You can often encounter situations where a person performs his or her job duties without formally concluding an employment relationship. This situation can develop according to two scenarios. In one case, when during an interview the employer immediately informs the employee that there will be no employment or promises employment after the probationary period.

And the second option, when an employee gets a job and after working for some time finds out that he is not officially employed. This work carries a lot of risks. Because If the employer is dishonest, it will be very difficult to prove the very fact of the existence of an employment relationship in court. The employee is not accrued length of service for this period, which is taken into account when paying pension accruals in the future, as well as sick leave if the employee himself or his children fall ill. Salaries are not posted according to accounting data.

Avoidance of concluding an employment contract is in itself a violation of the law. According to the law, an employment contract must be drawn up no later than three working days from the date the employee is actually admitted to work (Article 67 of the Labor Code of the Russian Federation).

In the absence of an employment relationship, other duties arising from this employment relationship, such as labor protection, medical examinations, and preparation of necessary personnel documentation, are usually not fulfilled. All these violations are also subject to sanctions. Well, if settlements with the actual employee are not carried out officially, i.e. “in the dark”, then this is a separate big “story” - a violation of tax legislation (on the payment of personal income tax) and legislation on the payment of mandatory contributions to the Pension Fund of the Russian Federation, compulsory medical insurance funds and insurance against industrial accidents.

If the employee is not a citizen of Russia, then his employment requires compliance with special norms of migration legislation. There is also liability for violating them.

Differences between an employment contract and a GPC agreement

Both the employment contract and the civil process agreement are concluded for the purpose of formalizing relations for a citizen to perform any work for an enterprise, however, in the first case, special working relationships arise that are not regulated by the Civil Code. The differences between the two types of agreements are as follows:

- according to the GPC, certain work or task is performed, while according to the labor employee, he performs a labor function and holds a position in the company;

- in labor relations, a citizen is obliged to comply with internal regulations, other local regulations, as well as orders and instructions from management. When concluding a GPC agreement, the principle of equality of parties applies;

- the employer has certain obligations in labor relations: payment of wages to the employee at least twice a month, payment of contributions, organization of labor and safety, certification of workplaces, etc. The relations of the parties in the GPC agreement are regulated only by agreement of the parties and the law, internal legal documents do not apply to them, payment of remuneration can be carried out in any manner that does not contradict the law, as agreed upon by the parties; There are no insurance contributions.

A GPC agreement must be distinguished from a fixed-term employment contract. Most often, working relationships are formalized on an indefinite basis; a fixed-term contract is concluded only if it is impossible to conclude an open-ended one. The difference between fixed-term contracts and GPC is based on the constancy of the functions assigned to the employee: the GPC agreement is concluded not just for a certain period, but to perform a specific task.

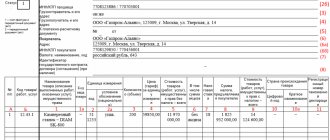

Here is a table of preferred formulations.

| Employment contract | GPC agreement |

| Names of parties: employee - employer | Names of parties: customer - contractor |

| Indication of positions according to the staffing table, indication of function, for example legal adviser | Indication of specific work, for example filing a statement of claim |

| Indication of a permanent nature, such as a reference to job descriptions | Indication of quantitative indicators, for example drawing up two statements of claim |

| Link to PVTR, mandatory compliance | Lack of reference to rules or other local regulations |

| Indication of the location of the workplace | A citizen is not provided with a job |

| Logistics and personal protective equipment are provided by the employer | We use our own materials, equipment, and personal protective equipment. |

| Payment of wages at least 2 times a month | Payment of remuneration is carried out in accordance with the agreement of the parties in the contract (it is advisable that the schedule does not coincide in dates with the salary payment schedule at the enterprise) |

| It is allowed to be involved in overtime work or sent on a business trip | Phrases about overtime work and business trips are unacceptable, this is an element of labor relations |

Sample GPC agreement

How to work informally in construction?

