Dear visitors!

Please note that the articles are for informational purposes only and do not relate to the services of the developer!

If you are interested in this service, please contact specialists on this issue.

Transactions concerning the re-registration of real estate must be approached responsibly, carefully, and scrupulously. Lawyers, notaries and realtors know how to re-register an apartment correctly, safely and honestly. It is very important to entrust this task to reputable, competent specialists.

We hope that after reading this material the reader will not only receive answers to pressing questions, but will also understand the seriousness of the procedure and seeking help from specialized specialists.

The current owner must submit documents for re-registration on a voluntary basis, and not under the influence of third parties. Otherwise the transaction will be declared invalid

Grounds for re-registration of property

Before we talk about re-registration of property, let us establish what ownership means. Civil legislation defines this as the right to use, as well as own and dispose of property. Thus, a person can do whatever he wants with his property - sell, donate, exchange, or even destroy, of course, if this does not cause damage to surrounding people and nature. Section 2 of the Civil Code (hereinafter referred to as the Civil Code of the Russian Federation) is devoted to this right.

Based on the provisions of the mentioned law, re-registration of ownership is nothing more than the transfer to another person of the right to dispose, own, use real estate or other property.

You may be interested in: what are the features of registering ownership of an apartment.

Sometimes it is enough to simply transfer the item to the new owner, and sometimes it is necessary to additionally draw up a written agreement. The latter is relevant for the transfer of ownership of an apartment. Based on the Civil Code of the Russian Federation, the Housing Code, laws regulating property relations, as well as the practice of lawyers, there are five ways to transfer an apartment to another person:

- Purchase and sale - the owner transfers the apartment to another person for a fee (Articles 549 - 558 of the Civil Code of the Russian Federation).

- Donation is a gratuitous transfer of property (Articles 572 – 582).

- Rent - a person undertakes obligations for the care and maintenance of the owner of the apartment or pays a certain amount during the period established by the agreement, and as a result receives it into ownership after the expiration of a certain time or the death of the owner (Articles 589 - 605).

- Exchange - in such a transaction, owners exchange property among themselves (Articles 567 - 571).

- Will - with this method, the apartment is transferred to the new owner after the death of the former owner and inheritance on the basis of a written order certified by a notary or a person specified in the law (Articles 1110 to 1175 of the Civil Code).

You can reduce your tax to zero if

For example, it is now 2021. You are selling an apartment for 3,000,000 rubles, but purchased the apartment as an inheritance from a close relative in 2021. Since you inherited an apartment from a close relative, the minimum period of ownership for tax exemption is 3 years. The cadastral value of the apartment for 2021 is 4,500,000 rubles (70% of 4,500,000 = 3,150,000 rubles). 3,000,000 is less than 3,150,000 rubles, which means: the sale value of the property indicated in the contract is less than 70% of the cadastral value.

The tax deduction is distributed in proportion to the share!

From 01/01/2021, Article 217.1 is valid for ALL owners, and not just for residents. Those. for non-residents, the rules of tax exemption after 3-5 years and the limitation of the tax base are now also applied - 70% of the cadastral value

- reduced price of liquid real estate;

- the seller’s inability or unwillingness to provide all documents regarding the apartment;

- the owner is too old or ill;

- the need to cooperate with a representative without personal contact with the seller.

Until recently, the secondary residential real estate market was seriously criminalized and dangerous for non-professionals. But active legislative measures, the attention of law enforcement agencies and the presence of reputable real estate agencies have significantly simplified the process and made it transparent. Now the purchase and sale transaction is insured, and registration of ownership is carried out in a matter of days.

Apartment purchase insurance

- evenness of vertical and horizontal surfaces (walls, floors, ceilings);

- presence and operability of doors and windows;

- availability of communications (gas, electricity, water supply, sewerage);

- condition of the electrical wiring (turn on the lights, check the sockets using simple electrical appliances);

- in the cold season, you need to check how the heating system works;

- absence of dampness and/or mold in rooms with high humidity;

- check how the plumbing equipment works, as well as the gas or electric stove in the kitchen;

- compliance of the apartment layout with the available technical documentation.

May 15, 2021 yuristco 155

Share this post

- Related Posts

- What do they give for the third child in 2021 in the Irkutsk region?

