The Family Code of the Russian Federation obliges both parents to support their minor children until they reach adulthood. If parents do not comply with this, then child support is collected from them in court. If parents do not pay alimony, then bailiffs will collect arrears of alimony from them by decrees.

What should a parent know from whom the bailiff is collecting or has already collected arrears of child support?

This will be discussed in this article.

Debt on alimony

I specifically decided to prepare this article for those parents from whom alimony was collected in court for their children, but for various valid reasons they could not properly regularly pay alimony, as a result of which the bailiff (hereinafter referred to as the bailiff) calculated they owe tens or hundreds of thousands of rubles in alimony.

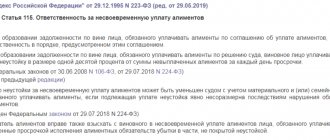

Debt for alimony for minor children is usually calculated by the bailiff on the basis of Article 113 of the Family Code of the Russian Federation (hereinafter referred to as the RF IC) and on the basis of Article 102 of Federal Law No. 229-FZ “On Enforcement Proceedings” (hereinafter referred to as Law No. 229-FZ ) at the request of the recipient of alimony or on his own initiative.

How to calculate the penalty for debt incurred for non-payment of alimony from August 2021

If the alimony debt arose after August 10, 2018, the amount of the penalty will be equal to 0.1% of the amount of unpaid alimony for each day of delay.

Each monthly alimony payment has its own overdue period. So, a January payment, for example, by September will be 8 months late (212 days): from February to September. And the February payment is 7 months late (184 days): from March to September. Therefore, the penalty should be calculated separately for each monthly payment.

Let us make a correct calculation of the penalty for an alimony payment in the amount of 10,000 rubles, collected from September 1, 2021 to the date of writing this article, that is, February 2021.

The Lifehacker Telegram channel contains only the best texts about technology, relationships, sports, cinema and much more. Subscribe!

Our Pinterest contains only the best texts about relationships, sports, cinema, health and much more. Subscribe!

So, if by February 1, 2021 you have not received a single ruble, you should calculate the penalty for the period from October 1, 2018 to January 31, 2019, for each month. You can submit demands for recovery of the received amount of the penalty to your ex-spouse in court from February 1, 2021 and within the 3-year limitation period.

1. We take the first monthly payment that you should have received in September, it is equal to 10,000 rubles. We multiply it by 0.1%, it turns out 10 rubles per day.

2. We count the number of days overdue for the September payment: from 10/01/2018 to 01/31/2019 - 122 days.

3. We multiply the number of days of delay by the amount of the penalty per day: 122 × 10 = 1,220 rubles.

Thus, the following formula is obtained: X × 0.1% × Y , where X is the amount of alimony awarded to you, 0.1% is the amount of the statutory penalty from August 10, 2021, Y is the number of days late in the monthly payment.

4. We do this calculation for every month. With each subsequent month, the number of days of delay will decrease, therefore the amount of the penalty will decrease.

5. We add up the penalty for all overdue months. We will have the total amount to be collected as a penalty for the entire period of payments.

In our example, the late payment for October will be 910 rubles, for November - 610 rubles, and for December - 300 rubles.

The total amount of the penalty will be 3,040 rubles.

When can the amount of the penalty be reduced?

The amount of the penalty for late payment of alimony may be reduced by the court, taking into account the financial and/or marital status of the person obligated to pay alimony, if the penalty payable is clearly disproportionate to the consequences of the violation of the obligation. These criteria are not established by law and remain at the discretion of the court. It can be assumed that if the penalty is equal to or exceeds the amount of the debt itself, then the court will consider the penalty disproportionate and will reduce it.

In addition, the debtor may apply to the court for complete exemption from paying the penalty.

The court will pay attention to the following circumstances:

- the health status of the debtor and his family members;

- the presence of minor children and other dependents - for example, elderly parents;

- mortgages, loans, other debts and enforcement proceedings;

- salary and income calculation for all family members;

- any evidence of financial difficulties, high expenses and personal problems.

That is, the court will find out why the alimony debt arose: due to deliberate evasion or loss of ability to work, loss of the writ of execution by the employer, or disability.

It is difficult to predict how much the court will reduce the penalty. This is where a good lawyer can help you.

From what income is alimony paid?

