Conditions for obtaining single mother status in 2021

The concept of “single mother” is not found in any legislative act.

Regulatory documents contain different definitions characterizing the status of a single mother, for example, a single parent or a single mother. This concept is introduced when talking about what benefits and benefits a single mother is entitled to in 2021. For example, within the framework of labor law, the status of a single mother is provided for a woman who raises a child alone when the child’s father has died, deliberately evades upbringing, or is limited in parental rights or deprived of them. The entry in the birth certificate in the “Father” column does not play a role.

Fiscal legislation does not provide for a definition of “single mother”. In the Tax Code there is the concept of “single parent”, which means the absence of the second parent, for example due to death, recognition of him as missing (missing), in the absence of a record of the father in the birth certificate.

Deadlines for obtaining housing

After writing an application for free housing (or allocating funds for the purchase or improvement of conditions) for a single mother and submitting the necessary documentation, you will have to wait about a month for a decision on the request in 2021 (clause 5 of Art. RF Housing Code). If the verdict is positive, then the single mother is given a certificate that she can use to receive various benefits.

But the period during which the state will allocate a free apartment to single mothers in 2021 is not specified by law. Sometimes you have to wait several years. Therefore, if possible, it is easier to buy housing with a preferential mortgage or become a participant in the Young Family program.

Grounds for recognizing the status of a single mother

In social security for single parents, specific criteria and conditions are used to assign preferential status. The determination principle is as follows:

| Recognized as a single mother | Not recognized as a single mother |

If the child:

| If:

|

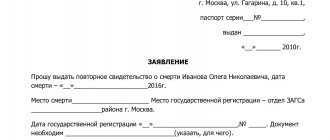

The special status of a single mother is documented. For example, when registering a newborn, the registry office issues the mother a certificate in form No. 25, which confirms the status of a single mother. This document allows single mothers to receive additional child benefits in 2021, but please note that the form is issued if there is a dash in the “Father” column or the information is written down from the mother’s words.

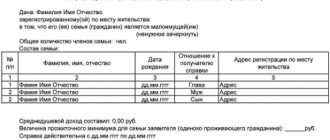

List of required documents

The list of required documentation is established by current regulations and includes:

- passport of the citizen of the Russian Federation of the applicant;

- a certificate confirming the received social status;

- application for registration;

- certificates of birth of all children of the family;

- information about the income and real estate of a single mother;

- reference data on places of registration for the previous 10 years;

- in some cases, you will need a set of certificates about the income of single family members living with the mother.

Municipal authorities have the right to expand the list of required papers.

Federal benefits and allowances

Special payments to single mothers are not provided for by federal law. A single mother has the right to count on generally established benefits, benefits and compensation.

List of benefits available to a single mother in 2021 at the state level:

- Benefit for a single mother who registered with the antenatal clinic in the early stages of pregnancy (up to 12 weeks). The payment is insignificant - 675.15 rubles. A certificate confirming registration is usually issued along with a maternity leave certificate.

- Maternity benefit for a single mother is sick leave for pregnancy and childbirth. Issued exclusively to employed women. The maternity period is limited: 70 days before childbirth and the same amount after, but in some cases the postpartum period is extended. The maximum amount is RUB 2,301.37. in a day.

- Lump sum payment at birth. This social compensation is paid to all mothers, regardless of employment or preferential status. Receive social benefits in the amount of 18,004.12 rubles. Not only the mother, but also the father, but only one of the parents has the right.

- Maternity leave is provided in the form of monthly additional payments until the child reaches a certain age. In 2021, several types of benefits are provided:

- All-Russian up to 1.5 years - calculated at 40% of average earnings, the amount is at least 3,375.77 rubles. per month for the first and 6,751.54 rubles. for the second and subsequent children; is prescribed to absolutely all citizens of the Russian Federation who have given birth to or adopted children under the age of 1.5 years;

- up to 3 l. - from the employer in the amount of 50 rubles, paid only for children born before 01/01/2020, payment is not provided for those born in 2021 (cancelled by presidential decree No. 570 of 11/25/2019);

- presidential up to 3 l. for the first or second child; the monthly supplement is set at one subsistence level in the region (on average 10,500 rubles); the payment is assigned if the average per capita family income does not exceed twice the subsistence level in the region; the benefit for the first-born will be paid by the Social Insurance Fund, for the second - by the Pension Fund of the Russian Federation at the expense of maternity capital;

- presidential allowance from 3 to 7 l. — this monthly payment is assigned to families whose income does not exceed one subsistence minimum per month; the amount of additional payment is 50% of the regional subsistence minimum (on average 5,500 rubles); the benefit is valid from 06/01/2020.

