2

The basis of inheritance is the family ties between the testator and the recipients of his property. A common option for acquiring rights is inheritance by children after the death of their parents. The procedure for succession varies depending on the grounds for inheritance. The father could leave a will, a testamentary disposition, or establish a testamentary refusal. In the absence of a proper document, succession occurs according to law. Let's consider how to enter into an inheritance after the death of a father.

Inheritance rights after the death of the father by law

The death of the father serves as the basis for opening an inheritance case. In the absence of a will, the father's property rights pass to the following persons:

- official children;

- blood parents;

- adoptive parents;

- official spouse;

- dependents (minor stepson, stepdaughter, ward, disabled relatives, cohabitant);

- grandchildren (if one of the children died before the death of the father).

The list of inheritance may include:

- corporate rights;

- royalties;

- stocks, bonds;

- bank deposits;

- insurance payments;

- apartment, house, land;

- automobile.

To register inheritance property, interested parties should submit an application to a notary.

Procedure and instructions for registering an inheritance for a house and land

At first glance, it seems that this is a complex and costly procedure. A person will spend most of his energy collecting documents for the building and the land on which it is located.

The whole process consists of several stages, the first of which is contacting a notary. This is followed by the collection and provision of a number of mandatory certificates and certificates.

You need to be prepared for the fact that some of them will have to be obtained from the competent authorities after a certain amount of time has passed. It is important that they are drawn up correctly and reflect the real picture of the inherited property.

Equally important! Before you begin registering an inheritance for a house and land, you should understand under what conditions the land was given to the deceased relative. It could be listed on it as private property, or as a lease with different periods of use and ownership.

Action 1. Contact a notary

It occurs at the place of registration of the deceased parent or where most of his property is located.

If the children are in another city, it is possible to send your application by mail to the locality where the inheritance case is opened, having previously notarized it (Article 1153 of the Civil Code of the Russian Federation).

You will need to provide a list of general mandatory documents indicating the right of inheritance.

These include:

- parent's death certificate;

- ID of the deceased;

- the applicant's civil passport;

- documents indicating relationship with the deceased;

- a will, if available, or a certified copy thereof.

Then you need to write a statement of title to the house and land in your own hand. In addition, you will need to pay 300 rubles. From this moment the inheritance case is opened.

Over a period of six months, a search is carried out for all legal successors and the amount of acquired property that belonged to the deceased parent is established. If the notary knows exactly this information, the certificate of inheritance can be issued within 6 months.

Action 2. Collection of documents

First of all, it is necessary to establish on what basis the land was transferred to the deceased. If it is from state ownership, you must obtain the appropriate certificate from the state archives.

If the process of land transfer took place on the basis of transactions, donation agreements, exchange, purchase and sale, a cadastral passport from the BTI will be required.

Required documents

| On house | To the ground |

| Registration certificate | Certificates of title |

| Certificate of estimated value from the BTI | Certificate of absence of encumbrances |

| A certificate stating that the object has not been seized or is not collateral. | Cadastral certificate of appraised value |

| Certificates of title | |

| Extract from the Unified State Register of Real Estate | A certificate stating that there are no debts to the state. |

| Certificate stating that there are no debts on utility bills |

Technical and title certificates are provided in originals, but it is recommended to attach copies of them.

It is possible that the notary may require additional documents to those listed above. This is only possible in specific cases.

Action 3. Obtain a certificate of inheritance for a house with land

First of all, the official carefully checks the authenticity of the entire package of submitted certificates, extracts, and passports.

Only after this can we talk about the onset of the final stage of the case, when a certificate of inheritance for the house and land plot by the legal successors of the deceased father or mother.

As mentioned above, this happens after six months or, in exceptional cases, earlier. Before handing it over, the notary will issue the account details where the state fee will need to be paid. Its size will depend on the estimated value of the site and the building.

Disabled people and combatants have benefits when paying fees. As soon as the certificate of inheritance is in hand, the final stage of the transfer of real estate and land to the new owner begins.

