Everything in this life ends sooner or later. Including bankruptcy proceedings. The closure of an insolvency case due to its logical conclusion is called termination of proceedings.

The process comes to its logical conclusion when the court comes to the conclusion that the debtor - a legal entity or an individual - is unable to fulfill its financial obligations to counterparties. In particular:

- Pay salaries to employees

- Transfer all required payments to the budget of different levels and social funds

- Pay off loans and borrowings

Arbitration proceedings, the course of which is regulated by the Law “On Insolvency” Federal Law No. 127, includes several stages. Once the debtor's insolvency has been fully proven and the last necessary stage has been completed, the court makes a decision and closes the case.

This article will tell you how the case is terminated and what legally significant consequences this has for the bankrupt. Or a person who happily avoided bankruptcy due to a settlement agreement or successful debt restructuring.

We can immediately inform you that the most significant consequence is the restoration of the debtor’s rights to use the property that remains with him. For throughout the entire time the procedure was ongoing, the defendant’s rights in this regard were significantly limited.

Grounds for termination of insolvency proceedings

The list of grounds on which a bankruptcy case can be terminated is enshrined in Article No. 57 of Federal Law No. 127. Proceedings are terminated if:

- The parties signed a settlement agreement between themselves

- The solvency of the legal entity was fully restored during the stage of reorganization (financial rehabilitation) or external management

- An individual, having found funds, fully satisfied the claims of all creditors included in the register

- The court found the demands of the counterparty, who filed a lawsuit against the debtor to declare the latter bankrupt, unfounded

- The counterparty who filed the bankruptcy claim himself announced the withdrawal of his claims against the debtor

- The debtor does not have funds to pay legal costs and remuneration of the arbitration manager

The list provided in the law is not mandatory/exhaustive. Which means the possibility of supplementing it with other rules of law. Moreover, both the rules of law contained in Federal Law No. 127 and the requirements of other legal acts are applicable.

For example, Article No. 125 of Federal Law No. 127 allows for the repayment of debts by creditors not by the debtor himself, but by a third party who agrees to do this. Consequently, it provides another legal reason for closing a bankruptcy case at the stage of bankruptcy proceedings.

The judge also has the right to terminate proceedings due to the fact that the debtor has discovered additional property that he hid when filing the application. In doing so, he will rely on the document approved by the Presidium of the Supreme Court of the Russian Federation on March 6, 2019 - “Selected issues related to the application of the bankruptcy law.”

Reasons for terminating a bankruptcy case

Let's take a closer look at the reasons that lead to the cessation of production. Conventionally, they can be divided into three groups, connected by a common procedure.

Conclusion of a settlement agreement

The peculiarity of the settlement agreement is that it can be concluded at any stage of the procedure. Its main goal is to stop the process and resolve the problem to mutual benefit, out of court.

This is a voluntary contract that the parties enter into between themselves. The parties make mutual concessions and reach consensus. Mostly, creditors are forced to make concessions. Especially if, in the event of the sale of the debtor’s property to them, as they say, “nothing shines” - the proceeds are barely enough for the participants in the priority queues. The settlement allows creditors to get at least some of their money back. Therefore, they voluntarily write off all accumulated penalties, reduce interest rates, restructure the debt, reducing monthly payments and increasing the loan term.

If there is more than one creditor, a settlement agreement is drawn up and discussed at the meeting. Third parties whose legal status allows it may take part in it. The settlement plan is considered adopted if a simple majority of those present votes for it.

The debtor has no voting rights at the meeting. But theoretically he takes part in it. Responsibility for the settlement agreement lies either with the debtor himself or with the financial manager. It depends on what stage the process is at.

At the observation stage, the head of the legal entity himself decides whether this option of the settlement agreement is suitable for him. At all subsequent stages, this is decided by the arbitration (administrative, external, bankruptcy) manager.

The individual is responsible for himself - after all, he has to pay according to the agreement. But the manager helps in the negotiation process.

Once the settlement agreement is drawn up and signed, it is submitted to the court for approval. The document acquires legal force. From this moment on, it cannot be changed unilaterally. Production stops.

But it will be renewed if one of the parties violates the obligations. Typically, this occurs if the debtor ceases to comply with the terms of the agreement. The resumed process immediately moves to the competitive stage of property sale.

Request by one of the parties

During the process, each interested party has the right to submit petitions to the court. This is a special document containing a request to the court to make this or that decision, or to take this or that action. If there are justified reasons for this and there are no legal obstacles, the court grants the request.

