Alimony in accounting

One of the most common deductions under writs of execution from an employee is alimony in favor of minor children. When calculating salaries, you need to take into account their payment after tax.

Alimony must be withheld from all income the employee receives each month. They must be transferred to their destination no later than 3 days after payment of wages. The organization's costs for transferring alimony (bank commission, cost of postage) are also deducted from the employee's salary.

The amount of alimony is usually indicated in the writ of execution. There are two options:

- Fixed amount of monthly deductions

- Share of wages: ¼ for one minor, 1/3 for two and ½ for three children or more

The amount of alimony is indexed in proportion to the minimum wage. The maximum amount of alimony should not exceed 50% of salary. There are two exceptions to this rule: for children, child support can be collected in the amount of up to 70% of income, if there are several enforcement documents, the requirements of all are satisfied, regardless of the amount of income of the employee.

The accrual of alimony is reflected in debit 70 of the account and credit 76. To deduct alimony from other employee income, an entry is made Debit 73 Credit 76. Payment of alimony can be made:

- Through the cash register: Debit 76 Credit 50

- Via mail: Debit 76 Credit 57

- Via transfer to the current account: Debit 76 Credit 51

The bank commission or postal fee withheld from the employee is reflected by posting Debit 70 Credit 76.

An employee of the organization receives a monthly salary of 47,000 rubles. According to the writ of execution, alimony must be withheld from him in favor of two minor children in the amount of 1/3 of his total income. The money is transferred to the current account. The bank commission is 0.2% of the transfer amount.

Payment amount

Depending on the number of children for each of them, the law establishes the amount of alimony. For one child, 25 percent of the payer’s total income is paid. For two – no more than 33 percent of income. Accordingly, each person gets 16 and a half percent. If there are three children, alimony is transferred in the amount of 50 percent of the payer’s earnings, 16 and a half percent for each of them.

It is unacceptable to withhold more than 50 percent of income. Therefore, for four and subsequent children, the amount of alimony will also be equal to half the payer’s earnings. It is distributed among all children in equal shares. Thus, every fourth child accounts for 12 and a half percent of income, and every fifth child receives only 10.

There are cases when deductions of this kind are made on the account of the ex-husband or wife, parents or other relatives.

Sources of income include:

- vacation pay;

- wage;

- surcharge for harmfulness;

- income from your own business;

- pension;

- bonuses;

- rewards;

- income from the rental of real estate;

- scholarship;

- sick pay.

Watch also the video about how to pay alimony and protect yourself:

How the accounting department transfers alimony: numbers and facts

You shouldn’t ruin your life and try to mend a broken vase of love if your spouse only evokes negative emotions. Divorce is a common thing in our harsh reality. However, if you have children, do not forget that they will want to eat and dress even after mom and dad separate. Child support is the responsibility of the parent with whom the child does not live. Many questions arise about withholding funds for a minor offspring. Many payers are perplexed about the amount of amounts charged or the timing of their payments, while recipients often complain about late receipt of funds. Let's discuss all the issues of concern and finally find out what the mystery of the transfer of alimony by the accounting department is.

Where to transfer child support?

The method of receiving child support payments is chosen by the child’s representative. If you want to save the transferred money until the person comes of age, the best way is to transfer it directly to a savings book opened in the name of the child.

If you need finances to meet the daily needs of a minor (for example, to buy groceries or clothing), it is recommended to have a separate card. It is issued in the name of the child.

The payer of alimony payments can independently choose the method of transferring funds that is convenient for him, but in this case it is necessary to obtain the written consent of the child’s representative.

When considering a case regarding the maintenance of a family member, the final decision on the procedure for enrollment and frequency of payments is made by the judge. He will take into account the wishes of both parties and choose the method that is best suited for the child and his representative.

How does the accounting department pay child support?

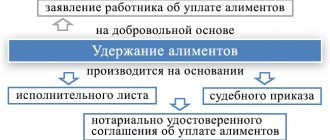

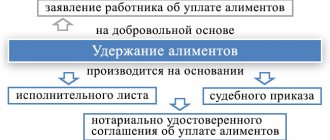

Withholding child support must have a legal basis. That is, a potential payer cannot come to the accounting department and say: “I want you to transfer a quarter of my salary to my ex-wife/husband.” For the process to proceed, you need an agreement certified by a notary, a court order or a writ of execution. Of course, the first option is more preferable, because litigation is not very pleasant and lasts quite a long time. However, the accounting department doesn’t care, and this service will accept any document confirming the legal grounds for deduction of alimony in favor of the former spouse. Let's look at the features of this operation through the eyes of an accountant:

