Mortgages are a clear example of the fact that there are still serious gaps in the legal provisions of the Russian Federation. Based on the provisions of the Constitution, any Russian has the right to housing, but buying an apartment with a mortgage can leave him without real estate - if the loan is not repaid on time. Today we will consider such an important issue as eviction from a mortgaged apartment - when and in what situations such a situation is likely, what features this procedure has.

Mortgage concept

A mortgage is a long-term loan secured by real estate. It can be of two types:

| Target. | Money is issued for the purchase of purchased real estate. It will also be the subject of collateral. The borrower does not receive funds in hand. |

| Non-targeted. | Money is given to the client in cash or transferred to his account. The collateral is a piece of real estate that is ALREADY owned by the borrower. |

The average mortgage term in Russia is 7-15 years.

The law provides for two types of collateral for obtaining a housing loan. But in practice ONLY one is used.

| Bail by force of law. | The mortgagee takes the property for himself in case of disputes. This is the main mortgage on which real estate is registered. |

| Pledge by virtue of the contract. | The apartment is not considered by the court as collateral tied specifically to the loan. It is much more difficult for a lender to take away such real estate. |

What if part of the apartment belongs to a minor?

When applying for a mortgage, the mother has the right to assign shares to her minor children. Using maternity capital to repay part of the loan makes this condition mandatory. When there is a delay, the actual debtor is considered to be the mother, and not her children . The bank has the right to sell such an apartment only with the permission of the guardianship authorities. They, in turn, will not be able to interfere at the very least, since the law is clearly on the side of the creditor.

Features of mortgage housing

Can a minor child be evicted from a mortgaged apartment? Of course, the law confirms the creditor’s right to repay loan debts at the expense of legally pledged housing.

When concluding a mortgage, banks often require the consent of trustees to register minors in new housing. But when minors are evicted from such housing, contacting the guardianship and trusteeship authorities will not help. Moreover, the bank is not obliged to provide any housing to expelled children.

If the borrower has stopped paying under the housing loan agreement for some reason, the lender applies to the judicial authorities with a demand to repay the loan debt by foreclosure on the mortgaged apartment. After the court grants the petition, the mortgaged property is put up for sale. The winning bidder becomes the new owner of the property and evicts the previous owners from the mortgaged apartment, while the residence of minors or young children in it is considered legally unimportant.

If no buyers are found for the mortgaged housing, it is transferred to the lender-bank, which formalizes ownership of it and can deal with the apartment at its own discretion.

In order not to end up on the street, the debtor with children in his arms has the only alternative. He needs to contact the social protection authorities in order to obtain the status of the poor and be able to receive assistance under the Housing program. Local authorities will be able to determine which project category a citizen belongs to.

Reasons for eviction of a debtor from a secured apartment

Collateral housing is taken away in certain cases. To do this, a credit institution needs to know that:

- The premises are leased, although this is prohibited by the contract.

- The same apartment is re-mortgaged under another loan obligation.

- Due to the negligent attitude of the tenant - the borrower, the premises turned out to be unfit for habitation.

- Requirements for insurance obligations have not been met.

- Bank employees are not allowed to inspect the property.

- There is an intention of the debtor to sell the apartment without notifying the creditor.

- Payments are overdue for more than 3 months.

Is it possible to evict from a mortgaged apartment?

A mortgage is a type of collateral obligation. When purchasing an apartment on credit, it remains pledged to the bank in order to ensure compliance with the terms of the loan contract. The ownership of mortgaged real estate is registered in Rosreestr along with the encumbrance. Once the debt to the lender is eliminated, it is removed.

Until the end of the term of the loan agreement, the mortgagee has the right to foreclose on the mortgaged property. In this case, the owner may be evicted from the apartment.

An extreme measure is applied to citizens who do not make loan payments . Housing is seized and sold at auction. The money received is used to eliminate the debt.

We recommend watching an interview with a judge about when a bank can evict a mortgage debtor.

For what reasons can the bank take away the apartment?

If the mortgage loan amount has not yet been fully repaid, the lender may demand that the owner of the apartment taken on credit return it to the bank. Such bank actions are possible if the borrower:

- violates contract terms

. In accordance with the law on mortgages, such actions by a credit institution are possible if it becomes known that the client has mortgaged the property to another lender without its knowledge; - violated the rules for repairing living space

or if, due to his negligence, the apartment became unsuitable for living in; - violated home insurance obligations

; - decided to sell the apartment

without obtaining permission from the bank for these actions; - did not make monthly payments for 3 months

more than 3 times during the year; - has mortgage debt

amounting (in practice) to over 80% of the cost of the loan apartment.

Grounds for eviction

Forced eviction from a mortgaged apartment does not occur spontaneously. There must be a reasoned decision for every action of the bank. The main reason for eviction from an apartment due to a mortgage is failure to pay monthly payments and the accumulation of significant debt .

The amount of contributions and the payment schedule are regulated by the mortgage agreement between the borrower and the bank. The agreement contains information on the accrual of interest, fines, penalties and other overpayments. By signing a mortgage agreement, the borrower knows what awaits him if the agreed requirements are not met. Nevertheless, delays do occur, and quite often.

This begs the question, is it really possible to evict someone after missing a monthly payment?

No, it is not profitable for the bank to apply sanctions after one incident. Eviction from an apartment under a mortgage occurs only in relation to arrears of 6 months or more . If the debtor does not even try to repay the debt, he may be evicted from the mortgaged apartment, and the housing may be sold at auction.

Eviction algorithm

To evict mortgage debtors, pre-trial work is carried out with the defaulter. The lender notifies the borrower in advance of non-compliance with the obligations of the mortgage agreement and the natural subsequent eviction.

If the bank sends a claim to the court without prior notification to the borrower, or the amount of non-payment is less than 5% of the collateral, the court may refuse to initiate proceedings against the defendant.

The creditor submits to the court the grounds for eviction, he must prove that the borrower was provided with conditions for repayment of non-payments, but the funds were never sent to the bank by the defaulter.

The court then makes a decision on eviction. District courts at the place of residence of the defendant hear eviction cases.

Grounds and conditions

In order to evict a child from an apartment, the desire of either the owner or the parents (legal representatives) is required. However, the legislator, in an effort to protect the interests of minors, obliges the involvement of guardianship authorities in this procedure - without their permission, no one has the right to deprive a minor of his registration.

So, these are the grounds that must exist in order to evict a child from a home:

- the owner of the property wants to sell it;

- the child’s legal representatives have lost the right to use the apartment, for example, temporary registration has expired;

- the child’s parents are registered at a different address;

- the minor is no longer a member of the apartment owner's family.

If parents are deprived of parental rights (in fact, family ties with the child are canceled), then this is not a basis for expelling the minor from the apartment.

Mortgage debt: Federal Law No. 102

Previously in articles we have already described the clauses and requirements of the Federal Law of the Russian Federation “On Mortgage (Pledge of Real Estate)” No. 102 of September 16, 1998. It is this legislative act that regulates loans for real estate and controls the relationship between the borrower and the lender, in particular the timely payment of payments and maintaining the collateral property in proper condition. According to this law, the borrower does not have the right to dispose of housing at his own discretion, including, he cannot sell it, give it as a gift, exchange it or bequeath it, unless the bank prohibits these actions. At the same time, the borrower has the right, without obtaining the consent of the lender, to rent out a residential property for a period of more than 6 months with the provision of temporary registration of residents, as well as register family members and relatives in the area (Article 12 of the Federal Law-102), carry out repair work and do redevelopment, unless these actions cause significant damage to the premises. Based on Art. 31 FZ-102 mortgaged real estate must be insured. In case of violation of the terms of the agreement, the lender has the right to demand from the borrower early repayment of the mortgage debt and seizure of the collateral on its balance sheet (Article 50 of the Federal Law-102), as practice shows, most often such actions occur after 6 months of delay.

