When applying for a mortgage loan, you will be faced with a requirement from the loan manager to evaluate the apartment for the bank. This is absolutely legitimate and is spelled out in Article 9. Law “On Mortgage” - the main regulatory act that regulates the process of issuing loans for real estate.

What's the point:

- You want to take out a loan from a bank;

- The amount is large, and the bank needs guarantees that this money will be returned - that is, a deposit;

- In the case of mortgage loans, the collateral will be the apartment, which is purchased with the bank’s money;

- If the loan is not repaid, the bank will be able to sell the property at auction and return the money.

At this point, the question arises: how much can the bank sell the apartment for? You need to know the market value of the property. The bank will only issue a loan for the same or lesser amount.

Mortgage borrowers sometimes confuse this indicator with the amount in the contract - these are different things. The amount in the contract is the price for which the apartment is sold in a specific transaction. Estimation of the average market value is a professional calculation, which depends on the area, layout, infrastructure, number of floors and other factors.

The average market value can only be assessed by qualified appraisers - this is also a legal requirement. Therefore, a professional assessment of the apartment for mortgage is carried out.

Researching the average market price is also useful for the buyer - sometimes it turns out that the market value is significantly lower than what the seller asks for. If the appraisal price turns out to be significantly lower than the desired loan amount, the bank may refuse to issue a loan.

What documents will be required for the assessment?

Please note that most of the list of documents belongs to the owner of the apartment being purchased. Therefore, order an assessment and start collecting a package of documents when you have already definitely decided to buy this particular home.

The list of documents required for the assessment includes:

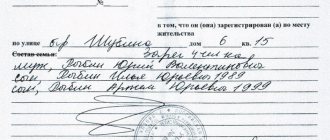

- Documents confirming the right to sell this apartment. For example, a certificate of ownership, a purchase and sale agreement, a gift agreement or an inheritance document. If we are talking about buying only part of the property - for example, a room - then a shared ownership agreement is suitable.

- You need a copy of the cadastral passport. This document can be obtained from the BTI. The paper will be issued only to the owner.

- The owner of the apartment must also provide you with BTI plans - this is a document with a complete description of the apartment. It contains a housing plan with exact dimensions. The total area and the area of individual premises are indicated. Please note that the BTI plan must indicate the area of all rooms, including the bathroom and corridor.

- A copy of your passport and contact details, such as telephone number;

If the apartment has undergone redevelopment, this should be shown on the plan. Usually it looks like this - on one sheet the old layout, on the second - the new, legalized one. Or both plans are printed on one sheet.

Was the layout changed without permission? To register a mortgage, the bank is provided with a report with information about illegal redevelopment and the bank will refuse to issue a loan. The owner will have to remodel the apartment or obtain permits.

Pay attention to two subtleties:

- Was the house built earlier than 1960? You need to obtain a certificate confirming the absence of wooden floors. The problem is that these ceilings have a high fire hazard class and insurance companies do not issue insurance contracts for such objects. Accordingly, it will not be possible to take out a mortgage.

- You may need a certificate stating that the house will not be demolished - the object is not in the demolition plan of the local administration.

Where can I make an assessment?

When applying for a mortgage, the apartment can only be assessed by a company that has the right to engage in this type of activity. There are also special requirements. Feel free to ask if the company meets these requirements when you first contact:

- The appraiser's work is insured;

- The appraiser - no matter whether it is a company or a private entrepreneur - is a member of the SRO. The association is professional and does not hide its contacts and list of members;

- The appraiser has a civil liability insurance policy for his work.

Please note that the bank may provide you with a list of so-called “accredited valuation agencies”. The manager, in pursuit of bonuses, may even report that the market valuation of an apartment for a mortgage can only be carried out by these organizations. Actually no - you are free to contact any independent agency.

But having an organization on an accredited list increases the chances that the organization will issue a report that meets all modern legal requirements. Before ordering a report, check the company to see how long it has been on the market and whether it has any recommendations.

We recommend contacting a company rather than an individual - in pursuit of savings, you may receive a report that a credit institution will not accept. Our organization has extensive experience in preparing appraisal company reports for obtaining mortgage loans. Documents are accepted by banks, borrowers become owners of an apartment without delays or problems.

Who has the right to evaluate an apartment in a new building?

Not every specialist working in the field of appraisal activities can evaluate apartments in a new building and other residential real estate. When ordering an assessment, owners must determine whether the specialist meets the following requirements:

- Listed in SRO.

- His civil liability is insured for the amount of 300,000 rubles.

- Has a higher education and at least one year of work experience in this field.