IMPORTANT!

All types of benefits and payments are united by a common principle on how to receive benefits for a single mother: financial support is assigned exclusively on an application basis. That is, it is necessary to prepare documents (certificates, copies of certificates) and submit an application to the government agency or place of work in order to take advantage of the benefit. Otherwise, there will be no payments from the state.

In addition to direct payments for children, the legislation provides for a number of special benefits for single mothers. For example, these are increased tax deductions or protection of a single mother from dismissal or layoff. We'll talk about them further.

Regional benefits and benefits for single mothers

Each subject of the Russian Federation establishes additional types of benefits for single mothers in 2021. The amount and terms of payments depend on the economic situation of the region. For example, the largest payment amounts apply in Moscow and St. Petersburg. Increased compensation has been established in the northern regions of Russia.

An example of what benefits a single mother living in Moscow can count on:

| View | Terms of service | Size in 2021 (in rubles) |

| Monthly compensation payment for child support | Assigned to single mothers who are orphans and are studying full-time at the expense of the Moscow budget in basic vocational educational programs and (or) vocational training programs for blue-collar professions, employee training programs | 3 168 |

| Monthly compensation payment to compensate for the increase in food costs | Assigned to single mothers (fathers) for children under three years of age | 713 |

| Monthly compensation payment to cover expenses due to rising cost of living | Assigned to single mothers (fathers) for each minor up to 16 years of age. and up to 18 years old, if the minor is studying in an educational institution that implements general education programs | 317 or 792 (depending on receipt/non-receipt of monthly child benefit) |

| Monthly child benefit | Provided to single mothers (fathers), whose level of property security is equal to low-income families with income below the Moscow subsistence level per capita |

|

| Monthly compensation payment for caring for a disabled child or disabled child from childhood to 23 years of age. | Established for single mothers (fathers), both employed and unemployed, in accordance with Law No. 1032-1 of April 19, 1991. | 12 672 |

| Monthly compensation payment for a child up to 18 years old. | Established for every minor under 18 years of age, if the single mother (father) does not work and is a disabled person of group I or II | 12 672 |

Moscow benefits are determined by the laws of Moscow No. 67 of November 3, 2004, No. 60 of November 23, 2005; Resolutions of the Moscow Government No. 911-PP dated December 28, 2004, No. 37-PP dated January 24, 2006, Appendix 1 to Moscow Government Resolution No. 1753-PP dated December 17, 2019.

IMPORTANT!

We recommend that you check what benefits and benefits for single mothers are available in your region. You should obtain up-to-date information directly from the authorized executive body or request information through the MFC or the single portal “State Services”, if available.

In addition to single status, a mother may have many children or belong to the category of low-income families. For such citizens, additional benefits are provided - free meals, free visits to kindergarten, compensation for housing and communal services, social compensation in terms of medicine, etc.

Can a single mother get an apartment from the state?

In modern Russia, single-parent families are common. Women raise a child or even several children alone. They work and take care of the baby at the same time. Due to the difficult situation, the category needs government support. Today, the government has developed many programs that help single mothers get housing.

Tax benefits and deductions

For single parents, double personal income tax deductions are provided for children. Let us remind you that a tax deduction is not compensation or payment, it is a documented right that exempts part of the income from personal income tax.

The amount of standard tax deductions for 2021 for single parents:

| Personal income tax deductions for children for single mothers | Who does the tax benefit apply to? | |||

| For each dependent under 18 years of age. and for each full-time student, graduate student, resident, intern, student, cadet under the age of 24 years. | For each dependent, if the minor is under 18 years of age. is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II | |||

| on the first | on the second | on the third and every subsequent | ||

| Single mother (parent), adoptive parent who is providing for the minor | 2,800 rub. | 2,800 rub. | 6,000 rub. | 24,000 rub. |

| To a single guardian, trustee, foster parent who is caring for a minor | 2,800 rub. | 2,800 rub. | 6,000 rub. | 12,000 rub. |

An example of determining the amount of a deduction: employee Morkovkina D.A., who is a single mother, has an only disabled daughter of 8 years old.