Eviction from a mortgaged apartment: pre-trial work

It is worth noting the fact that not all banks are ready to take urgent measures against mortgage debtors and seize collateral apartments from them; in most cases, banking organizations are ready to accommodate borrowers who find themselves in difficult financial situations and offer various ways to repay the debt:

- restructuring (reducing the amount of payments by increasing the loan term);

- credit holidays (exemption from payments for up to six months);

- writing off part of the loan debt (at the discretion of the lender, penalties, penalties, and interest may be written off);

- state support (at the request of the debtor).

Also part of the pre-trial claim work is notifying the debtor of non-fulfillment of debt obligations and further eviction of him from the mortgaged apartment (Article 55.2 of Federal Law-102). This is a mandatory condition for a banking organization before going to court, otherwise the claim may be denied.

The only housing

The court considers the living space under the mortgage as collateral for the loan, so you can refer to Article 446 of the Code of Civil Procedure, which does not allow the eviction of the borrower from the only home. The family of the owner of the premises is also evicted. The child in this case has no rights to the mortgaged property and will follow his parents.

Federal Law 102 allows you to get a deferment of eviction for a year. This will take into account the fact that the payer did not shirk its obligations, and in the future, having received debt restructuring, will continue the stopped payments on longer but preferential terms.

Families with newborns, single mothers, and guardians of minors can count on court support when obtaining a deferment in payments.

Thus, the procedure for eviction from an apartment that becomes the subject of collateral is completely legal; the housing can be taken away to pay off the debt. If the person being evicted actively resists the court’s decision in favor of the bank and the eviction affects the interests of minor children, the elderly, and people with disabilities, then when the apartment is repossessed, representatives of the prosecutor’s office are present, who only record the correctness of the process of repossession of the home.

Bailiffs, on the basis of a writ of execution, which becomes the basis for discharge, discharge the child along with the defaulter.

Features of eviction with minor children

When it comes to a mortgage, the eviction of a minor child is in practice carried out under standard conditions. The enforcement procedure is applied, the child is deregistered with the Federal Migration Service.

The only thing a debtor can do in such a situation is to ask for government assistance under the Housing system. There he will be given housing after he receives the “low-income” status.

When a minor is evicted from a residential premises, a prosecutor is always involved in the case. He monitors to ensure that there are no illegal activities.

Eviction of such a citizen from housing is possible only by court. Not only the prosecutor, but also the representative of guardianship and trusteeship participates in the case.

Thus, children are evicted along with their parents and other family members - no special privileges are provided in this situation, the law is the same for everyone.

It is worth noting that eviction from mortgaged housing with maternity capital is carried out on the same grounds. So the borrower should not be brought to such a situation.

Is it possible to evict a large family?

If the family living in the mortgaged apartment has many children, the judicial authority may take the side of the defendant, but in accordance with legislative norms, the status of having many children is not a basis for mitigating the decision to evict the debtor and his family members from this living space.

If the square meters purchased on credit are the only ones, and minor children live in it, the court has the right to issue an order to the borrower not to evict from it. This allows the court to establish a moratorium on the seizure of real estate for one year.

The borrower will have to begin immediately repaying the debts on the loan and pay off any overdue payments on time. If after a year the mortgage debts are not paid, the bank has every right to evict a large family from such housing.

Can a minor child be evicted from a mortgaged apartment?

Eviction from mortgaged housing does not depend on the presence/absence of child-age tenants. If we are talking about a privatized apartment, they have no right to evict without providing other housing. The situation is different with collateral real estate. The bank is not obliged to provide the debtor and his family with alternative living space to replace the one seized for non-payment.

What advice can you give to borrowers with minor children? First of all, submit an application to the social protection institution. You will need to confirm your status as a “low-income family.” If you are in arrears on your mortgage, you should focus on the absence of your primary place of residence. Most likely, the application will be approved - the family with the child will receive municipal housing or a room in a dormitory.

It is important to note that the eviction of children from a mortgaged apartment occurs under the control of the guardianship authority and the prosecutor. Officials are always present at court hearings. Their task is to ensure that the child’s interests are not violated.

Example:

The district court considered the claim of a banking institution against the Rykov family. The family, which included a mother, father and a minor child living in the apartment, was behind on their mortgage payment. The amounts were not paid for about 7-8 months, as a result of which the borrower accumulated a significant debt. The bank’s exhortations and attempts to understand the reasons led nowhere - Rykov simply did not respond to notifications, SMS and emails.

The plaintiff petitioned the court to foreclose on the mortgaged apartment against the borrower's debt. The basis was Art. 50 FZ-102 “On mortgage (real estate pledge)”. The creditor indicated that there was a minor child living in the family, but the defendant did not even try to start repaying the debt (fines and penalties).

Having considered the claims, the court recognized the existence of a debt, the absence of valid reasons for non-payment, and the bank’s ignoring of notifications. The defendant also did not appear in court, which was the reason for making a decision in his absence (clause 1 of Article 233 of the Code of Civil Procedure of the Russian Federation).

The final decision is to satisfy the bank’s claims for a mortgaged apartment; collect housing as collateral for a mortgage; sell an apartment at auction; evict the defendant's family within the period established by law; oblige Rykov to enter into a social rental agreement and move into a municipal apartment.

To summarize, it should be noted that eviction from an apartment due to a mortgage is a serious and unpleasant matter. If the borrower does not pay the monthly installments, the lender has the right to take the case to court and demand repossession of the home for debts. Evacuation from a mortgaged apartment occurs only on the basis of a court decision. Children or disabled people registered in the apartment are evicted along with the debtor. Late payments for more than 6 months are grounds for eviction. The living space is sold at auction, and the proceeds go towards repaying the borrower's fines, debts and penalties.

If housing is the only one

In practice, there are often situations when a mortgaged apartment is the only home of a citizen.

According to paragraphs 2, 3 of paragraph 1 of Article 446 of the Code of Civil Procedure of the Russian Federation, it is prohibited to foreclose on the debtor’s only home. Judicial practice supports property immunity (Resolution of the Constitutional Court of the Russian Federation of May 14, 2012 No. 11-P).

However, it does not apply to a mortgaged apartment. If the only residential property is encumbered with a pledge, it is allowed to be sold for debts (Determination of the Supreme Court of the Russian Federation dated May 29, 2012 No. 80-B12-2, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 26, 2013 in case No. A65-15362/2009-SG4-39) .

Example 1. LLC Commercial Bank "Moscow Lights" with a demand to evict L. (O.V.), O.M. from a mortgaged apartment. The property was pledged to the bank in connection with the conclusion of a loan agreement with citizens. The debtors violated their obligations to faithfully transfer loan payments, so the property was foreclosed on. The apartment was transferred to the ownership of the bank. The court came to the conclusion that its actions were lawful, therefore the owners are subject to eviction (Appeal ruling of the Moscow City Court dated July 20, 2012 in case No. 11-12044).

If part of the apartment belongs to a minor child

The presence of children by the owner is not an obstacle to the seizure of collateral real estate. A credit institution has the right to initiate the eviction of a minor child from a mortgaged apartment.

The Constitutional Court confirmed the possibility of foreclosure on mortgaged residential real estate for loan debts, even if there are children (ruling No. 246-O dated February 17, 2015). After the sale of the property at auction, all family members are subject to eviction.