- From what payments are deductions made? Contributions in favor of the child are transferred not only from the basic salary. The Government of the Russian Federation has decided to pay alimony from many types of citizen’s income. So the payer will not be able to cheat on the premium. What can I say, even remuneration in kind is subject to mandatory division. Alimony is withheld from wages at the main place of work and from any additional earnings, as well as from most payments provided for by the legislation of the Russian Federation. This includes compensation for meals, income from rental property, income from copyrights, and dividends. In general, a single parent will be forced to share almost all income imaginable with their children. This is not true in all cases, since often after deducting taxes and alimony the payer is left with a very modest amount. But you can’t argue with the law, and you have to get out of it like crazy until your son turns 18.

- Payment terms. Since alimony is directly related to the payer’s income, the date of their transfer usually coincides with the arrival of fixed assets to his account. That is, on the day of the alimony provider’s salary, funds for the maintenance of the child are received by the recipient, a maximum of three days later. Usually, accountants monitor the timely payment of alimony, since they are the ones who face punishment for late payments. How many times a month are funds collected for the maintenance of a minor child? After all, according to the law, salaries are paid in installments twice a month, that is, workers receive an advance and the bulk of the funds. Most often, alimony is paid once a month, deducted from the total amount of income, but there are exceptions. It is clear that the first option is more convenient for accountants, but sometimes a single parent requires double payment. By the way, you can receive alimony in three ways: by mail, at the cash desk of the organization where the payer works, and by bank transfer using the account number. Needless to say, the last method is the most convenient and popular. In one moment, the funds appear on your bank card, and you don’t need to go anywhere to get your legitimate money.

- Personal income tax and alimony. Is alimony transferred by the accounting department before personal income tax is deducted or after? This issue justifiably worries payers, because funds for child support are most often paid as a percentage of income. And before deducting personal income tax, the figure would have looked much more impressive. However, the amount of child benefits is calculated after taxes are paid, from the “net” salary. If the employee is entitled to benefits and personal income tax is not withheld from him, then alimony is calculated from total income without tax deduction.

- What income cannot be withheld? Are there any funds that will go to the child support provider’s account in pure form, and they do not need to be shared with the children? Yes, there are some. This may include payments on the occasion of the birth of another child, marriage registration, compensation in connection with the death of close relatives, business trips, therapeutic and preventive nutrition, moving to a remote area, and wear and tear of working tools. Also, alimony is not charged for financial assistance in the event of a serious illness or work injury. The survivor's pension remains entirely with the recipient. If an employer reimburses an employee for the cost of trips to a sanatorium, then it is also impossible to collect funds for child support from these payments.

Sending money via Russian Post

In this case, a certain amount of money is credited to the bank account of the payee. The frequency of transfers can be different - monthly, quarterly, once every six months or a year.

The parties must agree in advance on the timing of the transfer of money in favor of the child using a notarial agreement. The frequency may be established by court decision.

Russian Post, as a rule, charges a certain commission for transferring funds. All costs associated with transferring money to the payee's bank account are borne by the payer.

The advantage of sending money using Russian Post is the presence of the nearest branch near your home.

The citizen must receive a certificate of payment transfer, which will be proof of the fulfillment of the obligation to support the child. In addition, it is recommended to keep the receipt for this document. To receive the service, a citizen only needs to have a civil passport.

Registration of transfer of alimony through accounting

If the spouses were able to agree with each other on the payment of alimony without bringing the matter to court, then all they have to do is confirm the terms of their agreement with a notary. When peace negotiations do not lead to anything, the potential recipient of child support brings an application to the court. If the defendant agrees to pay alimony under the specified conditions, the court will issue an order. If there are serious disagreements between the former spouses, the single parent will be forced to file a statement of claim in court, after which the verdict will be a writ of execution. In order for an employer to begin transferring alimony, he must provide documents confirming the legal basis for the payments. Such papers include notarized agreements between spouses, court orders and writs of execution.

All these documents must indicate the conditions for the transfer of alimony, as well as the details for their transfer (mailing address of the defendant or bank account). The claimant must himself send the original papers to the organization where the future payer works. If the alimony worker works at several enterprises at once, then it is necessary to deliver documents to each of them. Duplicates, photocopies and scanned electronic versions are not accepted.

