Work without registration as an individual entrepreneur or LLC

This violation relates to economic crimes - namely, illegal business activities. If you have opened an online store, but have not registered as an individual entrepreneur or LLC, then you are at great risk. In addition to the illegal activity itself, you will thereby violate a number of other requirements: you will not be able to issue checks to customers (after all, the online cash register must be registered with a company that you actually do not own), pay taxes (from a non-existent company?), employ employees (where?) . And suppliers are wary of private owners, preferring to cooperate with individual entrepreneurs or legal entities.

It is clear that many people work this way - there are a lot of shops on social networks that are run by private individuals, but this is not a reason to break the law. There is also an opinion that if your income is less than 100 thousand per month, you don’t have to register anything. In fact, this is not true: illegal business activity is when you constantly make a profit and do not pay taxes . Checking the owner of such a store is as easy as shelling pears - and both the tax office and the department for combating economic crimes can do this.

What are we risking?

- Fines from the Department of Economic Crimes: 500-2000 rubles.

- Fines from the tax office: if you started a business and have not registered as an individual entrepreneur - from 20,000 rubles, if you have been doing this for more than 3 months - from 40,000 rubles or 20 percent of the profit. We wrote more about this in the article about online store inspections.

Procedure for removing unvaccinated employees

Step 1. Get the employee to refuse vaccination.

The refusal is drawn up in free form. The main thing is that the employee clearly defines his position: I don’t want to get vaccinated and I won’t. Here is a sample application:

Step 2. Record the basis for removal in a memo.

The fact of groundless refusal to vaccinate must be recorded in a report. It is drawn up in any form by the responsible person, usually the head of personnel:

Step 3. Issue a removal order.

Based on the refusal and the memo, issue an order for removal. For example, in this form:

An employee can be suspended for the entire period of an unfavorable epidemiological situation until he gets vaccinated, or until the decision of the regional health doctor is canceled.

Work without a contract

This applies to those entrepreneurs who hire employees without drawing up an employment contract or contract. Unfortunately, this practice is still common. This is especially true for novice entrepreneurs, for whom every penny counts. If you hire at least one employee, you will need to pay taxes, pensions and insurance contributions for him... And if you periodically attract remote workers (programmer, designer, copywriter and others) - you also need to conclude a civil contract or a contract with them . In addition, the contract must indicate the employee’s working conditions, and a second copy must be handed over to the person.

Does everyone do this, tell me honestly? It’s expensive and tedious, but it’s necessary, and there’s nothing you can do about it.

What are we risking?

An offended employee can contact the labor inspectorate or complain to the tax office. And hello, checks and fines! Failure to formalize an employment or civil law contract or its incorrect execution is punishable by an administrative fine. Officials will pay from 10 to 20 thousand rubles, legal entities will be unlucky - the fine ranges from 50 to 100 thousand.

What is PVTR

Internal labor regulations are a local act, that is, a document drawn up by the employer. This may be a separate document or an annex to a collective labor agreement. In essence, PVTR is a set of instructions regulating issues that, in accordance with the Labor Code, must be resolved by the employer. For example, what operating hours should be established in the company, how to reward employees, and whether to assign a probationary period when hiring.

The legislation does not establish any specific form or structure for the PVTR, so the document can be drawn up arbitrarily. It is then approved by order of the manager or individual entrepreneur. The rules are mandatory for use by all employees, so each person hired must be familiarized with them and signed before concluding an employment contract.

All employers – organizations and individual entrepreneurs – must develop and approve the PVTR.

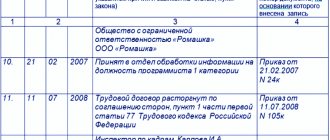

Payroll and personnel records

“Black” salary

Another common violation of the Labor Code is giving people salaries in envelopes. This is often done like this: the employee is registered at the minimum wage in order to make fewer deductions, and the rest is given to him in his own hands . It seems that everyone is happy: the employer reduces tax expenses, and the employee still gets his money in the end. But the Labor Code is categorically against it. First of all, this is an infringement of the rights of workers, whose pension size will depend on the size of their salary.

