When a person dies, the question arises between relatives about the fate of the property acquired by the deceased. An acute problem is the receipt of funds stored in the savings book. This document is part of the inheritance, and receiving money from the savings book of a deceased relative is permitted in accordance with the rules of inheritance law.

Successors entitled to receive the contribution

The following persons have the right to withdraw funds from the deceased:

- The successors who are indicated in the will (it must be stated which relative gets the money from the savings book).

- Heirs of the first stage.

- Citizens who are designated in the banking agreement as heirs of the funds lying on the deposit opened by the testator.

- Other persons who have the right to succession if there are no heirs of the first priority.

- People who handled funerals when the deceased had no relatives left.

If the deceased had no relatives, those who handled the funeral may be able to claim money from the account to compensate for their expenses.

Important! You can withdraw funds from the book only after 6 months from the date of death of the person. The law does not regulate the urgent receipt of money for organizing and conducting a funeral. This is possible only with the assistance of a notary and a detailed consideration of all the subtleties of the issue.

To obtain the status of an heir, they contact a notary at the place of registration of the testator to draw up an application. The notary is given a package of documents:

- Passport.

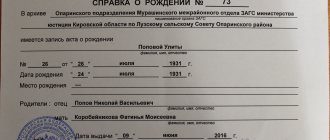

- Death certificate.

- Papers confirming family ties with the deceased (birth certificate, marriage certificate).

- Savings book.

If the successor missed the 6-month deadline, they go to court to restore their rights by presenting strong evidence of missing the deadline.

Is it possible to get money?

Yes, heirs have such an opportunity.

This is due to the fact that although the savings book itself is not valuable, it gives access to the savings of the deceased. Therefore, it may well be considered as a material value, since on its basis it is possible to obtain the savings of the deceased, which will also be part of his inheritance. Receiving funds from the deceased's savings account for the most part follows the standard procedure: it is transferred in the same way as any other funds. However, after the savings book itself falls into the hands of the heir, money will need to be withdrawn from it. In general, the entire process of withdrawing money from the account of a deceased relative will look like this:

- One of the heirs opens the inheritance;

- The notary conducts the inheritance process in the standard manner: notifies relatives, conducts an inventory of property, etc.;

- The notary determines the future holder of the savings book, who will be able to receive money from it;

- The heir receives the necessary package of documents and goes to the bank.

The process is generally quite standard. However, even the smallest mistake in it can cost the heirs dearly. In this regard, we will consider it in more detail.

Opening an inheritance

The distribution of property between the heirs of the deceased begins from the moment one of the heirs submits a document recording the fact of the citizen’s death to a notary. From this day begins the countdown of six months, during which the notary will be obliged to notify all potential heirs that they can participate in the division of property.

It is worth noting an important detail - if the testator had a will, this will not save the notary from the need to open an inheritance and wait six months. This period is given so that all relatives who had the opportunity to participate in the division of property can familiarize themselves with the text of the will and challenge it if necessary.

Managing an inheritance

After opening the inheritance, the notary will begin its management. Everything is simple here. If the deceased did not have a will, then the call to inheritance will begin in the order of legislative priority. Thus, the first applicants for the deceased’s savings book will be his immediate relatives - spouse, parents and children.

If the testator has a will, then the deceased’s savings book will go to the person indicated by the testator himself. Relatives, regardless of the queue, third parties and even an existing organization will be able to receive a savings book. In this case, any of the potential heirs will be able to challenge the will. If his initiative is successful, the will will lose force, and the savings book, along with other valuables, will participate in the distribution of property in the order of legal priority.

Definition of heir

As a rule, if there is a will, there are no disputes over the determination of the heir - he has already been determined by the deceased himself in advance. Therefore, problems can only arise if inheritance takes place in order of priority. The fact is that the notary has the right to divide the money available on the book into equal shares between all representatives of one of the lines of inheritance. However, in practice, this creates a lot of problems - firstly, it will be quite difficult to formalize such an operation and carry it out, and secondly, each of the testators will have to write their own application and go to the bank.

