General rules for allocating a mandatory share

The legislator uses the rule of compulsory share as one of the types of guarantees to the relatives of a deceased citizen that are not included in the contents of the testamentary form. The provisions of Article 1149 of the Civil Code of the Russian Federation allow the following categories of citizens to claim a mandatory share:

- children under 18 years of age;

- adult children, if they are recognized as disabled;

- disabled spouse of the deceased owner;

- disabled parents of the deceased.

All listed persons are heirs of the first priority by law, but may not be included in the contents of the will. The execution of a testamentary disposition is a free expression of the will of a citizen made during his lifetime. At the same time, any subjects, including strangers and legal entities, can be included in the heirs under the will.

The opening of the inheritance occurs upon submission of the death certificate to the notary's office. Conducting inheritance proceedings is within the competence of a notary, therefore all further actions to allocate the obligatory share will take place in a notary’s office. Let us highlight the following nuances of drawing up testamentary documents, which will have legal significance for the allocation of a mandatory share:

- according to the will, you can indicate all the property or part of it, which will be distributed among the heirs specified in the document;

- in the testamentary form you can indicate not only the actual acquired property, but also future assets (for this, the document indicates the phrase “all property owned at the time of death”);

- the testator has the right to dispose only of his own property (for example, the husband cannot include in the will movable or immovable property that belongs to the wife as personal property).

Since the contents of the will are protected by legislative secrecy, a relative will be able to learn about all the conditions of inheritance only after the death of the citizen. If children, spouse or parents establish that they are not listed among the heirs under the will, they have the right to a compulsory share - for this they need to confirm their incapacity for work.

The size of the mandatory share and its composition

The provisions of paragraph 1 of Art. 1149 of the Civil Code, the legislator determined the minimum size of the obligatory share in the inheritance, which today is no less than half the share of the inheritance that the obligatory heir could claim if he were called upon to inherit in the general manner by law.

It should be noted that in comparison with the Civil Code of 1964, the size of the share was reduced - until 2002 it was 2/3 of the share entitled to the heir by law. Interestingly, when calculating the size of such a share, it is also necessary to take into account persons called to inherit by right of representation, conceived but unborn heirs, as well as other obligatory heirs claiming such a share.

For your information

According to paragraph 3 of Art. 1149 of the Civil Code, the obligatory share includes everything that such a disabled heir receives from the opened inheritance mass on any basis (for example, under a will), including the cost of the things he receives, property rights, testamentary refusal, etc. .

In addition, you need to remember that:

- Obligatory heirs have a certain priority in the division of inherited property. Thus, in order to most fully take into account the interests of unprotected heirs, the obligatory share is subject to satisfaction in the presence of a will, primarily from the part of the inheritance to which such a will does not apply . In case of insufficiency of such a part, satisfaction is carried out at the expense of property bequeathed to specific persons (clause 2 of Article 1149 of the Civil Code).

- The allocation of a mandatory share in its minimum amount from property that is not covered by a will is carried out even before determining the shares of those legal successors who are called to inherit in the general order of priority. This happens even if the allocation of a share leads to a significant reduction in the shares of ordinary heirs or their complete exclusion from succession.

- Since the law establishes the priority of a will as the only instrument for disposing of property in the event of death, the obligatory share affects it last. However, if the allocation of such a share is carried out precisely from the bequeathed part of the property, this inevitably leads to a reduction in the parts of the inheritance due to the successors under the will, and in some cases even excludes them from inheritance, thereby ignoring the dying will of the testator.

The specified size of the mandatory share is a minimum and, depending on certain circumstances, can be significantly increased . At the same time, under a certain set of circumstances, the size of the allocated part may be reduced or its allocation may be completely refused.

Reducing the size of the mandatory share and refusing to award it

The provisions of paragraph 4 of Art. 1149 of the Civil Code, the legislator determines the right of the court, taking into account the property status of the heir, to reduce the size of the minimum part of the inheritance assigned to him or to completely refuse to award it . The specified reduction of such part of the inheritance or refusal to award it is possible provided that such part is satisfied at the expense of property bequeathed to some other legal successor.

Important

Moreover, the specified property, even before the death of the testator, had to be used by the heir under the will for residence (apartment, house) or for livelihood (tools, premises, equipment, etc.), and was not used by the obligatory heir at all.

