Under an agreement for the free use of non-residential premises, one party transfers to the other party the temporary right to use the property free of charge.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The subjects of the agreement are the Lender - the person who provided the property for temporary use, and the Borrower - the person who uses such an object within the framework of the rules established by the agreement on a free basis.

Both individuals and legal entities can act as subjects of an agreement for the free use of residential premises. Individual entrepreneurs are especially benefited when concluding this type of agreement.

This document needs to be in writing, since there is a need to establish the obligations of the Parties under the agreement. Therefore, below, using the example of a contract for the free use of a store premises, we will step by step examine how to draw up such a document and what nuances you should pay attention to when drawing it up.

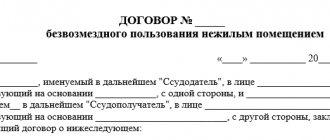

Agreement for free use of non-residential premises

Kurgan

May 24, 2023

Karpov Viktor Petrovich, born 07/08/2000, living at the address Kurgan region, Kurgan city, Lenin street, building 76, apartment 898, passport XXXXX XXXXXXX, issued by the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan 00.00.0000, hereinafter referred to as Lender I IP Petrov Viktor Petrovich, passport ХХХХ ХХХХХХ, issued by the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan 00.00.0000, hereinafter referred to as the Borrower, have entered into this agreement as follows:

The preamble to the treaty traditionally includes:

- type of agreement;

- place and date of conclusion of the contract;

- names and roles of parties to the transaction;

- residential addresses and passport details of the parties.

The contract will be considered concluded if the parties reach an agreement on all essential terms of the contract. The essential terms of the contract for the provision of services free of charge are:

- subject of the agreement;

- term of provision of services;

- duties of the parties;

- responsibility of the parties.

Item

Information about the subject of this agreement is stated in the initial paragraphs of the document. In this case, the subject will be non-residential premises. The section about the item should clearly describe the characteristics of such a room, namely:

- indicate at what address it is located;

- indicate whether there is any equipment attached to the premises;

- indicate the number of square meters in the room;

- indicate to whom the non-residential premises belong by right of ownership and whether it is encumbered with the rights of third parties.

So the item clause looks like this:

The Lender transfers the right to use free of charge to the Lender the non-residential premises located at the address: Kurgan region, Kurgan city, Burova-Petrova street 72B. The total area of the premises is 50 (fifty) square meters. According to an extract from the register of real estate of the Russian Federation, the Lessor is the owner of the premises. The intended purpose of the rented premises is retail trade in non-durable goods (clothing). This agreement is concluded for an indefinite period.

Obtaining ownership rights

The right of ownership, both of legal entities and citizens, is of course central to legislation. Judicial practice allows us to outline recommendations for writing a statement of claim. To remove barriers to the ownership of non-residential premises, you need to:

- Present to the court documents on the ownership of this area, in the direction of which obstacles are being erected in the exploitation.

- Show all the necessary evidence of the presence of barriers to use, and it is advisable to attach photographs from the site, inspection reports, and testimony from neighbors. A prerequisite for this is that the violation occurs within the boundaries of your premises.

- To eliminate obstacles, you need to prove to the court that they arose in the possession of the premises after the conclusion of the contract for this area.

- Justify the impossibility of operating the premises without damage to the owner.

- Before filing a claim, make sure once again:

- the renewal agreement has not expired;

- the violator is the very person against whom the complaint is filed.

- If the defendant interferes with the necessary restoration of the premises, evidence of changes in the planned structure must be presented to the court.

Reference! Additionally, you can write in the statement of claim for reimbursement of expenses at the expense of the defendant if he does not comply with the court decision on time.

Duties of the parties

The obligations of the parties are an integral part of the document. This section may spell out various obligations by mutual agreement of the Parties, but we will focus on the basic wording. So this section looks like this:

The lender undertakes to: Provide the non-residential premises specified in the paragraphs of this agreement in proper condition according to the acceptance certificate. Do not interfere with the Tenant in carrying out his activities during the lawful use of non-residential premises. Provide the Borrower with access to the specified premises. Familiarize the Borrower with the rules for using non-residential premises. Fulfill your obligations in strict accordance with this agreement. The Borrower undertakes to: Maintain the store premises and the equipment contained therein in good condition. Do not carry out any work related to changing the structure of the premises without the consent of the Lender. Use the premises strictly for their intended purpose. Observe safety precautions when using non-residential premises. After termination of the contract, return the non-residential premises in technically sound condition in which it was upon acceptance and transfer (taking into account natural wear and tear). Fulfill your obligations in strict accordance with this agreement.

