Over the past few years, Internet technologies have deeply penetrated human everyday life. Today, banking, trade, services and entertainment operate successfully online. But with such technological breakthroughs, online fraud is also flourishing everywhere. As usual, the main goal of scammers is to lure money out of the user and disappear into the vastness of the Internet. In this article we will describe the main directions in which online scammers operate, and we will also tell you where to go to get your money back first.

Let's start with a description of the most common areas in which scammers operate. We will be based on our own experience.

Fraudulent online stores

This is the most common deception scheme that gullible users fall into. Today it costs nothing to create a fake online store and launch “trade” of non-existent goods on it. Advertising is ordered online, positive reviews are generated, and prices are quoted extremely low. All these subtleties lull the vigilance of users who send money to scammers without basic checks. Payments are accepted online and by cash on delivery, but all this happens before the fraud is discovered. With all this, the creator of such a marketplace remains in the shadows and is able to easily erase traces of his activities by simply deleting the site and blocking the “official” number of the store.

Fraud in online stores can be as simple as a seller accepting money and disappearing, or quite complex, where a whole scheme is created to sell substitute goods. Such a scheme involves official organizations and third-party recipients of money, so it becomes very difficult to prove the fact of deception. We have already written about such schemes several times; we recommend reading the article about PIM-MAIL LLC and the LLC Parcels Pro online store.

Deception through ad sites

In the case of advertisements, scammers work in two directions - they deceive both sellers and buyers. The standard scheme prevails: a person sees an ad, orders a product and makes an advance payment, but in the end nothing comes to him and the seller disappears. There are quite a lot of scam schemes with advertisements, and on the most popular resource Avito, scammers successfully bypass the special “Safe Transaction” function. Here are some examples:

- They write to the seller directly via (Whatsapp, Viber) and offer to purchase his product. Referring to a secure transaction, a fake electronic receipt indicating prepayment is sent to the seller’s email. After some time, the scammer writes that he has changed his mind and asks to send the advance payment back - people are fooled.

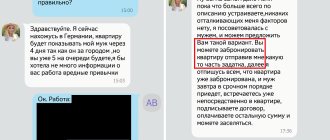

- They communicate with the buyer through messages on Avito, but “for convenience” they switch to a third-party messenger. Next, the buyer is sent a link to a fake website where he can make an advance payment (under the terms of the “Safe Transaction”). Very often people do not notice the substitution and transfer money.

An attempt by scammers to provide a link to a fake website

Making money through subscriptions

Also very popular on the Internet is the scheme of issuing paid online subscriptions to second-rate services. Such services include dating sites, loan selectors, and online cinemas. The deception process involves hacking a bank card and linking it to purchase online services. A person simply discovers that a debit has been made in favor of a fictitious dating site. After contacting support, the person is shown a personally signed subscription.

This is the most difficult process for a defrauded cardholder, since it is very difficult to prove the intervention of third parties. It’s easy to guess that the owners of the service personally activate people’s hacked cards, but it’s impossible to prove this fact. As a result, hackers legally withdraw money from hacked cards.

To understand the danger and scope of such fraud, we recommend reading our articles about the dating site LoveDateme and the loan selector Qzaem.

“Legitimate” withdrawal of funds in favor of a Banando subscription

Deception through spam mailings

We will call the simplest and slightly naive type of fraud spam mailings that report a “million dollar win” or “inheritance under a will.” Such notifications must include a link to the scammers’ website, where you need to pay a certain amount to process the payment. Most often these are fake lotteries, fake notifications from the tax office, notifications about government payments. This type of spam is distributed via email, SMS, Viber or WhatsApp. Oddly enough, people fall for such alerts and transfer money by flashing their bank cards.

Spam from loan selection sites

Where to go first?

If the connection with the scammers has not yet been severed, start with a motivated complaint demanding a refund. Do not resort to insults and personalities, just correctly describe your position (you are not going to put up with fraud) and all your further steps (contacting the bank and law enforcement agencies), immediately add your card number and telephone number for a refund. If it doesn't help, proceed to the next steps.

All the answers on the Internet boil down to logical advice - contact the police or prosecutor's office regarding fraud. This is all good advice, but the first step is to contact your bank. This should be done as soon as possible, as a quick response will help increase the chances of a refund. If the transfer was made from an electronic wallet (Qiwi, Yandex, WebMoney) - write to their support. Inform the specialist about the fact of transferring funds to scammers and describe the essence of the situation.

