As is known, gift relationships are always characterized by their gratuitousness in relation to the recipients. It is precisely because of these properties of the deed of gift that it is most often concluded in favor of close people, including in favor of spouses. A characteristic feature of such a transaction is that there is no need to pay income tax.

Another important point is that in order to gift jointly owned property to a husband or wife, it is first necessary to establish a regime of shared ownership of the property. And only after this, one spouse will be able to give the other his share in the common property. Let's consider these and other aspects in more detail.

Features of donating property jointly owned by spouses

The provisions of Art. 256 of the Civil Code of the Russian Federation, the legislator established a regime of joint ownership of all property acquired by spouses during marriage , except in cases of receiving it as a gift and inheritance. Also, the results of intellectual activity and personal items do not belong to such property.

Additionally

According to paragraph 2 of Art. 576 of the Civil Code, donation of joint property is permitted with the consent of all co-owners , which, however, is initially presumed.

So, according to paragraph 3 of Art. 253 of the Civil Code, each of the spouses has the right to donate their joint property, unless the marriage contract concluded between them provides otherwise. Taking into account the presumption of consent to donation on the part of the other spouse (clause 2 of Article 253 of the Civil Code), each of them can donate joint property to anyone, in fact, without asking permission from the second spouse.

If one of them was against the alienation by the second spouse of jointly owned property, then the first has the right to have the transaction declared invalid . However, there is only one basis for this - the donee knew or should have known that the donor’s spouse was against the donation, otherwise the transaction is considered valid (clause 3 of Article 253 of the Civil Code).

An exception to which the presumption of consent of the second spouse does not apply are cases of donation of real estate that is jointly owned, as well as cases of donation of common property that require notarization. So, according to paragraph 3 of Art. 35 of the Family Code, such a gift is permissible only with the notarized consent of the second spouse .

Cases of donation of joint property between the spouses themselves require special consideration. Since the joint ownership regime does not involve the allocation of shares of property, each spouse has it equally. Based on this, donating such property between spouses without dividing it is not possible .

Cases of donation between spouses of their joint real estate deserve special attention. Since both spouses already own the property, it must be transferred from joint ownership to shared ownership. This is feasible within the framework of Art. 38 IC, by dividing it into shares and subsequent state registration of each of them. Only after the shares have been allocated , one spouse can donate his share to the second spouse.

Terms of a transaction

Since a minor cannot independently complete a transaction, in order to receive real estate as a gift, mandatory consent from the parents or persons replacing them is required.

Attention! Even if the donation of a land plot is made by a relative, for example, an uncle, but the child’s parents do not give consent, the transaction will not take place.

Moreover, the nature of the transaction depends on the age of the recipient . If he is under 14 years old, then his parents take over the property instead. If it is more than 14, then the minor himself receives the gift, and only written consent is required from the parents.

Do you want to donate a plot of land without a house or buildings? Find out the nuances of the process from our article!

Taxation on gifts to husband or wife

As is known, the recipient receiving a gift of real estate, vehicles, stocks, shares and interests is equivalent to receiving income equal to the market value of these gifts. According to Art. 208, 224 of the Tax Code, upon receipt of the specified property, the donee becomes obligated to pay income tax , the amount of which is 13% of the specified market value.

Attention

According to clause 18.1 of Art. 217 of the Tax Code, income received by way of gift, where the donor is a close relative or family member of the donee, are exempt from income tax .

The provisions of Art. 2 of the IC, the legislator determined the circle of persons who should be considered family members. Since husband and wife are included in this list , taking into account the above, when making a gift between them, the spouse acting as the donee will be exempt from 13% personal income tax.

To do this, it is advisable to indicate in the agreement that the parties to the donation are family members, and, if necessary, to provide documents confirming this fact to the tax authorities. Please note that former spouses are not family members, which is why the exemption does not apply to them.

Please note that marital relations can arise exclusively in marriage, which, according to Art. 2 of the IC, only the union of a man and a woman is recognized that is officially registered with the registry office. Thus, cohabitation that is not registered as a legal marriage cannot be a basis for exemption from personal income tax , even if the cohabitants have children together.