Based on this, it follows that:

- The size of the minimum part of the inheritance mass, which is due to the most vulnerable heirs , may be less than that established in paragraph 1 of Art. 1149 GK minimum . In some cases, such an heir may be completely deprived of his obligatory share, but such cases are rather the exception.

- When considering such cases, the first thing that the courts must take into account is the property status of the heir , whose share in the inheritance is subject to reduction or he is subject to deprivation of it altogether. At the same time, the property status of the successor under the will, who, most likely, is the applicant in the process, does not require any analysis or assessment, since in this case, the legislator gives priority to the execution of the dying will of the testator rather than the will of the law.

- The introduction of such a provision is based on judicial practice, according to which, the provision of the specified mandatory part in full, in private situations, may to some extent violate social justice and deprive the heirs under the will of social and judicial protection (Definition of the Constitutional Court of the Russian Federation No. 209-O dated 09.12.99 .).

- Some provisions of this norm require more detailed legislative regulation. In particular, the legislator does not explain whether the legal successor must reside temporarily or permanently in the premises bequeathed to him; what exactly can be used by the heir under a will to earn money and how to objectively assess whether such bequeathed property was used to earn money, etc. Today, the resolution of these issues falls within the competence of the courts and is decided by them, based on the characteristics of each specific situation.

- Please note that the size of the required share, like any other share, cannot be changed at the request of the heir either by the notary himself or by a court decision, except for the cases specified in paragraph 4 of Art. 1149 Civil Code. In the absence of a set of circumstances for such a change, it can be carried out by mutual consent of the heir under the will and the required heir. So, in accordance with Art. 1165 of the Civil Code, they can enter into an agreement on the division of inherited property not in accordance with the shares due to them.

Example

The only inherited property of the deceased T was a car, which he bequeathed to his son. My son has been using it for 5 years to work in a taxi service. However, T’s wife, due to being retired, was disabled and had the right to a compulsory share, which is why she demanded compensation for part of the car. T's son, in turn, filed a lawsuit demanding that T's wife be denied a mandatory share. He justified it by the fact that she was a wealthy citizen who received real estate and gold jewelry as a gift from her father. The controversial car was used by T’s son for work, which was his only source of income. Guided by paragraph 4 of Art. 1149 of the Civil Code, the court refused to award T’s wife compensation for her obligatory share in the inheritance and transferred the rights to the car to her son.

How is disability confirmed?

The right of pensioners to an obligatory share in the inheritance is confirmed by the fact of incapacity for work. Due to objective reasons, the most common cases are when the parents or spouse of a deceased citizen are pensioners. Disability can be confirmed by the following evidence:

- the presence of a retirement age regulated by law;

- availability of a pension certificate issued by the Pension Fund of Russia;

- availability of a certificate of early retirement on preferential grounds - disability, etc.

When confirming the right to a compulsory share, it is necessary to prove that retirement or reaching retirement age took place at the time of the owner’s death.

Please note that confirmation of the fact of retirement is only important when inheriting under a will and registering a mandatory share. If there is no will, parents or a spouse of retirement age will be included in the first place as heirs at law only based on the fact of family ties with the deceased.

How to calculate

Determining the size of the mandatory share is difficult for some citizens. To make the calculation, it is necessary to imagine that there is no will regarding the testator’s property.

The calculation of the required share will look like this:

- The number of heirs of the first stage is determined.

- The share of each heir is determined legally.

- The resulting share is divided by two.

Example No. 1. The testator made a will for his apartment in favor of a charitable organization. He is survived by a wife of retirement age and a 12-year-old daughter. If the inheritance were distributed legally, then the wife and daughter would each receive half a share in the apartment. But since the testator made a will, the relatives can only count on half of their share. Consequently, the mother and daughter will inherit ¼ of the property in the apartment, half will go to the organization according to the will.

Example No. 2. The testator left an apartment in the amount of ¾ to his minor daughter, and he left another ¼ to his close friend. He also left behind a wife, but she is able-bodied and has no right to a compulsory share. In this case, the allocation of a mandatory share loses its meaning, since the rights of the minor daughter were not violated: according to the law, she would have received ½ of the ownership of the apartment, but otherwise – ¾ (i.e., more than the mandatory and legal share).

