Wages are not paid at all or are delayed: what to do?

Paying employees wages in full and on time is one of the main responsibilities of the employer.

Delays in wages are considered a serious violation of labor laws, which may result in penalties including criminal liability. Types of employer liability for delayed wages:

The legislation provides for serious liability for the employer in such cases. However, it is more important for the employee to get the money he earned as quickly as possible, and not just to punish the unscrupulous employer. Therefore, he needs to take the initiative into his own hands.

Where to turn if your salary is not paid? There are several legally permitted mechanisms for influencing the employer in order to resolve the issue of unpaid wages. Some of them allow workers to achieve the desired result with the help of pre-trial activities. If the efforts made are not crowned with success, working citizens are left with judicial procedures for collecting wage debts. In addition, the law does not prohibit going to court without going through pre-trial mechanisms.

Find out what to do if your salary is delayed for a long time in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

Algorithm of requests. From simple to significant

There are several possible paths that an employee who has not received his financial support on time can take. You can act in several directions simultaneously, but it would be more effective and correct to follow the “ascending line”: start by contacting immediate management, and if there is no response, gradually increase the level of authorities.

R. filed a claim against the organization to recover the unpaid amount of the wage supplement for work in the Far North, citing the fact that the employer, in violation of Art. 317 of the Labor Code of the Russian Federation did not pay her the specified bonus in the amount of 100%. View the court decision

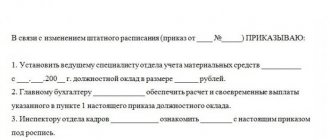

Written appeal to management

The employee must inform the governing bodies of his organization about the current situation, remind him of his rights and declare his intentions. To do this, you need to write an application addressed to the director, head of the organization, owner of the company, etc. In the text of the application, indicate from what period they have not paid you, what date the next payment should have been issued, and the amount that you did not receive. Then refer to the basis of the calculations that were violated:

- salary payment period specified in the employment contract or other local document;

- severance pay upon dismissal on the day of departure;

- payment of vacation pay (3 days before going on vacation), etc.

Mention the administrative responsibility of the employer for violating the rights of employees. Very often employers prefer to forget about it.

Next, communicate your future intentions. You can choose one of the options:

- absenteeism from work if the delay in payment continues;

- appeal to higher authorities that control this area (trade union, state labor safety inspectorate, tax authorities, prosecutor's office, court).

What to do if there is a long delay in salary payment ?

As with any business document, put a date and signature.

NOTE! Make two copies of the application and try to get a receipt stamp on the one you put for yourself (for example, if the document is submitted through the secretariat). You can also send such an application by registered mail with notification - this method will definitely protect you from the risk of losing evidence of your appeal to your superiors.

Suspension of work

A forced suspension of work may be a remedy for an employee who is offended by non-payment of wages. It’s logical: why work if the work is not paid? Such forced downtime is not considered absenteeism and cannot be grounds for dismissal of an employee if, after 15 days of delay in payment, the employee contacted the employer in writing and warned about such an outcome. If the employer responded to the employee’s request with an agreement to make a payment as soon as work resumes, he will need to begin his duties the very next day.

Art. 142 of the Labor Code of the Russian Federation, which allows workers this form of protest against the unlawful actions of the employer, limits the categories of workers to whom it is allowed, since there are professions where downtime is unacceptable. The following specialists should resort to other forms of self-defense without suspending work:

- ensuring people's livelihoods (ambulance, emergency gas service, energy, heating, communications, etc.);

- public sector workers;

- employees of hazardous industries;

- employees in government departments (police, search teams, rescue services, firefighters, military, etc.);

- employees in whose jurisdiction a state of emergency or martial law has been introduced.

Contacting the labor inspectorate

This is one of the most effective and practically applicable options for employees, since the competence of this body is precisely to consider issues of compliance with the labor rights of personnel. You must apply in writing. There are no special requirements for the format and content of the complaint; you can freely state your problem. Your application will serve as a catalyst for an audit of the employer’s activities, and the outcome of the audit will determine certain sanctions. If necessary, labor inspectors will initiate legal action. In any case, your request will not go unnoticed.

