The presence of current enforcement proceedings initiated against a particular person means that this person has some unfulfilled obligation, and the fact of the existence of a debt is confirmed by a court decision that has entered into force and a writ of execution issued on its basis.

What happens? The debtor is obliged to pay some amount of money to the claimant. According to the Law “On Enforcement Proceedings”, bailiffs have the right to foreclose on property. In such a situation, it is very important to know the answer to the following question: is it possible to make real estate transactions in the presence of enforcement proceedings?

Who should pay housing and communal services debts: the former or the new owner of the apartment?

Russians owe 625 billion rubles for their communal services (Rosstat data for October 2021, cited by Rossiyskaya Gazeta).

Although when selling an apartment the seller is obliged to pay off the debt for utilities and present the buyer with the appropriate certificate, very often real estate is sold with debts for housing and communal services. Some owners falsify documents. Others honestly admit that there is no money to pay, but they will definitely pay off the debt as soon as they sell their living space, and in the end, having received the funds, they disappear.

What happens if you don’t pay your utilities? More details

Citizens who bought apartments with utility debts want to be forced to pay them off, Izvestia writes with reference to the bill of the Housing and Communal Services and Urban Environment association. Simply put, new home owners, in addition to square meters, will receive the debts of the former owners. For now this is just a bill. AiF.ru tells who should pay the debt on housing and communal services.

Let's start with the fact that everyone living in a residential building (regardless of living conditions) must pay for utilities and housing maintenance. This is stated in both the Civil and Housing Codes.

“According to Article 153 of the Housing Code of the Russian Federation, citizens, exercising the right to use residential premises and the right to receive utility services of proper quality, are responsible for timely and full payment for residential premises and provided utilities. Thus, debts for utility services can be collected in court from all registered and living citizens in the owner’s apartment. Debts can be collected jointly and severally in court, but only for the period from the moment of registration in the owner’s apartment until the moment of deregistration,” explains Olga Miteva, a member of the Russian Lawyers Association .

Why do the rich have the biggest debts for housing and communal services? More details

According to her, before the date of transfer of ownership, the seller of the apartment is obligated to pay, and after that, the buyer, unless the parties have agreed on a different procedure, for example, payment of the debt existing at the time of the transaction by the buyer. Otherwise, the buyer, having paid the debt, will be able to collect from the seller or involve him in the case (if legal proceedings have already been initiated).

The only exception is debts for major repairs. In this matter, the law does not divide the debt between former and current property owners, adds Alisa Khramova, associate professor of the department of commerce and trade at Synergy University . That is, if a citizen bought an apartment with a debt for major repairs, he will have to pay it off.

According to the expert, a bill obliging new homeowners to pay the debts of old owners could become a kind of measure to help pay off the debt.

“This bill has been sent to the Ministry of Construction. If the initiative is approved, then new apartment owners will be required to pay debts for housing and communal services of previous owners.

How will they be fined for non-payment of housing and communal services? More details

This will encourage potential new owners to demand that sellers pay the debt before the transaction is completed,” Khramova said.

In what cases can a debtor not make real estate transactions?

The debtor will not be able to get rid of the property if:

- The bailiff or court has established a ban on registration actions. According to the Civil Code of the Russian Federation, ownership of real estate passes from the seller to the buyer only after such a transfer is registered with the Rosreestr authorities. Namely, these actions are prohibited. That is, the parties can come to an agreement, sign an agreement, transfer money and property. But they will not be able to implement the last stage, which is mandatory for real estate transactions.

- A bailiff or court has seized the property. If a ban on registration actions does not give the right to register the transfer of rights in Rosreestr, then arrest is a broader concept. The bailiff, in the event of a seizure, has the right not only to prohibit the debtor from disposing of the property, but also from using it.

- The presence of property as collateral. A typical example: a mortgage. This encumbrance is registered in Rosreestr at the moment when the loan agreement is concluded. It is important to know that it is possible to foreclose on a mortgaged property, even if it is the debtor’s only home.

In other cases, alienation of real estate is not prohibited. The task of the bailiffs is to promptly identify real estate owned by the debtor and take measures to ensure that the debtor does not make transactions with his property. By the way, since we are talking about the debtor’s only home, we need to say this: the only home can be alienated in any case, except if it is pledged, since the bailiffs cannot seize it.

Buying an apartment: how not to become a debtor for utility bills

Have you decided to buy an apartment, have you already selected an option and are preparing to finalize the deal? To ensure that the joy of your purchase is not overshadowed by utility bills left over from the previous owner, follow the algorithm.

