Author of the article: Anastasia Ivanova Last modified: January 2021 5223

The estate is a legal term implying the totality of property, property obligations and rights belonging to the testator during his lifetime and after his death passing to his heirs. However, heirs are not always able to contribute to the inheritance and inherit all the property owned by the deceased testator. Difficulties in this matter most often arise due to the fact that before his death the owner did not privatize the residential property, did not register ownership rights to the property he acquired, did not resolve disputes, did not pay off debts - in simpler words, did not put his documentary affairs in order.

Expert commentary

Gorbunova Olga

Lawyer

To resolve this situation, the heirs will have to resort to such legal measures as the inclusion of property in the inheritance mass and recognition of ownership, which can only be done by filing a claim with the judicial authorities.

When is it necessary to include property in the estate?

Inheritance is property (movable and immovable) belonging to a citizen, which he can bequeath during his lifetime to his relatives or other persons. The testator gives a written order about who will inherit his property after he dies (1118 Civil Code of the Russian Federation). In fact, this is a one-sided transaction, during which one participant gives the other the obligation to accept the inheritance.

To exercise his rights to an unregistered inheritance, a person must be the full owner of the property and have legal capacity (i.e., perform any legal actions without restrictions). If he cannot manage his things, the process cannot be started.

In practice, there are several options when a similar problem arises during inheritance:

- the testator did not legitimize the housing construction erected by him during his lifetime;

- the apartment was not privatized;

- dividends from securities have not been received;

- the property has not been fully formalized and ownership has not been registered;

- violations committed by a notary when drawing up documents and transactions, which led to the fact that the rights to material goods were declared invalid (incorrect details of the parties to the agreement were indicated, the subject and object of the legal relationship were incorrectly described, the persons involved in drawing up the agreement were identified with errors).

If measures are not taken in time, then all property acquired by a person (not registered) will be transferred to the disposal of the executive authorities. To prevent the onset of negative consequences, legal successors will need to contact the competent authorities.

How to correctly draw up an application for inclusion of property in the inheritance estate

A legal document is a type of claim. It is required to comply with the rules for its registration outlined in Art. 131 Code of Civil Procedure of the Russian Federation. When writing a claim to include property in the inheritance, the application must be correctly drawn up, indicating:

- The name and legal address where the citizen applies.

- Passport details of the plaintiff, as well as third parties involved in the process.

- The price of the claims, the cost of the statement of claim for inclusion in the estate.

- Document's name.

- The reason why a lawsuit is filed.

- Citizen's requirements.

The application includes a list of documents attached to it, a handwritten signature and date. The document is written independently, it reflects the specifics and all the circumstances of the problem. It does not matter in what form the property is presented: the inclusion of a plot of land or a car in the inheritance mass does not make any difference.

Attached documents

To start the legal process related to the inclusion of property in the inheritance, several documents will be required. Their list is indicated in Art. 132 Code of Civil Procedure of the Russian Federation. The heir needs to prepare in advance:

- passport;

- a statement that he wishes to assume the rights of an heir;

- receipt (check) for payment of state duty;

- confirmed facts indicating that the testator owned unregistered property;

- certificate of death of the testator;

- evidence indicating the possibility of inheriting;

- information that an employee of a notary’s office refused to include (add) the object to the property mass;

- certificate of appraised value.

It is recommended to make photocopies of all submitted documents and statements, because this is required when accepting documents in court. Another reason is that if third parties participate in the meetings, photocopies of the application are sent to them.

How is the composition of the inheritance formed?

The procedure for generating benefits that will be received by applicants is strictly regulated. It consists of two procedures. The first involves the inclusion of values in the list, and the second - their exclusion from it. One way or another, the process has legal features.

Inclusion of property

If the deceased managed to draw up a will, then the list is reflected directly in its text. In addition, benefits can be added to it, drawn up in the form of a separate list. The inventory is compiled in a notary's office in the presence of witnesses and heirs.

The paper contains the following information:

- list of assets;

- papers certifying the ownership of goods;

- a comprehensive description of things;

- the cost of each item.

The paper must be endorsed by the lawyer and each of the applicants. If witnesses or a custodian of property are involved in the case, they are required to put their visas on the document.