Operating procedure

At the legal level, requirements have been adopted that owners of commercial properties must comply with . And at the same time, these rules are designed to guarantee the protection of the interests of other owners in an apartment building. In this way, a balance of interests of all parties is maintained.

In a private rented establishment, you cannot carry out actions that will result in environmental pollution or an unfavorable sanitary and epidemiological situation. In other words, the equipment of a public toilet or medical facility for patients with infectious diseases is prohibited in rented non-residential premises.

Important! The premises must meet sanitary and fire safety standards, have a separate entrance, and can only be placed on the ground floor. In the case of an equipped cafe or other catering establishment, work must be completed no later than 23:00.

Responsibility of the parties

This section discusses situations in the event of which the Parties bear financial responsibility. By mutual agreement of the Counterparties, many circumstances can be included in this clause. We will focus on those that are the main ones. So, in the text of the document the points are written as follows:

The parties bear financial responsibility for failure to fulfill or improper fulfillment of their obligations under this agreement. The Lender is responsible for the shortcomings of the object handed over to him that interfere with its normal use. If such shortcomings were specified by the parties when concluding the transaction, the Lender is not responsible. The borrower bears financial responsibility in the event of damage to the property handed over to him for use under an agreement for the gratuitous use of non-residential premises. The borrower bears financial responsibility if the premises are not used for its intended purpose.

How can the gratuitous use of property result?

Letters from our readers often describe the following situation. An organization uses premises or other property owned by another company for free, either without concluding any agreement at all (for example, rent, etc.), or under a gratuitous use agreement (fixed or unlimited). I would like to warn you about the possible negative tax consequences of such use .

What will it cost you?

The fact is that the free use of property entails the receipt of non-operating income from the gratuitously received right to use the property <1>. This income is calculated by estimation according to Art. 40 Tax Code of the Russian Federation. And if you do not take it into account when calculating the tax base for income tax or tax under the simplified tax system <2>, then the tax authorities, having discovered this state of affairs, will do the following:

- additional income tax will be charged (tax paid in connection with the application of the simplified tax system) on the amount of such income, calculated based on the prices at which similar property is rented out <3>; — the corresponding penalties will be charged <4>; — will be fined for failure to pay income tax (“simplified” tax) in the amount of 20% of the amount of unpaid tax <5>.

Attention! Anyone who provides their property for free use may also have problems. Firstly, he does not have the right to charge depreciation on such property <6>, and secondly, he may be charged additional VAT on the market rental value of similar property <7>.

This was confirmed to us by the Federal Tax Service of Russia.

FROM AUTHENTIC SOURCES

MELNICHENKO ANATOLY NIKOLAEVICH - State Councilor of the Russian Federation, 1st class

“When conducting on-site audits, tax authorities pay special attention to the legal basis for the taxpayer’s use of property, property rights, works and services of other persons in his activities.

If an organization has received from another organization the right to use its property (for example, an office) free of charge, then in this case it is obliged to include in the tax base the amount of non-operating income determined on the basis of market prices for the rental of identical property excluding VAT. This position is also shared by the Presidium of the Supreme Arbitration Court of the Russian Federation <8>.”

All of the above consequences will also occur when you received the right to use the property free of charge from your founder, whose share in your authorized capital is more than 50% <9>. Indeed, for tax purposes, income in the form of property received free of charge from the founder, and not property rights <10>, is not taken into account.

The only ones who should not take into account gratuitously received property rights as income for profit tax purposes are non-profit organizations that use state and municipal property free of charge to conduct statutory activities <11>.

When to recognize “gratuitous” income

As for the date of recognition of income for the gratuitous use of property, for organizations using the accrual method, everything is more or less clear: they must recognize such income during the entire period of use of the property at the end of each quarter (month) <12>. By the way, many simplifiers do not want to recognize income in the form of a property right received free of charge, since they actually do not receive any money and the moment of recognition of income in such a situation is not determined.