Action 4. Registration of ownership

This is a mandatory procedure that is regulated by law. It involves recording the transfer of ownership from a deceased person to his children. Without this step it is impossible to complete the entire process.

To implement it, you need to contact the Registration Chamber at your place of residence, where you write a corresponding application.

Along with it, you must provide:

- certificate obtained from a notary;

- title documents;

- receipt of payment of state duty;

- passport.

The authorized person in the Registration Chamber accepts this entire package and issues a receipt to the applicant, according to which he will receive an extract from the Unified State Register on the designated day. After its completion, the new owner has the right to fully dispose of the land and housing construction.

When can you inherit an inheritance?

Registration of inheritance becomes possible immediately after the death of an individual. The basis for opening a case is a death certificate or a corresponding judicial act.

are given 6 months to submit documents . An increase in the period is allowed in exceptional cases - elimination of applicants, abandonment of property, death of the main heir.

Documents are submitted by persons who have reached the age of majority. If the heirs have not reached the age of majority or are declared incompetent by the court, then parents/guardians act on their behalf.

Who are the legal successors upon death?

The Civil Code devotes us to the questions of who are the heirs upon the death of a particular person.

Article 1141 of the Civil Code contains a list of persons who belong to various categories of kinship. There are 8 lines in total.

And the first, that is, the category closest to you, is the closest relatives, who are the first on the inheritance list.

If there is no will, it is these persons from the first category who become the owners of the inheritance.

If there are no persons who belong to the first line, then they are automatically replaced by representatives of the second, third, and so on.

- The first line of kinship includes children, parents, and spouse. These persons are rightfully the owners of the inheritance, because they are in a direct, inextricable connection with the testator.

- The second line of kinship includes brothers and sisters, then grandparents, and so on in descending order.

How to register an inheritance after the death of a father according to the law

Each relative who applies to a notary office to enter into an inheritance must provide documents proving the existence of family ties. If the successor has lost such a document, then he must restore it within the established time frame (within 6 months from the date of the father’s death).

Documents are submitted to the notary office:

- at the place of registration of the deceased owner;

- at the location of the testator’s real estate (in the absence of information about the place of registration of the deceased);

- at the place of storage of the father’s most expensive property (if the inheritance does not include real estate);

- at the place determined by the court decision (if the place of opening of the inheritance was established in court).

If one of the heirs renounces their rights or is excluded from inheritance, relatives of the next line are given 6 months from the date such a right arose.

Procedure and procedure

Procedure:

- Visit to a notary's office.

- Submitting an application.

- Collection of documentation.

- Conducting an assessment.

- Payment of state duty.

- Obtaining a certificate of inheritance rights.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

If during the preparation of documents one of the relatives dies, then the property will be accepted as part of the hereditary transmission. The period for registering an inheritance with a notary can be increased to 3 months.

Missed deadlines lead to loss of rights to property. Their restoration is carried out in court.

Also, an applicant who has missed the deadline can agree with other relatives so that they submit an application to include a new participant in the list of heirs. If there is an application, the notary will cancel the previously issued papers and issue new certificates.

When submitting documents, the interests of minors and incapacitated persons are protected by their legal representatives.

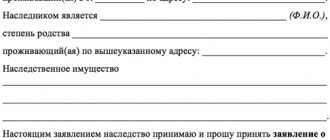

Statement

The document must contain the following information:

- name of the notary office;

- information about the heir (registration address, full name);

- the essence of the request;

- data on the degree of relationship;

- date of document preparation;

- applicant's signature.

Sample application for acceptance of inheritance

Expenses, cost

To submit an application to accept an inheritance, you must pay a state fee of 100 rubles. The heirs bear the main expenses when receiving the certificate.