Example No. 3. The woman bequeathed her property to her sister, and inherited a plot of land to her disabled daughter. But with a legal inheritance order, the daughter would have received the apartment in the amount of 100%, which indicates that her rights were violated. Taking into account the rule on the obligatory share in the inheritance, the daughter will receive a 50% share in the apartment, which was bequeathed to the testator's sister.

Example No. 4. The citizen divorced his wife, with whom he had two children. He got together with another woman, but they did not register the marriage. During his lifetime, he bequeathed an apartment to his common-law wife, knowing that she was not included in the circle of legal heirs. But in doing so, he violated the interests of minor children. Their obligatory share was ¼ each (½ under the legal order of inheritance). Accordingly, the second half was given to the common-law wife of the deceased on the basis of the last will of the deceased.

How is the mandatory share allocated?

To qualify for the allocation of a mandatory share, pensioners must complete the following actions:

- obtain a death certificate of a relative and present it to a notary office;

- establish the contents of the will, including the composition of the property and the list of heirs;

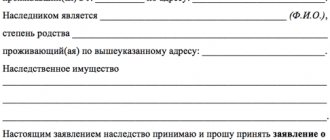

- no later than six months from the date of death of a citizen, you must submit an application to the notary’s office to accept the inheritance by right of compulsory share - this document indicates the presence of family ties and the fact of incapacity for work;

- after six months, you need to obtain from a notary a certificate of right to part of the property of the deceased citizen;

- if the compulsory share included real estate, the rights to it are subject to registration in the Rosreestr service.

Based on the content of Part Three of the Civil Code of the Russian Federation, in addition to the application, the following documents are submitted to allocate the obligatory share - a court decision, a marriage or birth certificate (to confirm family ties); pensioner's ID. Heirs also have the right to submit title documents for the property. If such documents are not presented, the notary must independently submit a request to the authorized services.

When exercising the right to a compulsory share, it is important to comply with the rule of the six-month procedural period. If the application is submitted later, the notary will legally refuse to allocate property to the pensioner.

The deadline can only be restored in court; to do this, you need to confirm that the reasons for missing time are valid (for example, a long-term illness with hospital stay, a long business trip, etc.).

When submitting an application for the allocation of a mandatory share, you must take into account that simultaneously with part of the property, the debt obligations of the deceased will also be transferred. The law does not allow the possibility of receiving an inheritance without accepting the debts of a deceased citizen, even if the heir is poor or retired. For this reason, even before submitting an application to the notary’s office, it is advisable to clarify the composition of the property and whether the deceased has outstanding debts (if there is a large debt, the requirement to allocate a mandatory share may not be profitable).

Selection order

The allocation of the obligatory share takes place at the notary. To do this, you do not need to go to court (only if no controversial situations have arisen).

When contacting a notary, applicants for the obligatory share must provide a certain set of documents, including:

- Documents confirming relationship with the testator (birth certificate, marriage certificate, passport, etc.).

- Documents confirming the right to a compulsory share: medical certificate of disability, birth certificate, pension certificate, certificate of family composition from the passport office (for dependents).

When a compulsory share is allocated, the will is not contested or revoked: it continues to be in effect, just to a limited extent.

Ideally, the testators, even at the stage of certification of the will, refuse to register it due to the fact that the rights of some relatives were infringed in it.

The procedure for determining the share

What share of the inheritance is a pensioner entitled to after the death of a relative? If the pensioner is the spouse or parent of a deceased citizen, by law he will be included first in the list of heirs. This means that in the absence of a will, all assets and funds of the deceased will be distributed among the first priority heirs in equal proportions. For example, if 4 people (a spouse, two retired parents and one child) declared their rights to inheritance, each of them will receive ¼ of the property. When inheriting by law, the fact of retirement age does not provide advantages for increasing the size of the share.

Determining a mandatory share in the presence of a will is characterized by the following nuances:

- the priority order for the allocation of a mandatory share is the use of part of the property not included in the contents of the testamentary document;

- if such property turns out to be insufficient to allocate a mandatory share, the assets of the heirs under the will will be taken into account (while changing their shares is allowed);

- the size of the obligatory share cannot be less than half the share entitled to the pensioner upon inheritance by law.

