Since mid-October 2021, a preferential tax regime for the self-employed, better known as the professional income tax, has been in effect throughout the country (Federal Law No. 422-FZ of November 27, 2018). On October 19, the last region, the Republic of Ingushetia, joined the experiment. Now anyone can take part in it.

Professional income to the income of individuals from activities in which they do not have an employer and do not attract employees under employment contracts, as well as income from the use of property.

In this article we will consider the following questions:

- Who can switch to a special tax regime

- What restrictions apply to the use of the special regime?

- What is recognized as the place of business of a self-employed person?

- What taxes are self-employed people exempt from?

- Registering a self-employed person

- Deregistration of a self-employed person

- Object of taxation for the self-employed

- The procedure for recognizing income for the self-employed

- Tax base and tax period

- Tax rate for self-employed

- Penalty for self-employed

- How to switch to professional income tax from other special regimes

- Official clarifications on the application of tax for self-employed people

- Tax deduction for self-employed

- Self-employed 2021: what will change

Who can switch to a special tax regime

This can be done by individuals and individual entrepreneurs who operate in Russia. Also, some foreign citizens have the right to become self-employed, namely citizens of Belarus, Armenia, Kazakhstan and Kyrgyzstan. They can apply the tax regime under the same conditions as Russian citizens.

By choosing a special regime for the self-employed, you can engage in those types of activities, income from which is subject to professional income tax, but without the need to register as an individual entrepreneur.

These activities include:

- provision of cosmetic services at home;

- photo and video shooting to order;

- sales of own-produced products;

- holding events and holidays;

- legal advice and accounting;

- remote work through electronic platforms;

- renting out an apartment daily or long term;

- passenger and cargo transportation services;

- construction work and renovation of premises.

Forms of entrepreneurial activity

Today, the following legal forms of entrepreneurship are distinguished in Russia:

- Production activities. This concept implies that an entrepreneur, through the use of tools and labor factors, produces a certain list of products, spiritual and cultural values, consumer goods, etc. Today, production types of entrepreneurship are considered the most risky, since despite the fact that significant changes have occurred market economy and the legislative order itself has changed, comfortable conditions for such activities are not provided.

- Commercial activity. This type of entrepreneurship covers numerous types of activities that are aimed primarily at exchanging produced goods and services for money. In other words, these are forms of business that are implemented through the opening of shops, boutiques, trading houses and bases, commercial shops, etc. in Russia.

- Financial and credit activities. These forms of entrepreneurship are among the most specific. This is due to the fact that subjects of legal relations (entrepreneurs) offer their consumers cash, securities, and other values that can be expressed in monetary terms as an object of purchase and sale. The procedure for carrying out transactions in this case is very simple: the entrepreneur purchases an item of trade (cash or valuables) from its owner for one amount, and provides it to his consumers for an inflated price.

- Mediation activities. In this case, we are talking about a form of entrepreneurship in which the business owner does not produce or sell products or services independently. He only acts as an intermediary - a link between the seller and the buyer. These intermediaries can be the following legal entities: brokers, dealers, commercial banks, credit organizations, etc.

- Insurance activities. In this case, entrepreneurship is aimed at the fact that for a certain fee received from the policyholder, the owner of the company guarantees financial payments, the forms and amounts of which are fixed in the contract, in the event of an insured event.

What restrictions apply to the use of the special regime?

Self-employed people should not have an employer or employees. This category includes citizens who receive income from their personal work activities.

The maximum income should not exceed 2.4 million rubles. per year, that is, 200,000 rubles. per month, if you distribute this limit by month (although the amount of income per month can vary up or down, the main thing is that the total amount for the year does not exceed 2.4 million rubles).

Those who sell excisable goods, such as alcohol or gasoline, cannot take advantage of the special regime. It also cannot be used:

- to persons engaged in the resale of goods, property rights, with the exception of the sale of property used by them for personal, household and (or) other similar needs;

- persons engaged in the extraction and (or) sale of mineral resources;

- persons who have employees with whom they have an employment relationship;

- persons carrying out business activities in the interests of another person on the basis of agency agreements, commission agreements or agency agreements, with the exception of persons providing services for the delivery of goods and acceptance (transfer) of payments for the specified goods (works, services) in the interests of other persons;

- persons applying other taxation regimes provided for in Part 1 of the Tax Code of the Russian Federation, or carrying out business activities, income from which is subject to personal income tax, with the exception of cases of application of other taxation regimes and calculation of personal income tax on income from business activities before the transition to the specified special tax regime.