The amount of deduction due to her will be 26,800 rubles. based on:

- 2,800 rub. (RUB 1,400 * 2);

- 24,000 rub. (RUB 12,000 * 2).

That is, the amount is 26,800 rubles. monthly excluded from taxation until the mother’s income exceeds 350,000 rubles. in year.

Labor benefits for single mothers

The Labor Code of the Russian Federation establishes the following guarantees for single parents:

- A ban on dismissal of a single mother raising a disabled child under the age of 18. or a minor under the age of 14 years. (Part 4 of Article 261 of the Labor Code).

- Providing annual paid leave at any convenient time at the request of a single parent raising a child under 12 years of age. (Article 262 of the Labor Code).

- Limitation of night work and overtime work, involvement in work on weekends and non-working holidays, assignments on business trips, provision of additional leaves, establishment of preferential labor regimes (Article 264 of the Labor Code).

In addition to generally accepted guarantees, employers have the right to introduce additional benefits and privileges. For example, collective agreements of institutions establish annual additional leaves without pay at a convenient time for up to 14 calendar days (Article 263 of the Labor Code).

New coronavirus support measures

The President, together with the government, has introduced new measures of material support due to the coronavirus epidemic in the country. Direct payments for children are provided for all categories of families.

Single mothers are entitled to two coronavirus benefits:

- Monthly in the amount of 5,000 rubles. for each child up to 3 liters. The payment is scheduled for the period from April to June 2021. That is, for each minor (up to 3 years old), the mother will receive up to 15,000 rubles.

- One-time payment in the amount of RUB 10,000. for each minor aged 3 to 16 years. The payment is due only to citizens of the Russian Federation living in our country.

Coronavirus cash benefits are paid on an application basis. A single mother must submit an application through the single portal “State Services”.

Rules for applying for child benefits for a single mother:

- instructions: we receive a payment of 5,000 rubles for a child under three years old;

- instructions: arrange a payment of 10,000 rubles per child

Where and how to apply for benefits for single mothers

All types of benefits are provided on an application basis. The specific place where to apply for benefits for a single mother depends on the category and type of payment:

- Apply for federal benefits for children for single mothers (maternity leave, maternity leave, payment at birth, benefits in the early stages of pregnancy) through the employer (for employed people) or through the Social Insurance Fund (for the unemployed).

- Apply for presidential benefits at the territorial department of social protection, MFC or Pension Fund, or on the State Services portal.

- Social compensations and benefits are provided by the social protection authority.

- Labor and tax benefits for a single mother should be processed through the employer. Deductions for personal income tax can be obtained through the Federal Tax Service.

- Apply for coronavirus financial assistance electronically - through the single portal “Gosuslugi” or your personal account of the Pension Fund of Russia.

IMPORTANT!

Almost all types of benefits and benefits for single mothers are issued through the Unified Identification and Information Agency “Gosuslugi”. A verified account is required.

The legislative framework

There is no separate law dedicated to single mothers. The above information is scattered across various legal sources. Here are some of them:

- Housing Code of Russia - articles: 51, 52, 57, 159, 160;

- Tax Code of Russia - Article 218 (on double deduction for personal income tax for single parents)

- Labor Code of Russia - articles: 64, 93, 259, 261, 262, 263;

- Law of the Russian Federation No. 81-FZ of May 19, 1995 – on state benefits paid to parents;

- Law No. 418-FZ of December 28, 2017 – on additional benefits for the 1st and 2nd child under 1.5 years of age;

- Law of the Russian Federation No. 178-FZ of July 17, 1999 – on state assistance to various categories of citizens;

- Government Decree No. 541 of August 29, 2005 – on the maximum permissible family expenses for rent;

- Government Decree No. 1710 of December 30, 2017 – on the program to provide citizens with comfortable housing;

- Order of the Ministry of Health of the Russian Federation No. 987 of November 29, 2012 - a list of diseases for which living together with a person in an apartment is considered impossible;

- Order of the Ministry of Health of the Russian Federation No. 991n dated November 30, 2012 - a list of complex diseases that give the right to additional living space.