MIP online legal encyclopedia - » Housing law » Renting residential premises » The right to exchange housing provided under a social tenancy agreement

Get an expert’s opinion on a social tenancy agreement in two clicks

The exchange of residential premises under a rental agreement is a rather complex legal mechanism.

The exchange of living quarters is a topic that is more relevant today than ever. If we turn to the legal literature, many scientists and practicing lawyers have paid increased attention to this issue. Among them we can highlight E.S. Getman, M.Yu. Tikhomirova and others. The exchange of residential premises under a rental agreement is a rather complex legal mechanism that affects not only the sphere of housing legislation, but also civil law, as well as related industries.

Disposal of housing and exchange of residential premises under a social tenancy agreement

The disposal of real estate is one of the key civil rights of a person, recorded in the Housing Code of the Russian Federation. At the same time, the disposal of real estate can be carried out both in the case of private property and in the case where a social tenancy agreement is provided. Since the subject of our interest is the exchange of residential premises allocated to citizens from the social fund of the state or municipality, we will dwell on this issue in more detail.

The exchange of residential premises under social rental contracts is regulated by the housing legislation of the Russian Federation, or, to be more precise, by Articles 72-75 of the Housing Code of the Russian Federation. Such a right is available both to the employer himself, who signed a social tenancy agreement with the owner-tenant, and to representatives of his family. Moreover, the reasons for carrying out such a transaction can be very different, starting with a change of job and ending with leaving for another city for training. The legislative procedure does not imply the provision of arguments on the part of the applicant for the disposal and exchange of residential premises, since such a right is completely legitimate.

Exchange of owned housing

The exchange of owned housing is formalized by an “ exchange agreement ” and, in fact, is not much different from a purchase/sale agreement. In practice, an exchange agreement combines two purchase/sale agreements. You often see on the Internet that experts are asked how best to complete a transaction: through barter or buy/sell? And the answer to this question is usually: “As you wish.” The procedure for drawing up an agreement, registration, transfer of real estate by the parties is the same as for purchase/sale. The exchange agreement must currently contain:

- identification data of the parties to the transaction, while usually (unlike a purchase and sale agreement) the parties are indicated not as “seller” and “buyer”, but as “party A” and “party B” (if there are several co-owners of the property, then each of them is indicated them);

- information about the objects of the transaction, including information about documents confirming ownership rights, as well as information about the cadastral value of the objects;

- the contractual value of the objects, which the parties determine themselves, but from 2021 it should not be less than 70% of the cadastral value;

- the amount of additional payment by one of the parties if the transaction is not equivalent;

- the procedure for mutual settlements and actual transfer of objects.

There is an opinion that with the help of an exchange agreement you can avoid paying tax or somehow minimize it. It's a delusion . When implementing an exchange agreement, the same rules and rates apply as when buying/selling. An attempt to avoid paying tax in the event of an unequal exchange by recognizing the contract prices as equal and the absence of additional payment could previously work, but now it is doomed to failure. The registration authorities will most likely suspend such a transaction, and if registration does take place, then troubles can be expected from the tax authorities. The only way to slightly reduce the tax is to modestly reduce the contract value in the amount of no more than 30% of the cadastral value. But today, in 2021, the cadastral value in most cases already significantly exceeds the real market value. So you won't save much here. Let us recall, by the way, that from 2021, a tax on the sale of real estate is generally levied if it has been owned for less than five years (and not three, as before).

The exchange agreement is not subject to mandatory notarization. But if the parties wish, they can do this, which will cost approximately 0.15-0.3% of the cost of the more expensive object of the transaction.

Another important point concerns the exchange of shares in an apartment. Here, too, the same laws and rules apply as for the purchase/sale of shares - initially the share must be offered on the same terms for redemption to the co-owners of the apartment. And this must be done not in words, but in official form (letter or telegram). If they refuse, then one month from the date they receive notification of the conditions for the redemption of the share, they can exchange the share with another person.

The risks in transactions under barter agreements are similar to the risks in purchase and sale transactions. The contract must be properly executed, ideally registered and documented. The reasons for terminating an exchange agreement or declaring it invalid are the same as for a purchase/sale agreement.

Object and subject of exchange of residential premises under a social tenancy agreement

If we turn to the regulations that regulate the housing sector, we can come to the conclusion that the subject of an agreement for the exchange of residential premises is real estate provided to a citizen (tenant) under a social rental agreement. Since the state or municipality can provide various real estate objects for living, an agreement for the exchange of residential premises may include the following categories of objects of a legal transaction:

- house;

- apartments in a multi-apartment building;

- room in a communal apartment.