What are we risking?

Tax and labor inspectorates, as well as the prosecutor’s office, can initiate inspections and clarifications, depending on where the employee applies. The administrative fine depends on the amount of unpaid taxes and contributions. This is 20 percent of the amount of unpaid taxes and from 5 to 10 thousand rubles for unpaid insurance premiums. There is also criminal liability for large-scale tax evasion. For example, if the amount of all unpaid taxes to the state has accumulated quite large and amounts to more than 2 million rubles, please go to court. The punishment may be a fine in the amount of 100 to 300 thousand rubles; arrest for up to six months or even imprisonment for up to two years.

Non-payment of wages

Everything related to wage fraud (non-payment of money, delays, wages below the subsistence level - now it, like the minimum wage, is 11,163 rubles, payment of wages in food or other goods, as in the 90s - bricks, toilets, and so on ) - then subject to the Labor Code. I didn’t give out the salary on the 15th, but on the 16th - it’s my fault. I couldn’t find the money for the advance, I promised to pay everything at once at the beginning of the month - it’s my fault. During this inspection you will explain that you have problems with suppliers and interruptions in orders, so there is nothing to pay people with money. Alas, all these are just your problems; the state does not care about them. However, as successful entrepreneurs say, first settle accounts with people, clear your conscience, and then don’t forget yourself .

What are we risking?

Yes, all the same - the ruble. This violation relates to Article 5.27 of the Administrative Code, specifically to the point of non-payment of wages. If you cannot comply with the requirements of the Labor Code, pay a fine of 10 to 20 thousand rubles if you are an individual entrepreneur, or from 30 to 50 thousand if you are a legal entity . If you have already been fined once, but you step on the same rake again, the fines will be higher: from 10 to 30 thousand and from 50 to 100, respectively.

That's not all. The Criminal Code also has an article - 145.1. If you have not paid a person a salary at all for more than 2 months or paid less than the minimum wage, pay from 100 to 500 thousand rubles or be imprisoned from one to three years . The court may still deprive you of the right to engage in entrepreneurial activity for several years. If you paid in part, the fine is reduced to 120 thousand rubles or less.

Working overtime without compensation

A familiar situation - you ask a manager to work on a day off because the season is at its peak, there are a lot of orders, and you don’t want to lose profit? The manager agrees, cancels plans and works on his day off - but does he receive compensation for this?

The Labor Code states that you need to work no more than 40 hours a week. Anything above that is already recycled. In addition, the employee needs to be asked if he agrees, and not presented with a fait accompli, and even under the threat of dismissal (we’ll talk about this a little later). For overtime work, the business owner must pay increased compensation or give the employee a day off. The increased size is also clearly recorded in the TC. From July 1, 2021, compensation for weekends and holidays spent at work is paid at double the rate. If an employee worked only a few hours, it means that these hours will cost the employer 2 times more.

Let's talk separately about irregular working hours. All these advertisements with the conditions of “irregular working hours” are mostly illegal, because it is unlikely that employees receive all the necessary compensation. Irregular working hours turn into plowing from 8 am to 10 pm, and so on every day. Meanwhile, according to the new amendments, an irregular schedule is introduced only if the employee works full time - and the work week must be incomplete. That is, you worked 14 hours a day - then rest, dear. And this does not apply to those employees who work part-time.

What are we risking?

This violation relates to the same article of the Code of Administrative Offenses as the previous one. Accordingly, the fines will be the same. There are no criminal penalties, thank God.

Position of government agencies on the suspension of unvaccinated employees

The vaccination campaign has already ended in most regions. The question remains open: how to deal with employees who are not vaccinated without good reason?

At the end of June, the Ministry of Labor and Rospotrebnadzor issued joint clarifications on the vaccination procedure. In them, government agencies obliged employers to remove employees from work without a medical exemption and without vaccination. Such a measure is possible on the basis of Art. 76 of the Labor Code and Art. 5 Federal Law No. 157 “On immunoprophylaxis of infectious diseases.”

