Author of the article: Lina Smirnova Last modified: January 2021 5901

The death of friends and loved ones is always a sad event. Relatives who are in a stressful situation, at the same time, will have to legally accept the inheritance of the deceased person by transferring it to themselves. Few people know that in order to get rid of unnecessary hassle, you can register an inheritance at the MFC. How to speed up the process of receiving an inheritance with the help of this organization, what it is, whether the participation of a notary is necessary - these questions may be of interest to anyone who is faced with inheriting the property of their loved ones. Let's look at the procedure for registering inherited property through this organization with a step-by-step description of all actions.

Registration of inheritance through MFC

Multifunctional centers are constantly expanding their capabilities to serve different categories of the population. There is a service for registering the right to inheritance. It is recommended to check detailed information with the MFC for a specific region.

The notary's office is not tied to a specific address, and rights are issued there in a standard manner. A person can contact any notary within the region where the inheritance is opened. But clients are often wary of the high cost of such services.

In order to avoid overpayments, citizens wish to register the distribution of real estate and other property by inheritance at the MFC. However, the question of whether it is possible to register an inheritance at the MFC should not be taken literally. The procedure carried out at the MFC only helps to finalize the rights to an inherited apartment and other property.

Problematic issues such as unclear inheritance, possible lawsuits to assert rights or revoke a will, as well as declaring an heir unworthy, require advisory support. In this case, contacting a notary or lawyer cannot be avoided. MFCs should not provide such services.

Where can I register a will for an apartment?

To draw up a will, the testator needs to contact any notary in the Russian Federation . In Russia, wills are subject to notarization.

The notary is obliged:

- establish the identity of the testator;

- check his capacity;

- clarify rights/responsibilities;

- provide assistance in drawing up administrative documents.

Important! Also, the duties of a notary include the calculation and withholding of state fees for performing a notarial act.

If such a possibility is absent, then it will be necessary to proceed from the life circumstances in which the person finds himself. If the testator finds himself in an emergency situation, the law allows him to draw up an ordinary written document. The order is signed by the testator. Witnesses must also sign it.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The term implies the presence of a real threat to the life of a citizen - a criminal attack, a natural disaster, a catastrophe. However, such a document must be notarized within a month, for example, if the person did not die. Otherwise, the order will lose its significance.

If a citizen dies from emergency circumstances after the document is executed, the heirs may receive a share under the will solely by a court decision. To do this, legal successors must apply to the court to declare the situation an emergency. The claim must be filed within 6 months after the death of the testator.

Example. Citizen L. visited his summer cottage in winter. Sometimes he lived for weeks in a country house. Family members knew about this and were not worried. He was attacked by unidentified citizens and beaten. The neighbors drove the criminals away. However, the ambulance could not get to the site. Therefore, citizen L. wrote a will. The neighbors assured him. A few hours later he died. The son had to go to court to recognize the situation of issuing the order as an emergency. The claim was granted.

What to do if a person cannot contact a notary? The legislator has provided for a number of situations when a will can be certified by other persons.

List of persons who have the right to certify an order

| No. | Job title | A comment |

| 1 | Warden | If a citizen is serving time in prison, he is deprived of the opportunity to visit a notary. Therefore, the legislator has vested corresponding powers in prison governors. |

| 2 | Head of the seasonal field base | A citizen is granted the rights of a notary in relation to persons who are on an Arctic expedition. At the end of the expedition, he loses this opportunity. |

| 3 | Captain of the ship | The specified person can certify the order of a citizen who is on a long voyage |

| 4 | Head physician of the hospital | If the testator is undergoing long-term treatment in a medical institution, the will can be signed by the head physician or his deputy. Doctors on duty and heads of hospitals have the same rights. |

| 5 | Commander of a military unit | The commander can certify the will of persons serving in the army. The rule also applies to their family members. |

| 6 | Head of local government | An official is vested with the powers of a notary only if there is no notary office in the locality |

| 7 | Manager of a nursing home | A citizen is given the right to certify wills exclusively in relation to nursing home residents |

The order is signed in the presence of the above persons. Later, the document is sent to the testator’s registered address or to a notary.