The exchange of occupied residential premises occurs in an equivalent manner, unless otherwise provided by the application submitted by the tenant and his family members (for example, in order to reduce the living space).

However, the Housing Code of the Russian Federation also fixes some restrictions on the exchange of real estate. Thus, the legislative order prohibits the transaction of exchanging social rental housing for real estate that belongs to the subject on the basis of private property rights. In addition, such transactions are not allowed with apartments located in residential complexes and housing cooperatives. In other words, based on Art. 72, we can conclude that the object of exchange of residential premises under a social tenancy agreement is only identical housing, the right to use and dispose of which belongs to another tenant under a social tenancy contract.

If we talk about the subjects of legal relations who have the right to carry out a social housing exchange transaction, then this cohort includes:

- employer;

- family members living with the employer;

- former family representatives who maintain a common household with the employer.

How to exchange a privatized apartment

The term “privatized” means an apartment that is privately owned - not only received as a result of privatization, but also purchased, inherited, etc.

There are several ways to exchange a privatized apartment:

- Direct exchange under the Apartment Exchange Agreement ;

- Exchange of apartments through purchase and sale (so-called “alternative transactions”);

- Exchange your old apartment for a new building (trade-in scheme).

Let us explain in more detail.

What do realtors actually do? Frankly about the hidden - in this note.

Direct exchange of housing

For clarity, let us first clarify that, if expressed legally correctly, then in relation to housing, the term “exchange” applies specifically to municipal premises, and the term “exchange” – to premises registered as private property. to the Apartment Exchange Agreement , and each party to the agreement is recognized as both a seller and a buyer.

The exchange of privatized apartments is a simple and convenient option, but unlikely for the same reasons as the direct exchange of municipal housing (see above about it). Finding an apartment on the market that suits you, so much so that its owners want to move into your home, is an almost magical situation. But if this miraculous coincidence did happen, then both parties were incredibly lucky, since the risk of such a transaction is minimal (in the worst case, the parties will simply return to their old apartments), and the mechanism of such a transaction is indecently simple (only one Exchange Agreement is signed and registered ).

But for all its attractiveness, direct exchange of apartments greatly narrows the possibility of choice (up to its complete absence), and therefore is extremely rare. And how do they get out of this situation? After all, there are a lot of transactions in the real estate market, as a result of which people change their apartment to another.

How to properly fill out a deposit when buying or selling an apartment - conditions, term and amount.

Exchange of apartments through purchase and sale

The vast majority of transactions for the exchange of privatized apartments occur through double purchase and sale - that is, by selling your apartment and buying another. In the same way, various congresses are carried out (for example, two “one-room apartments” into one “three-ruble note”), travel (for example, one “three-ruble note” into a “two-room apartment” and “one-room apartment”), as well as all kinds of settlements and exchanges with an additional payment. These types of transactions are called alternative (for more information about them, see the link in the Glossary).

The procedure for registering an exchange of apartments through purchase and sale is reduced to the following steps:

- Preliminary assessment of the market value of your apartment and the apartment you want to move to (collection of statistics from open databases of apartments for sale);

- Solving the issue of additional payment (if required) - to whom and how much;

- Searching the market for a suitable option for moving (among apartments for sale);

- Finding a buyer for your apartment (putting it up for sale through the same databases);

- two Apartment Purchase and Sale Agreements on the same day (i.e. simultaneous sale of your own and purchase of another apartment);

- Registration of both agreements in Rosreestr (this can be done through the MFC “My Documents”);

- Physical transfer of apartments (signing of Transfer Deeds), and moving to a new place of residence.

That's it in a nutshell. More details about how all this is done (with making deposits, collecting documents, organizing payments, etc.) are described in a separate article about alternative transactions (see the link to it below).

How to evaluate your own apartment for sale? Evaluation factors and price calculation method.

Pros and cons of exchanging privatized apartments through purchase and sale

The undoubted advantage of such an exchange is the huge selection of options. You can choose to exchange any of the apartments for sale (and there are thousands of them in cities!). There are no administrative restrictions - permission from local authorities is not required, and standards for the provision of housing are not taken into account. The terms of the transaction are as flexible as possible and depend only on the wishes and agreement of the parties (amount of additional payment, availability of repairs and furniture, form of mutual settlements, terms of transfer of apartments, etc.).

