After the divorce, the obligation to support their children and take part in the expenses required for their food, education, treatment and other needs remains relevant for both parents who have ceased to be husband and wife. The court determines which of them the minor children will live with. As a rule, they stay with their mother. In this case, the payer of alimony is the father, and its amount is established in court or determined by an alimony agreement between him and his ex-wife. In some situations, it is possible to reduce the amount of such payments.

The court's decision

The court of first instance partially satisfied the plaintiff's demands.

The court found that the plaintiff receives a disability pension and a regional social supplement. The amount of payments received by the plaintiff in total exceeds the minimum subsistence level for pensioners established in the city of Moscow. Based on these facts, the court reduced the amount of alimony collected from the defendant.

Submission procedure

The completed statement of claim is sent to the court at the place of residence of the child’s mother (defendant). This can be done in two ways :

- Personally through the office of the institution, having received an acceptance mark on the third copy;

- By mail with a valuable letter with an inventory and notification of delivery.

An authorized person, a representative of a hired law firm, can draw up and submit a claim through the office. In this case, a power of attorney must be attached to the application.

The requirement follows from the provisions of paragraph 4 of Article 131 of the Code of Civil Procedure of the Russian Federation. Not necessarily, but the office may require documents from the person filing the claim . If his data does not match the applicant’s data, and there is no power of attorney to represent interests, the application may not be accepted. When sent by mail, these nuances are avoided.

Where to start reducing alimony payments?

Of course, a popular question is “Is it possible to reduce the amount of alimony and how to do it?” requires consultation with a family law lawyer. We remind you that questions are answered in a free format by specialists of our portal.

If, after legal assistance, a decision is made to start a trial to reduce payments, you should be mentally prepared for the fact that it will take a lot of time. It is also necessary to collect the relevant documents and have serious grounds for filing such a claim.

Please note that the application must be drawn up in a legally correct manner. A specialist can also help with this.

In addition, you should obtain a preliminary decision from the magistrate. To do this, you need to make an appointment in person and justify why and on what basis you are filing a claim to reduce the amount of alimony. As a rule, the reasons are as follows:

- there is a real need to reduce financial assistance to the child;

- when satisfying a claim, one should rely on the absence of infringement of the child’s rights;

- reductions in payments should not affect the quality of life of minor children.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Only with solid reasons and a real change in the family and financial components of the payer’s life can the court grant the application. Otherwise, consideration or satisfaction of the claim will be denied.

General provisions

Before you begin the process (either on your own or with the help of a lawyer), you need to understand all the consequences. Firstly, it can worsen the parent's relationship with the child. Especially if the relationship between the former spouses is strained or bad.

The fact of a decrease in material expenses on the part of the father can be used as evidence, for example, that the son or daughter whom he abandoned (and this is exactly how it is presented) has become a burden to him. This creates a negative perception of the child support paying parent, which will have an impact in the future.

Secondly, family law obliges not only parents to financially support minor children . The latter, when they become adults, are also obliged to financially help their disabled father and mother.

But the fact that the amount of child support has been reduced can be used by them to reduce the amount of financial assistance for their father or to evade these payments.

Often mothers deliberately do not file for child support in order to free their children from the obligation to financially support their father.

Of course, not only fathers leave the family, sometimes the opposite happens, mothers leave the family. But this trend is not so widespread, so men, not women, are considered conditionally alimony payers.

The law (Family Code of the Russian Federation) determines the amount of financial support for children from the total income , depending on the number of minors and young heirs of the alimony payer:

- One child – 25%;

- Two or three children - 1/6 each;

- Four or more - calculated using the D/K formula, where D is the father’s total income, and K is the number of children.

The court proceeds from these requirements when assigning alimony, and parents should be guided by them when establishing the amount of financial support for the child by signing an agreement.

Persons with the right to appeal

To apply to the court for collection of arrears of alimony, citizens must be:

- biological or adoptive parents;

- family having custody of the child;

- representatives of the educational organization;

- honey. institution;

- guardianship authorities.

In other words, any persons or organizations that are involved in the upbringing and maintenance of disabled children under 18 years of age. An application for alimony or accumulated debt must be submitted to the judicial authorities at the place of residence of the applicant.

In cases where we are talking about a dispute in which payments should be reduced, the claim is also filed at the address of the claimant.

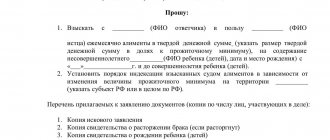

As for the claim itself to reduce alimony payments, it must be correctly and correctly drawn up from a legal point of view. In addition to the details, it must contain the following information:

- judicial contact information;

- the essence of the request;

- reasons for filing the application;

- attached regulatory framework and facts;

- explanations in the disputed payments;

- data on the pre-trial method of dispute resolution (if any);

- list of documentation.

In addition to the real circumstances due to which it is necessary to reduce alimony payments, there are also reasons that are not grounds for a reduction.

So the next area of justification cannot be satisfied. Let's look at it in detail:

- you cannot refer to the fact that the recipient has increased his well-being;

- the emergence of movable and immovable property from the raising parent (provided it is not used as income);

- the child receives government support in the form of subsidies.

Also, when considering a dispute, the magistrate will calculate the new amount based on factors such as:

- what is the percentage of payments withheld:

- the number of relatives of an incapacitated nature;

- what level of percentage is deducted in favor of all children supported by the applicant.