In this regard, in practice the following action is used - all heirs choose among themselves one representative to whom the savings book will be inherited. He undertakes to independently receive the money from the savings account, after which it must be divided equally according to the share of each recipient. This saves time and effort, allowing you to tackle more complex inheritance issues.

Receiving the money

So, all the issues have been settled, the disputes have been settled, the legal period for entering into inheritance has passed and the savings book has found a new owner. All that remains is to get money from the savings book. It's very easy to do. First, prepare your documents. You will need:

- Conclusion from a notary on the transfer of inheritance;

- The savings book itself;

- Your account number for transferring funds;

- Death certificate;

- Your ID.

With these documents you will need to go to the bank and write a corresponding application. All that remains for you after this is to transfer the package of documents and receive money into your personal account.

Methods of inheriting deposits

Receiving money from the deceased's savings book is regulated by Part 3 of the Civil Code of the Russian Federation. The regulation describes legal ways to withdraw money from an account after a person’s death. These are:

- A will drawn up in accordance with all the rules by a notary.

- Testamentary disposition.

- Automatic receipt of funds according to the law.

The legislation speaks of eight lines of heirs who will be able to withdraw money from the savings book of the deceased after 6 months from the date of his death. But there are successors who are entitled to an obligatory share in the inheritance, even if they are not mentioned in the testamentary document. These include:

- Minor children (including adopted ones).

- Father and mother.

- Spouse.

Important! If the testator had debt obligations to the bank, they pass to the heirs.

The procedure for inheriting bank deposits

The order of inheritance of funds in the account largely depends on the actions of the owner during his lifetime. Currently, there are three forms that determine how relatives will inherit the property of the deceased. The main types of inheritance are considered:

- by law according to priority;

- according to a previously executed will;

- by testamentary order.

In the absence of direct orders from the deceased in the form of clear instructions regarding the recipient of the inheritance, the order of inheritance of the balance of funds in the account is determined in the Russian Federation according to a legally defined sequence. There are currently 8 inheritance queues:

- the first priority includes immediate relatives, who are considered to be the spouse, children and parents of the deceased;

- second-degree relatives are considered to be siblings and brothers, parents of parents;

- then uncles and aunts act as applicants.

Next, the great-grandparents of the deceased act as successors. The heirs of the fifth and sixth order are cousins - great-grandchildren, nephews, nieces, aunts and uncles. The right of the sixth stage is given to the stepdaughter, stepson, stepfather and stepmother. Disabled dependents close the chain of queue 8.

Important! The order of inheritance after the death of mother, father or other relative is determined based on the degree of relationship. Such a rule for determining the order of succession exists in Russia, Ukraine and many other states. Relatives, if desired, can refuse and transfer their part of the inheritance to another person claiming the right of inheritance.

Receiving funds in the presence of a will

If a person drew up a testamentary document in a notary’s office, the passbook details are indicated in the text. The deceased's savings automatically become part of the estate and pass to the heir.

Algorithm for inheriting savings:

Expert opinion

Anastasia Yakovleva

Bank loan officer

Apply now

Right now you can apply for a loan, credit or card to several banks for free. Find out the conditions in advance and calculate the overpayment using a calculator. Want to try?

- Receipt of a testamentary document, drawn up in accordance with the requirements of the law and certified by a notary.

- Contacting a notary and drawing up an application for acceptance of inheritance.

- Checking the submitted papers (death certificates and ownership of shares, wills) for authenticity.

- Issuance of a document confirming the right to inherit under a will. It is certified by a notary.

- Transfer of received papers and the deceased’s passbook to the financial institution.

When 6 calendar months have passed from the date of death of the deposit owner, the savings will be available for withdrawal and other manipulations.