Thus, to determine the size of the share of a pensioner not included in the terms of the will, the notary needs to establish the following fact - what part of the property this citizen would receive upon inheritance by law. To do this, the composition of all first-stage heirs (children, spouse and parents) is taken into account. Let's use the above example - if there are four legal heirs (spouse, two retired parents and one child), the obligatory share will be at least 1/8 of the total property.

To confirm the allocated share, the pensioner will be issued an inheritance certificate. This document, issued at a notary's office, will allow you to legally receive part of the movable property, as well as register rights to a share of real estate.

Who has the right to an obligatory share in the inheritance?

Mandatory share in the inheritance, according to Art. 1149 of the Civil Code, one should consider the minimum amount of a share in the inheritance , which is guaranteed to the most vulnerable heir from a legal point of view (obligatory heir) upon the death of the testator.

What is noteworthy is that the obligatory share is allocated to such a successor regardless of the existence of a will and its contents - this is the only exception that, in the opinion of the legislator, may violate the principle of freedom of will (Article 1119 of the Civil Code). The circle of persons entitled to the specified share must be clarified by the notary before issuing a certificate of the right to inheritance under a will, after which he explains to them the scope and composition of their right to an obligatory share (Article 73 of the Fundamentals of Legislation on Notaries).

Important

Not all legal successors have the right to an obligatory share in the inheritance, but only disabled heirs of the first stage (Article 1142 of the Civil Code) and disabled dependents (Article 1148 of the Civil Code). If there is a will, they are called upon to inherit along with the heirs under the will.

Based on the above, these obligatory heirs can be divided into three categories, which it is advisable to consider in more detail:

- Minor or disabled children of the testator . According to paragraphs. 1 item 2 art. 10 Federal Law No. 400 of December 28, 2013, all children under 18 years of age are recognized as disabled. In addition, children under 23 years of age are recognized as such if they are in training or children older than this age if they became disabled before the age of 18. Until reaching the age of majority , this category of heirs will have the right to a compulsory share, even upon marriage or emancipation (Article 27 of the Civil Code) for some other reason.

- Minor children will be entitled to a mandatory share, even if they are adopted after the death of the testator. They cannot be deprived of it, since at the time of the opening of the inheritance, related legal relations still took place. Moreover, it should be noted that the right to an obligatory share will have the children of the testator, born after the opening of the inheritance, but conceived by him before it (Article 1116 of the Civil Code).

- Disabled spouse and parents of the testator . According to paragraphs. 3 p. 2 art. 10 Federal Law No. 400 of December 28, 2013, the parents and spouse of a deceased testator may be recognized as disabled and claim a mandatory share in the inheritance in cases where men reach 60 years of age and women reach 55 years of age, as well as in cases where they are recognized by a medical and social examination as disabled. Disabled adoptive parents, according to Art. 1147 of the Civil Code, have the right to an obligatory share on the same grounds as the parents of the testator. Spouses can also claim the specified share if they have not reached the age of majority.

- Disabled dependents . Based on the provisions of paragraph 3 of Art. 10 Federal Law No. 400, persons can be recognized as dependents if they were fully supported by the testator, or received regular assistance from him, which was their main source of livelihood. However, they can be called upon as obligatory heirs only under the combination of the following conditions : recognition of their incapacity for work, which is established on the general basis specified for heirs of the first stage. According to paragraph 4 of Art. 10 Federal Law No. 400, the dependency of minor children of deceased parents does not require proof ;

- being a dependent of the testator for at least a year before the day of his death (Article 1148 of the Civil Code);

- living with the testator for at least a year before the day of his death, if such a person is not included in the circle of heirs by law.

The right to an obligatory share is exercised in the following cases:

- If all inherited property is bequeathed to other persons.

- If part of the property leaving him is less than the established amount of the mandatory share.

Example

Citizen B divorced his wife, left the family and entered into a de facto marital relationship with his friend, M. Due to the fact that B feared for his life, he decided to draw up a will, in which he decided to leave all his property to M. After some time An attempt was made on B, after which he died. As time passed, M decided to formalize hereditary rights and enter into inheritance. However, having visited the notary, she found out that B had two minor children, who, due to their status (according to paragraph 1 of Article 1149 of the Civil Code), have the right to receive a mandatory share in the inheritance equal to half of what they would have claimed when inheriting under law. Thus, M had to share the property left by B with his children.