- If the payment was made automatically and without your participation, indicate to the specialist that your card has been hacked, request that it be blocked and declare your desire to submit an application for a refund. After submitting such a request, the bank's security service must begin checking your transfer.

- If you personally transferred money, but the fact of fraud was discovered, immediately call the bank’s support and tell them about the details of the transfer (to whom, where and for what reason the money went). Keep in mind that banks are reluctant to consider refund cases if the client personally confirmed the transfer. Declare your desire to write a written application at the bank branch for a refund. There are not many chances, but if a large amount was transferred, it is worth a try.

- It also happens that the operation is carried out with the participation of official payment systems. For example, a transfer through the Yandex.Money service will be indicated by the symbols YM or YM. In this case, you need to additionally write to the support of this payment system with a statement of fraud.

The main difficulty in this whole situation is the speed of transfers. Now transactions from card to card or by phone number are performed almost instantly, and the law prohibits banks from debiting money from the recipient’s account without his consent. The bank may see the fact of fraud - but it’s not so easy to write off money from the swindler’s account and return it to you.

The deceived person will have a good chance of canceling/freezing the transfer if the operation remains in the “In Progress” status. Depending on the recipient's details, the money can take up to 1-2 business days.

Shopping without risk

It is easy to avoid being deceived when buying online, since most common fraudulent schemes owe their success not to complex technical tricks, but to the banal gullibility and inattention of users.

To ensure your safety, it is enough to follow a few simple rules: never make an advance payment for goods, do not follow links to external sites if they were sent by other users, do not dictate or send personal data to anyone - CVV/CVC code of a bank card, codes from SMS from a bank or other services.

It sounds simple, but users of popular classifieds sites regularly break these rules. For example, recently a resident of Kursk, who was selling furniture through one of these sites, lost money after she clicked on a link sent to her by a fake buyer and entered her card details there. The link supposedly led to a payment registration page, but it turned out to be fake. A resident of Zheleznogorsk, who tried to buy equipment secondhand, also became a victim of a similar scheme. The woman also followed the link from the fake seller and also entered her bank card information in the form that opened. It is noteworthy that when contacting the police, both victims said that they had heard about fraud with fake links.

How do attackers manage to gain people's trust and manipulate them? How not to fall for these tricks? Let's look at the three most common deception schemes.

The first is substitution of the payment page (phishing). You want to buy or sell something on an advertisement site, and another user offers to pay online or arrange delivery. You receive a link from him, supposedly leading to the ordering page. At the same time, the interlocutor may claim that on the advertisement site itself (through which all operations must be carried out) the order confirmation, delivery or payment buttons do not work.

Fraudsters often insist on transferring communications to WhatsApp or another instant messenger

This is always a lie, the only purpose of which is to lure you away from the real site to a fake one and gain access to your payment information. Fraudsters imitate pages of well-known resources. Even the address of a fake fraudulent link can be very similar to the real one. However, there will still be differences. For example, if you buy or sell something on Avito, then the link can only lead to the website www.avito.ru. If the address looks a little different (avitopayments.ru, avito-dostavka.ru or avitto.ru) - this is definitely a scam.

Large classifieds sites block the ability to send active links to external resources in built-in chats on their platform and warn users with notifications that going somewhere may be unsafe. This is why scammers often insist on transferring communication to WhatsApp or another instant messenger.

But there is simply no need for an honest seller or buyer to send you a link, since everything necessary for placing an order and delivery is already available inside a large classifieds site. A false seller can disable the delivery function for his ads, and then lie that the site is faulty and therefore delivery is supposedly unavailable. You should not believe this or follow any links.

The second deception scheme is to lure out payment information. You buy or sell something on an classifieds website. Another user contacts you, seemingly ready for a deal, and to complete it asks you to dictate/send three or four numbers written on the back of your card (CVV/CVC code), your PIN code or a code from SMS from the bank.

The scammer will justify the need to provide this data in a variety of ways. For example, he may claim that according to the bank's security rules, this is necessary to verify your card, or say that without this data it is impossible to arrange delivery.

Under no circumstances should such codes be provided to anyone. Neither buyers nor sellers may ever need them. This data can only be used by strangers to gain access to your online bank to withdraw money or make online purchases using your card.

Most fraudulent schemes owe their success not to complex technical tricks, but to simple gullibility

The third scheme is an advance payment requirement. A sought-after product is put up for sale, perhaps rare or attractively priced. When the buyer shows interest in him, the seller begins to rush the decision and asks for an advance payment - sometimes full, but more often partial. The fraudster asks to credit money to his account in the Internet bank or, again, by following a fake link to the payment page. Having received the money, such a seller disappears from sight and adds you to the blacklist.

