The state protects the interests of citizens by providing guaranteed payments when they reach retirement age or in case of incapacity for work.

But the law of the Russian Federation does not exempt pension recipients from certain material obligations, which include alimony.

Alimony obligations apply not only to payments to children, but also to support of a former spouse, as well as elderly relatives.

Pensioners, along with other persons, are obliged to make alimony contributions from their pension, which is included in the list of specific income of a person. Only the courts have the right to determine the amount of alimony collection from a pensioner, as well as analyze the amount of income, the level of his material well-being and health.

Dear readers! To solve your problem right now, get a free consultation

— contact the duty lawyer in the online chat on the right or call: +7 Moscow and region.

+7 St. Petersburg and region. 8 Other regions of the Russian Federation You will not need to waste your time and nerves

- an experienced lawyer will take care of all your problems!

Is alimony collected from a pension?

A pension is a state benefit paid to citizens for old age, disability or other circumstances. According to Government Decree No. 841 of July 18, 1996, alimony from pension benefits is withheld.

Several factors influence the amount of alimony:

- the amount of pension provision;

- number of children, form of punishment;

- living wage.

Let's consider from which pensions and payments alimony is and is not withheld:

| Paid | Not paid |

| on disability | for the loss of a breadwinner |

| old age | surcharges for hazardous working conditions |

| by length of service | one-time compensation |

| social |

From what pension payments is it unlawful to withhold alimony?

Law 229-FZ in Art. 101 defines a list of sources of funds from which the deduction in question cannot be made. Based on this rule, the only type of pension that is inviolable and cannot be reduced in any way is the survivor's pension.

At the same time, the document separately mentions this type of benefit, which is paid at the expense of the federal budget, and separately at the expense of the budget funds of the constituent entity of the Russian Federation. Accordingly, maintenance for a relative cannot be deducted from this type of income even if there is a court decision to collect periodic payments in the form of a percentage of the income.

Important!

In addition to the types of pensions, there are some additional payments to them, which also cannot be subject to deductions. These include the so-called “veteran” benefits (for example, compensation for travel to the place of treatment, purchase of medications, etc.), supplements to the pensions of elderly people (reliant on paying those who care for them) and some others similar.

Who has the right to collect alimony from a pension?

According to the RF IC, alimony may be collected for the maintenance of the following categories of citizens:

- Spouses and former spouses.

- Minor children.

- Adult children with disabilities.

- Parents.

- Grandparents.

- Stepfathers and stepmothers.

- Brothers and sisters.

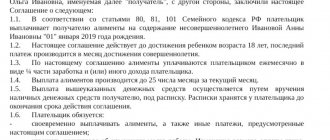

Alimony is collected in three ways: by way of claim or writ proceedings, or by concluding an alimony agreement. If we are talking about withholding payments to parents and other relatives, alimony can be recovered through legal proceedings, or by concluding an agreement.

Is alimony withheld from a military personnel's pension in Russia?

Alimony according to the minimum wage

Is a pension a basis for reducing the amount of alimony?

Often in court, alimony payers put forward the argument that they cannot pay alimony because they receive a pension.

Alas, all of these are just attempts to avoid obligations to support a child - after all, current legislation does not provide for an exemption from paying alimony for pensioners or even a possible reduction in its amount below that established by law.

Therefore, a pensioner alimony payer is just as obliged to provide for his minor children as a working or even unemployed citizen.

Shape, size and features of collection

The Insurance Company establishes several forms of collecting alimony payments:

- as a share of earnings;

- in a fixed amount of money (TDS);

- in a mixed form, combining the two above.

Let's consider when a specific form is assigned:

| Share | If the exact amount of earnings (pension) of the payer is established |

| TDS | If the person obligated for alimony does not have an official job, receives a salary in foreign currency, “floating” income (for example, individual entrepreneur), or if alimony in shares does not correspond to the interests of the child |

| Mixed | This is relevant when the payer has two types of income – stable and “floating”. For example, he receives a pension and income from renting out housing under a rental agreement |

The TDS collects alimony for the maintenance of spouses and relatives. Children can be restrained in any of three ways, depending on the specific situation.

Per child

Parents' alimony obligations towards children are established by Ch. 13 IC RF. It is allowed to collect mixed, TDS or alimony in shares.

Let's look at examples where one of the options:

Alimony in shares of pension

Citizen Astakhov O.V. receives an insurance pension in the amount of 12,000 rubles. Of these, 25% is paid per minor son. How is the calculation made: 12,000 x 25% = 3,000 rubles. Here, the amount of payments is significantly lower than the minimum monthly wage per child, but it will not be possible to recover a large amount, since the court takes into account the financial situation of the parties. Pensioners often require medications, and if the amount of payment is increased, their rights to ensure minimal needs will be violated.