Agreements on the payment of alimony, writs of execution and court orders are documents of strict accountability. Therefore, the employer appoints a responsible accounting employee to record, store and process them. These papers are handed over against signature and are stored not in a general pile of documents, but in specially designated places: safes or metal locked cabinets.

If documents on the assignment of alimony are lost, the responsible person may be punished with a fine of up to 2,500 rubles.

The entire procedure for withholding and paying alimony is specified in the Family Code of the Russian Federation. Upon receipt of writs of execution, orders and agreements, the accountant is obliged to record their appearance in the reporting journal. Then the responsible employee determines from what date the funds must be withheld. The date must be indicated on the documents received. Sometimes the papers arrive much later than the start date of collection stated in them. In this case, the accountant is obliged to borrow the debt for the previous days or months from the employee of the enterprise. If all the necessary documents arrive on time, then the accounting department begins to calculate payments for child support from the employee’s next salary according to the specified percentage or a fixed amount after deducting personal income tax. Alimony is not paid in advance, so the recipient can expect it no earlier than the day the former spouse “pays”, but no later than three days after this event.

According to the law, alimony cannot amount to more than 50% of a citizen’s income. If, in addition to the basic monthly contribution, a child support debt is withheld, then the total amount of payments should not exceed 70% of the salary. Before making payments, the accounting department checks whether these conditions are met.

Postings for the transfer of alimony reflect quantitative changes in the payer’s salary and are usually characterized by the debit and credit of the accounting item. So, the debit part will always have account No. 76, and the credit part will depend on the method of paying alimony. That is, account No. 50 is a cash payment, No. 51 is for payment by bank transfer, No. 71 is for a postal transfer. And the posting of alimony through the eyes of an accountant always looks like this: Dt 76 Kt 50 (51, 71).

When transferring alimony, the organization does not undertake additional expenses associated with the delivery of funds to the recipient. That is, the costs for bank commissions and postal transfers are paid by the employee.

Also, payers often have a reasonable question: is it necessary to pay alimony from the refund of tax deductions? For example, if an employee gets sick, studies or buys a home, he can get some of the funds back by filing an application with the tax office. In fact, these payments are not listed in the list of income from which alimony is collected. Therefore, the payer can be calm in the event of receiving a tax refund.

Actions of the bailiff related to the receipt of alimony

Bailiffs are officials, have among their responsibilities the implementation of court decisions, including the collection of alimony , as well as arrears thereon. In order for a person to exercise these rights and perform actions related to debt collection, he must have a document. It serves as the basis for opening court cases in which further work is carried out. Bailiffs of official duties, including:

- Calling the debtor and the recipient of alimony to obtain the necessary information. For example, for whatever reason, one party refuses to pay.

- Get the information he needs and check the facts. Through authorities or services, find out the place of work, send a request to the debtor, take the necessary actions regarding identifying the size of the property.

- Require the manager to withhold the appropriate amount of alimony for the execution of court decisions, which can subsequently be paid through the bailiffs .

- Go to the debtor’s place of residence and visit the premises that belong to him. This is necessary to determine the solvency of a person before implementing court decisions.

- Prohibit the debtor from leaving the state.

- Bailiffs the right to seize property to the extent of the debt to pay alimony , as well as to carry out court orders. The debtor will also have to pay for enforcement proceedings.

- Through the bailiffs , a person, as well as his property, can be put on the wanted list.

How to keep and in what amount

Payment of alimony can be made either voluntarily or judicially. In the first case, their size is not limited. And the basis for withholding and transferring alimony for the accounting department will be a statement written by the alimony payer.

In case of collection of alimony in court, the basis for its withholding and issuance may be (Part 1, Article 12 of the Federal Law of October 2, 2007 No. 229-FZ):

- a writ of execution issued by a court of general jurisdiction on the basis of a judicial act adopted by it;

- court order;

- a notarized agreement on the payment of alimony or a notarized copy thereof.

Reasons why the alimony rate may be reduced

The amount of alimony obligations may be reduced in exceptional cases. In practice, by the way, the amount of alimony collected as a percentage is extremely rarely reduced by the courts, even if there are formally valid reasons for this.

Such grounds include the following circumstances occurring with the debtor:

- presence of disability;

- the presence of an incurable disease (injury);

- sharply fallen income level;

- loss of a job in the specialty;

- the emergence of new dependents (birth or adoption of children, disability of parents).

If debt arises, the total amount of child support accrued and debt retention cannot collectively exceed 70% of the debtor's total income.

Accounting entries for alimony from wages

A company or individual entrepreneur must withhold alimony from its employee according to writs of execution and reflect the transaction in accounting. Failure to fulfill this obligation may result in a fine. Let's look at the postings for alimony from wages.

