Dismissal by way of transfer to another organization: what is regulated?

An employee’s right to dismissal by transfer to another organization is enshrined in Art. 72.1 Labor Code of the Russian Federation. According to Part 2 of Art. 72.1 transfer is possible in two situations:

- at the initiative of the employee - in this case, the consent of the organization’s management is not required;

- at the initiative of the organization, but only with the consent of the employee.

According to sub. 5 hours 1 tbsp. 77 of the Labor Code of the Russian Federation, if an employee is transferred to another organization, the contract with him is subject to termination. That is, transfer to another organization without dismissal is not allowed.

It is necessary to dismiss the employee in this situation on the basis of subclause. 5 hours 1 tbsp. 77 of the Labor Code of the Russian Federation - transfer of an employee, and not at his own request or by agreement of the parties. Moreover, this moment has not only formal significance, but also makes it possible to resign without prior notice to the management of the organization 2 weeks before termination of the contract, which is necessary when resigning at your own request.

Dismissal through transfer: legal grounds for the procedure

To begin the transfer procedure to another company, the employee must confirm the fact that this is a transfer. In practice, such a document is a letter (invitation), which indicates the consent of the new employer to accept the transferred employee. The letter is written in free form. It may look like this:

General Director of Start LLC

Drozdov A.I.

Dear Alexander Ivanovich!

Iris LLC is ready to hire Nadezhda Grigorievna Petrova, your current accountant, as a chief accountant since ___________. In this regard, we ask you to formalize the dismissal by transfer of this employee.

General Director of Iris LLC _________________ I. P. Fedorov

In addition to the letter, the organization receiving the employee requires a letter of resignation from the employee himself. The presence of these two documents is required to begin the dismissal procedure.

If the initiator of the transfer is the organization in which the employee works, then his consent can be noted on the transfer letter itself - then there is no need to write a letter of resignation.

Important! The letter of transfer subsequently obliges the new employer to enter into an employment contract with the transferred employee and hire him in the position specified in the letter. That is, the presence of such a letter is a guarantee for the employee that the receiving organization will not refuse him employment.

As for the transfer date, it is approximate. The practice is based on the fact that an employee must be employed in a new company within a reasonable time after dismissal. This is considered to be 1 month.

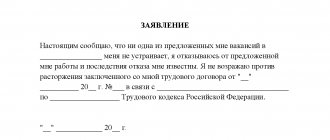

Application for dismissal by transfer to another organization - sample

Another question that arises in practice is about the correct wording of the request for dismissal in the application. Here is an example sample with the correct wording, written in accordance with subparagraph. 5 hours 1 tbsp. 77 Labor Code of the Russian Federation.

General Director of Start LLC

Drozdov A.I.

from the accountant of Start LLC

Petrova N. G.

Statement

I request that you dismiss me from my position as an accountant at Start LLC in accordance with subclause 5 hours 1 tbsp. 77 of the Labor Code of the Russian Federation in connection with the transfer to work at Iris LLC from ________ ____.

__ __ ____ of the year

Accountant LLC "Start" _____________________________ Petrova N. G.

One of the key questions when writing an application is the date of transfer. Since the norms of the Labor Code of the Russian Federation do not indicate how to determine it, the date indicated in the letter of transfer can serve as a guide.

However, the current employer, for technical reasons, may not be ready to release the employee within the specified period. For example, due to the need to transfer material assets, conduct an audit, hand over cases, etc. Therefore, the date in the letter of transfer should be indicated taking into account the provision of sufficient time for such activities.

Accordingly, the employee submits an application for transfer in advance.

When deciding what period is sufficient for carrying out all dismissal measures, it is logical to use, by analogy, the provisions of Part 1 of Art. 80 Labor Code of the Russian Federation. That is, this period should be considered 2 weeks.

All documents that must be completed when transferring an employee to another organization are given in ConsultantPlus. Get trial access to the system for free and proceed to samples.