The only thing the debtor can count on is a delay in the sale of the mortgaged apartment for a period of up to 12 months. It is provided for valid reasons.

To protect the interests of children, guardianship authorities and the prosecutor's office are involved. Their main task is to ensure that the bank does not commit violations in the process of evicting residents from a mortgaged apartment.

If maternity capital is used

Many women pay for housing with maternity capital. This money is used as the down payment for the loan. They can also be used to repay the principal debt and interest on it.

The use of maternity capital to purchase a mortgaged apartment is not regarded as a mitigating circumstance. If the owner does not pay the loan, the home is repossessed for debt.

At the same time, the bank risks receiving a court refusal to evict residents from the mortgaged apartment. The presence of the debtor's guilt is taken into account. If the debt arose for valid reasons, the collateral property is not confiscated. In such a situation, the fact of paying the loan at the expense of maternity capital is interpreted in favor of the borrower (appeal ruling of the Moscow City Court dated December 2, 2013 No. 11-39562).

Eviction of a minor child

Need legal assistance RECOMMEND FOR MY REVIEW TO COURT RESPONSE TO THE CLAIM OF JSC "RAIFFEISENBANK" on October 1, 2015 at a meeting of the Council for the Development of Civil Society and Human Rights by the President of Russia in relation to citizens who took out loans in foreign currency and exercised their constitutional right to housing through authorized and previously supported by the regulator of a banking product - foreign currency mortgages, it was said: “This especially applies to single housing, we need to look carefully, not allow any wild cases, of course, make a decision to resolve this situation. This is the first,” said the President of Russia. Secondly, economic, social and cultural rights, freedoms and principles of man and citizen include: - The right to housing (Part 1 of Article 40 of the CONSTITUTION of the Russian Federation). Art. 446 of the Code of Civil Procedure of the Russian Federation does not allow foreclosure on “the only residential premises available to the borrower suitable for habitation.” Thirdly, to the stated claim of Raiffeisenbank JSC and the latter’s demand dated 06/01/2015 for early termination, I express a categorical objection and must point out the following arguments that deserve attention to my personal circumstances listed below when considering the case in court meeting. 1. The issue of sustainability of foreign currency mortgage debt depends on its nominal expression in rubles and on its reduction in terms of maturity. The loan agreement was concluded for the amount of $131,000.00, equivalent to the amount (25.4401*$131,000.00=3,332,653.10 RUB more than 8 years ago and as a result of a violation of the rights of consumer borrowers who were misled regarding the false information provided by the bank according to the total amount of expenses in ruble equivalent, which turned out to be underestimated by 2-3 times compared to the actual amount of expenses on the loan today (the amount of expenses was taken from the payment schedule and recalculated at the rate of the Central Bank of Russia 25.4401 * $251,163.50 = 6,389,623 ,80RUB, and is expressed in an amount equivalent to the amount in currency on the date of the loan agreement on July 20, 2007. Consumer loans are provided, as a rule, for the purchase of durable goods (apartments, cars, furniture, etc.) and other purchases. In most cases, consumer credit comes in the form of selling goods with installment payment or in the form of providing a bank loan for consumer purposes.In accordance with Article 489 of the Civil Code of the Russian Federation, an agreement on the sale of goods on credit may provide for payment of goods in installments. According to Part 1 of Art. 10 of the Law of the Russian Federation “On the Protection of Consumer Rights” dated 02/07/1992 N 2300-1, an agreement for the sale of goods on credit with the condition of payment by installments is considered concluded if it, along with other essential terms of the agreement (paragraph 4 of part 2 of the same article) with when providing a loan, the price in rubles, the size of the loan, the full amount to be paid by the consumer, and the repayment schedule for this amount are indicated (as amended by Federal Laws dated December 21, 2004 N 171-FZ, dated October 25, 2007 N 234-F3). When a conscientious, but less wealthy borrower (compared to the one who took out a ruble loan) is unable to pay the debt, which has grown 2-3 times in a short period of time, and does not make the next payment for the loan sold in installments within the period established by the contract goods transferred to him, the seller has the right, unless otherwise provided by the contract, to refuse to fulfill the contract and demand the return of the sold goods, except for cases where the amount of payments received from the buyer exceeds half the price of the goods. As of 06/03/2015, the borrower paid at the rate of the Central Bank of Russia an amount in rubles of about 4,200,000.00RUB (equivalent to the amount of $136,000.00 - more than half of the total amount from the payment schedule), which in ruble equivalent is 22% higher than the equivalent amount in rubles , following from the payment schedule for the past period, established at the exchange rate of the Central Bank of Russia on the date of conclusion of the agreement. As of 06/03/2015, the remaining amount under the payment schedule is less than $99,000.00 - less than half of the total amount from the payment schedule, equivalent to the amount at the rate of the Central Bank of Russia = 6,474,689.20RUB, which is 155% more than the equivalent amount in rubles following from the schedule payments when recalculated at the exchange rate of the Central Bank of Russia on the date of conclusion of the agreement up to September 24, 2020 as the deadline for the final repayment of the loan after 5 years. In total, the total amount of payments under the agreement will be an amount in rubles according to the exchange rate of the Central Bank of Russia of about 10,700,000.00RUB, which is 7,300,000.00RUB more than the initially established loan amount at the exchange rate of the Central Bank of Russia on the date of the agreement and has already led to an increase in the cost of the loan by more than 3 times. In view of the violation of consumer rights, I ask the court to correctly assess the balance of property interests of the parties, taking into account the fact that I have already paid more than two-thirds of the amounts in US dollars under the loan agreement. If, when concluding an agreement, the draft of which was proposed by Raiffeisenbank JSC and contained conditions that were clearly burdensome for the other party and significantly disrupted the balance of interests of the parties (unfair contractual terms), and this party was placed in a position that made it difficult to agree different content of individual terms of the agreement (that is, it turned out to be a weak party of the agreement), then the court has the right to apply to the subject of the agreement in accordance with clause 2.3 of Article 2 of the loan agreement the provisions of clause 2 of Art. 428 of the Civil Code of the Russian Federation on accession agreements, changing or terminating the relevant agreement at the request of the interested party. In the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated March 14, 2014 No. 16 “On freedom of contract and its limits” when resolving disputes arising from contracts, in case of unclear terms of the contract and the impossibility of establishing the actual common will of the parties, taking into account the purpose of the contract, including established practice in the mutual relations of the parties, customs, as well as the subsequent behavior of the parties to the agreement (Article 431 of the Civil Code of the Russian Federation), the court’s interpretation of the terms of the agreement must be carried out in favor of the counterparty of the transaction party who prepared the draft agreement or proposed the wording of the corresponding condition. Until proven otherwise, it is assumed that such a participant was a person who is a professional in the relevant field requiring special knowledge (for example, a bank under a loan agreement... etc., etc.) 2. Next, I ask the court to comprehensively, completely and objectively examine the evidence confirming the circumstances on which the applicant bases his claims, in their relationship in favor of maintaining rather than canceling obligations, as well as based on the presumption of reasonableness and good faith of participants in civil legal relations, enshrined in Art. 10 Civil Code of the Russian Federation. At the same time, since according to paragraph 4 of Art. 1 of the Civil Code of the Russian Federation, no one has the right to take advantage of their unfair behavior; the weaker party to the contract has the right to declare the inadmissibility of applying unfair contractual terms on the basis of Art. 10 of the Civil Code of the Russian Federation or the nullity of such conditions under Art. 169 of the Civil Code of the Russian Federation. Taking into account the fact that in the period from the date of signing the agreement to the present day, the borrower and the lender did not agree on the relevant term of the agreement (the currency clause), which relates to the essential ones, but then joint actions to execute the agreement and its acceptance did not eliminate the need for agreeing to such a condition, I ask the court to consider the contract not concluded in this part. Further, if there is a dispute about the conclusion of the agreement, I consider it necessary to inform that before concluding the loan agreement, the bank manager assured us of the sufficient stability of the US dollar exchange rate and the profitability of the proposed loan, which then determined the choice in favor of the amount in dollars. At that time, this was an absolutely normal and widespread practice, when a currency corridor was in effect, supported by the Central Bank of Russia for 10 years. In this regard, the bank strongly recommended taking out a loan in foreign currency. The bank's argument was that in any case the risk of a foreign currency loan is minimal. According to the Central Bank of Russia, the dynamics of the US dollar exchange rate, which are presented on the website of the Central Bank of Russia for the entire period of validity of my loan obligations on an average annual basis, indicates “parity” deviations of the Central Bank of Russia exchange rate during the 7-8 years of the agreement in the range of -3% up to +20%: 2007 -24.95 rubles, 2008 -24.87 rubles, 2009 -32.36 rubles, 2010 -30.13 rubles, 2011 -29 .77 rubles, 2012 -31.08 rubles, 2013 -31.47 rubles, 2014 -39.38 rubles. It was the last dynamic exchange rate as of October 1, 2014 that was recommended by the Central Bank of Russia in a letter dated January 23, 2015 for recalculating the debt of Raiffeisenbank JSC, allowing the latter to restructure foreign currency mortgages without the obligatory additional accrual of reserves, but, unfortunately, it was completely ignored creditor to take reciprocal steps. When issuing a loan, 40% of my monthly income was taken by Raiffeisenbank JSC as the basis for calculating the available loan amount in US dollars, which thereby provided the opportunity for borrowers to show the necessary care and reasonable prudence during a period when the financial and economic situation in the country is not raised doubts neither among the giant bank, nor among the President of Russia, nor among us. These income and credit parameters are still used today on the Raiffeisenbank JSC website in the mortgage calculator and at the same time are the initial conditions when concluding a loan agreement for a certain loan amount in rubles, and also serve as an essential condition for the borrower to fulfill its financial obligations. Today, the standard restructuring programs offered by Raiffeisenbank JSC, in fact, either further increase the burden on my family’s budget, which is already unbearable today, or (or in addition) - while remaining “tied” to the US dollar exchange rate - fix default, irrevocable and enslaving obligations, simultaneously increasing and prolonging the income of the giant bank and completely ignoring the debt burden on the borrower himself. The borrower could not foresee an increase in the monthly payment by 2-3 times higher than the average monthly income in Moscow, otherwise this transaction is enslaving and void by law. All this has no meaning for the creditor, for whom, as it turns out, there are no moral standards. The last time the bank offered me to pay 150% of my salary until I reach the age of 60. In accordance with Art. 450 of the Civil Code of the Russian Federation, amendment and termination of the contract are possible by agreement of the parties, unless otherwise provided by this Code, other laws or the contract. At the request of one of the parties, the contract can be changed or terminated by a court decision only: 1) in the event of a significant violation of the contract by the other party; 2) in other cases provided for by this Code, other laws or agreement. A violation of the contract by one of the parties is considered significant, which entails such damage for the other party that it is significantly deprived of what it had the right to count on when concluding the contract. According to paragraph 2 of Art. 451 of the Civil Code of the Russian Federation, if the parties have not reached an agreement to bring the contract into compliance with significantly changed circumstances or to terminate it, the contract may be terminated, and on the grounds provided for in paragraph 4 of this article, changed by the court at the request of the interested party if the following conditions are simultaneously present:

1) at the time of concluding the contract, the parties assumed that such a change in circumstances would not occur; 2) the change in circumstances was caused by reasons that the interested party could not overcome after their occurrence with the degree of care and prudence that was required of it by the nature of the contract and the conditions of turnover; 3) execution of the contract without changing its terms would so violate the relationship of property interests of the parties corresponding to the contract and would entail such damage for the interested party that it would largely lose what it had the right to count on when concluding the contract; 4) it does not follow from business customs or the essence of the contract that the risk of changes in circumstances is borne by the interested party. Consequently, I make a demand to the court to change the contract, taking into account that if the parties have not reached an agreement to bring the contract into compliance with significantly changed circumstances (or its termination), the contract can be terminated or changed by the court at the request of the interested party if the conditions listed are met in Art. 451 of the Civil Code of the Russian Federation, and arose for objective reasons not through the fault of the borrower (the debt burden on the borrower has increased by 155% since its signing). If the contract is terminated due to significantly changed circumstances, the court, at the request of either party, determines the consequences of termination of the contract, based on the need for a fair distribution between the parties of the costs incurred by them in connection with the execution of the contract. Changing the contract due to a significant change in circumstances is permitted in exceptional cases when termination of the contract is contrary to public interests or will entail damage for the parties that significantly exceeds the costs necessary to perform on the terms changed by the court. If the borrower, when concluding a mortgage agreement, did not pursue the goal of making a profit, but merely exercised his constitutional right to housing, then all commercial risks are entirely transferred to another party to the mortgage agreement - a commercial bank, since for him a mortgage is a commercial transaction, the goal which is the receipt of profit and excess profit. And the bank, if it considers it necessary, can insure these risks, but exclusively at its own expense. Based on this, as a result of a dispute about currency risks, I ask the court to confirm that the purpose pursued by the borrower when concluding a mortgage agreement was the latter’s acquisition of a one-room apartment as the exercise of his constitutional right to housing. Since this mortgaged housing is the only one for the borrower and does not exceed standard living standards, the court can divide the currency risks between the parties to the agreement on a fair and parity basis and make a decision in favor of the borrower. IN THE CONCLUSION OF THE ACCOUNTS CHAMBER of the Russian Federation dated April 16, 2015 No. ZSP-88/06-01 on bill No. 700708-6 “On the restructuring of citizens’ obligations under credit agreements and loan agreements, expressed in foreign currency, into the currency of the Russian Federation,” paragraph 3 reads : “It should be noted that the choice by individuals of credit products that assume foreign currency as the contract currency was due to a lower interest rate compared to loans in rubles, but initially implied the acceptance by both banks and borrowers of an increased risk of changes in currency exchange rates , since currency risks are an integral element of loan relations using two or more currencies.” Debt obligations have a higher priority in such “mezzanine” financing, which only benefits the bank. In Russian legislation, the creditor providing borrowed funds is much more protected by bankruptcy law compared to the owner of the apartment, since borrowed funds are repaid first, and the owner’s accumulated investments are repaid last. Moreover, even in the event of a forced bankruptcy of the borrower at the request of the bank due to the inflated amount of the applicant’s claims in ruble equivalent, the principle of fairness for the loan agreement in question is violated, since to compensate financial losses for the sums of money sent by me to the profit of the giant bank within 7- 8 years is not possible. Taking into account the above, where there is a direct connection between the loan agreement (mortgage) and the purchase and sale agreement for a one-room apartment by bona fide buyers who made their down payment on July 20, 2007 under the purchase and sale agreement 1-k. apartment in the amount of $27,000.00, while the fate of the balance of the principal debt in 2015 at the US dollar exchange rate, which was 2-3 times higher than the rate of the Central Bank of Russia on the date of the agreement, is in question, and therefore the amount of debt as of 12.10. 2015, expressed in US dollars, will not allow it to be repaid even by 80% of the market value of the property when recalculated into rubles, and since the balance of the loan debt at the current rate is even HIGHER, and the amount of the claim is not settled in rubles due to necessity agreeing on the market value of the subject of the mortgage between the parties to the agreement in an additional agreement, I am forced to go to court with a private complaint against the actions of the lender and his attempt to unjustly enrich the bank in the amount of unrealized exchange rate difference +3,500,000.00RUB. (according to paragraphs 1 and 2 of Article 350 of the Civil Code of the Russian Federation). 3. The loan agreement was initially aimed at infringing on the rights of the consumer, since the terms of the agreement did not contain the necessary currency clause regarding the possible minimums and maximums of the US dollar exchange rate during the period of debt repayment. According to the Central Bank of Russia, on the day of signing the loan agreement (07/20/2007), the dollar exchange rate against the ruble was 1 US dollar = 25.4401 RUB, respectively, the amount of the monthly payment was about 35,000.00 RUB ($1,403.15 × 25.4401). Currently (11.11.2015) the dollar exchange rate against the ruble is 1 US dollar = 64.3908 rubles, thus, the monthly payment has increased to 110,000.00RUB ($1,480.06x64.3908) by 155%. The above is a significant change in the circumstances from which the borrower proceeded when concluding the agreement. I could not foresee the increase in the monthly payment, which now exceeds the average monthly income in Moscow by 2-3 times, otherwise this transaction is enslaving and void by law (since under worse conditions the borrower would hardly have agreed to take out a mortgage loan). In 2015, the rate charged by the bank was 3.65 times higher than the nominal interest rate of 9.9% on the loan and exceeded the Lombard rate as a result of the debt load in rubles having increased by 3 times and the application of penalties by the lender (increased by another 3 times ) in the form of a penalty of 36.5% on the entire amount of the outstanding balance in US dollars). And this is taking into account the fact that at the turn of 2014-2015 there was a devaluation of the ruble, which was unexpected on the part of Raiffeisenbank JSC with its threshold of professionalism, and at the same time, with all the degree of care and prudence on the part of the borrower, it was not accepted by JSC " Raiffeisenbank" into the calculation of its own risks, as evidenced by the obvious fact that only on November 6, 2014, the bank introduced a program for refinancing foreign currency loans into rubles for its own borrowers, and until that time it was valid only for clients of third-party banks, due to than the borrower repeatedly (9 times) contacted the bank with an application for refinancing in rubles. Thus, Raiffeisenbank JSC demonstrates a completely inadequate “DIFFERENCE IN RELATIONSHIP” (this slogan is