Alimony in a fixed amount

Volnov P.I. receives 15,000 rubles. pensions and alimony for one daughter are 25% or 3,750 rubles. After paying alimony, the person obligated to receive alimony is left with 11,250 rubles. The minimum monthly wage per child in the region is 9,000 rubles. Guided by Art. 83 of the RF IC, which talks about the possibility of collecting payments in TDS in case of a significant violation of the interests of the child, the recipient filed a claim to change the method of payment from equity to TDS, arguing that the daughter’s needs were not met and the significant difference between the PM and the father’s actual payments. The claims reflect the recovery of half of the PM, i.e. 4500 rub. The plaintiff's salary is 10,000 rubles. The combined income of the payer and recipient does not allow them to adequately provide for the child. Having considered the case materials, the court satisfied the claims: the plaintiff’s earnings are negligible, 90% of the money goes to the child. The woman has no help from relatives. The person obligated to pay alimony spends the pension only on himself, in addition to alimony. There are no medical needs or other valid reasons for rejecting the claim.

For a spouse or ex-spouse

In accordance with Art. 91 of the RF IC, alimony for the maintenance of spouses or former spouses is collected in the TDS, taking into account the financial situation of the parties.

Alimony is collected from spouses during marriage and for 1 year after its dissolution in the following cases:

- Disability and need.

- Wife's pregnancy, maternity leave for up to 3 years.

- The needs of a spouse caring for a disabled child under 18 years of age or an adult child with a childhood disability of group 1.

Since the defendant is a pensioner, the total amount of his income is taken into account. If the pension is small and there is no additional income, then the payment may be assigned in a small amount.

If there is additional income, the court will take into account their regularity and amount:

- Wage.

- Funds from renting out an apartment.

- Availability of funds on deposits.

If the plaintiff wants to recover payments from the defendant’s additional earnings, the fact of its existence will have to be proven in court.

For parents

According to Art. 87 of the RF IC, disabled parents in need have the right to collect alimony from able-bodied adult children in the TDS. The amount of payments is determined in proportion to the number of children, taking into account the financial situation of the parties. The cost of living in the region is also taken into account.

If the defendant is retired, he has the right to file a counterclaim or raise an objection, indicating that he himself needs financial assistance due to the high costs of medicine.

Does a pensioner need to pay alimony?

Alimony can be collected from any person only after deduction and payment of taxes established by law on income.

Articles 81 and the Family Code of the Russian Federation contain a list of alimony obligations that apply to pensioners. This category of citizens is required to make contributions:

- natural children who have not reached the age of majority and live with the other parent after the dissolution of marital obligations;

- a former spouse who became unable to work during the marriage or in the first year after its termination;

- adult children who are not able to work. They must be paid for life.

There are several types of pension accruals. Alimony is withheld:

- from labor pension;

- from disability benefits;

- from payments to military pensioners and combat veterans;

- from pension payments to employees of law enforcement units.

A recipient of a military subsidy who has a labor pension for working in civilian life is required to provide information about this type of activity for retention purposes.

The Family Code also states that citizens receiving disability benefits are also required to make alimony payments on a general basis. The decision on such deductions is made by the court. During court hearings, the financial situation of both parties, the category of disability of the alimony payer and his financial expenses for his support will be taken into account. The court has the right to ease the payer’s alimony burden or cancel it completely.

Alimony deductions are made not only from the pension subsidy, but also from the allowances, indexations and compensatory additional payments accrued to it.

How to collect alimony from a pension: step-by-step instructions

Collection of alimony from a pensioner through the court consists of several stages:

- Preparation of documents. The plaintiff does this independently or draws up a power of attorney and acts through a representative.

- Drawing up a statement of claim in triplicate.

- Sending one copy of the claim to the defendant via Russian Post.

- Submitting a claim with documents. The claim is considered by a judge within 5 days, and based on the results, a decision is made to accept the documentation for processing. The parties receive notices with the date of the preliminary hearing.

- A preliminary hearing, after which a trial is scheduled by the court.

- Trial. The opinions of the parties are heard and evidence is studied. The income of the parties and the reporting of the child’s needs, which the plaintiff has to pay, are taken into account.

- Making a decision.

When the decision is made in final form, the plaintiff needs to receive a copy of it and a writ of execution. In the future, these documents can be presented to the Pension Fund or bailiffs so that payments are transferred. The decision comes into force in a month.

The accounting department of the Pension Fund of Russia usually handles the withholding of alimony from pensioners.

