To save relatives from bureaucratic procedures for dividing inherited property, many property owners prefer to formalize the transfer of rights to apartments, garages, land plots or houses in advance. The main problem in this case is the choice of the legal form of registration - a deed of gift or a will. There are pros and cons to each option.

Gift deed and will - the main differences

What is the difference between a deed of gift and a will? Legally, both concepts imply the free transfer of ownership of any real estate to third parties. However, each option has its own characteristics. The main difference is the moment of transfer of ownership rights to the object:

- when registering a deed of gift, ownership of real estate begins at the moment of signing the donation agreement and after its corresponding registration;

- When drawing up a will, the heir gets the opportunity to personally dispose of the property only after six months from the death of the testator.

When choosing a method for transferring rights to an apartment or other real estate, you need to take into account other nuances - the cost and complexity of the registration procedure, taxation issues, and the possibility of canceling orders made.

How to draw up a gift agreement

There are no strict rules for paperwork. But here's what should be in the document.

Parties' details

It is necessary to indicate the last name, first name, patronymic of the donor and recipient, dates of birth, passport details and registration address.

I, citizen Bilbo Baggins, born September 22, 2890, place of birth in the Shire, Middle-earth, registered at Bag End, Hobbiton, Shire, on the one hand,

and citizen Frodo Baggins, born September 22, 2968, place of birth in the Shire, Middle-earth, registered at Bag End, Hobbiton, Shire, on the other hand,

being of sound mind and sound memory, acting voluntarily, we have entered into this agreement as follows.

Gift information

What is it, with what characteristics, to whom and on the basis of what documents does it belong. So, if an apartment is donated, then this will be the address, square footage, cadastral number, number and date of registration of ownership, as well as the reason for its occurrence - for example, a purchase and sale agreement.

I, citizen Bilbo Baggins, have given to my nephew Frodo Baggins a smial with countless rooms, located at Bag End, Hobbiton, Shire. Cadastral number of the object: 11:111111:111. The said smial belongs to Bilbo Baggins on the basis of certificate of inheritance 00AA1111111.

Recipient's consent to accept the gift

It's a two-way deal, so it's worth pointing that out.

I, Frodo Baggins, accept the indicated smial from Bilbo Baggins.

The rest of the contract content is standard, so just check the templates.

- Real estate donation agreement template →

- Car donation agreement template →

- Template for a future donation promise agreement →

If the agreement does not require a visit to a notary, it comes into force after signing. If required, then after its assurance.

Registration of deed of gift

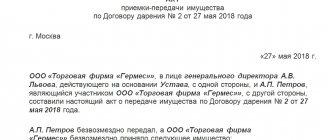

The fact of transfer of property as a gift is formalized by a civil gift agreement. In this case, the recipient can be either a relative of the donor or any other individual or legal entity. When drawing up a contract, two conditions must be met:

- the subject of the donation (apartment, house, land plot) must be fully described indicating all the data - all characteristics, address, area, etc., with an extract from the Unified State Register attached;

- The gift agreement is unconditional, that is, it should not contain limiting conditions - for example, the recipient’s reaching a certain age, the fact of his marriage, the appearance of children, etc.

Important! Keep in mind that the popular formulation when donating apartments “with the right of lifelong residence” is not specified in the law and has no legal force. If the recipient subsequently wants to violate the set condition, it will be difficult to protest his actions.

The deed of gift does not require notarization, so you can save on such services. However, qualified lawyers still recommend sparing no expense and additionally visiting a notary. In the future, this may save you from problems if you need to confirm the donor’s legal capacity in court if there are other claimants to his property.

List of documents that will be required to prepare a deed of gift for real estate for registration in Rosreestr:

- application for state registration and change of property owner;

- receipt (cheque, payment order) for payment of the duty;

- documents proving the identity of the donor and the recipient;

- real estate documents - cadastral passport, USRN certificate ;

- certificate of the value of the object, certified by the BTI;

- if an apartment or house is donated - a certificate of registered persons.

Important! If minor children are registered in the house or apartment, permission from the guardianship authorities will be required to conclude a gift agreement.

Depending on local government requirements and the type of property being donated, additional information may be required from the owner. The exact list of required documents will have to be clarified on the Rosreestr website or at MFC branches.

Important! The law requires written, notarized consent to the transaction from the spouse of the donor if the property was acquired during a legal marriage. If the property was purchased during the premarital period, the consent of the second spouse does not need to be obtained.

pros

Now it’s clear what a deed of gift is. What advantages does this document have? This method of transferring property is of interest to the bulk of the population. More and more often, this particular scenario is used when resolving inheritance disputes.

What are the positive aspects of gift agreements? Among the advantages are:

- Possibility of cancellation after registration of the agreement. To do this, certain conditions must be met. We will talk about them a little later.

- Gifted property is not considered acquired during marriage. Accordingly, during a divorce it will not be subject to division.

