Ask a question Order a service

A long time ago, changes were made to Russian legislation, in accordance with which the number of contracts subject to mandatory notarization was reduced. In this regard, it has become much easier to conclude certain transactions - less time is required to prepare documents, therefore, the transaction will be completed faster. However, certification of contracts is still required in a number of particularly important cases. These include those listed in this article.

Competent loan processing

As a rule, when receiving borrowed funds, the debtor writes a receipt for their receipt, which indicates the amount and period of repayment. The lender (the person who lent the money) is often confident that this is enough to confirm his rights. Indeed, a receipt is a document that can be presented to the court if it contains all the necessary information to establish the existence of a debt.

Unfortunately, the receipt often forgets to indicate other essential conditions: the interest rate on the loan, the frequency of repayment if the debt is to be paid in installments, passport details and place of residence of the borrower. If he violates the agreement and payment terms, the creditor has the right to go to court.

Moscow notary Kolganov I.V. comments:

“This is a troublesome procedure that takes a lot of effort and time. If you certify the loan agreement with a notary, the debt collection procedure is significantly simplified.”

What documents need to be certified by a notary?

The notary carries out notarization of documents. After it, ordinary papers receive legal force and can be used as evidence of transactions. You can have a variety of papers certified by a notary, but among the most popular options are the following:

- prenuptial agreement or contract;

- translations of official documents already notarized;

- rent, purchase and sale agreement (entire real estate, shares in it);

- lifelong maintenance agreements;

- powers of attorney indicating the transfer of rights (in case of representation);

- applications for inheritance (acceptance or refusal).

The signing of each agreement shifts responsibilities onto a person’s shoulders. There are many other documents, agreements and statements that can be registered by a notary. Powers of attorney are especially often drawn up, since with its help a person can transfer part of his powers to another person. If the power of attorney is not certified by a notary, it will not be recognized as legally effective, which means that the authorized person will not be able to perform the functions assigned to him.

What can be the subject of a loan

In most cases, the subject of the loan is cash, but this is not necessary. Raw materials, materials, and other things and items can be provided on loan. In addition, according to Art. 818 of the Civil Code of the Russian Federation, debt on rent (real estate, production tools), as well as that arising as a result of a purchase and sale agreement, can be replaced by a debt (loan) obligation.

An agreement (document) on borrowing relations is drawn up between legal entities and individuals. At the same time, the notarized form of the loan agreement is not mandatory; it is certified voluntarily, by agreement of the parties.

Benefits of notarizing a loan

To protect yourself from possible troubles, the lender prefers to draw up an official document. Certification of a loan agreement by a notary provides many advantages:

- the text will indicate all the necessary details of the borrower (passport details, residential address)

- the interest rate for the use of borrowed funds and the procedure for its payment to the lender (usually monthly);

- the notary will check the borrower’s documents against the database of the Ministry of Internal Affairs and the bankruptcy register, which eliminates the falsification of documents;

- the parties are explained the provisions of the Civil Code of the Russian Federation on the procedure for granting and repaying loans;

- If the borrowers fail to fulfill their obligations, the lender may contact the notary for affixing a writ of execution.

A notarized loan agreement between individuals or, in the case where one of the parties is an organization, relieves the lender of the need to go to court if the borrower fails to pay the debt. The notary's writ of execution gives the loan agreement the force of an executive document. The creditor can submit it to the bailiff service or to the enterprise where the debtor works, as well as to the credit institution where the borrower has an account. The funds will be written off to repay the debt unconditionally.

Is it necessary to translate documents received by the company in foreign languages?

In the overwhelming majority of cases, Russian organizations and individual entrepreneurs draw up and use in their practice documents drawn up in Russian. But in some situations, for example, when a company cooperates with foreign counterparties and suppliers, there is a need to process and translate documents drawn up in a foreign language.

The need to translate documents is due to the fact that Russian is recognized as the state language of the Russian Federation throughout its territory, which is subject to mandatory use in relations between government agencies, local governments, institutions, organizations of all forms of ownership and citizens (clause 6, clause 1, article 3 of the Federal Law dated 01.06.2005 No. 53-FZ “On the state language of the Russian Federation”). Official paperwork in all Russian organizations, enterprises and institutions is conducted exclusively in Russian (Clause 1, Article 16 of the Law of the Russian Federation of October 25, 1991 No. 1807-1 “On the languages of the peoples of the Russian Federation”).

Therefore, if a document drawn up in a foreign language is somehow involved in the document flow of an organization/individual entrepreneur, then it must be translated into Russian. Documents used by companies in the field of tax legal relations, in particular to confirm expenses they have incurred, are no exception.

