Under an agreement for the free use of non-residential premises, one party transfers to the other party the temporary right to use the property free of charge.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The subjects of the agreement are the Lender - the person who provided the property for temporary use, and the Borrower - the person who uses such an object within the framework of the rules established by the agreement on a free basis.

Both individuals and legal entities can act as subjects of an agreement for the free use of residential premises. Individual entrepreneurs are especially benefited when concluding this type of agreement.

This document needs to be in writing, since there is a need to establish the obligations of the Parties under the agreement. Therefore, below, using the example of a contract for the free use of a store premises, we will step by step examine how to draw up such a document and what nuances you should pay attention to when drawing it up.

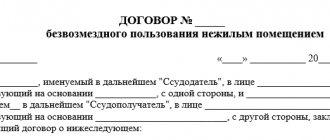

Agreement for free use of non-residential premises

Kurgan

May 24, 2023

Karpov Viktor Petrovich, born 07/08/2000, living at the address Kurgan region, Kurgan city, Lenin street, building 76, apartment 898, passport XXXXX XXXXXXX, issued by the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan 00.00.0000, hereinafter referred to as Lender I IP Petrov Viktor Petrovich, passport ХХХХ ХХХХХХ, issued by the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan 00.00.0000, hereinafter referred to as the Borrower, have entered into this agreement as follows:

The preamble to the treaty traditionally includes:

- type of agreement;

- place and date of conclusion of the contract;

- names and roles of parties to the transaction;

- residential addresses and passport details of the parties.

The contract will be considered concluded if the parties reach an agreement on all essential terms of the contract. The essential terms of the contract for the provision of services free of charge are:

- subject of the agreement;

- term of provision of services;

- duties of the parties;

- responsibility of the parties.

Who can enter into: parties to the contract

Under the non-residential real estate loan agreement, the parties are:

- legal entities;

- individuals or individual entrepreneurs;

- legal and natural person (IP).

If such a document is drawn up by an individual entrepreneur, he has the right to act on behalf of the individual. But to apply the preferential tax system, he will need to provide his details. These include all those codes that he received when registering with the tax authority. Based on tax registration, individual entrepreneurs are defined as business entities.

An individual entrepreneur does not receive the status of a legal entity and is not equal to legal entities.

In the introductory part of the document, individuals are indicated with the following information:

- last name, first name and patronymic;

- year and place of birth;

- passport data;

- places of residence.

Legal entities must enter information about themselves:

- Company name;

- form of ownership;

- details of the legal entity;

- legal address;

- who acts on behalf of the company and on what basis;

- Full name, position and passport details of the authorized person.

The agreement defines the parties as the lender and the borrower. Further in the text, in all paragraphs and subparagraphs, only these definitions are used.

The parties to the agreement are called the lender and the receiver

The recipient is required to:

- reaching adulthood;

- full legal capacity;

- being of sound mind and sober memory at the time of the procedure.

The main condition for the lender:

- official recognition of the transferred premises as non-residential, which is indicated in the cadastral records of Rosreestr;

- registered ownership of it with registration in Rosreestr.

If a proxy acts in the interests of one of the participants, he is not considered a party to the contract, but only its representative, performing technical actions of a legal nature, without the right to perform the action.

Item

Information about the subject of this agreement is stated in the initial paragraphs of the document. In this case, the subject will be non-residential premises. The section about the item should clearly describe the characteristics of such a room, namely:

- indicate at what address it is located;

- indicate whether there is any equipment attached to the premises;

- indicate the number of square meters in the room;

- indicate to whom the non-residential premises belong by right of ownership and whether it is encumbered with the rights of third parties.

So the item clause looks like this:

The Lender transfers the right to use free of charge to the Lender the non-residential premises located at the address: Kurgan region, Kurgan city, Burova-Petrova street 72B. The total area of the premises is 50 (fifty) square meters. According to an extract from the register of real estate of the Russian Federation, the Lessor is the owner of the premises. The intended purpose of the rented premises is retail trade in non-durable goods (clothing). This agreement is concluded for an indefinite period.

What documents will be required?