State duty amount

| Category | Amount of state duty |

| Close relatives (father/mother, son/daughter, brothers/sisters, second spouse) | 0.3% of the property value. The maximum collection amount is RUB 100,000. |

| Other persons | 0.3% of the property value. The maximum collection amount is RUB 100,000. |

Additional costs arise when paying for notary services. Their size depends on the region of circulation. The tariffs are set by the Regional Notary Chamber. However, only a specific notary can provide the exact amount.

The cost of services varies depending on the presence/absence of real estate as part of the inheritance. The payment is withheld from each heir, regardless of age and ability to work, for each property item in the certificate.

The maximum tariffs in the region can be clarified on the website of the Federal Notary Chamber. For example, for the Vologda region in 2021 you need to pay from 100 to 1900 rubles. in the absence of real estate. And also 2200 – 3400 rub. if there is real estate as part of the inheritance.

The heirs will also need to order an assessment of the inherited property. The assessment act serves as the basis for determining the amount of state duty, which is withheld from the heirs. The services of appraisers will cost an additional 3,000 rubles. If a commercial property is being assessed, the price may increase.

The costs of registering ownership of movable/immovable property are paid by the heir separately.

What is included in the inheritance volume?

When all the necessary documents have been collected, you need to understand what is included in the inheritance.

These include:

- Real estate.

- Obligations.

- Things.

It must be remembered that not only rights and obligations that already exist are transferred by inheritance, but also those in which registration has begun and has not been brought to a successful conclusion.

The inheritance will not include:

- Those rights and obligations that are associated only with the deceased. A common example is the payment of alimony.

- All rights that are prohibited from being inherited. These can be state awards and much more.

How to register an inheritance after the death of a father under a will

There is only one way to accept an inheritance - by filing an application. Applicants need to contact a notary office.

The territorial reference goes to the place of residence of the deceased subject.

Procedure

Procedure for entering into inheritance under a will:

- Search for a will.

- Visit to a notary's office.

- Submitting an application.

- Conducting an assessment.

- Payment of duty.

- Obtaining a certificate.

An inheritance case is opened upon the filing of a written application by one of the legal successors. For example, if several persons are specified in the will. If there is only one applicant, then it is he who must contact the notary. Otherwise, the property will go to the heirs by law. The period for accepting an inheritance is 6 months.

The duties of a notary are to establish the identity of the successor, explain his rights and obligations, check and accept documents. The certificate of inheritance is issued six months after the death of the testator. Interim actions of the heir (assessment of property, payment of fees) are the same as in inheritance by law.

The interests of minor legal successors are represented by parents or guardians. Their powers must be confirmed by relevant documents.

Statement

Submitting an application for acceptance of inheritance is carried out in the same manner. The only difference is that the basis for inheritance changes.

The application is filled out and signed in the presence of a notary. The text of the document must be written in legible handwriting.

Expenses, cost

When registering an inheritance, successors must pay a state fee and notary services. The rates were discussed above. They depend on the degree of relationship and the value of the inheritance. The method of inheritance does not matter.

Another expense item is payment for the services of an appraisal company. Property valuation is done as of the day of the owner’s death. It is subsequently used to calculate the amount of the fee.

Expenses for registration of ownership rights are paid by the legal successor separately. Registration actions are carried out in the presence of a certificate of inheritance.

Applicants for an obligatory share of the inheritance

The circle of priority applicants for the inheritance, in addition to members of the father’s family, including children by birth or adopted by him, includes persons who are entitled to a mandatory share of the existing inheritance. These include:

- citizens considered disabled, who were dependent on their father, regardless of whether they lived with him or not. For example, if his ex-wife was dependent on his father due to disability, then she will also claim a share of his inheritance;

- dependents who lived with their father for at least a year before his death are also required to receive part of his inheritance. This means that the children of the father’s second wife, who were supported by him, will claim a share of his property. And only if they are adults and provide for themselves, then their right to this inheritance practically moves to seventh place.

Right of the unborn child

When inheriting, the rights of the father's unborn child conceived during his lifetime are also taken into account. By law, he has the same rights to his inheritance as other children. Therefore, the distribution of the father's inherited property is allowed only after his birth.