In a situation where alimony was calculated in shares relative to the payer’s income, then their reduction will occur in the same way. The court has the right to satisfy the claim in full or in part, but only if the debts incurred and the grounds for reducing them are valid. These factors include:

- serious illness;

- financial situation;

- the presence of a disabled child in a second marriage, etc.

In order for the court to consider a dispute regarding the reduction of alimony and make an appropriate decision, it is necessary to draw up a statement of claim and send it to the magistrate at the address of the alimony recipient.

How to legally reduce the amount of child support - step-by-step instructions

Decide on the method of assigning alimony.

Adhere to the following order:

- When making changes to the notarial agreement before filing a claim, draw up and send a valuable letter with a list of the attachment to the alimony recipient with a proposal to change the terms of the agreement. Wait 30 days from the moment you receive it, unless a different period is provided for in the contract.

- Prepare strong evidence to support the validity of filing a claim in court.

- Decide on the court - such cases are subject to consideration by the district (city) court at the defendant’s place of residence (clause 2 of the RF Supreme Court Ruling No. 56).

- File a claim to reduce the amount of alimony/amend the notarial agreement.

- Send the claim with copies of the attached documents to the Defendant (ex-wife) by mail in a valuable letter with a list of the attachments.

- Check the court website/office for details for paying the state fee and make the payment.

- Submit a statement of claim with attachments to the court. If it is impossible to submit documents in person, send them by post in a valuable letter with a list of attachments or through the State Automated System “Justice” portal on the court’s website.

- Wait until you receive notice from the court about the time and place of the court hearing.

- Take part in legal proceedings.

- After a positive decision is made by the court and it comes into force (after 1 month), receive and send a writ of execution to the bailiffs/employer at your place of work to recalculate alimony.

- If the decision is not made in your favor, appeal - clause 2 of Art. 321 Code of Civil Procedure of the Russian Federation.

Important! If the court changes the previously established payments, they are collected in a new amount from the day the court decision enters into legal force (i.e. in a month) - Art. 209 Code of Civil Procedure of the Russian Federation. Keep in mind that such a reduction will not free you from paying your existing alimony debt.

How to reduce child support payments for your first child at the birth of your second

If you have a baby in your new family, this is a reason to reconsider the amount of payments for your children from your previous marriage. To do this, you need to decide on a way to reduce child support for your first-born children.

Actions to reduce benefits will vary depending on how they are allocated to the first child. The following methods are distinguished:

- Payments are assigned as a share of the payer’s income.

- Alimony is set at a fixed amount.

- Payments are determined in a mixed form - shares and a fixed amount of money.

- Alimony payments are made by agreement of the parties.

The algorithm of actions for each of the above methods is described in detail in the article How to reduce child support for the first child at the birth of the second and third in 2021 - step-by-step instructions.

How to reduce payments from ¼ to 1/6 of income

To reduce the amount of maintenance as a share of income, adhere to the following procedure:

- The mother of your common child (spouse) files a claim with the court for the recovery of alimony and waits for the court to make a decision, which is subject to immediate execution - Art. 211 Code of Civil Procedure of the Russian Federation.

- After receiving a writ of execution for the collection of alimony payments, it is necessary to send it to the bailiffs for execution.

- Prepare and submit a claim to the court to reduce the amount of child support previously established by the court for a child from the first marriage from ¼ to 1/6 of earnings. In the application, indicate the circumstances confirming your difficult financial situation in connection with the birth of your second baby.

- Wait until a positive court decision comes into force (in a month).

- Receive a writ of execution and send it to the bailiffs/employer for recalculation.

Such claims are often granted by the courts. In this case, the provisions of the law apply, according to which the amount of payments for the maintenance of two children cannot exceed 1/3 of the parent’s earnings.

Important! When the court awards alimony in shares of income, its new amount must also be determined in shares.

How to reduce the fixed amount of alimony

In the absence of an agreement between the parents on the payment of alimony, payments are collected in a fixed amount of money, if the parent is obliged to pay them - Art. 83 Civil Code of the Russian Federation:

- Has unstable earnings/income.

- Receives wages/income fully or partially in kind/foreign currency.

- Has no earnings/income.

Also, alimony is collected in a fixed amount if its assignment in proportion to the parent’s earnings/income is impossible, difficult, or violates the interests of one of the parties.

Reducing such payments is also possible on the basis of judicial acts (as with the share form), but has its own nuances.

As a rule, difficulties arise if the amount of alimony is fixed and is related to the subsistence level. In this case, you must prove the fact:

- Changes in financial situation (loss of main/additional source of income).

- Increased expenses (payment of alimony/utility payments/repayment of loan obligations/taxes, etc.) - after which the amount of your security goes below the subsistence level.

- Salary reductions due to circumstances beyond your control.

- Receiving unemployment benefits.

- Inability to obtain a higher income due to serious illness/disability.

- Bankruptcy - in connection with which you are deprived of the right to occupy certain positions/conduct certain activities.

- Inability to maintain payments at the same level.

Sometimes it is possible to achieve a reduction in payments by switching from a fixed form to an equity one. If you are officially employed, this will be an additional basis. However, you will need to prove a change in the situation/absence of reasons that served as the basis for collecting alimony in a fixed amount of money - Section VIII of the Review of Judicial Practice of the Armed Forces of the Russian Federation.

How to reduce child support to a minimum

The minimum amount of alimony is not determined at the legislative level.

