When property is seized, the debtor shouts in panic, “What should I do?!” and rushes to the lawyers. He begs to be told how to get by with little blood and not allow the innocent cat Barsik to be arrested. Yes, yes, there are legends about the treachery of bailiffs. To force the debtor to pay, they resort to the most brutal methods.

If you already owe money and can’t pay it off, go to a lawyer in advance. He will explain in detail what can be property and how to protect those dear to your heart from arrest. It will also offer an option for debt restructuring and advise on how to pay it off faster.

When property can be seized

An arrest can be made on the basis of a decision in criminal proceedings that has entered into force. Sometimes material assets or real estate are seized during the consideration of a claim, as a security measure at the request of the second party in the case. Most often, this measure is resorted to after a court decision in a civil lawsuit has entered into legal force.

Seizure of property is the last resort to encourage the debtor to pay the debt. Before resorting to it, the bailiff notifies that enforcement proceedings have been initiated against the debtor.

To voluntarily pay off the claim for property collection, 5 days are given. If it is not satisfied, a fine may be imposed. This is an enforcement fee, which is 7% of the total debt. Minimum amount: 1000 from an individual/individual and 10,000 from an organization.

If this amount is not paid, the fine increases - an individual or individual entrepreneur must pay 5,000, an organization - 50,000 rubles. And only when these sanctions remain unheeded do bailiffs take measures to search for material assets in property. In other words, property that can be seized to collect debt.

Bailiffs send requests to authorities that have information about the debtor’s possession of real estate and other material/monetary assets. These are Rosreestr, traffic police, etc.

As information is received about the presence of property suitable for seizure, a ban on registering transactions with it is sent to the relevant authorities. For example, to Rosreestr - for real estate, to the State Traffic Safety Inspectorate - for vehicles.

If the amount of debt is no more than 3,000 rubles, collection cannot be imposed (does not apply to money or collateral). However, if the defaulter has several debts and their total amount is more than 3,000 rubles, it is allowed to seize material assets.

It happens that the registration authorities do not have such information. Then the bailiff goes to the debtor’s registered address. There he checks for the presence of valuables that can be foreclosed on. If any are found, an inventory is made and a report is drawn up.

The inventory is drawn up in the presence of witnesses, things are immediately assessed - the bailiffs have an assessment methodology. If the preliminary cost is more than 30,000 rubles, the item is transferred to the appraiser. The form of the inventory act is approved by law.

Everyone present must sign the document. If desired, you are allowed to make adjustments or notify of disagreement.

The decision to impose a penalty and a copy of the inventory are transferred to the participants the next day, and are also sent to the registration authorities for control: the traffic police, Rosreestr and others. After the assessment, ten days are given to appeal it. After this period, the seized property is transferred for sale.

The procedure for seizing real estate

The process of seizing an apartment is carried out during enforcement proceedings by order of a judge, bailiff or government agencies. The enforcement service is obliged to notify the owner of the property and other interested parties about the start of the procedure.

Within 10 days after receiving the writ of execution, the owner can pay off all debts, thereby preventing the apartment from being seized. During this period, the imposition of a ban is not allowed. If voluntary repayment does not occur, then the executor performs the following actions (Article 64 of the Federal Law “On Enforcement Proceedings”):

- conducts an inventory of property and seizes it by drawing up a special act;

- performs real estate valuation;

- sends the apartment to public auction in order to sell it and obtain funds to pay off the debt.

In the act of seizure of real estate, the bailiff indicates the following data (Part 5 of Article 80 of the Federal Law “On Enforcement Proceedings”):

- characteristics of the home : general condition, visual assessment of repairs, number of rooms and premises, floor;

- passport details , residential addresses and signatures of witnesses present;

- information about the person who is responsible for the safety of square meters.

Debtors should be wary of undervaluation of property, so they need to insist on an examination of the value by licensed institutions.

What can be disputed

The bailiff cannot describe things that do not belong to the debtor. However, if there is no document proving ownership, the thing, as a general rule, is considered the property of the defaulter and will be described.

Often the bailiffs are in a hurry and describe everything that catches their eye. You can appeal if:

- interior items and personal items not related to luxury;

- household essentials: refrigerator, stove;

- food, money sufficient for the subsistence level of the debtor and his family members;

- pets not intended for breeding and sale;

- coal, firewood, etc. for cooking or heating;

- state awards;

- things and transport, if the debtor is disabled;

- tools or equipment for professional activities.

Also, the only housing and the land plot on which it is located are not subject to foreclosure. An exception is housing that is pledged to the bank if the bank is the plaintiff in the case.

A complete list of property that cannot be seized is given in Art. 446 Code of Civil Procedure of the Russian Federation. You can challenge the act in court if material assets are seized in an amount exceeding the amount of the debt.