Checking whether the deceased has a passbook

The availability of funds in savings accounts can be determined if their details are indicated in the testamentary document. Detailed information about the amounts and location of funds should be provided here.

If there is no will, then the following is done to determine the accounts of the deceased:

- Contacting a notary in order to identify the existence of agreements on savings books and deposits of a deceased relative.

- Sending a formal request to those banks in which the deceased person may have had accounts. Done by a notary. To simplify this procedure, Sberbank has a simple and transparent scheme of cooperation with notary offices.

It should be understood that banks do not independently search for heirs of deposits. Therefore, the search for savings must be carried out by the heirs themselves. If the deceased's accounts are not used for more than three years from the date of his death, then all funds will go to the state.

Testamentary disposition

People often make sure that after their death, their heirs can easily withdraw funds from their savings book. To do this, a person prepares a testamentary disposition in the bank when registering a deposit. The paper is signed by the account holder and the bank employee. The document has legal force equal to a will certified by a notary.

The order indicates the names of relatives and the amount of the amount due to each (if there are several successors). It will be valid after the notary draws up a document accepting the inheritance.

Procedure for receiving funds:

- Presentation of the passport by the heir to the bank employee.

- Submission of testamentary disposition.

- Presentation of a notarized certificate of the right to inheritance.

The banking institution is contacted no earlier than six months after the death of the deposit owner.

Pros and cons of deposits with interest capitalization

Like any banking product, deposits with interest capitalization have certain advantages and disadvantages.

pros

:

- Obtaining additional income by accruing interest on interest already accrued in previous periods;

- High interest rates when placing a large amount of money for a long period.

Minuses

:

- To get maximum income, you should choose a deposit without the ability to manage finances;

- In case of early termination of the agreement, interest on deposits is calculated without taking into account capitalization.

Receipt of the deceased's savings according to the law

It often happens that a citizen dies suddenly without having time to draw up a will. And after his savings book is found, a struggle begins between his relatives for this money. In this case, you should turn to the letter of the law. All property of the deceased (movable and immovable) is inherited by law in order of priority (Article 1141 of the Civil Code of the Russian Federation).

The right to withdraw finances from the savings book is automatically granted to first-degree successors. The deceased's assets are divided equally among the heirs. The right to inheritance is certified by a notary.

The process of obtaining savings in the absence of a will:

- Contact the notary office at the place of residence of the deceased with a death certificate and documents confirming family ties.

- Verification of the authenticity of the transferred papers and issuance of a certificate of the right to receive an inheritance.

- Transfer of documentation to a banking organization. The clerk checks them.

If there are no claims to the papers, the heirs will be able to withdraw funds from the savings book 6 months after the death of the owner of the deposit.

Is it possible to get money?

Yes, heirs have such an opportunity. This is due to the fact that although the savings book itself is not valuable, it gives access to the savings of the deceased. Therefore, it may well be considered as a material value, since on its basis it is possible to obtain the savings of the deceased, which will also be part of his inheritance.

Receiving funds from the deceased's savings account for the most part follows the standard procedure: it is transferred in the same way as any other funds. However, after the savings book itself falls into the hands of the heir, money will need to be withdrawn from it. In general, the entire process of withdrawing money from the account of a deceased relative will look like this:

- One of the heirs opens the inheritance;

- The notary conducts the inheritance process in the standard manner: notifies relatives, conducts an inventory of property, etc.;

- The notary determines the future holder of the savings book, who will be able to receive money from it;

- The heir receives the necessary package of documents and goes to the bank.

The process is generally quite standard. However, even the smallest mistake in it can cost the heirs dearly. In this regard, we will consider it in more detail.

Opening an inheritance

The distribution of property between the heirs of the deceased begins from the moment one of the heirs submits a document recording the fact of the citizen’s death to a notary. From this day begins the countdown of six months, during which the notary will be obliged to notify all potential heirs that they can participate in the division of property.