Where to contact

According to Art. 29 of the Code of Civil Procedure of the Russian Federation, when collecting alimony, plaintiffs have the right to apply to district or city courts of their choice:

- At your place of residence (Article 29 of the Code of Civil Procedure of the Russian Federation).

- At the defendant's residential address.

If a court order for the collection of alimony is needed, an application for issuance is submitted to the magistrate's court.

Contents and sample of the statement of claim

The claim must comply with the requirements of Art. 131 Code of Civil Procedure of the Russian Federation. What information is reflected in it:

- Name, address of the court.

- Full name, address of the defendant.

- Full name, address, passport details, telephone number of the plaintiff.

- Dates of marriage and divorce (if there was one).

- Date of birth, details of the child’s certificate.

- Amount of monthly expenses for a minor.

- Claims: to recover alimony in TDS, shares of all types of earnings, in shares and TDS.

- Description of submitted documents.

- Signature and date of compilation.

Sample claim

Documentation

Along with the claim, the following is submitted to the court:

- Passport.

- Child's birth certificate.

- Certificate from the Pension Fund about the amount of the defendant’s pension (if available). If it is not available, the judge will request it from the defendant at the preliminary hearing.

- Certificate of family composition to confirm the joint residence of the mother and children.

- Certificates of registration and divorce (if any).

To confirm the validity of the requirements, it is recommended to provide checks and receipts for expenses for the child.

State duty and deadlines

Cases regarding the collection of alimony are considered within a month. The plaintiff does not need to pay state duty; he is exempt from this under Art. 333.36 Tax Code of the Russian Federation. It will be collected from the defendant later: 150 rubles. for demanding child support, 300 rubles. - for payments to him and his mother.

Conditions for collecting alimony from a pensioner

Payment of alimony by pensioners is made according to general rules. When resolving a case in court, not only the financial situation of the mother raising the child is taken into account, but also the size of the father’s pension. If the amount of old-age benefits he receives is several times lower than the subsistence level in the region of residence, then the court may reduce the amount of required alimony. The court is also interested in the marital status of the parties and whether they have other dependents in need of financial support.

In addition to all that has been said, documentary evidence of the blood relationship between the child and the defendant father is required. In most cases, this document is the child's birth certificate. If it does not contain information about the father, then before applying for alimony, it is necessary to prove in court that this particular person is the father of the child. Also, the mandatory conditions for assigning payments include the confirmed fact of need of a minor child. The lack of financial resources is determined based on the information provided on the income certificates of the mother supporting the child.

Arbitrage practice

Typically, courts are primarily guided by the interests of children, but the rights of pensioners are also taken into account. The financial situation of the latter also plays a significant role.

Here are some examples of real solutions:

- The plaintiff wanted to change the method of collection from equity to TDS, and demanded reimbursement of additional expenses for the child’s education from the defendant-pensioner. By decision No. 2-58/2020 2-58/2020~M-2/2020 M-2/2020 dated February 26, 2021, in case No. 2-58/2020, the claims were denied.

- The woman was thinking of collecting alimony from her retired husband in the TDS for two children in the amount of one monthly minimum. By decision No. 2-956/2020 2-956/2020~M-804/2020 M-804/2020 dated May 13, 2021 in case No. 2-956/2020, the requirements were partially satisfied. 1/3 of all income was collected for alimony, plus 1/5 for each child.

- The plaintiff applied to the court with a request to dissolve the marriage and collect alimony for the children she shared with the defendant. Decision No. 2-297/2019 2-34/2020 2-34/2020(2-297/2019;)~M-324/2019 M-324/2019 dated February 4, 2021 in case No. 2-297/2019 the demands were partially satisfied, the marriage was dissolved.

Expenses

The legislator exempted the plaintiff parent from paying the fee for filing a claim for alimony.

The 150 rubles due for payment will be collected from the defendant if the situation is successful and the decision is positive.

Costs when filing a claim for alimony can only arise when paying for a lawyer's services if the plaintiff is unable to draw up a statement on his own or represent his interests in the lawsuit.

In addition, if alimony is sought as part of a divorce action, the plaintiff will also incur the cost of paying divorce fees.

Lawyer's answers to private questions

Can money be withdrawn from the EDV pension for alimony?

Yes, all bonuses and additional payments to the pension in accordance with Government Decree No. 841 are subject to consideration when calculating alimony.

Is alimony collected from the funded part of the pension?

No. The funded part is formed from the salary from which alimony is already withheld. In addition, payments are not included in the list established by PP No. 841.

Is it possible to collect alimony from a pensioner in a fixed amount?

