Composition of legal successors

When registering an inheritance, one of the key issues is the composition of applicants. When inheriting by law, the order of recipients is provided for by the Civil Code.

The law defines 7 queues of applicants for property:

- Parents, children, spouses.

- Brothers/sisters of the testator, his grandparents.

- Brothers/sisters of the deceased citizen's parents.

- Great-grandparents.

- Cousins/granddaughters.

- Great-great-great-grandchildren of the deceased subject.

- Stepfather/stepmother, stepsons/stepdaughters.

Property is distributed among relatives of the same line in equal shares. If the first-priority claimants renounced their rights or were not identified, then the assets of the testator pass to the next-ranking successors.

Important! If there are no recipients of the deceased’s property in all stages or they refuse the property, the inheritance is transferred to the benefit of the state.

If, when registering an inheritance, information about a conceived child is revealed, then he is a potential applicant. The notary suspends the issuance of documents until his birth. If the baby is born alive, then he is included in the priority legal successors.

If the testator had dependents, then they are entitled to a certain share of the property. When registering an inheritance according to the law, dependents are included in the circle of legal successors of the corresponding order. Their share is similar to that of the legal heirs.

Methods of accepting inheritance by law

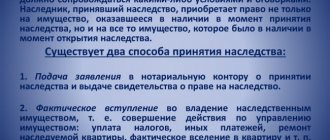

Heirs can accept property in 3 ways:

- Through a notary. To do this, you need to identify a notary office, submit an application and pay a fee. A feature of notarial registration is the need for strict adherence to deadlines.

- Judicially. The heirs' appeal to the court is inevitable in case of violation of deadlines or conflict between recipients. A popular variant of the dispute is the recognition of the fact of acceptance of the inheritance and recognition of the right of ownership. The result of the trial will be a judgment. After receiving it, the citizen does not need to contact a notary. Based on a court decision, it is possible to re-register the property of the deceased to the heir without additional documents.

- Acceptance as a matter of fact. When registering an inheritance, applicants for property must submit an application within 6 months . However, the actual heirs are not bound by any deadlines. The only requirement is to perform actions indicating acceptance of the inheritance within the period established by law. Such citizens can submit an application to a notary after several years. Of course, the package of documents upon actual acceptance of the inheritance will be significantly expanded. They will have to prove the commission of legally significant actions. Otherwise, the notary will not issue a certificate. Consequently, the heirs will have to go to court.

The procedure for accepting inheritance by law

The property is considered accepted from the moment of its opening (Article 1152 of the Civil Code of the Russian Federation). However, to do this, the heir must perform a number of actions.

Algorithm for the recipient to accept an inheritance legally through a notary:

- Collection of documentation.

- Submitting an application to a notary.

- Payment of state duty.

- Obtaining a certificate of inheritance rights.

- Registration of rights to inherited property.

Documentation

The final list of papers depends on the status of the applicant and the list of property. The applicant must prepare:

- passport;

- death certificate of the testator;

- a certificate from the place of residence of the deceased citizen;

- evidence of relationship with the owner of the property;

- evidence of dependent status;

- court decision on recognition as a dependent;

- documents for inherited property;

- asset value report;

- receipt of payment of duty.

The notary may require additional paperwork. For example, if a descendant of a deceased heir enters into inheritance rights or a young child acts as a contender.

Upon actual acceptance of the inheritance, the list of papers will depend on the actions performed by the applicant (carrying out repairs, paying off debts, moving into the testator’s apartment, cultivating the land).

Statement

An inheritance case is opened upon the application of the successor. The document is submitted to the notary, who opens the inheritance case.

The place of opening of the inheritance is:

- place of last registration of the deceased;

- location of the owner's real estate;

- place of storage of the testator's most valuable property;

- the place established by a court decision establishing the fact of opening of inheritance.

Required sections of the application:

- name of the notary office;

- information about the legal successor;

- description of the fact of death of the testator;

- the purpose of contacting a notary;

- list of inherited property;

- link to the presence of other applicants;

- basis for entering into inheritance rights;

- date of application;

- signature of the legal successor.