- Payments for the birth of a third child in Kuban in 2021

- How much does alcohol sell in Tyumen in 2021?

- Benefits for a Participant in Combat Actions A L N R

Re-registration procedure

Documents required for re-registration of an apartment:

- Passport;

- a document confirming the emergence of ownership rights (DCT, rent agreement, etc.);

- consent of the spouse, confirmed by a notary.

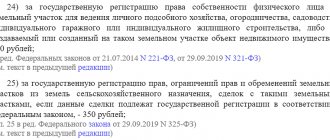

To re-register, you need to submit these documents to Rosreestr and write a corresponding application. Order of the Ministry of Economic Development of Russia dated November 26, 2015 No. 883 established that the collected package can be sent by Russian Post, through a representative, the online portal of State Services or the website of Rosreestr, MFC, or submitted in person to the branch of the registration authority. The applicant also needs to pay a state fee - 2,000 rubles.

After submitting the application, within 12 days the specialist will make a decision on registration or refusal (for example, due to an error in the execution of the contract), which can be appealed in court.

Thus, to re-register an apartment, it is necessary not only to draw up a written agreement, but also to prepare a package of documents and register the acquired property. Below we will look step by step at re-registering an apartment in different ways.

There is nothing complicated in the instructions provided, however, certain knowledge is required so that all actions and executed documents have legal force.

Purchase and sale

You can sell an apartment to absolutely any person or organization. To find a buyer, you can place an ad online or contact a real estate agent. Next, we presented instructions for independently conducting a transaction for a private apartment.

Step 1. Appraisal of the apartment.

Since the apartment lease transaction is of a paid nature, it is necessary to realistically assess its value. When selling, you can rely on the results of a cadastral valuation, but they do not always satisfy the owners or buyers of real estate. Therefore, it is worth contacting specialists to conduct an independent assessment of the apartment and determine its market value specifically for the period of sale.

Don't agree with the cadastral value of your property? Fill out the form to the right and our highly qualified attorney will tell you how to challenge the results of a government assessment.

Step 2. Prepare documents.

When buying an apartment with a registered child, the new owner takes on a big risk. Since he will not be able to discharge him without providing similar housing.

These documents are collected directly by the owner. The future owner should carefully study all the documents, and pay special attention to the USRN extract.

The buyer will only need a passport and the consent of the spouse.

Step 3. Draw up a policy statement.

This agreement is drawn up in simple written form, but in compliance with certain requirements. He contains:

- details of the seller, buyer;

- information about the apartment: address, location in the house, area, number of rooms;

- transaction price;

- payment method (cash, non-cash);

- payment method (one-time payment, installments);

- conditions for re-registration of ownership (after payment of the entire amount, after the first installment);

- rights, obligations of the parties to the contract;

- liability for breach of contract;

- additional conditions.

It is also necessary to draw up a transfer deed, which will be an annex to the agreement.

For the agreement, you will additionally need the buyer’s passport and the consent of the spouse (if he has one).

You can draw up this agreement yourself; notarized confirmation is not required, except in cases where one of the parties to the transaction is a minor child, incapacitated, the documents will be sent by mail, or when a share in the apartment is being sold.

Step 4. Register ownership.

Costs for realtor services

Any party to the transaction can use the services of a realtor.

Accordingly, the initiator will bear the costs. The cost of services depends on the prices of the company in force at the time of the interested party’s application. It is included in the contract concluded with the realtor. The size is determined as a percentage of the cost of housing. On average it is from 2 to 5%. In the capital, for example, this is how much it costs to complete a transaction with the participation of a realtor:

- A typical purchase or sale of a typical apartment will cost a client of a large agency 150–200 thousand rubles.

- A smaller company may require 100–150 thousand.

- Private realtors charge 70–80 thousand and more for their services, depending on their own ambitions and the current state of their bank account.

Donation

You can transfer an apartment under a gift agreement to any persons, in particular, those who are not relatives. The deed of gift is gratuitous, so a real estate appraisal is not required; you can start immediately by preparing the necessary papers.

Step 1. Prepare documents.

To draw up a deed of gift, you will need the same list of papers as for the DCT.

