The Labor Code allows you to legally reduce wages with the consent of the employee himself, under Article 72 of the Labor Code of the Russian Federation, or at the initiative of the employer as a result of the introduction of technological or organizational changes in working conditions, under Article 74 of the Labor Code of the Russian Federation. The introduction of part-time work in companies under Article 93 of the Labor Code of the Russian Federation will also lead to a reduction in payroll.

In addition, there are several other informal ways to reduce wages, for example, sending employees on vacation at their own expense.

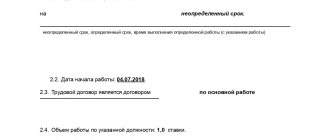

The salary amount is specified in the employment contract. Therefore, its change is always a change in the essential terms of the contract, which is documented in writing.

Companies that have established a salary and a bonus, and if the bonus is drawn up correctly and is not a mandatory part of the salary, can reduce the employee’s payments at the expense of the bonus. This is the easiest and most convenient way.

About the awards:

When you can deprive an employee of a bonus: do it correctly

In what cases does an employer have the right to deprive its employees of bonuses?

What is employee depreciation?

Ways to reduce employee wages permitted by the Labor Code of the Russian Federation

In the legislation you can find several ways that allow the director to reduce wages. Please note that this has nothing to do with the quality of the employee’s performance of his duties or labor discipline. You can't punish someone with a salary reduction. And the bonus can be deprived only if the documents clearly state for what and upon achievement of what indicators it is paid.

All ways to reduce employee wages

- leave without pay (Article 128 of the Labor Code of the Russian Federation);

- part-time or part-time work week (Article 93 of the Labor Code of the Russian Federation);

- transfer to a position with a lower salary (Article 72.1 of the Labor Code of the Russian Federation);

- reduction of wages as a result of technological or organizational innovations (Article 74 of the Labor Code of the Russian Federation).

- based on the results of certification (Resolution of the Plenum of the Armed Forces of the Russian Federation dated March 17, 2004 No. 2)

Grading as a way to vary salaries

Art. 132 of the Labor Code of the Russian Federation allows the employer to change wages within a certain level gradation established for a particular position. The minimum level must be ensured and fixed in the appropriate documentation, and the maximum is theoretically not limited. An employee’s earnings during grading may depend on:

- qualifications;

- amount of time spent;

- complexity and effort;

- workload;

- achieved indicators;

- other conditions.

IMPORTANT! When establishing payment levels, any discrimination is unacceptable: the salary and tariff rate for employees of the same level and general labor function should not differ. Variations are possible in the variable part of wages.

FOR EXAMPLE. The salary for computer typing operators, indicated in the staffing table, is 12 thousand rubles, it is the same for all operators working in the computer center. The local regulatory act describes the possibilities relating to the variable part of the salary: the possibility of increasing payment if certain criteria are met. For example, the absence of customer complaints for a month, grateful reviews, you can also vary the number of tasks completed, timely response to management requests, assistance to other employees, and other factors. The selected factors are assessed at certain intervals; when a certain level is reached, a set coefficient is applied, which the employer has the right to change. If an employee has collected a sufficient number of positive factors, his salary increases. Thus, a computer typing operator cannot earn less than the salary specified in the documents - 12 thousand rubles, and the maximum earnings depend on the established coefficient.

Reduction of wages by agreement with the employee

If the employee is not against a reduction in wages with a simultaneous reduction in the volume of his work or the number of responsibilities, this can be formalized:

- transfer of an employee to a position with a lower salary (Article 72.1 of the Labor Code of the Russian Federation).

- transfer of an employee to a part-time work week or part-time work (Article 93 of the Labor Code of the Russian Federation).

In both cases, the employee must sign:

- additional agreement to the employment contract, which indicates the new reduced salary;

- order issued by the manager.

By agreement of the parties, part-time or part-time work may be established, including with the division of the working day into parts. Part-time work may be without a time limit and for any period, as agreed between the employee and the employer.

More on the topic:

How can you reduce employee salaries?

How to cut employee salaries

A salary reduction is one of the essential terms of the contract; this must be recorded in writing in an additional agreement, which becomes an integral part of the contract.

Analysis of the components of the compensation package

To make a decision on excluding components from the compensation package, it is necessary to conduct an analysis and identify the least useful and sought-after benefits by employees, while taking into account which of the components are directly related to the performance of job duties (for example, the use of mobile communications and corporate meals), and which are not of a similar nature.

Voluntary health insurance (VHI) for employees is the most popular and widely used component of the compensation package; completely excluding insurance is not recommended for several reasons. Firstly, as a rule, the provision for voluntary health insurance is included in employment contracts, which means that they will have to be amended in the event of an exception. Secondly, spending on voluntary health insurance can reduce taxable profit (within 6% of the wage fund), which in itself is beneficial for the company. Secondly, the exclusion of voluntary health insurance from the compensation package will significantly reduce the employer’s position in the market for job seekers. In order to save money, the VHI program can be revised in the direction of reducing the volume of services provided, while retaining the necessary and vital services; in this regard, a survey of employees can be conducted and, based on the results, the ones that are in great demand can be left to choose from.

