Russians are losing interest in mortgages. In May, the number of mortgage loans issued decreased by 27%, to 57.1 thousand, and their volume decreased by 28.2%, to 184 billion rubles, according to data from the Equifax credit history bureau.

A year after the launch of the preferential mortgage program, compatriots began to get rid of mortgaged housing because they could not afford the monthly payments. the head of the urgent purchase of federal real estate Alexey Panov told Izvestia , the number of apartments with encumbrances put up for sale in the Russian Federation has sharply increased: by 20%. This is housing mortgaged from banks, as well as purchased using maternity capital. We have already written about the risks of purchasing the latest real estate, now we will tell you how safe it is to buy mortgaged apartments.

Question and answer How long has the preferential mortgage program been extended?

Roulette game

The presence of an encumbrance creates significant difficulties for the owner, and sometimes is fraught with long legal proceedings and even loss of property. When real estate is pledged, its owner voluntarily assumes some kind of financial obligation, and housing acts as a guarantee of its fulfillment. Until the obligation is fulfilled, the apartment is pledged and is considered encumbered, explains Alexandra Belous, president of the Interindustry Association of Self-Regulatory Organizations in the Field of Construction and Design “Synergy”.

According to her, when buying real estate at too attractive a price, you should always remember that the stingy pays twice. “A price that is too low when there is an encumbrance on the apartment is a signal that the property is “problematic” and it is better not to deal with it,” she warns.

If an apartment is purchased directly from the owner, the bank must give consent to the transaction. This procedure requires time or costs for a lawyer. If the housing is divided into shares, then you cannot do without a notary. These are also expenses. “There are also common pitfalls, such as unauthorized redevelopment. The bank may not know about it, but the buyer may rely on its authority. The consequences range from a fine to a sale at auction with the imposition on the new owner of the obligation to bring the apartment to its previous condition. In any case, there are significant financial costs,” notes Kursk lawyer Victoria Bessonova.

What will happen to mortgage rates by the end of the year? Expert forecasts Read more

The sale of housing encumbered with a mortgage at a discount is due to the fact that not every buyer is suitable for such a purchase, says Alexei Nilov, director of the department of security in the field of real estate and legal services of an international company, an independent expert of the Russian Ministry of Justice, and a deputy of the State Assembly - Kurultai of the Republic of Bashkortostan. The fact is that in order to cover someone else’s mortgage, the buyer himself needs to be approved by the bank, which buys mortgages from other financial organizations. Or, as an option, the buyer must have the cost of the apartment in cash (with this money the seller’s mortgage will be repaid and the encumbrance removed).

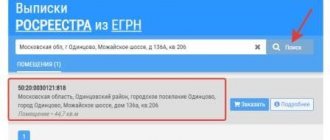

“As for a transaction with a “mortgage” apartment for cash, it is necessary to conduct a full check of the seller and the property, collect all the necessary documents and information. And only after this, with the buyer’s money received under the preliminary agreement, pay off the seller’s mortgage, then sign the purchase and sale agreement and, together with all the documents, submit it for state registration of the transfer of rights to Rosreestr. The remaining funds must be placed in a secure bank account. Next, the seller and the bank must submit an application to redeem the mortgage record, after which Rosreestr will conduct state registration of the buyer’s right,” the expert describes the scheme.

If the transaction is concluded according to the scheme “buyer’s mortgage for seller’s mortgage,” then it goes through the bank, and the chances of being left without an apartment and without money are minimal.

Article on the topic

How to choose the best mortgage insurance and save money? Financial educational program

As Marcel Akhmetshin, general director of a real estate agency, real estate expert at the MGO “Opora Rossii”, head of the real estate legislation committee of the Moscow Guild of Realtors, says, buying an apartment that is pledged to a bank is a game of Russian roulette.

“On the one hand, the price is good and you can save money, on the other hand, there are risks of termination of the contract under Art. 179 of the Civil Code of the Russian Federation. The invalidity of a transaction made under the influence of deception, violence, threat or unfavorable circumstances... The statute of limitations for such transactions, according to Art. 181 of the Civil Code of the Russian Federation, is three years from the date of execution of the transaction. Thus, having bought an apartment with collateral, the buyer risks losing it within three years,” he notes.

Buying a mortgaged apartment: pros and cons

The lending company can't just post a sale ad. Bidding is held during which buyers submit bids. The initial price is low: the bank has no goal of making a profit, the main thing is to compensate for its own expenses. This is the main advantage of the procedure. But there are also pitfalls: for example, there are many participants at the auction and everyone raises the bid, wanting to beat the competition. As a result, the cost is compared with the market average and the benefit will be reduced to zero.