The minimum is calculated in each case individually - depending on the payer’s income or the subsistence level in the region/RF.

How to minimize payments set as a share of income

Most often, payments are set as a percentage of the payer’s income/earnings - from 25 to 50%, which cannot be less than the minimum wage (hereinafter referred to as the minimum wage).

If a person who is obliged to provide maintenance to a minor by a court decision has a permanent income, the amount of monthly penalties is - clause 1 of Art. 81 RF IC:

- For 1 child – ¼ part (25%).

- For 2 children – 1/3 (33%).

- For 3 or more children - half of the amount of earnings received (50%).

From January 2021, the minimum wage is 12,792 rubles. Therefore, by simple calculation it can be determined that the minimum content in this case will be:

- For one child - (12,792 - 13%) × 25% = 2782.26 rubles. per month.

- For two - (12,792 - 13%) × 33% = 3672.58 rubles. per month.

- For three or more - (12,792 - 13%) × 50% = 5564.52 rubles. per month.

If you work, to reduce payments to the minimum limit, in some cases it is enough to agree with the employer to reduce the official salary to the minimum wage, on the basis of which child support is calculated. You can simply receive the rest of the amount in an “envelope”.

In this case, there is no need to go to court. It is enough to submit a certificate of income to the bailiff at the place of enforcement proceedings.

This method is suitable if you work in a small private or your own company. However, this risks the fact that the ex-wife, suspecting a scam, may initiate an audit by the bailiffs and have you held accountable for concealing income.

If the payer is unemployed and receives unemployment benefits in the minimum amount (in 2021 it is equal to 1,500 rubles), the minimum amount of alimony when collecting from such benefits will be 1,500 x 25% = 375 rubles.

What to do with payments in a fixed amount

Payments in a fixed amount of money by court decision are assigned based on the cost of living. The minimum amount of alimony collected in a fixed amount of money is usually equal to half the subsistence level for a child in the region.

The provisions on the collection of alimony in the amount of ½ the subsistence level in the area where the minor lives are not enshrined in law. However, they have entered judicial practice and are actively used by courts when assigning payments in a fixed amount of money.

How to reduce payments to a living wage

The size of the subsistence minimum for 2021 for Russia as a whole is established by RF PP No. 2406 - per capita it is 11,653 rubles.

The method of reducing payments to the subsistence level will depend on how the fixed sum of money was assigned. If:

- An agreement on the payment of alimony has been concluded between you and your ex-wife; with the consent of the recipient, you have the right to amend it. This must be done in writing, followed by certification from a notary - clause 2 of Art. 101 IC RF.

- The payments were established in court - if there are grounds (change in financial/family status, etc.), you can apply to the court with a request to change their amount - clause 1 of Art. 119 RF IC.

Let me give you an example. At the time the court appointed alimony, the payer had a high income in foreign currency, equivalent to 250,000 rubles. The court ordered him to pay double the subsistence minimum. Which amounted to, for example, 16,000 rubles. During the pandemic, he was laid off, and at his new job his earnings amounted to 20,000 rubles.

After deducting alimony (not taking into account inflation), his income will be equal to 4,000 rubles, which is significantly below the subsistence level. Consequently, this may serve as a basis for changing the size of payments in a fixed amount.

How to reduce alimony for an unemployed person

Family law establishes that parents are obliged to support their minor children regardless of the presence/absence of income or earnings - clause 1 of Art. 80 IC RF.

If you lost your job after pre-trial/trial payments were established and are not currently employed, this still does not relieve you of the obligation to support children.

The only difference between the employed and the unemployed is the procedure for calculating payments. Sometimes an unemployed person has to pay even more than when he was working. This is explained quite simply.

When officially employed, the payer pays alimony from his salary, the amount of which may be low. If there is no work, you will have to pay based on the average salary in the defendant’s region of residence/in the Russian Federation - clause 4 of Art. 113 RF IC. According to Rosstat, the nominal average monthly salary at the end of 2020 was 51,083 rubles.

If you have lost your job and cannot find a job, I recommend:

- Immediately register with the employment center - this will allow you to officially receive the status of unemployed and, accordingly, start receiving unemployment benefits. In this case, alimony will be calculated based on its amount, which will prevent debts from accumulating.

- Try to negotiate peacefully with your ex-wife (if you have more or less friendly relations) - for example, ask for time to stabilize your financial situation. And during this period, pay alimony as agreed.

- If an alimony agreement has been concluded between you, and you have determined a fixed amount of payments, make changes to it by notarizing it.

- If you are unable to reach an agreement with your ex-wife, go to court with a claim to change the amount of payments.

However, to resolve the issue in court there must be good reasons:

- Loss of work due to staff reduction/liquidation of the enterprise.

- Temporary disability due to serious illness/accident.

- If you become disabled, etc.

If the payments were initially established by the court in shared form, if you lose your job, you have the right to ask for the debt to be determined in a fixed amount - clause 4 of Art. 113 RF IC. Be prepared to provide documents supporting these grounds.

See also: How a mother or father can refuse child support in 2021 - instructions

How to reduce the percentage of alimony payments from 70 to 50%

The amount of alimony payments is established in the Family Code of the Russian Federation (from 25% to 50% of earnings) and depends on the number of children the payer has. However, in some cases, alimony may be collected in the amount of 70% of income if there are grounds. Next I will tell you under what circumstances this is possible.

When can alimony amount to 70%?

