So, to register real estate ownership, you need to submit a corresponding application to Rosreestr. It is important to remember that if the mortgage agreement is drawn up in simple written form and is not notarized, then both the mortgagor and the mortgagee submit an application for state registration. If there is a notary verification, only the mortgagor can submit the application.

More details about the procedure

A mortgage agreement is a written agreement between the parties to pledge real estate, while the pledged object remains in use by the mortgagor, but restrictions (encumbrances) are imposed on it until certain conditions are met (for example, until the obligations to the bank under the loan agreement are fully repaid). If there is an encumbrance, the client does not have the right to sell the property or make inseparable improvements (for example, remodel the premises) without written consent from the other party.

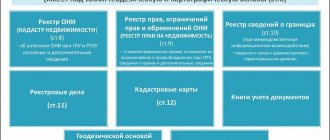

The mortgagee under a mortgage agreement can be a legal entity that provided borrowed finance for the purchase of real estate or an individual when selling a property in installments. The imposition of an encumbrance must be registered in the Unified State Register (USRN), which is an electronic repository of information about all real estate located on the territory of the Russian Federation.

Note! State registration of the transfer of an object as collateral is proof of ownership of property at the state level. Challenging can only be done in court.

State registration of mortgages is recognition by public authorities of the emergence of rights to real estate and the conditions for the transfer or termination of existing rights to the object.

The following basic information is stored in a single register:

- Property owners;

- Technical characteristics of the premises;

- Information about copyright holders;

- Information about the existence of an encumbrance and its reasons.

Required documents

To register a mortgage in Rosreestr you will need to collect documents according to the following list:

- Russian passports from all owners;

- a completed application from the person taking out the mortgage and the lender (it is signed in the presence of an employee from the registering organization);

- mortgage agreement and all annexes thereto;

- contract of sale;

- papers for the property being purchased, certifying the rights of the seller to it;

- cadastral passport for the object;

- appraisal act;

- an extract from the house management confirming that there are no debts on utility bills;

- mortgage and annex to it;

- documentary approval from the guardianship authorities (if one of the owners is a minor citizen);

- notarized consent for the sale of housing from the seller’s spouse;

- receipt of transfer of state duty.

Additionally, a number of certificates may be required, depending on the situation. For example, if you buy an apartment in a new building, the developer must provide:

- share participation agreement;

- act of putting the building into operation;

- technical passport for the house;

- act of transferring living space to the owner;

- paper reflecting the assignment of an index and address to the building.

If housing purchased on the secondary market is subject to registration with Rosreestr, then they usually ask for documents regarding those. the condition of the house and whether any redevelopment was carried out in the apartment.

For your information

How to correctly draw up and fill out an application can be clarified directly from the registration authority. When the owner is an individual, they indicate: initials, date and place of birth, gender, citizenship, passport details, address of actual residence.

Registration procedure

State registration of rights to a property takes place in the following order:

- Collection of a complete package of documentation for this operation.

- Contacting the state body providing the service - Rosreestr, transferring documentation.

- Conducting legal monitoring of the transaction to ensure that all information is filled out correctly.

- Checking the legality of the transfer of rights to the object. Note! The exception is notarized transactions.

- Entering information into the Unified State Register of Real Estate. Note! The rights of the mortgagee can be evidenced by a mortgage signed by both parties to the mortgage agreement.

- Certification of the completed state registration procedure for the transfer of real estate as collateral.

It should be noted! An encumbrance on real estate can be issued not only for the period of validity of the loan agreement with the bank, but also, for example, for the period the buyer fulfills his obligations, i.e. until all funds are transferred when selling real estate in installments.

Filling out an application

The application form for registering a mortgage can be downloaded from the Rosreestr website. The application is submitted in paper or electronic form (if it is signed with an electronic signature).

Main points of the statement:

- information about the mortgaged property;

- transaction amount and value of secured obligations;

- terms of the mortgage and other terms of the contract;

- list of attachments to the application.

The application will need to state a request to register a restriction (encumbrance) on the mortgagor’s right in the form of a mortgage.

For example, the wording may sound like this : a request to register the mortgage of an apartment at the address: Novy Arbat, 14, with cadastral number 456660000000, in connection with the conclusion of loan agreement No. 5678 on the basis of purchase and sale agreement No. 234567 and issue a certificate (name and details of the document) on state registration. The application is signed personally by the borrower.

The application form can be obtained not only on the Rosreestr website, but also in paper form in the departments of territorial authorities.

How does the procedure take place in Rosreestr?

A mortgage can be registered by force of law on the basis of a joint application by the mortgagor (borrower) and the mortgagee (creditor bank).

For a notarized mortgage agreement, state registration can be carried out upon the application of the notary who certified the agreement.