It is these advantages that ensure the popularity of this form of exchange of privatized apartments. This is exactly how real estate agencies exchange apartments (through buying and selling).

But, as always happens, this method also has disadvantages. The first and most important is the legal risk of the transaction . That is, the risk that as a result of a legal dispute and recognition of the transaction as invalid, one of its participants may lose the acquired ownership of a new apartment, and the ownership of their previous apartment will not be returned to them. Sale and Purchase Agreement is concluded for each apartment , and formally these two agreements are in no way connected with each other (although they are signed and registered at the same time).

How to protect yourself from this risk? Study the guide to buying and selling apartments , and seek advice from specialized lawyers.

You can, of course, contact a real estate agency, but this will not give any guarantee to apartment owners (see why here), but the costs of the transaction will increase many times over.

Another disadvantage of exchange through purchase and sale is the obligation to pay personal income tax for the sold apartment. But in some cases, this tax can be reduced to a minimum (and even to zero), and when purchasing an alternative apartment, you can also receive a tax deduction on your salary, for example. That is, this “disadvantage” can even turn into an additional “plus” of such a transaction, due to the processing of a personal income tax return (see the links for how this is all done).

What conditions must be taken into account when concluding Agreements for the sale and purchase of apartments are described in a separate Glossary article at the link.

A sample Agreement for the sale and purchase of an apartment - see HERE.

More information about how to exchange your apartment for another (including with an additional payment) and arrange everything correctly is laid out here: “How does an alternative transaction for the purchase and sale of an apartment take place?”

Regulation of relations for the exchange of residential premises: rules and conditions

The suitability of objects for the exchange of residential premises under a social rent contract is a key determinant of such a transaction. This issue should be considered from its reverse side, that is, based on a regulatory article with prescribed conditions that do not allow a citizen to realize his legal right.

So, Art. 73 of the RF Housing Code states that:

- The exchange of residential premises is not allowed if a lawsuit is filed against the tenant of the living space, which raises the issue of the legitimacy of the use and disposal by the subject of legal relations of the allocated real estate from the state or municipal fund.

- A transaction aimed at bartering a residential building, apartment or room is not allowed, even if this object is recognized by the authorized bodies as unsuitable for habitation.

- It is impossible to exchange living space if during the process a citizen who has been diagnosed with a serious chronic illness is moved into a communal apartment (the list of diseases can be analyzed in the Decree of the Government of the Russian Federation).

- Bartering of residential premises is also not allowed in cases where it is recognized as unsafe and is subject to demolition, or may also collapse. In this case, citizens have the right to receive other social housing with more comfortable living conditions.

- The exchange of housing classified as official is prohibited. This is due to the fact that such a disposal of real estate would lead to a change in the legal status of official housing.

- Such a transaction aimed at exchanging residential premises is not permitted in cases where the property requires major repairs, as part of which refurbishment or redevelopment will be carried out.

The rules for exchanging residential premises are traditional. First, the employer sends an application to the landlord, having previously received consent from all co-tenants. Then a complete list of required documents is attached to the application. And finally, within ten days after receiving the notice, the landlord must decide whether to barter housing or refuse to carry out the transaction. If the legislative order is not followed, the exchange of residential premises may be declared invalid.

Inadmissibility of the transaction

In what case is a transaction not allowed? This:

- Bringing a claim to the employer for the need to terminate or change the social tenancy agreement.

- The right to use housing challenged in court

- The conditions of the living space are far from suitable for living (the house is subject to demolition, etc.).

- Dramatic changes are planned in the apartment building due to major renovations .

- a disease that is dangerous to society (active tuberculosis, mental disorder, etc., see the list in the government decree of June 16, 2006, No. 378) moves into communal housing

- The document is fictitious : it is concluded to obtain material benefits, and the parties do not actually exchange real estate.

- After moving, housing conditions become uninhabitable , which gives the “injured” party the right to receive another housing on a first-come, first-served basis.

- Property under collateral .

- The living space was seized (a criminal case was initiated).

- Transaction with apartments located in different cities with a discrepancy in the number of residents living in them.

In what case is a transaction considered invalid ?

If a deal is concluded, but the exchange of a specific living space is prohibited by law, then it is disputed in court.

After the court makes a decision on the illegality of the transaction, both parties must return to the living space occupied before moving.

Find out on our website about the grounds for terminating a social tenancy agreement, as well as the conditions for eviction and relocation under this agreement.