Rostrud expressed a similar opinion in its July letter. A reasoned decree of the chief sanitary doctor may oblige workers in certain areas to be vaccinated. In case of refusal, an unvaccinated employee who has no contraindications will be subject to suspension.

In August, the Ministry of Labor published its own letter with cunning theses.

The Ministry of Labor spoke about the explanations of government agencies as follows:

We note that these clarifications are advisory in nature, do not constitute a regulatory legal act and do not create new obligations for the employer and employee.

And then he added:

Regarding the issues raised in the appeal related to vaccination in order to prevent the spread of the new coronavirus infection COVID-19, we inform you that these issues are regulated not by labor legislation, but by legislation in the field of ensuring the sanitary and epidemiological well-being of the population.

Literally this translates as “If you want, remove him, if you want, no, no one is forcing you. But all questions should be addressed to Rospotrebnadzor - he is the main one here.”

Refusal to hire

Anyone has the right to look for work and find it. Relax - not every person on the street can be rejected for work. We are talking only about an unreasonable refusal - for example, if the candidate meets your requirements, but you personally did not like it. Or a girl came - an excellent specialist, smart, but pregnant - which means she won’t work for long. Even advertisements “wanting an employee no older than 40 years old” are already age discrimination. Now there are fewer and fewer of them - people have learned to defend their rights.

As stated in Article 64 of the Labor Code of the Russian Federation, an unreasonable refusal is one without specifying a reason at all, for personal reasons that have nothing to do with the business qualities of the applicant, or on the basis of gender or age (discrimination of an employee).

What should an employer do in such a situation? We all understand perfectly well that a girl on maternity leave really won’t work much, and a person who makes a bad impression from the first meeting is unlikely to fit into the team. This means that it is necessary to introduce clear selection criteria - interviews, testing of employees, possession of professional knowledge and skills.

What are we risking?

A lawsuit. A rejected candidate can appeal to the labor inspectorate or court. Also, for an unreasonable refusal of a pregnant woman or someone who has a child under three years of age (if the boss has not explained an objective reason), criminal liability may arise under Article 145 of the Criminal Code of the Russian Federation. The fine will be up to 200 thousand rubles or compulsory work.

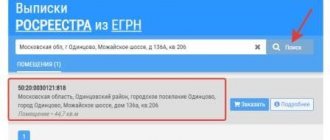

Is it possible to appeal driver fines issued to a legal entity?

Judicial practice shows that it is possible.

The owner of the car is released from liability if, during the consideration of the complaint against the decision, it is established from the camera that at the time of recording the vehicle was in the possession or use of another person (Part 2 of Article 2.6.1 of the Code of Administrative Offenses of the Russian Federation).

It is necessary to collect evidence that a specific driver was driving at the time of the violation. The RF Supreme Court indicated that the following can be used as evidence:

- power of attorney for the right to drive a vehicle;

- MTPL policy if the driver is included in it;

- rental or leasing agreement for a vehicle;

- testimony of witnesses and (or) the driver.

The organization can additionally provide a waybill with a note about the duration of the driver’s shift.

As a rule, courts of first instance refuse to appeal to legal entities and indicate that they are responsible for the actions of their drivers. But there are cases when organizations reached the Supreme Court, and it made a decision in their favor (Case No. 45-AD14-12, Case No. 48-AD16-4).

If you need help appealing fines, enter the UIN of the decision on the appeal page from the Online State Traffic Safety Inspectorate service. For small fines, the service will automatically create a written complaint and tell you what documents to attach and where to send it. Our lawyers will help you with large fines and controversial situations.