Only an appraiser who meets these requirements has the right to draw up an official document - an appraisal report, which will be accepted by the credit institution as a source of reliable and objective information. Sometimes banks require approval of the “candidacy” of an appraiser. This is due to the fact that the credit institution and clients expect different results from the assessment. The first one wants to reduce the value of the collateral property, and the second one wants to determine the value of the object as close as possible to the market value. This is one of the important reasons why banks will carefully, meticulously check the appraisal report, so it is very important to contact a professional appraiser. The result of his work will not cause any complaints from interested parties.

How much will the assessment cost?

The cost of an appraisal in Moscow varies on average from 3.5 to 6 thousand rubles. In the regions you can find an appraiser for 1.5-3 thousand rubles. It is best to order an assessment in advance - urgent work from an expert is more valuable.

Please note that you need to choose an appraiser not only based on the lowest price. Look at the organization's reputation and its approach to working with clients. Yes, you can find a private owner who will do everything quickly and very cheaply. But the bank may not accept such a report due to violations in the format or the assessment process itself.

What must an appraiser have?

- Professional education.

- Membership in SRO.

- Insured liability.

- Work experience of at least 2 years.

Assessing an apartment for a mortgage and drawing up a report is a process that requires qualifications, experience and knowledge. Choose an organization that has been in the market for a long time.

Are you planning to take out a mortgage?

The question “how to evaluate an apartment for a mortgage” arises at the stage when the bank has already pre-approved you for a mortgage, and you have already chosen the apartment that you are definitely going to buy.

What does this mean:

- You have decided which bank you will take out a mortgage loan from, you are satisfied with the proposed terms and interest rate. You have already submitted a 2-NDFL certificate from work, a copy of the Work Book. And the bank assessed you as a reliable payer and is ready to provide a mortgage loan.

- Of all the options that you chose yourself, or with the help of a realtor, you left one - with specific indicators for area, number of floors, year and type of construction and, of course, price.

Now you need to evaluate the apartment for a mortgage. If you take the missing money from the bank, there is no way around this issue, and here's why. While you are paying off the mortgage loan, the apartment is a property with an encumbrance and is pledged to the bank. In other words, it does not completely belong to you until you return the money you borrowed from the bank. If this does not happen for various reasons, and due to circumstances you are unable to make payments, the bank will seize the apartment from you and sell it at auction to recover the invested funds.

Assessing an apartment for a mortgage will show how easy it will be to sell.

By the way, valuing an apartment for a mortgage also has its own benefits for you. Because Even on the shore, you will be able to understand whether the apartment is worth the money they are asking for it or not. If it is sold above/below market value, then this is a reason to think about it. Especially if it is below the market value - this situation may indicate that your seller is on the verge of bankruptcy, which in turn carries the risk of losing the apartment. Because the transaction in this case can be contested in court.

How does the bank appraise an apartment?

There are several methods for valuing real estate for a mortgage loan. The main one is comparative. This is an objective method that takes into account closed transactions in the housing market and gives the most accurate market price for the property.

It is impossible to talk about all the intricacies of assessment in one article. There are a lot of special coefficients that the expert operates with during the research. Not only the condition of the apartment and its characteristics are taken into account, but also a lot of subtleties. For example, the distance from the main urban infrastructure facilities, the availability of parking, the landscaping of the yard, etc.

There are other methods. For example, expensive. Here we are talking about how much money is needed to build a similar facility. Suitable for analyzing a house rather than an apartment.

Another method is to find out how much income the owner will receive for rental use. It’s called the income method. Used extremely rarely.

Please note that the assessment is made not only based on documents or the BTI plan. The appraiser takes photographs of the premises - you will receive them in the report.

Overvaluation of housing: what a buyer needs to know

Even if there is no money for a down payment, there are alternative ways to solve the problem:

- obtain a consumer loan to cover the start-up fee;

- take money as collateral for existing housing;

- attract a co-borrower who can provide a small start-up capital;

- agree with the seller on installment payments for the first payment - a well-drafted advance or deposit agreement is required.

If you don’t want to have problems with the inflated cost of housing and get a profitable mortgage without unnecessary delays, contact a mortgage broker. A competent and experienced specialist has the necessary connections in banking circles, while playing on the client’s side. You receive a comprehensive solution to the mortgage issue and do not have to worry about approval even if there are stop factors in your credit resume. This is very convenient: a broker protects your interests, and you calmly prepare for moving to a new apartment. With us, borrowers get a mortgage without any problems!

What affects real estate valuation?

In addition to the factors listed in the section on evaluation methods, the final cost is influenced by several other parameters that a competent expert takes into account:

- The prestige of the area and the environmental condition are taken into account - if the apartment is near an industrial zone, the cost will be lower.