What types of entrepreneurship are allowed in the Russian Federation

Different:

- production;

- services;

- retail and wholesale trade;

- finance;

- insurance, etc.

In addition to “external industry” characteristics, types of business are divided into those that require special permits (licenses) and simple ones, where a license is not needed.

It is important to understand: individual entrepreneurial activity of a citizen (IP) as a form of government registration is not always suitable for a specific type of production, trade, etc. There are also areas that are only available to organizations. For example, the production and sale of strong alcohol.

Where can I find out more specifically? In our country, there is an All-Russian Classifier of Types of Economic Activities (OKVED) - a list of all existing works and services, designated by special codes.

What is recognized as the place of business of a self-employed person?

This is the location of the taxpayer when carrying out activities. An individual notifies the tax office of the place of business when switching to the use of a special regime.

What rules apply in this case:

- if a self-employed person operates in the territories of several constituent entities of the Russian Federation, then he has the right to independently choose the subject in whose territory he conducts activities;

- the place of business can be changed only once per calendar year;

- if a self-employed person ceases to operate on the territory of the selected entity, then for the purposes of applying the special regime, he selects another entity included in the experiment, on the territory of which he operates, no later than the end of the month following the month of such termination;

- when changing the place of business, an individual is considered to be operating in the territory of another entity starting from the month in which he chose this entity.

What taxes are self-employed people exempt from?

- Individual: from personal income tax, in relation to income that is subject to taxation on professional income tax;

- Individual entrepreneurs applying a special tax regime: from personal income tax on income that is subject to tax on professional income, from VAT (exception: VAT payable when importing goods into the territory of the Russian Federation and other territories under its jurisdiction), from fixed insurance premiums (however in other special regimes, insurance premiums are paid even in the absence of income).

If there is no income during the tax period, then there are no mandatory or fixed payments. At the same time, self-employed people participate in the compulsory health insurance system, so they can count on free medical care.

Online accounting for self-employed entrepreneurs who do not understand accounting. Beginning entrepreneurs get a year as a gift!

Try for free

Registering a self-employed person

Those who wish to take advantage of the special tax regime will need to register as an occupational income tax payer.

This can be done in a matter of minutes using several tools: a special mobile application “My Tax”; taxpayer’s account “Professional Income Tax” on the Federal Tax Service website; on the State Services portal.

However, the easiest way is to use the “My Tax” mobile application.

How the My Tax app works for self-employed people

The registration algorithm includes the following steps:

1. Sending a set of necessary documents to the tax office:

- applications for registration;

- copies of the passport and photograph of the individual (not required if a citizen of the Russian Federation has access to the taxpayer’s personal account on the Federal Tax Service website or the State Services portal).

An application, a copy of a passport, and a photograph of an individual are generated using the “My Tax” mobile application (can be downloaded from Google Play and the App Store), and this does not require an enhanced qualified electronic signature.

2. Notification from the tax authority is received through the “My Tax” mobile application - no later than the day following the day the application is sent.

The tax office has the right to refuse registration if contradictions or inconsistencies are identified between the submitted documents and the information available to the tax authority (in this case, the tax office indicates the contradictions and offers to resubmit the documents).

The date of registration of an individual as a taxpayer is the date of sending the corresponding application to the tax authority.

Foreigners can also register through the “My Tax” mobile application, but only using a TIN. Registration using a passport will not be available.

At what point does a citizen become an entrepreneur?

General rule: a citizen has the right to engage in business from the moment of registration with the Tax Service (Article 23.1 of the Civil Code of the Russian Federation).

Submission of documents is available both in traditional paper and electronic format, for example, on the Federal Tax Service website:

- choose an OKVED code and taxation system;

- fill out an application;

- pay the state fee;

- submit documents (they must be reviewed within 3 working days);

- a citizen is recognized as an entrepreneur from the moment the Federal Tax Service makes a decision to register an individual entrepreneur.

