The dismissal of a chief accountant, by law, is no different from the dismissal of any other employee. The process is regulated in the same way by Article 80 of the Labor Code, although there are some nuances. But this is by law. In fact, if the chief accountant wants to leave the company, there are a number of actions that are not regulated by law, but which the accountant needs to do, at a minimum, for his own legal safety.

Next, we will look at options when the chief accountant can be fired.

Dismissal at your own request

As already mentioned, an accountant has the right to resign at any time . It is clear that during the submission of reports, or when there is no replacement yet, as a rule, chief accountants do not leave. But this depends on the employer and on the relationship that has developed with the chief accountant.

If the relationship is not the best, management refuses to accept the application and fire the chief accountant, who has other options for this application to reach the employer.

Firstly, he can submit an application through the secretary (if there is one). If the secretary is given strict instructions from the chief accountant not to accept anything, then there is also Russian Post. The resignation letter is sent by a valuable letter with a list of attachments.

Calculation, compensation for unused vacation, entry in the work book - do not differ from those with other employees.

Missed moment

The difference between the two types of dismissals comes down not only to who initiates the initiative. If the employer dismisses the chief accountant on his own, then he has the right to oblige the chief accountant to submit all the necessary reports before his dismissal or to adjust the date of the last working day - this is another fundamental difference between the dismissal of the chief accountant and an ordinary employee of the company. In our subjective opinion, this measure is fair. If the director misses the opportunity to submit reports on time and trusts the conscientiousness of his employee, then there will be a high probability that the chief accountant will be poorly motivated to fulfill his job duties in good faith. Judge for yourself - he probably already knows that he doesn’t have long to work, he’ll get his salary in any case - why worry? This is a matter for each individual employee and his integrity. The director should not focus on the personal qualities of his employee, but rather monitor his work, so as not to create additional problems for himself and the “newbie”. As we have already said, it would not be amiss to take an inventory and check the availability of all the necessary documentation, especially the originals of primary documents. By the way, we have already written about liability for the loss of the “primary”. We recommend that you familiarize yourself with it:

Among other things, we draw your attention to the fact that if the chief accountant made significant errors when submitting reports, deliberately reduced the tax base, or organized fraudulent schemes related to the theft of money and company assets, then even after dismissal, responsibility cannot be removed from him. This is another “point” in favor of a full audit of the chief accountant’s activities while he is still at work. Otherwise, you will have to look for it, and sometimes for a very long time, because... he can easily leave the country. Does the director need such troubles in the future? We believe not.

Dismissal at the initiative of the employer

It is impossible to fire the chief accountant (like any other employee) simply because of personal hostility. A reason is required for termination of the employment contract by the employer. What is called, “according to the article” .

Not long ago they wrote on “Clerk” that the head of the HR department was looking for ways to fire the chief accountant only because she wanted an increase in salary due to the assignment of additional responsibilities. Moreover, in essence, there was nothing to undermine the work - the chief accountant performed her duties without complaints.

But if the chief accountant is still unscrupulous, then the Labor Code has a basis enshrined in clause 5, part 1, art. 81 Labor Code (repeated failure to fulfill labor duties).

Another reason is the adoption by the chief accountant of a decision that led to a violation of the safety of property , its unlawful use or other damage to the company’s property (clause 9, part 1, article 81 of the Labor Code of the Russian Federation).

If the chief accountant combines work with servicing inventory (for example, he is also a cashier), then the grounds for dismissal under clause 7.1, part 1, art. 81 TK. Due to loss of trust .

Another option is to reduce the accounting department in principle, with the aim of outsourcing accounting .

In all other cases, including the famous “write your own way,” there is a risk for the employer of going to court, being forced to return the fired employee to his position, and paying average earnings for the period of wrongful dismissal.

Results

As a rule, the chief accountant is the second most important person in the organization after the manager.

In many ways, the financial well-being of a company depends precisely on its actions, knowledge and experience in the field of accounting. Removing a person from this position involves several challenges, which include finding a new competent employee, reviewing the current position of the firm and transferring authority. At the same time, the chief accountant bears the burden of higher responsibility to management for his work. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What if the chief accountant is on probation?

If the chief accountant has not completed the probationary period in the company, the grounds for his dismissal do not differ from those for other employees.

There is no need to work for two weeks; in accordance with Article 71 of the Labor Code, an employee who is decided to be dismissed during a probationary period must be notified about this three days before dismissal. The chief accountant himself, if he realized before the end of the probationary period that this job is not suitable for him, can also leave by notifying the employer three days before dismissal.

By the way, for chief accountants the probationary period can be up to 6 months.

conclusions

Thus, the chief accountant is dismissed on the generally accepted grounds and procedures of the Labor Code of the Russian Federation. If he has the status of a financially responsible person or a managerial employee, his dismissal may be carried out with some nuances. For example, an inventory of accounting documentation, an expert audit, and an audit will be required.

An important point is the transfer of affairs to the new employee from the outgoing chief accountant. The fact of such a transfer can (and is even strongly recommended) be formalized by a special transfer deed. This act is not regulated by law, but it must be signed by both parties. At the same time, the legislation provides for the responsibility of the chief accountant for accidental errors and intentional misconduct.