Suppliers of goods and other contractors

Immediately after the new legal entity is registered in the state register, you need to deal with contracts. They will have to be transferred to a new organization. Everything in the new documents will change: full name of the director, bank details and other information: INN, OGRN (OGRNIP), legal address. This data is reflected in new contracts.

It is better to assign a specialist for this work so that he can deal with the issue in detail. I called contractors and suppliers, arranged meetings, and then visited everyone to sign new agreements. What can be done remotely, do it remotely. You can scan one copy of the agreement with your stamp and signature of the director and send it to your partner by email. He puts his stamp and signs the document, after which he also takes a scan and sends it to you. As a result, you both have a certified copy of the contract that is legally binding.

Dismissal due to transfer to another job - step-by-step procedure

After the administration of the organization receives the employee’s application and letter of transfer, the dismissal procedure begins. It is carried out according to the general rules provided for in Art. 84.1 Labor Code of the Russian Federation.

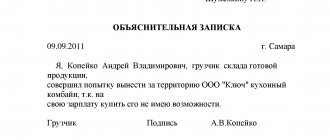

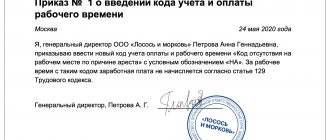

Issuance of an order

According to Part 1 of Art. 84.1 of the Labor Code of the Russian Federation, the dismissal of an employee is carried out on the basis of an order signed by the head of the organization. The employee must be notified of the contents of the order against receipt. In addition, the administration of the organization can issue the employee a certified copy of the order. If the employee insists on this, the organization is obliged to give him such a copy.

To issue an order, the administration of an organization can use the unified form T-8 (approved by the Decree of the State Statistics Committee of the Russian Federation “On approval...” dated January 5, 2004 No. 1). It is not necessary to use this form, so the organization can develop its own version of the order.

The wording in the order must exactly correspond to subparagraph. 5 hours 1 tbsp. 77 Labor Code of the Russian Federation. That is, in the column “Grounds for dismissal” the following phrase must be indicated: “transfer at the request of the employee to work with another employer” with reference to this subparagraph.

Download a sample order for the dismissal of an employee in the order of transfer to another organization from ConsultantPlus. To do this, get trial access to K+ for free.

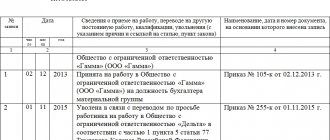

Dismissal by transfer - entry in the work book

On the last working day, the employee must be given a completed work book with the corresponding notice of dismissal. Entries in the work book are made in accordance with paragraphs. 14 and 15 of the Rules, approved by the Decree of the Government of the Russian Federation “On Labor ...” dated April 16, 2003 No. 225. That is, the dismissal record must exactly repeat the wording of the order and the norm of the Labor Code of the Russian Federation, on the basis of which the contract is terminated. The entry is made without any abbreviations.

For a sample entry in the work book about dismissal by transfer, see ConsultantPlus. Get trial access to K+ for free.

In addition to the work book, exactly the same entry must be made in the employee’s personal card. The employee becomes familiar with its contents by signing.

In practice, situations are possible when an employee cannot personally pick up a work book. Then the administration of the organization is obliged to send the employee a notification by mail about the need to pick up the document. After sending such a notice, the employer is relieved of responsibility for late issuance of the book.

Payments upon dismissal

On the day of dismissal, the employee must be paid in full his salary, vacation compensation and other amounts due to him.

In order to avoid disputes about the amount of payments, compensation, deductions, etc., the company’s accountant, together with a personnel employee, can draw up a calculation note in form No. T-61 (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1).

This document consists of two parts: front and back.

On the front side of the note, information about the employee is indicated, and the number of unused vacation days is also indicated. On the back, in the appropriate columns, compensation for vacation, as well as other payments due to the employee, is calculated.

