Be that as it may, shared ownership can help a citizen out in cases where he does not have sufficient funds or the necessary intentions for a full-fledged legal transaction.

At the same time, it becomes clear to every citizen claiming this type of right that this procedure requires a more careful approach than in the case of ordinary property transactions. However, owning a share allows you to participate in all property transactions without exception, including exchanging it.

Legislative framework regulating the exchange of shares

An agreement for the exchange of shared ownership can be drawn up in a fairly free form, but have the basic parameters provided for by law for such documents.

The main one is the provision of Ch. 31 Civil Code of the Russian Federation. It formulates the basic terms of the transaction.

In addition, exchange participants should be familiar with the following articles:

- Civil Code: Art. 163, Art.

168, art. 169, art. 209 and Art. 567. And also: articles 177, 178, 179; 288, 289, 290; 549, 550, 551. - Housing Code: Art. 17, Art. 18, art. 30 and 37, 38, 39.

- Articles and 35 of the RF IC.

Read about what the legislation says about exchange contracts and non-privatized real estate here.

If other co-owners are against the deal

Since the law provides for mandatory notification of other co-owners of real estate about the upcoming alienation of part of the property, it is possible that the owners will object to the transaction. In this case, the owner of part of the apartment has three options:

- send a written notice to the co-owners and wait for a response within 30 days; if no response is received, you can conclude a deal without obstacles;

- allocate the exchanged part in kind, if such allocation does not contradict the law and does not cause damage to the property;

- refuse to enter into an agreement.

If other owners are notified, they will not be able to oppose the transaction without legal grounds. The only thing they can do is offer the owner to buy out his share.

Contents of the agreement

An agreement for exchanging a share of an apartment for an apartment or exchanging an apartment for a share in an apartment includes the fact of the transaction, while focusing on specific aspects of the procedure. The exchangers must clearly approve the conditions under which the transaction will be carried out, as well as through which the alienation and acceptance of the property of each party will be carried out.

The content of the agreement for the exchange of shares in an apartment includes the presentation of personal data of the owners of the shares, the presentation of the objects participating in the property transaction, based on the information reflected in the legal regulations and technical documents.

The main fragments of contractual terms are those that define the exchange process itself or the procedure that has become the only legal basis for recognizing the ownership of another share transferred to the owner in exchange for the alienated one.

This fact must be clear from the context of the document and not give rise to interpretation.

Therefore, any contract document must be drawn up concisely and legally correct. Below you can see a sample agreement for the exchange of real estate shares.

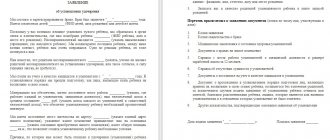

Sample agreement for the exchange of shares in an apartment (shares of an apartment).

The undercurrents that motivate the exchange should be expressed here Most likely, citizens will not enter into a deal without special reasons. These may include:

- change of area;

- extension;

- receiving additional payment.

These points must be reflected when drawing up the contract in order to avoid disputes as a result of its cancellation.

The conditions for cancellation and non-recognition of the contract must also be carefully spelled out, since if the specified conditions are not observed by one party, the other has the power to force compliance. Otherwise, it will have to be terminated.

This type of contractual relationship is characterized by the fact that in this aspect it is impossible to convey a specific spatial characteristic of a real object, that is, a place or part of the area in one of the rooms where the subject could legally be.

This type of right is virtual to a certain extent; it provides for the use of an object based on the rights certified in the contract, and subsequently in the act. Let's look at an approximate example of how a document can be compiled. BARGAIN AGREEMENT

Compiled on 08/31/10

We, Viktor Mikhailovich Boev, hereinafter referred to as “Party 1”, passport (specify details) on one side,

And Miroshnichenko Igor Vasilievich, hereinafter referred to as “Party 2”, passport (specify data) on the other hand, have drawn up this agreement as follows. 1. THE SUBJECT OF THE AGREEMENT

1.1. Each Party undertakes to transfer its share of ownership of the apartments in exchange for the other. Subject to the conditions specified below.

