Required conditions for return

The family legislation of the Russian Federation establishes a rule according to which the return of previously transferred alimony is not allowed . However, the law provides for certain exceptions to this rule. In particular, a refund may take place if:

- the judicial act that established the payments was canceled due to the provision of false documents or information by the recipient of alimony (usually the plaintiff);

- the agreement on the conditions of child support was declared invalid due to its conclusion using violence, threats, or deception by the recipient of funds;

- the verdict of the judicial authority has entered into legal force, by which the persons who falsified the court decision, writ of execution or alimony agreement were found guilty of having committed a criminal act.

The alimony payer can count on the return of excess amounts collected from him if this was due to a counting or arithmetic error, including due to a malfunction of the computer of the relevant organization.

When exercising the right to return funds, the payer must make a corresponding demand specifically to the guilty person , who is obliged to repay the debt at the expense of his personal funds, since funds intended for the maintenance of children, or property acquired with such funds, must remain inviolable.

The Supreme Court taught how to calculate alimony penalties

For alimony - go to court

Olga Miller* divorced her husband. The child remained with her, and the court decided to collect alimony from the father as a percentage of income and 10 times the minimum wage. But he didn’t pay the money, and his son was fully supported by his mother.

Some time later, the woman filed a lawsuit against her ex-husband. She demanded to collect the debt from the defaulter, a penalty due to late payment, and at the same time deprive him of parental rights in relation to their common son and reimburse legal costs. According to Miller, the ex-husband also does not participate in the child’s life and does not care about his health and development, so his parental rights must also be deprived.

- The Supreme Court clarified the statute of limitations for the division of property

October 10, 8:51

The Prikubansky District Court of Krasnodar completely rejected the applicant. The Krasnodar Regional Court overturned the decision in part and adopted a new one: to satisfy Miller’s demands for a penalty. The other part of the act of the first instance remained unchanged: failure to pay child support is not a reason to deprive parental rights. The regional court proceeded from the calculation of the penalty provided by the plaintiff. According to family law, if a debt arises due to the fault of the alimony payer, he must pay a penalty in the amount of 0.5% of the debt amount for each day of delay. Referring to this provision, the penalty was calculated as follows: the amount of the total alimony debt (226,439 rubles) was multiplied by the total number of days of delay (1163), and then multiplied by 0.5%. As a result, the amount amounted to 1.32 million rubles. The appeal proceedings regarding the claims for collection of arrears of alimony payments were terminated.

The sun thinks correctly

The alimony defaulter appealed the decision to the Supreme Court. The case (No. 18-КГ19-123) was considered by the panel for civil disputes chaired by Judge Alexander Klikushin. The Supreme Court indicated that the penalty was calculated incorrectly in the appeal. The board reminded us exactly how to do this.

The Supreme Court reminded what will be needed in disputes over a child in court

According to family law, if the alimony debt arose due to the fault of the payer, he pays a penalty in the amount of 0.5% of the total debt for each day of delay, the Supreme Court agreed. But exactly how to make the calculation is clarified in paragraph 64 of the Plenum of the Supreme Court No. 56 “On the application of legislation by courts when considering cases related to the collection of alimony.”

It must be taken into account that alimony is a monthly payment. Consequently, the penalty must be determined for each overdue amount of the monthly payment and the number of days it is overdue (as of the day of the court decision to collect the penalty).

But the appeal chose an erroneous calculation scheme and also did not check whether the amount of the principal debt was calculated correctly. It was necessary to take into account that the defendant considered the calculations to be incorrect. The court should use the calculation of alimony debt made by the bailiff and study the parties’ arguments as to whether it is correct or not, the Supreme Court indicated.

The Supreme Court overturned the decision of the appeal in part and sent this issue back to the appeal for a new consideration. The rest of the appeal ruling remained unchanged (editor's note - not yet considered).

Calculating penalties for late payment of alimony is a very painstaking job. In accordance with paragraph 2 of Art. 115 of the SK is carried out by the bailiff, this is done monthly at the request of the claimant.

A little math

The amount of debt for alimony paid for minor children in shares of the debtor's earnings is determined based on the earnings and other income of the debtor for the period during which alimony was not collected.

The calculation is made using the formula:

D x P = Σ,

D – the value of the monthly income of the person obligated to pay alimony, minus personal income tax; P – the amount of withheld alimony in shares of the debtor’s earnings and other income (1/6, 1/4, 1/3, 1/2); Σ – amount of monthly alimony.

What if the debtor did not work or did not provide documents confirming his income? Then the alimony debt is determined from the average salary in Russia at the time of debt collection (Part 3 of Article 102 of the Law, Article 113 of the SK).

After receiving a certificate from the bailiff about the amount of monthly alimony payments, the penalty is calculated = amount of debt for the period x number of days of delay x 0.1%.

Lawyer Elena Ovchinnikova helped do the calculations.

In practice, bailiffs do not have much time to correctly calculate the debt, which leads to mistakes, says family dispute lawyer Elena Ovchinnikova: “For example, only one place of work of the debtor is taken into account. Additional earnings are not taken into account.”

* – the names and surnames of the participants in the dispute have been changed by the editors.

- Irina Kondratyeva

- Civil process

Refund of alimony when paternity is contested

If paternity is contested during a period when funds for the maintenance of, as it turns out, a step-child have already been paid for a certain period, the man certainly expects to be able to return the money illegally collected from him, thereby establishing the truth. But at the same time, the child participating in the dispute is not guilty of anything, and therefore cannot pay for the mother’s deception or substitution in the maternity hospital.

Even if a genetic examination shows that the father and child are not relatives, payments will stop only from the moment a judicial act is issued. If until such time the debtor deliberately does not make payments, then the court has the right to determine the appropriate punishment for him.