Form No. T-61 is not mandatory, so an organization can develop such a document independently. The advantage of issuing it to the employee is that the entire mechanism for calculating all amounts due upon dismissal is shown.

Bank account

It needs a new one - that's obvious. In principle, there is nothing complicated - go to the bank and open a new current account . If the bank whose services you used before is not satisfactory in some way, go to another one. First study the conditions of different banks: the cost of opening and servicing an account, prices for additional services, a set of useful online cash register[/anchor], acquiring, currency control or online accounting. Perhaps you have thought more than once that at the start you rushed to choose a bank due to inexperience, and there was no time to correct the mistake, and it was a troublesome matter. Now you have the opportunity to do it completely painlessly.

In your personal bank account, immediately create templates for important payments, fill out a list of counterparties with details and other information. Connect all the necessary additional functions - salary project, currency control, and so on. Apply for a business card linked to your account.

Results

The procedure for dismissal during transfer is similar to the procedure for dismissal at will.

However, the significant features are, firstly, the need to provide the old employer with confirmation of further employment, secondly, agreeing on the date of dismissal, thirdly, the absence of the employee’s obligation to work 2 weeks for the old employer and, fourthly, an indication in the order and labor book of other grounds for dismissal (subparagraph 5, part 1, article 77 of the Labor Code of the Russian Federation). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Online cash register

When changing a legal entity, cash register equipment will have to be re-registered. The old owner removes the device from tax registration and sells it to the new owner. He, in turn, registers the cash register on his own. The process is exactly like re-registering a car. As with the purchase of a motor vehicle, the seller and buyer must enter into a purchase agreement. It will serve as the basis for registration with the tax office.

All work is done through the personal account of an individual entrepreneur or legal entity on the Federal Tax Service website - the same as during initial registration. An electronic signature and all information about the new entrepreneur are required.

Of course, the agreement with the fiscal data operator (FDO) will also have to be concluded in a new way. The procedure is no different from the standard one. It makes no difference whether an agreement is concluded for the first time or because of a change in legal entity - everything is the same.

But the fiscal registrar will have to be replaced with a new one . It is registered to the old company and cannot be re-registered to the new owner. Therefore, prepare at least 6 thousand rubles to purchase a drive. This is the cost of a device designed for 13 months of operation.

If the manager refuses to let the employee go

If an employee has expressed a desire to resign by transfer, but his employer is against this, then the employee has no choice but to leave of his own free will. In this case, the employee is left without protection before the new manager.

That is, if dismissal occurs due to transfer, then the receiving party must employ the employee within a month, otherwise he may go to court. By a court decision, they can either reinstate him to his previous place of work, or oblige the head of the receiving enterprise to hire this employee.

If the dismissal occurs at will, then there will be no one to file a claim with.

If the initiator of the transfer is a new employer

If a company is interested in hiring a specific specialist, it can send a petition to the organization requesting the transfer of the employee. In the letter, the potential employer invites the current employer to consider the possibility of a transfer under certain conditions. The letter contains the following information:

- Full name of the employee.

- Proposed vacancy and salary.

- Estimated hiring date.

This is also important to know:

Forced dismissal: what threatens both parties and how to react to it

The current employer reviews the letter within the period established by the business rules (usually 5 working days) and makes a decision. If you agree, the corresponding visa will be stamped on the document. The employee who is offered a new position is informed in writing about the request received and receives his consent to the transfer or a reasoned refusal.

Important

If the issue is resolved positively, the responsible specialist sends a letter to the interested party confirming the possibility of the transfer and the employee’s consent to change jobs.

Is the employee entitled to vacation compensation?

The Labor Code of the Russian Federation stipulates that the employer is obliged to compensate a resigning employee for all days of unused vacation. There are no exceptions established by law for employees resigning by transfer. Consequently, such compensation must be paid to him along with his due salary on the final day of work.

It might be interesting!

