How to transfer an apartment to your wife while you are married?

The law establishes that spouses own equal shares of real estate acquired during their official marriage.

In this case, the size of each person’s earnings does not matter. The exception is apartments or houses received by a husband or wife as an inheritance, or under a deed of gift.

Real estate acquired by one of the spouses before the official registration of the relationship is in his personal possession.

If a husband plans to assign his share to his wife, then he should focus on the time of acquisition of real estate, during marriage or before official registration.

Key legislative aspects

Issues relating to the transfer of property rights from one person to another in Russia are regulated by many legislative acts.

In the topic we are considering, it is most relevant to consider some provisions of the Family Code (FC) of the Russian Federation.

Based on the information presented in this code, the method of transferring an apartment from a husband to his wife is largely determined, which is important to consider.

First of all, let us turn to paragraph 3 of Article 34 of the RF IC, which determines the status of property belonging to a particular family.

In accordance with it, any apartment is considered the common property of the spouses if it was acquired for compensation during the period after marriage. In this case, the wife already has the right to own the apartment, or rather to ½ of its area.

Moreover, this law applies regardless of who bought the apartment and in whose name the purchase and sale agreement was drawn up. In such situations, property is divided, followed by the husband donating/selling his part of the apartment to his wife.

If the apartment was acquired by the spouse before marriage or after that, but free of charge (donation, inheritance, etc.), then he is the sole owner of the property.

In such a situation, the easiest way is to conclude a gift agreement, according to which the property will pass to the wife. By carrying out the manipulation in this way, the family is exempt from taxation on the transaction, since the spouses are close relatives.

Articles 38 and 42 of the RF IC also regulate the procedure and method for transferring an apartment from spouse to spouse through the mandatory conclusion of a notarized marriage contract or other agreement that will determine the fact of transfer of property.

When considering some situations on this topic, it may be necessary to refer to the articles of the Civil Code of the Russian Federation, which define such concepts as “joint” or “shared” property (Chapter 16). In most cases, the use of these legislative acts is sufficient to carry out the re-registration correctly and without problems.

Sources

- Konin, N.M. Administrative law of Russia. General and Special Parts / N.M. Konin. - M.: YURIST, 2004. - 560 p.

- Traffic rules and fines. Only the most important and necessary. With changes for 2021. Icon of St. Nicholas the Wonderworker with a protective prayer on the back; Higher school - Moscow, 2021. - 625 p.

- Practical accounting. Official materials and comments (720 hours) No. 10/2015; Science - Moscow, 2015. - 666 p.

- Law and Economics No. 10/2008: monograph. ; Justitsinform - M., 2008. - 120 p.

- Municipal Management Practice No. 8 2014; MCFR - M., 2014. - 140 p.

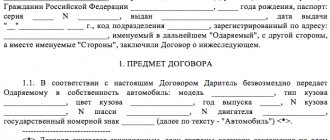

Drawing up a gift agreement for a married wife.

The husband has the right to issue a deed of gift to his wife, transferring his part of the apartment to her.

This method is considered one of the most reliable, since the procedure is difficult to challenge in court.

To draw up a deed of gift, it is important that the spouse is considered fully capable and is not subject to physical or psychological influence.

In order to transfer your apartment to your wife under a gift agreement, you will need to complete the following steps:

- Prepare the necessary documents.

- Draw up an agreement between the spouses.

- Have the paper certified by a notary office.

- Perform state registration of the transaction.

The procedure will not be considered valid if the rights of the new owner are not registered. By law, when donating real estate, neither the donor nor the recipient must pay tax.

Download the deed of gift for an apartment between close relatives:

1-obrazec-dogovora-dareniya-kvartiry

Gift deed

This is a reliable option. But when transferring property purchased during marriage from husband to wife using a deed of gift, difficulties are possible, since it is considered jointly acquired (Clause 3 of Article 74 of the Family Code of the Russian Federation), and it will not be possible to simply conclude a gift agreement. The wife already owns half of the apartment here.

In order to legally transfer housing to her, it is clearly determined which part each spouse owns. This needs to be formalized. Afterwards, the husband can give his share as a gift to his wife. Simply put, it is required to re-register joint ownership into shared ownership .

There are several ways to solve this issue. The procedure for dividing the apartment is carried out, and subsequently the husband has the right to donate his part to his wife, or a marriage contract certified by a notary is drawn up, which will also determine the boundaries of the property of each spouse.

Registration of a marriage contract

This is the easiest way for free transactions with jointly acquired property. Drawing up a contract with a mandatory clause in it of separate ownership rights will make it possible to immediately re-register the apartment for the second half using a deed of gift. But you can’t do it without notaries: the documentation must be certified.

The marriage contract is drawn up as follows:

- the spouses come to an agreement about what will belong to the wife and under what conditions;

- they draw up their agreements with a notary;

- the drawn up contract is signed by the parties.

