What it is

Installment payment for the purchase of an apartment is a phased payment of the cost of the apartment, which is divided into equal parts depending on the period for which the buyer completes the transaction and the remaining amount after making the first payment. Installment means monthly or quarterly payment of payments in equal amounts.

As a rule, installment plans are drawn up when signing an equity participation agreement (DPA), which implies the purchase of real estate before it is put into operation. Simply put, the house has not yet been built or is at the construction stage. In this way, the buyer can save money due to the fact that such a purchase will be cheaper than ready-made apartments, and the buyer will also pay off the debt for the purchase of the apartment in installments.

Registration occurs less frequently if the installment plan is drawn up already at the conclusion of the contract for the purchase and sale of real estate. Sellers do not want to participate in such procedures and often refuse the deal. Such points should always be discussed at the very beginning.

Differences from mortgage

The differences between a mortgage and installment plans for the purchase of real estate are that the buyer does not need to take certificates from his place of work about his solvency. The buyer of an apartment in installments will only need a document that confirms his identity, that is, a passport and a down payment, which usually ranges from 10-50% of the basic cost of the property.

When applying for an installment plan, the buyer’s credit history and issues related to employment are not checked by the developer, who will provide you with an installment payment plan to complete the purchase of an apartment.

Installment payment is a simplified type of lending, so there is no need for guarantors or pledges of movable and immovable property. It is not associated with financial risks and other issues. You don’t need any life insurance or anything that the bank requires when applying for a mortgage loan.

Installment plans can be interest-bearing or interest-free. Depending on the conditions and the down payment, as well as the terms for which the buyer plans to arrange payment in installments, conditions will be provided by the developer. If the buyer is offered an interest-bearing installment plan, the rates are usually the same as in mortgage lending. On average, for the purchase of real estate they give 12-12.5% per annum for installments. In comparison with a mortgage loan, we will show you the average mortgage percentage - in large banks, a mortgage for the purchase of real estate is issued at 11-13% per annum.

What's the benefit?

By concluding an installment agreement, the buyer has the opportunity to pay for his purchase in installments. This reduces costs at the initial stage and allows you to save money to pay for the apartment in full or sell other real estate during this period and pay the required amount.

Unlike a mortgage, the buyer does not need to collect employment certificates and other documents confirming his solvency. It is enough to have a passport and money to pay the down payment. No one will study your credit history and demand confirmation of official employment - the developer simply does not have the time or resources for this.

Important: The installment plan is simplified as much as possible. No guarantors, life insurance, financial risk or ready-made real estate as collateral are required.

Even in the case of interest in installments, the rates are usually comparable to bank mortgages (12-12.5% per annum for installments and 11-13% per annum for a mortgage loan in large banks).

Advantages and disadvantages

Installment plans for purchasing an apartment have both their pros and cons.

The advantages of making an installment payment are:

- possibility of making a partial down payment. There is no need to pay 100% of the cost of the apartment at once.

- Minimum overpayment. If the buyer is offered an installment plan with an interest rate, it will be 12-12.5% per annum, and if there is a loyalty program, then the overpayment will be no more than 5-10% of the original cost of the apartment.

- There is no control over the buyer's income by the lender. The borrower is not interested in either a certificate of income or information about the client’s solvency.

- The cost of housing will not increase due to overpayments. If you are an investor, then you can resell the purchased property and make money on it. Usually people who have capital invest money in unfinished real estate and then earn good money on its resale. This is one of the types of investing capital in real estate.

Along with the advantages, installment plans also have their disadvantages:

- The installment plan must be repaid even if the buyer is in a “long-term construction” phase or the construction was frozen due to bankruptcy or other circumstances.

- If the buyer does not make payments on time, he will face serious fines and penalties. Installment plans provide for timely payment of each subsequent payment.

- An installment payment program for the purchase of real estate may not be available for all types of real estate. For example, for less popular apartments on the market.

- With an interest-based installment plan, as with a mortgage loan, the buyer will be subject to an overpayment. This is normal for this type of lending.

- Not all developers have the opportunity to offer their buyers a real estate installment program. Unfortunately, this narrows the search and choice of apartments. If apartments are in demand and are being snapped up, developers usually curtail the installment plan. They prefer to receive 100% payment for real estate immediately.

Installment plan for an apartment without a down payment

The real estate market, given the difficulties that arise with the purchase of housing, offers marketing options that do not require a down payment.