What reasons should there be for someone to be officially dismissed under the Labor Code of the Russian Federation?

Dismissal due to reduction in working hours

As a result of production and technological transformations at the enterprise, the employer may need to introduce a part-time working regime. As a rule, this forced measure is introduced for a period of up to six months in order to preserve jobs. Labor legislation sets only the upper limit of working hours.

The working week cannot be longer than 40 hours. Its minimum duration is not specified either in the Labor Code or in other regulations.

When a reduced working hours regime is introduced, it is necessary to notify the staff of the upcoming changes no later than 2 months in advance. Notice of this must be made in writing. Failure by the employer to comply with the established deadlines allows the employee to challenge the decision to reduce working hours in court, to recover lost earnings and compensation for moral damage. Any changes regarding this issue should be recorded in the employment agreement.

The employee may not agree to the new working conditions. In this case, the employer offers him vacant positions. If there are none, and the employee refuses to work under the terms of a shortened working week, the employer has the right to terminate the employment agreement unilaterally.

The need to work out.

The law does not establish terms of service when an employee is dismissed by transfer. This means that the employee and the employer (both current and potential) have the right to set their own terms of service.

Expert advice:

Natalia

Labor expert

If the current employer has set a working period that is too long and does not suit you, you can resign of your own free will after working the 2 weeks required by law.

What to do with the property

To avoid problems with the tax authorities, you need to correctly transfer fixed assets belonging to the old legal entity to the ownership of the new owner. If the previous organization is liquidated, then there is only one adequate option - sale.

If you don’t want to pay income tax, sell assets at the prices at which the equipment is listed on the residual balance . If you sell for more than you bought, you will pay tax on the difference in value to the budget. It is better to formalize the transfer of money for assets through a loan agreement.

In the case when the old legal entity does not go anywhere, but continues to work, fixed assets can be transferred free of charge, as part of the reorganization procedure. The tax office will not find fault in this case.

Significant changes to the employment contract

In daily work, organizations are often faced with the need to transfer an employee for various reasons. If as a result of this the terms of the employment agreement are changed, then it does not matter what was the reason (production necessity, reorganization of a legal entity, expansion or contraction of the enterprise, certification or health status of the employee). The fact of change is important.

If they affect:

- job responsibilities,

- place of work,

- wages,

- schedule,

- other conditions specified in this document.

In this case, the transfer can only be carried out with the written consent of the employee . The legislation does not establish an exhaustive list of significant changes to the terms of the employment agreement. The degree of materiality is assessed differentially for each case.

What to do with the old legal entity if there are no plans to conduct business

Option 1. Eliminate

Suitable in cases where the organization’s activities from a tax point of view were impeccable. The thing is that during liquidation an on-site inspection is very possible. It is not necessary that this will happen; the Federal Tax Service has every right to carry it out. The Tax Code directly states this in paragraph 11 of Article 77.

An on-site tax audit is not the only difficulty in closing an LLC. This is a rather troublesome procedure in general. It includes:

- meeting of founders. Based on the results of the meeting, a decision on liquidation is made. It is drawn up in the form of minutes of the meeting with the signatures of all founders;

- inventory. A list of liquid assets is compiled indicating the residual value;

- creation of a liquidation commission. This is also documented in a protocol indicating the chairman and members of the commission. The tax service must be notified of the creation;

- written notice to all creditors;

- publication of the liquidation decision in the media. After the publication appears, creditors are given at least two months to submit claims;

- drawing up an interim balance sheet;

- drawing up a liquidation balance sheet. Obviously, for trouble-free liquidation it must be positive;

- fulfillment of creditors' requirements;

- LLC liquidation.

Direct liquidation is a long and tedious task. The process may take several months. If you want it faster, consider the following option.

Option 2. Sell

Unlike an individual entrepreneur, a legal entity can easily be sold, and with all its giblets: property, employees and even debts. The most important thing is to find a buyer. Selling a legal entity is not the most difficult procedure, but there are pitfalls and here’s what the plan is. Let's look at an example.

