Prices for lawyer services business lawyer

Forced liquidation of a legal entity is applied by court decision. A claim for liquidation of an enterprise can be filed by authorized government agencies if there are appropriate grounds. The law contains a list of reasons why a company can be forcibly liquidated.

Citizens and organizations have the right to freely carry out activities permitted on the territory of the Russian Federation and terminate their implementation at any time. At the same time, the principle of inadmissibility of arbitrary interference in anyone’s affairs has been introduced by law.

However, in a number of cases there is a need to involve regulatory structures in the affairs of individuals and organizations.

The current legislation of Russia provides for both the voluntary liquidation of a legal entity and the forced closure of an enterprise. The forced closure of an enterprise is a rather complex legal procedure that requires deep knowledge of the law on the part of the management of the forcedly liquidated company.

What if you don’t close the LLC?

Closing an LLC is long and difficult, so organizations without employees, income and transactions are often found. Such firms do not pay taxes and contributions, but still must submit zero reports.

There are abandoned organizations that have no movements in their bank account and do not submit reports. If this continues for more than 12 months, the tax office has grounds to liquidate the LLC unilaterally without the consent of the founders. But this is a right, not an obligation of the tax office, so in practice it rarely happens. Much more often, an abandoned organization continues to be listed in the Unified State Register of Legal Entities, and is fined for failure to submit reports.

Another option to get rid of an LLC is to sell it. This is easier than closing an organization, but it has its downsides:

- This possibility should be provided for in the organization's charter.

- The purchase and sale agreement must be certified by a notary - this costs a minimum of 10 thousand rubles, and the maximum cost can reach 150 thousand.

Stage 2

Notification to the tax authority

When the decision to terminate activities is in hand, you need to fill out form No. P15001 and have it certified by a notary. Next, the documents are sent to the Federal Tax Service, and within 5 working days the tax authority undertakes to issue a Unified State Register of Legal Entities entry sheet with a note that the liquidation of the legal entity has been started.

The deadline for submitting documents is 3 days from the moment of signing the decision (protocol) on liquidation. (Clause 1, Article 62 of the Civil Code of the Russian Federation). Otherwise, the company will receive a fine for late provision of documents.

Bankruptcy

Bankruptcy is also called the insolvency of an organization, which refers to its inability to satisfy the demands of creditors.

This failure must be recognized by a decision of the arbitral tribunal.

An organization is declared bankrupt if, within three months, it has failed to satisfy the demands made by the creditor, and if the amount of obligations incurred exceeds the value of the property owned by it.

Art. 65 Civil Code and Bankruptcy Law

indicate that any legal entity may be declared bankrupt, with the exception of state-owned enterprises, parties and religious organizations, institutions, and some funds (if provided by law).

A number of measures have been formulated by law to prevent an organization from being declared bankrupt:

- judicial rehabilitation,

- external control,

- financial recovery,

- bankruptcy proceedings,

- settlement agreement

- designed to restore the debtor's solvency.

For example, an external manager may be appointed, who must develop a set of measures to protect the debtor’s property.

Based on the results of his activities, he draws up a report, which must be carefully considered at a meeting of creditors, after which it is subject to approval by the arbitration court.

As a result, creditors may petition to terminate the activities of the arbitration manager in connection with the establishment of the organization’s solvency or to declare the debtor bankrupt and open bankruptcy proceedings.

To carry out bankruptcy of a legal entity, experts advise contacting special bankruptcy agencies, since this is a complex and lengthy procedure (it can drag on for many months).

We recommend that Muscovites and all those who conduct business in the Moscow region contact an experienced lawyer, Candidate of Legal Sciences, Igor Yuryevich Noskov.

Bankruptcy of legal entities in Moscow is one of the frequent questions with which clients turn to Igor Yuryevich. In addition, the most popular lawyer services are representation in courts, protection of the interests of legal entities and individuals in the field of monetary obligations, provision of services and trade, real estate, etc. The main principles of a lawyer are honesty, openness, fairness and impeccable professionalism in everything.

Let us emphasize once again that bankruptcy is a legal way to hide from financial liability to your debtors.

But remember that fictitious bankruptcy is a criminal offense.

Consequences of forced liquidation of LLC

The main result of the liquidation of an LLC (both voluntary and forced) is the entry into the Unified State Register of Legal Entities of data on the procedure carried out and the termination of the organization’s existence. The legal capacity of the organization completely ceases to exist, as does the company itself.

The main consequences are as follows:

- LLC can no longer be the subject of legal relations;

- universal legal succession is not possible, however, certain rights and obligations can be transferred to other persons, for example, founders;

- the property that remains after satisfying the claims of all creditors is transferred to the founders and divided in accordance with the size of their shares;

- The organization dismisses all employees due to the liquidation of the company.

These consequences apply to the Company itself. However, forced liquidation also affects the founders. We are talking primarily about possible subsidiary liability.

If, after the liquidation of the LLC, there are outstanding debts, they can be presented to those persons who made decisions regarding the activities of the Company. However, this is not always allowed.