Recovery of payments in the amount of 70% is possible under the following circumstances:

- If there is arrears of alimony - if the reasons for its occurrence are unjustified, collection in an increased amount will be made until the debt is fully repaid - Art. 138 Labor Code of the Russian Federation, clause 3, art. 99 No. 229-FZ.

- The alimony payer is the parent of three or more children, one of whom is disabled. According to the RF IC, alimony for three children amounts to 50 percent of earnings. However, financial assistance for the maintenance of a disabled child should be provided in a larger amount. In this connection, the court may award alimony in the amount of 70%.

- The child receiving them has suffered physical/mental harm. Since a minor, as a rule, requires expensive treatment/rehabilitation.

- The parties entered into a notarial agreement in which they determined payments for minors in the amount of 70%. In this case, the number of children does not matter.

If this is your case, depending on the method of assigning alimony, to reduce payments you should:

- Make changes to a previously concluded alimony agreement. This is possible with the consent of the other party. Such changes require notarization. If the ex-wife refuses to resolve the issue peacefully, you will have to file a lawsuit to amend the agreement, having first received a refusal from her.

- Apply to the court with a claim to reduce alimony if the payments are established by the court. In this case, you will need to provide reasons that will be documented.

Important! The circumstances due to which your income decreased must occur after the payments were assigned. Otherwise, you can’t count on a change in alimony.

See also:

In what cases is the payer exempt from paying alimony in 2021 - a complete list of grounds

How to avoid alimony in a legal way in 2021 - all the ways

How to terminate an agreement to pay child support in 2021 - instructions + judicial practice

How to reduce alimony payments with a high income

High earnings of the payer imply payment of alimony in a large amount. It is possible to reduce them if it can be proven that the amount of payments exceeds the reasonable needs of the minor. To do this, you will need to collect evidence and file a lawsuit.

Let me give you an example. The payer receives high earnings in the amount of 300,000 rubles. Alimony for a minor in the amount of ¼ of income is 75,000 rubles, which is significantly more than the amount of money sufficient to support the child, because The cost of living in this region is, for example, 12,700 rubles.

The income of the ex-wife is 50,000 rubles. If she paid alimony, the amount would be 12,500 rubles. According to Art. 61 of the RF IC, parents bear equal responsibilities for the maintenance of children, therefore, in the statement of claim we ask:

- Reduce the amount of alimony to the amount of 12,700 rubles.

- Change the previously established amount of payments from a share of earnings to a fixed sum of money equal to one subsistence minimum in the child’s region of residence, which will amount to 12,700 rubles.

How to reduce your child support debt

If the payer fails to fulfill alimony obligations, alimony debt accumulates - the amount of unpaid child support previously established by a notarial agreement or a judicial act.

Not everyone knows that such a debt can be reduced on the basis of Art. 114 RF IC. At the same time, it is possible to reduce the debt both by a court decision and by an alimony agreement:

- If the debt arose due to non-payment under a notarial agreement, it can be reduced by mutual agreement of the parties, drawn up in an additional agreement and certified by a notary.

- If a debt arises during enforcement proceedings (alimony is assigned in court), it can be reduced only by filing a claim with the payer in court to reduce the amount of alimony debt under Art. 114 RF IC.

What are the grounds for reducing alimony debt?

If the parties fail to reach an agreement, or if maintenance is paid for a minor, partial release is possible only by court decision and in the simultaneous presence of the following grounds - clause 2 of Art. 114 RF IC:

- The valid reasons for non-payment of alimony are illness/compulsory military service/force majeure.

- Inability to repay the debt due to financial/family status - being dependent on the payer of other persons/low income, etc.

Please note that these circumstances must be documented.

How to reduce alimony under a settlement agreement in court

Current legislation does not provide for the possibility of making changes to the conditions specified in the settlement agreement, which was approved by the court. However, an agreement accepted for execution can be challenged/appealed if there are compelling reasons.

If your financial/family situation changes, you can submit:

- Application for review of a judicial act due to newly discovered or new circumstances - such a requirement should be submitted no later than 3 months from the moment you became aware of them.

- A claim to change the terms of fulfillment of alimony obligations - as a basis, refer to a deterioration in financial situation or a change in family status.

How to reduce alimony for your ex-wife

Please note that alimony is reduced not for wives, but for children. To reduce the content size, follow the instructions above.

However, in some cases, the law obliges the husband to support his ex-wife by collecting alimony from him in court.

The reasons for this may be the following:

- Wife's pregnancy.

- Raising the ex-wife of your common child under three years of age.

- Incapacity for work of the ex-wife, which occurred before the dissolution of the marriage or within 1 year after its dissolution.

- The need of a spouse who cares for a joint disabled child until he comes of age/a disabled child since childhood.

Current legislation provides for changes in the amount of payments in court. If this is your case, in order to reduce/completely cancel them, you should file a claim with the court and provide compelling evidence that the ex-spouse does not need the previously assigned alimony.

The following can be specified as legal grounds for reducing the amount of payments:

- Official employment of the ex-wife at a permanent place of work.

- Reaching the age of majority by the child in whose name child support was paid.

- The mother of the child has a sufficient level of income.

- Entry of a former spouse into a legal marriage.

Also in your claim you can refer to your difficult financial situation/change in marital status or other significant circumstances.

What documents will be needed

Depending on the subject of the claim, prepare a package of documents:

- A copy of your passport.

- Copies of children's birth certificates.

- A copy of the marriage/divorce certificate.