It is worth noting an important detail - if the testator had a will, this will not save the notary from the need to open an inheritance and wait six months. This period is given so that all relatives who had the opportunity to participate in the division of property can familiarize themselves with the text of the will and challenge it if necessary.

Managing an inheritance

After opening the inheritance, the notary will begin its management. Everything is simple here. If the deceased did not have a will, then the call to inheritance will begin in the order of legislative priority. Thus, the first applicants for the deceased’s savings book will be his immediate relatives - spouse, parents and children.

USEFUL INFORMATION: Increase in the long service bonus from 2020

If the testator has a will, then the deceased’s savings book will go to the person indicated by the testator himself. Relatives, regardless of the queue, third parties and even an existing organization will be able to receive a savings book. In this case, any of the potential heirs will be able to challenge the will. If his initiative is successful, the will will lose force, and the savings book, along with other valuables, will participate in the distribution of property in the order of legal priority.

Definition of heir

As a rule, if there is a will, there are no disputes over the determination of the heir - he has already been determined by the deceased himself in advance. Therefore, problems can only arise if inheritance takes place in order of priority. The fact is that the notary has the right to divide the money available on the book into equal shares between all representatives of one of the lines of inheritance. However, in practice, this creates a lot of problems - firstly, it will be quite difficult to formalize such an operation and carry it out, and secondly, each of the testators will have to write their own application and go to the bank.

In this regard, in practice the following action is used - all heirs choose among themselves one representative to whom the savings book will be inherited. He undertakes to independently receive the money from the savings account, after which it must be divided equally according to the share of each recipient. This saves time and effort, allowing you to tackle more complex inheritance issues.

Receiving the money

So, all the issues have been settled, the disputes have been settled, the legal period for entering into inheritance has passed and the savings book has found a new owner. All that remains is to get money from the savings book. It's very easy to do. First, prepare your documents. You will need:

- Conclusion from a notary on the transfer of inheritance;

- The savings book itself;

- Your account number for transferring funds;

- Death certificate;

- Your ID.

With these documents you will need to go to the bank and write a corresponding application. All that remains for you after this is to transfer the package of documents and receive money into your personal account.

What to do if you don’t know where the deposit is

Sometimes relatives know that the deceased had savings, but it is not known in which financial institution they are located. And there is no savings book in hand. Banks do not search for heirs of deceased account holders.

Important! If no one requests the savings within 3 years, they are transferred to the state.

To find the account of a relative who has died, it is advisable to contact a notary. He will make a request to all banking institutions at the place of registration of the deceased.

About inheritance

First, you need to understand the legal subtleties and nuances and define the terms used. The main concept that is worth focusing on is inheritance. This is a procedure that determines the transfer of property (as well as rights and obligations) of the deceased to his heirs, the circle of whom is established by a will or law.

All inheritance and property disputes are regulated by Articles No. 418 and No. 1112 of the Civil Code of the Russian Federation.

About the features of receiving deposits

Bank deposits have special inheritance conditions. Regardless of the institution in which the account was opened, the procedure for receiving funds to relatives or heirs is the same.

There are several categories of inheritance depending on the basis on which a particular person acquires the right to dispose of material assets:

- in accordance with the law;

- according to the will of a deceased relative;

- by special notarized order.

The procedure for actions of heirs carried out in order to obtain material benefits is strictly regulated. First of all, you need to contact a notary so that he can add the assets located in the bank to the inheritance database.

Do I need to pay tax

In accordance with the provisions of the legislation of the Russian Federation, property (movable and immovable) received by inheritance is not subject to tax. Money from the account of a deceased relative comes to the full disposal of the successor - he has the right to withdraw savings and close the deposit or extend it.

When it comes to savings accounts that depreciated in the early 90s, based on a 2010 decree of the Government of the Russian Federation, owners of such deposits can expect compensation for deposits before 1991. If a deceased relative has a depreciated deposit, the successor can receive savings under the following conditions:

- The savings book was opened in Sberbank.