Step 2. Draw up a deed of gift.

This act of will must be drawn up only in writing. There are no special requirements for the structure. But the deed of gift must contain:

- details of the parties;

- information about the apartment;

- rights, obligations of the donor and the donee;

- liability for breach of contract.

The need for notarization arises in the same situations as with DCT.

Step 3. Rewrite the apartment.

Rent

The legislation allows for the transfer of ownership under a rent agreement for a fee or free of charge. In the first option, the agreement specifies a condition for the periodic transfer of funds to the owner during his life (lifetime annuity) or indefinitely (permanent). And in the second there is a condition on the provision of services and the fulfillment of certain obligations - lifelong maintenance with dependents.

Does the rent recipient continue to live in the re-registered apartment? Write to our legal adviser by filling out the form on the right, and he will definitely help you solve the problem.

If the agreement contains a condition for payment, then the rules of the monetary contract apply to it, and if the transfer of property is free, the gift agreement applies. However, annuity is not one of these contracts.

You may be interested in the apartment rental agreement and its features.

Step 1. Prepare documents.

The package of documents for an annuity agreement does not differ from the DCP.

Step 2. Draw up an agreement.

The rent must also be drawn up only in writing and must be certified by a notary. Otherwise, the agreement will not have legal force. It includes:

- data of the parties;

- information about the apartment;

- rights, duties, responsibilities;

- additional conditions.

Step 3. Rewrite the apartment.

Exchange

In practice, apartment exchanges often occur within the same city, region or even country. It can be either without additional payment or with additional payment.

Step 1. Prepare documents.

For exchange, both parties to the transaction collect a package of documents for each subject of the contract, as in the case of purchase and sale.

Step 2. Draw up an agreement.

The peculiarity of this agreement is that the parties to the transaction act as a seller and a buyer at the same time. The agreement contains the same conditions as the above agreements. Notarization is not necessary; the contract can be certified at the request of the parties.

Step 3. Rewrite the apartment.

The nuances of re-registration of housing for a spouse, grandchildren, brothers/sisters and parents

To re-register property to a spouse, a purchase and sale agreement is usually used, since you can receive a tax deduction in the amount of 260,000 rubles. In case of registration of a gift, there is no tax deduction from the transaction. The same is true for re-registration of rights to parents, brothers/sisters or grandchildren. In the latter case, it is permissible to resort to writing a will. There is another way for those who acquired an apartment during marriage; in this case, you can draw up an agreement on property division.

Will

The peculiarity of a testamentary disposition is that it comes into force only after the death of the owner. It also has an advantage over inheritance by law.

Step 1. Prepare documents.

To draw up a will, it is enough for the owner of the apartment to provide a passport and title documents for the apartment.

Step 2. Make a will.

To draw up a will, you must contact a notary or other authorized person. For example, if a person is in a hospital, then the head physician can certify the “last will”.

When receiving an apartment under a will, the heir acts as follows:

- Collects documents.

To receive an inheritance you must provide:

- heir's passport;

- testator's passport;

- original will;

- certificate of ownership in the name of the testator;

- extract from the Unified State Register of Real Estate.

- Presents documents to the notary.

To re-register the apartment in his name, the heir needs to obtain a certificate of inheritance. To do this, the documents indicated above are transferred to the notary for examination.

- Pays the state fee.

After reviewing the documents, the heir receives a payment order to pay the state fee. For children, spouse and parents of the testator, the payment amount is 0.3% of the value of the inherited property, and for other categories - 0.6%.

- Receives a certificate.

Having paid the fee, the heir receives a certificate of the right to inheritance - the basis for re-registration of the apartment.

- Registers property rights.

You may also be interested in: how to challenge a will for an apartment.

Required documents for the seller

Wanting to sell his property, the seller must be prepared for the fact that compliance with all legal requirements will necessitate additional actions.

Such actions will be aimed at preparing the papers that are necessary to conclude a transaction and its subsequent registration.

The seller has the following list:

- Document basis of ownership.

- Extract from the Unified State Register of Real Estate.

- Certificate of absence of debt.

- Extract from the house register.

- Copy of the bill (housing department).

- Cadastral passport.

- Explication.

- Floor plan.