borrowed from its “universal” advertising today on TV channels: First, NTV, RBC, Russia 2, Russia 24) - an increase in interest on the loan by 9 times to sky-high values in response to statements from a loyal client about refinancing, ignored by the lender 9 times along with the recommendation of the Central Bank of Russia, as a mega-regulator, to use the US dollar exchange rate as of October 1, 2014 for restructuring 39.38 rubles/$. Taking into account the above, I believe that sufficient evidence has been presented that Raiffeisenbank JSC is abusing its right arising from a contractual provision that is different from the dispositive norm or precluding its application, or is abusing its right based on a mandatory norm, and in this case I ask the court, taking into account the nature and consequences of the abuse, to give a proper assessment of these verifiable circumstances, and to refuse to protect the creditor’s right in whole or in part, or to apply other measures provided for by law (clause 2 of Article 10 of the Civil Code of the Russian Federation). From July 2, 2015, the creditor forcibly collects a penalty in the form of a penalty in the amount of 0.1% for each calendar day for the entire amount of debt in US dollars, which is 36.5% per annum in foreign currency and significantly exceeds the current interest rate under the agreement 9.9 % (3.69 times). In Art. 10 of the Civil Code of the Russian Federation establishes that actions of legal entities and individuals carried out solely with the intention of causing harm to another person are not allowed, as well as abuse of rights in other forms, as well as the right of the court to refuse in this case to protect the rights belonging to him. In relation to us, as bona fide buyers of the only home and at the same time disciplined foreign currency borrowers, who find themselves in a difficult financial situation and life situation due to the devaluation of the ruble and who are taking all actions to reach an amicable agreement in the conditions of the financial and economic crisis, Raiffeisenbank JSC shows a frontal , cynical, rude non-recognition of the difficult financial situation of borrowers and irresponsibly exercises his subjective right, which consists in using a specific form of implementation in the form of charging penalties on the entire balance of loan debt at a rate of 36.5% per annum with capitalization for each month, which is contrary to the social purpose rights and is aimed at causing maximum harm to borrowers. And this, unfortunately, is not the only case of abuse/illegal inaction or malicious infringement of consumer rights on the part of the bank. 4. In addition, it should be noted that in the Zyuzinsky Court of Moscow, in separate proceedings, a statement of claim is pending on the part of the plaintiffs Kryuchkova E.V. and Kryuchkova E.V. to the defendant Raiffeisenbank JSC to recognize the terms of the loan agreement as partially invalid, to collect the amount of the commission for granting the loan, interest for the use of other people's funds in the amount of 2,613.69 US dollars and compensation for moral damage in the amount of 50%. In connection with the illegal commission paid by the plaintiffs for granting a loan in the amount of 1.0%, as well as the illegal priority collection of a penalty, and a unilateral change in the loan repayment period, the borrowers do not agree with the amount that the bank charged in its claim and demand that the illegal commission be offset against debt repayment account. The account of such situations related to the violation of the legal rights of consumers, which primarily relate to the bank with foreign capital JSC Raiffeisenbank, already goes beyond the manifestation of “maximum” loyalty to its own clients with a “negative” difference in attitude. The inclusion in the loan agreement of a clause allowing the bank to unilaterally change the essential terms of the agreement regarding the repayment period does not meet the requirements provided for in paragraph 1 of Art. 310 of the Civil Code of the Russian Federation, since in relations with citizens unilateral changes in obligations are not allowed unless otherwise established by law, therefore, such conditions infringe on the rights of the consumer in comparison with those established by law, and also lead to failure by the creditor to fulfill the obligations assumed when concluding the contract, which leads to to the invalidity of Article 5 of the loan agreement. 5. Further, for early repayment of the mortgage loan during the first 5 years, the bank used legal sanctions in the contract in the amount of 4% of the early payment amount and deprived us of the opportunity to make partial or early repayment of the loan without penalty within 5 years from the date of loan issuance. However, in the period from February 2012 to July 2013, I made an early repayment of the loan in the total amount of $12,050.00, which automatically reduced the loan payment schedule by 21 months, but is now not taken into account by the bank for providing borrowers with a vital deferment in making payments under the loan agreement to bring it into line with the originally established loan repayment deadline of June 24, 2022. In connection with the above facts, I, as a disciplined borrower, who had never previously been listed as “overdue” and faced one alone with a serious socio-economic problem, I have the right for the bank to compromise and carry out a fair restructuring and reduce its appetite for excess profits. Clause 5.4 of the loan agreement on the right of the lender to make a demand for early fulfillment of the obligation to repay the loan in the event of a deterioration in the financial condition of the borrower (loss of job, etc.) contradicts current legislation, recommendations of regulatory and supervisory authorities (Administration of the President of the Russian Federation, Central Bank of Russia, Government of the Russian Federation, State Duma , AHML, Rospotrebnadzor) on the restructuring of foreign currency mortgages and violates the rights of consumer borrowers, because: 1. I conscientiously warned the lender in advance (06/06/2014) about the existing extremely difficult currency situation in order to obtain a deferment on the payment of the principal debt and offered options solving the problem. 2. I asked the creditor what options/programs there are for other debt repayment, restructuring (10/8/2011, 02/20/2012, 08/10/2013, 08/19/2013, 05/27/2014, 08/22. 2014, 11/13/2014, 05/28/2015, 06/05/2015), which options are easier or more difficult when making decisions, who is the authorized person from the credit administration making such decisions, and none of the bank employees The giant did not propose to change the loan repayment procedure to reduce the size of the monthly payment, or to temporarily suspend the accrual of penalties for late payments, taking into account the deterioration of the borrower’s financial situation. 3. I actually took all actions to convince the creditor not to apply legal sanctions in connection with the search for work and foreign exchange earnings, participating since July 2, 2015 in an open competition for positions within the financial and administrative department of the Council of Europe and the European Court of Rights Human. 