Order of succession

The first priority is the children, spouse and parents of the testator.

In this case, it does not matter from which marriage the children were born - from the previous one, concluded at the time of death or out of wedlock. Instead of the testator's children who died at the time of opening the inheritance, their descendants, that is, the testator's grandchildren, receive the inheritance. The second stage is the testator’s full and half-siblings, his grandparents on both the father’s and mother’s sides.

The third priority is the full and half brothers and sisters of the testator’s parents (testator’s aunts and uncles).

If there are no heirs of the first, second and third orders, the right to inherit according to the law is given to the relatives of the testator of the third, fourth and fifth degrees of kinship, who are not related to the heirs of the previous orders.

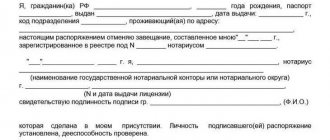

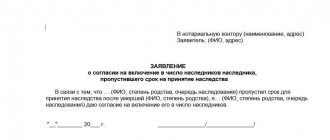

To acquire an inheritance, the heir must accept it within six months from the date of opening (clause 1 of article 1152, clause 1 of article 1154 of the Civil Code of the Russian Federation).

to accept an inheritance (Article 1153 of the Civil Code of the Russian Federation):

- submit an application to a notary (the most common method);

- perform actions indicating the actual acceptance of the inheritance.

After accepting the inheritance, the heirs must obtain a certificate of right to inheritance from a notary. On its basis, the transfer of rights to real estate, as well as shares, shares and interests in legal entities is registered.

As we see, inheritance by law can lead to the actual division of the company, as they say, in a live manner: on the one hand, equal shares between the heirs (children, grandchildren, spouses, etc.), who are not always interested or are simply unable develop or at least maintain life in business; on the other hand, there are partners who cannot or do not want to work with the heirs. As a result, the business can become completely unmanageable.

Of course, the owner has the opportunity to ensure in advance the safety and prospects for the development of the business after his death. The only way to posthumously dispose of your property is a will, which must be certified by a notary.

Is it possible to transfer a share in a business by inheritance?

You can bequeath any property (property rights and obligations), including those acquired in the future (Articles 1112 and 1120 of the Civil Code of the Russian Federation).

That is, shares in the authorized capital of an LLC, shares, shares in cooperatives, etc. can be inherited without restrictions. This is fully confirmed by judicial practice, in which the subject of dispute becomes the ownership of shares in legal entities passed by inheritance, both by will and by law.

Let us note that you can even bequeath shares in legal entities that have not yet been created at the time of registration of the posthumous will. For example, you can indicate that shares in all legal entities that belonged to the deceased are transferred to the heir.

It is important that the property and/or property rights are identified to a sufficient extent to enable it to be determined which property is being referred to. If you indicate, for example, that only shares in “construction organizations” are transferred to the corresponding heir, then disputes will certainly arise about which organizations were meant.

If the provisions are formulated incorrectly, the entire will or part of it may be declared invalid due to recognition as such by the court (voidable will) or regardless of such recognition (void will). The limitation periods in this case are the same as for transactions - 1 year for a contested will and 3 years for a void one.

A will may be declared invalid by a court upon the claim of a person whose rights or legitimate interests are violated by this will.

Contact lawyers

Lawyers with experience in inheritance and corporate law will help you arrange the transfer of a business by inheritance. Typically, companies with this specialization are not actively advertised, but you can find out about them from a notary who deals with the drafting and execution of wills.

If business assets are very large and not just a share, but an entire enterprise as a property complex, including land plots, will be inherited, a specialist will draw up a scheme for the transfer of all assets.

Features of transferring a share in a business by inheritance

The inheritance is accepted within 6 months.

At the same time, rights to shares, shares, shares, etc. transferred at the time of making an entry in the relevant register (Unified State Register of Legal Entities or register of shareholders). As a result, from the moment of death until the registration of the transfer of rights to the heirs, the shares in the business actually remain ownerless: the previous owner died, and the new owners cannot exercise management rights, since the transfer of rights has not been formalized.

The only way out is trust management, the founder of which is a notary (Article 1173 of the Civil Code of the Russian Federation).