It should also be noted that family relations do not relieve the donee spouse from the obligation to pay property tax (Article 399 of the Tax Code).

So, according to Art. 401 of the Tax Code, when receiving real estate from a husband or wife as a gift, the recipient becomes obligated to pay an annual property tax, the amount of which ranges from 0.1% to 2%, depending on the type and value of the real estate (Article 406 of the Tax Code).

How to donate land to a close relative

A standard agreement is drawn up. If relatives have the same surnames, this benefits them. It is not necessary to confirm your relationship! But there are cases of fraud when a transaction occurs between namesakes and not relatives. Therefore, it is recommended to indicate the fact of relationship in the “body” of the agreement, and attach supporting documents to it.

For example, a father gives his daughter an apartment. Their surnames are different, since the daughter got married and is already in her second official marriage. To confirm your relationship, you must attach copies of the following documents:

- her birth certificate, which shows her previous name;

- marriage registration certificate confirming the transition to the surname of the first husband. An archival certificate from the registry office is also suitable;

- certificate of termination of these ties;

- a new certificate of remarriage, and a transition to the current surname.

Important! Confirmation of relationship is necessary in order to exclude the obligation to pay tax. Otherwise, tax authorities may become interested in the transaction and require confirmation of preferential treatment or payment of personal income tax.

You can get more detailed information regarding the issue of donation between close relatives in our other article.

Donating an apartment to your spouse

The donation of real estate between spouses, including apartments, has a lot of features related both to the nuances of the civil turnover of the real estate itself, and to the special property regime that applies to the property of the spouses.

As a general rule, donating an apartment to a spouse presupposes its gratuitous transfer or the promise of such transfer into his ownership. Interestingly, this procedure, along with inheritance, excludes the possibility of joint ownership (clause 2 of Article 256 of the Civil Code) - the donee spouse becomes the sole owner of the apartment.

Important

Alienation of an apartment through donation presupposes its state registration (Article 131 of the Civil Code). The procedure for carrying it out (Article 13 of Federal Law No. 122 of July 21, 1997) requires the applicant to submit documents, including a deed of gift. Thus, the donation of an apartment is always formalized in writing .

Thus, having an apartment in his private property (having acquired it before marriage, by way of gift or inheritance), one spouse can give it to the second spouse without any problems. Similarly, a gift between spouses of a share of a privately owned apartment is completely acceptable. Problems with this method of alienation can arise only when donating an apartment that is in joint ownership.

To transfer to one of the spouses the rights to an apartment that is jointly owned by both spouses, it is necessary to initially divide it and allocate the shares of each spouse (Article 254 of the Civil Code), and then register the ownership rights to them. Only after this, each of the spouses, in accordance with paragraph 2 of Art. 246 of the Civil Code, can donate his share to the second spouse.

An agreement for donating an apartment to a husband or wife must contain a detailed description of the gift, which is required by the only essential condition on the subject (clause 1 of Article 432 of the Civil Code). To do this, the contract must contain the location of the residential premises, its address, floor, number of rooms, area, technical and cadastral passport data, condition, and other features.

According to Art. 556 of the Civil Code, the transfer of real estate is carried out by drawing up a transfer deed , which also describes the transferred apartment.

In addition, the deed of transfer must contain a description of all the shortcomings about which the donor must warn the donee in order to avoid harm to his life, health and property (Article 580 of the Civil Code).

Giving a house to your spouse

According to Art. 16 of the Housing Code, a residential building is recognized as an individual building , consisting of rooms and separate auxiliary premises for economic use, designed to satisfy the household and other needs of citizens related to living in the house. A house, as an independent object of law, may well be donated to a spouse under a gift agreement. Since the house is real estate, the transfer of rights to it to the spouse is subject to state registration (Article 131 of the Civil Code).

Additionally

According to Art. 273 of the Civil Code, when the rights to a building belonging to the owner of the land plot on which it stands are transferred, the ownership of the land also passes to the acquirer of the building. Thus, having ownership rights to both the building and the land, the donor cannot give his spouse the rights to one object without transferring rights to the other .