4. I actively took part in consultations with AHML, which was already capitalized at 700 billion. rub. from the government's anti-crisis fund, and with which Raiffeisenbank JSC refuses to work. Despite the existing mechanism of state support, according to which the bank converts a foreign currency mortgage into rubles at a preferential rate of the Bank of Russia on the date of restructuring, while 50% of the loss is compensated by AHML JSC, and 50% is assumed by the lender, and the restructuring is carried out at a rate no higher interest rate on a current loan. JSC Raiffeisenbank could not even transfer rights under a mortgage on the Russian market either through external securitization or under the ongoing program to assist borrowers who find themselves in a difficult financial situation, since it has not yet concluded a cooperation agreement with JSC AHML. 5. I am taking active steps to reduce foreign currency obligations in connection with the creditor’s obvious failure to comply with the letter of the Central Bank of Russia dated January 23, 2015 and for obviously inflated interest rates, hoping that my conscientious behavior will lead to adequate retaliatory measures on the part of the creditor / offset of the illegal commission towards repayment debt and cancellation of penalties. Therefore, with regard to penalties after a unilateral refusal to fulfill the agreement by the bank with a change in the deadline for early repayment of the entire amount of the debt, I ask the court to assess the proportionality of the violation and the ensuing consequences of failure to fulfill obligations in the amount of the claim, filed without taking into account the different terms of payment in installments. I also ask the court to check the correctness of the amount of penalties for the amount of late payments under the contract, as opposed to the amount of penalties for the overdue principal debt. Further, the amount of the lender's costs is not disproportionate to the profit received by the latter from changes in the exchange rate, taking into account the increase in the US dollar exchange rate by 2-3 times in the period from the date of conclusion of the agreement to today in the amount of 1 million rubles and its terms as a whole, thus, it can be recognized unfair and the court did not apply the condition on the obligation of the weak party to the contract, exercising its right to unilaterally refuse the contract, to pay for this a sum of money in the form of a negative exchange rate difference of +3,500,000.00 rubles, which is clearly disproportionate to the losses incurred by the bank. I ask the court to take into account the requirements of Art. 333 of the Civil Code of the Russian Federation and the complexity of the financial situation of borrowers who have developed negative cooperation with the lender due to shifting all responsibility onto the borrower in the amount of a negative exchange rate difference, even exceeding the amount of the initially established loan amount in rubles, reduce penalties for overdue principal debt of the loan and penalties for overdue interest . Further, in accordance with paragraph 1 of Art. 367 of the Civil Code of the Russian Federation, a guarantee is terminated with the termination of the obligation secured by it, as well as in the event of a change in this obligation, entailing an increase in liability or other adverse consequences for the guarantor, without the consent of the latter. Since the agreement was an agreement of adhesion, and such consent on the part of Kryuchkova E.V. Raiffeisenbank JSC was not received, and a settlement cannot be concluded before the judicial stage, then in order to restore my solvency, I ask the court to verify whether there is an consent of the guarantor in case of signing such a settlement agreement, since the lack of appropriate consent may be legally significant for determining for determining the size of the civil liability of each of the payers of the loan for the permissible delay in payments under the contract. Therefore, 1. I ask the court to assess the controversial conditions in conjunction with all the terms of the contract and taking into account all the circumstances of the case, as well as the ratio of property interests as a result of a significant change in circumstances during the execution of the loan agreement. The banks themselves explain this situation by the impossibility of an objective assessment of collaterals in the current period, when it is not clear what exactly will be with the national currency. It complicates the position of foreign exchange borrowers against the backdrop of sanctions by Europe and the economic crisis and the tough position of the Western giant bank, which does not follow the instructions of higher authorities to resolve it and does not meet its borrowers-after numerous official requests-to approach the restructuring of it individually. In the case of the implementation of the pledged property according to the scheme of Raiffeisenbank JSC, which has compiled a claim for early repayment of the loan as a unilateral refusal to fulfill the contract by virtue of clause 3 of Article 450 of the Civil Code of the Russian Federation, I declare the court a requirement to terminate the contract and the return of my overpayment within six months under an agreement recorded at the rate above 39.38 rubles/$, starting from payment under the agreement on 10.24.2014. 2. I also ask the court to determine, in relation to specific conditions, the possibility of changing the loan currency while changing other significant loan parameters. Since the borrower was faced with a change in the amount of the monthly payment by 2-3 times, and its size was significantly increased as a result of the appropriation by the creditor of penalties by more than 3 times, I also apply to the court with a statement on the revision of the terms of the loan agreement in rubles in the amount, equivalent to the US $ 909.34 equivalent to 07/27/2015, taking into account the fair separation of foreign exchange risks between the parties to the agreement on a parity basis. 3. Increasing the interest rate, together with the requirement to return the amount of debt, significantly violates the rights of borrowers who, with the usual monthly repayment of the debt, would pay a substantially shorter amount of interest, and then provokes the borrower to failure to comply with obligations, therefore, the measures under consideration should be applied to the creditor in the most extreme cases, And they can only mean a difficult financial situation in the Raiffeisenbank JSC itself, which the Government of the Russian Federation included in the top ten socially significant, extending it with anti -crisis measures before January 1, 2021 and providing all the possibilities for fair restructuring of foreign exchange loans for borrowers. 4. Over the past 7-8 years, not a single precedent of violation of the terms of the contract has been committed on my part, and in the current situation of falling real estate prices, together with a decrease in the cost of a pledge in US dollars, a measure of foreclosure on the housing of a borrower without fixing the ruble value of the size The claims of the creditor are unlawful. Given the fact that the disputed apartment is the only one available to Kryuchkov E.V. Both Kryuchkova E.V., and the fact that the highest level was announced about the prevention of the eviction of debtors from only housing, as this threatens us as conscientious borrowers with a violation of human rights and casts doubt on the reputation of a socially significant bank, which is trying to squeeze everything out of everything From their borrowers to the maximum, not at all wanting to facilitate their credit burden - I ask the court as a counter claim to oblige Raiffeisenbank JSC to recalculate the stated requirements with the credit of the illegally paid commission and interest for illegal use of other people's funds in the total amount of the lawsuit 2,613.69 US dollars, demanded by borrowers on 09/22/2015 in the Zyuzinsky District Court, as well as taking into account the parity of the course difference between the parties to the loan agreement. 5. My situation is absolutely typical for most currency borrowers. None of us refuses to fulfill the necessary conditions for the restoration of paymentness and fair restructuring, including converting into rubles, taking into account the interests of both borrowers and a bank. However, I consider our requirement for Raiffeisenbank JSC to revise these conditions and the transition to new, adequate to the current state of the economy and a sharp decrease in real income in the currency, as well as an increase in the cost of life in Russia.

