How is the staff reorganized?

In the process of merging one company with another, the legal entity is usually liquidated.

Or something new can be created. At the same time, in a company that becomes part of another, there is almost always a need to reduce some of the staff. The law does not allow dismissing employees due to the reorganization of an enterprise. Article 75 of the Labor Code of the Russian Federation allows dismissal in such circumstances only if the person himself expresses his desire and refuses the new conditions proposed by the employer. If a decision is made to make redundancies during the reorganization of an enterprise, the employer is obliged to:

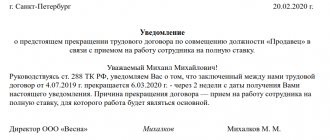

- Notify your employees about this no later than 2 months in advance. Do this in writing, indicating in the notice the period of reorganization and a complete list of changes in employment contracts, if any are expected.

- Notify the territorial Employment Service and trade unions. Also in 2 months, with the planned mass reduction - in 3.

- Offer vacancies available at the newly created enterprise to everyone who is subject to layoffs. The law allows you to offer positions that are lower in salary and qualifications.

- If there are no vacancies or they are refused, dismissal occurs at the time of reorganization of the enterprise. A corresponding order is drawn up about this, the dismissed person is given a full paycheck, a work book, a certificate of income for the last 2 years and other documents.

What is this change?

Reorganization in the form of affiliation is a complex legal procedure that results in the merger of two or more organizations. In this process, some legal entities can be liquidated and new ones created.

At the same time, the subjects who receive certain rights and responsibilities change.

The legal successor receives all rights to property and monetary resources.

The reorganization is regulated by several legislative acts of the Russian Federation, including laws on LLCs, the Civil Code, and the Labor Code.

It is noteworthy that only firms with the same organizational and legal form can participate in the merger.

As a rule, reorganization inevitably affects the interests of the company's employees. Once this process is completed, their terms of employment and employment contract may change.

Where does the reduction occur during reorganization in the form of affiliation? In an acquired institution, often in a company that merges with another organization, there is a need to reduce the number or staff of employees.

This is not a rare practice when a newly created institution provides far fewer vacancies than there are workers themselves. Thus, part of the personnel of the acquired enterprise is subject to layoffs.

Important . No form of company reorganization is considered a valid reason for terminating employees. Dismissal is possible only on the personal initiative of an employee who is not satisfied with the new conditions. This norm is enshrined in Article 75 of the Labor Code of the Russian Federation.

If the employment relationship with the employee continues after the reorganization, he automatically becomes an employee of the new successor company - there is no need to dismiss such a person with documentation and then re-employ him.

What documents need to be completed when laying off people as a result of reorganization?

This procedure always requires lengthy and complex preparation, including the preparation of a large number of papers. If you make even one mistake or miss a seemingly insignificant point, you may encounter serious problems in the near future. Anyone can protest their dismissal, and this will result in serious reputational, time and financial losses.

So, we prepare all the documents correctly and on time. It is important to note that all paperwork relating to staff reductions must be dated. Since meeting deadlines when reorganizing a company is very important.

List of required documents:

- Minutes of the general meeting of shareholders, founders or directors, recording the adoption of a decision on merger. It should indicate the reasons and timing of the reorganization, the conditions for its implementation, and the list of responsible persons.

- A reduction order with information about the reasons, timing, specific positions to be reduced, as well as the persons responsible for carrying out this procedure.

- Order on the creation of a reorganization commission. It indicates the list of persons involved and their main tasks (monitoring compliance with the legality of the process).

- New staffing.

- Notifications addressed to each employee in 2 copies. Employees must put personal signatures on both. They take one copy for themselves, the second remains in the HR department. If a person refuses to accept the notice and sign it, it is necessary to draw up a corresponding act and verify it with the signatures of at least two witnesses.

- Notices to the trade union body and the central control center. Do not neglect this point.

- An act offering vacancies to employees. It must be drawn up and signed three times: on the day of delivery of the notice of layoff, a month later, and two months later on the day of dismissal. If an employee accepts a vacancy, one act is sufficient.

- Application for refusal of the proposed vacancies and order of dismissal. Issued if the employee did not accept the employer’s offer. Or - one order - if there are no available positions at the enterprise.

- The final protocol of the reorganization commission, confirming the legality of the employer’s actions.

Reporting

The old company, when filling out the DAM report, includes the amounts of payments to employees until the end of the reorganization. In turn, the new employer reflects the amount of payments of such employees from the first day of work with him in the calculation.