- Gifts are an excellent way to transfer property (mainly real estate) to loved ones during the life of the testator.

- The document helps resolve inheritance disputes in the family. Typically, such paper helps older people divide their inheritance between children and grandchildren when there is no trust.

- You can draw up a gift agreement with the donor’s lifetime residence in a particular apartment. It is enough to stipulate this in the agreement.

The objects of the agreement can be different things. Any property of a person in Russia can be transferred using a deed of gift to another person.

Making a will

You can draw up a will in any form yourself or seek the help of a lawyer. For it to be valid, several conditions must be met:

- registration is carried out with mandatory notarization;

- the text of the will must contain all information about the property, excluding the possibility of discrepancies - an extract from the Unified State Register of Real Estate , full address, full characteristics of the property;

- indication in the text of the data of the intended heirs (passport, registration) and the exact share allocated to them by the testator.

When drawing up a will, lawyers recommend clearly stipulating your will so that later discrepancies or different interpretations do not arise. It happens that heirs not included in the will go to court in the hope of redistributing property. That is why the document drawn up should be as transparent as possible.

It is possible to stipulate the procedure for transferring property in the event of the death of the first named heir. The appointed executor (executor of the will) will become the guarantor of the fulfillment of the will of the testator.

Important! When drawing up a will, you need to remember that there are several categories of heirs, the allocation of a share of the property to whom is required by law. These are minor children, disabled relatives, and retired parents. If they are not specified in the will, it can be challenged in court.

What is more profitable – a will or a deed of gift?

Will or deed of gift for an apartment – which is better for the owner to choose? The main criteria by which you can evaluate the way of disposing of your real estate are the timing, complexity of registration and its price.

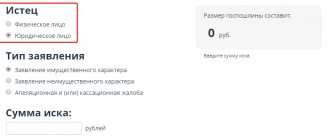

Registration cost

The price of registration of a deed of gift depends on the value of the real estate being donated and the proximity of the relationship between the donor and the recipient. For close relatives it looks like this:

- for state registration of a self-drafted gift agreement, the fee will be 2,000 rubles;

- when drawing up a deed of gift through a notary, he will take 3,000 rubles. for services and a fee of 0.2% of the housing price, but not more than 50,000 rubles.

If the recipient is a distant relative or even a stranger, then the price of the issue changes:

- for real estate value up to 1 million – 3000 rubles. + 0.4% duty;

- at a cost of 1 to 10 million rubles. – 7000 rub. + 0.2% duty;

- at a cost above 10 million rubles. – 25,000 rub. + 0.1% duty (but not more than 100 thousand rubles).

In addition, when receiving real estate as a gift, the recipient is required to pay income tax (NDFL) in the amount of 13% of the value of the property received. In such a situation, only close relatives of the donor are exempt from taxation, which the law includes parents, grandparents, brothers or sisters, children, and grandchildren.

When drawing up a will, you will only have to pay for the fact that it has been certified by a notary - 100 rubles. and for the valuation of inherited property. The main expenses will arise only at the time of opening an inheritance case and receiving a document for the right of inheritance - from 0.3 to 0.6% of the value of the property.

Registration deadlines

The period for registering a gift agreement should not exceed 2 weeks. In rare cases, it will take a month to obtain a USRN certificate. It will take several hours for a notary to draw up a will.

However, if the object of the donation is only a share in an apartment or house, you will have to spend time allocating the owner’s share (room, utility premises) in physical terms. This is done through the court in order to subsequently protect the rights of other owners and avoid discrepancies when using joint property or its possible sale. After receiving the court certificate, you will have to re-register the property for each owner in Rosreestr.

Opportunity to change your mind

What is easier to cancel – a deed of gift or a will? In general, the legislation provides for the possibility of canceling the alienation of property, but this is not always easy to do.

The act of donation can only be canceled for serious reasons. Both the relatives of the donor and the donor himself can go to court in an attempt to invalidate the gift agreement. The main arguments are usually:

- incapacity of the property manager - he has a documented mental illness, drug or serious alcohol addiction;

- causing physical harm by the donor to the donor or his family members in order to eliminate it;

- the fact of concluding a gift agreement less than six months before the bankruptcy of the donor as an individual or individual entrepreneur - in this situation, both relatives and judicial authorities can challenge the gift deed.

A property owner can easily change his or her last will by simply rewriting the will. Unlike the situation with a gift agreement, this can be done as many times as you like without much time investment. As a result, after his death, the will with the most recent date of preparation will be recognized as legitimate.

As for the heirs in whose favor the property was assigned, they can only challenge the orders of the deceased through the court. If they do not belong to categories protected by law (disabled people, retired parents, children under 18 years of age), then the reasons for which the will can be revised will be:

- proven incapacity of the testator at the time of drawing up the order;

- the will itself is not written by the hand of the testator;

- the fact of forcing the testator to transfer property to specific persons has been proven;

- The text of the will contains clauses that contradict the law.