- Justifying the emergence of an obligation to pay alimony (agreement of the parties/judicial act).

- Confirming the fact of a change in the financial/family situation of the payer and the impossibility of making payments in the established amount.

- A certificate of the payer’s income for the year preceding the filing of the claim.

- Evidence of child support payments previously made by the alimony payer.

- Proving the existence of grounds for reducing alimony.

- Confirming compliance with the pre-trial order (when making changes to the alimony agreement).

- About payment of state duty.

- Confirming the direction/delivery of copies of the claim with attachments to the parties.

- Other.

What are the costs when changing the agreement and when going to court?

The maximum fees for the provision of legal and technical services by a notary are established annually by the notary chamber for each region of the Russian Federation. You can find out the cost of the service in your district on the website of the Federal Notary Chamber.

For example, in St. Petersburg, the fee for certifying an agreement to amend a notarized contract is 200 rubles.

When going to court, your costs will be:

- For filing a claim to change the alimony agreement, the state fee is 300 rubles. — pp. 3 p. 1 art. 333.19 RF IC.

- In a claim to reduce the amount of alimony, when calculating the state duty, the rules for statements of a property nature subject to assessment are applied. In accordance with paragraphs. 2 p. 1 art. 333.20 of the Tax Code of the Russian Federation, the price of the claim is determined according to the rules of clause 6, part 1, art. 91 of the Code of Civil Procedure of the Russian Federation - based on the amount by which payments are reduced, but not more than for a year.

I described in detail how to calculate the state duty in this case in the section “How much is the state duty paid for filing a claim” in the article How to reduce child support for the first child at the birth of the second and third in 2021 - step-by-step instructions.

Birth of a second and subsequent child in a second marriage

If the reason for the appeal is the birth of a child in a second marriage, then this is not a basis for the court to reduce alimony for the first. Also, if no agreement has been concluded, then in accordance with Article No. 81 of the IC of Russia, monthly payments must be made for incompetent children, the amount of which is established by the judge, namely:

- for the first child, payments are ¼ of the income;

- for two children, at least ⅓ of the share must be transferred;

- and if three or more children are born, then half of the salary is transferred.

These payments may increase or decrease depending on the decision of the judge. To resolve the issue in your favor, you must provide specific reasons. Which? We have listed in the previous sections.

What to do if the court refuses to grant a reduction

In the event of a refusal, it is important to timely and competently prepare a complaint against a judicial act. If a court decision

is not in your favor, you can appeal it within 1 month from the date of its issuance through the appeal procedure (clause 2 of Article 321 of the Code of Civil Procedure of the Russian Federation). To do this, prepare an appeal and submit it to the court that made the decision to refuse to reduce the amount of alimony.

The court decision of the first instance may be canceled by the court in whole or in part. In this case, the appeal ruling comes into force from the moment it is issued.

If the appellate authority refuses to reduce the amount, an appeal is possible through the cassation procedure. The basis for cancellation may be a significant violation of procedural and substantive law.

Reduce child support payments for children from different marriages

The payer has another obligation regarding alimony payments and when adding up the amounts of alimony, they exceed the maximum established by the Legislation of the Russian Federation. For example, a mother is the payer to support her child from her first marriage.

The amount of payments is ½ part of income. If in her second marriage she had a child, and she again has to pay child support. It turns out that in total, these payments exceed 33%. Then you can apply for a reduction in alimony payments.

But in this case, you need to file 2 identical statements of claim that the reduction in alimony was equivalent in relation to each obligation.

Expert opinion

Makarov Stanislav Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

Valery Isaev graduated from the Moscow State Law Institute. Over the years of work in the legal profession, he has conducted many successful civil and criminal cases in courts of various jurisdictions. Extensive experience in legal assistance to citizens in various fields.

Human nature is such that we are more willing to receive than to give. And some parents who pay child support for their minor children want the amount of payments reduced.

This is a completely legitimate desire, supported by the norms of the Family Code. In Art. 81 of this document states: “The size of these shares (meaning the payment of alimony for minor children) may be reduced or increased by the court, taking into account the financial or marital status of the parties and other circumstances worthy of attention.”

- Most cases regarding alimony are extremely individual and consist of a very large number of factors.

- Understanding the legal framework is desirable, but it cannot guarantee a solution to your specific situation.

Therefore, you can check any information with our on-duty legal consultants 24/7 and free of charge.

You can contact them in the following ways:

1) in online chat or through the form below

2) Or call the 24-hour hotline by phone: Moscow: St. Petersburg: For other regions: – the call is free from anywhere in Russia.

But try this. What else can you do?

When thinking about how to reduce alimony payments, you can try to prove that the funds received for the child are excessively large, and they are used not only by him, but also by his mother. But this argument can work if the father’s income is very high, and the alimony ordered by the court for the child greatly exceeds his personal needs. However, if the mother proves that she manages them in the interests of the common child, all efforts will be in vain.

The second side of the coin is that my father’s salary is low (“gray”). He can provide a certificate as evidence and try to convince the court that the income indicated in it is the total monthly income. However, the child's mother, being aware of the real state of affairs, can present evidence to the court to the contrary. And then the attempt will also not be successful.