Who has the right to receive an inheritance

Guarantees established by law do not work automatically. Each heir must formalize in writing his intention to use them, regardless of the place of application (notary office, MFC or government agencies).

The main characteristics of the intended successor when registering an inheritance:

- The existence of a right of claim in accordance with a will or succession by law (based on family or marital ties with the testator).

- Fulfillment by the heirs of all necessary procedures when entering into an inheritance: writing an application, conducting a property assessment, paying a fee, obtaining a certificate of the right to inherit property.

- Compliance with the title of a worthy successor.

Recognition of a single heir or one applicant among all as unworthy can only be done through the court. Any interested person has the right to file a claim, but usually it is another claimant. The grounds for assigning such status are specified in Article 1117 of the Civil Code. This includes, for example, violation of the rights of successors after the opening of an inheritance, the interests of the testator during his lifetime, etc.

Procedure for registering a will for an apartment

To register a will, the testator can contact any notary office. By that time, the beneficiary should already be determined.

While the notary is preparing the papers, you will need to pay a state fee. After which the notary will read the text of the document to the testator. The completed will is signed, and the second copy is given to the citizen.

Algorithm of actions of the testator:

- Determine the list of property and composition of heirs.

- Contact a notary office.

- Provide the text of the document or use a notary’s sample as a basis.

- Pay the state fee.

- Study the text of the will.

- Sign and pick up the administrative document.

- Transfer the order to a potential heir.

The last point is at the discretion of the testator. However, if the heir does not find out about the existence of a will, then he may never assume his rights if the testator suddenly dies. Therefore, you need to at least inform the person about its presence.

Example. Citizen N. issued an order for his nephew. However, he did not provide the young man with information about the document. After the death of the testator, his children found a declaration of will in his documents. To avoid being disinherited, they decided to keep silent and threw him out. The nephew did not find out about the existence of a will and was unable to inherit.

What is the price

Costs for registering a will in 2021:

- Registration. For certification of an administrative document by a notary, the testator must pay 100 rubles. For each new document, the state duty is charged again. Payment of the fee is carried out in any bank in the Russian Federation or directly from a notary.

- Payment for notary services. The cost of services depends on the region of treatment. You can find out more about the tariffs on the website of the Federal Notary Chamber. On average across the country, in 2021, the cost of a will is 2,500 rubles. However, the tariff varies in individual regions. For example, in Dagestan, an administrative document costs 900 rubles, and in the Altai Territory - 3,300 rubles.

- Registration outside the notary's office . If the notary leaves the office, the price will rise 1.5 times.

Deadlines

Typically, a will is drawn up and registered on the day the testator applies to the notary's office. If a citizen has a large list of property that needs to be signed between several heirs, then the notary may offer to come the next day. For example, if there is little time left until the end of the working day or there is a heavy workload.

But, if the testator has problems with the documents or difficulties with the description of the property, and does not have the title papers with him, then the procedure for registering the will may be postponed.

Documentation

What is needed to draw up a will for an apartment? When making a will you usually need:

- testator's passport;

- a list of claimants for his property;

- title papers (to avoid typing errors or typos);

- medical documents on sanity (if a will is drawn up by an elderly citizen, the notary may require a certificate from a psychiatrist).

Such a measure is an additional protection against recognition of the order as invalid, for example, due to the inability of the testator to realize the consequences of his actions when drawing up the document.

Testamentary refusal

An administrative document with a condition is practically no different from an ordinary will. However, it contains a clause regarding the fulfillment by the heir of the testator’s last instructions (Article 1137 of the Civil Code of the Russian Federation).

A will may contain:

- requirement for the right to use premises in an inherited apartment;

- requirement to transfer some things or part of the value of property to another person;

- accept the testator's animals for maintenance.