To conclude a DBPNP, the parties will need to present the following documents:

1) Documents indicating the details of the parties, including:

- For legal entities persons - a power of attorney certifying the powers of the authorized representative of the enterprise.

- For an individual – passport or other identification document.

2) Title documents of the owner of the non-residential building that is the subject of the agreement.

3) Extract from the Unified State Register of Real Estate.

4) Technical passport for the building.

Duties of the parties

The obligations of the parties are an integral part of the document. This section may spell out various obligations by mutual agreement of the Parties, but we will focus on the basic wording. So this section looks like this:

The lender undertakes to: Provide the non-residential premises specified in the paragraphs of this agreement in proper condition according to the acceptance certificate. Do not interfere with the Tenant in carrying out his activities during the lawful use of non-residential premises. Provide the Borrower with access to the specified premises. Familiarize the Borrower with the rules for using non-residential premises. Fulfill your obligations in strict accordance with this agreement. The Borrower undertakes to: Maintain the store premises and the equipment contained therein in good condition. Do not carry out any work related to changing the structure of the premises without the consent of the Lender. Use the premises strictly for their intended purpose. Observe safety precautions when using non-residential premises. After termination of the contract, return the non-residential premises in technically sound condition in which it was upon acceptance and transfer (taking into account natural wear and tear). Fulfill your obligations in strict accordance with this agreement.

Analytics Publications

Regardless of what thoughts the owner of the property is guided by when transferring it for free use, the time will come when he wants to return it to his possession. This can happen before the loan agreement expires. What should the lender provide for in order to maintain a path to retreat - early termination of the contract?

An agreement for gratuitous use (Chapter 36 of the Civil Code of the Russian Federation) is similar in nature to a lease agreement, and part of the rules of the latter applies to it (clause 2 of Article 689 of the Civil Code of the Russian Federation). Its main difference from a lease agreement is that it is free of charge. Moreover, the owner of the property (lender) may at any time have a need to dispose of his property in a different way. For example, a profitable tenant or buyer was found who needed to transfer the property free of third party rights, or the company decided to use it for its own production purposes.

In this case, the lender has a question: is it possible to terminate the agreement for gratuitous use ahead of schedule and without consequences? After all, the borrower becomes the legal owner of the specified property, without being the owner, he has the same rights as the owner, and has the right to protect his possession even against the owner himself (Article 305 of the Civil Code of the Russian Federation).

The Civil Code of the Russian Federation provides for termination of the contract by agreement of the parties and in connection with significant changes in circumstances (clause 1 of Article 450 of the Civil Code of the Russian Federation, Article 451 of the Civil Code of the Russian Federation).

In addition, the Civil Code of the Russian Federation establishes termination of the contract on other grounds (clauses 2, 3 of Article 450 of the Civil Code of the Russian Federation):

Disguising a rental loan

The Property Management Committee filed a lawsuit to evict the defendant, the Union of Combat Veterans, from the occupied premises. The latter organized a children's aircraft modeling club on the premises. In the lease agreement concluded between the parties to the dispute, the rent was set at 0 rubles. for 1 sq. m. The committee sent the tenant a letter of cancellation of the lease agreement, but the tenant did not vacate the premises within the prescribed period.

Satisfying the applicant's claim, the courts came to an unequivocal conclusion: the disputed agreement cannot be qualified as a lease agreement. After all, the use of non-residential premises is carried out free of charge, and in fact, a relationship has arisen between the parties regarding the free use of property. Consequently, the parties entered into an open-ended loan agreement, since the defendant continued to use the property even after its expiration in the absence of objections from the plaintiff (FAS Resolution U0 of September 10, 2008 No. F09-6543/08-S6).

Civil law. Treaties

- in case of unilateral refusal to fulfill the contract, when such refusal is permitted by law or agreement of the parties;

-by a court decision at the request of one of the parties in the event of a significant violation of the contract by the other party (as well as in other cases provided for by the Civil Code of the Russian Federation, other laws or the contract).

Unilateral refusal: timing matters.