In order for the creditor to be able to make claims against the founder, he must be at fault for the consequences. For example, if, due to the direct decisions of such a person, the company lost funds and was unable to pay the bank, the latter has the right to demand payment. If the events occurred unintentionally, then there will be no liability.

There are also administrative consequences for the founders and directors of a company that was liquidated at the request of a government agency. Registration of a new company may become impossible within a three-year period after completion of the procedure.

The impossibility of registering a new company makes it possible to reduce the number of fly-by-night companies that were opened for the same people for a short period.

Another possible consequence is that the founder or head of the company may have difficulty obtaining a loan in the future. There is no direct government ban, but banks often adhere to such a policy.

If a person has been blacklisted and does not have the opportunity to register a new company, then he does not have the right to act as the head of a new organization.

Read: What to do if your LLC liquidation request is refused

Stage 6

Drawing up an interim liquidation balance sheet

To do this, you need to report the property that is listed on the balance sheet, provide information about the debt, if any, and indicate the measures that are being taken to repay it. There is no single document template, but the requirements are the same as for financial statements. The finished balance sheet is approved at the meeting of founders.

Next, a notification is drawn up in form P15001. It must be certified by a notary and submitted to the tax authority along with a copy of the publication in the media and the approval protocol. Within 5 working days, the Federal Tax Service Inspectorate undertakes to consider the application and issue a Unified State Register of Legal Entities entry sheet with a note indicating the acceptance of the interim liquidation balance sheet.

Sometimes the PLB itself is required, but this is specific.

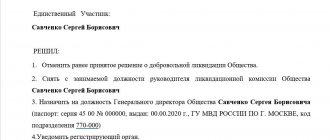

Stage 1

Making a decision on liquidation

The closure of a legal entity must be discussed at an extraordinary meeting of the founders. If the decision is made unanimously, it is recorded. If there is only one member of the company, the decision is personal.

A liquidation commission is formed from among those present. It may include one person (liquidator) or a group represented by an accountant, lawyer, director, founders or third parties. Once the group has been identified, its leader is chosen. Next, he will act as the Applicant.

Procedure for liquidation of a legal entity

The procedure for abolishing a legal entity by members of the liquidation commission is carried out in the following stages:

- The decision to permanently close a company must be immediately published in the press.

- Further, the commission is authorized to create an interim balance sheet of the company being liquidated, which includes the composition of the company’s assets, the presence of debts and unfinished transactions, and so on.

- If the finances on the company’s balance sheet are not sufficient to satisfy the interests of creditors and the tax service, then the liquidation commission has the right to sell the company’s property.

- The company cannot be dissolved until the financial interests of all financial institutions and creditors are fully satisfied. Repayment of debts to creditors is the most difficult and lengthy stage of the company closure procedure.

- Immediately after all debts have been repaid, the liquidator must draw up a final balance sheet for the company. If any funds and property remain at the company's disposal, they will be distributed among the company's shareholders.

- Upon completion of all the above procedures, the liquidation commission draws up a document that is issued to the former head of the closed company. It contains all aspects of the procedure performed.

Liquidation at the request of tax authorities

The forced liquidation procedure can be initiated by various government bodies for many reasons. Applicants can be prosecutors, tax authorities, licensing authorities and other structures. Here are a few reasons why a company may cease to operate:

- a gross violation of the law, if it is irreparable (in fact, this is any repeated violation of the law, for example, failure to submit a tax return);

- conducting activities subject to licensing without a license;

- carrying out activities that contradict the statutory goals;

- repeated violation of the legislation on the use of cash register systems (for example, systematic failure to issue a cash register receipt);

- the presence of a negative net asset value for more than two years (for JSC).

If an organization has not undergone re-registration and declared itself before January 1, 2003, it will not be considered liquidated. At the same time, the tax authorities have the right to go to court with a demand to terminate its activities.

The forced liquidation procedure can be initiated by:

- Ministry of Antimonopoly Policy;

- The Federal Tax Service;

- Ministry of Finance;

- Federal Commission for the Securities Market.

Currently, the Federal Tax Service of Russia is considering some possible options:

- introduce a procedure for suspending activities, that is, registration authorities will temporarily restrict the organization’s right to carry out business activities.

Transactions that the organization makes during this period will be declared invalid. If in the future she does not declare herself, she will be excluded from the register.

It remains to be noted that today the liquidation process is quite long and painful.

Stage 8

Submitting documents to the tax authority

To close an LLC, you need to submit the following package of documents to the Federal Tax Service:

- Final liquidation balance sheet and protocol on its approval;

- Application in form P16001 (certified by a notary);

- Receipt for payment of state duty;

- Certificate from the Pension Fund of Russia.

You need to submit documents to the tax office at your place of registration. Within 5 working days, the tax authority undertakes to issue a sheet of registration for the Unified Legal Entities with a note about the liquidation of the company.

The priority of satisfying the interests of creditors during the liquidation of a company

The main stage of the company dissolution procedure is to satisfy the interests of creditors. This happens in the following order:

- payments to persons who in one way or another interacted with the closed company and suffered any losses from it;

- payments to employees who entered into an employment contract with the company being closed;

- payments to extra-budgetary and budgetary funds;

- payments to creditors and financial institutions.