The reorganized company must provide personalized accounting information to the Federal Tax Service within 1 month from the date of approval of the transfer act in relation to dismissed employees.

As you and I can see, the accountant of the reorganized company has urgent matters to submit reports on personal income tax and insurance contributions before the organization ceases to operate. And the accountant of the successor company will not have any difficulties if the previous company transfers to it all the documents regarding the employees.

Who can't be fired?

Regardless of the circumstances that an enterprise faces, there are categories of specialists whose layoffs are prohibited by law. In this list:

- Persons on regular vacation or “sick leave”.

- Pregnant women on maternity leave and women raising children up to 3 years (in some cases up to 6 years).

- Single parents raising children under 14 years of age or disabled children under 18 years of age.

- Trade union members.

- Workers under 18 years of age.

The Labor Code provides for a priority right to retain jobs for those whose qualifications and labor productivity are higher than those of their colleagues. Those who do fall under layoffs receive several mandatory payments:

- Salary for hours worked, bonus, compensation for unused vacation.

- Severance pay (in the amount of one month's salary).

Such employees retain their average salary while looking for a new job (no more than 2 months).

Personal income tax and deductions

According to the Ministry of Finance, the former company itself must provide information about the income of employees in Form 2-NDFL from the beginning of the year until the moment of termination of activity, and not the successor (Letter of the Ministry of Finance dated July 19, 2011 No. 03-04-06/8-173).

The successor company will provide employees with standard tax deductions from the moment they began working for that company, taking into account wages received from the beginning of the calendar year in which the reorganization was carried out.

What to do with an employee who received a property deduction from his previous employer? As you know, the notification issued by the Federal Tax Service confirming the right to deduction includes the name of a specific employer. Therefore, in order to receive the rest of the deduction, the employee needs to receive another notice and give it to the accountant of the new company. The deduction will be provided from the month in which the employee brought a new notice and wrote an application for the deduction.

What are the consequences of violating the staff reduction procedure?

If his labor rights are violated, a dismissed employee can file a complaint with the State Labor Inspectorate and even the prosecutor's office. At the same time, he can demand protection and compensation either immediately after dismissal or much later. If the fact of violations is confirmed, the employer faces a fine, suspension of the enterprise for 90 days, and most importantly, the need to pay monetary compensation to the offended employee.

To avoid mistakes when organizing such an important process, use the help of professionals - contact. We have been successfully working in this market for more than 3 years and help our clients efficiently and quickly resolve any issues related to compliance with labor law at all stages of business operation.

Call us and get expert help in reorganizing your staff!

Insurance premiums

The base for insurance premiums is calculated on an accrual basis from the beginning of the year. After the base reaches the maximum value (in 2021 - 1,392,000 rubles), contributions will be calculated at a rate of 10%. Hence, the question very often arises: is it possible for a successor organization, when determining the base for insurance premiums, to offset employee payments for the same year, but from the previous organization?

Alas, the answer will not please you - you can’t do this. According to the Ministry of Health and Social Development of Russia, in the event of reorganization, the successor organization does not have the right to take into account the base for calculating insurance premiums formed before the reorganization. It turns out that if before the reorganization the employee’s insurance premium base reached the limit (the previous company applied a 10% tariff), then after the reorganization the successor will have to apply a 22% tariff to him (if there is no right to benefits).

Possible mistakes

Each form of reorganization has its own characteristics of completing cooperation. But usually employers, when firing employees for this reason, make the same mistakes:

- A citizen is fired due to the absence of his position in the staffing table of the new organization. The employee can challenge such termination of the employment relationship in court, since the manager, before formalizing the dismissal, was obliged to offer the employee all available vacancies.

- The ill specialist was not properly notified of the upcoming changes.

- Documents for terminating the employee’s employment contract were drawn up despite the citizen’s refusal to sign the corresponding order. Upon the fact of refusal, you should draw up a report certified by the signatures of witnesses, and only after that continue the dismissal procedure.

- The employer issued notices to employees too late because he incorrectly calculated the end date of cooperation.

- The employer forced the specialists to resign of their own free will in order to save money on compensation payments. Employees can challenge such termination of a contract in court, but only if there is conclusive evidence.

- The dismissal of workers began earlier than measures to reduce staff or personnel.

Almost all of the listed errors can serve as the basis for legal proceedings. If the court satisfies the employee’s claim, the employer will be obliged not only to reinstate the citizen in his position and compensate him for material damage for forced absence, but also to fully pay for the moral damage caused to the employee.