Restriction of freedom of expression

When drawing up a will, the testator must take into account the interests of citizens who are entitled to an obligatory part of the property. This includes disabled persons (parents, spouse, dependents) and minor children of the testator.

A will cannot exclude the above-mentioned citizens from inheritance. Therefore, if at the time of death the notary identifies such persons, then, regardless of the contents of the order, they can claim part of the assets of the deceased person.

When can you inherit an inheritance?

As for the permitted delay, you can formalize your claims to inheritance from the moment the inheritance case is opened and over the next 6 months. This procedure is carried out exclusively when opening an inheritance after the death of the testator. Assignment of property and the opportunity to register objects in your name (or transfer of funds to accounts) occurs later.

You can register your share within six months from the date of opening of the inheritance. During this period, legal successors have the right to write statements of consent to accept the inheritance or refuse it. Waiting for the established period is mandatory even when carrying out all the procedures required of the heir.

After six months, the successors receive a certificate of inheritance from a notary (not through the MFC). This is where the notarial support ends, and the future owner has the right to contact the authorities to register new property, for example, to Rosreestr to register real estate (apartment, house) in his name, to the traffic police for vehicles, or to register an inheritance through the MFC.

Refusal to register a document

The reasons for refusal are individual in each case. If an MFC employee refuses, you need to consult him about the reasons for this decision. The most common reasons for refusal to register documents are :

- an application for registration of documents incorrectly completed by the registrar;

- presence of blots and corrections in documents;

- imposition of judicial seizure on inherited property;

- presence of encumbrance;

- litigation regarding the inheritance estate;

- failure to pay state fees or lack of supporting receipts.

Accepting an inheritance is always accompanied by hassle and a large number of required documents. By contacting the MFC, the heir will save a lot of time, because all he has to do is obtain papers certifying ownership of the inherited property. If he has questions, he can get answers to them from an MFC employee.

Ask any questions about registering an inheritance in the comments, we will answer within 24 hours.

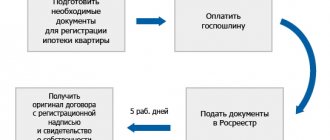

How to register an inheritance through the MFC: step-by-step instructions

To register an inheritance at the MFC, citizens need to visit a notary and collect all the documents. The branch is selected according to the place of residence of the heir. The MFC provides for registration of inheritance with an appointment or while waiting in line after receiving a coupon.

The procedure for registering the right to inheritance with the participation of the MFC:

- Visit a notary and clarify the list of required documents.

- Fill out a statement of intent to appropriate the due share.

- Pay the state fee.

- Obtain a certificate of inheritance from a notary.

- Visit the MFC with the necessary documents.

In fact, registration of rights can only be completed through a notary. At the MFC, the final recognition of these rights takes place and the property is transferred to the name of the new owner. The procedure for registering property is simplified. For the same reason, the answer to the question of whether it is possible to draw up a will at the MFC is also negative.

List of documents for registration of inheritance

To take ownership and receive an inheritance at the MFC, you need to collect documents. The list may differ depending on the status of the assignee. If there is a large number of heirs, it is not necessary to provide a death certificate to all applicants.

A package of documents or basic papers required at the initial stage:

- executed death certificate of the testator;

- applicant's passport;

- documents confirming the degree of relationship with the deceased.

The papers from the last paragraph are required if it is necessary to formalize an inheritance according to the law (in the absence of a will). However, it is not always known whether the testator had time to formalize his last will.

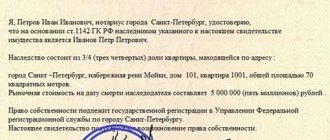

After completing all the procedures, the person receives a certificate of inheritance. It is submitted to the MFC along with other documents to complete the registration procedure. Also, for the multifunctional center, an extract about the address of the deceased’s last registration according to the passport and his documents on ownership is added. The MFC transmits an extract from the Unified State Register of Registered Rights.