If there are no other options, the offer may attract, but when choosing, not everyone will encroach on the proposed conditions.

Everything is based on interconnectedness and conditionality, and installment plans without a down payment more than compensate for this advantage over other types of lending.

The popular purchase option “Rent and Buy” is common in large cities such as Moscow, Novosibirsk, Yekaterinburg.

The program involves the purchase of an apartment subject to living in it and depositing funds:

- for rent;

- for ransom.

We must give it its due - the overpayment at the interest rate is small, but renting a house is not much higher than the average cost in similar houses with the same characteristics. But upon termination of the loan agreement, the company returns the paid ransom amount without retaining anything from it.

When applying for a mortgage without a down payment, banks offer extremely unfavorable conditions for the buyer, most likely at a high interest rate.

In other situations, citizens have to obtain additional credit, which increases the risks of using debt obligations. The exception is the use of maternity capital, which is invested instead of a down payment.

Risks

Let's look at what risks there may be when taking out an installment plan for an apartment and what the buyer will have to face.

- Problems with the developer. If the developer turns out to be dishonest, problems may arise. How can they manifest themselves?

- bankrupt developer. In this case, the refund for the purchase of real estate is practically zero. Only if the developer ceases to be bankrupt will he be obligated to return all the money to apartment buyers.

- If the developer decides to delay construction. When buying an apartment in a new building, there is always a risk of receiving your property not within the time frame that was originally promised. Therefore, it is worth studying the history of the developer’s buildings during the period of the company’s existence on the market.

- If the buyer does not pay the installments on time, he ends up overpaying. For failure to fulfill the obligations stipulated and specified in the contract, the buyer undertakes to pay all penalties. This can lead to a significant overpayment for the apartment. You always need to know under what conditions you apply for an installment payment plan for the purchase of any type of real estate - be it an apartment or a house.

Installment plan for an apartment from the owner

Buying an apartment on the secondary housing market provides for the option of drawing up a purchase and sale agreement, which sets out the following conditions:

- Transfer the object to the buyer for possession and use for its intended purpose on the basis of an agreement.

- Determine the conditions for transferring funds in installments, establishing the terms of settlement with the seller and indicating the periods of payments made.

- Write down a condition that gives ownership of the object after mutual settlements.

- Agree in case of unforeseen and other situations that do not allow fulfillment of obligations. Provide for penalties and sanctions for non-compliance.

- Describe situations in which the contract of the parties is terminated by consent or unilaterally.

When purchasing a home, the owner has the right to allow the buyer different conditions for the transfer of money.

The guarantee will be the issuance of a certificate and the transfer of real estate to the copyright holder only after repayment of the missing amount.

If these conditions are reflected in the contract, the property will be sold faster, and citizens will not lose anything.

What you should pay special attention to in an installment plan agreement and its sample

Concluding an installment payment agreement is one of its most important parts. It is important to establish and discuss all aspects related to payments, overpayments, fines and sanctions. There are many situations and conditions in the installment payment agreement that need to be paid attention to and studied in more detail, perhaps even by consulting a legal agency.

First of all, pay attention to:

- documents that confirm the adequacy of the person providing the installment plan. A prerequisite is that your borrower in the installment agreement for the purchase of real estate must be the developer from whom the apartment is being purchased.

- The amount of the first payment must be specified in the contract.

- Some organizations indicate that they have the right to increase the amount of payment (change the cost of housing) in the event of inflation and other circumstances, up to changes in the exchange rate for national or foreign currencies. The buyer must pay attention to this point and, if anything happens, state that the price should not change under any circumstances.

- The conditions for early repayment must be specified in the contract. If the buyer will be able to repay the loan before its expiration date, this must be stated in the contract. Developers who offer installment plans with interest are not interested in the client repaying the loan ahead of schedule. Often they stipulate this point in the contract, thus insuring themselves.

- Transfer of ownership rights from the developer to the buyer. The developer may indicate several moments of transfer of rights to the buyer - after full repayment of the payment, at the time of the down payment or after putting the apartment into operation. It’s worth discussing this point and choosing the best one, whether for you or for the developer.

- The contract must stipulate responsibility for failure to fulfill the obligations of each party.

- Possibility of re-registration of agreements. If the buyer becomes insolvent, the person specified in the contract will pay off the installments for him.

- You can enter into an agreement that will stipulate the possibility of transferring the installment payment into a mortgage loan if it is more profitable for the buyer to repay or if it is easier to pay. It is also an insurance option for the borrower in the event that the buyer is unable to pay under the previous installment payment arrangement.