Valid reasons for non-payment

The nature of non-payment of mortgage payments varies. Someone does not pay deliberately, believing that the bank will not take away the mortgage on the apartment. Someone is faced with a difficult life situation, which means there is a lack of money to pay off collateral obligations.

Valid reasons for non-payment of mortgage:

- difficult financial situation;

- layoffs at work, serious illness, unforeseen expenses;

- violation of the terms of the loan agreement due to ignorance (this also happens);

- committing a crime with further serving the sentence in places of deprivation of liberty (Read, “How to discharge a convicted person from an apartment or private house”);

- death of the primary mortgage borrower.

Naturally, no one will take your word for it - you will need to prove the presence of a good reason. This could be a certificate of employment, a dismissal order, a death certificate, a copy of a court verdict, etc.

You should not think that good reasons are a release from previously assumed obligations to fulfill the mortgage agreement. Quite the opposite. Lenders are accommodating to conscientious payers, and good reasons are just time to take a breath or change the payment schedule.

What can a debtor do when moving out?

It is self-evident that the reasons for non-payment can be different and, most often, have a well-reasoned basis. For example, a complication of the financial situation due to the loss of a job or a difficult life situation, incorrect interpretation of the terms of the contract, prolonged illness, etc.

If the reason is truly valid, then the debtor has the right to contact the bank at any time, writing an application with a request to make concessions (give installments, reduce the mortgage rate, etc.).

Application form for a reduction in mortgage interest to Sberbank

It should be accompanied by documentary evidence of the valid reason why he cannot make payments as before.

For your information, eviction of a debtor and repossession of housing is an extreme measure in which the bank is essentially not interested. It involves unnecessary time, financial expenses and risks. Therefore, it is more profitable for both parties to settle the issue out of court.

If, nevertheless, the bank proceeds with eviction and repossession of housing, the debtor has the right:

- Challenge the housing assessment in court.

- Appeal the decision.

If the seizure was made with violations, then a challenge (appeal) will enable the debtor to restore his rights. It is also possible that these actions will allow him to gain time, delay the eviction, or even reduce the debt.

It will take time to challenge or appeal. During this period, the debtor can improve his financial situation. Then he will be able to resolve the issue with the bank peacefully, continuing to make the required payments.

How are tenants evicted from a mortgaged apartment for debts?

The issue of eviction of the owner from mortgaged housing is resolved in court. The procedure takes place in several stages:

- The bank identifies loan debt that has not been repaid for a long time.

- The client is given a notice requesting that the debt be eliminated.

- Attempts are being made to resolve the dispute out of court (postponement, restructuring, reduction in payment).

- A claim is filed in court to collect the debt and seize property to pay the debt.

- After a court decision is made, the property is sold at auction.

- The owner is being evicted from the apartment.

If the property cannot be sold, it becomes the property of the bank. He has the right to decide the fate of the apartment at his own discretion.

Notifying the borrower is a mandatory condition before going to court. If the procedure is not followed, the bank may receive a refusal. The claim must contain the final amount of the debt and the deadline for its liquidation. After the debtor receives the notice, he must pay the bank in full.

Can they be evicted if there is a mortgage debt and the only place to live?

Question:

Hello!

We took out a mortgage in 2021, entered into an agreement with the bank and discussed a monthly payment schedule. We didn't have children, so we both worked. At first, there was enough money for both living and mortgage payments. But then my husband lost his job, and my earnings were only enough for groceries and utility bills. We immediately notified the bank, but the debt to it is still accumulating. Can the bank now take away the apartment and evict us onto the street, given that we have no other housing?

Lawyer's explanation:

Good afternoon.

It is not profitable for the bank to evict the borrower and his family due to non-payment of mortgage payments. Even if the housing is put up under the hammer, the bank will receive a much smaller amount than the market value of the apartment.

It's good that you informed the bank. Write a statement asking to resolve your situation and meet halfway. Usually in such cases banks do not refuse and try to help.

What can help in case of debt on a mortgage apartment:

- debt restructuring (installment plan) – reducing the amount of payments to be paid with an extension of the payment period;

The total amount will increase, but it can be repaid in small installments over a longer period than usual.

- “credit holidays” (deferment) – shifting the payment schedule for several months or six months;

- write-off of interest, fines, penalties - at the discretion of the banking institution;

- application for the State Program “Housing” - suitable for young families facing financial difficulties.

If you do not take care of payments in advance, the bank has the right to file a claim in court in order to seize the collateral apartment. A positive court verdict is grounds for eviction of the debtor and his family members. Moreover, it does not matter whether this is the borrower’s only home or whether he has alternative living space - the mortgaged apartment will go towards debt collection (Article 334 of the Civil Code of the Russian Federation).

However, you need to remember that you will not be evicted until the court issues an appropriate decision. That is why try to agree with the court on a deferment - if your husband is looking for a job, or on installment payments with the bank - if you can pay off the debt in installments.

Who has the right to evict from a mortgaged apartment?

Eviction from a mortgaged apartment can be carried out either by bailiffs or by the creditor himself, on the basis of a court decision (Article 55 of the Federal Law No. 102 provides for the eviction of a debtor from a mortgaged apartment by the creditor if this condition is specified in the agreement). When a debtor is evicted by bailiffs, Federal Law No. 229 applies; the seizure of the mortgaged apartment occurs as part of enforcement proceedings. Based on Art. 107 FZ-229, the bailiff must notify the debtor of the voluntary release of the mortgaged apartment no later than 10 days from the date of receipt of the written notification. If this requirement is ignored, the debtor is given a second deadline with an enforcement fee. The eviction procedure takes place in the presence of witnesses and police officers; if necessary, the bailiffs have the right to call the Ministry of Emergency Situations officers to vacate the apartment. The bailiff can provide the debtor with the service of transporting and storing personal property for a period of no more than 2 months. If the eviction is carried out directly by the lender, this procedure is carried out by agreement of both parties. If the debtor still refuses to vacate the mortgaged apartment, eviction will take place in the presence of prosecutors in an administrative manner or through the court.

Important! Any actions to evict a borrower-debtor from a mortgaged apartment without a court decision can be challenged by the debtor in court with satisfaction of his demands.

Eviction of a child from privatized housing

Discharge of a minor from a privatized apartment can occur in two ways:

- voluntarily;

- forcibly.

His legal representatives can voluntarily discharge a child, and if the minor has reached 14 years of age, then his consent is required. Forced deregistration occurs through the court and is most often initiated by the owner of the apartment. Also in this case, the consent of the guardianship authorities will be required, since it is necessary for the child in the new place of residence to be provided with conditions no worse than in the old home.

In order to determine the procedure that is necessary to evict a minor from an apartment, it is necessary to determine whether the legal representatives agree to the eviction or not.

The procedure for eviction through the Department of Internal Affairs of the Ministry of Internal Affairs

If the parents have a positive decision or they themselves are the initiators, then everything is simple - you need to contact the Department of Migration Affairs of the Ministry of Internal Affairs of Russia (Department for Migration Issues, formerly the Federal Migration Service of the Russian Federation) and write a corresponding application according to the sample. Then, within the prescribed period, the child is discharged from the apartment.

To register at a new place of residence, you must contact the Department of Internal Affairs of the Ministry of Internal Affairs of the Russian Federation serving this territory and write a corresponding application, as well as provide:

- title documents (property registration certificate, lease agreement, etc.);

- birth certificate or passport of the minor;

- passport of the legal representative;

- certificate of discharge from previous place.

Extract and registration services do not require payment of state fees.

To minimize time costs, you can immediately contact the government agency at your new place of residence. Write an application, provide the same documents, and the child will be simultaneously deregistered in the old apartment and placed at a new address.

Order and procedure for eviction through court

If it was not possible to agree with the legal representatives of the minor on his voluntary removal from the privatized apartment, then the owner must apply to the court of general jurisdiction that serves the territory in which the apartment from which the minor needs to be evicted is located.