Alimony is withheld:

- from wages, bonuses, rewards and other types of payments to wages;

- from all types of pensions, scholarships;

- from benefits for temporary disability, unemployment;

- from amounts paid for the period of employment to those dismissed in connection with the liquidation of the organization;

- from income from business activities, from the lease of property, income from shares;

- from amounts of material assistance, except for one-time financial assistance in connection with emergency situations, a terrorist attack, in connection with the death of a family member, as well as in the form of humanitarian assistance and for providing assistance in solving terrorist acts and other crimes;

- from amounts paid in compensation for harm caused to health;

- from compensation payments to victims of radiation or man-made disasters;

- from amounts of income received under civil contracts;

- from monthly payments made to doctoral students;

- from an amount equal to the cost of the issued (paid) food, as well as other payments made by the employer in accordance with labor legislation.

Withholding of alimony is made from the salary of military personnel, police officers and other similar categories of persons.

Collection of alimony is made only after taxes have been withheld from this type of income.

The only thing more expensive than a wife is an ex-wife (folklore).

Alimony through the court in a fixed amount of money

Alimony in a fixed amount is collected based on a court decision. The judge can no longer consider such a case without calling the parties, and a hearing is scheduled. To obtain alimony, you need to submit a statement of claim to the court.

According to Article 83 of the RF IC, alimony in a fixed sum of money is prescribed if the alimony holder has an unstable income. The amount of the amount is determined by the court based on the interests of the child. As a rule, the amount of alimony in a fixed amount is a multiple of the cost of living per child in the region. The period for consideration of the case is up to 30 days (Article 154 of the Code of Civil Procedure of the Russian Federation). The decision comes into force immediately after it is made (Article 211 of the Code of Civil Procedure of the Russian Federation).

Who gets paid

Chapters 13 - 15 of the Family Code of the Russian Federation establish categories of citizens entitled to receive alimony:

- minor children in respect of whom their parents do not fulfill their maintenance responsibilities;

- adult disabled children;

- disabled low-income spouse;

- wife during pregnancy, as well as for three years from the date of birth of the common baby;

- a spouse who cares for a common disabled minor child, or a group I disabled person since childhood after 18 years of age;

- a former spouse who cares for a common disabled child under 18 years of age, and after that for a group I disabled child;

- a disabled former spouse who lost his ability to work before the divorce, or within a year after that moment;

- a spouse who became an old-age pensioner within five years after the end of the marriage relationship and needs financial support.

Each of the groups indicated in this list can receive payments, but the procedure for assigning them and the specifics of collection differ in each specific case. Here you can find detailed descriptions of how alimony is collected for each type of recipient, and find answers to questions on a topic that is important to you.

Alimony within and without marriage

Couples living together without formalizing the relationship is a fairly common occurrence. But citizens living without marriage registration still have mutual rights and responsibilities, especially to provide for common children . By going to the appropriate section on our website, you can find out what kind of protection of their property and non-property rights children born out of wedlock can count on.

Here we have collected experience in the application of legal norms and judicial practice in cases in which parents, for some reason, did not formalize their relationship, but this did not prevent them from assigning and collecting funds to provide for their common children.

Also, thanks to our specialists, you will be able to understand the intricacies of the paternity determination procedure, which is mandatory in cases where the father is not included in the birth certificate of a child born out of wedlock. Indeed, in this case, an unconditional determination of the father’s identity based on the fact of birth is not applied.

- Answer a few simple questions and get a selection of site materials for your case ↙

1

What's your gender

Select your gender.

Woman

Man

Your answer progress

Often the parents of the baby come to an agreement, and paternity is determined voluntarily by making an appropriate entry in the birth documents, and if this was not done, then in court . And then it becomes important what evidence the mother can provide, and which of it is taken into account by the courts.

If you are still in a marital relationship, and you are additionally interested in the legal subtleties and consequences of divorce from your spouse, issues of determining the place of residence of a child after a divorce, and the division of jointly acquired property, then the specialized website razvod-expert.ru will help you.

Calculation algorithm

The period for collecting alimony is limited to three years, if the circumstances of the case do not indicate the direct guilt of the debtor in the formation of the debt (clauses 1-2 of Article 113 of the RF IC). The court sets the amount of withholding based on the number of dependents of the debtor, income level, number and age of citizens who require periodic maintenance payments.

The amount of debt in each case may vary

Next, you should find out how bailiffs calculate alimony arrears for previous periods. The executor calculates the alimony debt as of the date of registration of the claim from the claimant. Debt is defined as a fixed (solid) amount or percentage of the amount of actual or potential income.