Step 1. Agree with the seller on the payment procedure for utilities.

As a general rule, the seller pays for utilities until the transfer of ownership of the apartment is registered <*>.

Note: Registration of the transfer of ownership is one of the stages of registration of the purchase and sale of an apartment <*>. It is carried out by the territorial organization for state registration of real estate, rights to it and transactions with it represented by the registrar <*>.

You can negotiate with the seller a different procedure for paying utility bills. For example, if the seller vacates the apartment after closing, he can pay the fee before the date of handing over the keys to you. Or you can pay all payments from the 1st day of the month in which the apartment is sold. It is advisable to consolidate the agreements reached in the apartment purchase and sale agreement.

Step 2 : Read the documents.

Ask the seller to show the utility contracts. This way you can find out what utilities you will need to pay for in this apartment.

The owner of the apartment must conclude contracts for basic housing and communal services. These include, but are not limited to:

— maintenance of a residential building;

— current and major repairs;

— cold and hot water supply, sewerage;

— gas supply;

— power supply;

— heat supply.

Note! After purchasing an apartment, you, as a new owner, will need to renew contracts for the provision of basic housing and communal services. If this is not done, you will still have to pay utility bills from the moment of registration of the transfer of ownership of the apartment <*>.

At the request of the owner, contracts for additional utilities can be concluded. In particular <*>:

— installation and maintenance of intercom;

— installation and maintenance of a video surveillance system;

— janitor (concierge) services;

- landscaping and landscaping of the yard.

Note: You have the right to refuse to pay for additional utilities <*>. For example, do not enter into a corresponding agreement after purchasing an apartment.

To find out whether the seller has arrears in paying utility bills, it is advisable to ask him to show a copy of his personal invoice. It can be issued by a settlement and reference center, a housing department, the chairman of a housing cooperative or an owners' association <*>.

Step 3. Check the serviceability and meter readings.

Ask the seller what metering devices are installed in the apartment.

Note: As a rule, apartments have meters for water and electricity. Gas and heat meters can also be installed.

Pay attention to whether the seals on the meters are damaged and check their serviceability. For example, turn on the water and check if the meter starts working. If you have any doubts, it is advisable to contact the appropriate organization to check the correct operation of the meter.

Note! If the meter is faulty, you will have to pay more. In particular, for electricity - at tariffs that ensure full reimbursement of the costs of providing energy supply services. This tariff will also apply for the previous period, starting from the date of the last check of the meter readings by a representative of the energy supplying organization <*>.

We recommend checking the actual meter readings with the data of the latest utility bill. A discrepancy in the numbers may indicate arrears in utility bills or faulty metering devices.

Step 4. Record the information received.

This can be done in the document on the transfer of the apartment from the seller to the buyer. Such a document must be drawn up during the actual transfer of the apartment and signed by both parties <*>. It can be called differently: deed of transfer, deed of acceptance and transfer (hereinafter referred to as deed of transfer).

As a rule, the transfer deed indicates the full name of the seller and buyer, the address of the apartment, its area, condition, equipment (gas stove, plumbing). We recommend that you also include in the transfer deed:

- meters data;

— information about their malfunction, damage to seals;

— the period for which the seller paid for utilities;

— the seller’s obligation to repay the debt if it is identified, including accrued penalties.

Note: If the condition of the apartment or equipment is worse than indicated in the purchase and sale agreement, indicate this in the transfer deed. Then you will be able to demand from the seller of your choice <*>: - elimination of deficiencies; - compensation for the costs of eliminating them; - a proportionate reduction in price. For example, the contract states that the apartment is equipped with a gas stove. During the transfer of the apartment, you discovered that there was no stove. If you reflect this in the transfer deed, you can ask the seller to install the slab back or pay you for the purchase and installation of a similar slab.

General rule for conducting real estate transactions in the presence of enforcement proceedings

Based on the Constitution of the Russian Federation and the Civil Code, we can say that the fact of the existence of a resolution on the initiation of enforcement proceedings does not in any way affect the rights of the owner. He, in particular, can dispose of his property as he sees fit. The Law “On Enforcement Proceedings” and some other legislative acts establish some exceptions, indicating situations when it is impossible to complete a real estate transaction.

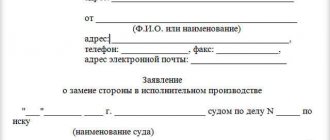

Legal assistance on transactions during enforcement proceedings

Consultation in the office and by phone

+7(495) 728-99-14

Help from a lawyer. 18 years of experience in transactions in enforcement proceedings!

We are working during the quarantine period of 2021! Call.