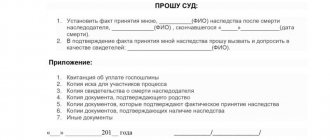

Sample application for acceptance of inheritance by law

An application can be submitted by a citizen as follows:

- personally;

- by mail (an application certified by a notary is sent);

- through a representative (a notarized power of attorney is required).

If one of the heirs is a young child (aged 0 to 14 years), then the application is submitted for him by a parent or guardian. On behalf of the incapacitated person, documents are submitted by the guardian.

A minor child (aged 14 to 18 years) submits documents independently. However, the consent of his legal representatives will be required.

Expenses of heirs

When preparing the documents, the heirs will have to pay:

- state duty;

- notarial services;

- work of an appraiser;

- registration of property rights.

If during the process of registering an inheritance disputes arise between the heirs, they are resolved in court. The state fee for filing a claim is paid separately.

Basic rates of state duty when entering into inheritance:

- 0.3% – the tariff is provided for children, parents, spouse, brothers/sisters of the copyright holder. The maximum collection amount is RUB 100,000.

- 0.6% – the tariff is provided for the remaining legal successors of the testator. The maximum collection amount is RUB 1,000,000.

If the heir belongs to the preferential category of citizens, then he is entitled to an exemption from paying the duty. In order for the notary to provide a benefit when calculating the amount of the fee, the assignee needs to prepare documents confirming such a right.

The cost of appraisal depends on the type of property, the region of residence of the copyright holder and the appraisal organization. Real estate appraisal costs about 3,000 rubles . To determine the cost of the car you will have to pay from 2,000 - 5,000 rubles.

Notary services are paid in addition to the state fee. Rates vary by region. The cost of services can be clarified on the website of the Federal Notary Chamber. Typically, registration of an inheritance costs from 1,000 – 5,000 rubles.

Issuance of a certificate

The inheritance procedure ends with the issuance of a certificate of inheritance rights. Applicants receive the document 6 months after the death of the property owner. If there was a dispute between relatives, then the certificate is issued after the judicial act enters into force.

Second degree relatives receive a certificate after 12 months . If the primary legal successors simply did not accept the property, then the certificate is issued 9 months after the death of the testator.

If additional property is discovered after the certificate is issued, citizens will have to visit the notary again. He will issue them an additional document for the remaining assets.

Limitation period for heirs

It happens that citizens learn about the inherited property due to them decades later. When they ask whether it is possible to enter into an inheritance after 10 years or more, they mean what statute of limitations is established for accepting inherited property. Let us remind you that it is impossible to protect a violated right in court (including the right of inheritance) after the end of the established period.

For applicants who missed the deadline, the general limitation period is 3 years. During this time, they must have time to declare their rights to the property and demand the return (restoration) of the period for its acceptance.

The statute of limitations is counted not from the date of death of the testator, but from the occurrence of the following events. The table will help you understand which ones.

| Event for counting the limitation period | Examples |

| The day when the reason that prevented a citizen from submitting documents to inherit the property of the deceased on time was eliminated. | – the day of return from a long expedition or business trip; – the day of discharge from the medical institution where he was placed for health reasons. |

| The moment when a person learned that his rights as an heir were violated. | – the day when he received information about the death of a relative in respect of whom he is the legal heir; – the day on which it became known that there was a will in his favor. |

In such circumstances, it does not matter when the owner of the inherited property died. These events can occur at any time after his death. But if the heir does not manage to meet the three-year period, not a single court will restore the missed deadline for accepting the inheritance.

Deadlines for accepting an inheritance by law

Each individual group of heirs has its own deadline. applicants are given 6 months . The starting point is the date of death of the owner of the property.

If the last day falls on a holiday, the application submission date is shifted. The heir has the right to visit the notary on the first working day .

The assignees of the 2nd line take over the property after 6 months . The basis for entering into inheritance rights is the non-acceptance of the inheritance by 1st line applicants.