For example, a debtor may file a motion to terminate the procedure and thereby prevent bankruptcy. This is possible, in particular, on the basis that he fully repaid his debt obligations to creditors while the procedure was underway.

According to Article No. 53 of Federal Law No. 127, this is a legal way to terminate the case. Naturally, documentary evidence of “retribution” should be attached to the petition. Creditors also have the right to file a motion to terminate the case if they consider its continuation inappropriate. They also need to justify their position.

If the petition is filed by the debtor, you will need to attach to it:

- Registration documents of the organization (for legal entities) or identity card (for individuals)

- Legal justification allowing you to file a petition on a particular issue

- List of requirements and minutes of the meeting of creditors

- Documents confirming that payments have been made in full

Financial problems

The first priority creditors are always the court and the financial manager. Therefore, if the debtor is unable or refuses to pay court costs, the work of the administrator, or the procedures necessary for the further course of the proceedings, the case is terminated.

Its further continuation is considered impossible and inappropriate. It is important to remember that the court can terminate the case for financial reasons only after it receives a report on the results of the bankruptcy proceedings.

Early completion of the case

In a number of cases, the goals of the process are achieved earlier than planned. The legislation does not directly prohibit the early completion of the proceedings if its extension does not make sense. The court makes this decision and closes the case.

Termination procedure

To understand how and when a bankruptcy case is dismissed, it is important to understand how it works. In fact, the insolvency of the applicant is determined immediately – as soon as the arbitration court accepts the application for consideration.

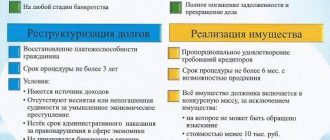

Then there are three possible scenarios: concluding a settlement agreement, debt restructuring, or selling the bankrupt’s property at auction. The proceeds are distributed to creditors, and the unrecoverable balance is written off. The legal entity is liquidated, the individual receives a temporary restriction of rights.

If the debtor violates the terms of the settlement agreement or restructuring, he has only one option - selling the property under the hammer. That is, the completion of bankruptcy proceedings in any case means the termination of the case. Since this is its logical end – the property is sold, debts are written off, the person is officially declared bankrupt.

Another thing is that such a situation is not always in the interests of the debtor. It benefits only hopelessly bankrupt people. For example, individuals who have neither property nor high income. Individual entrepreneurs for whom the commercial experience was so unsuccessful that they want to forget it like a bad dream, even at the cost of losing property.

For enterprises and organizations that have neither material assets nor prospects for organizing the company’s operations, liquidation is the only reasonable option.

Most debtors want to avoid complete bankruptcy and avoid a sale. They consider their difficult financial situation to be a temporary phenomenon. And they submit an application to the arbitration court because they were unable to agree with creditors on out-of-court restructuring. A court-approved restructuring or settlement gives them the breathing space they need to get their act together and restore their solvency.

Entering into a settlement agreement is a legal way to get the lender to relax the terms of the loan and close the case.

The opposite situation also happens. The creditor, knowing that the debtor has enough assets, files for bankruptcy, since the sale of the bankrupt's assets will allow him to fully recover his money. The debtor also understands this and agrees to a settlement. It is preferable for him to sell part of his property himself to pay off the debt, or to find funds elsewhere. But do not go through the competitive stage.

ATTENTION! In essence, there is no difference between debt restructuring and a settlement agreement. In both cases, we are talking about writing off fines and changing the payment schedule to a more comfortable one for the borrower. The difference is purely procedural. Having approved the settlement agreement, the court closes the case and does not interfere with settlement issues as long as the agreement is fulfilled by both parties. Restructuring takes place under the control of an arbitration manager and is a stage of legal proceedings that has its own rules and deadlines.

If the debtor insists on restructuring, the court usually gives him the opportunity to avoid bankruptcy in this way. For such a debtor, it would be preferable to close the case due to full repayment of the debt or restoration of solvency as a result of reorganization/external administration. It is in his interests to have the case dismissed on a motion of this nature.

For those who want to go completely bankrupt, it is beneficial to close the business as early as possible. The shorter the process, the lower the costs, the shorter the period of legal restrictions associated with the process, which include travel bans and border restrictions, seizure of property and bankrupt accounts.

And also, the negative consequences of bankruptcy will begin to expire earlier (which is especially important for individuals).

As a rule, the minimum period for closing a case is eight months after filing an application (two months for consideration of the application and six months for the competitive stage).

The case may be closed earlier if the parties sign a settlement agreement. Or it could drag on for three years—the maximum period for the restructuring phase.

In many ways, the duration of the process depends on what exactly the debtor or creditors want to achieve.