- If there are many schools, kindergartens, clinics and other important social facilities near the apartment, the cost will increase.

- It is important not only the condition of the apartment’s finishing, but also the condition of the entrance and common partitions. Roughly speaking, a renovated apartment in a dilapidated building will not be valued highly.

- The presence of a yard is also taken into account - an area equipped for recreation is valued higher than a “patch” for ten cars.

Let us remind you that the apartment itself is valued according to:

- Squares;

- Number of rooms;

- General condition – finishing, ceilings, layout;

- The presence or absence of defects in the repair;

- The first or last floor is cheaper.

What is the market value of an apartment made up of?

- Location. The appraisal of an apartment for a mortgage will always take into account the location where the apartment is located. What is important here is whether the house is in the central area or not. If not in the central area, then how good is the transport and social infrastructure there: are there schools, kindergartens, hospitals, etc. It also plays a role how favorable and well-groomed the area is overall. If a factory or industrial zone, military units, courts, pre-trial detention centers are located nearby, all this will affect the cost estimate.

- Technical characteristics of the building. Here we mean the year and type of construction, how long ago major repairs were done, whether the building is in disrepair or not, the number of floors of the house and layout. When choosing a “Khrushchev” or “Brezhnevka”, check especially carefully whether the house is designated for demolition or reconstruction, whether sewer pipes or heating have been replaced.

- Condition of the apartment. The main parameters here, of course, will be the number of floors, number of rooms, layout (if redevelopment was carried out, then confirmation that it was legalized). In addition, the presence of repairs (high-quality or done in a hurry), household appliances, furniture that will remain after the sale will be used as increasing or decreasing coefficients. This also includes the presence or absence of plastic double-glazed windows and balcony glazing.

- Market position. A comparison is made of similar apartments: a one-room apartment in a monolithic building is compared with the same offers. Up to 5 objects are usually selected for comparison: this makes it easier to understand where prices are artificially high or low. Don't forget about force majeure circumstances. Now, for example, due to the coronavirus, the solvency of the population has also decreased. On the other hand, there is state support, through which you can purchase housing in a new building, which also reduces the demand for apartments on the secondary real estate market.

What does the evaluation album look like?

An assessment report is an official document that must be completed in accordance with the regulatory requirements of laws and state standards. Check if it contains the following data:

- Information about the company that conducted the examination. Company contact details.

- Information about the customer of the assessment - that is, about you.

- Full characteristics of the apartment you are planning to buy. Check the address, area, layout, etc.

- Analysis of the real estate market for your property - numerical indicators.

- The amount of liquid value and market value of the apartment for purchase.

- Attachments – photographs, copies of appraiser’s diplomas, etc.

The appraiser's report should have a concluding section - this is what loan officers read first. It contains information about the price of housing and how much the bank can get for this apartment at the moment - if the mortgage agreement is terminated.

There are no requirements for the appearance of the report. Usually this is a folder with at least 20 A4 sheets, usually much more. The documents are bound and numbered. The appraiser's signature is everywhere. There is a seal.

Please note that the report is only valid for 6 months. If the contract for the apartment was not concluded, or refinancing is planned, a new assessment will have to be made. The reason is constant changes in the real estate market.

How to conduct a property valuation - step-by-step instructions for beginners

When conducting assessment work, questions arise. Where to begin? Who should I contact? What if they count incorrectly? Do not worry!

Let's look at this procedure in order.

Step 1. Decide on the object and purpose of the assessment

First, let’s decide what and for what purpose we want to evaluate.

Objects can be any material goods, a collection or any components of property, services, information, as well as property rights and claims. It's quite simple! You can find out the value of any form of ownership.

With the goal, everything is a little more complicated. Here you need to formulate the assessment objectives as accurately as possible; the cost of the appraiser’s services will depend on this.

The objectives of the assessment are divided into mandatory (stipulated by legislation) and proactive (carried out by the interested party).

Mandatory concerns:

- state property;

- insurance of state property;

- lawsuits;

- taxation;

- division of property.

Initiatives are related to:

- execution of transactions;

- reorganization of enterprises;

- lending;

- rent;

- private property insurance.

A correctly formulated goal gives an advantage in choosing a method and approach to appraisal activities, which helps reduce the price of work performed.

Step 2. Select an appraisal company

We pay attention to the cost of services and the specialization of the appraiser. Cheap is, of course, good, but an erroneous conclusion about the price can cost much more. Therefore, compare prices for the same services from different companies.

Things that are dear to you may not correspond to their market value and vice versa! Experienced appraisers will declare their reputation and immediately provide preliminary advice regarding further work.