Reasons for not accepting an inheritance:

- recognition of the applicant as unworthy;

- abandonment of assets;

- absence of primary legal successors.

As a general rule, the application is submitted within 6 months . The usual non-acceptance of inheritance by priority applicants allows you to reduce the period to 3 months .

3rd line applicants accept the inheritance after relatives of the previous line. If the 2nd line relatives have not accepted the property within 90 days, then current applicants can submit papers 3 months after the right arises. If the case file contains a written refusal of the inheritance, then the papers are submitted within 6 months.

A similar principle applies to each individual queue of applicants. The ultimate beneficiary is the state. It accepts the property automatically upon the emergence of such a right. To obtain a certificate, an authorized representative of the authority must visit a notary.

Acceptance of inheritance after expiration of terms

When registering an inheritance, unusual situations occasionally arise. Such circumstances may change the composition of participants and the deadline for completing documents.

Reasons for the delay

| No. | Cause | A comment |

| 1 | Death of an heir | If the applicant dies during the execution of the documents, then the property goes to his children. The share of the inheritance is divided equally among relatives. For example, if there are three legal successors, then each is entitled to 1/3 of the property. The deadline for submitting papers is calculated based on the amount of time remaining. For example, the priority heir died 4 months after the death of a relative. The assignee had 2 months left until the end of the 6-month period. In such circumstances, the period may be extended to 3 months. |

| 2 | Availability of information about the conceived child | An inheritance case is opened upon the application of the heir. If a notary becomes aware of a conceived child, he must check the information. If there is indisputable evidence, a decision is made to suspend the issuance of documents. The restrictive measure is in effect until the baby is born. Usually the displacement occurs for up to 3 months. If the child is born alive, the notary includes him among the legal successors. The only condition is that the baby’s mother must present papers confirming his relationship with the testator. If the act record was made only from the words of the mother, then the woman will have to go to court. |

| 3 | Actual acceptance of property | The legislator excluded time limits. Most often, the inheritance is accepted by members of the testator's family. They continue to use the property without any restrictions. Difficulties may arise when alienating an inheritance. The legal successors will have to draw up paperwork from a notary. Otherwise, they will not be able to participate in the transaction. An application to a notary can be submitted even after several years. However, you will have to prepare papers confirming the actual entry into the inheritance. They must confirm the completion of legally significant actions within 6 months after the death of the testator. |

| 4 | Trial | Suspension of the issuance of documents occurs at the request of the interested person. Court proceedings must be opened within 10 days. If the notary receives a subpoena, the issuance of documents is suspended until the actual consideration of the case. The court decision enters into legal force 1 month after its announcement. If a party files an appeal, then the procedural act is given force based on the results of the hearing of the case in the court of 2nd instance. |

Restoring deadlines

Missed deadlines are restored as follows:

- By agreement of the parties. Relatives independently negotiate and issue written consent. Based on the document, the notary cancels certificates of inheritance rights and issues new ones. The property is subject to redistribution taking into account the share of the new recipient. A new state registration of inherited property will be required.

- By the tribunal's decision. If relatives cannot find a common language, then litigation is inevitable. The applicant will need to prepare documents and file a claim in the district court. When filing a claim, you will have to pay a state fee. It is calculated based on the price of the inheritance. Expert assessment is taken as the basis.

To submit an application, 6 months after the end of the reason for absence. The deadline for the protection of civil law is 3 years . Subsequent filing with the court may result in the claim being dismissed.

If the court satisfies the claim, the recipient will only have to register ownership. The choice of institution depends on the type of property.

Hereditary transmission

This is succession of inheritance: the heir dies without accepting the inheritance within a six-month period, his heirs are called to inherit. The estate of a deceased heir does not include the right to inheritance .

The hereditary transmission can be carried out before the expiration of a total period of six months from the date of death of the first testator, but this period must be at least three months. The term can be restored in accordance with the general procedure.

The right to an obligatory share does not pass (Article 1156 of the Civil Code of the Russian Federation).