Those men who remarried and had offspring have a definite chance of making alimony payments less. If the “current” spouse agrees to file for alimony for her child, this may be a solution to the problem of how to reduce alimony for the ex. The 33% of income required by law must be divided in the form of alimony for a child from a divorced marriage and a child born in a remarriage. And then alimony in the first case will actually decrease by almost 9%, since instead of 25% it will turn into 16.5%. This method is risky, since the spouses will have to be as convincing as possible, proving to the court that collecting alimony for a child growing up in marriage is the only way to force a man to support him. If the true reasons are revealed, it is unlikely that the amount of alimony will be reduced.

It is important to remember that only the court can authorize a reduction in alimony payments. Unauthorized reduction of them will lead to the formation of debt, which will still have to be repaid simultaneously with the penalty.

Reasons for reducing the amount of alimony

Legislators have not prescribed a specific list of grounds for this, therefore, when making decisions to reduce the amount of alimony, judges are guided by judicial practice. In Art.

119 of the Family Code there is only a vague definition of the reasons that can serve to go to court: “If, in the absence of an agreement on the payment of alimony, after the amount of alimony has been established in court, the financial or marital status of one of the parties has changed, the court has the right, at the request of any of the parties, to change the established the amount of alimony or exempt the person obligated to pay alimony from paying it. When changing the amount of alimony or when releasing it from payment, the court also has the right to take into account other noteworthy interests of the parties.”

Despite this uncertainty, claims to reduce the amount of alimony are common in judicial practice. Such civil cases are considered complex, because citizens need to prove their right to reduce the amount of deductions from income, and the court must consider all the arguments of both sides and, first of all, be guided by the protection of the rights of a minor child, whose rights should not be infringed.

The plaintiffs give a lot of reasons that, in their opinion, should influence the reduction of alimony. Judicial practice identifies several factors that are taken into account when considering a case. These are the changes regarding:

- the state of health of the alimony payer, resulting in disability of the first or second groups. A reduction in the amount of alimony may occur if a person proves that he needs special care and additional expenses. To do this, you need to provide a certificate from the federal state institution of medical and social examination, approved by Order of the Ministry of Health and Social Development of Russia dated November 24, 2010 N 1031n (as amended on June 17, 2013);

- the financial situation of the person paying alimony or the person receiving it;

- family composition of the alimony provider.

Let's take a closer look at the last two points that affect the reduction in the amount of alimony. Judicial practice has variations on a given topic.

Agreement on payment of alimony

The best solution would be if the parties can reach a consensus on their own, Art. 80 IC RF. But in accordance with Article 103 of the RF IC, alimony must correspond to the amount that the court would assign.

Such an agreement is drawn up in writing in the presence of a lawyer. The agreement may be terminated and changes and amendments may be made to it.

By agreement of the parties, the amount of payments may be minimal, but compensated by additional investments: payment for sections, purchase of clothing, payment for vacation, etc. Or intangible, for example, regularly spending time with children.

A fixed amount of money

The alimony payer regularly pays alimony, but the remaining amount after deduction does not correspond to the minimum subsistence level. In this case, going to court is justified, the rights of the parent are infringed. Or, on the contrary, the recipient may demand payment of alimony in a fixed payment when the payer’s income is unstable. File a claim in court.

Methods for reducing alimony

All the methods we have listed are aimed at direct participation in the lives of children, managing one’s own funds, and not evading child support. They are necessary for those who cannot achieve justice through the courts. It happens that a conscientious payer is financially squeezed and is in a state of despair. As we know, the alimony collection system protects the recipient, as a rule, the mother, without assessing her actions. A woman can interfere with the father’s participation in the children’s lives, it is inappropriate to waste alimony, which is practically unprovable in court.

Half the Large Alimony Method

The essence of the method is that part of the alimony, but not more than fifty percent, is transferred to an account in the name of the child.

Will it suit me? Only those who have a large income can use this method. Suitable for those who consistently receive a high salary and will not change their occupation.

Pros – an investment in the child’s future.

Disadvantages - it does not allow you to regain control over your cash flow, does not increase personal income, and does not allow you to manage even the part that is transferred to the child’s special account. To use the funds, you will have to obtain the consent of the guardianship and trusteeship authorities and the consent of the recipient of alimony.

How to use the method? Go to court with a claim. Argue that your payments are disproportionately high compared to the expenses for the child.

Individual entrepreneur method

The essence of the method is to change the type of activity, move from an employee to an individual entrepreneur.

Will it suit me? Suitable for those who are ready to work for themselves.

Pros - individual entrepreneurs themselves extract personal income from their business and control it. The entrepreneur determines for himself how to develop the business and what part of the income he will invest in the business and what part he will spend on himself. The main thing is to choose the right taxation scheme and regime. There are only two modes: general and special. The general regime is disadvantageous and difficult. The special regime includes several tax schemes. The tax is levied on a fixed amount, which does not depend on actual income and expenses. Or such a simplified “income minus expenses” scheme. With this scheme, any costs associated with the business can be included in expenses. The schemes allow you not to declare real income, for example imputed income (IMNI).

The advantage of this method is obvious: managing your income and the ability to control it using a properly selected taxation scheme.

Disadvantages – the income remains personal. The second disadvantage is that the entrepreneur's income may vary.

How to use? Start your own business. Or perform the duties of an employee on behalf of an individual entrepreneur. For example, you were listed as a driver in a company, you can open an individual entrepreneur, enter into an agreement with the employer and provide driver services on behalf of the entrepreneur.