If you decide to contact a private company, be sure to request an insurance policy from the company and make sure that the company performing the assessment has at least two employees (a mandatory condition of Russian law).

Step 3. Arrange a meeting and conclude an agreement

Having decided on an appraisal company, you submit an application to carry out the work. This can be either an oral statement (telephone conversations) or an electronic form. The conditions are the same in both cases. It is necessary to provide your passport details, indicate the object and purpose of the assessment and set a convenient time for the work.

At the next meeting, an agreement is concluded - from this moment you enter into a legal agreement with the appraiser. To sign the transaction, you must have identification documents with you, as well as identifiers of the object and your rights to it.

After signing the contract, you must pay for the services of the appraisal company, which will further move forward the concluded agreement. This can be done at any bank branch or at the appraiser's office, provided that they issue you a cashier's check confirming the legality of the transaction.

Step 4. We provide the assessment object for inspection

Next, you must provide access to the property being assessed. A mandatory form of contract means that you must allow a specialist to inspect and study the property.

There is no need for your presence in the future. This task can be performed by a trusted person. You can draw up a power of attorney for free at the appraiser’s office. During the inspection, you may have to answer any questions that may affect the value of the property, so the trustee should be someone close to you!

The appraiser will draw up an inspection sheet, take copies of your supporting documents and set a date for finalizing the property appraisal report.

Step 5. Receive a work report

The conclusion is prepared, according to the law, no more than 3 days. It is prepared in writing and represents a report of the estimated value of the property.

Study the document and ask any questions that interest you. After explaining all the nuances, you sign the acceptance certificate of the property valuation document. This report, original or copy, is provided at the place of request.

At all stages of the work, you can consult with professional lawyers from the Pravoved company. You can count on support and resolution of the full range of legal issues at any time convenient for you.

Contact a specialist

09/18/2018 / Questions about assessment and examination / Leave a comment

What is the validity period of the assessment report?

The assessment report is valid for six months. But it is better to check with the bank manager - in some cases, the requirements of credit institutions may differ from this period. In reviews of mortgage products, you can find complaints from citizens who were denied a loan or mortgage refinancing a month after the assessment.

- Ask the bank manager if the report will be valid if the mortgage application expires - some banks can take up to 2-3 months to review a new one.

- Check to see if the bank has any other requirements for the appraisal report.

Who orders a real estate appraisal, the seller or the buyer?

The buyer pays for the appraisal of the seller's property. This is logical - the buyer is interested in obtaining a mortgage, and accordingly, the buyer is interested in the assessment procedure. There is no point in the seller spending his money - it is easier to wait for a buyer in cash.

Therefore, we recommend ordering an appraisal only when you are already sure that the purchase and sale transaction will be completed without problems.

Once again, the buyer pays for the appraisal, so first collect all the documents, make sure the apartment is clean, and only then apply to set the appraisal amount so as not to waste money and time.

Is a re-evaluation of an apartment necessary when refinancing?

If you are planning to refinance your mortgage - i.e. renew the mortgage loan agreement; a re-assessment will be required if the first report is more than six months old.

In fact, refinancing is a new agreement. Accordingly, the bank carries out all operations again. This includes finding out how much money he will receive if your deal is broken and the apartment has to be put up for auction. To do this, he needs data on the liquid value of housing.

If you decide to refinance less than six months after drawing up the appraisal report, then in theory there is no need to re-do it. In practice, you need to check with managers - judging by customer reviews, some managers still require you to redo the document.

What is the liquidation value of an apartment?

Liquidation value is calculated using a special formula. It is important for us to know that it is influenced by two basic factors:

- Time value of money factor;

- Factor of price elasticity of demand.

What is price elasticity of demand? This is the number of potential buyers and the degree of specialization of the object. The greater the number of potential buyers, the higher the elasticity of demand (and this is good). The higher the specialization of an object, the lower the price elasticity of demand for it (which is not good). In other words: if you buy a standard one-room apartment in a relatively new house, not on the first or last floor, with a standard layout, near the metro, then you will then sell it very quickly, because... A lot of people will want to buy it. If your apartment is a three- or four-room apartment with a designer renovation, or a townhouse outside the city, then you cannot count on a very quick subsequent sale

Do you need an appraisal for a mortgage on a new building?

Judging by the reviews, some bank managers require such an assessment. In fact, this is not necessary - the amount for the apartment is set by the developer and indicated in the share participation agreement.

If you are planning to take out a mortgage loan, you will have to order an appraisal report in any case. Choose an organization that is responsible for hiring appraisers. Only high qualifications and responsibility guarantee an independent study and report that will be accepted by any bank.