If paternity is contested, previously paid funds cannot be returned . But if the payer proves that the child’s mother initially misled both him and the court regarding paternity, then the funds can be returned only for the 3 years preceding the challenge of paternity, that is, within the limitation period.

If alimony is transferred excessively, can it be returned?

In case of disagreement with the accrued alimony, the payer will not be able to return the overpaid amount - this is prohibited by law. However, the latter has the opportunity to recover the material damage caused from the person responsible for it.

Thus, an unreasonable overestimation of the amount of payments may occur due to the fault of the accountant who deducts alimony from the payer’s wages. In such cases, first of all, it is better to solve the problem peacefully. Thus, an accounting employee can be motivated to return excess funds from personal funds, indicating that the latter’s actions are a violation of both family and labor legislation of the Russian Federation. Otherwise, the solution to the issue of compensation for lost wages is subject to judicial review.

However, there are also situations when an erroneous excess of alimony payments occurs not through the fault of the accountant, but as a result of a calculation error as a result of a malfunction in the program.

In this case, the accountant’s actions will not bear any signs of unjust enrichment, and the collection of personal funds from the latter will be unlawful. In this case, overpaid funds can be counted, at the request of the parent, towards payment for subsequent periods during enforcement proceedings.

It also happens that the legal rights and interests of parents paying child support are affected by unlawful actions of employees of the enforcement service. In order to resolve this issue, Russian legislation provides for the right of payers to recover damages caused from the guilty employee of a government body. This right is provided for in Part 2 of Art. 119 Federal Law “On Enforcement Proceedings”.

Refund of overpaid alimony

Excessive withholding of alimony may occur due to:

- erroneous accrual by employees of the accounting department of the organization in which the payer is employed and which deducts from his wages;

- untimely notification of the enterprise about changes that affect the amount of payments or even the need for their transfers (for example, if the child recipient has reached 18 years of age);

- a mechanical error made during the process of registering charges;

- intentional actions of certain officials.

To return such extra transfers, you need to contact the management of the company or go to court if you cannot reach an agreement with the management of the company.

Is it possible to return overpaid alimony: law

As you know, the issue of paying alimony does not always go smoothly and without complications. One of these complications is the return of overpaid alimony. So is it possible to return child support paid in an inflated amount or completely illegally? Definitely no. This action will harm the interests of the minor, and this is prohibited by the laws of the Russian Federation. However, the legislation defines the procedure for compensation of said damage by the guilty parties.

Yes, Art. 116 of the Family Code provides that alimony that has already been accrued is not subject to demand, with the exception of the following situations:

- Cancellation of a court decision on the payment of such alimony, due to the fact that the said decision was based on false information or forged documents;

- The invalidity of the agreement on the payment of alimony in connection with its preparation under the influence of threats, deception or violence on the part of the person receiving such payments;

- The presence of a court verdict, which established the fact of forgery of documents related to alimony payments (court decision, writ of execution, agreement).

The same article notes that if the above actions are committed by a person who is the parent or legal representative of the child, then the damage from such actions is recovered from the specified person in court.

IMPORTANT: The above list is absolutely exhaustive. There are no other cases when payments paid in favor of a child are subject to return. Even if paternity has been disputed and biologically the recipient of alimony is not the child of the payer.

In addition, there are cases when excessive calculation of alimony occurs due to the fault of an official, for example, an accountant of the enterprise where the payer is employed or a bailiff. In this case, in accordance with Art. 1102 of the Civil Code of the Russian Federation, compensation to the parent for damage caused is made by the specified officials. Child support. Again, they don’t take it.

Peaceful settlement of alimony debt

If, during a divorce, the parents entered into an agreement on voluntary financial participation in the life of the child, then the situation develops in brighter colors. But even here, difficulties may arise with the payment of alimony by one of the former spouses.

In this case, collection occurs on the basis of a drawn up agreement, but with the help of regulatory authorities. Most often, the settlement agreement on providing support to the heir is observed impeccably, because already at the stage of forming the document it was based on voluntary principles.

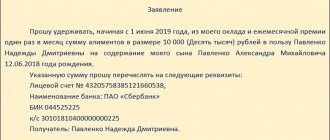

In the agreement itself, parents indicate the following information:

- the amount of money to be transferred monthly to the child’s account (also find out how to collect child support after 18 by following the link);

- terms of payment of alimony;

- procedure for making monthly payments.

ATTENTION : watch our video on the issue of alimony and subscribe to the YouTube channel

General concept of alimony and the principles of its calculation

Alimony is money that able-bodied citizens are required to pay for the maintenance of disabled members of their family. Since alimony is most often paid by parents for the maintenance of children, many believe that only such alimony exists, but this is not so.

Not only parents should take care of their children, but also children should take care of their parents. Adult citizens are required to care for their spouses, in some cases their former spouses, their parents, and disabled adult children. In all cases of the need for such maintenance, alimony may be prescribed. Sometimes, in order to obtain payments, disabled citizens or their representatives have to go through alimony court.

Alimony can be calculated in three different ways:

- Interest charges . In this case, the amount of alimony will depend on the income of the payer and will be a certain percentage of it.

- Fixed amount . In this case, a specific amount is assigned, which must be transferred at a certain frequency. The fixed amount of alimony is necessarily indexed to the amount of inflation based on the results of the year. Alimony is paid for a long time and, if not for this measure, ultimately the assigned amount of alimony would depreciate.

- Combined method of calculating alimony . A percentage of the income of the alimony payer is assigned for payment, but it is indicated that payments during a certain period cannot be less than a specific fixed amount.

Child support can be awarded in any of the available ways. Child support for adult dependents is always awarded as a fixed amount.