It’s not worth getting a job at a large construction site: there are a lot of workers here, but they are not treated very well. It’s better to find a place in a small company where you can quickly earn money in Moscow by renovating apartments and building cottages. What vacancies are there:

- Installer. Of course, an unofficial worker will not be allowed to assemble major structures, but it is possible to lay reinforcement, install scaffolding and perform other auxiliary work without experience. They pay up to 2,000 rubles a day for this;

- Painter. You can learn how to use a roller, brushes and a spray gun to apply paint to walls, ceilings and facades in just a couple of days. It is also useful to master surface preparation technologies. Salary reaches 50,000 rubles per month;

- Digger. At almost any construction site, you need to dig holes for foundations and pillars, lay cables and pipelines, and it is not always possible to use an excavator for such work. You can earn up to 2500 rubles daily;

- Handyman. Light duties include carrying materials, raw materials and equipment, preparing solutions, dismantling structures and removing debris. Such unofficial work for students brings in from 1000 rubles a day.

How to work unofficially in advertising?

Unofficial work in advertising is interesting for two reasons: firstly, there are no requirements for experience, age or education of candidates, and secondly, they usually pay for performing duties at the end of each day. What vacancies are popular:

- Poster of advertisements. The functions are simple: you need to stick leaflets at bus stops and at entrances in the specified area, place them in mailboxes or insert them into the entrance doors of apartments. You can work at any time, they pay 1–2 rubles per leaflet;

- Promoter. People for distributing advertising on the streets are almost always hired informally, since due to the high turnover and short-term nature of the promotions, there is no point in formalizing them under a contract. The salary is 150–250 rubles per hour;

- Consultant. Its tasks are to conduct tastings of any product among supermarket visitors. You can find how to earn money as a full-time student in the evening, since the duration of the shift does not exceed 3–4 hours;

- Sales Manager. To look for new clients and conclude deals with them, you do not have to be on staff. Many firms allow agents to work on their behalf, as intermediaries. There is no rate, and the fee is calculated as a percentage of sales.

How to work informally without specialization?

In general, unskilled personnel are rarely employed under contracts. This is quite convenient for citizens; it is much easier and more profitable for pensioners in Russia to earn money without notifying the Pension Fund of the Russian Federation about their additional income. Who is better to get a job with:

- Street cleaner. The most promising vacancies look like those in luxury residential complexes, where employees are provided with special clothing, all the tools and decent pay. It’s a little worse to work for public utilities: they pay no more than 12,000 rubles per month;

- Cleaner. An employee is needed to restore order everywhere - in shops, restaurants, offices, shopping centers. If the amount of work is small, you can work for half a day or collaborate with several companies at once. They pay up to 1000 rubles per day;

- Security guard. It is not at all necessary to be a master of shooting and wrestling. Sometimes it’s enough just to monitor the monitor, regularly walk around the site and call the police in time. You can earn from 18,000 rubles per month;

- Loader. You can unofficially get a job as a loader in a transport company, warehouse or supermarket. All that is required from an employee is decency, endurance and good health. The salary is 1200–1500 rubles per day.

How to work informally on the Internet?

It is very difficult to check the legality of labor relations on the Internet. Therefore, there are many ways for a 14-year-old schoolchild, a pensioner and a mother on maternity leave to earn money, because the risk of a fine for the employer is minimal. Where can you get a job:

- Moderator. Such an employee is needed to monitor order in social network groups, forums and entertainment sites. Sometimes he is tasked with publishing news and managing advertising. The average level of payment reaches 6000–8000 rubles per month;

- Content manager. Its functions include full control over the operation of the resource, including preparation and uploading of materials, setting up advertising, and distributing tasks between authors and designers. A good specialist receives up to 40,000 rubles per month;

- Copywriter. He makes money by writing informational and entertaining articles, posts on social networks, advertising and selling texts, product cards in virtual stores. An experienced copywriter is paid 150–250 rubles per 1000 characters;

- Store administrator. Managing a trading platform includes accepting orders, adding new products, holding promotions, communicating with customers, and interacting with the delivery department. There is plenty of work, and they pay 50,000 rubles a month for it.

Working under an employment contract without a work book

The disadvantages of working without a book are much greater than the advantages. A definite advantage for the employer can be considered the almost complete absence of formalities and bureaucratic difficulties. The citizen receives relative freedom when performing a task, including the absence of inclusion in the hierarchical system of the enterprise. When drawing up a GPC agreement, it is much easier to terminate the relationship, which can be considered both pros and cons, depending on the situation (although here, too, you need to be careful and comply with the requirements of Article 310 of the Civil Code of the Russian Federation).