USEFUL INFORMATION: Time off for a donor in 2021

The inventory is needed in order to formulate the shares of each of the participants in the process and determine the size of the tariff. At the same time, disagreement with the actions of a lawyer related to the inclusion (exclusion) of any assets may be challenged in court.

To defend their position, citizens will need to file a claim with the district authority. The document must contain the following information:

- personal information about the deceased;

- a list of property that is in dispute;

- information about the notary office and the lawyer to whom the case is assigned;

- information about other heirs specifying the degree of relationship with the deceased;

- requirement to include goods from the list;

- evidence supporting the applicant's position.

The authority must order a hearing of the claim and invite the parties to establish the circumstances of the issue. If the authority accepts all the evidence presented along with the appeal, then appropriate changes will be made to the inventory.

Important! According to Resolution of the Plenum of the Supreme Court of the Russian Federation No. 9, in the absence of documents confirming the registration of land or real estate, the latter can be included in the list of distributed benefits by successors. To do this, they need to apply to the judicial authority with the appropriate petition.

Property exclusion

This procedure is similar to the process of including values. To do this, you need to go to court. If interested parties believe that real estate or an object is not an item that is inherited in accordance with the general procedure or by will, then he is free to report this to the authorized bodies.

Judicial practice shows that this often happens when the spouse of the deceased does not agree with the inclusion of a jointly owned apartment. According to the law, housing should remain with her.

Submission order

The entire procedure for including new property in the inheritance consists of several stages following each other. The main thing is not to violate the procedure established by law and to correctly draw up a statement of claim for the determination of unregistered property. The heir will need:

- indicate the list and value of the inheritance;

- collect in advance documents indicating that he has the right to the specified property;

- prepare a claim for inclusion of property in the estate

- pay the state fee;

- take the application to the court office (this can be done in person or sent by registered mail);

- take part in meetings;

- obtain a court decision;

- arrive with the document at the notary's office to begin the procedure for re-registration of property and inclusion of it in the inheritance.

When all the formalities with the notary have been completed, it is recommended to promptly register the property with the Rosreestr authorities. Violation of the deadlines for the implementation of the procedure for including property in the inheritance is unacceptable.

Popular questions for a lawyer

The father remarried. During their marriage, he and his wife bought several cars. But only one is registered for the father. A year ago he died, his heirs are me and his wife. Only one car is considered as an inheritance. I want to include all cars purchased during marriage as part of my inheritance.

Since the period for entering into inheritance has expired, it is necessary not to include the property in the inheritance, but to recognize the right of ownership. You are entitled to a ¼ share of each car. You can agree with the heir on a different division.

My father began to formalize privatization. I collected the documents and submitted the application. But he died before receiving an answer. The notary refuses to issue a certificate, since at the time the privatization decree was issued, he was already dead. Who will be the defendant – the notary or the administration?

If the dispute concerns real estate, then the administration at the location of the residential premises will act as the defendant.

My mother wanted to apply for privatization for a room in a communal apartment. She submitted documents, but the deadline for a response has long passed. She was unable to apply again. She got sick and died. I want to include the room as part of my inheritance. Is it possible? The Supreme Court considered a similar situation. In this case, the deadline was violated by the administration. Feel free to go to court. Your chances are high.

I want to file a claim to include my grandmother’s dacha in the inherited property. This is a non-property claim. Will the state duty be 300 rubles?

This claim relates to property claims. Therefore, it is necessary to evaluate the property and calculate the duty based on the market value of the property.

My father had a summer cottage. He built a house on it, but decorated it as a dacha. The plot was given to the garden society for use. There are no documents of ownership. If he didn't register the title, can I inherit it?

To do this, you need to go to court to include the site in the inheritance. In 2012, the Supreme Court of the Russian Federation ruled that even an unregistered plot can be included in the inheritance.

Which court should I apply to?

Based on Art. 23 of the Code of Civil Procedure of the Russian Federation, the application is submitted in this locality where the unregistered inheritance is located. When vehicles, apartments, securities, or business are located in another city or town, you will need to arrive there and write an application to the local court.