The purchase of collateral apartments is available with a mortgage. Despite the fact that the bank has already made a mistake once in issuing a loan to an unreliable client, it is ready to take the risk again. The conditions are usually standard, but in some cases clients are offered a preferential interest rate (when housing has not been in demand for too long).

Until the property has an owner, the previous owners have the right to live there. Consequently, one of the disadvantages associated with the procedure is the poor condition of the rooms, lack of repairs, and dirt. It is possible that you need to invest a large sum for restoration.

REFERENCE:

| The purchase of an apartment with collateral can be canceled if the previous owners decide to challenge the deal and restore their rights. The bank will give back the amount received without any problems, but the new owner is unlikely to return the money, time, effort and nerves spent. |

Accumulated utility debt is another drawback. The court will oblige the previous owners to pay receipts for electricity, gas, and water. But not for major repairs and maintenance of common property: they are classified as an apartment, not a person. Consequently, it is necessary to pay off the debt to the management company - this is another unforeseen expense item. An additional problem when the housing has already been cut off from communications.

Have you decided to purchase collateral real estate? Ask in advance if there are any minors among the owners. It is very difficult to discharge children from their only home; it is better to refuse the deal and look for another option.

Will the share of housing sold with encumbrances increase?

More than half of housing is purchased with a mortgage. The decline in real disposable income, which has already become chronic, always increases the share of mortgaged apartments sold.

“The share of such facilities may increase if the economic situation worsens. Most likely, real estate properties that were purchased using a minimum down payment (up to 20%) will enter the market, as well as apartments on the primary market, because they cannot be rented out (as some mortgage holders do on the secondary market) and thereby reduce debt burden of the borrower,” believes Dmitry Shchegelsky, president of the St. Petersburg Chamber of Real Estate.

The apartment is sold with a “refusenik”. Is it safe to buy? More details

Victoria Bessonova recalls that about a year ago a bill was introduced to the State Duma giving citizens the opportunity to independently sell mortgaged housing. “That is, in a situation where it is no longer possible to repay the loan, a person will have a chance to quickly sell housing to a specific buyer without enforcement proceedings and bidding. This will further expand the market. The bill was developed jointly with the Central Bank and adopted in the first reading in December last year,” the expert sums up.

Features of the procedure

There are people who specifically monitor offers for the sale of collateral real estate: in this way they invest funds. All current lots are published on the resource “Official website of the Russian Federation for posting information about bidding”. Are you interested in buying apartments as collateral from the bank? We tell you how to take part:

- Register and confirm the availability of funds with an account statement.

- Deposit a cash guarantee (about 200 thousand rubles). It is subsequently returned to those who did not win.

- After winning, within a month, pay for the lot in full and register ownership of the home.

The auction is held even when one person participates in it - these are the rules.

Advantages

When providing a mortgage loan in the traditional way, the real estate for the purchase of which borrowed funds are provided acts as collateral and secures the transaction, insuring the bank’s risks. At the same time, the funds received are used exclusively for the intended purpose - for the purchase or construction of housing. In turn, a mortgage secured by real estate provides much more freedom of choice.

Loan “State support for families with children” SberBank, Individuals. No. 1481

from 0.1%

per annum

up to 12 million

up to 30 years old

Get a loan

Funds received through a loan can be used for specific purposes. Firstly, it can be used as a down payment or as full payment for a new home. In this case, supporting documents must be submitted. Secondly, act as payment for any needs (this includes treatment, business development, repairs, training, etc.). This type of loan is not targeted, so the rates on it are higher, and the period for which it is issued is shorter.

In the second case, the loan provided is still called a mortgage loan due to the fact that it is secured by existing real estate.

Buying a mortgaged apartment that is pledged to the bank - methods

There are three main ways (methods) of organizing a transaction:

- Early repayment of the loan by the Seller and subsequent sale of the apartment.

- Early repayment of the loan by the Buyer in the process of purchasing an apartment.

- The mortgage debt is not extinguished, but is transferred to the Buyer as a result of the transaction. That is, in fact, a mortgaged apartment is being purchased using a mortgage .

Which way is better to go? What is the procedure for purchasing an apartment with a mortgage? Where will the Buyer's risk be higher? The answer is ambiguous and will depend on the specific situation. In the real estate market, all three options for purchasing a mortgaged apartment . Let's look at them one by one.

Assignment of rights of claim under the DDU - how does this happen? Nuances, risks, features.

Early repayment of the loan by the Seller and subsequent sale

The easiest way to get rid of the encumbrance of a mortgage apartment is to repay the loan ahead of schedule . Then the Seller can act freely, without asking the bank’s consent to the transaction. The only question is how exactly (by what means) will the Seller be able to repay the debt to the bank?