Since in Russia all official paperwork is conducted exclusively in Russian, primary accounting documents drawn up in accordance with business customs in a foreign language must be necessarily translated into Russian (letter of the Ministry of Finance dated January 20, 2021 No. 03-03-06 /1/2476).

Moreover, in some cases, companies must have not just a translation of foreign text documents, but a translation carried out/certified by a notary.

What are the benefits of a notarized loan?

Borrowing money from an individual (legal entity) has significant advantages compared to a bank loan. As a rule, the bank requires a certificate of income, the involvement of guarantors, and collateral. In addition, the interest rate changes depending on specific conditions (income level, loan term), the decision can take a long time. If it is negative, an entrepreneur or private individual who urgently needs money will waste time.

At the same time, a loan agreement between individuals is certified by a notary on the day of application, which significantly simplifies the borrower’s task.

Moscow notary Kolganov I.V. comments: “The creditor more easily agrees to such a transaction, knowing that he receives guarantees of debt repayment through the use of the writ of execution mechanism. The debtor, in turn, protects himself from unfounded claims: unexpected increases in interest rates, demands to return the money ahead of schedule.”

Rules of the Civil Code on loans

- If the borrowed amount is over 10,000 rubles, a written agreement must be drawn up between individuals. When one of the parties is an organization, the agreement under any conditions must be written, regardless of the size of the loan.

- The date of conclusion of the agreement is considered the day of transfer of money (things), which is confirmed by a receipt or other document confirming their receipt by the borrower (an act indicating in the agreement that the subject of the agreement has been transferred and received).

- Before notarizing the loan agreement, the notary will make sure that the amount is indicated in ruble equivalent. Foreign exchange transactions in private relationships are not permitted.

- The document must specify the procedure for repaying the debt: in parts, in full and terms, as well as a condition on interest. If the loan is interest-free and its size is over 100 thousand rubles, this must be indicated directly. If there is no indication, interest is charged at the Central Bank rate in the general manner.

- If the loan agreement certified by a notary does not indicate a repayment period at all (on demand), then the creditor can demand the debt only after a written warning to the debtor 30 days before the day the demand is made.

Decide who pays for the notary services: the seller or the buyer

There are three types of payments for notary services:

state duty

- it is paid when it is necessary to contact a notary. For example, when selling an apartment with a minor owner or for obtaining the spouse’s consent to the transaction. The amounts of state fees are determined by law and are the same for all notaries throughout the country.

notary fee

— it is paid for transactions that can be executed without a notary. The tariffs are also fixed in law; they are higher than state duties. For example, to certify a contract for the sale of an apartment worth up to 10 million rubles costs 3,000 rubles + 0.2% of the cost of the apartment.

fee for additional services

— copies and verifications of documents, consultations. The cost of additional services is set by the notary himself based on the recommendations of the regional notary chamber, which is based on the cost of living and other factors. Thus, additional services for certification of a contract in the Moscow region cost 8,000 rubles.

The laws do not stipulate who pays the notary costs: the seller, the buyer, or equally. But the size of state duties and tariffs is known in advance. Calculate how much you will need to pay and agree on who pays for what. For example, if the buyer wants to certify the contract, but this is not necessary, it is logical that he should pay.

Features of calculation and payment of interest

The lender and the borrower agree on the presence (absence) of interest for the use of money (things) at their own discretion. In this case, the provisions of the law must be taken into account.

- If the amount does not reach 100 thousand rubles, and the agreement does not indicate interest, the loan is considered interest-free;

- If the loan size exceeds the above limit, the general rule applies: the rate (or lack thereof) is directly specified in the contract, otherwise the calculation is made at the Central Bank rate (5.5% as of July 2020);

- Interest can be paid in any order under the agreement: monthly, along with the payment of part of the debt, or at the end of the contract;

- If the debt is paid in installments, the creditor has the right to demand early repayment of the entire amount if the partial installment is not paid within the agreed period;

- With an interest-free loan, the borrower has the right to repay the entire amount ahead of schedule;

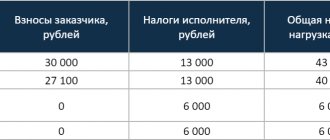

- The amount of interest received by the creditor is a financial benefit. Income tax is calculated and paid from it.

If the parties decide to draw up a loan agreement with a notary, they will be explained all the provisions of the law and warned of the consequences of failure to fulfill the agreement. If a legal dispute arises, a notarized agreement is the main evidence in court, and the fact of the loan does not require additional confirmation (proof).

In the case where the notarial loan agreement does not include provisions on liability for late payment, the default rule applies: penalties are charged on the overdue amount for the period from the established payment date to the date of actual repayment. Interest corresponds to the key rate of the Central Bank for the calculation period.