Since the gratuitous transfer of a residential house in favor of a spouse requires subsequent state registration, the transaction of donating a house is always formalized in writing . The right of ownership of the house arises from the donee spouse only after such registration has been carried out (clause 2 of Article 223 of the Civil Code).

The contract itself must necessarily contain a description of the house being transferred , indicating its individualizing features. In particular, the following data must be included in the contract: address, number of rooms, number of floors, area, passport data, condition and other features that distinguish it from other real estate properties.

Please note that spouses may have difficulties when formalizing the donation of a private house that is in their joint ownership . The donation of such property requires the preliminary division of joint property and the allocation of shares of each spouse (Article 254 of the Civil Code), which is carried out by signing an agreement and subsequent registration of shares in Rosreestr.

If the house is in the private (separate) property of the spouses, its donation is carried out within the framework of the usual donation of real estate, taking into account the peculiarities of taxation provided for in clause 18.1 of Art. 217 NK. Note that after donating a house, the donor spouse can no longer claim division of property and allocation of his share, since according to Art. 36 of the Family Code, donation excludes the emergence of a regime of joint property of spouses.

Registration procedure

The donor must begin the procedure by preparing documents for land and property confirming ownership rights.

Then the owner of the house and the recipient:

- draw up a contract in 3 copies with a description of the subject of the contract and the deadline for execution;

- affix the signatures of the parties and the date;

- submit documents to the MFC, Rosreestr at the place of residence to confirm the fact of transfer of ownership rights from one person to another.

Today, many users submit documents through the single portal of Rosreestr by uploading the necessary files. It's fast, convenient and profitable. Documents can be sent by mail, placed in an envelope and numbered individually for the inventory.

Registration actions by authorized bodies are carried out within 4-7 days. If the deadline is specified in the terms of the contract, then the transfer of ownership rights may take place earlier.

Donation of land to a spouse

Under land plots, in accordance with clause 3 of Art. 6 of the Land Code, is understood as a real estate object that is a part of the earth’s surface and has a number of characteristics that make it possible to define it as an individual thing (for example, marked boundaries). Land plots, if they are not seized and not limited in circulation , can be donated by their owners, including to a husband or wife (Article 260 of the Civil Code).

For your information

Land plots are subject to special regulation by the state. Therefore, the procedure for their civil circulation has a lot of features that distinguish land plots from other real estate objects. According to Art. 7 of the Land Code, each of the land plots has a designated purpose, depending on the category of land to which it belongs.

According to Art. 35 of the Land Code, the alienation of a land plot with a building located on it, owned by one legal entity, is carried out together with such a building . Based on this, the donor cannot give his spouse only a plot of land, without a building standing on it, if he has ownership rights to both of these objects.

Since a land plot is a piece of real estate (Article 6 of the Land Code), its donation in favor of a wife or husband requires state registration (Article 131 of the Civil Code), which, in turn, requires the mandatory written execution of the agreement. For registration, Rosreestr authorities charge a state fee, the amount of which, according to Art. 333.33 Tax Code is 350 rubles for the whole plot and 100 rubles for its share.

Since the spouse is a member of the donor’s family (Article 2 of the Family Code), he will be exempt from the obligation to pay 13% income tax on the market value of the land plot given to him. In addition, during notarization, a special notarial fee will be provided for such entities.

Separately, it should be noted the peculiarities of giving spouses land shares - shares in the ownership of land plots that are in common ownership. The regime for their alienation is quite specific - the donation of a land share is permissible only in favor of another shareholder , an agricultural organization or a member of a farm also using this land plot (Article 12 of the Federal Law No. 101 of July 24, 2002).

Donating a share in favor of other entities, including a spouse, is permissible only after the allocation of such a share into private ownership . To do this, the owner of the share must contact a cadastral engineer who will prepare a land surveying project. The formation of a new land plot is permissible only if there are no claims regarding such a project from other co-owners (Article 13 of Federal Law No. 101 of July 24, 2002). After this, the share can be gifted to the spouse.