Deregistration of a self-employed person

Deregistration is possible for two reasons:

- if an individual refuses to apply the special regime;

- if an individual ceases to meet the requirements of Part 2 of Art. 4 of Federal Law No. 422-FZ of November 27, 2018, that is, it falls into the list of those who are not entitled to apply a special tax regime. In this case, the tax office removes the taxpayer from the register on its own initiative, without an application, and notifies him about this through the “My Tax” application.

In the event that an individual refuses to apply the special regime, a statement is required from him. The date of deregistration is the date the application for deregistration is sent to the tax authority. The tax office also warns about deregistration through the “My Tax” application - no later than the day following the day the taxpayer sends the corresponding application.

After deregistration with the tax office, an individual has the right to re-register in the absence of tax arrears, arrears of penalties and tax fines.

Aspects of entrepreneurial activity of a citizen

Today, modern legislation provides for both the legal capacity of a citizen to open his own business and the obligations that a business entity must fulfill. In particular, we are talking about the following aspects of such activities:

- If a citizen carries out transactions, but at the same time violates the legislation of the Russian Federation, namely Art. 23 of the Civil Code of the Russian Federation, then he does not have the right to refer to the fact that he is not an entrepreneur. Regulation of business activities in such situations implies that the judicial authority has the full legal right to apply to the implementation of such transactions all the obligations that business entails.

- A citizen who has completed the state registration procedure for his individual business undertakes to register with the Federal Tax Service within 10 days. If entrepreneurship is carried out simultaneously in several localities, then this period increases to 1 month. The regulation of this process is prescribed in the Tax Code of the Russian Federation, namely, Art. 38, 3 paragraph.

- A citizen engaged in entrepreneurial activity must make timely payment of tax costs after filing a declaration with the Federal Tax Service.

- The citizen-entrepreneur undertakes to register, in addition to the tax office, with the Pension and Medical Funds, as well as the Social Insurance Fund.

The aspects we have listed are key conditions for legitimizing a newly-minted entrepreneur’s activities aimed at making a profit.

Object of taxation for the self-employed

The object of taxation means income from the sale of goods (work, services, property rights).

At the same time, there is a whole list of income that is not recognized as an object of taxation:

- received within the framework of labor relations;

- from the sale of real estate, vehicles;

- from the transfer of property rights to real estate (with the exception of rental (hiring) of residential premises);

- state and municipal employees, with the exception of income from leasing (renting) residential premises;

- from the sale of property used by taxpayers for personal, household and (or) other similar needs;

- from the sale of shares in the authorized (share) capital of organizations, shares in mutual funds of cooperatives and mutual investment funds, securities and derivative financial instruments;

- from conducting activities within the framework of a simple partnership agreement (joint activity agreement) or a property trust management agreement;

- from the provision (performance) of services (work) by individuals under civil contracts, provided that the customers of the services (work) are the employers of these individuals or persons who were their employers less than two years ago;

- from the activities specified in paragraph 70 of Art. 217 of the Tax Code of the Russian Federation, received by persons registered with the tax authority in accordance with clause 7 of Art. 83 Tax Code of the Russian Federation;

- from the assignment (assignment) of rights of claim;

- in kind;

- from arbitration management, from the activities of a mediator, appraisal activities, the activities of a notary engaged in private practice, and advocacy.

The procedure for state registration of an individual entrepreneur

Business activity will be considered legal and legitimate if the state registration procedure is carried out. At the same time, the state registration of entrepreneurship is given the character of a generally obligatory process, but not for the purpose of total control over the commercial activities of citizens, but for carrying out the initial registration of organizations.

Regulation of state registration of business activities is carried out on the basis of Federal Law No. 129. It should be noted that the procedure for registering individual entrepreneurs is practically no different from the procedure for legitimizing legal entities. Thus, the registration procedure implies compliance with specific stages:

- An individual who wishes to register his or her business must provide the Federal Tax Service of Russia with a complete package of documents, a list of which can be obtained from the tax office.

- Based on the received data and documents, new information about the formation of an organization engaged in entrepreneurial activity is entered into the Unified State Register of Individual Entrepreneurs. This process is regulated by Federal Law No. 129-FZ.