1.2. Party 1 transfers to Party 2, 1/6 share in the right of common shared ownership of the square. N 60, located in the house at the address: st. Sovetskaya 72. In exchange for Party 2's 1/2 share in the sq.m. owned by the right of shared ownership. N 8 in the house located at the address: lane. Tsurkova 220.

1.3. 1/6 share in the right of common shared ownership of the sq. N 60 in the house located at the address: st. Sovetskaya 2, belongs to Party 1 on the basis of a purchase and sale agreement (specify).

The ownership of Party 1 for a 1/6 share in the right of common shared ownership of the apartment was registered in the Sverdlovsk Regional State Committee for Property Management.

The apartment is located on the 3rd floor of a residential brick building, consists of 2 rooms, has a total area of 83.7 sq. m. m, living area 46.6 sq. m, utility area 9 sq. m. Cadastral number (specify), which is confirmed by cadastral passport No. (specify).

The inventory assessment of 1/6 of the share of the specified apartment is 240,000 rubles. (two hundred forty thousand).

1.4. 1/2 share in the right of common shared ownership of the sq. N 8 in the house located at the address: lane. Tsurkova220, belongs to Party 2 based on the right of inheritance (specify). The ownership right of Party 2 for a 1/2 share in the right of shared ownership of the apartment is registered in the Sverdlovsk Regional State Committee for Property Management. The apartment is located on the 2nd floor of a residential brick building, consists of 1 room, has a total area of 24 sq. m. m., living area 12.2 sq. m, without balcony and utility area. Cadastral N (specify) which is confirmed by cadastral passport No. (specify).

The inventory assessment of 1/2 share of the apartment is 442,000 rubles. (four hundred forty two thousand).

1.5. The parties guarantee that they are the owners of the transferred property, which is not under arrest, pledged, or encumbered by other grounds. 2. EXCHANGE PROCEDURE

2.1. The exchange is carried out simultaneously.

September 1, 2013 at the address: st. Sovetskaya 2, Party 1 transfers the property to Party 2.

1.09.2013 at the address: lane. Tsurkova 220, Party 2 transfers property to Party 1.

2.2. Ownership of shares in property rights passes to the Parties simultaneously upon fulfillment of the obligations to transfer rights to each of the Parties. 2.3. The property to be exchanged has different values.

The difference in the price of the exchanged property is 242,000 rubles. (two hundred forty-two thousand). This amount is due to be paid by Party 1 in favor of Party 2.

2.4. Payment must be made on September 2, 2013 as a result of the transfer of rights to a share in real estate by deed of transfer. 3. RESPONSIBILITY OF THE PARTIES

3.1. If the deadlines for payment of the difference are violated, Party 2 has the right to demand from Party 1 payment of a penalty in the amount of 300 rubles for each overdue day.

3.2. Violation of the agreed procedure or contractual deadlines for the transfer of property rights entails consequences for the unscrupulous Party and the possibility of requiring it to pay a penalty in the amount of 500 rubles for each day of delay. 3.3. For failure to fulfill obligations, each of the Parties is responsible based on the provisions of the Civil and Housing Codes of the Russian Federation. 4. FORCE MAJOR CIRCUMSTANCES

4.1. The parties are released from liability for complete (partial) failure to fulfill their obligations in the event of force majeure: extraordinary and unavoidable circumstances under the given conditions (list).

4.2. When they occur, the Parties are required to provide notification within 5 days.

4.4. If they continue to operate for more than 1 calendar month, the Parties have the right to terminate the Agreement. 5. FINAL PROVISIONS

5.1. This Agreement is drawn up in four copies having equal legal force.

5.2. The transfer of ownership of the specified shares in the ownership of apartments is subject to state registration in the cadastral records of the Sverdlovsk Regional State Property Committee.