Note! State registration of a mortgage by force of law occurs in cases of purchasing housing in installments or using credit funds.

After monitoring all submitted documents by the registrar and checking the legality of the transaction (for example, if there are children among the owners of the property, it is additionally necessary to provide written consent from the guardianship authorities), the information is recorded in the register and the information is certified by a signature and seal.

Completing the state registration procedure is proof of the emergence of a mortgage.

Why do you need state registration of a transaction when applying for a mortgage loan?

Registration of a mortgage agreement is provided for by the Law “On Mortgage (Pledge of Real Estate)”, Article 20 of the Law, paragraph 2. An entry in the register about an encumbrance in favor of the bank limits the disposal of mortgaged housing .

The borrower cannot sell his apartment or house, pledge it to another bank, or exchange it for other real estate without the consent of the lender. In the event of his sudden death, if his life is not insured, the debt will be transferred to the heir along with the encumbrance.

Another reason for registration is an additional verification of the legal capacity and capacity of the parties to the transaction. Rosreestr checks the age of the borrower and his ability to sign contracts, as well as the real estate itself, which must be free from seizure, pledge and not be the subject of legal disputes.

State registration fee

The state has determined the following total amounts of the state fee for registration and entering the characteristics of the terms of the mortgage agreement:

- parties to the agreement - individuals

: 1,000 rubles; - parties to the agreement - legal entities

: 4,000 rubles; - parties to the agreement - individuals and legal entities

: 1,000 rubles.

Note! By virtue of the law, no state fee is charged for completing the procedure.

The details that will be needed to pay the state duty can be clarified on the official website of Rosreestr by selecting a specific region.

Note! When individuals interact electronically with Rosreestr, there is a 30% discount on registration of rights.

What to do after receiving documents from Rosreestr?

If the owner plans to live in the purchased apartment, then after registering the mortgage and receiving documents from Rosreestr, the citizen must visit the following institutions:

- Cash Settlement Center (CSC). With the existing title documents for housing, they contact the center in order to re-register a personal account for housing and communal services in their name. To do this, write a corresponding statement. After completing this procedure, do not forget to take an extract. This is in case the new owner is incorrectly charged payments or a debt arises. Then there will be something to prove that at the time of purchasing the apartment there were no debts on housing and communal services.

- Passport Office . Based on the norms of the Decree of the Government of the Russian Federation of August 15. 2014 No. 809 “On amendments to the Decree of the Government of the Russian Federation of July 17, 1995 No. 713”, after being discharged from the old living space, a citizen is required to register at a new residence address within 7 days. To do this, you can personally visit the migration service office or use the mail, the State Services portal, or the MFC. Confirmation of rights to residential real estate will be an extract from the Unified State Register of Real Estate (in accordance with Federal Law 218).

- Management company . Here it is necessary to conclude an agreement according to which the maintenance of the living space will be carried out. If at a general building meeting it was decided that residents independently settle payments with suppliers of water, gas and electricity, then it is necessary to conclude agreements with Oblenergo, Vodokanal and Gorgaz.

- Telephone company . If you need a landline phone after registering a mortgage with Rosreestr, contact the nearest branch specializing in telephony to arrange an access point. If the apartment has it, then all that remains is to take information about the former owner from the RCC and present it to the operator. Then the telephone line will be re-registered in the name of the new tenant.

It should be noted that the extract received during electronic registration of housing does not need to be presented to government agencies to receive any services. If necessary, they themselves can make a request to the Rostreestr (Clause 1, Article 7 of the Federal Law “On the organization of the provision of state and municipal services”).

What is required to register a mortgage?

To register the transfer of the transaction object as collateral, the following documents must be submitted to Rosreestr:

- statement;

- passports and notarized powers of attorney (if necessary);

- mortgage agreement;

- report on the assessment of real estate;

- technical documentation;

- confirmation of payment of the state fee in the required amount.

- If the rights of the mortgagee are certified through the registration of a mortgage, then the mortgage and the documents and attachments specified in it are additionally provided for state registration.

Note! Rosreestr has the right to require additional documentation to confirm the legality of the transaction, for example, notarized consent of the spouse.

Documents are submitted for review to the territorial division of Rosreestr, through electronic registration services or multifunctional centers.

Algorithm of actions

In Rosreestr

- Collect the necessary package of documents (you can find out what documents the borrower must bring for state registration of the mortgage, as well as what package of papers and certificates are required to obtain bank approval, here).

- Fill out the application form and pay the state fee.

- Submit documents to the nearest branch of Rosreestr.

- Receive a registered contract within 5-14 days. If an application to Rosreestr is submitted by a notary (if the contract is notarized), then the borrower may not take part in the procedure at all - everything will be done independently and in a short time - up to 5 days.