Full access for a month! — Generate documents, test reports, use the unique expert support service of the Glavbukh System.

Call us at 8 (toll-free).

Attention! The following will help you correctly calculate, withhold and document alimony in your records:

Termination of labor relations with the alimony payer

When dismissing an employee, the employer prepares the necessary package of documents and makes settlements with the employee and the recipient of alimony.

If alimony was paid for the maintenance of a minor, then upon dismissal the accountant collects alimony from the severance pay and compensation for vacation. For other categories of alimony recipients, collections from accrued amounts upon dismissal are not made.

When dismissing an employee, the employer is obliged to send a notice of termination of the contract and a writ of execution to the FSSP. Documents must be sent no later than 3 days from the date of dismissal of the payer.

From what income is alimony deducted from the employee?

According to Article 98 of the Federal Law of October 2, 2007 No. 229-FZ, alimony withholding (see below for postings) is carried out by:

- from the entire amount of the employee’s income received under the employment contract;

- from the entire amount of the employee’s income received under the GPC agreement.

In more detail, the types of income from which alimony must be withheld can be found in the List approved by the Government by Decree No. 841 of July 18, 1996. In particular, these include wages, bonus payments, income in kind, sick leave benefits, etc.

In addition, alimony should be withheld:

- from the compensation paid to the employee for the use of his personal vehicle for business trips;

- paid at the initiative of a company or individual entrepreneur for housing, food, travel, etc.;

- average earnings for days of blood donation and additional days of rest provided in connection with donation.

There is also a list prohibiting the withholding of alimony from certain types of income (Article 101 of Law No. 229-FZ):

- amounts of compensation for expenses incurred on a business trip (except for amounts of payment based on the average earnings of the days of the business trip) and other types of compensation payments established by law;

- compensation payments for wear and tear of personal tools;

- benefits that the Social Insurance Fund pays to parents;

- payments related to marriage registration, birth of children, death of relatives;

- maternity capital funds;

- amounts of payment for travel to the place of treatment and back, established by law;

- payments that were related to those received in the performance of official duties.

- other types of payments and compensation.

Transferring payments to a savings book, card or bank account

How to force your ex-husband to pay child support? The procedure for terminating a marriage contract is https://urmozg.ru/semeynoe-pravo/rastorzhenie-brachnogo-dogovora/.

The procedure for concluding a marriage contract is.

If a citizen does not have official employment or receives earnings in foreign currency, he can transfer the required amount of funds independently. This can be done through an ATM, payment terminal or cash desk of any bank.

As mentioned above, all additional costs that a citizen is forced to face fall on his shoulders. In other words, the commission for transferring money to the child’s account is not included in the amount of the credited payment.

To make a transfer, a citizen may need a civil passport. As a rule, to deposit money through a terminal or ATM, it is enough to know the details of the child’s bank account. Contacting a bank branch requires the payer to have a passport.

Sequence of alimony withholding

The amount of alimony is indicated in the writ of execution. You need to withhold it once a month from the amount of income that remains after taxation (Part 1, Article 99 of Law No. 229-FZ).

Alimony is a first-priority recovery (Part 1, Article 111 of Law No. 229-FZ; Chapter IV of the FSSP Guidelines dated June 19, 2012 No. 01-16). This also includes:

- compensation for harm caused to health;

- compensation for damage to a person who has lost a breadwinner;

- claims for compensation for moral damage.

Second stage collections:

- requirements related to the payment of taxes, fines and other sanctions from the Federal Tax Service to the budget.

Collections of the second stage - all other deductions.

Collections for each subsequent queue are made only after the claims of the previous queue have been fully paid off (Part 2, Article 111 of Law No. 229-FZ).

Transfer to the account of bailiffs

Sometimes the decree on the execution of a court decision does not indicate the second parent as the recipient, but the Office of the Federal Bailiff Service. This situation arises, for example, when collecting a debt, in the absence of the ability for the applicant or the child to receive funds either in cash or in non-cash form (no bank card or account), and if the children are supported by the state. In this case, the recipient of the payment is the Federal Bailiff Service. But despite the fact that the funds are transferred to a government agency, the payment order for alimony should not be filled out in the fields intended for payments to the budget. This is explained by the fact that such a payment is not a transfer to the budget (tax, fee), but is simply accumulated by the bailiff service in a special account for further payment to the recipient.

Why do you need to go to court?