Forced exchange and protection of the interests of certain categories of citizens

The exchange of residential premises can be either voluntary or compulsory. As for the first option, in this case it was possible to obtain consent from all co-tenants who live in the same territory as the primary tenant.

Forced barter occurs only if it is not possible to reach an agreement between family members.

In such situations, Art. 76 Housing Code of the Russian Federation. This legal norm states that any subject of legal relations (who is a party to a social tenancy agreement) who has reached the age of majority may demand a forced exchange of an apartment or other living space. In this case, the decision is made by the judicial authority, which takes into account all the circumstances of the case.

However, voluntary or forced exchange of social rented housing should not infringe on the interests and rights of any of the parties to the agreement. In particular, the interests of incapacitated and minor citizens who are direct parties to the social rent agreement must be protected. In such situations, in order to make an exchange, it is necessary to obtain additional consent from the guardianship and trusteeship authorities.

Author of the article

Step-by-step instruction

We are trying to find our own option: housing that is more suitable for you, where the owner is also a tenant.

If you can’t find the right option, the landlord (administration or other organization that has part of the housing stock of the Russian Federation at its disposal) can offer you another option .

You must write a statement stating that you need other housing. A social rent agreement is attached to the application. The landlord will find an option for you. Perhaps an alternative will appear over time, when this happens you will be notified.

agreement is concluded in accordance with Part 2 of Article 74 of the Housing Code of the Russian Federation. Its subject can only be living space provided to citizens on social rent, and its subjects can be social housing tenants (this is specified in Article 74 of the Housing Code, Part 1).

Such premises cannot be exchanged for specialized or commercial premises. If a person is moved in as a member of the employer’s family, it is impossible to exchange his share for the share of another person (based on paragraph 33 of the Resolution of the Plenum of the Armed Forces of the Russian Federation of July 2, 2009, number 14).

to register the document with the Office of the Federal Registration Service.

Terms and cost of registration

After submitting the documents, the landlord will need up to 10 working days to make a decision. After this period, the applicant will be provided with a response in writing .

If the deal is approved, you will have to wait another 10 days, which the organization will need to terminate the old employment contract and draw up a new one.

state fee when exchanging social housing, but this does not mean that there are no financial costs:

- If a real estate agency is engaged in barter, naturally it will charge a fee for its services. The cost will depend on the organization.

- Each party to the transaction may demand material compensation in the event of unequal barter.

- It is advisable to find out the market value of your apartment. This will also require money.

When can they refuse?

The legislative act approved the conditions , failure to comply with which will result in refusal when registering an exchange. They are given in Art. 73 Housing Code of the Russian Federation:

- They can refuse when a claim is brought against the employer for termination of the social contract. hiring

- If the right to use housing is disputed in court.

- The housing is being prepared for demolition or has been declared uninhabitable.

- A resolution on major renovations of the house was approved.

- After the conclusion of the transaction, a person moves into the living space with violations of physical standards, which are on the list given in paragraph 4 of Art. 51 Housing Code of the Russian Federation.

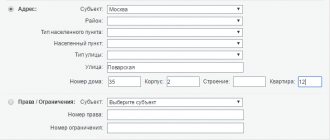

What documents are required?

Below is a list of required documents . The collection of these papers must begin immediately after the decision to barter the living space is made:

- an application addressed to the landlord for the exchange of residential premises;

- employer's passport;

- a document that confirms the right to use the housing involved in the transaction. This could be: a social contract. rental, exchange order for living space, extract from the decision of bodies, local government, on the provision of living space;

- certificate of family composition;

- written consent of the apartment residents;

- permission from the guardianship authorities. It will be required if there are certain categories of citizens in the family (they are listed above, in the paragraph on laws);

- signed barter contract.

The entire package of documents must be submitted to the organization with which the contract was concluded .

Usually this is: a ministry, service, department, municipal administration.

The documents attached to the application can be submitted in person or sent by mail.

Personal application will require presentation of the employer's passport. A copy of the main identification document must be attached to the sent documents.

Where to begin?

Instructions:

- The first step is to resolve the issue of consent of family members.

- Next, find a living space that suits the applicant. Private agencies and the landlord will provide assistance in solving this problem.

- The last point is collecting and submitting documents.

According to paragraph 5 of Art. 72 of the Housing Code of the Russian Federation, a new living space can be located not only in the tenant’s locality, but also in any part of Russia .