- After state registration is completed, the tax authority provides all the necessary information to government agencies, local self-government bodies, or extra-budgetary funds.

At the same time, the legislator established clear time limits for the registration of an entrepreneur. The Federal Tax Service must make all necessary decisions and send documentation to the responsible departments within a period not exceeding 5 working days from the date of receipt of all documentation.

The procedure for recognizing income for the self-employed

The date of receipt of income from the sale of goods or services is the date of receipt of the corresponding funds or the date of receipt of funds into the taxpayer’s bank accounts or, on his behalf, into the accounts of third parties.

When a taxpayer sells goods or services on the basis of agency agreements, commission agreements or agency agreements with the participation of an intermediary in the calculations, income is considered received by the taxpayer on the last day of the month the intermediary receives funds.

Individual entrepreneurs who previously applied other special regimes do not recognize as income when calculating tax income from the sale of goods or services, payment (partial payment) for which was made after the transition to a special tax regime for the self-employed, if the specified income is subject to accounting for taxation in in accordance with other special tax regimes in the period before the transition to tax payment.

Tax base and tax period

The tax base is the monetary expression of income received from the sale of goods or services, which is subject to taxation. It is determined separately by type of income, for which different tax rates are established.

In order to determine the tax base, income is taken into account on an accrual basis from the beginning of the tax period.

If the taxpayer returns amounts previously received as payment (advance payment) for goods or services, the income of the tax period in which the income was received is reduced by the amount of the refund.

A taxpayer may correct previously submitted information about the amount of settlements that lead to an overstatement of tax amounts in the following cases:

- if a refund is made of funds received as payment (advance payment) for goods or services;

- if the information is entered incorrectly.

The amount of overpaid tax is subject to offset against the taxpayer's upcoming payments, repayment of arrears, arrears of penalties and fines for tax offenses only for professional income tax or is subject to refund in the manner prescribed by Art. 78 Tax Code of the Russian Federation.

The tax period is a calendar month.

Tax rate for self-employed

A self-employed person pays 4% in respect of income received from the sale of goods or services to individuals, and 6% in respect of income received from the sale of goods or services to individual entrepreneurs (for use in conducting business activities) and legal entities.

Officials guaranteed that conditions would not worsen for 10 years. “No changes can be made that worsen the payer’s situation, either from the point of view of the rate or from the point of view of the level of income,” said Chairman of the Committee on Budget and Taxes Andrei Makarov, co-author of the law on the self-employed.

Algorithm for calculating and paying tax on professional income

No later than the 12th day of the month following the expired tax period, the tax office sends a notification to the self-employed person through the “My Tax” application about the amount of tax that needs to be paid. The notice already contains the details necessary for payment.

Tax payment is made:

- no later than the 25th day of the month following the expired tax period;

- at the place of business.

There is no need to submit a tax return.

If a self-employed person does not meet the deadline, the tax office, no later than 10 calendar days from the date of expiration of the tax payment deadline, sends him demands for tax payment, as well as information about measures to collect the tax.

The tax amount is calculated as a percentage share of the tax base corresponding to the tax rate, and when different rates are applied - as the amount obtained by adding the amounts of taxes calculated separately as percentage shares of the corresponding tax bases corresponding to the tax rates, taking into account the reduction of the corresponding tax amount by the amount of the tax deduction .

If the amount of tax that must be paid at the end of the tax period does not reach 100 rubles, then this amount is added to the amount of tax payable at the end of the next tax period.

The taxpayer can set up the tax payment process so that the required amount is debited from the bank account. To do this, in the mobile application you need to provide the tax authority with the right to send relevant instructions to the bank.

Entrepreneurial activity without forming a legal entity

Individual entrepreneurship is a more popular form of registration among ordinary citizens than other forms. Therefore, entrepreneurial activity without the formation of a legal entity requires additional consecration.

The main advantage of such activities is that a commercial organization is a fairly flexible and mobile structure.

Individual entrepreneurs operate within narrow areas of activity, so they can respond very quickly to all changes, adapting to new economic conditions.

In addition, entrepreneurial activity of citizens without the formation of a legal entity has a number of other advantages that increase its popularity. In particular, such an organization has the opportunity to provide more simplified reporting to the authorized bodies on its financial activities and profits received.