State duty amount

Without paying the state fee, there will be no certificate of inheritance. It is issued by a notary at the end of the six-month period established by law. To determine the amount of state duty, an assessment of the inheritance share is required. The amount payable is calculated as a percentage of the appraised value.

In this case, the interest rate can be 0.3 and 0.6% and depends on the status of the heir. If a spouse or close relative (for example, mother and father, children, brothers and sisters) claims the inheritance, then a reduced rate applies to him. For other candidates, an increased rate is applied.

Registration deadlines

When registering ownership of an apartment and other inheritance through the MFC, the terms and methods of entry may differ. This depends on the specifics of a particular situation, and not on the activities of the MFC (initiation of legal disputes, seizure of property, etc.).

More about state tax

As of 2021, the amount of inheritance tax from the state is calculated individually depending on the type of property. In this case, the value of the object and the degree of relationship of the future heir with the deceased are important. Thus, heirs of 1–2 stages pay 0.3% of the cadastral value of a land plot or any other property. In this case, the final price in no case can exceed 100,000 rubles. For other relatives, the interest rate is 2 times higher (0.6%), but the final amount cannot be higher than 1 million rubles. Each heir has his own state tax, the amount of which is directly affected by the size of their shares of the property. After making the payment, they must provide receipts to the notary.

Main reasons for failure and solutions

The refusal to provide the opportunity to participate in the division may be explained by the person’s lack of this right initially or his exclusion from the inheritance division in a lawsuit. To solve the first problem, you need to file a statement of claim submitted to the court. The solution depends on the specific problem.

Perhaps this is the restoration of a deadline for acceptance that was missed for a good reason or a reasonable request to recognize a will certified by a notary as invalid. Cases often come to light with a request to include unaccounted heirs in the division, for example, on the right of compulsory share.

How to write a will for an apartment correctly

When drawing up an administrative document, you need to take into account the legal requirements:

- Will form . The document is drawn up exclusively in writing. Oral transactions regarding inheritance are considered invalid.

- Notarization of a document . Moreover, 1 sample remains with the notary, and 2 is given to the testator.

- Purposefulness and clarity of the will of the testator . When reading the document, it should be clear that the citizen is transferring property to beneficiaries in the event of his death.

The administrative document must contain:

- place, date of compilation;

- Title of the document;

- citizen registration address;

- passport details (series, number, date of issue);

- information about the testator;

- the essence of the order;

- list of property to be signed off (location);

- list of applicants (full name, registration addresses);

- designation of the shares of property that are due to the heirs;

- document number (for notary forms);

- link to familiarize yourself with the text of the document;

- proof of payment of state duty;

- signature of the testator, transcript of his surname.

The contents of the will depend on the preferences of the testator, the volume of the inheritance, and the number of claimants to the property.

Types of inheritance

A will allows people to enter into an inheritance, regardless of the nature of their connection with the deceased. The absence of a notarized declaration of will or the listing of not all of the owner’s property activates the mechanism of division under the law. The MFC is not involved in these processes.

How can you register an inheritance:

- by will;

- in order of legal priority;

- under an inheritance agreement.

The third option was introduced into the Civil Code relatively recently and makes it possible to formalize a bilateral transaction between the testator and the heir. The latter must comply with his part of the contract, fulfilling the obligations assigned to him during the life of the testator. This form is similar to the situation of inheritance assignment under a standard will.

Is it possible to make a will at home?

Yes. The law does not prohibit calling a notary to your home . Especially if a person is sick and finds it difficult to move independently.

Identification and verification of his legal capacity takes place at the place of residence. All necessary data is entered into the register of inheritance cases (Order of the Ministry of Justice dated April 16, 2014 No. 78).

The only difference is the cost of notary services. The amount increases by 1.5 times the base rate (Article 333.25 of the Tax Code of the Russian Federation).