Legal encyclopedia of MIP online - » Housing law » Utilities » Payment for rental housing under a rental agreement for social housing stock

Get an expert’s opinion on the rental agreement for social housing stock in two clicks

How is the rental fee calculated under a social lease agreement, what does the tenant pay for, and how are the services provided charged?

The peculiarities of rental agreements include the fact that one of the parties to the agreement (the owner of the premises of a private housing stock) are government bodies or authorized organizations that act on behalf of the Russian Federation as owners of living space (Article 91.2 of the Housing Code of the Russian Federation).

As a result, the terms of payment for renting living space under a social tenancy agreement differ from the terms of payment for a standard rental agreement. How is the rental fee calculated under a social lease agreement, what does the tenant pay for, and how are the services provided charged?

Determining the amount of payment under a social tenancy agreement

Article 67 of the Housing Code establishes the most important obligation of the tenant - timely payment for the rental of premises and services provided. As a rule, payment must be made no later than the 10th day of the month following the expiration date. The agreement may establish other payment terms for accommodation.

In what form and in what amount the payment will be made under the rental agreement must be agreed upon by the parties before signing the relevant agreement and indicated in the agreement itself.

Payment amounts, according to housing legislation, are determined by state authorities, local authorities and the lessor on the basis of agreements on the development of the territory.

According to Resolution No. 1356 of December 12, 2014, the amount of payment is determined on the basis of one square meter of the total area of the premises.

In March 2015, a cap was set on the maximum amount of rent that a municipality can charge for residential rentals. The established amount for rental housing can change no more than once within 3 years (excluding the indexation process).

What laws, codes and acts are regulated?

- Rules for the provision of municipal residential premises under a social tenancy agreement and conditions for the use of space.

- Is it possible and how to exchange an apartment under a social tenancy agreement?

- Is it allowed to rent out a municipal apartment and what is required for this?

- Rules for drawing up a rental agreement for a room in a communal apartment.

- Features of the procedure for relocating from dilapidated housing under a social tenancy agreement.

- Who and how can become the main tenant of social housing and what to do with municipal housing after the death of the main tenant?

Who is exempt from the calculation?

- location (transport interchanges, infrastructure);

- degree of improvement (availability of all amenities, elevator, garbage chute, etc.);

- level of wear and tear (residents of dilapidated houses are exempt from rental fees).

At the same time, certain amendments were made to the Tax Code. They establish that the tax amount will increase by 20% per year for 5 years. This period is needed for a smoother transition to the modern system. Since the cadastral value is 10 times higher than the inventory value, a sharp increase could seriously hit the pockets of Russians.

What is included in the rental fee for residential premises?

One of the significant differences between rental agreements for residential premises from the social housing stock and rental agreements is the amount of payment for living space and services provided.

So, according to Part 1.1 of Art. 154 and part 2 of Art. 156.1 Housing complex, payment for the rental of residential premises and for services under rental agreements of the social housing stock, including payment for the rental of living space and for utilities.

Payment for rent of living space includes payments:

- related to the acquisition, construction or reconstruction of a social housing project;

- related to the maintenance and ongoing repairs of the apartment;

- for major repairs of a social housing building;

- other legally established expenses.

Accommodation in an apartment provided under a rental agreement for social housing facilities costs tenants more than under social tenancy agreements. Such a fee is not symbolic, as when renting social housing. The amount of the fee is set on the basis of compensation for all costs from the budget and the costs of building a house.

The services provided are also fully paid for by the employers. As a result, there is no need to allocate budget funds for capital and current repairs or for the maintenance of the building. According to preliminary data, the established fee allows you to recoup the costs associated with the acquisition or construction of houses for social use in 25 years.

Housing and communal services from January 1, 2021, in Moscow: tariff changes, latest news

The department reports that from July 1, 2021, all capital residents will pay for electricity according to a single tariff menu. The reduction factor of 0.7 will remain for taxpayers in their rural settlements, as well as for gardeners, gardeners and summer residents organized in TSN.

The reason for the early and almost emergency increase in utility tariffs is the increase in the VAT tax rate in Russia. President Putin signed a law increasing VAT from 18 to 20 percent. In itself, without additional inflationary factors, this means an increase in the cost of most goods and services in the country by 1.7%.

Calculation of housing fees

Government Decree No. 1356 dated December 12, 2014 defines a new procedure for indexing the payment for social rent of residential premises under a social tenancy agreement for a housing stock for social use.

Thus, the amount of payment under a social lease agreement for residential premises includes:

- expenses for the acquisition and construction of premises (construction and installation work, acquisition of property rights, rent, acquisition of the right to lease a plot of land, preparation of design documentation, examination, work on the construction of a system of engineering networks, costs of connecting the house to engineering networks, expenses for landscaping and so on);

- expenses for major repairs, for the very maintenance of a social building;

- expenses for equipment of household premises; expenses for equipping living quarters with equipment, furniture, and household items;

- expenses for paying interest on loans;

- expenses related to the payment of taxes, fees and other obligatory payments;

- expenses for reimbursement of state support for the creation and operation of a social housing project.

Moscow will increase the cost of social rental housing by 8 times

The official also said that the minimum economically justified social rent tariff is 60 rubles per square meter per month. “This is a federal methodology. The cost of housing construction was taken - 90 thousand rubles per 1 square meter, an adjustment factor of 0.8 - and all this was depreciated over 100 years,” he explained. The market price for rental housing in Moscow is currently about 700 rubles per 1 square meter per month, the publication notes.

