Funds to support the child are collected on the basis of a writ of execution - a notarized agreement, a court order, an extract from a court decision. If the payer is employed, the executive document is sent to the administration of the enterprise. In the future, the responsibility for transferring alimony from the salary and other accruals of the alimony recipient lies with the accounting department.

Previously, we told you whether alimony is deducted from bonuses, financial assistance or sick leave.

Can funds be withheld based solely on the payer’s application, that is, without executive documents? We will talk about this now.

Grounds for collecting alimony

Monetary deductions (including alimony) are provided for by law and are divided into three types:

- mandatory - personal income tax (NDFL), penalties under executive documents and notarial inscriptions in favor of individuals or legal entities, according to court verdicts, etc.;

- deductions initiated by the administration of the enterprise - in case of damage to the enterprise, release of defective products, untimely return of the accountable amount or loan provided, and so on;

- deductions initiated by the employee - in favor of individuals or legal entities based on the application of the payer.

If alimony is ordered by the court, an extract of the decision or court order to the enterprise is transferred not by the alimony payer, but by the bailiff or the alimony recipient. In this case, an application from the alimony parent or a corresponding order from management is not required.

Note! The recipient of alimony, an accountant or the administration of an enterprise do not have the right to change the procedure, the amount of alimony payments, or cancel alimony deductions assigned in court.

At the same time, the payer may also be the initiator of the transfer of alimony. If a parent agrees to transfer money on his own initiative, but there is no executive document, he needs to contact the accounting department of the enterprise and submit an application.

Document requirements

It is necessary to take into account the requirements for business papers:

- The title must indicate to whom the document is addressed and by whom it was written;

- The main text is presented in such a way that it is clearly clear what the document is about;

- The date of completion is required;

- The compiler must personally sign the form.

The form is not legally approved, so the payer has the right to compose the text independently, taking into account the above rules. Then the document is transferred to the accounting department of the company where the employee works.

Voluntary consent to withhold alimony

A parent who lives separately from the child and has decided to voluntarily pay funds for his maintenance independently chooses the method of making such payments. So, the payer can send money by mail, hand it over personally to the recipient, transfer it to an account created for these purposes, and the like.

A common option for paying alimony on a voluntary basis is deduction from wages by the company’s accounting department based on an application from the father or mother of a minor.

It should be noted that it is better to formalize the transfer of alimony, but not to give the money from hand to hand. If necessary, payment of funds for a child on a voluntary basis can always be confirmed by a certificate from the company. This will protect you from possible claims and litigation.

Benefit amount

A document proving the existence of agreements between parents should not violate the rights of the child granted to him by the state.

Citizens, as a rule, are interested in the following question: “If I pay benefits to children, then how much money should be withheld?” According to the law, the amount of payments for 1 child must be at least 1/4 of the parent’s total income. The payment of alimony for two children is at least 1/3 of all funds received by the payer. If there are three or more children, they receive half the income (you can find out how child support for four children is calculated here).

When the payer's family or property status changes significantly, the voluntary agreement may be adjusted. Or the recipient is given the right to go to court to obtain protection and determine alimony obligations under a court decision.

Application for deduction of alimony from salary (sample)

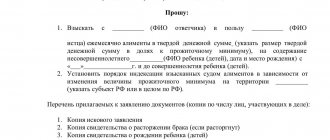

There are no strict requirements for the content of the document. The application is made in writing, in any form. The document must contain the following information:

- the name of the organization where the child support parent works;

- information about the payer – full name, date of birth, place of residence, passport details;

- information about the child for whose benefit the funds are being held – full name, date of birth, place of residence;

- amount of alimony;

- the procedure for withholding funds - by bank transfer, postal transfer, or through a cash register;

- bank details of the alimony recipient;

- from what date should child support be withheld?

- date of document preparation;

- signature.

Sample application for deduction of alimony from wages

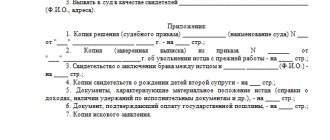

Receipt

Whatever method of voluntary payment of alimony the former spouses choose, it is imperative to ensure that the transfer of funds (or property) is documented. The simplest and simplest way is to write a receipt indicating:

- who transfers money or property;

- to whom it transmits;

- on whose contents;

- in what form and amount;

- for what period;

- be sure to indicate that this payment is for alimony;

- date;

- signatures of those present (preferably a third party as a witness).

Sales receipts, bank or postal transfer receipts can also serve as confirmation of the transfer of voluntary alimony.

Otherwise, if a dispute arises in the future, it will be difficult for the payer to prove that he made payments for alimony to the children.

To voluntarily pay alimony, the payer and recipient enter into: an alimony agreement with a notary

Article 99 of the Family Code of the Russian Federation

The alimony agreement can be modified or terminated at any time if: both parties agree

clause 2 Article 101 of the Family Code of the Russian Federation

The amount of alimony in the agreement must be: not lower than the amount that the court could establish

clause 2 Article 103 of the Family Code of the Russian Federation

Accounting department's obligation to pay alimony

Having received an application for withholding alimony (as well as a court order or agreement), the company's accountant registers and stores it as a strict reporting document. The administration of the enterprise is obliged to inform the bailiff service and the debt collector that such a statement has been received.

If the employee from whose salary alimony was transferred quits, the accounting department stops withholding the funds. And informs the alimony recipient about this fact.

Having found a new job, the alimony worker again writes an application and submits it to the accounting department. If more than a month has passed from the moment of dismissal to the moment of enrollment in a new place of work, a debt will arise. The debt can also be withheld based on the payer's application.

You can read here how to collect arrears of alimony established by a court decision or agreement.

According to Art. 109 of the RF IC, the management of the enterprise at the parent’s place of employment is obliged to withhold a portion of the funds from his salary and other income every month. The timing of the transfer is limited - the accountant is obliged to transfer alimony to the bank account of the claimant within 3 days from the date of payment of wages (or other income).

Important: if an accounting employee does not fulfill his duties or provides knowingly false information about the income of the alimony payer, he may be prosecuted. This offense is punishable by a fine or imprisonment.

Court order and agreement

If there is already an agreement between the parties, it is carried out to the letter and there is no reason to challenge it, there is no point in filing an application with the court to issue a court order. Even if this is done, the second party to the agreement can appeal to the same court and demand that the order be canceled, since alimony is already being paid under the current agreement.

Paying alimony voluntarily is much more profitable and easier than compulsorily, however, such a system may be associated with some risk (especially without an agreement). Before deciding to take such a step, it is recommended to consult with our experienced lawyers for a free consultation. Specialists will clarify the most controversial and dangerous points, and if the case goes to court, they will be able to represent the client’s interests in it.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

4

Child support from an individual entrepreneur

Child support can be recovered from an individual entrepreneur based on...

9

Alimony for three children: amount, percentage

Any parent is obliged to support their children, regardless of...

Revocation of driver's license for failure to pay child support

The very fact of debt formation and the accrual of penalties is not always...

1

Minimum amount of child support

There is not a single clause, regulation or clarification in the legislation that...

7

Receipt for receipt and payment of child support

Alimony can be transferred to the recipient in any convenient way, the legislation in this...

2

Court order for the collection of alimony

The rules for collecting alimony starting in 2021 have changed somewhat and...