Legal entity method

The essence of the method is that you become a legal entity, the income of this legal entity is not subject to alimony, since the personal obligations of the owner (founder) are not the obligations of the legal entity. Since the company is a separate legal entity, business profits are no longer personal income, so alimony cannot be withheld from it. You can be in an ordinary position and receive a salary, but in reality you manage the company and control its income. Businessmen use the profits of their companies and include part of their own expenses in the company’s expenses: business trips, buying a car, etc. However, it should be remembered that unreasonable expenses may arouse suspicion from the tax service.

Pros: complete control over personal income. The ability to provide for children directly.

The disadvantages are the complexity of this method.

How to use? Start your own business as a legal entity.

What documents are needed to change the amount of alimony?

When parents agree amicably on money paid for the needs of their children, they back this up with a notarized agreement. Otherwise, you will have to solve the problem in court. You must provide the court with:

- statement. To compile it, it is more efficient to use the services of professional lawyers;

- copies of the document on marriage and its dissolution;

- copies of children's birth certificates;

- copies of documents confirming that the parent pays child support;

- documents and certificates helping to establish the legitimacy of the plaintiff’s claims.

The reduction in alimony is confirmed by a court decision with a writ of execution or a court order. Until these documents come into force, the amount of child benefit paid does not change.

The legislation of the Russian Federation in the field of financial law says that alimentary relations between individuals are not unchanged. There are frequent cases when the recipient wants to recover a large amount, and the payer, on the contrary, wants to reduce the amount of monthly payments.

This can be done in a completely legal manner. Reducing the amount of alimony is not an easy task, but judicial practice shows that it is possible to reduce payments if there are serious reasons for this.

Is it possible to legally reduce their size to a minimum?

The Supreme Court indicated compelling reasons for reducing the amount of alimony back in 1996 (ninth resolution, paragraph 14). It is to them that lawyers and plaintiffs refer who are seeking ways to reduce alimony payments. These include grounds related to the deterioration of the payer’s financial situation, namely :

- Disability of the payer and members of his new family;

- Deterioration in health leading to disability;

- Identification of pathologies that are incompatible with previous activities.

Even if members of the payer’s family have been disabled, the amount of alimony may not allow them to receive the necessary assistance due to lack of funds. To prove this, you must document :

- Level of total income.

- All mandatory monthly, quarterly or annual (property, land, vehicle taxes) payments, including loan payments, utilities, etc.

- Calculation of the remaining amount received.

- Official data on the average and minimum wages in the region, as well as the cost of living.

In addition, you need to consider:

- Awards.

- Payments for health improvement.

- Income of other family members.

- Other financial income.

If they are hidden, and the other party points to them, attaches supporting documents, or obtains a court request in response to which these amounts become known, this will work against the plaintiff.

Read more about the grounds for reducing alimony in this article.

Other grounds are related to a change in the financial situation of the child, who:

- Began to engage in labor activity;

- Engaged in entrepreneurship;

- Received ownership of property that brings him income.

A prerequisite is that the income must satisfy the needs of the minor offspring in full.

Other reasons:

- Child support began to be paid for other children;

- The payer has a high total income;

- The child is supported by the state; he was sent to an orphanage.

The presence of any of the above grounds does not in itself mean that the court will side with the plaintiff. Judicial practice shows that it is necessary to rely on several reasons and carefully substantiate each of them with documentary evidence.

How to reduce under an alimony agreement

Reducing the amount under an agreement requires certification by a notary.

If you have entered into an agreement on alimony and have it certified by a notary, then the easiest option to reduce the amount of maintenance is to agree with the recipient and make changes to the settlement agreement. If the other party to the agreement agrees, follow the following procedure:

- Draw up an additional agreement - you can simply rewrite the text of the previous document, changing only the amount of payments in it. Bring 3 copies of the agreement and a certificate of your income to the notary's office.

- Make an appointment with a notary. Pay the state fee (notary fee) in the amount of 250 rubles - the amount is regulated by the “Fundamentals of the legislation of the Russian Federation on notaries”.

- Sign a new alimony settlement agreement with the recipient. Receive your copy of the amended agreement, certified by the seal and signature of a notary.

For more information about the features of making changes to a notarized agreement with the mutual consent of the parties, read the article Changing the agreement on the payment of alimony.

Appeals to higher authorities

If the magistrate refuses to satisfy the claims, you can resign yourself or file a complaint for appeal and cassation. An application to these authorities is submitted by analogy with a claim. The document must indicate :

- The name and address of the institution to which the appeal or cassation is filed.

- Last name, first name and patronymic of the defendant and applicant.

- When and by what institution the decision was made.

- Brief summary of the matter.

- What are the violations of substantive and procedural law committed when making a decision?

- Links to legal norms and evidence.

- Appellant's claims.

- List of attached documents.

- Date of compilation and signature.

The period for filing an appeal is 1 month , for cassation - 5 months or one month more if an appeal has not been filed. As a rule, people turn to higher authorities in connection with disagreement with the decision made on the merits. Complaints about unfounded refusals to accept a claim or return it are isolated cases.

Find out more: where to apply for a reduction in alimony? We recommend you read it.

Lawyer's answers to private questions

When can you file a claim to reduce alimony for your ex-wife?

This is possible if the recipient’s financial situation has changed for the better. If she remarried, you can generally demand the termination of alimony obligations (Article 120 of the RF IC).

Is it possible to apply for a reduction in alimony to the bailiff, and not to the court?

No. Such issues are dealt with in the courts. The bailiff is only obliged to execute decisions and orders.