What documents are needed to enter into an inheritance after the death of the father?

The list of required documents depends on the method of inheritance and the type of property.

Basic papers:

- death certificate;

- documents confirming the relationship of the applicant with the deceased citizen;

- applicant's passport;

- the applicant's birth certificate;

- certificate from the place of registration of the testator;

- documents on the property of a deceased citizen;

- evaluation report;

- receipt for payment of state fees and notary services;

- notarized power of attorney for a representative.

When registering an inheritance under a will, you will also need the original order. A package of documents for registering property rights is prepared separately.

If there is a will

Situations often occur when there is only one or several children in a family. In this case, according to the law, after death they will receive equal shares. Another case is when, in addition to children, other relatives also live. Then it is better to draw up a paper so that the rights of individuals are spelled out in it.

A will is a legal document that is drawn up and notarized. This is prescribed in Article 1125. If the will is certified incorrectly or not certified at all, then it has no legal force.

IMPORTANT !!! Until the will comes into force, it is kept in the notary's office and acts as a guarantor. The specialist must make sure that the person was fully competent and could understand.

When drawing up a will, it is necessary to provide documents that confirm the right to own property. Most often, this is an extract for real estate. If the conversation is about an apartment or cottage, then you need to write a document, indicate the technical characteristics of the building, and also attach a copy of the paper on the existing rights. This procedure must be followed carefully to avoid problems in the future.

Registration must be carried out without the participation of unauthorized persons. A person must be aware of what he is doing. You can also provide a certificate from a mental health clinic, which states the person’s normal condition.

ATTENTION !!! When a will is drawn up, it acts as a guide to action for the notary and his children. In this case, the inheritance is formalized only according to the actual will of the deceased. For example, a person wants to leave the right to own his living space only to the only heir, and not give the inheritance to everyone else.

Only here you need to remember some nuances. When there are minor citizens, dependents, and spouses in a family, they are required to receive a certain portion. If the testator did not want to mention them, then they have the right to defend their rights through a court hearing. Usually, this is half of what is due when registering an inheritance.

How is the marital share allocated?

The joint property of the spouses is considered to be the property that they acquired during the marriage. Consequently, it is subject to division on the eve of registration of the inheritance.

If there are supporting documents, the notary independently allocates the marital share. However, the issuance of the relevant certificate is carried out upon the application of the spouse.

The procedure is paid. The applicant must pay for notary services. In 2021 in Moscow you need to pay from 4000 to 6000 rubles.

The remainder of the property is divided among the legal successors in equal shares.

What are the ways to inherit a house and land?

There must be a legal basis for this. Current legislation defines the following methods: contact a notary and write a statement or by filing a claim in court.

The optimal solution to the issue would, of course, be the first option. In the second case, contacting the competent authority is usually necessary when there are disputes between heirs and the six-month period has been missed.

Another way of registering property, through the court, occurs when the property is actually accepted. But we'll talk about this a little later.

Legally

The entire process is initiated on the basis of blood ties to the deceased. All relatives are divided into 8 groups.

The first stage, which has an advantage over the rest, includes:

- surviving spouse;

- children;

- parents.

It is they who, after the death of the mother, along with the living father, will be called upon to inherit in the first place (Article 1141 of the Civil Code of the Russian Federation).

All other groups of citizens who are more distantly related cannot, in such a situation, claim the property of the deceased if her children or grandchildren are alive.

If there are two children, for example, a son and a daughter, then all the property of the deceased parent is divided between them in equal shares.

In case of disputes, the law allows for the possibility of negotiations on this issue.

Legal successors can distribute the inheritance among themselves by concluding a written agreement, which is certified by a notary office.

If there is a will

In the text of this document, one of the parents can designate the circle of heirs among whom his property will be divided.

By law, a father or mother can designate in a will only personal property received after the death of relatives, as a gift, or acquired before the start of family life. This also includes half of the property acquired jointly during marriage (Article 256 of the Civil Code of the Russian Federation).