The obligatory share is not subject hereditary transmission and the right of representation. For any other reasons, the heirs of all subsequent orders cannot claim it.

Protecting the interests of the child during the division of inheritance

The rights of minor children are described above, but the law provides for the protection of the rights of unborn children . In Art. 1116 of the Civil Code of the Russian Federation establishes that children conceived during the life of the testator are also called to inherit.

Art. 1166 of the Civil Code of the Russian Federation directly states that the division of property is possible only after the birth of an unborn heir. are two possible situations here :

- The child was born alive . Then he becomes a subject of law. This is due to the general rules of legal capacity of individuals (clause 2 of Article 17 of the Civil Code of the Russian Federation), which arises at their birth and is valid until their death.

- The heir was stillborn . In this case, the division of property will be made between the heirs who were alive at the time of opening of the inheritance.

If the inherited property was divided before the birth of the child, then Art. 168 of the Civil Code of the Russian Federation, such a transaction is recognized as void (not valid), since it does not comply with the requirements of the law.

Protecting the interests of the testator's disabled dependents

To recognize compulsory heirs as dependents, the following conditions are necessary :

- Disability.

- They must be fully supported by the testator, or receive material assistance from him, which is their main, permanent source of livelihood.

- This situation must remain in place for at least a year before the opening of the inheritance.

disabled :

- Men over 60 years old, women over 55 years old.

- Disabled people of the 1st, 2nd or 3rd degree if there are restrictions on work activity recorded by the state medical and social examination bodies.

- Minors.

Judicial practice in this matter has developed a provision according to which citizens are recognized as dependents . Individual cases of providing financial assistance cannot be the basis for establishing dependency.

Thus, the inheritance becomes a source of material support for dependent citizens on the one hand and does not worsen the social situation in the state , since, in addition to the survivor’s pension, the state may not find additional ways to maintain the financial situation of such citizens.

Nuances of registering a mandatory share

If a mandatory share is allocated at the request of a pensioner, other property inherited for other reasons (for example, by law or by testamentary refusal) will be taken into account in its composition. Such situations arise if the will determines the conditions for inheriting only part of the property.

For example, if the contents of the will indicate only half of the assets of the deceased citizen, the second part will be distributed according to the law. If a pensioner is included in the first stage, he will participate in the distribution of property on an equal basis with the other heirs. If a pensioner submits an application for the allocation of a mandatory share, its composition will include the property received through inheritance by law. It must be taken into account that the renunciation of part of the inheritance distributed by law will also be taken into account when determining the size of the obligatory share.

Thus, based on the rules of part three of the Civil Code of the Russian Federation, only pensioners from the first line of heirs by law will have the right to receive a mandatory share. An exception to this rule is provided only by Article 1148 of the Civil Code of the Russian Federation - if the deceased citizen did not have close or distant relatives, the right to inheritance and compulsory share is acquired by disabled dependents (for example, the common-law wife of the deceased or other citizens who lived together with the testator at the time of his death).

Waiver of the obligatory share of inheritance

The necessary successor has the right to renounce the minimum portion of the inherited property due to him. However, such a refusal can only be unconditional - a directed refusal in favor of any other person from among the legal successors is unacceptable (clause 1 of Article 1158 of the Civil Code). Such a prohibition is due to the specifics of the part of the inherited property allocated to the necessary legal successor, which is directly aimed at material support for the most vulnerable category of successors.

Information

It should be understood that the allocation of the obligatory part of the inheritance is carried out on the basis of the specific qualities - minority or incapacity for work (clause 1 of Article 1149 of the Civil Code). Thus, the transfer of the right to it to other persons due to the refusal of the main necessary successor would contradict the fundamental essence of the necessary share of the inheritance.

When refusing the part of the inheritance allocated to him, the necessary heir must remember that subsequently the refusal cannot be changed or taken back (clause 3 of Article 1157 of the Civil Code). In addition, he must know that:

- Refusal of the obligatory share in the inheritance is carried out according to the general rules provided for in Art. 1157 and Art. 1159 of the Civil Code of the Russian Federation. So, according to paragraph 2 of Art. 1157 of the Civil Code, the necessary successor has the right to renounce the part of the property due to him within the period provided for accepting the inheritance (Article 1154 of the Civil Code).