An agreement with a trustee is concluded by a notary with the consent of all heirs known at the time of signing the agreement, who are indicated as beneficiaries. Once new heirs are discovered, they must also be indicated in the contract. In the absence of the consent of the heirs, the agreement with the trustee may be declared invalid (see Ruling of the Supreme Court of the Russian Federation dated July 7, 2015 No. 78-KG15-7).

In this case, the legal entity must provide the heirs with a reasonable period for appointing a trustee, “the company, in turn, should not take any actions affecting the rights and legitimate interests of the heirs before the expiration of such period” (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated March 27, 2012 No. 12653 /11 in case No. A36-3192/2010). If the heirs do not exercise their right within a reasonable time, then the company “has the right to take the necessary actions without the participation of such a trustee, unless other circumstances prevent the continuation of the company’s activities” (ibid.).

The testator can record his last will in more detail using a testamentary refusal or assignment.

Testamentary refusal and assignment

With the help of a testamentary refusal (Article 1137 of the Civil Code of the Russian Federation), one, several or all heirs can be obliged to transfer property and/or fulfill any obligation to a third party (legatee).

What is the meaning of a testamentary refusal ? The fact is that the heir can be transferred to any right (for example, the right of ownership or lease, etc.) that the testator himself had - no more, but no less. A testamentary refusal allows you to more diversely determine the fate of the use of inherited property. The refusal can be assigned both to the heir under the will and by law. A testamentary refusal is established in a will. The contents of the will can only be exhausted by it. A legacy is not inherited, that is, with the death of the legatee, the obligation to execute the legacy disappears.

So, for example, by transferring a share in an LLC to one of the heirs, the testator may oblige part of the dividends received to be transferred to other heirs or other persons. Or oblige your heirs to lease, for example, some property to your partner. Upon subsequent transfer of ownership of the property that was part of the inheritance to another person, the right to use this property granted by testamentary refusal remains in force.

The right to receive a testamentary refusal is valid for three years from the date of opening of the inheritance. That is, the legatee can use a testamentary refusal, for example, in the form of a lease agreement for premises for life or for a period specified in the will, but he must apply for execution of the refusal within three years after the death of the testator. A testamentary refusal can impose on the heirs only obligations of a property nature in relation to a specific person.

Another tool that allows you to determine the fate of an inheritance in more detail is testamentary assignment . It obliges the heir to perform any action of both a property and non-property nature (Article 1139 of the Civil Code of the Russian Federation). An assignment may, for example, actually regulate corporate relations.

Such an assignment may be the obligation to vote in a certain way at the general meeting of LLC participants or to perform other actions.

The notary must notify the interested parties about the testamentary refusal and assignment, but is not obliged to look for them. Therefore, to ensure their interests, it is advisable for the testator to notify all interested parties about the granting of any rights under the will already when drawing it up. This will allow them to properly execute the death will.

If the heirs do not execute a testamentary refusal or assignment, then interested parties can apply to the court with a demand to force them to perform certain actions in accordance with the will. The courts actively support legatees in cases of violation of the posthumous will by the heirs.

If, as a result of circumstances established by law, the share due to the heir who was entrusted with the obligation to execute a testamentary refusal or testamentary assignment passes to other heirs, the latter (unless otherwise follows from the will or law) are obliged to fulfill such refusal or such assignment.

A will can work in conjunction with intestate succession. The testator, using a will, can distribute certain property among heirs or transfer part of the property to a third party. A will can also disinherit one or even all legal heirs.

Heirs are not always ready to continue their parents' business. Entrepreneurial dynasties are rare. In such cases, shares in the business can be transferred to the heirs, but through a testamentary refusal and/or assignment, give the reins of power to your partners for a certain period, which is determined by the testator and specified in the will. Such possibilities of a will bring it closer to a corporate agreement. And this gives rise to hopes for its wider use... For example, as a tool for resolving relations between partners after the death of one of them, as well as for controlling individuals who own shares or occupy leadership positions (nominees). However, this is virtually impossible.

The fact is that the testator is not obliged to inform anyone about the contents, execution, change or cancellation of the will, while he has the right to cancel or change the will he has drawn up at any time after its execution, without indicating the reasons for its cancellation or change. (clause 2 of article 1119 and clause 1 of article 1130 of the Civil Code of the Russian Federation). As a result, you will not even know that, for example, the nominee has changed the terms of the will.