Stationary withholding is used in situations where the debtor is in a difficult financial situation, has children, dependents, and does not have a stable income (Articles 83, 85, 87, 91, 98 of the RF IC).

There are three fundamental methodologies for determining the amount of debt:

- By income.

- Based on the average salary in the country.

- According to the cost of living per capita.

The amount of obligations for citizens is determined by a court decision or an alimony agreement in a fixed amount or a share of the subsistence level established by the administrative-territorial unit on the date of calculation. The fixed amount of alimony is subject to mandatory indexation in accordance with the increase in the base indicator.

Let's consider the use of this calculation option using a specific example. A citizen of the city of Tver, Fedorov, is not employed; from June to September 2021, funds for child support under a writ of execution in the amount of a quarter of income were not transferred to the wife’s account. The minimum per capita in this city in the second quarter of 2021 was 10,242.64 rubles, in the third - 10,261.84 rubles. The calculation of debt is presented in the table:

How to calculate alimony debt if the debtor does not work

When an individual is not employed, is hiding, and there is no information about official sources of income, the bailiff calculates the amount of alimony based on the level of the average salary in Russia. The indicator is taken from official sources, for example on the website of Rosstat or the labor exchange. There is no need to withhold personal income tax from this amount, since the income is potential and not actually received by the citizen.

For example, Volgograd resident Balukhin S.A. by a court decision must support a disabled mother, the amount of alimony is determined as ten percent of income. The alimony provider does not transfer money during the third quarter of 2021. Since the bailiff was unable to find out the debtor’s place of work, the average salary in the Russian Federation is taken into account, equal to 35,845 rubles in the specified period. Then the debt will be 10,753.50 rubles. (35,845*0.1*3).

This technique has negative consequences for the debtor, since on average in the regions the actual income of individuals is significantly lower than the average. Therefore, a debtor who recklessly hides his income seeks to increase the amount of alimony by two or more times.

For citizens who are officially employed and have a stable level of income, the amount of alimony debt is determined as a percentage of the amount after taxation (clause 3 of article 102 229-FZ, clause 4 of article 113 of the RF IC). All payments are included in the calculation: tariff rate, bonus, professionalism coefficients, vacation pay, etc.

One child receives a quarter of all payments, two children receive one third, and three or more receive half. For aggregate claims, the total amount of deductions cannot exceed seventy percent of income. It is recommended that the bailiff specify the percentage in the decree in order to avoid discrepancies and errors in deductions.

For example, the income of Stepanov S.I. is 15 thousand rubles. per month. From April to October 2021, no funds are transferred to the recipient of alimony for the maintenance of his minor daughter, despite the fact that the debtor continues to work in his previous place and receives wages. Based on the claimant’s application and according to established criteria, the bailiff calculates the amount of debt as of the date of application. Unfulfilled alimony obligations amounted to RUB 22,837.50. The step-by-step calculation is shown in the table:

Features of calculation for individual entrepreneurs

To calculate the alimony debt of an individual entrepreneur, the bailiff must take into account some nuances. For individual entrepreneurs on OSNO, the amount of income is determined according to the 3-NDFL declaration. If the debtor operates on a single income tax, the simplified tax system executor will need to obtain information from the debtor about income and expenses.

In any of the above cases, the FSSP must take into account the net income of the individual entrepreneur, that is, the amount of profit minus costs (Articles 346.5, 346.17 of the Tax Code of the Russian Federation), taxes payable to the budget. When it is impossible to determine the amount of benefit of an entrepreneur, it is allowed to use the average salary in the country in the calculation (clause 4 of Article 113 of the RF IC). If the defaulter later submits a declaration on his own initiative, the bailiff will recalculate the amount of debt.

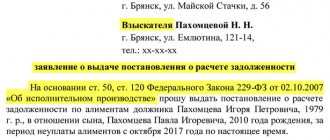

Where to file a claim for a penalty

The penalty is collected by the court on the basis of the submitted application. The claim is filed in the magistrate’s court at the address of residence (yours or the alimony payer’s).

The claim must be accompanied by a decision on the collection of alimony (a court order or a notarial agreement on the payment of alimony), a bailiff’s order with the calculation of the debt, the child’s birth certificate and a calculation of the penalty. The set of documents is submitted to the court in two copies; on the third copy, put a mark indicating delivery.

State duty is not paid.

Use technology