Procedure for registering an apartment in installments

Buying an apartment in installments is carried out as usual; there are no special differences from the standard transaction. It involves going through the following steps:

- The parties will agree on the basic terms of the upcoming transaction.

- A preliminary purchase and sale agreement is signed and an advance payment or deposit is made.

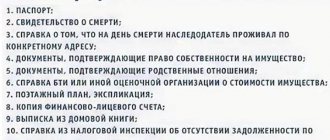

- The seller begins to collect the documents necessary to conclude the transaction.

- The parties sign the main purchase and sale agreement, which includes additional conditions.

- The seller and buyer will re-register property rights through Rosreestr or through the MFC. At the same time, in the application for the alienation of property rights in favor of the buyer, an indication is made of the imposition of an encumbrance on the apartment in favor of the seller.

- Submitted documents are verified by Rosreestr within 7 working days (9 days when submitted through the MFC).

- On the appointed day, the buyer receives an extract from the Unified State Register of Real Estate, which has replaced the certificate of ownership since 2021. It states the encumbrance on the apartment in the form of collateral. This limits the buyer’s rights to dispose of the apartment: he does not have the right to sell or give it away without the consent of the mortgagee.

- After the buyer makes the last payment, the seller contacts Rosreestr to remove the encumbrance from the apartment.

If the buyer stops paying his obligations, the seller will have to go to court.

It is worth noting that judicial practice in such cases has not yet been developed: the courts may oblige the buyer to pay the debt for an unlimited time, which is unfavorable for the seller, or simply issue a decree on a one-time repayment of the debt, which the buyer will not be able to fulfill.

Registration of the contract

Therefore, a very important aspect in such transactions is the competent execution of the apartment purchase and sale agreement, which details the payment procedure. The purchase and sale agreement must comply with the requirements of the Civil Code.

In particular, Art. 454, which indicates that one party, as part of such a transaction, transfers property, and the second is obliged to pay a certain amount for it, agreed upon by the parties. Article 488 stipulates the buyer’s obligation to make payment within the period specified in the installment agreement. If it does not fulfill the specified condition:

- then must return the unpaid property;

- pay the cost of the property, as well as penalties accrued on the debt.

An agreement for the purchase and sale of an apartment in installments is drawn up according to general rules and must necessarily contain the following points:

- parties to the transaction: full names of the seller and buyer, their contacts and passport details;

- subject of the transaction: apartment, its area, floor, address, cadastral number;

- grounds for disposal of the apartment by the seller (details of title and title documents);

- transaction amount: contract price of the apartment;

- rights and obligations of the parties.

The features of this document are related to the specifics of the transaction.

The apartment will be held as collateral by the seller until the full amount is paid for it by the buyer with reference to Articles 488 and 489 of the Civil Code.

The agreement must contain a payment schedule, namely:

- total cost of the apartment;

- the amount of the first payment (down payment) in percentage and numerical terms;

- quantity and size of subsequent financial tranches with specific dates,

- procedure for making payments;

- deadlines for full repayment of debt;

- penalties for late payment (for example, 0.3% of the amount due for each day of delay);

- procedure for terminating a transaction if payments are not received (for example, going to court with the seller if money is not received for 30 days or more).

In order to protect the seller, it is worth including a clause stating that the seller removes the encumbrance from the apartment and the buyer becomes its full owner only after making the last payment.

If the above rules are observed, the purchase and sale agreement will be registered as a mortgage, which will remove some of the risks from the seller.

The child tax credit in 2021 is only available to employees who have met certain conditions. Is your employer forcing you to resign of your own free will, but you don’t want to? Find out what to do in such a case by reading our article.

When dismissing employees, the employer must issue an order. You can find the form to fill it out here.

Types of payments and their features

What types of payments exist and what are their features?

As we have already said, there are two types of installment plans - interest-bearing and interest-free. It all depends on the developer, on the conditions he provides and on his and your financial condition.

How to choose the optimal period

The period for which the buyer plans to make an installment payment for the purchase of an apartment should be based on family income and the possibility of monthly or quarterly payment. The buyer should not overestimate his abilities, this can lead to delays in payments, and therefore a significant overpayment of installments for the apartment.

If the buyer has a certain amount and has his eye on a property and plans to sell some expensive property in the near future, then he can take out an installment plan for a shorter period.