How to find out if there is a restriction on residential premises

When performing any actions with residential real estate, the question may arise: how to find out whether an apartment has been seized or not. There are several ways to obtain information for this:

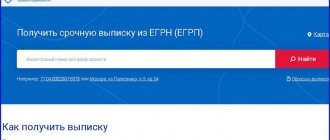

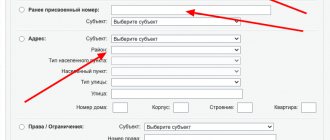

- Providing an extract from the Unified State Register. This document is issued upon application:

- to the MFC with an application and the applicant’s passport;

- on the Rosreestr website. A short certificate will be issued online at the full address of the apartment or its cadastral number, in which in the “Rights and Restrictions” section there will be an entry “Prohibition of entering into transactions.”

- In the FSSP (Federal Bailiff Service):

- the request can be submitted in person when contacting the bailiff service. To do this, it is enough to have a passport with you and have basic information about the object. You will need to know the exact address or full name of the apartment owner;

- You can create a request on the official website of the FSSP (https://fssprus.ru/iss). If the owner of the apartment has debts, by entering his last name, first name, patronymic and date of birth in certain fields of the request, information will be provided on all cases related to this citizen. If he has a debt, then there is a threat that at any moment a restriction may be imposed on this person’s apartment.

These requests are provided free of charge to any person interested in such information.

What should the debtor do?

Within five days after the inventory, the debtor may try to remove some of the seized items from the encumbrance. To do this, he files a statement of claim with documentary justification for the conclusion.

The debtor can simply wait for the repossessed items to be sold and the debt to be closed or reduced. After the inventory, the former owner of the assets can begin selling them himself. He needs to come to an appointment with the bailiff and write an application for independent sale of the seized items. This must be done no later than ten days after the inventory.

When permission is received, the debtor must transfer the required amount to the account of the executive body. When transferring money, you must indicate that it is being transferred for the sale of seized items.

A person who has no debts and no enforcement proceedings must be designated as the payer. After the funds are credited, this person will be considered the owner of the sold items; these items cannot be described again.

Which authorities have the right to seize an apartment?

A judge or bailiff can apply a restriction in the form of seizure of an apartment. The court makes a corresponding decision during court hearings to secure the statement of claim (clause 1, part 1, article 140 of the Code of Civil Procedure of the Russian Federation), and the executive service - on the basis of a court writ of execution or within the framework of an enforcement case (part 1, article 80 of the Federal Law "On enforcement proceedings").

When investigating criminal cases, seizure of property can also be requested by investigative or inquiry bodies (Article 115 of the Code of Criminal Procedure of the Russian Federation), and in the course of their activities, tax authorities or the customs service can initiate a ban (Part 1 of Article 77 of the Tax Code of the Russian Federation).

When the arrest is lifted

The seizure of property is lifted:

- after the debt has been repaid by the debtor himself;

- in case of satisfaction of the claim for the exclusion of certain things from the encumbrance;

- if the bailiff made procedural errors and his actions were appealed.

Within 5 days after the decision to lift the arrest is made, the defaulter must be notified of this. It happens that bailiffs “forget” to remove the encumbrance. Then it must be removed in court.

Sources:

Data Bank of Enforcement Proceedings

Definition of the bailiff department

What is an apartment under arrest

The concept of seizure of an apartment is that a ban is imposed on transactions with it. The reason for this is the debt of the property owner for utility bills, bank loans, seizure of property as collateral or other violations.

The ban is imposed in order to limit the violator’s right to dispose of the apartment until debts are repaid or the issues that served as the basis for the arrest are resolved. The owner of seized square meters cannot perform legally significant actions to transfer ownership of them (Part 4 of Article 80 of the Federal Law “On Enforcement Proceedings”).

For example, the restriction applies to transactions on:

- exchange;

- purchase and sale;

- inclusion of property in the will;

- using an apartment as collateral;

- rental.

The arrest acts as a strict restriction for the owner of the apartment, but its imposition does not prevent further residence and use of the property.

Grounds for seizure

Now let's figure out in what cases an apartment is seized. As we have already said, we are almost always talking about property and financial penalties arising from non-payment of debts, periodic or mandatory payments, and so on.

The range of forms and types of such obligations is huge: we can talk about debts for utilities, and debts for mortgages, alimony and even taxes. We invite you to discuss in more detail why your apartment may be seized.

Arrest and utility debt

The owner of a residential premises is obliged to bear the costs of its maintenance, in particular, to pay for utilities. Since utility costs do not seem so impressive, citizens often ignore their responsibility, which is why they accumulate debt amounting to tens of thousands of rubles. In the future, such residents will face seizure of their apartment for utility debts.

Delay in even minor monthly payments can lead to a restriction of administrative rights, because throughout the entire period of non-payment the amount of debt is added up.

In addition, according to paragraph 14 of Art. 155 of the Housing Code of the Russian Federation, starting from the second month of delay, a penalty is imposed on the amount of debt, the amount of which increases as the debt increases:

- 1/300 of the Central Bank refinancing rate for the 2nd and 3rd month of delay;

- 1/130 of the Central Bank refinancing rate, starting from the 4th month.

When the amount of debt reaches significant amounts, municipal institutions file a lawsuit to collect housing and communal services debts. In this case, the amount of legal costs will be added to the amount of debt and penalties.

After making a decision, the court will submit a writ of execution to the FSSP to collect the debt. If, when filing it, they simultaneously request the seizure of the debtor’s property, the apartment will be seized as a measure of enforcement.