An open-ended contract has been concluded

Unilateral refusal of any of the counterparties (lender and borrower) is permitted by law when the partners have entered into an open-ended agreement (clause 1 of Article 699 of the Civil Code of the Russian Federation). In this case, there is no need to additionally include in its text a condition on the possibility of unilateral refusal of one or another party from the agreement. It is sufficient to notify the other party one month before termination of the contract or in compliance with another period established by the contract. This conclusion is confirmed by judicial practice (rulings of the Supreme Arbitration Court of the Russian Federation dated May 31, 2007 No. 6173/07, dated October 31, 2007 No. 12035/07).

A fixed-term contract has been concluded

If the agreement is concluded with a specified period, then only the borrower has the right to refuse such a transaction (clause 2 of Article 699 of the Civil Code of the Russian Federation). Of course, only if the agreement itself does not contain a prohibition on the borrower’s refusal. In this case, the latter must notify the partner of his refusal one month before termination of the contract (or during another time established by the contract).

As for the lender, the courts believe that he cannot unilaterally refuse a fixed-term agreement. Termination of such an agreement at the initiative of the lender is possible only in court (Article 310, paragraph 2 of Article 450 of the Civil Code of the Russian Federation) and only on the grounds provided for in paragraph 1 of Art. 698 of the Civil Code of the Russian Federation (discussed below).

An example of such a court decision is the resolution of the Federal Antimonopoly Service of the Federal Antimonopoly Service of March 4, 2008 No. F03-A51/08-1/390.

In it, the court rejected the argument of the applicant-lender that the right to withdraw from the contract was provided for by the contract itself. The clause of the agreement contains only the condition that in the event of a unilateral refusal of the agreement for gratuitous use, the party must notify the partner in writing one month before termination of the agreement. However, from this point, according to the judges, it does not at all follow that the lender has the right to refuse the transaction.

In addition, the judges emphasized: Article 699 of the Civil Code of the Russian Federation does not allow the lender to refuse a contract for gratuitous use concluded for a certain period. This means that the parties did not have the right to provide in the contract for the possibility of such a refusal.

The lender, the arbitrators stated, can only demand early termination of the contract in court on the grounds listed in paragraph 1 of Art. 698 Civil Code of the Russian Federation. However, the FAS DO did not find any of these grounds in the case under consideration.

True, we consider some of the court’s conclusions in the case considered to be erroneous. We believe that the lender still has the right to unilaterally refuse a fixed-term loan agreement if the possibility of such a refusal is clearly stated in the agreement itself. After all, Art. 699 of the Civil Code of the Russian Federation does not contain a direct prohibition on such a refusal. And in paragraph 3 of Art. 450 of the Civil Code of the Russian Federation states that unilateral refusal of one of the partners from the transaction is possible if this is permitted by law or by agreement of the parties.

The contract is valid until the occurrence of a certain event

In practice, the parties often indicate that the loan agreement is valid until the occurrence of a certain event (for example, until the reconstruction of a building in which the premises are transferred for free use).

In this case, it is necessary to be guided by the separate rules of the lease agreement, which are also applicable to the loan agreement (clause 2 of Article 689 of the Civil Code of the Russian Federation), the norms of the Civil Code of the Russian Federation on terms and clarifications of the Supreme Arbitration Court on determining the period in the lease agreement.

According to Art. 190 of the Civil Code of the Russian Federation, the period can be determined by a calendar date or the expiration of a period of time, or by an indication of an event that must inevitably occur (that is, it does not depend on the will and actions of the parties).

The same is stated in paragraph 4 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 11, 2002 No. 66 “Review of the practice of resolving disputes related to rent.”

It turns out that an agreement is considered concluded for an indefinite period if it does not indicate a calendar date, a period of time, or an event that must inevitably occur (paragraph 1, paragraph 2, article 610, paragraph 2, article 689 of the Civil Code of the Russian Federation). Accordingly, to whom the provisions of paragraph 1 of Art. 699 of the Civil Code of the Russian Federation on the right of each partner to refuse the transaction.

In other words, if the loan agreement states, for example, that it is valid until an event, the occurrence of which depends on the will or actions of the parties (the event is not inevitable), the period will not be determined. And the lender, accordingly, has the right to unilaterally refuse

such an agreement.