Penalties (fine) are not collected if the agreement establishes a penalty for delay in debt payment, unless otherwise provided by law or agreement (Articles 395, 811 of the Civil Code of the Russian Federation).

Is notarized translation of documents required?

The answer to this question depends on what exactly this or that document is intended for and who acts as the party receiving the foreign documents. For internal use, if it suits the company itself, documents drawn up in a foreign language may not be translated into Russian at all.

If the document is intended for transfer to contractors, government agencies or any third parties, then it must be translated, since paperwork in our country is carried out in Russian.

And unless otherwise provided by law, translation can be carried out by any specialized translation agency or full-time certified specialist who has a document on education in the profession of translator. The qualifications of the translator are not essential. The accuracy of the translation is certified in such cases by the signature of the translator himself.

This is a general rule. However, in some situations, an ordinary, uncertified translation cannot be used. Then organizations, entrepreneurs and ordinary individuals are required to have a notarized translation of foreign text documents.

Cases when a translation must be notarized are specified in separate laws. If the law does not require a notarized translation of a document, such a document should not be notarized, and the receiving party does not have the right to demand the opposite from the applicant.

In accordance with the current legislation, the following documents require notarized translation:

- written evidence submitted to arbitration courts (part 5 of article 75 of the Arbitration Procedure Code of the Russian Federation);

- documents provided for the purpose of obtaining Russian citizenship (clause 7 of Decree of the President of the Russian Federation of November 14, 2002 No. 1325);

- documents submitted to the registry office for state registration of a civil status act - birth, marriage, divorce, adoption, establishment of paternity, change of name and death (Article 7 of the Federal Law of November 15, 1997 No. 143-FZ “On Civil Acts” states");

- documents provided for the purpose of obtaining a residence permit (clause 47 of the Order of the Ministry of Internal Affairs dated June 11, 2020 No. 417);

- documents of adoptive parents - foreign citizens (part 4 of article 271 of the Code of Civil Procedure of the Russian Federation);

- other documents requiring notarized translation due to direct instructions in laws and regulations.

How to draw up a loan agreement through a notary

The form of agreement between the lender and the borrower provides for the inclusion of the following main provisions:

- description of the item (amount of money, things, items);

- deadlines for fulfilling obligations (schedule for installment plans);

- procedure for calculating and paying interest (if provided);

- rules for resolving conflict situations;

- liability of the parties for violation of the contract;

- identification data of the parties.

In practice, private loans against a notary receipt are the most common, but there can be many options. Often contracts include a collateral clause, then in addition to the main document, a collateral agreement is drawn up.

If real estate is used as collateral, the loan agreement must be notarized - this is a legal requirement.

The text of the agreement must indicate which party actually has the collateral. The second case, also often encountered in practice, is a notarized loan between the founders and the management of the LLC. As a rule, an interest-free agreement is drawn up, which must be expressly stated in the document.

What to do if the debtor becomes bankrupt or dies

Both a legal entity and an individual, including an individual entrepreneur, can be declared bankrupt.

If the loan agreement was drawn up through a notary, the lender, based on the application, is included in the register of creditors. You need to contact the temporary (administrative) manager within 2 months after the publication of information about the debtor’s bankruptcy on Fedresurs or other publications (“Kommersant”).

If the borrower dies, the debt is legally transferred to his heirs. They are obliged to pay it within the value of the inheritance received.

How much does it cost to draw up a loan agreement with a notary?

For notarial acts, a tariff (state fee) is paid in accordance with the Tax Code, plus legal and technical services or UP&T are paid.

Under loan agreements with a notary, the price of technical work is a fixed amount, the amount of which is established by the chamber, and the amount of the state duty depends on the amount of the transaction. *see current rates in the appropriate section

Certifying a money loan agreement from a notary will cost less than paying possible court costs and legal fees if it is necessary to collect a debt from an unscrupulous borrower. The use of a writ of execution saves time and does not allow the debtor to transfer assets to dummies.

The notary office of Igor Vladimirovich Kolganov is located at st. Mnevniki, 23, open daily until 20:00, and also on Saturdays until 17:00. Please contact the telephone numbers listed on the website to arrange a convenient appointment time to certify a loan agreement between individuals (legal entities), including urgent ones, in urgent situations.

Choose a notary

You can choose any local notary within your subject of the Federation.

That is, if you buy an apartment in Odintsovo, the notary can be from any city in the Moscow region, but not from Moscow. Notary prices are almost the same, so when choosing, it is better to focus on service, professionalism and willingness not to impose additional services on you. To do this, read reviews about it on the Internet, ask your friends or your realtor. Just in case, check that the notary has a license in the special service of the Federal Notary Chamber.

For which transactions should you contact a notary?