If the buyer relies on his income, then it is better to take for a long period. This way, payments will be lower and it will be easier for the buyer to close them without any delays.

Terms and requirements

What conditions and requirements must be taken into account in order to receive an installment plan to purchase an apartment?

- The buyer must have a down payment amount. It can be from 10% and higher, but it must be at least 10% of the entire cost of the apartment.

- A prerequisite for making an installment payment is the presence of a document that confirms your identity, that is, a passport.

- Willingness to bear full responsibility for arranging installment plans and make monthly or quarterly payments in good faith.

This concerns the requirements for the buyer.

It is worth considering that the developer also has requirements that he undertakes to fulfill in the case of providing installment plans for real estate.

- Official registration and documents that confirm it.

- Availability of a building permit, which is approved by the municipal authorities and the chief architect of the city.

- The authorized capital must be at least as required by law.

- The developer must have programs that provide for installment payments for real estate that the developer disposes of.

Buyer's instructions

What is the procedure for applying for installments? Let us highlight the most basic stages of choosing and applying for an installment payment plan for the purchase of an apartment:

- Find a developer who has such a program.

- Study the history of the developer’s work in this market segment. Find out how reliable and responsible he is, whether there have been any problems with past projects before, what feedback from clients who took and repaid installments from this developer.

- It is necessary to demonstrate a desire to register a DDU and submit documents for registration of an installment plan.

- Conclude an agreement with the developer and register it with the authorities/

- Comply with all terms of the contract and pay payments on time.

Housing in a new building

Often, installment plans are issued specifically when purchasing apartments in new buildings.

Firstly, the housing is fresh, it will be cheaper than apartments that have already been put into operation.

Installments are taken during the construction period and payments begin from the moment the contract is signed, but there is another option. The first involves the signing of a participation sharing agreement (DSA). The second option provides for installment payments when the house has already been put into operation and this type is drawn up on the basis of a real estate purchase and sale agreement between the buyer of the property and the seller, an individual.

This option is more complicated and is rarely concluded, since such conditions are not always beneficial to the developer.

In such cases, price changes are also used. It is worth considering that if the developer has agreed, he can stipulate in the clause that the price of the apartment will change (increase, as practice shows) when the house is put into operation.

Secondary

As a rule, secondary housing is less likely to be arranged in installments. Apartment owners do not want to deal with such a complicated procedure for them and delay the transfer of ownership.

This option is used when an apartment is sold to relatives or friends, and even then rarely. To purchase and apply for an installment plan, an apartment purchase and sale agreement is made and signed, all points that are related to payments and agreed upon by both parties are entered, information about the first payment, the moment of transfer of the home into ownership of the buyer and sanctions that must be written down are also entered. case of delayed payments.

No down payment

Regarding taking out an installment plan for an apartment without a down payment, one thing can be said - this is quite rare, since it is not profitable for either developers or apartment owners to take such risks. We are mainly talking about mortgages.

State assistance

The state can provide assistance in obtaining installment plans. This is true. There are various loyalty programs that provide financial assistance from the state to those in need. But it's not so easy to get it. To do this, you need to meet the selection criteria based on age, income, or be in military service, or work in government agencies.

Basically, such programs are developed for young families or youth in general.

Installment plan for an apartment from the developer

The conditions for depositing funds into the building under construction are divided into periods. Repayment is required by the time the multi-storey building is put into operation. This does not take too much time and during the construction of the building, shareholders have to find the required amount of money.

During this time, you can: sell other real estate properties, the owner’s existing home, apply for a loan or borrow money from relatives and friends.

The problem is that most shareholders are not able to meet the harsh conditions of the installment plan provided, returning to the issue of mortgages.

Other development companies, navigating the situation with an understanding of the roots of the problem, find opportunities to extend the period of repayment of the balance, on terms favorable to both parties, at an agreed acceptable percentage.

For this period, the property remains in the ownership of the developer, subject to permission for use by potential owners.

Late fees

With late payments when applying for an installment plan for the purchase of real estate, everything is quite strict. If the buyer misses a monthly or quarterly payment, according to the contract he undertakes to pay a fine or penalty, which he promptly negotiates with the seller.

On average, one day of delay will cost the buyer 0.5-1% of the amount owed. Therefore, the overpayment will be colossal. You should stick to it and initially expect to pay everything on time. This applies to both applying for installment plans from a developer and applying for installment plans from an individual. Therefore, we recommend that you evaluate your strengths and take an installment plan for the period that the buyer can handle.