An important aspect of making a will is its validity - it must be certified and properly executed.

Parents usually do not make wills for their children unless there are other heirs or persons who can lay claim to their property.

This usually happens when other relatives live in the household. Or the parents remarried and do not want the property to go to their second spouse.

In accordance with the document, the property will be divided between the citizens designated in it in the shares determined by the deceased father or mother. Unless specifically described in the text of the will, the building and land will continue in equal shares among the assignees.

Let us pay attention to an important nuance: when inheriting by law and will, it is necessary to take into account the rights of the so-called obligatory heirs, if they exist.

This category includes:

- Dependents who have been in care for at least a year.

- Disabled spouse and parents.

- Minors and disabled children.

In accordance with Art. 1149 of the Civil Code of the Russian Federation, these persons have the right to claim 50% of the share that was due by law. Therefore, regardless of what is stated in the will, if there are “mandatory heirs,” then the children will share the mother’s property with them.

Actual acceptance and trial

This concept means the actual ownership and management of the parent’s property after his death (Article 1153 of the Civil Code of the Russian Federation).

This means that the inheritance of the house after the death of the father passes to the children who lived in the same living space with him on the basis of certain actions that they took.

Such actions include:

- security and repair of housing construction;

- payment of utilities and current payments for the house and land;

- voluntary payment of debts and loans.

If a mother or father dies, then the children, as first-degree heirs, actually take ownership of the building and land where they lived with them.

However, citizens will not be able to dispose of this property: sell, exchange, donate until they re-register the property with the registration authorities.

With this option, you will need to go to a notary to obtain a certificate of inheritance. Or you can file a lawsuit in court, which will make a decision allowing you to inherit this property. This document actually legally replaces a notarial certificate.

Is it possible to register an inheritance if the father got married before his death?

Registration of marriage relations leads to an increase in the number of heirs.

However, in practice, the distribution of property takes into account the following factors:

- existence of a will;

- minor and/or disabled children/parents/dependents;

- the presence of joint property of the spouses.

If the deceased father managed to acquire movable or immovable property together with his wife, then such property is their joint property. Consequently, the spouse's share is allocated from the inheritance mass.

The rest of the property is divided among the heirs who submitted the application. If the assets of the deceased citizen were his personal property, then it is all included in the estate.

Example. Citizen G. was a widower and raised a son. After some time, he remarried. 2 years later the man died. The testator had a personal apartment and a bank deposit. On the day of death, the man lived with his wife. His son was a 3rd year student at a university and lived in another city. The 1st line heirs according to the law include the spouse and child of the deceased citizen. The testator's parents died before he did. When filing an application with a notary, it was determined that the deceased person did not leave a will. Consequently, the property of an intestate testator is divided equally between his wife and son. If the testator left behind an administrative document and bequeathed the apartment to his son, and the contribution to his wife, then the woman’s claims to part of the apartment would have no legal basis.

Features of inheriting an apartment after the death of a mother or father

After the death of the mother and father, some features of inheriting an apartment arise. So, if there is only one child in the family, and there are no more heirs left in the first line, then he may not claim his rights to the inheritance, but continue to actually use the property.

This means that for one reason or another a person may not carry out actions that are complex in their execution, but simply accept the inheritance in fact.

This method is provided for by law, however, in cases where there is no risk of violating the rights of third parties.

Read more about the will of a mother or father for an apartment for a minor child - daughter or son.

Having familiarized yourself with the main nuances that may arise when receiving an inheritance after the death of close relatives, you will certainly be able to carry out this procedure without prompting. But now you will always be ready, and in the event of force majeure situations, you will not have questions about what to do at the moment.

How to take ownership of property not inherited by your father

After the death of parents, their property legally goes to their children. If children die before accepting the inheritance, then hereditary transmission or the rule of representation of heirs applies. It all depends on when exactly the relative who was entitled to the property died.