Contacting the prosecutor's office

The appeal of offended citizens is quite legitimate to become the basis for a prosecutor’s inspection of a negligent employer, because the prosecutor’s office is the highest supervisory body. If you want to seek help and protection from the prosecutor, proceed in the following order:

- Find out from the prosecutor's office which officer on duty you should contact (this could be an assistant or deputy prosecutor);

- in the office during a personal conversation, tell us about your problem;

- write a statement with the help of a prosecutor's office employee.

REFERENCE! You can, of course, send an appeal by mail, but a personal appeal is always more effective.

We resolve the issue of salary debt directly with the employer

Employees often encounter a situation where an employer does not pay wages . The question immediately arises: where to go if you don’t get paid?

Before complaining to regulatory or law enforcement agencies, contact your employer directly. Before your visit, prepare - fill out a written complaint in two copies and give one of them to the head of the enterprise. In your complaint, state the essence of the problem (what amount and since when you have not been paid), and also indicate your details (full name, position, department) and a request for payment of the debt. You will have a second copy of the document in your hands, which needs to be registered with the secretary. This is your safety net - a registered claim will confirm the fact of contacting the employer if you have to go to court with the issue of unpaid wages.

Most likely, you will be denied registration of a claim. In this case, feel free to send it by registered or certified mail with a description of the attachment. The fact that the claim has been sent to the employer will be confirmed by a postal receipt and a postal worker’s mark on the enclosure inventory.

It is possible that the employer, after your visit and receipt of the claim, will pay off the salary debt. But often attempts to resolve the issue directly with the employer are unsuccessful.

What to do if wages are not paid? You can try another legal way.

Personal income tax on compensation for late payment of wages

On the one hand, the Tax Code of the Russian Federation establishes that it is not necessary to pay personal income tax to the budget on compensation if it must be paid to an employee due, in particular, to the performance of labor functions in the company (clause 3 of Article 217 of the Tax Code of the Russian Federation).

On the other hand, the Labor Code of the Russian Federation limits the scope for establishing a specific amount of compensation to a minimum limit. The upper limit is not standardized. Consequently, the employer can set arbitrarily high compensation by fixing it in the collective agreement.

The question arises: will the amount of compensation be subject to personal income tax (both in terms of the minimum and in terms of exceeding the minimum under the Labor Code of the Russian Federation)?

Regarding the minimum amount of compensation, the answer is transparent: it will not be subject to personal income tax. This has been confirmed more than once by the regulatory authorities in their explanations (letters of the Federal Tax Service of the Russian Federation dated 06/04/2013 No. ED-4-3 / [email protected] , Ministry of Finance of the Russian Federation dated 02/28/2017 No. 03-04-05/11096, 01/23/2013 No. 03- 04-05/4-54, etc.).

In the case of exceeding the minimum allowable amount, controllers take a similar position: the amount of excess is not subject to personal income tax, but only if such excess is consistent with an employment or collective agreement (letter of the Ministry of Finance of the Russian Federation dated November 28, 2008 No. 03-04-05-01/450, dated 06.08 .2007 No. 03-04-05-01/261).

NOTE! If a company abuses this exemption and, under the guise of compensation, pays, for example, the salary itself to employees, then this is fraught with disputes with inspectors and additional personal income tax amounts being assessed during the inspection. In this case, the court will most likely side with the inspectors, since content has priority over form: regular payments of compensation in an amount significantly exceeding the amount of wages accrued to employees prove that wages were actually paid. This means that it is necessary to pay personal income tax (resolution of the Federal Antimonopoly Service of the Ural District dated November 30, 2012 No. F09-11655/12 in case No. A60-7589/2012).

Whether it is necessary to accrue personal income tax when paying other compensation payments, read the materials in the section “Compensation and personal income tax” .

What should an employee do if wages are not paid: an alternative method

Are you not getting paid? Try to resort to another procedure for influencing the employer provided for by law - do not go to work. According to Art. 142 of the Labor Code of the Russian Federation, if wages are delayed for more than 15 days, the employee has the right to suspend work. Perhaps such forced inaction of the workforce will prompt the employer to quickly raise funds, and further trips to the authorities will not be necessary.

The mechanism for legal suspension of work is prescribed in Art. 142 Labor Code of the Russian Federation. The employee is required to do only one thing - notify the employer in writing. See below for what such a notification might look like:

From the date of filing such a notice, the employee may not appear at his workplace until the employer notifies him in writing of his readiness to repay the salary debt. During forced absence, the employee retains his average earnings.