This position is wrong. After all, income is not only the actual receipt of money, but also the receipt of other property or property rights <13>. Moreover, non-operating income for simplifiers is taken into account in the same manner as for organizations applying the general taxation regime <14>. And for the latter, the property rights received free of charge are directly listed among their income. If we speak the language of economics, then the income (economic benefit) from the free use of property consists of the saved money that the simplifier would have paid if he had used the property for a fee.

And here is what the Federal Tax Service told us about the date of recognition of income by simplifiers for the gratuitous use of property.

FROM AUTHENTIC SOURCES

MELNICHENKO ANATOLY NIKOLAEVICH, State Advisor of the Russian Federation, 1st class “For taxpayers using the cash method, the date of receipt of income in the form of a gratuitously received right to use property is: <or> the date of signing of documents confirming the transfer of property rights; <or> the day of actual receipt of property rights to gratuitous use of property.”

It turns out that if there is a document that indicates for what period the property is transferred, then you need to immediately take into account the income for the entire period of use of the property. If there is no such document, then income must be determined in each reporting period based on the rental cost of similar property.

How can you mitigate unpleasant consequences?

It turns out that when using property free of charge, it is better not to have any documents at all, from which it would be clear how long you have been using this property. In this case, you will at least be able to tell the tax authorities that “you just moved to this office a week ago.” Thus, the taxable income imputed to you will be small and you can get off with what is called a small loss. But keep in mind that the tax office can prove the opposite, namely that you have been using the premises for a long time. Inspectors may interview your neighbors in the office building, or you could easily be given away by, for example, an old newspaper advertisement with your address. And then additional taxes and other troubles cannot be avoided.

But even in this case, it’s too early to give up. You have many chances to challenge in court the correctness of the tax authorities’ determination of the market rental price for similar property, on the basis of which they determine the income received <15>. The fact is that they are not often able to find identical or homogeneous objects to compare prices, especially if they are real estate. Legal disputes on this issue that the Federal Tax Service would win are rare. And even then this happens when the taxpayer does not try to challenge the correctness of the tax authorities’ determination of the market price <16>.

WARN YOUR MANAGER

If the tax authorities become aware that your company is using someone else’s property for free, they will certainly charge additional taxes on the money saved on rent, and will also fine your organization.

* * *

So, gratuitous use of property is akin to free cheese, which, as you know, only comes in a mousetrap. This may lead to additional tax risks. Therefore, before you rejoice at the opportunity not to pay, for example, for the premises you occupy, adequately assess all the possible negative consequences of such a situation. Still, it is safer to conclude a lease agreement, even with a small rent, which you will include in expenses, and sleep peacefully than to flinch from every call from the Federal Tax Service.

——————————- <1> clause 8 of Art. 250 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of Russia dated December 11, 2009 N 03-03-06/1/804, dated 02/04/2008 N 03-03-06/1/77 <2> Letter of the Ministry of Finance of Russia dated October 31, 2008 N 03-11 -04/2/163; Resolution of the Federal Antimonopoly Service of the Eastern Military District dated July 29, 2008 N A29-9662/2007; FAS SZO 01.10.2008 N A44-96/2008; FAS North Caucasus Region dated October 22, 2008 N F08-6323/2008 <3> clause 8 of Art. 250, paragraph 1, art. 346.15, paragraph 1 of Art. 39, paragraph 3, art. 40 Tax Code of the Russian Federation <4> Art. 75 Tax Code of the Russian Federation <5> clause 1 art. 122 Tax Code of the Russian Federation <6> clause 3 art. 256 Tax Code of the Russian Federation; Letter of the Federal Tax Service of Russia for Moscow dated October 31, 2007 N 20-12/104582 <7> sub. 1 clause 1 art. 146, paragraph 2 of Art. 154, art. 40 Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated 05.05.2009 N 03-07-11/133; Resolution of the Federal Antimonopoly Service of the Eastern Military District dated 02/18/2008 N A31-567/2007-15 <8> clause 2 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 12/22/2005 N 98 <9> Letters of the Ministry of Finance of Russia dated 03/14/2008 N 03-05-05-02 /12, dated January 24, 2007 N 03-11-05/10 <10> sub. 11 clause 1 art. 251 Tax Code of the Russian Federation <11> subp. 16 clause 2 art. 251 Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated March 19, 2010 N 03-03-06/4/24 <12> clause 1 art. 271, art. 285 Tax Code of the Russian Federation <13> clause 2 art. 272, paragraph 1, art. 346.17 Tax Code of the Russian Federation <14> clause 1 art. 346.15 of the Tax Code of the Russian Federation <15> see, for example, Resolution of the Federal Antimonopoly Service of the Eastern Military District dated July 29, 2008 N A29-9662/2007; FAS SZO dated 01.10.2009 N A42-7203/2008 <16> see, for example, Resolution of the FAS SZO dated 31.03.2009 N A33-4100/08-F02-1119/09