If we analyze the legal literature, then in addition to the above advantages, we can also highlight the following advantages:

- the process of creating and liquidating a business has been simplified several times;

- The owner of the organization can use the proceeds received from business activities at his own discretion;

- individual entrepreneurs are exempt from paying property tax, within the framework of which their activities are carried out;

- decisions within the framework of individual entrepreneurs are made much easier, since a meeting of shareholders, shareholders, etc. is not required.

Despite significant advantages, this form of entrepreneurship also has significant disadvantages, which are embodied in the fact that:

- In case of failure to fulfill obligations, an entrepreneur is liable with his real or movable property.

- Entities are limited by law in their rights to obtain certain types of licenses.

- It is almost impossible to get a lucrative contract with a large company, since organizations refuse to cooperate with individual entrepreneurs.

- Maintaining an individual entrepreneur requires constant participation from the owner. There is no provision for the appointment of a managing director.

Entrepreneurial activity is one of the most important areas that allows the Russian economy to develop progressively and stably.

Author of the article

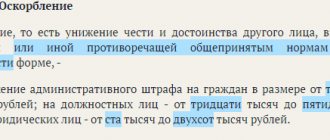

Penalty for self-employed

With all the privileges and benefits, the self-employed need to prepare for fines in case of failure to pay tax on professional income. It is assumed that the amount of the fine will be the amount of income that the self-employed person receives.

The fine is provided only for those who registered as self-employed, but violated the conditions for issuing a check.

As part of the pilot project, for violation of the procedure or deadlines for the generation of fiscal checks during settlements, a fine of 20% of the amount for which the check was not issued will be charged. Repeated violation within 6 months involves a fine in the amount of the entire settlement amount for which a check has not been generated.

In 2021, the Federal Tax Service expressed its readiness not to apply sanctions against the self-employed in the first year of the experiment.

How to switch to professional income tax from other special regimes

Explanations on this issue are given in the Letter of the Federal Tax Service dated December 26, 2018 No. SD-4-3/ [email protected]

Individual entrepreneurs using the simplified tax system, unified agricultural tax, and UTII can switch to paying tax for the self-employed by notifying the tax office within a month from the date of registration as a payer of this tax.

You can switch to the above special regimes if you lose the right to apply tax on professional income. To do this, you need to notify the tax office within 20 calendar days from the date of deregistration as a payer of this tax.

Official clarifications on the application of tax for self-employed people

State Duma deputy Andrei Makarov emphasizes that “the law provides a right, but does not impose obligations.” It “does not establish any additional tax audits or the possibility of catching anyone for tax evasion.” The existence of this law provides people with a convenient opportunity to fulfill their constitutional obligation to pay taxes and fees.

On the official website of the State Duma, Andrei Makarov gave explanations on numerous questions that come from citizens.

Are those who provide one-time assistance considered self-employed?

Do not apply. The fact of regular provision of services is fundamental: for example, you help people dig up their gardens and make money from it. However, if you once helped a neighbor dig up a garden, this will not be considered the provision of services.

Can an individual entrepreneur re-register as self-employed?

Maybe if he considers that this mode is more profitable for him. But the main goal of the law on self-employed people is to allow people who are not yet registered to leave the “gray zone”.

Will self-employed people be able to obtain income certificates to purchase government guarantees and benefits?

They can, like any citizen.

Where will the tax money go?

They will go to the regional budget at the location of the activity. Regions will be able to distribute them and send part of the income to municipalities.

“And this is very important for the regions. Because today the regions make payments to the Compulsory Health Insurance Fund for the non-working population. As soon as a person leaves the “gray” zone, 1.5% of the tax he paid will be credited to the Compulsory Medical Insurance Fund, and the region will no longer pay for it to the Compulsory Medical Insurance Fund,” notes Andrei Makarov.

Where should a self-employed person register if he operates in several regions?

He can choose the region most convenient for him to register. You do not need to register in all regions.

Explanations on this issue are also given in the Letter of the Federal Tax Service of the Russian Federation dated February 21, 2019 No. SD-4-3/ [email protected]

The designer works with foreign stock platforms. Does he fall under the self-employed law?