It is necessary to take into account this nuance - the law does not allow certain categories of workers to suspend work if wages are not paid. And in certain cases, suspension of work is not permissible at all:

If, according to the law, you do not have the right to suspend work due to delayed wages or this measure does not have the desired effect on the employer, try another out-of-court method of collecting wage debt.

Compensation for delayed payment of wages under the Labor Code of the Russian Federation

In times of crisis, many Russian companies, often small businesses, are increasingly delaying wages (hereinafter referred to as wages) to their employees.

In most cases, this is not the fault of the company: each of them is a link in a dependent chain of counterparties. Consequently, as soon as payment interruptions (payment under contracts from customers/purchasers are not received on time) occur in one link, this automatically affects all subsequent ones. As a result, this may lead to the fact that employees of one, or perhaps several levels, will not receive salaries on time. If this happens and the employees do not receive the wages due to them on time, then the employing company will subsequently be obliged to pay the employees not only their wages, but also compensation (which in its content represents interest on late payments). This is stated in Art. 236 Labor Code of the Russian Federation.

IMPORTANT! Failure to pay wages on time, among other things, gives the employee the right to temporarily suspend the performance of his labor functions, as well as apply for compensation for moral damage (Articles 142, 237 of the Labor Code of the Russian Federation).

Compensation for late payment of wages is accrued from the day following the established payment deadline until the day the employer repays the debt to employees, inclusive.

Example 1

If the salary, for example, was supposed to be paid on the 5th, but was actually paid on the 12th, then the compensation will be calculated for 7 days (from the 6th to the 12th inclusive).

If a delay did occur, the employing company will have to pay the employee appropriate compensation, regardless of whether it is directly to blame for the delay in the salary or not.

NOTE! Today, the situation is especially relevant when, due to the revocation of the license, the bank did not transfer the salary to the employees of the organization - the payroll client. This circumstance does not relieve the employer of the risk of falling under Art. 236 of the Labor Code of the Russian Federation, since the fact of guilt does not matter. Therefore, in order to minimize this risk, the company should more carefully select a bank for its salary project.

Moreover, if, for example, the bank is to blame for the delay (in particular, it did not fulfill the payment order of the client organization on time to transfer the salary to employees), then the company should remember that it has the right to make a recourse claim to the bank for the fact that it did not timely transferred the salary to the employees, which means he violated the terms of the salary project with the company. However, you will still need to pay workers' compensation first.

Appeal to the labor dispute commission is a legal way to influence the employer

If wages are not paid or are delayed, the employee may try to influence the employer through the labor dispute commission (LCC). But only if such a commission is created in the organization.

KTS is a special structure at the enterprise:

- created to resolve individual labor disputes (including regarding non-payment or delay of wages);

- formed from representatives of the workforce and representatives of the employer;

- performing its functions and vested with powers in accordance with Art. 384-390 Labor Code of the Russian Federation.

What is the advantage of contacting CTS? Isn't it better to immediately contact the prosecutor's office or court? The main advantage of resolving a dispute in the CCC is the relative speed of achieving a result (compared to the time frame for judicial collection of wages) and less red tape with documents. The commission must consider the employee’s appeal within 10 days. And after making a decision, the employer must comply with it within 3 days after the 10 days provided for appeal have expired.

The certificate issued by the CTS is forcibly enforced by a bailiff (Article 389 of the Labor Code of the Russian Federation). Judicial procedures take considerable time and take a lot of effort - you need to comply with certain regulations, collect documents in the proper form, etc. And the CTS is located directly at the enterprise and has all the necessary information without additional confirmations or requests.

Unfortunately, CTS is an extremely rare phenomenon in our modern life. They have been preserved only at large enterprises, where regulations for resolving labor disputes have been established and have been in effect since Soviet times, there is a strong trade union and an active workforce. Most medium and small companies do not create CTS.

If your company does not have a CTS or is inactive, try influencing the employer through the labor inspectorate.

Salary was paid once a month

In one of the disputes, the employment contracts concluded by the employer with the employees stipulate the deadline for paying wages twice a month - no later than the 10th and 25th of the next month.

According to payroll records, wages were paid by the employer: for May - June 10, for June - July 10, for July - August 10, for August - September 10, for September - October 10, etc. That is, once a month instead of twice.

By decision of the Irkutsk Regional Court dated October 23, 2019 No. 21-666/2019, an official of the company was brought to administrative liability under Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (fine for officials in the amount of 10 thousand to 20 thousand rubles).