The consequences of bankruptcy through the eyes of the debtor. Myths and reality

How do debtors themselves imagine the consequences of “bankruptcy” and what do anti-crisis specialists think about common misconceptions?

The unsuccessful bankruptcy of some companies, isolated cases of raider takeover of organizations and bringing the beneficiaries and managers of the bankrupt to criminal and personal property liability are firmly imprinted in the minds of representatives of the business community and have given rise to many myths that are far from reality. So:

Myth No. 1. As a result of bankruptcy, all valuable property will be auctioned off, and the debtor will be left with nothing.

Reality. When handled professionally, bankruptcy is an effective way to maintain control over financial assets.

Myth No. 2. “Who will trust a bankrupt person”? To go bankrupt means to irreversibly lose the reputation and trust of clients, partners and banks.

Reality. It's impossible to please everyone. This statement is true for both individuals and businesses. It is difficult to create a universal image that would suit all social groups. Therefore, it is important to maintain a trusting relationship with the audience that is most important for a particular business. Openness and trusting dialogues with partners will allow us to continue business cooperation on mutually beneficial terms.

Myth No. 3. Bankruptcy is a “point of no return” for business activities

Reality. In fact, bankruptcy is a good opportunity to move to a new stage of business development.

Myth No. 4. One of the most negative consequences of bankruptcy is the high probability of bringing the controlling party to subsidiary and criminal liability. Inevitable punishments in the form of large fines, arrests, and imprisonment.

Reality. The sad experience of “unlucky colleagues” is far from an indicator, but the result of illiterate actions of management and the arbitration manager.

Important: the “informal” consequences of bankruptcy depend 99% on the legally competent actions of the bankrupt’s representatives and the competence of the manager.

The same cannot be said about the legal consequences that occur “a priori”, regardless of anyone’s will and actions.

But: even the legal consequences can be managed to the benefit of the bankrupt.

Recommendations for drawing up an application

The petition is written according to the rules common to maintaining business documentation. That is, at the beginning of the document, in the upper right corner, there must be a “Header”, including the standard lines “To” and “From”. After this, the name is written in the center (in our case, “Petition to terminate the bankruptcy case”). Then the main text. At the end there is a signature with a transcript and the date. Marks and corrections are not allowed, regardless of whether the document is handwritten or typed on a computer.

The document content requirements are as follows:

- The name of the judicial authority conducting the case must be correctly written

- The case number must be indicated - this is necessary for its accurate identification

- All circumstances and facts of significance must be described clearly, consistently, concisely

- If necessary, the document should contain information about other interested parties

- If documents are attached to the application, the text must contain a complete list of them.

- It is necessary to indicate the legislative norm that determines the filing of the application

Drawing up a settlement agreement

Let us repeat: the settlement agreement is a kind of anti-crisis measure that gives the debtor the opportunity to pay off its obligations and not let its assets go under the hammer. The text of the settlement agreement is usually no more complicated than the loan agreement, that is, it is quite accessible to a non-specialist.

But the same rule applies here as when signing a loan agreement. Such documents may contain nuances and features that are not fully understandable to a person without special education. And when a citizen signs a document without fully understanding its content, very unpleasant surprises can await him later.

This point is especially relevant for individuals, since legal entities still have more experience working with legal documents.

Therefore, it will be useful to at least show the text of the agreement to an independent lawyer before signing. This can be done on the Prav.io portal. This will not take much time, you will receive accessible explanations of the text of the agreement, and you will be sure that it does not conceal any “pitfalls”.

Changes to the LLC Law.

From 09/01/2017, the deadline for liquidation of an LLC based on a decision of the participants or executive body will be one year, which can be extended in court for no more than six months (Clause 6, Article 57 of the Federal Law of 02/08/1998 No. 14-FZ[ 3]).

If the participants or body cancel their decision to liquidate the LLC before the expiration of the above deadline, then a second decision on the voluntary liquidation of the LLC can be made no earlier than six months from the date of entering information about this into the Unified State Register of Legal Entities (Clause 7, Article 57 of the Federal Law No. 14-FZ).

The liability of the LLC has been clarified. As is known, according to Art. 3 of Federal Law No. 14-FZ LLC is liable for its obligations with all the property belonging to it, but is not liable for the obligations of its participants.

In the event of insolvency (bankruptcy) of an LLC due to the fault of its participants or due to the fault of other persons in the event of insufficient property of the LLC, these persons may be assigned subsidiary liability for the obligations of the LLC.

These rules are supplemented by the fact that the exclusion of an LLC from the Unified State Register of Legal Entities as inactive entails the consequences provided for by the Civil Code of the Russian Federation for the refusal of the main debtor to fulfill an obligation.