A marriage agreement is also convenient because it makes it easy to change the title owner of real estate if, for example, it is necessary to change an entry in the Unified State Register of Real Estate. To do this, a clause is simply added to the document about the decision between the spouses to change the ownership of the apartment from one person to another.

Division of an apartment and determination of shares

Married citizens have the right to divide everything that they have acquired jointly by agreement of the parties. This is stipulated by the Family Code of the Russian Federation (clause 2, article 38). It is possible to draw up a specific document on the division of property: its essence is the redistribution of all property between spouses. But its inconvenience is that it is valid only if equivalent property is assigned to the spouse.

If you only need to transfer real estate into your wife’s ownership, it will be safer to collect two documents: enter into an agreement to determine the share and then draw up a deed of gift. Division of shares and donation under the supervision of experienced lawyers can be done in one action.

An agreement on determining shares in joint property rights is drawn up in the similarity of a marriage contract:

- an agreement is drawn up between the married couple as to what part of the property will belong to each of them;

- an agreement is drawn up and certified;

- signatures are placed.

After this, you can register the document with the relevant government agency.

The deed of gift must contain complete information about the property and the surrounding area, such as: the number of floors in the house, address, construction material, outbuildings, land plot, cadastral number and total area.

Step-by-step preparation of a gift agreement:

- preparation of documents;

- drawing up a standard gift agreement;

- certification optional;

- passing the state registration procedure.

Donation involves depriving the husband of all rights to housing. However, if during a divorce it is possible to prove through the court that significant changes were made to the improvement of the property at the expense of the spouse, it will be possible to return part of it back.

It is easier to transfer an apartment to your wife while you are married than after a divorce. A gift between legal spouses is formalized without tax, but if a house is given to an ex-wife from a husband, then you will need to pay a fee - 13% of its value.

What is required to re-register an apartment for my wife?

In order to re-register an apartment in the name of your spouse, you will need to prepare the following papers:

- passports of both parties;

- technical and cadastral documents for living space;

- certificate of family composition;

- certificate confirming ownership.

Sometimes additional documents may be required depending on the specifics of the transaction. The donation agreement must indicate the technical parameters of the property, its address, and total area.

If the apartment was purchased with a mortgage by both spouses after registering the relationship, then in order to re-register it in the wife’s name, you will need to obtain permission from the financial institution where the loan was issued.

If a woman’s income is too small, the bank may refuse the procedure.

If the financial institution has given permission to re-register the apartment, then changes are made to the loan repayment agreement.

The agreement states that the husband is released from financial obligations, but also does not claim ownership of the property.

Spouses can also enter into an agreement on the division of property.

In this case, each of them has a share in the apartment determined, and the amount they must pay on the mortgage is also indicated.

Documentation for re-registration of property rights

To complete a transaction to transfer real estate from a husband, a wife should prepare a standard package of papers:

- civil passports of the parties to the transaction;

- marriage or divorce certificate;

- registration certificate of the residential premises;

- deed of gift for living space or purchase and sale agreement;

- extracts from the fiscal authority confirming the absence of tax debt;

- cadastral documentation;

- marriage contract or agreement on division of real estate;

- title documentation for real estate;

- information about citizens registered in the apartment, certified by a notary;

- application from the husband to transfer property to his wife.

Depending on the situation, additional documentation may be required. After submitting a package of official papers to Rosreestr, ownership will be issued within 30 days. After this, the wife can pick up a document from a government agency confirming her right to own housing.

How to register real estate so as not to divide it during a divorce?

By law, all real estate acquired during marriage is considered joint property.

Therefore, during a divorce, it will be divided between the spouses in equal shares.

This rule does not apply to the following types of real estate:

- inherited;

- issued to one of the spouses under a deed of gift;

- purchased before marriage.

There are several ways to design an apartment in such a way that no one has any questions or disputes during a divorce.

Donation of a house, apartment, car, plot

The type of property also matters when completing a transaction.

| Object of the agreement | Details |

| House | By law, a building and the land underneath it are considered an indivisible object. Therefore, the donee will receive everything . It is necessary to collect the necessary papers, in particular, confirming the status of the donor as the owner of the property. Papers for the site: • plan - drawn up by a cadastral engineer; • a certificate confirming the complete absence of debts on taxes and other payments. Moreover, the owner has the right to give away part of the building. Then the contract specifies the size of the share. It is important to highlight it by providing a separate entrance with a porch, equipping a bathroom and kitchen. Conduct all major communication networks. Accordingly, the land will also be divided. When family members are involved in the transaction, all costs can be discussed in advance. |

| Apartment | It is more difficult to separate it, because a second kitchen and entrance will be required. But there will be one object in the deed of gift. It is important to check the absence of: • utility debts; • encumbrances; • arrest. Otherwise, all obligations forgotten by the previous owner will be transferred to the new one. Otherwise, the transaction proceeds as usual. We advise you to follow the established procedure , regardless of the existence of a marital relationship. The oral agreement is invalid because the transfer object is expensive. |