This type of business activity will also be subject to the new tax regime. The fact of performing work or providing services in favor of a foreign person does not matter for the purposes of calculating and paying income taxes, since the object of taxation is income from sales.

Depending on the characteristics of the final buyer of goods (works, services), taxpayers of the professional tax will be required to apply one or another tax rate (4% for sales to individuals and 6% for sales by organizations or individual entrepreneurs).

It should be noted that taxpayers of professional income tax when selling goods (works, services) using intermediary mechanisms should pay special attention to identifying the final buyer.

Hayk Safaryan Partner, Tax Practice, CMS, Russia

A benefit is provided for companies purchasing goods from self-employed people. How will it work?

The law provides that payments by organizations or individual entrepreneurs to individuals who are taxpayers of professional income tax for goods, works, and services sold, taken into account in the tax base, are not recognized as subject to insurance contributions.

Thus, corporate taxpayers will have the opportunity to reduce the base for taxation of insurance premiums when purchasing goods (works, services) from self-employed people.

Hayk Safaryan Partner, Tax Practice, CMS, Russia

Article 23 of the Civil Code of the Russian Federation. Entrepreneurial activity of a citizen (current version)

1. One of the important rights of a citizen included in the content of his legal capacity is the right to engage in entrepreneurial activity, which is understood as independent activity carried out at one’s own risk, aimed at systematically obtaining profit from the use of property, sale of goods, performance of work or provision of services ( see commentary to article 2).

Paragraph 1 of the commented article establishes that a citizen can engage in entrepreneurial activity without forming a legal entity, i.e. as an individual entrepreneur, from the moment of state registration in this capacity. The procedure for carrying out this registration is established by Federal Law of August 8, 2001 N 129-FZ (as amended on December 31, 2017) “On State Registration of Legal Entities and Individual Entrepreneurs”

According to Art. 4 of this Law, state registers are maintained in the Russian Federation, containing, respectively, information on the creation, reorganization and liquidation of legal entities, the acquisition by individuals of the status of individual entrepreneurs, the termination by individuals of activities as individual entrepreneurs, other information about legal entities, individual entrepreneurs and relevant documents .

As explained in paragraph 13 of the Resolution of the Plenum of the Armed Forces of Russia and the Plenum of the Supreme Arbitration Court of Russia dated July 1, 1996 N 6/8, “disputes between citizens registered as individual entrepreneurs, as well as between these citizens and legal entities, are resolved by arbitration courts, with the exception of disputes not related to the implementation of entrepreneurial activities by citizens.

Considering that a citizen engaged in entrepreneurial activity, but who has not passed state registration as an individual entrepreneur, does not acquire the status of an entrepreneur in connection with this activity, disputes involving such persons, incl. related to their business activities are subject to the jurisdiction of a court of general jurisdiction.

When resolving such disputes, the provisions of the Code on obligations related to the implementation of entrepreneurial activities may be applied (clause 4 of Article 23).

From the moment of termination of the state registration of a citizen as an individual entrepreneur, in particular, in connection with the expiration of the certificate of state registration, cancellation of state registration, etc., cases involving these citizens, incl. and related to their previously carried out business activities, are subject to the jurisdiction of courts of general jurisdiction, except for cases where such cases were accepted for proceedings by an arbitration court in compliance with the rules on jurisdiction before the occurrence of the above circumstances.”

In some cases, directly provided for by law, it is possible to engage in entrepreneurial activity without state registration.

2. According to paragraph 3 of Art. 23 of the Civil Code of the Russian Federation, the rules of the Civil Code of the Russian Federation, which regulate the activities of legal entities that are commercial organizations, apply to entrepreneurial activities of citizens carried out without forming a legal entity. However, this norm is of a dispositive nature and something else may follow from the law, other legal acts or the essence of the legal relationship.

In particular, all rules governing the commercial activities of legal entities are applicable to the activities of individual entrepreneurs, except for those that are determined by the essence of the legal relationship, the specifics of a particular legal entity, and also in cases where, in relation to individual entrepreneurs, the law or other legal act does not provide otherwise . For example, the rules on liquidation of legal entities are not applicable to individual entrepreneurs. The Supreme Arbitration Court of the Russian Federation, in information letter No. 50 dated January 13, 2000, explained that the provisions of the Civil Code on the liquidation of legal entities are not applicable to individual entrepreneurs due to the peculiarities of their legal status.