According to Kommersant's source in the mayor's office, since the announcement that major repairs would be included in the payment for housing and communal services (de facto since the beginning of the year), 10 thousand applications from citizens for the privatization of housing have been withdrawn from the mayor's office in Moscow. Citizens are deprivatizing apartments due to the increasing financial burden: the introduction of payments for major repairs and the transition to a new procedure for paying real estate taxes, calculated from its cadastral price, which will lead to a significant increase in tax payments.

Change of fee established by agreement

The amount of payment specified in the contract may be changed by the landlord, but not more than once every 3 years. The exception is annual indexation. If the payment under a residential lease agreement changes, the owner must notify the tenant three months in advance.

In turn, the responsibility of the tenant is to inform the owner about changes in the conditions that give the right to use the living space under a social tenancy agreement. For example, if the income of the tenant increases (which is the basis for revising the terms of the contract), the latter must inform the other party about such changes within 10 days from the date of the increase in income.

Among other things, changes in the amount of payment for housing under a social tenancy agreement occur as a result of the privatization of housing.

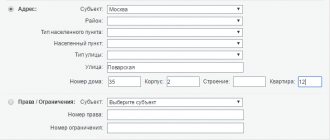

Withdrawal of charges for social rental services and other charges must be carried out from the moment the document on state registration of ownership rights to the apartment is issued. If the receipt includes the above charges, but the residential premises are the property of the person, you should contact the URC branch (Unified Settlement Center) with an application, passport, and documents of ownership.

Subsidies

At the state level, programs have been developed to support citizens in difficult life situations. Such assistance is targeted and issued in the form of subsidies. In order to qualify for full or partial repayment of housing payment receipts from budget funds, the Tenant must prove that the cost of rent is more than 22% of his family’s income (in some regions this threshold is less).

The subsidy is issued only if there are no debts for housing and communal services (at least for the last six months).

In addition to the poor, there are other categories of people eligible to apply for subsidies:

- young families;

- large families;

- young people ready to work in rural areas;

- disabled people and disabled children;

- pensioners;

- single mothers.

To receive a subsidy, you must contact the social welfare department or the nearest MFC (multifunctional center).

Note! The payment amount is not the same for everyone. Each category has its own criteria and compensation amounts.

Particular attention should be paid to collecting information on income, since this concept includes not only wages, but also the following financial income:

- documents on scholarships and benefits;

- certificate of pension amount;

- all certificates of additional income and more.

Lack of work also needs to be documented.

Utilities: composition and payment procedure

In addition to payment for the use of residential premises, payment under social rental agreements also includes payment for the services provided.

The amount of actually consumed services is determined based on the readings of the meter (individual or collective). In its absence, the consumption standard approved by government agencies (electricity and gas supply consumption standards) and local self-government bodies is taken into account.

In Russia, there are two types of service consumption accounting:

- Accounting for supplied housing and communal services according to the collective meter installed at the house. The calculation is carried out in this way: the readings of individual metering devices are subtracted from the general meter readings and the approximate services provided for non-residential premises are subtracted (for example, there are office premises or a store in the building). The result is “scattered” among consumers depending on the square footage of the living space.

- Accounting for services in the absence of a common building meter. In this case, the standard is multiplied by the total area of the building. The result is also distributed depending on the square footage of the living space.

Question of the week: Should the tenant of non-residential premises reimburse the owner for contributions for major repairs?

Should the tenant of non-residential premises reimburse the owner for capital repairs? not specifically stated in the contract. What's in the law about this?

I inform you the following:

Standards for consumed services

From January 1, 2021, for those citizens who do not have metering devices installed, the standards have increased by an increasing factor. But this applies to consumers who have the technical ability to install meters, but do not install them.

According to the Decree of the Government of the Russian Federation of December 17, 2014 No. 1380, the size of the increasing coefficient is:

- from 01/01/2016 to 06/30/2016 - 1.4;

- from 07/01/2016 to 12/31/2016 - 1.5;

- from 01/01/2017 - 1.6.

Note that according to the indexation of payment amounts, its growth varies depending on the region. Thus, for residents of Moscow, the threshold increase will be 7.5%, for St. Petersburg – 6.5. Whereas for the Novosibirsk region tariffs will increase by no more than 3.5%.

This difference is due to climatic and territorial location, infrastructure development, degree of congestion, type of energy resources, and so on.

Author of the article

Housing and communal services news

Chairman of the Yabloko party Sergei Mitrokhin agrees: citizens are deprivatizing apartments due to the increasing financial burden. “From July 1, a fee for major repairs will be introduced in Moscow - 15 rubles. for 1 sq. m. This is the highest rate in the country: for example, in St. Petersburg it is 2.5 rubles. This rise in price will primarily affect the lower and middle classes. It is likely that in anticipation of this event, citizens renounce their property rights. The Moscow authorities decided to put up a kind of barrier for them,” says Mr. Mitrokhin.

Elena Nikolaeva, first deputy chairman of the State Duma Committee on Housing Policy and Housing and Communal Services (United Russia), on the contrary, believes that deprivatization “cannot be prevented under any circumstances.” “This is a legal opportunity for citizens to cope with a difficult life situation by transferring their apartment into city ownership. Therefore, I doubt that Moscow is raising the stakes precisely to combat deprivatization - this, in my opinion, is a strange explanation,” says the deputy. According to Elena Nikolaeva, many municipalities refuse to deprivatize citizens. “We want to streamline this process. I have already submitted a bill to the State Duma that would secure the right to deprivatization only for the poor,” she says.