Is it possible to reduce alimony due to the birth of a child in a new marriage?

In theory, yes, but in practice, courts rarely satisfy such requirements. There are more chances if the new wife seeks alimony for him and herself.

How can I apply for a reduction in child support if I live in another city?

You can send an application through the State Automated System “Justice” online and apply for an absentee hearing. Or hire a lawyer and issue a power of attorney for him.

What to do if your ex filed for a reduction in alimony?

If a man has all the grounds and they are supported by documents, the court will most likely satisfy his demands. The defendant can only file an objection, indicating for what reasons the alimony cannot be reduced. For example, if a child is seriously ill, but in this case additional expenses are usually collected for him (Article 86 of the RF IC).

Practical examples

Judicial practice in matters of reducing alimony is ambiguous, and to assess the likelihood of a claim being satisfied, it is enough to familiarize yourself with practical examples:

The claim was satisfied. The Martashovs divorced in 2015, leaving a three-year-old son with their mother. At that time, the father earned 50,000 rubles, alimony was prescribed in the amount of 25% of income. In 2021, a man receives group 1 disability and quits his job. His income is reduced to 12,000 rubles. in the form of a benefit.

To ensure that payments were not collected based on the amount of previously received earnings, the representative of the alimony obligee filed a claim to reduce alimony, reflecting in the requirements the calculation of 25% of the benefit.

The claim was satisfied despite the fact that instead of 12,500 rubles. the child will receive 3,000 rubles. – all evidence indicating the difficult financial situation of the payer was presented to the court.

The claim was denied. The court ordered Orekhov S.N. to pay alimony for his minor daughter in a fixed amount - 10,000 rubles. He transferred money in good faith, but his earnings dropped significantly, and his mother became a dependent.

Then the payer filed a claim for a reduction in payments based on a decrease in earnings and the presence of another dependent.

The court did not satisfy the claim because the plaintiff did not provide evidence of a salary reduction. He worked unofficially and could not bring accounting certificates.

Arbitrage practice

There are several other examples from real judicial practice:

- Previously, alimony was collected from the man for three children - 0.5 of the subsistence minimum for each while he was not working. Then he got a job and filed a lawsuit to reduce payments to 1/2 of his income. Children would receive 50% less. By decision No. 2-239/2020 2-239/2020(2-6047/2019;)~M-6295/2019 2-6047/2019 M-6295/2019 dated February 13, 2021 in case No. 2-239/2020 the demands were denied.

- The man paid 1/4 of his earnings to support his daughter. Then they exacted alimony from him for his son and father. In the demands, the plaintiff indicated a reduction in the amount of payments for his daughter to 1/6. Decision No. 2-147/2020 2-147/2020(2-4038/2019;)~M-3982/2019 2-4038/2019 M-3982/2019 dated January 14, 2021 in case No. 2-147/2020 the claim was satisfied.

- The man was paying child support for two children. One of them reached the age of 18, and therefore the plaintiff asked to change the amount of payments from 1/3 to 1/4 of all types of earnings. By decision No. 2-74/2020 2-74/2020~M-57/2020 M-57/2020 dated May 22, 2021 in case No. 2-74/2020 the claim was satisfied.

Case resolution practice

The provisions of family law clearly indicate the amount of alimony, which depends on the number of children. However, courts often deny applicants' claims. They believe that there is no reason to reduce the amount of alimony when the payer has a second child in a new family.

The reasons for this decision are as follows:

- The plaintiff lives with the mother of the second child in one family;

- His place of work did not change, his health did not deteriorate;

- The applicant's salary increased.

In cases on how to reduce the amount of alimony, the courts take a comprehensive and objective (and not formal) approach, and stand on the side of the interests of the defendant mother and her child.

Another example relates to a case in which the applicant requested a reduction in the amount of child support awarded in a fixed amount on the following grounds:

- The amount of income decreased to 10 tr;

- He is dependent on his sick, disabled mother.

The court rejects the claims, justifying the decision as follows::

- The amount of alimony paid is below the minimum subsistence level established in the region for minors and minors.

- The plaintiff did not provide evidence that he could not find a better paying job.

- The fact that the applicant’s mother is dependent is questionable, since she receives a pension, the amount of which exceeds the minimum subsistence level established in the region.

In this decision, the most interesting from a legal point of view is the second argument. According to the judge, the plaintiff was required to document that he:

- I was looking for a well-paid job and made every effort to achieve this.

- The applicant was rejected for objective reasons.

There is no rule obliging the alimony payer to look for a more decent income. But it is also necessary to take this turn of events into account when asking how the amount of alimony can be reduced.

In what cases is reduction possible?

The legislation on marriage and family that was in force before the introduction of the Family Code clearly formulated the grounds that give the right to change the shares of income collected from minor children.

| No. | Situations when it is possible to reduce alimony |

| 1 | When a parent who is obligated to pay child support in a new family has a baby and with the previously established shared amount of deductions, this is reflected in his financial support |

| 2 | Loss of ability to work and, as a consequence of the previous level of income from earnings, in connection with the establishment of the first or second group of disability, regardless of whether this is due to a general illness or professional, domestic injury or received in the course of work |

| 3 | If a child officially gets a job, which is not prohibited by labor legislation, from the age of 16, and in some cases with the permission of his parents earlier (from the age of 14), and fully meets his needs from earned money |

| 4 | Excess income of the payer, when the withheld alimony is clearly enough not only for the child, but also for his entire family |