Disadvantages of not having a work book under a GPC agreement:

- vacations and sick leave are not paid, vacation is not provided at all, this is an element of the labor relationship;

- insurance contributions are not deducted, as a result of which the employee’s guarantees are reduced;

- lack of incentive and compensation payments, including bonuses;

- lack of liability of the employer in case of industrial injuries (if the damage is not caused by the fault of the customer).

Some experts mistakenly consider various types of civil law contracts as work under an employment contract without an entry in the work book. This is incorrect, since agreements of this type are purely civil in nature. Accordingly, the employer does not have to issue a book. For example, this applies to contracts for the provision of services or author's orders.

However, the Labor Code of the Russian Federation provides for three cases of concluding an employment contract without recording in the work book:

- registration of part-time work;

- remote employment;

- the employer is an individual.

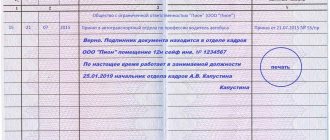

Part-time work

In accordance with paragraph 5 of Article 66 of the Labor Code of the Russian Federation (Part 5 of Article 66 of the Labor Code of the Russian Federation), when hiring a citizen to work in an organization who will perform part-time duties, information about this is entered into the book at his request. In this case, information can be indicated by the main place of employment. To do this, you must provide a document confirming the fact of part-time employment. For example, a certified copy of the employment order or a certificate from the second place of employment indicating details and other necessary data.

Sample contract for part-time work

What is a pension?

Who are pensioners?

Having retired and being in excellent physical shape, having a good memory and a fighting spirit, you can continue to work.

But here you need to analyze whether the double payment will remain: the pension and the salary received at the place of work or whether only the salary will be paid.

And if the salary level is lower than the accrued pension, is it worth going to such a job?

Official registration of an old-age pensioner for work will allow him to receive a pension and wages established at his new place of work. Moreover, the Pension Program has introduced a points system, which allows you to increase its size for each year worked in retirement.

As for a military pensioner, there may be two options. If he, being a pensioner, enters into a contract with the Armed Forces of the Russian Federation, then he will only be paid a salary.

If he is accepted into a civilian position, he will be paid a military pension (for length of service) and wages at the new job. In the near future, it is possible to receive two military pensions: one for long service and another for old age.

To calculate an old-age pension, you will need 5 years of work experience in a civilian position after retirement.

Disabled people with working group I or II can receive a salary at work and a disability pension.

Those with disability group I, recognized as a non-working group, receive only a pension.

In the event of the loss of a breadwinner, a pension is paid to members of his family. When family members reach the age specified by law, these payments will no longer be accrued, but an old-age pension will be issued.

Remote employment

Work under a contract without a work book, in accordance with Part 6 of Article 312.2 of the Labor Code of the Russian Federation, is possible with remote employment, provided that the employee is employed for the first time (the employer is relieved of the obligation to issue a book). In order for the employer to realize this opportunity, a corresponding agreement between the parties is signed. It can be put on paper by adding a phrase to the document confirming this agreement. Or the employee draws up a statement asking not to include information about remote work in the document.

In this case, in accordance with Part 6 of Article 312.2 of the Labor Code of the Russian Federation, the main document confirming the employee’s length of service will be his copy of the agreement. Additional confirmation may be copies of orders for admission to remote work and dismissal issued by the employer. This conclusion can be drawn from an analysis of the provisions of Part 5 of Art. 312.1, part 2 art. 312.5 Labor Code of the Russian Federation. The employee organizes the recording and storage of such documents independently.

Employer is an individual

In accordance with paragraph 3 of Article 66 of the Labor Code of the Russian Federation, an individual who is not an individual entrepreneur does not have the right to make entries in employee books and register them for persons hired for the first time. A document confirming the period of employment with such an employer is a rental agreement concluded in writing (paragraph 2 of Article 309 of the Labor Code of the Russian Federation).

Individual entrepreneurs are not exempt from the obligation to make entries in this document in relation to each employee. This fact is confirmed by paragraph 1 of Article 309 of the Labor Code of the Russian Federation.

Employers - individuals without the status of individual entrepreneurs can also enter into employment contracts. Such an employer does not have the right to make entries in the work book, or issue a new one. Thus, evidence of a citizen’s activities in this case is only his copy of the contract. At the same time, the employer - an individual is also obliged to make contributions to the funds and issue an insurance certificate if such work is the first for the employee. The agreement can be concluded either for a certain period or be of an indefinite nature. Such an employer is obliged, in accordance with Art. 303 of the Labor Code of the Russian Federation, notify local authorities and register the agreement (at your place of residence).