At the MFC

- Pay the state fee (you can do it at the terminals on the territory of the MFC).

- Submit an application and documents (copies can be made free of charge at the MFC).

- Receive a registered agreement within 7-30 days.

If you pre-pay the fee at Rosreestr, and then apply with the documents to the MFC, you will have to pay it again, since the documentation will not be accepted.

The details of Rosreestr can be found on the website of this organization , and the MFC can be asked from the employees of this department, since not every center has its own website.

Features of mortgage registration

For the convenience of clients, credit institutions offer additional services that allow you to register a mortgage without visiting the MFC and the registration chamber

In Sberbank

. PJSC Sberbank offers an online registration service on the official mortgage portal Domklik.

How the mortgage registration procedure is carried out:

- a mortgage manager or a specially appointed bank employee collects a package of documents and sends it to government authorities electronically;

- When Rosreestr registrars accept the documentation, the state registration procedure begins.

- The purchase and sale agreement and an extract from the state register indicating the owner and the presence of an encumbrance on the property is sent to the client’s email (certified by an enhanced qualified signature that has legal force). The received extract is valid indefinitely.

Something to keep in mind! Since July 15, 2021, certificates of ownership have not been issued, and the USRN extract fully confirms the rights of the owners.

Note! For Sberbank borrowers, an additional bonus of using this service is a reduction in the interest rate on the current mortgage agreement.

More details about the Sberbank service:

In other banks. The borrower collects a package of documentation to complete the procedure, then, independently or with the help of bank employees, transfers it to Rosreestr in person, through the MFC or remotely (the option of registering the service through the State Services service is available).

Stages of registering ownership of an apartment

The procedure for registering property rights is divided into several stages:

- Submitting the necessary documents to Rosreestr and checking their compliance with certain requirements.

- Conducting legal due diligence of the transaction.

- Making a decision to satisfy the request.

- Entering information into the Electronic Register of Property Owners.

- Registration of an extract from the Unified State Register of Real Estate.

The entire registration process, from submitting the application to signing the statement, may take from 5 to 10 business days.

Refusal of registration

Sometimes situations may arise when the procedure is temporarily suspended.

Possible reasons:

- an incomplete package of documents or significant errors were made when preparing them (for example, in information about the client’s identity);

- inaccurate data was found in the documentation provided;

- there is no additional mandatory documentation (for example, spouse’s consent);

- the object was seized;

- there are legal proceedings regarding the rights to the property in question;

- the registrar has not received data through interdepartmental channels (for example, from the Federal Tax Service of Russia), etc.

Legal basis

The fundamental document regulating the procedure for registering rights to a real estate property is the Federal Law of July 16, 1998 No. 102 “On Mortgage” and the Federal Law of July 13, 2015 No. 218 “On State Registration of Real Estate”. In addition, the fundamentals are enshrined in the following regulations:

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

- Article 131 of the Civil Code of the Russian Federation;

- Part 1 of the Tax Code of July 31, 1998 No. 146-FZ;

- Federal Law No. 214 dated December 30, 2004;

- Federal Law of July 16, 1998 No. 102 “On Mortgages”;

- Order of the Ministry of Economic Development of the Russian Federation dated December 8, 2015 No. 920.

Registration refusal

A mortgage is a responsible matter consisting of several stages. Rosreestr has the right to refuse to re-register property if certain circumstances are identified:

- The documents are not presented in full. In this case, it is enough to bring the necessary papers and contact the Rosreestr office again.

- Some of the submitted documents are incorrect or have expired. When doubts arise, the authority has the right to send requests for verification to other authorities. If there are errors, the papers are reissued taking into account the identified violations.

- Problems with paying the fee (incorrect payment amount or errors in the details). When several co-owners appear in a transaction, the amount of the duty is divided among all in equal proportions. When paying the fee by an authorized person, a power of attorney will be required.

- Refusal from the previous owner, who changed his mind about selling the property at the re-registration stage. Such options rarely occur, and if signs of fraud are detected, the issue of re-registration of property is referred to the court. The costs of the trial are paid by the party of the defendant accused of fraud.

- The seller of the apartment died after signing the contract, without having time to re-register the documents for the property.

- Tax deduction when buying an apartment with a mortgage

A mortgage transaction is registered according to the same rules as a regular purchase and sale, with the exception of some documents confirming the fact of the purchase with partial borrowings. In addition, the statements issued to the buyer must establish the fact of an encumbrance that arises automatically after the mortgage is documented.

© 2021 zakon-dostupno.ru

- Related Posts

- Life and health insurance for a mortgage: conditions and consequences of refusal

- Tax deduction when buying an apartment with a mortgage

- Will they give you a mortgage if you have a loan: what do they pay attention to?