Legal assistance with appealing fines

Appeal the fine

Illegal dismissal

According to Article 81 of the Labor Code, an employee can be dismissed only for several reasons . This is the liquidation of an organization, reduction of staff, absenteeism, failure to fulfill official duties, committing an immoral act and others. But it happens that the scythe lands on a stone - well, the manager and one of the employees don’t get along, and that’s it. At the same time, the unwanted employee fulfills his job description, no matter what, he only brings confusion to the team, is rude and spoils his colleagues. What to do with this?

As a rule, such toxic employees are persistently asked to write a statement of their own free will . Or arrange a staff reduction - but do not forget that you will have to pay compensation - three salaries and notify the person two months in advance. But even if everything goes amicably, there is no guarantee that the offended person will still complain. In this case, we would advise you to protect yourself - pay compensation to the troublemaker or place him in another place so that he does not leave offended.

What are we risking?

An administrative fine - for individual entrepreneurs it will be 1000-5000 rubles, for legal entities - from 30 to 50 rubles, it is also possible to suspend activities for three months. If you fired a pregnant woman or a woman with a child under 3 years old, Article 145 again comes into force for legal entities - from 30,000 to 50,000 rubles or administrative suspension of activities for up to 90 of the Criminal Code. The fines are the same - up to 200,000 rubles or compulsory work.

"Voluntary" fines

In some organizations, conscientious employees, on their own initiative, introduce a penalty-like system in order to improve work culture and efficiency. They can themselves develop and propose a procedure and amount that will be given to “violators” of certain rules, for example, foul language or smoking in unauthorized places. The funds collected go towards public needs: a useful purchase for the office, a communal lunch or entertainment at the end of the month, etc.

IMPORTANT POINT! The amount that employees pay as such a “fine” should not be deducted from their wages; it can only be given from their own pocket, after the employee has received the funds due to him from the employer.

Such a “penalty system” is no longer an administrative impact, but a kind of game, which, with voluntary participation, does not contradict the law and can be very effective for public discipline.

Work without vacations

Even on hot days, seasons of discounts and sales, and an influx of customers, people have the right to go on vacation. There are options to reschedule or cancel vacation - but only with the consent of the employee. And here there is a nuance - it is no longer possible not to take a vacation for two years. Article 123 of the Labor Code confirms this. If you allow employees to go on vacation and adhere to vacation schedules, thank you! If not, you will have to answer according to the law.

What are we risking?

As usual, fines. For failure to provide leave, an individual entrepreneur will pay a fine from 1000 to 5000 rubles, a legal entity - from 30 to 50 thousand. For failure to draw up a vacation schedule, the fines are the same.

Fines

You cannot fine employees, although this is practiced in many online stores. If you are 5 minutes late, you will be fined. If you don’t call the client back, pay in rubles. If you fail to fulfill your sales plan, we will deduct a certain amount from your salary. It is forbidden. The Labor Code specifies the types of punishments for failure to fulfill labor duties or violations of labor discipline. This is a reprimand, reprimand and dismissal - fines, as you can see, are not on this list. The only exception is financial liability for causing specific damage. Lost profit (the employee made a sales plan of 100 thousand, not 200 thousand) does not apply to them. In case of violation of the law, the employee can file a complaint with the labor inspectorate or the court.

Why and for what should fines be introduced?

Any management, both at the personal level and in the field of entrepreneurship, is based on the method of combining “carrot and stick”, that is, encouraging and punitive influences. A large percentage of employers believe that strictness and exactingness will ensure the efficiency of employees, which will be facilitated by punishments for undesirable behavior or actions that are unacceptable, from the point of view of management. Moreover, the list of such actions is not always consistent with labor legislation and is determined only by the will of management. It may include:

- being late;

- leaving work before the end of the working day;

- non-compliance with the dress code;

- bad habits;

- complaints from customers;

- problems that have arisen with products (shortages, failure to meet deadlines, failure to fulfill the plan, damage, etc.);

- failure to maintain order in the workplace;

- “waste” of government materials or funds, etc.

In most cases, fines for such offenses are set in monetary form, and sometimes detention systems are used.

Is it possible to apply a fine as a disciplinary sanction ?