Upon completion of the execution of contractual provisions, the texts of all copies must be signed by the subjects of the exchange and the required rights must be attached. The agreement without registration is invalid. Accordingly, the transaction must be entered into the accounts.

State duty, expenses

There are notary and government expenses when making an exchange of shares. Tariffs are standard, but depend on the situation in the region:

- certification from a notary – 0.5% of the contract amount , but not less than 300 rubles;

- notary services (UPTH) – from 1,000 to 7,000 rubles;

- drawing up a draft exchange agreement - from 500 rubles and above;

- The state duty for registration in Rosreestr is 2,000 rubles per owner .

It happens that money does not appear in the transaction, but this does not negate its connection with purchase and sale. Hence the calculation of the state duty for approval of the agreement by a notary - % of the agreement price.

Taxes

One of the responsibilities of exchange participants is to file a tax return on receipt of income from the transaction. The personal income tax rate is 13% of the difference between the cost of shares in apartments (for example, one costs 300,000 rubles, and the second 150,000 rubles - which means the difference is 150,000 rubles).

Additional documents and applications

When drawing up a contract, you will need to provide a passport, as well as:

- Legal and legal documents.

- Documents for technical and inventory information.

- Permissions from all co-owners to share in the right from each party.

- Permission from the spouse, in his absence, submit a statement about his absence.

- The act of accepting the transfer under the agreement for the exchange of shares.

Sample act of acceptance of transfer under an agreement for the exchange of shares (property).

In addition, it is necessary to draw up acts of alienation of the right and its acceptance by the other party.

This is very important in the sense that in some cases the information obtained during the presentation of a share in the right is strikingly different from the real state of affairs. On the basis of such an act, it will be possible to demand from the co-owners the unhindered observance of the right of use. Otherwise, the contract may be cancelled.

Is it possible to exchange upon entering into an inheritance?

Such operations are not prohibited by law. However, their direct implementation is permissible only after entering into inheritance rights and undergoing a standard notarial registration procedure. Then you will have to wait another 6 months to be able to dispose of the property without restrictions. This standard period is necessary to ensure that there are no other claimants to the inheritance.

Exchange of shares by inheritance

If there is no will, the heirs have the right to distribute the inheritance among themselves. By agreement between them, in the presence of a notary, shares can be exchanged.

For example, the testator owns an apartment, a country house and a car. Of the heirs, there are only two sons, who should receive ½ for each type of real estate. But the brothers made an agreement among themselves that the car and the country house would immediately become the property of one brother, the apartment - the other. The notary will prepare a certificate for each heir taking into account their agreement.

Moreover, if the market value of the distributed property is not the same, no one pays the difference to anyone.

If there is a will, it will not be possible to distribute the property by agreement. The notary will enter the relatives into the inheritance exclusively in the manner specified in the will, fulfilling the will of the testator. Then the heirs can re-register rights to the real estate through an exchange transaction.

Submission of documents

After a successfully completed property transaction, the parties will need to:

- Make 2 copies of documents.

- Attach 4 copies to the originals and copies of documents. contracts, 2 of which will remain in the State Property Committee, and one will be returned to each of the owners.

- Pay the state fee and attach receipts.

- Submit what is indicated for inclusion in cadastral records by writing an application.

Documents will be accepted against signature, and after 21 working days, upon presentation of a receipt and passport, new ones will be received.

Where to begin?

You need to advertise your home for sale. This can be done by contacting a real estate agency , or independently - through specialized websites or printed publications.

When a buyer has been found and has proven the seriousness of his intentions (made an advance or a deposit), you need to start looking for suitable options for purchase . This is done by analogy with finding a buyer for your property - through realtors or on your own.

Minor copyright holder

Parents often acquire a share in the right to their children and draw up an agreement for the exchange of shares of an apartment with the minor.

If they have not yet reached 18 years of age, this is not an obstacle to the transaction. To register a share, such a copyright holder needs a representative.

Typically, this role is played by parents who act in the interests of the child and have the right to sign instead.