How much does it cost to issue a deed of gift for a house and land through the MFC?

Multifunctional centers are located throughout the Russian Federation. They are a kind of intermediaries between government organizations and applicants. At the MFC you can register a gift agreement and transfer of rights under it. Moreover, since there is a lawyer position in the multifunctional center, you can order the drawing up of an agreement there for a fee. On average, such a service in Russia will cost three thousand rubles.

Taking into account the size of the state duty, the average price for processing such a transaction will be five thousand rubles. It is worth noting that if both the house and the land are registered in the deed of gift, then you will have to pay an additional fee of 350 rubles for the land.

Giving without the consent of the spouse

As already mentioned, the regime of joint ownership of spouses applies to almost all property acquired by them during marriage, except for cases of acquisition of property by gift, inheritance, through intellectual labor and the acquisition of things for individual use (Article 256 of the Civil Code).

Without the consent of the spouse, only those things that are not subject to the regime of joint ownership can be given as a gift. In addition to the above, the property that was acquired by each spouse before marriage is added to them.

Important

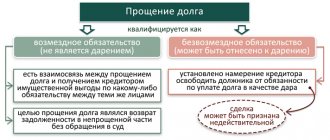

According to paragraph 2 of Art. 253 of the Civil Code, donation of property jointly owned by spouses is permitted only with the consent of the second spouse . However, according to paragraph 2 of Art. 35 of the Family Code, when making a donation of common property by one of the spouses, it is initially assumed that he acted with the consent of the other.

At the same time, if there was no such consent to the donation on the part of one spouse, and the second spouse nevertheless alienated the joint property, in accordance with clause 3 of Art. 253 of the Civil Code, such a transaction may be declared invalid . However, to do this, the spouse interested must prove the very absence of such consent, as well as the fact that the donee knew or should have known about it.

Donation of real estate subject to the regime of joint ownership. According to paragraph 3 of Art. 35 of the IC, such a transaction is permissible only with the notarized consent of the second spouse .

When donating real estate without such consent, the spouse whose consent was not obtained has the right to petition on this basis to have such a donation declared invalid . To do this, he is given one year from the moment he learned or should have learned about its commission.

Example

Citizen V. entered into a deed of gift with his brother, according to which he gave him a car that he bought immediately after his wedding with B., using the money he donated. B. did not know about the conclusion of this transaction and, since she was against its conclusion, filed a lawsuit to have it declared invalid. In court, she argued her position by the fact that the property donated by her husband, according to Art. 256 of the Civil Code, was in their joint ownership. Based on this, its donation was allowed only with the consent and in the interests of all co-owners. Since her interests were violated by such a donation, especially since she did not give consent to it, she asked that the transaction be declared invalid.

Having heard B.’s position, the court explained to her that, in accordance with paragraph 2 of Art. 35 of the Family Code, a transaction completed by one of the spouses is presumed to have been completed with the consent of the second spouse. At the same time, in order to recognize invalidity based on the lack of such consent, B. had to prove that the donee knew or should have known about its absence. Since this was not proven, the court rejected B.’s claims.

Is it possible to revoke a deed of gift?

There are legal grounds for revoking a gift agreement. These include:

- initiative of the guardianship authorities and their reasoned decision if the transaction violates the rights of minor children;

- a committed and proven crime that the donee committed against the life and health of his donor;

- recognition of the donor (he may be an individual or individual entrepreneur) as financially insolvent. To cancel, it is necessary that less than a year has passed since the signing of the agreement;

- initiative of the donee himself, if he refuses to take possession of a plot of land under a gratuitous transaction.

Cancellation of the donation is carried out in court. Except for the last case! It is enough for the recipient of the gift not to sign the contract for the operation to not take place. If he is pressured, threatened or otherwise forced to sign a document, he can challenge the transaction afterwards. But he will have to prove the fact of coercion.

After the court cancels the deal, the gift is returned to its former owner. Based on a judicial act, ownership rights are re-registered.