation of several representatives.

Participants of the act:

- seller and buyer;

- donee and donor;

- exchangers;

- landlord and tenant;

- employee and responsible person of the company;

- service provider and customer.

How to conduct an inspection?

During the initial inspection (before the transaction), ask the owner for technical and title documents for the apartment. It is necessary to verify the actual address, location of rooms and area. Pay special attention to the redevelopment: it must be registered and reflected in the technical passport.

The least risky transactions are with apartments that have been owned for more than 3 years. If housing often changes hands, this may be a wake-up call: either there is something wrong with the property, or there are scammers at work.

When you go for an inspection, take a notepad and pen with you to take notes. You can write a list of mandatory items to check in advance and follow it. A phone with a flashlight and a small electrical device for checking sockets (for example, a smartphone charger) are also useful.

What you need to pay attention to when inspecting a secondary apartment:

- District and infrastructure. Even if you are used to traveling by car, make an exception and get to the place by public transport to assess the location of shops and other important social facilities.

- Yard Find out if there is a parking space, a playground, or a place for trash. Look around the surrounding area to get an overall impression.

- Presence of non-residential objects in the house. Often shops and offices make renovations without taking into account building codes, damage supporting structures, and cockroaches and rodents escape from public catering into apartments.

- Walk around the house and look for obvious damage (such as unraveling seams).

- Entrance. Are there any unpleasant odors, cracks or mold on the walls? Excessive humidity in the entrance may indicate a failure of communications in the basement. And the overall impression should be positive (there are no cigarette butts lying on the floor, repairs have been made, etc.).

- Check that the elevator is working properly.

- If the apartment is on the top floor, it is necessary to inspect the technical floor. To do this, you will have to contact the HOA or management company in advance so that this room can be opened for you. Look for any leaks or even holes on the roof.

- Walls, floor and ceiling in the apartment: is there any mold, traces of water, crumbling plaster, etc. Carefully examine not only open surfaces, but also under carpets, behind pictures and furniture (where possible).

- Turn on the faucets in the kitchen and bathroom. Find out if there is hot water, what the pressure is and the general condition of the plumbing.

- Check the serviceability of sockets and light bulbs.

- Assess the condition of the pipes (if there are any leaks) and find out when they were last replaced.

- During the heating season, touch the radiators to evaluate how well they heat.

- Check whether the door and window handles work and whether the locking mechanisms are intact.

- Smells. Musty air indicates high humidity, which will eventually lead to the appearance of fungus. The smell from pets is another possible nuisance, and it will not be easy to get rid of it.

- Study utility bills. This way you will not only find out the amount of future expenses, but you will also be able to make sure that there are no current debts. It is also necessary to check the meter numbers and the last readings submitted.

You can learn a lot of interesting things by talking with your neighbors. They will tell you about noisy residents upstairs, problems with the management company and sidewalks that are not cleared of snow.

As a rule, all this is examined at the first meeting. But if you are determined to buy, you can come again. Immediately before the transaction and acceptance of the apartment on the secondary market, you will know about all its features.

Of course, not all detected problems are critical: when purchasing real estate, it is necessary to take into account the possibility of future repairs. In addition, the flaws found will help you reduce the purchase price.

Signing procedure

The APP is the document that completes the transaction. After signing it, the buyer assumes all risks and responsibilities arising from the ownership of housing (payment for housing and communal services, natural disasters, damage to property, etc.).

The document must be signed after all residents of the apartment have left the apartment. The period of relocation should be determined by the terms of the policy. If there are none, then the housing will be vacated within about a month.

The MFC or Rosreestr may require you to support the DCT with a transfer deed to register real estate ownership rights. Participants can sign it before transferring the package of documentation to the government agency, since legislators do not set deadlines for drawing up the act. You can sign the document after completing the registration procedure, if the employees of the listed institutions do not require you to attach a document.

Do not underestimate the importance of the APP, since without it it is difficult to prove the transfer of ownership rights from one citizen to another. In addition, the document may be required by government agencies registering real estate transactions.

Purchasing housing from accredited developers

Before purchasing his own square meters in a new building, the borrower is obliged to check the availability of a license and statutory documents from the construction organization. You should also go online and study customer reviews about the developer. The acquisition of real estate is fixed in an equity participation agreement (DPA).

If a construction organization offers to sign an “investment agreement,” the borrower will not be able to defend its rights in court. “Investment agreements” are not subject to mandatory state registration. The only legal document that confirms the purchase of housing under construction is the DDU.

Sberbank cooperates with a large number of reliable construction companies. All of them undergo a mandatory accreditation procedure. A company wishing to become a partner of the bank must provide:

- Statement of the established form;

- Financial reporting;

- Documents confirming the fact of construction work (permission to commission residential buildings or a contract);

- Land lease agreement or certificate of land ownership;

- Project declaration and construction permit issued by local authorities;

- Sample DDU;

- Legal opinion on the compliance of the company’s activities with the requirements of Federal Law-214;

- Photos of houses and videos of construction work.

The submitted package of documents is examined by bank experts within a week. After verification, the developer is assigned a certain category, on the basis of which the bank determines the tactics for further interaction with the counterparty. A bank client who has purchased a home from an accredited developer will be able to obtain a mortgage at a reduced interest rate.

Signing an agreement with a trusted construction company will reduce the time spent on completing the transaction. The buyer of a residential property will not have to look for clear examples of paperwork. The developer's lawyers will provide ready-made documentation, which is drawn up in accordance with the requirements of current legislation.

Bank requirements for collateral

A mortgage loan is issued to the applicant only if there is collateral real estate (house, apartment, land). The bank has the following requirements for a mortgaged apartment:

- Stone or brick foundations and reinforced concrete floors (wooden houses and living quarters in old panel houses are not accepted as collateral);

- The wear and tear of an apartment building cannot exceed 70%;

- The building does not belong to the dilapidated and emergency housing stock and is not subject to demolition;

- The apartment has no encumbrances (rent, lease, arrest, etc.);

- No unauthorized persons are registered in the premises;

- The residential building is connected to public utilities (there is a heating radiator in each room);

- There are no illegal alterations in the rooms;

- The premises have a kitchen, bathroom and toilet;

- The building has no obvious structural defects;

- The apartment is in satisfactory sanitary and technical condition;

- The housing is located in the region where the credit institution operates.

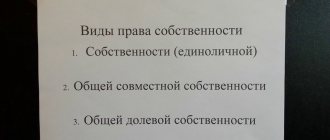

Title borrowers who are married are required to register the collateral living space as shared ownership. A regime of separate ownership of living space can be established if there is a notarized marriage contract. If children are registered in the apartment, then the living space can be mortgaged only with the written consent of the guardianship and trusteeship authorities.

Collateral must have known liquidity. The credit committee rarely accepts elite cottages located on the shores of picturesque lakes as collateral. Objects of this class are quite difficult to implement in a short time. Bankers are willing to take land plots belonging to the middle price category as collateral. Loan officers pay great attention to the area in which the building is located.

Objects located in places with poorly developed infrastructure and poor environmental conditions are not accepted as collateral. Housing on the first and last floor of an apartment building is also not considered as collateral.