- The refusal of the due required share must not be in any way motivated or justified by the successor. If the necessary successor is a minor, incompetent or limited in legal capacity, then in order to protect their rights and legitimate interests, such a refusal is permitted only with the prior permission of the guardianship and trusteeship authorities (clause 4 of Article 1157 of the Civil Code).

- Refusal of the obligatory part of the inheritance property is carried out at the place of opening of the inheritance , by submitting an appropriate application by the necessary legal successor (clause 1 of Article 1159 of the Civil Code). If the inheritance case has already been opened with a specific notary, then the specified application is submitted to him.

- The legislator allows 3 ways to submit the specified application for renunciation of part of the inheritance - in person, by mail or through a representative (clause 2 of Article 1159 of the Civil Code). If the application is submitted by mail or through a representative, the signature of the required legal successor must be certified by a notary (paragraph 1, paragraph 2, article 1153 of the Civil Code). In case of refusal through a representative, he must have a power of attorney, which must contain such of his powers, which, however, does not apply to the legal representatives of the heir (clause 3 of Article 1159 of the Civil Code).

The procedure for registering an inheritance for a pensioner

When opening an inheritance case, the notary examines the documents presented to him. If it turns out that the circle of applicants includes a compulsory heir, the specialist is obliged to notify him of the opening of the inheritance.

Procedure:

- Visit to a notary.

- Provision of documents.

- Carrying out property valuation.

- Payment of duty.

- Obtaining a certificate of inheritance rights.

Papers are submitted at the place of registration of the owner. If the heir does not have such information, then the application is submitted at the location of the real estate of the deceased citizen.

The certificate is issued after a six-month period. After which the applicant will only have to register ownership.

Documentation

The heir needs to prepare a basic package of documents, as well as data that confirms the status of a pensioner:

- pension certificate (if receiving a disability pension);

- documents confirming the presence of disability (ITU certificate);

- civil passport (upon reaching old age retirement age).

When submitting documents through a representative, a notarized power of attorney will be required. The notary will make a copy and return the original to the authorized representative.

Expenses

When registering an inheritance, you need to pay a state fee. Its size is determined based on the price of the property and the degree of relationship. If the obligatory heir is a disabled person of groups 1 or 2, then he is exempt from paying the fee.

Thus, payment of the fee is assigned to non-disabled pensioners:

- if a citizen is the parent or spouse of the deceased, then he will pay 0.3% of the value of the inherited property (no more than 100,000 rubles);

- if the heir is a disabled dependent of the owner, but does not have a disability, then he will pay 0.6% of the value of the deceased’s property (no more than 1,000,000 rubles)

Notary services are paid in addition to the basic fee. However, rates differ by region. Details must be obtained from the notary before submitting the application. The maximum rates established for the region can be clarified on the website of the Federal Notary Chamber.

The cost of services of an appraisal organization depends on the type of property. For example, real estate valuation costs about 3,000 rubles. Subsequent registration of ownership of an apartment or house will cost another 2,000 rubles.

Inheritance methods for pensioners

The transfer of inheritance to pensioners is carried out according to law/will. Sometimes citizens accept property for two reasons at the same time. For example, if a person made an order for part of the property.

Receiving an inheritance by law

Inheritance by law occurs in the absence of a will or for property that was not included in the disposal (Article 1141 of the Civil Code of the Russian Federation). The principle of priority applies here. The owner's property goes to his relatives.

A pensioner has the right to a share in the property if he is part of the succession line. The primary right to inheritance is given to the parents, children and spouses of the deceased.

An alternative option for inclusion in the heirs appears for a pensioner if he is a dependent of the deceased. Dependents include disabled citizens who lived together with the owner for at least 1 year and ran a joint household with him.

The dependent's share is no different from the priority heirs' share. The testator's assets are divided equally among the participants. If a pensioner is part of the successor line, then he loses the right to a mandatory share.

You must accept the inheritance within 6 months . The link goes to the date of death of the owner of the property.