In some cases, upon reaching the age of 14, with the permission of the parents and under their control, the copyright holder is able to personally sign documents confirming property rights.

Sample: agreement for the exchange of shares in an apartment with a minor.

Operation approval

If the child is not the owner of the property or a share in it, but is only registered , then there is no need to coordinate the exchange operation with anyone.

It is necessary to deregister it with the Federal Migration Service in advance and register it elsewhere (for example, with relatives or friends).

At least one of the parents must go through the same procedure with the child , since by law a child cannot live alone without a family.

Other Important Aspects

If the co-owners of the property are minors, you need to very carefully prepare the related exchange transaction . Everything related to the rights of minors is supervised by the guardianship authorities. There you will need to receive a document confirming their consent to the exchange. Trustee bodies control the equivalence of the exchanged shares of property so that the interests of the child are not infringed in any way.

In modern legal practice, all of the above-described options for related exchange of shares in housing are encountered. Such an exchange is carried out according to standard rules; no preferential treatment is provided for related persons. If a transaction results in a profit for one party or another, it becomes necessary to pay income tax.

What else to pay attention to

You should especially carefully check exchanges with shares of apartments of minors. Such situations are controlled by the guardianship and trusteeship authorities; in order to carry out the exchange, their consent must be obtained. The equivalence of the transferred and received parts of the property is checked to ensure that the interests of the child are fully respected.

All of the above methods are used in practice. The general rules do not provide any special advantages if the exchange of shares is carried out by relatives. Like other individuals, they are required to pay tax on their profits.

Three important exchange points: Rosreestr, notary, taxes

Regardless of the form in which relatives exchanged shares in the property they own, all documents related to the transaction are drawn up by a notary. The notary certifies the authenticity of contracts with his signature and seal.

The next step will be registration of new documents in the Unified State Register of Real Estate . It is done by the shareholders themselves (in the MFC) or by a notary. Registration of submitted documents is not an automatic process. First, the correctness of the exchange will be checked, the presence of encumbrances, injunctions, and debts in terms of real estate taxes. If everything is in order, new entries are made in the Rosreestr database - the real estate transaction can be considered completed.

The need to pay tax on a related exchange of shares arises if these shares have different values. This legal requirement remains in effect even if the price difference is minor. What can be exempt from income tax? The tenure of real estate is more than 3 years (if the property was registered before January 1, 2021) or more than 5 years (if after the above date). The personal income tax return must be submitted to the tax office no later than April 30 of the year following the conclusion of the transaction. Payment must be made by July 15 (inclusive).

Obtaining consent of co-owners

Any transaction needs careful preparation to prevent the possibility of it being declared invalid. Related exchange of shares is no exception. If the type of purchase and sale or exchange is chosen, the law requires written consent to complete the transaction given by the owners of the remaining shares of the apartment. The document must be certified by a notary.

The written consent form contains detailed conditions for the sale (or exchange) of shares. The response from the co-owners, according to the letter of the law, should be expected within one month. After this period, you can make a transaction. Naturally, the transaction is completed upon receipt of written consent from the other owners of the apartment.

Attention!

When making a gift between relatives, the law allows you not to contact co-owners for consent - you can immediately complete the transaction.

We must not forget about the role of the guardianship authorities: if one of the parties to the transaction is a minor, then these authorities will definitely be vigilant. Without their consent, it will not be possible to use maternity capital or change the child’s share to a smaller one.

Reasons for refusal of exchange by the administration

Local administration bodies have the right to refuse to carry out an exchange in several cases (Article 73 of the RF Housing Code):

- One of the premises is in disrepair,

- There is a court decision on the secured right to use housing,

- The building in which one of the apartments is located is in the plan for demolition,

- One of the parties to the transaction has a chronic disease that is dangerous to others,

- One of the houses needs major repairs,

- One of the apartments has the status of official housing, and, therefore, cannot be the subject of a transaction.

If the reason for refusal to exchange shares does not correspond to those listed above, then further resolution of the issue is possible only in court.