Important!

At the same time, judicial practice proceeds from the fact that objective financial difficulties in the company, which entail a delay in the payment of wages (lack of money in the account, delay in payment by counterparties), cannot serve as a basis for exemption from liability for late payment of wages. This is due to the fact that the employer is obliged to pay wages twice a month (Resolution of the Supreme Court of the Russian Federation dated May 18, 2015 No. 25-AD15-2, decision of the Moscow City Court dated October 18, 2018 No. 7-11917/2018 ).

Complaint about non-payment of wages to the labor inspectorate

A complaint about unpaid wages filed by an employee with the State Labor Inspectorate may also force the employer to pay back wages to employees. A complaint may provoke an unscheduled inspection of the organization with the subsequent issuance of an order to repay salary debts and punishment of the manager. A complete list of consequences of citizens applying to the labor inspectorate for restoration of violated rights (including late payment of wages) is presented in the figure:

The application (complaint) is drawn up in free form. Labor inspectorates may also use unified forms for citizens’ appeals. They can be obtained by visiting the inspection office in person.

Modern technologies make it possible to file a complaint through the website of the regional labor inspectorate.

Lawsuit

If, during the pre-trial proceedings, the employer has not paid the wages or paid the debt partially, it is necessary to file a claim in court to collect the arrears of wages.

In order to force the employer to pay wages, it is necessary to collect evidence confirming the fact of the debt. You must provide the court with:

- employment contract;

- documents on pre-trial proceedings (response to a written complaint addressed to management, results of a complaint to the labor inspectorate or prosecutor's office);

- a statement indicating the amount of debt and the period during which wages were not paid.

If the salary of an employee who does not have official employment is deceived, instead of an employment contract, documents confirming the fact of working in the organization are provided.

In addition to the salary debt and compensation for each day of delay, you can recover funds from the employer for moral damage. The amount of moral compensation is established by the court.

Please note that state fees are not charged for legal proceedings in labor disputes.

In accordance with Article of the Labor Code No. 392, it is necessary to file a claim in court within a year from the first day the debt arose. If you did not have time to submit an application, the court may extend the period for filing a claim for the following reasons:

- inpatient treatment or serious illness (only in cases where the employee was prohibited from getting up);

- long business trip (only when the employee was in a remote area where there is no postal service);

- caring for a seriously ill relative;

- natural disasters.

If the case was decided in favor of the employee, the court order is transferred to the bailiffs. They give 5 days to voluntarily pay off the debt. If the debt is not repaid, the bailiff will forcibly collect the amount specified in the order.

Are wages delayed or not paid? Contact the prosecutor's office

Another authority where you can turn if your salary is delayed is the prosecutor’s office, a body that oversees compliance with legislation, rights and freedoms of citizens on behalf of the state.

Here you will also need to fill out an application. Its composition and form will be advised by the prosecutor on duty, to whom you will be referred when visiting the prosecutor's office. The application is written addressed to the chief prosecutor and must contain the following information:

The content of the application may look like this:

The prosecutor's office independently verifies the facts stated in the application or forwards it to the labor inspectorate.

How to resolve a salary issue through the prosecutor's office

If payment is delayed after the dismissal of a worker, he can file a written complaint with the prosecutor's office. It is also drawn up in any form and must necessarily include the following details (clause 2.8 Order of the Prosecutor General’s Office of Russia dated January 30, 2013 No. 45):

- the name of the prosecutor's office and the official to whom the application is sent;

- Full name and contact details of the applicant;

- the essence of the dispute, a list of violated rights, as well as requirements to eliminate abuses on the part of the employer.

- date of writing and personal signature of the applicant.

Documents substantiating the requirements contained in it must be attached to the application. For example: a copy of the employment contract, extracts from time sheets, copies of work orders, an order to terminate the employment contract. Applications are allowed to be submitted:

- by post (registered letter with acknowledgment of delivery);

- through the official website of the prosecutor's office;

- through a personal visit to the prosecutor's office.

The received appeal is also subject to registration within 3 days. If its consideration requires an inspection of the employer, then it is considered within 30 days. In cases where additional actions are not required to confirm the facts stated in the application, it can be considered within 15 days.