The contract has expired

Let's assume that the term specified in the loan agreement has expired. And the borrower continues to use the property. The lender does not object to this, but after some period he decides to terminate the contract. In this case, the contract is considered concluded for an indefinite period. Let's explain why.

Let's turn to clause 2 of Art. 621 of the Civil Code of the Russian Federation (we are talking about rental relations, but the provisions of this paragraph are also applicable to the loan agreement - clause 2 of Article 689 of the Civil Code of the Russian Federation). It says here: if the tenant continues to use the property after the expiration of the contract and in the absence of objections from the lessor, the contract is considered renewed on the same terms for an indefinite period.

Accordingly, the lender has the right to unilaterally refuse such an agreement on the basis of clause 1 of Art. 699 of the Civil Code of the Russian Federation (resolution of the Federal Antimonopoly Service of the North-West District dated

07.08.2008 No. A05-12981/2007).

Termination of the agreement at the request of the lender

As we have already said, early termination of the contract is also possible at the request of one of the parties in court, when this is directly provided for by the Civil Code of the Russian Federation, other laws or the contract (clause 2 of Article 450 of the Civil Code).

The list of cases giving the lender the right to demand early termination of the contract in court is provided for in paragraph 1 of Art. 698 Civil Code of the Russian Federation. These are cases when the borrower:

- uses the thing not in accordance with the contract or the purpose of the thing;

- fails to fulfill obligations to maintain the thing in good condition or its contents;

- significantly worsens the condition of the thing;

- transferred the item to a third party without the consent of the lender.

As can be seen from the list above, all cases of termination of an agreement at the request of the lender provided for by law are associated with the guilty actions (or inaction) of the borrower. The lender must prove in court that these actions (inaction) on the part of the borrower took place (Article 65 of the Arbitration Procedure Code of the Russian Federation)

The lender is also obliged to follow the procedure for submitting a request for termination of the contract. It can be filed in court only after the borrower refuses to terminate the agreement or does not respond within the prescribed period. This period may be established by law, contract, or specified in the proposal to terminate the contract. If the response period is not specified by law, contract or proposal, then it is thirty days (Article 452 of the Civil Code of the Russian Federation).

Please note: the plaintiff must send a proposal to terminate the contract to the defendant in writing. Then, as evidence of attempts to pre-trial resolve the issue, he will be able to present to the court a letter and a postal notification with a mark on the delivery of registered mail to the borrower (Resolution of the Federal Antimonopoly Service VVO dated January 29, 2007 No. A29-4536/2006-2e).

Recovery of unjust enrichment

Upon expiration of the gratuitous use agreement, the owner of the premises invited the former borrower to enter into a lease agreement. The lender refused, but did not vacate the premises on time. Then the owner went to court. The judges indicated that in accordance with Art. 689 of the Civil Code of the Russian Federation, the loan is terminated and the premises must be returned to the owner by virtue of Art. 309.310 of the Civil Code of the Russian Federation.

But regarding the claims made by the plaintiff for the recovery of unjust enrichment (the defendant used the premises for free without having the right to do so), the court of first instance did not support the plaintiff. He indicated that the agreement concluded by the parties is free of charge for a long time. Therefore, the plaintiff has no grounds to recover unjust enrichment for the transition period during which the defendant continues to use the premises.

However, the appeal court corrected the decision and rendered it in favor of the applicant (FAS resolution from the contract dated May 4, 2008 No. F09-2122/08-Sb). The arbitrators concluded that unjust enrichment of the borrower did occur, since “the defendant had no grounds for using this premises after the specified period, but he continued to use the premises and did not pay a fee for use.”

How does the court evaluate evidence?

Analysis of judicial practice showed the following.

Under agreements for gratuitous use, the object of which is state and municipal real estate, evidence in court is often acts of commissions on the part of the lender, as well as testimony of witnesses, documents indicating that the borrower transferred the premises to third parties without the consent of the lender (FAS PO decisions dated 02/26/2008 No. A55-5850/2006; FAS VVO dated 07/13/2005 No. A82-5230/2004-36).