It’s simple to protect yourself: transfer money in person when receiving the goods, and if this is not possible or inconvenient, use the built-in functions of a secure transaction or postpaid delivery, which are available on many popular classifieds sites. Such functions freeze an amount on the buyer’s card equal to the price of the product on the website. The seller will receive the money only after the buyer confirms in the system that he has picked up the goods and is convinced that everything is in order. If upon delivery at the point of delivery it turns out that there is something wrong with the goods, you can refuse the purchase, and the money will automatically be returned to the card.

Contacting the police and prosecutor's office

Next, you need to file complaints with law enforcement agencies - the Police and the Prosecutor's Office. This can be done online or by visiting a branch in person. A fraud complaint is filed against the person who received your money. If the recipient’s region is known (registration, registration, address), you need to indicate it in the “place of event” item, this item is available when filing an online complaint on the Ministry of Internal Affairs website. The complaint itself is written in free form - you describe in detail the essence of the situation, indicating dates, phone numbers, accounts and amounts. If possible, attach screenshots confirming your words.

Unfortunately, the detection rate for cybercrimes is quite low. The whole difficulty lies in the “smart” actions of scammers who have learned to properly cover their tracks and hide their real names. Today's Internet allows you to do a lot:

- left-handed electronic wallets and virtual cards issued with gray numbers are used;

- one-day payment systems registered abroad are used to accept transfers;

- transfers are made to organizations registered in Cyprus or Gibraltar;

- schemes are being created in which the fraudster can prove that he “received money for the service provided to clients” (we wrote above about paid subscriptions).

An example of a police report against an online store:

An example of a police report about fraud in an online store

How to recognize a scammer?

1. Intrusive calls at any time of the day.

There is a known case where a fraudulent broker treated a woman this way for several months before she transferred her money. Remember: a professional and honest broker or financial trader will never impose his services over the phone. Clients look for a good specialist themselves. 2. Calls come from a mobile or hidden number. Keep in mind that a serious brokerage company always has a single telephone number - federal or local.

3. The promise of fabulous profits from invested funds in a short time - 10–20% or more per week or month. Moreover, no broker can guarantee 100% profit. Investing is always a risky activity.

4. Refusal to provide the website address of the brokerage company. Lack of information about her on the Internet. Or there is no information on the company’s website about the owner of the company, legal address or contact information.

5. Refusal to provide license information or lack thereof. Every organization that professionally carries out transactions in financial markets and with financial instruments using borrowed funds is required to have a license1. You can check whether a company has a license on the website of the Central Bank of the Russian Federation.

If a broker company is registered abroad and operates without a license from the Central Bank of the Russian Federation, it is an offshore organization operating outside the legal framework of our country. After signing an agreement with such a broker, if your rights are violated, you will not be able to defend your interests on Russian territory.

6. The broker refuses to meet in the office and conclude a brokerage agreement. It offers to quickly open an account without checking your documents and assures that it is enough to create a personal account on the website.

Super offers

Quite often you come across advertisements about 99% discounts and sales for 1 ruble due to liquidation. Most often, the objects of such discounts are the latest models of famous smartphones, clothing and cosmetics of popular brands.

If you decide to buy yourself a phone with a 100% discount, you will not spend money on the purchase. But then you need to pay for delivery, which in fact will not happen . Beware of such “bargain” offers.

C.O.D

Many fans of online shopping calm down when they see that they can pay for the goods upon receipt at the post office. However, it is worth considering the fact that you can see the contents of the parcel only after it has been paid for. Many unscrupulous owners of online stores take advantage of this, sending items of poor quality or completely different items instead of ordered goods.

It is quite difficult to catch such violators, since such sites are created for a short period of time and are deleted after collecting a certain amount. In this case, you will not be able to hold anyone accountable.

The only way out in such a situation is to refuse to receive the goods. You may not come to the post office, and if you do not pick up the parcel within a month, it will be sent back, and the scammer will be forced to pay for storage and double delivery.

Some attackers, if buyers do not pick up the parcel, call them with threats to immediately receive the goods, otherwise they will be forced to contact the tax service. In fact, no normal store will do this, so you should not pay attention to such calls. If the demands of the “sellers” come too often, threaten them in response with contacting the appropriate authorities.