- The depositor was born before 1945 and the amount deposited in 1991 will be tripled.

- If the account holder was born between 1946 and 1991, the amount of savings will double.

Each case has its own nuances. If disputes arise, it is recommended to consult a notary or a professional lawyer.

Compensation for old deposits

Features of receiving

Let's consider who can receive the lost money:

- clients who did not have time to issue a refund;

- having Russian citizenship and currently residing on its territory;

- citizens born before 1991 (before 1945 - 3 times the amount, others - 2 times);

- their heirs;

- heirs who spent money on funeral services for those who died in 2001-2021 will receive 6 thousand rubles, if the balance in 1991 was more than 400 rubles;

- the same category receives 15 times more if the balance was less than the specified amount.

A special system for calculating the amount of deposit refunds was developed and approved.

The following categories cannot issue a refund:

- citizens of former Soviet republics;

- heirs are not citizens of the Russian Federation;

- received compensation;

- the account was opened after June 20, 1991;

- presence of a closed balance sheet from 06/20/1991 to 12/31/1991.

What does that require

Compensation for deposits made in Soviet times at Sberbank will take place in 2021 in a certain order. The applicant applies to any branch of a banking institution, since during the collapse of the USSR there was a significant reformation of the previous banking system. You must first submit an application about your decision to receive funds and appear with a passport and passbook. If the interests of the owner of the book are represented by another citizen, then he will need to present documents confirming this right (power of attorney certified by a notary). If the investor is undergoing treatment, the power of attorney is certified by the management of the medical institution.

Today, people who did not do so earlier continue to receive payments on deposits.

What card was left from the deceased?

- Credit. The funds contained on it belong to the bank. When funds are spent, the financial organization goes into the red. Therefore, spending them after the death of the holder is illegal.

- Debit. The money on it belonged to the deceased. Theoretically, you can start spending funds only after entering into an inheritance. In practice – we’ll tell you further.

The heirs are only entitled to the money contained on the debit card.

The debt tied to the credit card will have to be paid off in the future. But withdrawing money from such an account will be illegal. After all, the bank did not allow anyone other than the deceased to dispose of them.

Summary. You need to be careful with the card

So, impersonal-looking plastic is the key to the funds linked to the account

.

They may belong to the deceased, and then they are included in the inheritance mass. Or be credit funds, which means they belong to the bank. Only heirs (by law or by will) have the right to dispose of the deceased’s money. But you can’t take out loans

- otherwise there is a risk of being subject to criminal prosecution.

A completely legal way is to notify the notary that you have a bank account or that cash has been withdrawn from the card. He will either send an order to a financial institution or put the money on his deposit. But if there is no dispute between the heirs... Then think for yourself - we cannot give advice that is not directly stipulated by law.

Responsibility is provided for the unlawful use of other people's money

. And also, the heir, having received even a small part of the property, also acquires all obligations (within the limits of his share). Therefore, in a difficult situation, we recommend that you get all the clarifications from a notary. And do not act at random - carefully think through all the steps.

We get money for funerals

In the event of the death of a depositor, his relatives or proxies can apply to the bank for compensation for funeral expenses. The financial institution undertakes to cover all expenses using the deposits of the deceased.

About the procedure for receiving money

The procedure for obtaining funds consists of several stages, these are:

- preparation of necessary documentation;

- notarized processing of provided information;

- issuing a decree for the heir.

Having the decree in hand, the person goes to the bank in order to receive money from the relative’s account.

What documents will be required?

To process the payment, the relative will have to prepare a documentary package. It includes:

- passport of a citizen of the Russian Federation;

- original death certificate;

- checks and statements that can reflect the scale of costs;

- details of the depositary of the deceased.

Only by submitting all the listed papers can you count on cash payments.

Compensation of expenses

The resolution on the basis of which the decision to issue cash is made is issued by a notary. The maximum amount for compensation is 100 thousand rubles.