If the debt accumulates, the debtor may be evicted from the apartment, and the apartment itself may be sold to pay off the debt.

Important: all residents of the apartment are collectively responsible for utility debts, and therefore their property may also be seized.

Alimony debts

Another reason for which an apartment can be seized is alimony debts. Seizure of property is probably the mildest measure to enforce alimony obligations: if payments are delayed by several months, the defaulter will be brought to administrative and then criminal liability. This is an extreme measure: usually, encumbering the property is enough to force repayment of the debt.

In order for an apartment to be seized for alimony, the following conditions must be met:

- alimony must be collected under an alimony agreement, writ of execution or court order;

- the writ of execution must be subject to compulsory execution in the FSSP division;

- the amount of debt must exceed 3 thousand rubles;

- the claimant filed a petition to encumber the real estate or all property of the debtor.

Arrest is not the only measure of forced collection of alimony. The debtor may also be prohibited from leaving the country, prohibited from using a driver’s and other special licenses, and so on.

Loan debts

For those who are wondering whether an apartment can be seized for non-payment of a loan, we answer: they can and, most likely, they will. Debts to financial organizations account for the lion's share of all enforcement proceedings. Any overdue loan can serve as the basis for the seizure of not only housing, but also all other property.

The dangers of debt to banks are:

- The amount of debts giving the right to foreclosure.

- Decisive actions of banks in debt collection.

As a rule, a lien on an apartment for non-payment of a loan is imposed at the stage of judicial review - banks require it as a measure to secure the claim and the courts do not refuse them.

If we are talking about a large loan, for example, a mortgage, arrest is not a mandatory requirement, because under such agreements the housing is already pledged to the bank. Banks often take away even the debtor’s only home to pay off the debt.

This, however, can be avoided. If the seizure of real estate by bailiffs has already been carried out, you should not shy away from negotiations with the bank. If the financial situation worsens, the borrower may apply, for example, for debt restructuring. Without this cooperation, the apartment can not only be seized, but also sold at public auction.

Compensation for damage caused by a crime

A claim for compensation for damage caused by a crime is one of the forms of protecting the rights of victims and another case when an apartment is seized. Victims have the right to file such a claim if there is reason to believe that the harm was caused by this particular crime (Article 44 of the Code of Criminal Procedure of the Russian Federation). We are talking about damage caused to the property of the victims or their health.

If the civil claim is satisfied and such financial liability is assigned, the plaintiff-victim will receive a writ of execution, which is sent to the territorial division of the FSSP at the place of residence / location of the property of the offender. In the process of executing the decision, the bailiffs will apply enforcement measures.

If the amount of compensation for damage turns out to be significant, the bailiffs may arrest and even seize the accused’s home for sale at public auction.

However, in such a situation, it is possible for the apartment to be seized by bailiffs on the basis of a court decision made in the framework of a criminal case.

In a criminal case

In accordance with Art. 115 of the Code of Criminal Procedure of the Russian Federation, the legislator allows the seizure of a suspect’s property, including real estate, as part of a criminal case. Such arrest is usually imposed for the following purposes:

- ensuring the execution of the civil claim of the victim;

- collection of a fine or other property penalties from the suspect, if they are provided for by the sanction of the charged article;

- confiscation of property, if the measure is provided for by the sanction of the article.

The court makes such a decision based on a petition from an investigator or interrogating officer in order to guarantee the protection of the rights of victims and not allow the suspect to get rid of property in respect of which material claims may be made. The court must justify this decision with specific circumstances, indicating the extent of the restrictions imposed.

In addition, the law allows for the seizure of property owned by third parties if there is reason to believe that it was obtained as a result of the criminal actions of the accused.

In each case, a protocol is drawn up for the procedural registration of the arrest of the accused’s real estate. If necessary, seizure may include the seizure and transfer of items for storage to third parties.

Seizure and tax debts, fines and other obligations

The question of whether bailiffs can seize an apartment for debts on taxes, fees and other obligatory payments is also of considerable interest. Tax debts, penalties accrued on them, arrears and other penalties are also collected through claims and then enforcement proceedings. Therefore, the tax authority interested in collection has the right to make a demand to seize the property of the taxpayer-debtor:

- as a measure to secure a claim;

- as a measure of enforcement of a court decision.

We remind you that from the moment of seizure of the debtor’s property for taxes and fees, in accordance with clause 6, penalties for such debts cease to accrue.

If the property is subject to sale to pay off debts, tax and customs officials cannot participate in auctions and purchase such property.

Spouse's debts and share seizure

The above-described grounds for seizing an apartment are the most common, but this list cannot be called complete. A citizen’s home can be seized due to the spouse’s debts, because everything acquired during marriage is common property, regardless of who it is registered in the name of.

Lenders sometimes take advantage of this. In accordance with paragraph 1 of Art. 45, if his personal property is not enough to repay a citizen’s debt, creditors have the right to demand the allocation of his share in the common marital property.

Thus, if the apartment is in common ownership, but is registered in the name of only one spouse, creditors may demand the transfer of half of the property to the debtor spouse for the purpose of its further arrest and foreclosure.