In addition, the heirs must carry out the will of the testator only within the limits of the inheritance. Therefore, the refusal or assignment will not be executed if the property that was inherited is not enough: the real estate has depreciated, for example, or the company has ceased to make a profit, etc.

Problems with inheriting shares

The transfer of shares by inheritance has some pitfalls due to the fact that the legislation pays too little attention to this issue. Not all aspects relevant to inheritance have been taken into account.

Lawyers are inclined to believe that in the absence of heirs or their refusal to accept assets, the formation of an escheat inheritance . In the case of shares, this principle is very unsuccessful, because participation in a joint stock company is burdensome and unprofitable for the state. It would be much more correct to establish a norm by which shares are transferred to the company’s balance sheet and then sold.

If on the day of the testator’s death the shares were not fully redeemed by him, they are returned to the company . It would be more logical to give the legal successors the right to pay the balance of the amount and redeem the papers.

Shares often have a non-documentary form, although the heir must confirm the testator's right to them. Lengthy correspondence often ensues between the successor and the register of shareholders, which delays the period of entry into rights.

Another problem is the emergence of fractional shares . They cannot be avoided in the presence of obligatory heirs, whose shares cannot be reduced in order to prevent fragmentation. But the other successors do not agree to prevent it by reducing their shares. Owners of fractional shares cannot participate in the management of the JSC.

Difficulties arise when attempting to market valuation of shares at the request of a notary: it is difficult if the securities are not included in the auction. Due to delays and the inability to formalize inheritance rights, successors have to go to court.

Only shares owned by the testator at the time of his death . That is, if, after opening the inheritance, the joint-stock company made a conversion and instead of 20 securities, 30 were formed, the heirs will receive only 20 of them.

Mandatory share in inheritance

And another significant fly in the ointment is the obligatory share in the inheritance.

In fact, freedom of testament is significantly limited by the right to a compulsory share. Minor or disabled children of the testator, his disabled spouse and parents, as well as disabled dependents of the testator who are subject to inheritance on the basis of law, inherit, regardless of the contents of the will, at least half of the share that would be due to each of them upon inheritance by law (mandatory share - Clause 1 of Article 1149 of the Civil Code of the Russian Federation).

That is, heirs-pensioners, children and disabled people will be entitled to half of what is due to them by law, regardless of the contents of the will.

The right to an obligatory share is preserved even if the disabled heir was directly deprived of the inheritance by the will. The courts interpret this provision literally and do not provide any opportunity to deprive the right to an obligatory share. For example, in the Appeal ruling of the Moscow City Court dated November 18, 2016 in case No. 33-41829/2016, the court directly stated that freedom of will is limited by the rules on compulsory share in inheritance.

The recipient of the obligatory share is determined by the notary, and in the event of a controversial situation, by the court. Nevertheless, it is possible to partially neutralize the negative consequences of this provision of the Civil Code.

The right to an obligatory share in an inheritance is satisfied from the remaining untested part of the inheritance property, even if this leads to a reduction in the rights of other heirs under the law to this part of the property, and if the untested part of the property is insufficient to exercise the right to an obligatory share, from the part of the property that is willed (Clause 2 of Article 1149 of the Civil Code of the Russian Federation).

That is, if there is enough property to pay the obligatory share that is not covered by the will, then the bequeathed property is transferred according to the will of the testator.

Thus, to protect the business, it is necessary, having disposed of shares in the business in the will, to leave part of the property untested for the heirs by law.

How can you find out if a person has shares?

The main difficulty when inheriting shares is the fact that the heirs often do not know about their existence. It is a rare owner of securities who boasts of this fact in front of their relatives.

Therefore, the simplest situation is if the testator made a will and indicated the presence of securities. It is ideal for the heir if the will indicates the number of shares and the name of the joint stock company.

For legal heirs, the situation is more complicated. They need to take steps to find information on their own.

Search order:

- Submit applications to the notary who is handling the inheritance matter.

- Provide a list of organizations in which the testator may have shares.

- The notary issues a request to the registry holder.

- The registry holder provides a response to the request.

Thus, in order to inherit shares, it is necessary to have information about their availability. Or know about what organization they might be in.

Important! The law does not provide for the possibility of automatic transfer of rights to shares of the testator. Recipients of property must independently register ownership of securities.