It all depends on the size of the balance of this debt. If the Seller has a relatively small amount left to pay the bank (for example, 100-300 thousand rubles), then this amount can be transferred to him by the Buyer before the transaction as an advance or deposit. Having repaid the mortgage loan with this money, the Seller obtains a debt repayment certificate from the bank and removes the encumbrance from the apartment from Rosreestr. A detailed algorithm of actions when buying a mortgaged apartment in this way is described in the link - see there Option No. 1 .

After this, the purchase of an apartment occurs in the usual way (see the link - the corresponding step of the INSTRUCTIONS).

Another option for early repayment of debt for the sale of a mortgaged apartment is refinancing the Seller for the duration of the transaction. That is, the Seller takes out a regular consumer loan for 2-3 months (from the same bank or another), pays off the balance of the mortgage debt, removes the encumbrance from the apartment, and sells it to the Buyer. Having received money for it, the Seller immediately repays his short-term consumer loan.

This method of purchasing an apartment with a mortgage (collateral) from a bank is the easiest, most reliable and safest for the Buyer. But expensive for the Seller. After all, consumer loans have the highest interest rates. Therefore, he needs to reduce the term of such a loan to a minimum.

What should be indicated in the Apartment Acceptance and Transfer Certificate - see the Glossary at the link.

Early repayment of the loan by the Buyer during the transaction

If the Seller has a significant debt balance, and he does not have the opportunity to refinance, then it is too risky for the Buyer to transfer him a large amount as an advance (to pay off the debt). In this case, the purchase of a mortgaged apartment pledged to the bank occurs with the involvement of the bank itself . The bank here requires not only written permission for the transaction (needed for registration), but also its direct participation in the transaction itself.

Then the Buyer, before making an advance payment for the apartment, must first agree on the terms of the transaction with the mortgage bank . In this case, the bank's lawyers take control of the transaction, so the risk of purchasing a mortgaged apartment for the Buyer is greatly reduced.

The key point here is mutual settlements under the transaction . After signing the Sale and Purchase Agreement, the Buyer transfers money for the mortgaged apartment in two parts at the same time - one part to the bank (to pay off the debt), the other part to the Seller (the price of the apartment minus the debt).

The method of transferring money for an apartment can be either cash or non-cash. For cash payments, respectively, two safe deposit boxes , and for non-cash payments, two letter of credit accounts (see how this is all done at the specified link in the Glossary).

After the agreement is signed, the transaction is registered in Rosreestr, and the payments are completed, the bank issues the Buyer a certificate of repayment of the mortgage loan. With this certificate, the Buyer himself removes the encumbrance from the purchased apartment in Rosreestr. The detailed algorithm for this scheme for purchasing an apartment with a mortgage encumbrance is described in the link - see there Option No. 2 .

Refund of the advance (deposit) for the apartment. Is it possible? The answer is in the note at the link.

Buying an apartment with a mortgage - how it's done

Here we are talking about a case where the Buyer himself expected to use a mortgage loan to purchase an apartment, but the chosen apartment also turned out to be mortgaged and already mortgaged to the bank. How can we be here?

There can be two situations:

- The buyer takes out a mortgage loan from the same bank in which the apartment he has chosen is mortgaged.

- The buyer obtains a loan from another bank .

In both cases, the very possibility and conditions of such a transaction will depend on the position of the bank.

In the first case, the procedure for purchasing a mortgaged apartment and re-issuing a mortgage to a new borrower will be much simpler. Here, the mortgage bank has complete control over the entire process and creates transaction conditions that are beneficial to it. At the same time, the mortgaged apartment itself remains as collateral in the same bank, and the encumbrance on it is not removed . The new borrower (Buyer) is approved for a new loan, and the apartment already mortgaged to the bank is approved.

Such transactions are carried out by many banks, including Sberbank. All of them are supervised by lawyers and the bank’s security service. The risk of purchasing a mortgaged apartment under such conditions for the Buyer is minimal.

In the second case, everything is more complicated. To obtain a mortgage for an apartment in another bank, you need to agree on the conditions and interests of two different credit institutions. At the same time, the conditions of Rosreestr for re-registration of a registered mortgage encumbrance on an apartment in favor of a new mortgagee must also be met. This is a rather complicated and lengthy procedure; banks are reluctant to do it, so it is rarely found on the market.

As a result, if the Buyer decides to buy an already mortgaged apartment with a mortgage , then it is better for him to apply for his loan in the same bank in which the apartment is mortgaged.

What you need to know about taxes and tax deductions when making a transaction for the purchase and sale of an apartment - see here.