Judicial practice recognizes that the exclusion of an inactive legal entity from the Unified State Register of Legal Entities is a special type of termination of the legal capacity of a legal entity, not related to the general procedure for liquidation of a legal entity established by law. At the same time, the consequences of such exclusion from the Unified State Register of Legal Entities are similar to the consequences of the liquidation of a legal entity. Therefore, at the moment of exclusion of a legal entity from the Unified State Register of Legal Entities, its legal capacity ceases - the ability to have civil rights corresponding to the goals of its activities, and to bear civil responsibilities associated with this activity (Resolution of the Fifteenth Arbitration Court of Appeal dated September 2, 2013 No. 15AP-12796/2013 in case No. A53 -30467/2012).

Now the legislator has provided the following: if the failure to fulfill the obligations of an LLC is due to the fact that authorized persons (Article 53 of the Civil Code of the Russian Federation) acted in bad faith or unreasonably, at the request of the creditor, such persons may be subject to subsidiary liability for the obligations of this LLC.

Consequences of completing insolvency proceedings

Every legally significant action involves legally significant consequences. Naturally, the termination of a bankruptcy case is no exception. So what consequences does it have?

- If the case is terminated due to the completion of the last stage, the bankrupt individual is subject to restrictions on his rights for a certain period. The legal entity is liquidated. Information about them is entered into the EFRSB

- The powers of the arbitration manager are terminated

- Restrictions that were in force during external management or reorganization are lifted with respect to managers of legal entities

- Individuals again receive the right to make transactions with their property

- If the bankruptcy case of a legal entity is terminated due to the restoration of its solvency, the rights of all its counterparties to file claims are restored.

- Also in this case, proceedings suspended during the process related to financial disputes between the legal entity and its counterparties are resumed.

Arbitrage practice

The most extensive judicial practice is to terminate bankruptcy cases against legal entities. And the most common reason for closing cases is due to the signing of a settlement agreement.

As a rule, creditors provide the debtor with payment in installments. If we are talking about temporary insolvency and a minimum amount of debt, this is usually where it all ends. The legal entity repays the debt without problems, and the business is not reopened.

The second most common reason for termination of proceedings is the lack of funds for a legal entity to pay legal costs. This is typical for companies that demonstrate clear and irrevocable insolvency. The cases against them are closed because further steps are not practical.

The case may also be terminated at the observation stage if, within a month after the first publication of the company's bankruptcy, the creditors renounced their claims. The resolution of the Supreme Council of the Arbitration Court dated June 22, 2012 explains the following.

If the creditors' claims have already been entered into the register, in order to avoid bankruptcy proceedings, they should be fully satisfied. The settlement of claims not entered into the register is not necessary in order to terminate the proceedings.

Reasons for the decision

- The decision to suspend the case is made by the court on the basis of an application from a participant who is a party to the case. Thus, the application can be filed by the debtor or the creditor. A prerequisite for submitting such an application is the presence of grounds, the presence of which entails the suspension of the case.

- Persons representing a creditor or debtor may be their representatives, whose powers are confirmed by statutory documents or a power of attorney that has been notarized.

- During the monitoring procedure, it may be revealed that the value of the property belonging to the debtor is insufficient to cover the costs associated with the trial and the payment of remuneration to the person appointed by the insolvency administrator.

- In the event that the creditors have provided written consent to finance the entire range of activities related to the case under consideration, these costs will be borne by these persons.

- The absence of consent of at least one creditor to finance expenses is grounds for termination of legal proceedings opened as part of a bankruptcy case (Clause 1 of Article 57 of Federal Law No. 127). Thus, the court does not have the opportunity to make a procedural decision on bankruptcy and proceed to bankruptcy proceedings.

- The presence of such an illegal decision is the basis for the bankruptcy trustee to go to court. His demands will be to terminate the proceedings, and the justification will be the impossibility of covering expenses at the expense of the debtor, due to the insufficiency of his property.

- In cases where the insufficiency of property is revealed during the competitive procedure, the bankruptcy trustee has the right to demand the recovery of funds for expenses incurred from the original applicant. He has grounds for making such demands.

Suspension of proceedings

Court proceedings related to bankruptcy can not only be terminated, but also temporarily suspended. This happens if the debtor, creditor or legal representative of each of them submits a corresponding petition to the arbitration court:

- On appealing certain judicial acts

- On appealing decisions made by a meeting of creditors

- Any other petition drawn up in accordance with the regulations of the Arbitration Procedure Code of the Russian Federation

If the court has made a decision to suspend the process, then, according to Article No. 52 of Federal Law No. 127, it cannot use other procedural acts during this period. But it has the right to make determinations regarding the current case.