Organizational changes in the company are a reason to reduce salaries

In the Labor Code, Article 74 allows for the reduction of wages to employees as a result of organizational and technological changes in the company.

There is no specific list of organizational or technological changes in working conditions in the legislation.

According to Part 2 of Article 74 of the Labor Code of the Russian Federation, the employer is obliged to warn the employee about changes and their reasons no later than two months in advance.

The notification must be in writing, in any form. All employees must be familiarized with the notice against signature. This is done by issuing one copy of the notice to each employee, and the second copy, signed by the employee, remains with the employer. You can prepare a separate log of acquaintance with notifications.

If the employee refuses to sign the Notification, a report is drawn up.

The notification must indicate:

- reasons for which wages will be reduced;

- terms of the employment contract that will be changed;

- the date from which the change comes into force.

If an employee does not agree to stay and work in the company, the manager is obliged to offer him:

- a vacancy that matches the employee’s qualifications;

- lower position, if any.

Reducing wages by introducing part-time work

The director of the company can, on his own initiative, introduce part-time work for up to six months. But this is provided that the technological and organizational changes taking place in the company threaten mass layoffs of workers. This is the requirement of Article 74 of the Labor Code of the Russian Federation.

Part-time employees are paid in proportion to the amount of work completed (time worked).

Previously on the topic:

Shortened working hours for the summer of 2021: by agreement, on the initiative of the director

The difference between remote work and downtime

In a remote (remote) work format, the employee does not suspend his activities, but performs his job duties outside the employer’s location.

In a situation where there is no work for all or part of the employees, the employer has the right to decide to lay off employees. Downtime means a temporary suspension of the work process, during which work is not carried out for reasons of an economic, technological, technical or organizational nature (Article 72.2 of the Labor Code of the Russian Federation).

Other options

The employer can also review the responsibilities included in the job function, which do not imply a change in this function, that is, transfer of the employee to another job. In this situation, the employee can remain in the same position, but the complexity and volume of work he performs is reduced. For this reason, wages are reduced.

Reducing the earnings of employees without any conditions and without reviewing work responsibilities is not allowed, even if the employee’s written consent to this has been obtained. Otherwise, the employer violates the principle of equal pay for work of equal value guaranteed by the Labor Code (according to paragraph 6, part 2, article 22).

Indeed, in this situation, the employee’s salary will be lower than the earnings of other employees for the same work.

Order to reduce salary: sample

Typically, employees agree with their superiors' arguments in order to avoid losing their jobs. Having received consent, the manager issues an order to reduce the salary, which stipulates the entire list of reasons for the decision. The agreed changes must be reflected here (see sample document below).

The employer and employee can discuss, review and even change the requirements in the contract. At the same time, agreement on both sides is documented.

Paying the cost of medical examinations directly to the clinic

If the employee pays for medical examinations on his own, then there will be no savings on fees, so enter into an agreement with the medical institution directly. Then you will not have to pay contributions for expenses incurred related to medical examinations.

In addition, you can sign a contract for voluntary health insurance, under which mandatory medical examinations of personnel are carried out at the company’s expense. Savings also arise here, and the amounts spent are taken into account when calculating profits (letter of the Ministry of Finance No. 03-11-06/2/25906 dated May 5, 2021).

The advantage of this method: Complete legality, no risks. Officials unanimously confirm that contributions are not calculated in this case (letter from the Ministry of Finance No. 03-15-06/45499 dated June 21, 2021, Federal Tax Service No. BS-4-11 / [email protected] dated January 27, 2021).

Disadvantages of this method: Not all organizations require employees to undergo medical examinations; as a result, the amount of tax savings may be minimal or even zero.

Salary reduction by agreement of the parties

When applying for a job, each employee first enters into an employment contract with the organization, which clearly states the salary amount and payment terms. The document is certified by the employer on the one hand and by the employee himself on the other hand. Based on this document, the employer does not have the right to change the salary at its discretion. But at the same time, as already noted, he has the opportunity to resort to one of the legal methods to implement the emerging need to reduce wages.

Today, in almost all regions of our country, the issue of employment is very acute. Nobody wants to get laid off. Thus, the manager always has a 100% chance to conclude an agreement between the parties and document a reduction in the salary of employees. The latter are invited to voluntarily agree to the conditions specified in the agreement, and thereby save their job. Perhaps no one has any reason to believe that in this case the employee will refuse his signature. At the same time, he reserves the right to ask on what basis this financial restructuring of his official earnings is being carried out. In this case, the employer is obliged to explain the current situation in the company and provide reasoned reasons for such negative actions on his part as a manager. Additionally, he will need to indicate the relative time frame of his decision.