But it so happens that it makes no sense to expect conscientiousness on the part of the spouse. He avoids talking about his participation in the financial support of the child, hides and does not disclose his place of work. For a mother, whose shoulders bear the full burden of raising and providing for her children, there is no time or energy left to deal with a good-for-nothing father. In such a situation, the best solution is to go to court. This is her right, which she can use. Some mothers ignore this opportunity, demonstrating a kind of pride, believing that they can cope with all the problems on their own. This makes sense if the mother earns well. If she barely makes ends meet, then there is nothing reasonable in such an act. We need to be guided by the interests of children, and not by resentment and self-flagellation. If a man leaves a woman and does not even think about financial assistance for his children, then the woman needs to feel sorry, first of all, for herself and her children. Here morality and victory are on your side.

The overwhelming majority of courts are on the side of protecting the rights of mothers and children. It was stated above that the father can reduce the amount of alimony. But, firstly, he is still obliged to pay a certain amount; the court cannot relieve him of this obligation completely, and secondly, this is very difficult to do. As a rule, it is required to provide evidence of the existence of several reasons.

What to do if bailiffs do not list transfers

In cases where a person loses his job, payments under a writ of execution can be transferred to the account of the bailiffs or transferred to them from hand to hand, and they will already transfer the money to the recipient’s account. They also act as intermediaries when the payer avoids payments and when the parties do not want to meet in person to transfer money.

But there are cases when the payer transferred funds to the bailiff, but they were not transferred to the recipient. If the recipient knows that the ex-spouse transferred the funds long ago, and the bailiffs do not transfer alimony, then the recipient has the right to complain about such an employee to his immediate superior.

The question arises, within what time the bailiff must transfer the money. He must transfer funds in order of priority, but no longer than five working days from the date the money is received in the bailiffs account.

How to transfer assistance by payment order

A payment order is a document by which the bank transfers funds from a citizen’s account to other accounts. It can be one-time or regular; the second option is more suitable for transferring alimony. That is, if a person has a bank account, he can entrust the payment to the bank; this option is convenient if the citizen pays a fixed amount.

Information to be provided in the order:

- order number;

- date of debiting;

- information about the payer;

- information about the recipient and his details;

- the amount to be written off;

- what is the payment for?

Practical examples

For a detailed analysis of the features of calculating the timing of alimony payments, it is enough to familiarize yourself with the examples:

Deadlines for alimony payments from vacation pay

The alimony payer goes on vacation from May 10. According to the Labor Code of the Russian Federation, vacation pay must be paid 3 days before the start of the vacation, i.e. no later than May 8.

The calculation of alimony is made after calculating personal income tax and other contributions. Money for child support must be received between May 8 and May 10 inclusive (possibly earlier if funds are transferred before the deadline).

Terms of alimony payments upon dismissal of an employee

The man wrote a letter of resignation on October 15, and was assigned two weeks of work. By law, the day of dismissal is considered the last working day, i.e. October 29, full payment is made. Upon termination of the employment contract, the employee is paid wages and compensation for unused vacation. Alimony is calculated from the total amount after the transfer of state contributions.

The deadline for receiving alimony payments is from October 29 to October 31 inclusive.

Transfer of alimony from salary

The advance payment in the organization is paid on the 16th, the rest of the salary is paid on the last day of the month. An employee pays child support for one child at 25% of income.

The accountant must transfer money in the first 3 days of the month following the month in which the salary was received.

Actions of interested parties in case of violation of legal deadlines for calculating alimony

If child support payments are not received on time or are not paid at all, you must take the following steps:

- Send a written request to the payer’s employer for clarification of the circumstances and reasons for non-payment of alimony. The request must be submitted in two copies (to obtain a stamp of incoming documentation) or sent by mail with notification. The employer's response period should not exceed thirty days from the date of receipt of the letter.

- Send a statement to the bailiff department indicating a violation of the terms for calculating alimony. Employees will check the facts specified in the appeal, and if they are confirmed, the employer will be held administratively liable.

- Go to court if the issue is not resolved by the above authorities.

The amount of the fine for violating the deadlines for assigning alimony ranges from fifteen to twenty thousand for a manager or chief accountant and from fifty to one hundred thousand for an enterprise.

If the recipient of alimony and the employee of the bailiff department are not informed in time by the employer about the dismissal of the employee, the manager may be fined three hundred to five hundred rubles, and the organization - three to five thousand.

In addition, the employer is charged a penalty in the amount of 0.5 percent of the debt amount for each day of delay in payments.