Yes, if the amount of payments in shares violates the interests of the child and does not meet his needs. When making a decision, the court takes into account the financial situation of the plaintiff and defendant.

What is the maximum percentage of alimony collection from a pensioner?

and three children are retained 50%. If there are debts, the amount of deductions can be increased to 70% (Article 99 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”).

Is it possible to apply for alimony to a pensioner if his adult son is also retired?

Yes. A retired parent can recover money for their own maintenance from a retired adult child. In this case, the court will take into account the general situation and financial situation of each party.

What is the collection procedure?

To receive alimony, a person must have a writ of execution in his hands. According to the law, these are, in particular:

- agreement on payment of alimony;

- court order;

- a writ of execution issued on the basis of a court decision that has entered into legal force.

To obtain one of the last two documents, a citizen must go to court. After receiving the writ of execution, the claimant also has 2 options at his discretion:

- Contacting the bailiff service with an application to initiate enforcement proceedings (with an attachment of the enforcement document). In this case, the bailiff issues a decision to foreclose on the pension provision of the alimony payer and sends it to the Pension Fund of the Russian Federation or another agency (the pension service of the armed forces in the case of payment of a military pension, the pension authorities of the Investigative Committee or the Prosecutor's Office, etc.).

- Independent submission by the claimant of a writ of execution to the Pension Fund of the Russian Federation to withhold awarded payments. This method allows you to directly contact the agency paying the pension to the debtor, but forces the claimant to independently monitor the execution of the sent document.

The withheld amounts of alimony are sent to the account of the claimant specified in the application or resolution of the bailiff.

Reduced old age benefits

There are several circumstances that the court takes into account and, on their basis, makes a decision to reduce alimony payments for pensioners:

- a large amount is spent monthly on medications and treatment;

- financial situation changes;

- children have another income that fully satisfies their needs;

- the second parent, with whom the child lives, receives property that constantly brings in cash;

- new alimony obligations appear.

Pensioners' incomes can increase significantly. If the amount of alimony is too large, i.e. significantly exceeds the child's needs, then, at the request of the payer, payments from the pension are reduced.

Statement of claim for alimony

The legal basis for applying to court to establish alimony will be a statement of claim. The content of the statement of claim must include the following points:

- name and address of the court;

- personal data and contact information of the plaintiff and defendant;

- an indication of the presence or absence of family relationships;

- information about the children of the plaintiff and defendant;

- requirement to establish alimony payments.

A sample statement of claim can be downloaded on our website, and to draw it up, we recommend consulting with our specialists. Only in this case can mistakes and violations of the law be avoided, which will lead to a significant delay in the collection of alimony. Fill out the feedback form or call one of the numbers listed on the website. We will offer the most optimal options for establishing alimony payments.

Is it possible to reduce the size

Yes, there are 2 ways to reduce the amount of payments in favor of minors. This:

- negotiate with the other parent and draw up a written agreement;

- achieve through court.

With a voluntary agreement, you can reduce the amount of alimony without good reason. If the payer wants to achieve a reduction in court, he needs to justify his position and provide clear and compelling evidence of his desire.

The amount of money paid through the court can be reduced if the following circumstances exist:

- deterioration of the financial situation of the payer. For example, collection is made from disability benefits, but the alimony payer’s health has deteriorated. The remaining amount is not enough for him to purchase the necessary medications or rehabilitation means;

- improvement of the financial situation of the parent with whom the minor lives, which gives him the opportunity to fully independently satisfy all the needs of the child;

- the addition of another dependent in the family. This could be the birth of another child or the loss of ability to work by the parents of the alimony payer, which led to an increase in expenses;

- the amount of alimony already paid is unreasonably inflated; the child’s needs can be met by transferring smaller alimony;

- the payer has new obligations to support another child or other relative.

If there is no agreement, then the court must submit the following documents:

- a statement of claim in which to indicate a request to reduce the amount of payments. you also need to describe in detail the reasons why the pensioner makes this demand;

- documents confirming the grounds for reduction that are stated in the statement of claim; documents about the plaintiff’s income, the amount of his pension and other sources of profit.

You need to contact the magistrate’s court at the place of residence of the defendant , that is, the person who acts as the alimony recipient. It could be:

- official guardian or trustee;

- parent;

- guardianship and trusteeship authorities, if they represent the interests of a minor;

- government institution where the child permanently resides. This could be a boarding school or a medical facility.

In the first two cases, the funds go to the bank account of an adult, who manages them in favor of the child. In the last two options, a personal account for the child is opened, in which these funds are accumulated. Upon reaching adulthood, he will be able to use this money at his own discretion.