Statement of claim for eviction of children

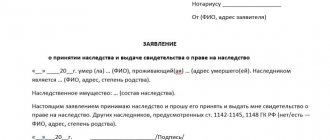

A statement of claim in which the apartment owner demands to evict a minor from his apartment is drawn up according to the general rule enshrined in the Civil Procedure Code of the Russian Federation. It should contain the following information:

- the correct name of the judicial body that will hear the case;

- personal data of the plaintiff;

- contact details of the defendant;

- name of the claim;

- the circumstances due to which the controversial situation arose must be described briefly, without unnecessary “water,” but in detail;

- your requirements and their motivation with links to regulations;

- evidence of the validity of the application with references to documents, testimony of witnesses;

- date of compilation, signature of the plaintiff;

- a list of attached documents and contact details of witnesses whom the plaintiff wishes to hear at the trial.

Attached documents

The statement of claim for termination of a minor’s right to use a privatized apartment must be accompanied by:

- a document establishing ownership of the apartment;

- plaintiff's passport;

- an extract from the house register;

- consent of the guardianship authorities (if necessary);

- receipt of payment of state duty;

- other documents that prove the validity of the eviction requirements.

Timing and cost

Since the claim for eviction from an apartment belongs to the category of non-property disputes, it is necessary to pay a state fee to the court of first instance in the amount of 300 rubles. Details for transferring funds can be obtained from the court office or the receipt itself can be generated on the official website of the judicial authority.

But the review period can vary from several weeks to several months. It all depends on the positions of the parties to the dispute. If no one objects to the child’s removal from the apartment, and all the necessary documents are collected, then the judge’s decision-making period will not take more than two months.

Example. The owner of the apartment, Ponomareva, registered her friend Luneva and her minor daughter with her, since the latter needed to enroll in a school that serves the area in which Ponomareva lives. Luneva and her daughter lived at a different address. After 2 years, the owner decided to sell her living space and asked Luneva to check out, but she refused to do it voluntarily and demanded 10,000 rubles for the checkout.

Ponomareva turned to a lawyer for advice. He explained to her that she had the right to file a lawsuit not for ejection from the apartment of Luneva and her daughter, but for deprivation of the right to use the apartment. He helped to formalize it, collect the necessary documents and represented her interests in court. As a result, the judge ruled in favor of Ponomareva and deprived Luneva and her daughter of the right to use the apartment.

Ponomareva contacted the passport office and, within three days, discharged her friend from the apartment. And regarding Luneva’s demand for money for discharge, she contacted the police.

Procedure for eviction from a mortgaged apartment

Eviction for loan debt takes place in three stages:

- The borrower must be in arrears in payments on the loan, the collateral of which is the purchased property;

- A banking organization files a claim in court to collect debt under a loan agreement. The foreclosure is applied to the mortgaged property - a mortgaged apartment.

- The court satisfies the creditor's requirements and the method of selling the mortgaged property, usually a public auction.

Ownership of the sold apartment passes to the winning bidder. If the apartment could not be sold at auction, it is transferred to the ownership of the bank, which can subsequently dispose of it at its discretion.

What can you do if you are evicted from your mortgaged home?

It is not very profitable for a banking organization to evict a client and sell residential premises at a reduced price.

The lender tries to find a compromise, so the situation can be resolved by the following methods:

- The best way to resolve the issue is to restructure the loan. It is used to reduce the amount of payments.

- They provide credit holidays (for a specific period of time).

- The lender has another chance to provide support to the borrower - by writing off part of the interest, penalties and other payments.

- If the borrower can use support from the state, it is possible to submit special documentation. Part of the loan will be repaid by the state.

If suddenly the housing is taken away, the banking organization will spend time and effort on its implementation, so this method is considered the most extreme - they try to use it as little as possible.

Attention! If the borrower’s mortgaged housing turns out to be his only one, the problem of the bank’s further housing issue is no longer concerned.

How to avoid eviction?

It is not profitable for the bank to evict a defaulter from a mortgaged apartment. Therefore, he is trying to solve the debt problem out of court.

The owner has the right to count on the following assistance:

- debt restructuring – the monthly payment is reduced by increasing the period of validity of the loan agreement;

- credit holidays – the debtor is exempt from part of the payments for up to six months;

- forgiveness of part of the debt - the bank writes off interest, penalties or fines;

- government programs - mortgage subsidies, maternity capital, military mortgages.

If there are good reasons, the mortgagee will make concessions. You will need to confirm that the borrower cannot pay due to illness, job loss, retirement, or decreased income.

What to do for those who are facing eviction for mortgage debts

For those facing eviction due to mortgage debt, many municipalities offer temporary support in the form of a float fund.

A maneuverable fund is a type of residential property that is the property of a municipality, in which citizens who are faced with a difficult life situation and have lost their only home can live for some time.

Theoretically, citizens can live in such premises until they cope with financial difficulties. But the problem is that many municipalities do not have such a flexible fund, especially in small settlements, and even if they do, these residential premises, to put it mildly, are not very suitable for people to live in them.

Therefore, if the court decision has already entered into legal force and you are being evicted, then the only hope remains that the seized apartment will be quickly sold, and the proceeds from the sale will be enough not only to pay off mortgage debts, but there will still be some amount left that the bank will give you will return. Depending on how much of the mortgage has already been repaid before the debt accrues, this amount, which the bank will return, may be sufficient to purchase an inexpensive apartment, or to pay for rented housing, at least for the first time.

Indeed, there are few options for solving the eviction problem, and all of them are temporary. Therefore, if you are faced with a problem with paying off your mortgage, then the best solution for you would be not to take the matter to court, but to try to prevent eviction at the first stage, when there are many more options for getting out of the current situation.

It is not the best option to ignore the requirements of the credit institution and try to hide your “head in the sand” in the hope that everything will somehow work itself out. Not formed.

At the first sign that you are no longer able to pay the debt, you should contact a credit institution. If the bank has the opportunity to restructure or defer the payment of the debt, it will meet you halfway. If not, you will have evidence for the court that you are a bona fide payer and your debt arose for reasons beyond your control.

Based on judicial practice, courts always take into account good reasons for the resulting debt. A positive moment for you when the court makes a decision will be the fact that you:

- do not refuse to fulfill loan obligations;

- took measures to resolve the problem out of court.

This evidence will likely help you avoid eviction even if you have a large mortgage debt.

Summarizing the above, we can draw a number of conclusions.

- Eviction from a mortgaged apartment if you have a large debt is quite likely.

- Even a large family, if there is a case of malicious evasion of debt payment, can be evicted.

- Eviction from a residential premises occurs only on the basis of a court decision that has entered into force.

- All family members registered in the residential premises are evicted along with the debtor.

- A mortgaged apartment seized by the court is sold at auction, the proceeds from the sale go to repay the debt, interest, and other costs of the bank in collecting the debt, the remaining money is transferred to the debtor.

- If the bank has filed a claim and you are facing eviction for debts, do not try to solve the problem yourself, seek help from a competent lawyer. If there is even the slightest possibility of avoiding eviction, a lawyer will do everything to help you.

Is it possible to get a deferment?

By law, the court takes the creditor’s side, but it is possible to obtain a deferment on eviction. Strong arguments must be presented for the court to agree to such a decision.

In cases of eviction from mortgaged housing where a minor lives, legal representatives of parents - adoptive parents - can participate.

It is the responsibility of local self-government bodies to provide those evicted with any housing with small square footage, which can later be privatized. Often such flexible housing stock is available in new buildings. A person may lose his old apartment, but in exchange receive new housing. These are the paradoxes encountered in judicial practice.