If there are no priority applicants, then the property goes to the relatives of the next priority. They submit the papers six months after the death of the testator. At the same time, the inheritance is accepted by the dependents of the deceased citizen.

Receiving an inheritance by will

Inheritance by order significantly changes the general procedure (Article 1118 of the Civil Code of the Russian Federation). The principle of priority does not work here.

The owner has the right to assign the property to close/distant relatives, an enterprise or an authority. He also has the right to exclude family members from inheritance.

Important! When drawing up a will, the notary is obliged to inform the testator about the need to allocate a mandatory share. And also about the possibility of challenging the will in case of refusal to allocate.

The rule applies regardless of the last will of the testator. Mandatory applicants must be mentioned in the order.

If they are not available at the time of execution of the will, then the testator makes the order without additional conditions. If such citizens appear at the time of the death of the property owner, the notary will include them among the legal successors.

Important! Concealing information about the presence of mandatory applicants may lead to the order being declared invalid.

If the testator draws up a closed will, then the owner is responsible for the legality of the document. Since the citizen does not allow the notary to familiarize himself with the text of the order.

When drawing up an order in emergency circumstances, the same principle applies. If the testator did not mention obligatory successors, but they appear on the day of his death, then the notary includes the applicants among the participants.

Rights of a compulsory heir in an inheritance fund

On September 1, 2018, the concept of an inheritance fund was introduced into the Civil Code. This is the rightful recipient of the inherited property. The foundation is registered by a notary at the request of the owner, included in the will.

With its help, a citizen can provide for the procedure for spending his own funds in the event of death. The fund makes payments determined by the owner. For example, for charitable purposes or for the maintenance of minors or disabled relatives of the deceased.

The owner of the property may not allocate a mandatory share for the pensioner in the will, but transfer all property to the inheritance fund and determine the procedure for payments.

In this case, the heir has the following rights:

- If a citizen has the right to an obligatory share and to payments from the inheritance fund, then the right to an obligatory share is lost. The exception is the situation when the recipient waives the rights to receive funds from the inheritance fund. In this case, the right to the obligatory share is renewed. However, an application to renounce the estate fund must be submitted within 6 months of the owner’s death.

- If a citizen refuses the funds from the inheritance fund, the court may reduce the obligatory share. This possibility is provided if the size of the obligatory share is very large.

Large size means an amount that significantly exceeds:

- income level of the heir;

- the amount of debt obligations of the heir;

- amount to ensure the recipient’s standard of living;

- the average amount of expenses before the death of the owner;

- the cost of providing reasonable needs.

What is a mandatory share

The rule on the allocation of the obligatory part is applied in the presence of a will. It protects the rights of disabled and minor legal heirs.

A compulsory share is a part of the property that is due to a certain circle of persons. Moreover, it does not matter how exactly the owner divided the property in the will.

Its minimum amount is ½ of the share of the legitimate applicant. The calculation of the obligatory part is made based on the number of heirs who contact the notary.

Circle of obligatory assignees

Composition of compulsory heirs

| No. | Name of heir category | Comments |

| 1 | Parents, legal spouse of the testator | The basic requirement is loss of ability to work. The right is given to citizens of retirement age and disabled people. |

| 2 | Young children (natural/adopted) | If a child is born out of wedlock, he may have certain difficulties. For example, in a baby’s birth certificate, information about the father’s father is written according to the mother’s words. The applicant will need a court order to establish paternity. |

| 3 | Conceived child | If there are supporting documents, the notary will suspend the issuance of the certificate. The decision is valid until the child is born. The opportunity is provided exclusively for children conceived in an official marriage or who are born within 300 days after the divorce. |

| 4 | Disabled dependents | There are more requirements for such heirs. They must not only lose their ability to work, but also be supported by the testator for at least a year. Sometimes citizens must live with the deceased subject for at least a year before his death. |

The applicants include retirees. These include:

- persons who have reached old age retirement age;

- citizens receiving a disability pension.

If the successor is deprived of legal capacity, then his interests are represented by a guardian or guardianship authority.

Mandatory applicants must submit to the notary papers confirming their relationship with the deceased citizen, the existence of a special status and/or being a dependent of the testator. Otherwise, the procedure for registering an inheritance is no different for them.