A businessman we know decided to sell an unprofitable LLC. He had two options: sale or bankruptcy - he chose sale. I posted an ad on Avito and began to wait for buyers. They were found quickly.

One fine morning the phone rang. On the other side of the line he heard a voice with a strong Caucasian accent. The voice announced a desire to buy an LLC. A meeting was scheduled, to which the buyer arrived with a new director. It was clear from his appearance that he was a figurehead and had no business at all.

Then our friend did not pay attention to it, but in vain. One way or another, the deal was completed. 2 years passed and the man stopped even thinking about selling, plunging headlong into another project, and one fine day he was summoned to the department for combating economic crimes with a summons.

There he met with the unfortunate director - he was also summoned to the Department of Economic Crimes. The guy had no face - he was already pleased with bleak prospects. And this is what happened. Using the purchased LLC, the new founders arranged for the purchase of construction equipment on lease. The amount was - not much, not little - 8 million rubles. According to the police, the equipment was taken to one of the Caucasian republics, where it was successfully sold for spare parts. There the trace of the founders and the accountant was lost.

The amount of 8 million hung on the director - he turned out to be the last one. The guy received a 2-year suspended sentence. There were no complaints against our friend, but his nerves were pretty frayed - he went to the Department of Economic Crimes for several months on this case. Therefore, when selling an LLC, be careful.

Option 3. Go bankrupt

Not the fastest or most pleasant procedure. In order for bankruptcy to go through without questions from the tax authorities, it must really be unprofitable and not be able to pay creditors. When checking, tax officials will try to prove the opposite. And if it turns out that before bankruptcy all assets were transferred to another legal entity, problems cannot be avoided. Both companies may have to respond.

In general, any actions with companies - be it reorganization, merger or sale - attract increased attention from tax authorities and other regulatory authorities. That is why we do not recommend creating a new LLC and transferring business to it in case of problematic situations . The tax authorities will go to court and have no problem proving that everything was started for the sake of tax evasion. And then, in addition to the payments themselves to the budget, you will also have to pay hefty fines, and if we are talking about large sums, it may even lead to a criminal case.

Therefore, we advise you to comply with the law and liquidate the legal entity according to all the rules. Yes, it is long, difficult and tedious. But after completing the procedure, you will not have any questions.

We do not recommend resorting to the services of intermediaries and dubious lawyers. It’s easy to calculate them: the announcement of the service will be approximately in this format: “Liquidation of individual entrepreneurs and LLCs!!!! We will help you LEGALLY close an LLC, including with debts!!! No bankruptcy!!! Guarantee!!!!"

There may be a little more or a little less exclamation marks, but the general background of the ad is clear. This is all from the category: “Legal loan write-off”, “I’ll return your license for money” or “Legal exemption from the army”.

We are not saying that all these companies will definitely scam you, but the percentage of scammers in this service industry is very high. Therefore, be careful. And good luck with your promotion!

Dismissal when essential conditions change

In certain cases, the employer may make significant changes to the provisions of the employment contract. These include:

- place of work;

- the date on which you should begin performing your professional duties;

- name of position, profession;

- rights, obligations of the parties to the contract;

- working conditions, payment, compensation payments, social insurance.

With these changes, the employer will have to fulfill certain obligations:

- notify the employee in writing about changes in conditions in advance (2 months). Exceptions to the deadlines apply to employers who are individuals (for them the period is 2 weeks) and employers who are religious organizations (a week). The employee must answer whether he agrees to continue working under the new conditions. The reflection time is not legally limited, so the employee can give an answer by the end of the two-month period;

- if you intend to continue cooperation, draw up a new employment agreement;

- in case of refusal to work in changed conditions, offer the employee vacant positions that he can occupy, taking into account his qualifications and professionalism.