Example. The couple got into a car accident and died before doctors arrived. The house was left behind. Their son was the only heir. The man submitted the necessary documents to the notary on time. After 4 months, the heir died. The deceased citizen had 2 children. In such a situation, hereditary transmission operates. That is, the children of a deceased father inherit the property of his parents instead of him. Each child gets ½ of the house. The period for acceptance of the inheritance by the grandchildren of a deceased couple can be increased to 3 months.

If there are no applicants in any queue

If there are no applicants from any line called up, the heirs come into play, so to speak, “by nomination.” These are the descendants of an heir who died before the testator or on the same day as him. That is, if he were alive, he would have inherited. Inheritance by will is not taken into account here. That is, representation in a will does not apply, only to priority according to law.

Example : the testator had a son who died a year before the testator. This son had a daughter - the granddaughter of the testator. After the death of the testator, the testator's spouse (in the first order) and granddaughter (in the first order) entered into the inheritance in equal shares. If the testator's son had been alive, the granddaughter would not have entered into the inheritance.

In other words, this is the entry into inheritance without a will after the death of the testator of certain persons instead of the heir who died by the time the inheritance was opened. According to representation, heirs come in only three orders:

- first priority: grandchildren;

- second priority: nephews and nieces;

- third line: cousins.

“Representatives” have an advantage over ordinary heirs of the lower order. But, if the deceased heir (in whose place the children inherit) was deprived or removed from the inheritance, then his children, the “representatives,” are also deprived of the inheritance.

Example : The testator had a brother. After death, the grandchildren of the testator (children of the deceased, for example, a daughter) were involved in the inheritance. It turns out that the grandchildren are heirs according to the first priority. They will inherit all the property. The brother (the heir of the second stage) will not enter into the inheritance.

When entering into an inheritance without a will, the following features must be taken into account:

All “representatives” inherit within the limits of the share of the heir in whose place they entered into the inheritance, in equal shares among themselves

Example : an apartment was left as an inheritance. The heirs of the first priority are the testator's wife (let's say, spousal allocation is not provided in this case), the testator's mother and three grandchildren (on behalf of the father - the deceased son of the testator). The apartment will be divided into the following shares: 1/3 for the wife, 1/3 for the mother and 1/9 for each of the three grandchildren.

The notary is presented with the following minimum package of documents:

- about the relationship of the deceased parent with the testator (for example, the birth certificate of the deceased father);

- parent's death certificate;

- your birth certificate as proof of your relationship with the deceased parent.

Actual entry into inheritance

This type of inheritance is quite common. For example, when children live with their parents, use property, pay taxes and bear the costs of its maintenance.

The only drawback is the impossibility of fully disposing of such an object without proper registration of the inheritance. Such heirs need to contact a notary and submit the necessary papers. And after receiving the certificate, you need to register ownership.

Documents that confirm the actual acceptance of the inheritance

| No. | Title of the document | A comment |

| 1 | Certificate from the Housing Office | The document confirms the registration of the heir at the residence address of the deceased citizen |

| 2 | Certificate from local government authorities or from the chairman of the cooperative | The document confirms the use of the testator's property. This includes a garage, a summer cottage or a plot of land. |

| 3 | Receipts for repayment of debts | If the deceased had debts to private individuals |

| 4 | Receipts for payment of utilities, shares or taxes | If the legal successor lives in the apartment of the deceased owner |

| 5 | Certificate from the bank regarding loan repayment | If the heir has paid off the debt obligations of the deceased (loans, mortgages) |

| 6 | Court decision to initiate legal proceedings against persons who illegally took possession of the testator's property | In case of retention of the testator's property by third parties |

| 7 | Agreements for the provision of services related to the maintenance of property | Security alarm installation, repair, reconstruction |

| 8 | Other papers |

If necessary, you can attract witnesses who will confirm the actual acceptance of the inheritance after the deceased relative. This includes the deceased person's friends or neighbors who visited the person regularly and knew how he was living.