| Plot of land | Before concluding an agreement, you need to check whether the site is registered in the Rosreestr system. Many owners who have been managing their plots for decades are not aware of the innovations in legislation. For example, about the need to register land. This is confirmed by the USRN extract. It is impossible to register an allotment without surveying and defining boundaries. The procedure is expensive, time-consuming, but necessary. Without it, no transactions can be made with the allotment. The owner is free to give away not all, but part of the land , after dividing it. If the area allows, this is not difficult. The rest of the donation procedure is standard. |

| Car | Citizens often transfer vehicles to close relatives free of charge. The procedure seems simple, but there are some nuances. For example, if the car is new, less than 3 years old and the recipient decides to sell the gift: • he cannot use the expenses incurred to purchase the car; • you can take a property deduction if the sale amount is above 250,000 rubles. He will have to pay 13% of the tax to the budget. Non-resident recipients of the gift will have to pay 30% of the tax. It doesn't matter how long they own the car. The procedure itself goes like this: 1. The owner of the car visits the traffic police, there he deregisters his property. This is possible if there are no debts (taxes paid, fines paid). 2. Writes a deed of gift, the participants sign, then the transaction is registered with the traffic police. Documents required: •PTS; •registration certificate – technical passport; •passports of the parties; •vehicle assessment report (drafted by an invited expert); •an extract from the notary register confirms that the transport was not pledged; • State Traffic Safety Inspectorate – the car is not stolen, there are no encumbrances; •receipt of paid state duty; •insurance reissued to the donee; •consent of the spouse, if the car was purchased by a citizen during marriage. 3. The new car owner receives a registration certificate. |

Important! Absence of any encumbrances (donation with encumbrance in a separate article) . Otherwise, it will be impossible to complete the transaction.

Drawing up an agreement on the division of common property.

Spouses can enter into an agreement on the division of common property. In order to get it properly executed, it is recommended to visit a notary.

Spouses should prepare the following documents:

- passports;

- real estate ownership documents;

- technical certificates, cadastral passport, etc.

Download the sample here:

Agreement on the division of common property.

Features of documentation

In modern legal practice, there are many options with which you can transfer an apartment from husband to wife. The possibility of problematic situations arising during the process of re-registration of an apartment depends on which method you choose. Do not forget that there are also tax payments, and their size depends on the method of re-registration of real estate that you consider most suitable. In order to transfer his apartment to his wife, a man will need a number of real estate documents. This may include title documents for living space, namely, a contract for the purchase of living space and a registration certificate (only the original, no copies), cadastral (taken from a special department) and technical passports, identification documents of both spouses (only passports are accepted), and also an extract from the house register.

How to transfer a share in an apartment to your spouse?

If a husband and wife own an apartment in shared ownership, then one of them can freely transfer his part to the other.

You can transfer real estate to your spouse using a gift agreement or an agreement on the ownership of jointly acquired property.

The procedure must be registered with the Federal State Registration Service.

The woman will be considered the new owner of the property only after she receives an extract from the Unified State Register of Real Estate. Usually the procedure takes up to 30 days.

If the apartment was purchased during marriage, then it is the property of both spouses.

In this case, a gift or “purchase and sale” agreement for the entire property is not concluded, since the wife already owns part of it.

In this situation, you should draw up an agreement to determine the share, and then draw up an agreement for the transfer of rights to the apartment.

It is not necessary to indicate the value of the property in the gift deed. However, practice shows that it is better to write this characteristic in the agreement.

Usually the average market price is indicated. But the cost can be set by agreement between the parties to the transaction.

Download the agreement for donating a share of the apartment here:

Agreement on donation of a share of an apartment.

After the death of her husband

Current domestic legislation establishes the following: property purchased during marriage belongs equally to both the husband and his wife. A woman is the full owner of half of the housing that belongs to her. The second half, owned by her husband, is divided among the recipients of the inheritance.

To register the right to inheritance, you will need to provide the notary with a certain package of documentation, including the following:

- applicant's passport;

- a certificate establishing the fact of the death of the spouse (both the original and a photocopy are required);

- a certificate of the spouse’s last residential address together with information about who lived at this place of residence at the time of the husband’s death;

- certificate of registration of marriage relations;

- a document certifying the fact of ownership of the apartment purchased during marriage.

In addition, the woman will need to provide the notary agency employee with a cadastral plan and extracts received from the BTI authorities at the request of the applicant.

The duration of the period allotted for accepting inherited property is six months from the moment the testator left this world. When reinstating missed deadlines, it will be necessary to initiate legal proceedings and prove that the reason for the missed deadline was sufficiently valid.

If the husband died without leaving behind any testamentary document, then people who are related to him have the right to divide the shares and transfer them to themselves through legal proceedings.