First published in the journal "Glavnaya Ledger" N 08, 2010

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.

Dispute Resolution

This section provides information on the procedure for resolving disputes between the parties. As part of the agreement, Contractors can specify various conditions, but we will highlight those that apply most often:

All disagreements that arise regarding the fulfillment of their obligations under the contract are resolved through negotiations between the parties. If during the negotiations the parties do not reach a common conclusion, disputes will be resolved in court.

At the end of the document, the signatures of the parties are placed, and the agreement is considered concluded.

Accounting for preferential rent in “1C: Public Institution Accounting 8”

The receipt, in accordance with the agreement, of non-financial assets related to operating leases on preferential terms for free-term use is reflected by the institution (user) of non-financial assets in the corresponding analytical accounts of account 0 111 40 000 “Rights to use non-financial assets” and the credit of account 0 401 401 82 “Future income from the gratuitous right of use” in the amount of fair (market) value for the period of use of the transferred non-financial assets (clause 41.1 of the Instructions for the use of the Chart of Accounts for Budget Accounting, approved by order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n, clause 67.3 of the Instructions on the application of the Chart of Accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n).

In the program “1C: Public Institution Accounting 8”, edition 1 and edition 2, this operation is reflected in the document Acceptance for accounting of rights to use OS, legal acts.

Depreciation on objects of registration of the right to use property received by an institution for free use related to operating leases is carried out in the amount of monthly lease payments and is reflected in accounting records (clause 19 of Instruction No. 162n, clause 26 of Instruction No. 174n):

Debit 0 401 20 224 “Expenses for depreciation of rights to use an asset” Credit to the corresponding analytical accounting accounts account 0 104 40 000 “Depreciation of rights to use an asset”.

At the same time, in the same amount, the accounting records reflect the assignment to the financial result of the current period of deferred income from obtaining the right to use the asset (under lease agreements on preferential terms):

Debit 0 401 40 182 “Future income from gratuitous right of use” Credit 0 401 10 182 “Income from gratuitous right of use”.

In the program “1C: Public Institution Accounting 8”, these operations are reflected in the document Accrual of depreciation of rights to use OS, legal acts.

Please note that from 01/01/2019, in accordance with the Procedure for applying the classification of operations of the general government sector (approved by order of the Ministry of Finance of Russia dated November 29, 2017 No. 209n, as amended by order of the Ministry of Finance of Russia dated November 30, 2018 No. 246n), the following KOSGU codes are used to reflect income from preferential rent :

- 182 “Income from the gratuitous right to use an asset provided by organizations (except for the public administration sector and public sector organizations)”;

- 185 “Income from the gratuitous right to use an asset provided by public sector organizations”;

- 186 “Income from the gratuitous right to use an asset provided by the general government sector”;

- 187 “Income from the gratuitous right to use an asset provided by other persons.”

Termination of the right to use an asset (subject to full execution of the contract) (disposal of an operating lease accounting object) is reflected in accounting entries in the corresponding analytical accounting accounts (clause 41.1 of Instruction No. 162n, clause 67.3 of Instruction No. 174n):

Debit 0 104 40 000 “Depreciation of rights to use assets” Credit 0 111 40 000 “Right to use non-financial assets”

- in the amount of the book value of the right to use the asset.

In the 1C: Public Institution Accounting 8 program, edition 1 and edition 2, this operation is reflected in the document Termination of rights to use OS, legal acts.

| 1C:ITS Budget For more information about the reflection in “1C: Accounting of a State Institution 8” of operations on preferential lease by the borrower, see the articles published in the methodological support for standard configurations of edition 1 and edition 2 of the BGU1 and BGU2 program. |