In one case, the judges, satisfying the lender's request to terminate the contract, proceeded from the fact that the premises were transferred to the defendant for an office, a filming pavilion and a video editing studio, but they were equipped with a weapons room of a third party (a security agency). To confirm this fact, the plaintiff presented a free use agreement for the transfer of premises for an office, pavilion and studio; sanitary and epidemiological conclusion; certificate of inspection of the premises (Resolution of the Federal Antimonopoly Service VSO dated April 29, 2008 No. AZZ-2674/2007-F02-1600/2008).

Another example: the judges made a decision in favor of the plaintiff based on the inspection report of the non-residential premises and adjacent territory. The inspection revealed that some of the premises transferred to the borrower are not used and are in unsatisfactory condition. The surrounding area is partially landscaped, the courtyard is cluttered. The borrower does not carry out current and major repairs in violation of the agreement. Based on this, the courts concluded that the defendant-borrower failed to comply with the terms of the agreement. After all, the contract directly provided for his obligation to improve and clean the territory, carry out major and current repairs (FASZSO resolution dated September 13, 2007 No. F04-6458/2007 (38301-A70-4)).

In another case, the lender presented to the court an act of verification of the intended use of the property transferred to him. In the statement of claim, he asked to terminate the contract for gratuitous use “in connection with the defendant’s violation of its terms regarding the use of the property for its intended purpose and maintenance, operation, necessary current and major repairs, necessary reconstruction of the property, and re-equipment at its own expense.”

But when examining and assessing the evidence, the court found that there were no facts of the property being used for other purposes, and also did not find evidence of improper use by the plaintiff. Namely:

- it turned out that in violation of Art. 691 of the Civil Code of the Russian Federation, the lender, under the transfer and acceptance certificate, transferred the building in a condition not suitable for use for its intended purpose. Major repairs of these facilities were required, which the plaintiff did not carry out;

— the act of joint inspection of the facilities confirmed the fact that the premises were being repaired by the defendant, as well as their use for their intended purpose.

On this basis, the judges refused to satisfy the lender's claim for early termination of the loan agreement (Resolution of the Federal Antimonopoly Service dated July 30, 2008 No. F03-A51/08-1/2255).

Notarial provision of evidence

It should be noted that the lender may encounter certain difficulties when presenting evidence to the court. For example, if the borrower refuses to sign an act or other verification document.

In this case, lenders often draw up a unilateral act, which is not always accepted by the court as proper evidence. Therefore, we recommend using the procedure for notarial provision of evidence (Articles 102, 103 of the “Fundamentals of the Legislation of the Russian Federation on Notaries” dated 02/11/1993 No. 4462-I). This procedure involves the notary questioning witnesses, examining written and material evidence, and ordering an examination. But let us recall that no evidence has pre-established force for the arbitration court (clause 5 of Article 71 of the Arbitration Procedure Code of the Russian Federation).

Notarial provision of evidence is possible upon a written application from the interested party, but only until the commencement of arbitration proceedings.

An application for securing evidence is submitted to the notary in whose area of activity these procedural actions must be performed. Both public and private notaries have the authority to provide evidence. The application must provide the following information:

1. The reasons for the provision and the facts allowing one to believe that the presentation of evidence will subsequently become impossible or difficult. In practice, a formal justification is sufficient. For example, to question a witness, it is enough to inform that the witness has a foreign passport and intends to travel outside the Russian Federation.

2. Contact details of the proposed opponents, since the notary is obliged to notify them of the time and place of the procedural actions. However, the failure of the opponent's representatives to appear is not an obstacle to the notarization of evidence.

3. List of questions for the witness. It must be taken into account that the witness is questioned by a notary, and not by a party to a potential dispute. In this case, the notary should not go beyond the issues specified in the application.