The court's decision to temporarily suspend the process is made based on an application from either party. An indispensable condition is that it must contain reasonable and legal grounds for suspending the process.

ATTENTION! When submitting an application, the representative of the debtor company must have with him not only a notarized power of attorney, executed accordingly, but also the statutory documentation of the legal entity

Suspension situation

The request to suspend proceedings in insolvency cases must come from a person who is a party to the case.

The reasons for this are:

- open procedures for appealing acts of the court, which are established by Art. 52 Federal Law;

- open procedures for appealing decisions made by a meeting of creditors;

- other factors provided for by the Arbitration Procedure Code of the Russian Federation.

A ruling to suspend a case made by a court is the basis for the impossibility of adopting procedural acts, which are defined in Art. 52 Federal Law. However, suspension cannot prevent the issuance of other types of determinations in the case.

Possible consequences

Profile Article No. 57 of Federal Law No. 127 contains not only the reasons for the termination of the case, but also the consequences of such a decision. It directly states that the main consequence of the arbitration court's decision to terminate the case is the complete termination of the restrictions on the debtor.

Regardless of whether they are stipulated by law or any of the stages of the procedure. First of all, the case concerns the right to travel around the world and the right to freely dispose of one’s property and bank accounts.

Standard insolvency proceedings involve either an immediate transition to the bankruptcy stage or a decision on the financial recovery of the enterprise.

Financial recovery implies that a company has a certain amount of funds, which gives it the opportunity to continue operating and restore its solvency. If there is no money or assets at all, the legal entity is liquidated, even without the competitive stage. If there is, an arbitration manager is appointed, who develops and implements an action plan for financial recovery and correction of the difficult economic situation.

There are cases when, at the observation stage, it turns out that the debtor’s funds are not enough to pay legal costs and the work of the administrator. In such cases the case must be dismissed. But sometimes creditors, believing that they will be able to return their funds by completing the procedure, give written consent to finance procedural measures. This leads to the case continuing and eventually ending at the competition stage.

It is important that creditors are unanimous on this issue. If at least one of them does not agree to pay legal fees, the case may be dismissed. The court will not proceed to the competitive stage, and if it does, the financial manager has the right to appeal the court’s decision. On the grounds that the debtor’s own funds are not enough to pay for his services.

If the lack of funds became clear during bankruptcy proceedings, the manager has the right to petition for the recovery of his remuneration from the one who filed the bankruptcy petition. That is, from the debtor, since if the creditor filed for bankruptcy, then he is obliged to pay the costs.

What are the consequences for the relatives of a debtor declared bankrupt?

The bankruptcy procedure also negatively affects the debtor's relatives, as it worsens their financial situation.

For the spouse, the consequences may be as follows:

- family income decreases;

- joint property is sold at auction;

- transactions between the debtor and the spouse are disputed by the financial manager and creditors.

The most painful consequence is the sale of the joint property of the spouses. In this case, the husband or wife may lose an apartment, a car, or a plot of land purchased with funds recognized as family income. The spouse is compensated for half the value of the property. The remaining funds are used to pay off creditors' claims.

Experts do not recommend removing property from the bankruptcy estate by concluding transactions with relatives. They will definitely be challenged and the buyer will have to return the property to the citizen’s bankruptcy estate.

Enforcement proceedings

After the bankruptcy procedure is fully completed, previously existing writs of execution against the debtor cease to be valid. All that remains are “non-debitable” and current payments. The following reasons for collection also remain relevant:

- Causing damage to intellectual property

- Violation of the rights of other subjects

- Causing damage

For other reasons, creditors and counterparties do not have the right to file new claims against the bankrupt.

Recovery upon termination of insolvency proceedings

Even after a bankruptcy case is dismissed, some debts are not discharged. There is a list established by law. The following cannot be written off:

- Alimony obligations

- Current payments

- Payments for damage to health

- Wage debts to employees

- Payments for subsidiary liability or for material damage caused (if imposed by a court)

Even personal bankruptcy does not free you from these debts. Moreover, it does not matter whether these obligations were included in the register of claims during the bankruptcy case. If there were, the corresponding writs of execution are issued by the court. If not, the claimants have the right to file a claim.

ATTENTION! When the bankruptcy procedure starts, all previous cases regarding financial claims of counterparties are terminated and enforcement proceedings are suspended. But this rule does not apply to non-write-off debts.