3. From clause 4 of the commented article it follows that a citizen who carries out entrepreneurial activities without forming a legal entity in violation of the requirements of clause 1 of the commented article on state registration as an individual entrepreneur does not have the right to refer in relation to the transactions concluded by him to the fact that he is not an entrepreneur.

The court may, for example, in relation to such transactions, apply the rules governing business activities, in particular the rule on increased liability (regardless of guilt) in business relations for failure to fulfill or improper fulfillment of one’s obligations (see commentary to paragraph 3 of Article 401). The Law on the Protection of Consumer Rights imposes on an unregistered individual entrepreneur, as well as on a commercial organization, a number of additional responsibilities to inform consumers, ensure the safety of goods for life and health in the case of the sale of goods, performance of work and services, etc.

4. Peasant (farm) farming (peasant farming) is a special form of management inherent in agricultural production and rural way of life.

In relation to peasant (farm) households, the legislator provided two models of existence. As before, any individual has the right to engage in production or other economic activities in the field of agriculture without forming a legal entity on the basis of an agreement on the creation of a peasant (farm) enterprise, concluded in accordance with the Law on Peasant (Farm) Economy. In such cases, the head of a peasant (farm) enterprise may be a citizen registered as an individual entrepreneur. This is exactly what is discussed in paragraph 5 of the commented article.

The law discussed above is the Federal Law of June 11, 2003 N 74-FZ “On Peasant (Farm) Farming”. From the date of entry into force of the Law, the previously valid Law of the RSFSR dated November 22, 1990 “On Peasant (Farming) Economy” became invalid.

A farm can be created by one citizen (Clause 2, Article 1 of the Federal Law “On Peasant (Farm) Farming”). Then the property of the farm is the individual property of this citizen.

The property of a peasant (farm) enterprise is not all the property of the members of the enterprise, but only that property that is necessary for the implementation of its activities.

At the same time, Art. 86.1 (see commentary to it), according to which citizens conducting joint activities in the field of agriculture without forming a legal entity on the basis of an agreement on the creation of a peasant (farm) enterprise (Article 23) have the right to create a legal entity - a peasant (farm) enterprise.

It should be borne in mind that the previously in force Law of the RSFSR dated November 22, 1990 “On Peasant (Farm) Economy” allowed for the creation of a peasant (farm) economy by an independent economic entity with the rights of a legal entity, represented by an individual citizen, family or group of persons engaged in production, processing and sale of agricultural products.

A considerable number of peasant (farm) farms were created on the basis of this Law. In this regard, in paragraph 7 of Art. 2 transitional provisions of the Federal Law dated December 30, 2012 N 302-FZ “On amendments to Chapters 1, 2, 3 and 4 of Part 1 of the Civil Code of the Russian Federation” it was said that “from the date of official publication of this Federal Law to peasant (farm) farms that were created as legal entities in accordance with the Law of the RSFSR of November 22, 1990 N 348-1 “On Peasant (Farm) Farming”, are subject to the application of the rules of Article 86.1 of the Civil Code of the Russian Federation (as amended by this Federal Law). Re-registration of previously created peasant (farm) enterprises in connection with the entry into force of this Federal Law is not required.

Comment source:

“CIVIL CODE OF THE RUSSIAN FEDERATION. PART ONE. ARTICLE-BY-ARTICLE COMMENT"

S.P. Grishaev, T.V. Bogacheva, Yu.P. Sweet, 2019

Tax deduction for self-employed

Payers of professional income tax have the right to reduce the amount of tax by the amount of tax deduction in the amount of no more than 10,000 rubles, calculated on an accrual basis.

The amount of tax deduction by which the tax amount can be reduced is determined:

- in relation to the tax calculated at the tax rate specified in paragraph 1 of Art. 10 of the Law on Self-Employed Persons, the amount of tax deduction is determined as corresponding to a tax rate of 1% of income;

- in relation to the tax calculated at the tax rate specified in paragraph 2 of Art. 10 of the Law on Self-Employed Persons, the amount of tax deduction is determined as corresponding to a tax rate of 2% of income.