If it is not possible to take the necessary actions (re-register the inheritance by filing an application), for a number of objective reasons it is allowed to do this with the help of a legal representative. A notarized power of attorney is issued to the citizen chosen by the heir, on the basis of which he carries out the necessary legal actions and travels to other regions of Russia (including re-registering the inheritance). The specified person can write a sample statement of claim for inclusion independently or submit it to the authority with a guarantor.

After which it is considered and court hearings are scheduled, the judge determines the composition of the inheritance mass and makes a decision on its possible inclusion in the inheritance.

Sample statement of claim for inclusion of property in the inheritance estate

Size: 31 KB

Jurisdiction provided

In accordance with Article 23 of the Code of Civil Procedure, such claims are sent to the court at the location of the disputed property, and the cost of the claim does not matter.

When the property is located far away, you will either need to travel yourself or enlist the support of a representative. If an application is submitted to the wrong judicial body, its acceptance is refused on legal grounds.

Watch the video. How to determine jurisdiction?

Possible reasons for refusal

Compliance with all legal requirements is a prerequisite for asserting your rights in court. All formalities must be completed in order for the unregistered inheritance to be transferred to the legal successor. A judge may refuse to accept a document for a number of reasons. This can happen if:

- The decision on this problem has come into force.

- The heir submitted an application to the wrong authority.

- The application for inclusion in the estate, sent to the court, was withdrawn by the citizen.

- The state duty has not been paid.

When a decision is made to refuse to consider a document by the court, the applicant is notified in writing within five days. The consideration of the case may be suspended if the person has not completed the actions prescribed to him. Once the issue has been ruled out, the trial continues. The refusal of one authority automatically leads to a similar result when it is sent to another authority. It will not be possible to judge the inheritance in any other way.

Completion of the trial

Any trial ends with a court decision. If the procedural document is too long, then the court can announce only the operative part (Article 199 of the Code of Civil Procedure of the Russian Federation).

A reasoned decision must be drawn up within five days after the end of the proceedings. The procedural document is handed over to the participants in the process.

If the plaintiff or defendant was not present at the court hearing, then a copy of the decision is sent to him by mail. The action is carried out within 5 days from the date of the final court decision (Article 214 of the Code of Civil Procedure of the Russian Federation).

Let's consider whether the parties can appeal the judicial act. Participants in the trial are given a month to file an appeal. If the complaint is not received, then the decision of the court of 1st instance comes into force. If the plaintiff or defendant filed an appeal, then the decision comes into force following a review in the court of 2nd instance.

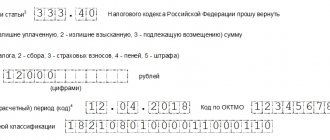

Government duty

This is a mandatory fee that is paid to the state when considering submitted applications involving property (tangibles). The procedure is regulated by Art. 333.19 Tax Code of the Russian Federation. The amount of deductions will be directly proportional to the value of the property that must be included in the inheritance mass. Therefore, a preliminary assessment of the object is required. This is done by a company that has the appropriate license. Based on a certificate indicating how much the property is worth, the amount of duty will be calculated.

When the price of the property is less than 20 thousand rubles, the plaintiff will pay 4% of the amount, but not less than 400 rubles. If from 20 thousand to 100 thousand - 800 rubles plus 3%. The cost of the object exceeds 1 million rubles - you will have to pay 13,200 rubles. plus 0.5%, but the amount should not exceed 60 thousand rubles.

Useful tips

Before writing a will, the successor(s) must make sure that the inheritance is legally valid for him. But if an unpleasant situation does occur, the heir must first:

- Check the availability of documents for property (inheritance).

- Establish when and under what circumstances illegal buildings were erected.

- Find out where and how cash deposits are stored.

- Check whether the property is pledged or transferred to another person.

By following these tips, the process of restoring rights to an unregistered inheritance and including it in the total estate will be successfully implemented. Prompt study and forcing of the issue, writing a statement of claim for the inclusion of property in the total inheritance removes all problems from the agenda. The guarantee of success consists in the correct implementation of the entire algorithm of actions and strict adherence to the letter of the law, and the property will be included in the inheritance.