If, as a result of requesting explanations from the employer and checking the requested documentation, the fact of non-payment of wages is confirmed, he is issued an order to eliminate the violation. The applicant must receive a written response to the submitted application. The prosecutor's office also has the right to independently file a lawsuit on behalf of the applicant to protect his rights.

Obtaining a court order is one of the ways to collect wages

If an employee individually fails to resolve issues of wage arrears, you can use another relatively quick way to collect funds - apply to a judge for a court order (paragraph 7 of Article 122 of the Code of Civil Procedure of the Russian Federation).

A court order is a document issued by a judge without holding a court hearing and summoning the employee (claimant) and employer (debtor) to court for trial. The issuance of a court order by a judge to collect wages also allows the employee to solve his problems faster (the order is issued within 5 days after receiving the application) than during the usual judicial procedure for recovering earnings from the employer.

To obtain a court order, the employee must submit an application and supporting documents to the judge. See below for the required details of such an application:

The following documents must be attached to the application:

The judge issues a court order after carefully examining the application and attached documents.

This method of collecting wages has one nuance - it can be used only on the condition that (clause 1 of Article 121 of the Code of Civil Procedure of the Russian Federation):

- the amount of the collected salary does not exceed 500,000 rubles;

- the salary was accrued but not paid, and the employee does not dispute its amount.

If the employee does not agree with the amount of the accrued salary and the salary debt has exceeded the half-million dollar limit, in order to collect it, he will have to go to court with a statement of claim, following the standard judicial procedure.

Collection of unofficial part of salary

When paying “gray” wages (in addition to the official part of the salary), the employee signs either in the cash receipt or in the cash disbursement statement. These documents are kept in the accounting department, which do not appear officially anywhere (from such payments, of course, personal income tax is not transferred to the budget and insurance premiums are not charged). Usually, when dismissing an employee, the employer “forgets” to pay him the unofficial part of the salary; compensation for unused vacation is calculated only on the basis of the official part of the salary.

In such disputes, everything depends on the availability of evidence from the offended employee. Otherwise, the court will impose the minimum wage in a specific region.

For example, from the case materials it is not clear that there is sufficient evidence confirming the amount of the employee’s official salary - 40,000 rubles.

When resolving the issue of the amount of wages due, the courts take into account the provisions of Art. Art. 133, 133.1. Labor Code of the Russian Federation, establishing the minimum wage in the Russian Federation and in the constituent entities of the Russian Federation, as well as the procedure for their establishment. Based on the above, the courts came to the conclusion that the employee’s salary was to be recovered from the minimum wage in Moscow. In accordance with the Minimum Wage Agreement for 2021. between the Moscow Government, Moscow trade union associations and Moscow employers' associations, the minimum wage from October 1, 2021 is set at 17,561 rubles.

Taking into account what is stated in favor of the plaintiff, wages for the period from 09.10.2016 to 10.10.2016 in the amount of 17,561 rubles are subject to recovery (Appeal ruling of the Moscow City Court dated 06.06.2019 No. 33-17011/2019 and dated 12.03 .2019 No. 33-6941/2019).

Deadlines and costs: how not to be late with collection and whether you need to pay a state fee

An employee should remember that he can go to court regarding unpaid wages within 1 year from the date of the established deadline for payment of wages (Article 392 of the Labor Code of the Russian Federation). What are these terms, see the figure:

These are general terms. There are also special deadlines for payment of wages established by law. For example, a resigning employee must pay all amounts due to him (including wages) on the day of dismissal (Article 140 of the Labor Code of the Russian Federation). And wages not received by the day of the employee’s death must be issued to his family members no later than a week, which is counted from the moment the relevant documents are submitted to the employer (Article 141 of the Labor Code of the Russian Federation).

Going to court is usually associated with additional costs of paying state fees. But when resolving issues regarding unpaid or delayed wages, you will not have to spend money on paying fees. This is expressly provided for in Art. 393 Labor Code of the Russian Federation.

Criminal punishment and the peculiarities of its application

The most severe measure of liability for non-payment of wages on time is the application of criminal punishment under Art. 145.1 of the Criminal Code of the Russian Federation. This provision presupposes the presence of two independent elements of a crime. Thus, for Part 1 to apply, two conditions must exist:

- Salaries are paid partially for three or more months in an amount less than half of what the employee is entitled to.