Reducing the amount of tax by the amount of the tax deduction is carried out by the tax authority independently.

Self-employed 2021: what will change

In addition to the fact that now all regions are participating in the experiment, from July 1, 2021, it has become possible to obtain self-employed status from the age of 16.

Tax capital for self-employed people under 18 years of age

For young self-employed people, the issue of an additional tax deduction in the amount of 12,130 rubles is being considered. The relevant amendments have already been considered by the legal commission on legislative activities.

It is assumed that citizens under 18 years of age who register as self-employed for the first time after January 1, 2021 will be able to take advantage of the right to an additional tax deduction.

In fact, we are talking about a starting capital of 22,130 rubles, of which 12,130 rubles. - this is additional support for a young age, and 10,000 rubles. - standard deduction for self-employed. This money can be used to pay future taxes.

Opportunities at the small business level

The pandemic period has shown that the government is ready to equalize the rights of the self-employed with small businesses. The question of the possibility of their privileged participation in procurement was repeatedly raised. Starting in April 2020, self-employed people received this right.

Participation of self-employed people in procurement: features and conditions

Responsibility and checks

In 2021, inspections of entrepreneurs who use the new special regime to optimize taxation are likely.

They had previously been warned that the Federal Tax Service was developing a special product based on big data to catch unscrupulous entrepreneurs.

Cunning schemes are already being revealed when businessmen, for example, replace full-time workers with self-employed ones in order to save on paying insurance premiums and taxes. According to Finance Minister Anton Siluanov, the tax office sees and already holds on its account enterprises that have questions. However, by agreement, as part of the experiment, tax authorities did not inspect businesses during 2021, but in the future they may well begin to do so.

We wrote about legal ways to cooperate with the self-employed in the article “How companies can work with the self-employed.”

Platform for hiring self-employed people

It is known that SuperJob launched a platform to attract self-employed people to cooperation. Now employers have the option “Self-employed and individual entrepreneurs” in the candidate search filter. It makes it possible to determine whether the applicant is ready to work as a self-employed person or individual entrepreneur.

Is it possible to combine hired work on a five-day week with self-employment?

You can combine permanent work with self-employment and at the same time open an individual entrepreneur.

The income that a self-employed person receives from his main place of work is declared at his place of work.

The law refers specifically to the activity for which he receives side income, which he does not document anywhere. For example, in ordinary life he officially sells potatoes, and his employer withholds taxes. And in the evenings this man translates articles. He can formalize this activity as self-employment. And then the tax office will not have any questions. Vasily Voropaev Founder and CEO of the platform for working with IT specialists Rubrain.com

How will self-employed people issue checks?

Self-employed people do not need cash registers. Everything can be done through the “My Tax” application: register, make payments, receive electronic checks, pay taxes. Data on the legalization of income will be automatically transmitted to the tax authorities.

A self-employed person will simply link the card of his partner bank in the smartphone’s mobile application, and the tax will be debited automatically.

Organizations and individual entrepreneurs that apply the general taxation regime, the simplified tax system or the unified agricultural tax, when determining the tax base, do not take into account expenses associated with the purchase of goods (work, services) from self-employed people in the absence of a receipt. This rule may indicate a simplified procedure for confirming the expenses of an organization or individual entrepreneur for goods, work, and services purchased from self-employed people.

Vasily Voropaev Founder and CEO of the platform for working with IT specialists Rubrain.com

Who has the right to do business?

Or in other words, what is the entrepreneurial ability of a citizen - this is a set of circumstances under which he has the right to register his business without asking anyone.

It’s easier to list who is prohibited:

- civil servants (with some exceptions specified in the civil service law);

- incompetent citizens due to age (minors - under 18 years of age or before marriage) or by court decision;

- individual entrepreneurs declared bankrupt (5 years after completion of the bankruptcy procedure);

- citizens disqualified by a relevant court decision.

IMPORTANT!

In the Russian Federation, a foreign citizen can carry out entrepreneurial activities on the condition that he is in our country legally. But for foreigners there are prohibitions on certain types of activities.

ConsultantPlus experts examined whether the inspectorate can charge contributions on imputed income if entrepreneurial activity is detected. Use these instructions for free.