If the notary refused to issue a certificate or the heir missed the deadline, then you will need to go to court. The hearing of the case takes place within the framework of special proceedings. The essence of the application is to establish the fact of entry into inheritance rights.

If the court satisfies the stated requirements, the heir will subsequently need to visit the notary again and submit documents, including a court order that has entered into force.

You can also file a claim for recognition of ownership of the accepted inheritance. The main difference lies in the requirements of the applicant.

The first option implies the absence of disputes about inheritance. In the second case, several people lay claim to the property. Therefore, the conflict between them is resolved in court.

An application to establish a legal fact is submitted at the place of registration of the heir. A claim for recognition of ownership rights is filed at the address where the property is located.

Methods of accepting property

In modern civil law, there are two ways to inherit the property of a deceased person.

- The first method involves entering into inheritance rights under a will. This means that the testator reflects his will in a testamentary document, which, in turn, was drawn up during the testator’s lifetime. Read more about the will of a mother or father for an apartment for a minor child - daughter or son.

- The second method is inheritance by law.

This method assumes that you are entering into the right of inheritance through kinship. That is, as a child, you are first in this line.

The second method is used only when the deceased did not leave a will.

As a rule, it is more difficult to obtain an inheritance by law than by a will.

What are the possible options?

You cannot enter into part of an inheritance; it can only be accepted in its entirety , and a group of heirs accepts it in its entirety, even if there is only one (Article 1152 of the Civil Code of the Russian Federation). This means that the debts of the deceased also pass into the general estate. For example, an apartment pledged to a bank under a mortgage agreement will be transferred to the heirs along with the obligation of the deceased to repay the debt to the lender. You cannot accept an apartment and refuse the debt, but you can refuse the apartment and the debt, since the law does not oblige you to accept an inheritance .

The property of the deceased becomes the property of the heirs:

- by will;

- in law.

In the first case, the expression of will is mandatory if it does not violate the rights of third parties, otherwise the law comes into force (Article 1111 of the Civil Code of the Russian Federation). A will can be challenged in court; there are a number of reasons for this in the law (Articles 178, 179 of the Civil Code of the Russian Federation). If the will is challenged by a court decision and declared invalid, then the inherited property, including real estate, is divided among all heirs who have declared their rights in the shares prescribed by law (Article 1164 of the Civil Code of the Russian Federation).

The inheritance opens on the day when the date of death is registered (confirmed by a death certificate). The place of opening of the inheritance will be recognized as the place of permanent registration of the deceased, or, if it is not possible to establish this fact, the location of the inherited property (real estate). If several real estate objects are included in the inheritance estate, then the address of the most valuable object will be recognized as the place of opening of the inheritance. The value of each object is assumed to be equal to its market value (determined through the examination of an independent appraisal company).

Features of privatized housing

In the matter of inheritance, the key role is played by the fact who exactly owns the property. The amount of inheritance that the relatives of the testator can claim depends on this.

Possible options

| No. | Ownership options | A comment |

| 1 | The apartment belongs to the deceased citizen alone | This includes personal, gifted or privatized property. The concept of joint property of spouses is not used here. The object is inherited in accordance with the will of the deceased. In the absence of an expression of will, the right to receive is transferred to the relatives of the testator. |

| 2 | The property belongs to several co-owners on the basis of shared ownership | The apartment can be privatized for several persons. For example, a husband, wife and two children. Each of them will own a certain share of the apartment. Only that part of the property that belonged to the deceased person is subject to inheritance. |

| 3 | The living space is jointly acquired during the marriage | If housing was purchased during marriage, then it is the property of the husband and wife. Only part of the deceased person is subject to inheritance. The second half is subject to separation from the inheritance. To do this, the living spouse needs to submit a corresponding application to the notary. Typically, the spouse's share of the inheritance is ½ of the joint property. The ability to allocate one's share is not a basis for a ban on inheriting the property of the deceased husband. |

Privatized property is the personal property of a citizen. The allocation of the marital share is not provided for by law.