Responsibility of the parties

This section discusses situations in the event of which the Parties bear financial responsibility. By mutual agreement of the Counterparties, many circumstances can be included in this clause. We will focus on those that are the main ones. So, in the text of the document the points are written as follows:

The parties bear financial responsibility for failure to fulfill or improper fulfillment of their obligations under this agreement. The Lender is responsible for the shortcomings of the object handed over to him that interfere with its normal use. If such shortcomings were specified by the parties when concluding the transaction, the Lender is not responsible. The borrower bears financial responsibility in the event of damage to the property handed over to him for use under an agreement for the gratuitous use of non-residential premises. The borrower bears financial responsibility if the premises are not used for its intended purpose.

Will of real estate

Another popular gratuitous real estate transaction, which provides for the transfer of property after the death of the testator. In fact, property can pass to the legal heirs without a will. However, if you want to distribute it in a certain way or transfer part of the property to third parties who are not the immediate heirs, you need to draw up a will and have it certified by a notary.

The opening of a will occurs after the death of the testator at his place of residence. Heirs must submit an application for acceptance of the inheritance within 6 months from the date of its opening. Then you need to obtain a certificate of inheritance from a notary. Since we are talking about the will of real estate, the next mandatory action of the heir is the state registration of the right to the bequeathed object.

Dispute Resolution

This section provides information on the procedure for resolving disputes between the parties. As part of the agreement, Contractors can specify various conditions, but we will highlight those that apply most often:

All disagreements that arise regarding the fulfillment of their obligations under the contract are resolved through negotiations between the parties. If during the negotiations the parties do not reach a common conclusion, disputes will be resolved in court.

At the end of the document, the signatures of the parties are placed, and the agreement is considered concluded.

Validity

An important feature of the agreement under consideration is urgency . If the contract were not urgent, we would be dealing with a donation. A loan agreement (like a lease) can be agreed for a specific period or for an indefinite period.

A transaction is considered agreed upon for an indefinite period when the parties indicated this in the agreement or when the parties did not stipulate the term in the document.

The loan agreement is considered renewed for an indefinite period if:

- the loan agreement for non-residential premises was initially limited to a specific period;

- the contract has expired;

- after the contract has expired, the borrower continues to use the thing;

- the lender does not raise any objections on this matter.

If the parties to the transaction are spouses

In practice, the question often arises about the use of non-residential buildings for business purposes by one of the spouses. More specifically, we are talking about cases when non-residential premises were acquired before marriage by one of the spouses, and the other spouse wants to use this area to carry out his business activities.

The Family Code establishes a presumption of joint property of spouses: everything acquired during marriage is common , but everything that was acquired before marriage is the personal property of the spouse.

Tax authorities require entrepreneurs to indicate the areas (for example, retail) on which tax is paid. In such situations, it is recommended to draw up an act of gratuitous use, rather than a lease. This will help reduce the tax base for operation and maintenance.

Is it registered and what is the procedure for state registration?

State registration will be required only in one case: when the subject of the transaction is an object of cultural heritage.

The procedure for state registration is established by the Federal Law “On State Registration of Real Estate”. To register a transaction with Rosreestr or the MFC (multifunctional center), one of the parties to the agreement (lender or borrower) must apply for registration.

The application must be accompanied by documents confirming the lender’s right to dispose of the premises transferred for use, as well as the loan agreement itself. Registration period: 7 working days if the application and documents were submitted directly to Rosreestr, 9 working days - if through the MFC.

For the state service of registering a loan for a cultural heritage site, you must pay a state fee in the amount of 2,000 rubles for individuals, 22,000 rubles for legal entities.

Taxation

What tax is the transaction subject to?

- Lender:

- Obliged to pay property tax as the owner of the premises transferred under the loan agreement.

- VAT in the form of the cost of services provided free of charge. The tax base is determined based on the price that has developed in the market for homogeneous services in similar economic conditions (in particular, this is the income that could be received from renting out real estate).

- Borrower:

Income (profit) tax. A property right received free of charge is subject to inclusion in the non-operating income of the borrower. Income is assessed based on the price on the market for homogeneous services in similar economic conditions.The borrower is obliged to take into account the costs associated with the use and maintenance of the subject of the agreement for the purpose of taxing profit (income).

The lender does not pay income (profit) tax. At the same time, the cost of non-residential space, which is transferred free of charge, is not taken into account when determining expenses.