Sample agreement: employer - individual

conclusions

- If you need to establish an employment relationship: assign specific responsibilities to the performer, oblige him to work according to an established schedule, equip a workplace - it is necessary to conclude a fixed-term employment contract;

- If the subject of the contract is the performance of a fixed amount of work or the creation of a new thing, it is worth concluding a GPC agreement. In this case, the contractor is not obliged to work according to a schedule and can work with the involvement of third parties;

- It is illegal to regulate permanent labor relations with a civil process agreement: in this case, the tax inspectorate under sub. 3 p. 2 art. 45 of the Tax Code of the Russian Federation or subparagraph 1 of paragraph 1 of Art. 31 of the Tax Code of the Russian Federation will oblige the employer to conclude an employment contract, assess additional taxes and require payment of a fine.

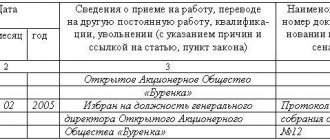

How are labor relations formalized?

The employment contract must reflect the following information regarding the employee and the employer:

- full name and place of residence of the citizen;

- details of his identity document;

- bank account details for payment;

- name of legal entity, full name Individual entrepreneur or citizen - employer;

- the name of the person authorized to represent the interests of the employer;

- employer's address;

- his bank details.

A complete list can be found in Art. 57 Labor Code of the Russian Federation. These are the usual details of the contract, but in this case special attention must be paid to filling them out.

Re-qualification of a GPC agreement into a labor agreement in court

Often, at the request of citizens, contracts are requalified. In this case, the court, when deciding on the essence of contractual relations, based on practice, evaluates the following conditions:

- the nature of the work performed (one-time tasks or certain job responsibilities);

- working conditions (presence or absence of a workplace, provision of equipment and materials, compliance with labor protection);

- procedure for payment of remuneration (dates and frequency);

- formulations of responsibilities (according to the Labor Regulations or not);

- the presence or absence of social guarantees for the employee (payment of sick leave, etc.).

Features for a pensioner

Article 3 of the Labor Code establishes the ability of citizens to equally exercise the right to work. It is prohibited to limit or provide benefits to a citizen based on age, so pensioners are registered and work on an equal basis with everyone else.

The only exception is the refusal to employ a person over 65 years of age for certain positions (heads of educational institutions, civil servants, etc.).

You can conclude an employment contract with a pensioner for an open-ended period, a document on the provision of services, or a fixed-term contract. Retired citizens have the right to work part-time; a work book is not required.

Responsibility of the employer for an employment contract without a work book

The article lists three cases where the possibility of concluding an employment contract without a book is legislated. In other cases, the employer must ensure that there is an entry in the book. Evasion of this obligation is punishable by law and faces certain consequences for the employer. This thesis is enshrined in Decree of the Government of the Russian Federation dated April 16, 2003 No. 225. In this regard, Article 5.27 of the Code of Administrative Offenses of the Russian Federation provides for fines for such an offense in the amount of 1,000 to 50,000 rubles. Repeated violation may result in a fine of 10,000 to 70,000 rubles, as well as disqualification of the manager. Moreover, payment of a fine does not relieve one from civil liability to the employee: obligations to properly formalize the relationship, payment of various compensations for the period of the relationship, etc.

Often, employers hide under civil law agreements relations that fall under the Labor Code of the Russian Federation. For example, concluding contracts for an author's order or for the performance of any services. Such violations may be discovered through an audit or as a result of a complaint received from employees. Inspectors are guided by the essence of the existing legal relations.

Often such cases go to court and are decided not in favor of the employer. This outcome is typical when inspectors come to the conclusion that the existing legal relationship between the customer and an individual is of a permanent nature and is subject to the Labor Code of the Russian Federation. Since when carrying out work under a GPC agreement, the employee is considered not to be socially protected, the court takes his side. In particular, the employee does not have the right to paid vacation and sick leave. The employer has no liability for compensation for damages in the event of a work injury, and pregnant women are not paid maternity leave. In addition, the contract can be terminated at any time. However, the employee does not receive notification of this in advance. Therefore, care should be taken in advance to ensure that employees are properly registered in order to avoid administrative liability and infringement of workers’ rights.

The article was prepared jointly with the United Consulting Group.