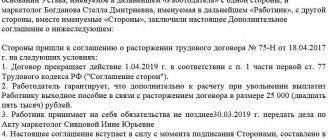

Dismissal by agreement of the parties

This, one might say, is an ideal option when dismissing a chief accountant. The parties calmly agreed on when he would leave and what he should do to ensure a painless separation.

With this method of dismissal, an agreement to terminate the employment contract is drawn up, which must indicate:

- subject of the agreement;

- date of dismissal;

- the conditions under which the procedure will be performed;

- possible consequences of violating the agreement.

It is compiled in free written form; there are no established models.

Features of parting with the chief accountant

Despite the importance of the position of chief accountant, parting with such an employee generally follows standard rules. Therefore, the employer first of all needs to start from what is the basis for the dismissal of the chief accountant in this particular case.

However, there is an additional nuance - the mandatory transfer of cases. The person who is responsible for the accounting of the enterprise must transfer all matters and documentation to one of the following persons before leaving:

- to the manager;

- new chief accountant;

- specialized accounting company.

The difficulty here is that such a procedure is not regulated by law. Therefore, in order to avoid controversial situations, the best solution would be for the management of the organization to adopt a local act, which will set out a clear mechanism for the acceptance and transfer of cases. If special regulations or rules have not been prepared in the company, the administration has another option - issuing an order to transfer affairs from the person resigning to his successor. In this document, you can describe detailed regulations according to which the delegation of powers will take place.

Other grounds for dismissal of the chief accountant

Also, the chief accountant, like other employees, can be dismissed during the liquidation of the organization, or when the owner of the property changes .

In case of liquidation, all employees are notified two months before dismissal. The chief accountant is no exception. If he helps the liquidator, he can formalize it under a GPC agreement.

When the owner of the organization’s property changes and the employment contract is terminated on this basis, the new owner is obliged to pay compensation to the manager, his deputy, and the chief accountant in an amount not less than three times their average monthly earnings (Article 181 of the Labor Code of the Russian Federation).

Compensation for unused vacations must also be paid.

The transfer of cases

One of the main differences between the dismissal of the chief accountant is the need to organize the process of transferring cases. The person responsible for all the accounting of the enterprise must hand over the files and hand over the documents to the manager or the new employee who will replace him. However, the current legislation does not regulate such a procedure in any way. Therefore, employers are recommended to record a unified mechanism for transferring cases in at least one of the following documents:

- local act of organization;

- employment contract and job description of the chief accountant;

- order to transfer cases.

The manager's order must include information about the basis for issuing the document, the receiving party, the timing and participants of the procedure, and the procedure for processing the results. As a rule, at the final stage the transfer deed is signed.

The act is drawn up in writing. The current legislation does not establish a unified model. However, it is recommended to include the following information in this document:

- about everyone involved in the procedure;

- about the period of the inspection;

- about transferred cases and documentation indicating their details.

If any shortcomings, shortages or other inconsistencies are identified, all this is also recorded in detail in the act, along with the explanations of the resigning person and the comments of the receiving entity.

What documents need to be completed?

Before the dismissal of the chief accountant, an inventory of property and a check of obligations (materials, goods, settlements with creditors and debtors) are carried out. The results of the inventory must be attached to the act of acceptance of the transfer of cases.

The new accountant must check the status of accounting and reporting.

The following documents are checked and prepared:

- tax and accounting registers;

- registration and constituent documents;

- reporting submitted to extra-budgetary funds;

- primary accounting documents (agreements with suppliers, invoices, acts).

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

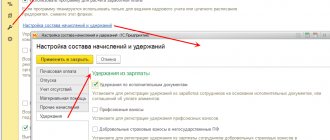

The procedure for calculating the payment and the formula for calculation

The calculation formula looks like this:

Severance pay = average daily wage × number of working days in the month following the month of dismissal.

To calculate severance pay, you need to determine the following values:

- billing period;

- the number of days that the employee actually worked;

- total salary;

- the number of days recognized as workers during the period for which benefits are paid.

Calculated payment period

The 12 calendar months preceding the month in which the employee is laid off are taken.

Actual days worked

All working days when the employee worked are taken into account.

The time spent on annual leave and sick leave is not taken into account.

Audit as a way to reconcile the parties

It is unlikely that the chief accountant will suddenly decide to resign of his own free will. The brief and streamlined formulation often hides the idea of changing jobs that has been mulled over for weeks or months, as well as accumulated mutual dissatisfaction with management. In this case, it may be acceptable for both parties to conduct an audit of the enterprise’s activities over the past few years.

Firstly, auditors will perform a complete review of all documentation instead of a selective one, which is practiced during the standard transfer of cases between accountants. Secondly, if deficiencies are detected, the company will be given recommendations on correcting them or restoring missing papers. Thirdly, under an agreement with the audit company, responsibility for all detected violations of tax or other legislation during the audited period will be assigned to the involved auditors.