- The reasons for incomplete payment are the selfish interest of the employer. That is, if an enterprise cannot pay its employees in full due to objective reasons, for example, there is simply no money in its accounts and there is no way to replenish them, then it is impossible to bring the management to criminal liability.

The penalty for this act varies from a fine to 120 thousand rubles to a year in prison.

To use Part 2 of Art. 145.1 of the Criminal Code of the Russian Federation it is necessary that:

- the enterprise did not pay wages at all or paid less than one minimum wage per month;

- the debt period exceeded two months;

- the reason for the debt is the employer’s self-interest.

The severity of the sanctions in this situation will be greater: a fine of up to 500 thousand rubles or imprisonment for up to three years.

If, in the presence of any of the specified parts 1 or 2 of Art. 145.1 of the Criminal Code of the Russian Federation, if additionally serious consequences occur, for example the death of a person, then the employer will face a fine of up to 500 thousand or imprisonment for up to five years.

Features of bringing to criminal liability for non-payment of wages

In Art. 145.1 of the Criminal Code of the Russian Federation also has a note that allows the management of the enterprise to avoid a fine or imprisonment. If the committed act did not entail serious consequences, was committed for the first time and within two months from the date of initiation of the criminal case the debt to the employees was fully repaid, the guilty person is released from liability under this article.

The employer does not pay wages: how to resolve this issue in court

Are your salaries being delayed? Do you have unsettled amounts of salary accruals and (or) your employer refuses to transfer you the payments and compensations required by law? We'll have to go to court.

Going to court is usually the most effective procedure. It begins with collecting documents and filing a statement of claim. The procedure for its preparation is subject to the general requirements for documents sent to the court (Article 131 of the Code of Civil Procedure of the Russian Federation).

Along with paying off the salary debt, you can ask the court to recover compensation from the employer for the delay. The application is accompanied by documents confirming the employment relationship with the debtor-employer (copies of the work record book and employment contract), the amount of debt, as well as the fact of non-payment (for example, a copy of the pay slip).

What compensation can you get if your salary is delayed?

In case of untimely payment of remuneration for work, the employee is entitled to monetary compensation (Article 236 of the Labor Code of the Russian Federation).

It is assigned regardless of the reason for the delay and is calculated using the formula: Salary amount * 1/150 of the key rate of the Central Bank of the Russian Federation * number of days of delay

In addition, you may be eligible for compensation for moral damages. You determine the amount yourself by indicating it in the statement of claim. Based on the results of the proceedings, the court may correct it or exclude it from the requirements.

Results

The question of where to turn if wages are not paid has long been resolved by law.

Employees are given the right to independently influence the employer through negotiations or suspension of work. A labor dispute commission will help resolve the issue of delayed wages if it exists at the enterprise and works effectively. Appealing to supervisory or judicial authorities will speed up the repayment of wage arrears. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Accounting for compensation for late wages in income tax expenses

Regarding income tax, the situation is somewhat more complicated. The Tax Code of the Russian Federation does not contain any provisions regarding whether such compensation can be taken into account as expenses or not.

The code only says that a company can include in its expenses compensation, the payment of which to employees is related to any working conditions (Article 255 of the Tax Code of the Russian Federation).

In addition, paragraph 13 of Art. 265 of the Tax Code of the Russian Federation allows sanctions for violation of contracts to be taken into account in expenses. However, no restrictions or sanctions have been established. There are also no special conditions regarding whether this rule applies only to civil contracts or to employment contracts as well.

Therefore, on the one hand, it is possible to consider compensation for the delay of the PO as a sanction and take it into account as part of the expenses. Previously, the courts agreed with this logic (resolutions of the Federal Antimonopoly Service of the Volga District dated August 30, 2010 in case No. A55-35672/2009).

At the same time, later the regulatory authorities took the position that such compensation cannot be included in expenses, since it is not related to working conditions (Article 255 of the Tax Code of the Russian Federation does not apply), and the norms of Art. 265 of the Tax Code of the Russian Federation does not apply to this compensation (letter of the Ministry of Finance of the Russian Federation dated October 31, 2011 No. 03-03-06/2/164).

Therefore, today it is quite risky to take into account compensation for delays in salary payments in expenses.

ConsultantPlus experts examined three points of view on this issue and presented arguments from officials and arbitrators in defense of each. If you do not have access to K+, get trial online access for free and go to the Encyclopedia of Disputed Situations on Income Tax.