- Home page

- Articles

- How to legally get rid of microloans if you have nothing to pay

March 4, 2020

- The dangers of avoiding debt payments

- Don't avoid dialogue

- Restructuring

- Take advantage of "vacations"

- Create a personal budget

- How to get out of microloans: refinancing option

- Avoid new loans and try to find another source of income

- Going to court or bankruptcy

Each borrower may face a situation in which he is unable to repay his existing debt on a timely basis. If you have nothing to pay the loan with, the worst thing you can think of is refusing to dialogue with the credit institution: changing your phone number, ignoring calls, etc. This will not help solve the problem and will only add new ones. When borrowers do not make contact and try to hide, microfinance institutions can launch a collection procedure and transfer the loan to collection agencies, demand early repayment of funds in full, or file a claim in court.

What happens if you don't pay?

Don’t think that the credit institution will forget about the debt if you don’t respond to payment reminders – calls, messages or notifications. The consequences will come anyway. If you have nothing to pay for a microloan, you still shouldn’t shy away from communicating with microfinance organizations. Otherwise, the microfinance organization:

- will charge penalties and fines;

- will file a lawsuit;

- will transfer the debt to collectors.

The first step of the MFO is the assessment of penalties. A penalty will be charged for each day of delay. The amount of the penalty must be specified in a written agreement signed by the client. Please note that the law of the Russian Federation limits the amount of penalties that banks and microfinance organizations can impose for late payment. According to it, the fine cannot be more than 0.1% of the overdue amount for each day of late payment. MFOs can bill more, then you can go to court.

Loan for 1 hour secured by PTS/car Credeo, Person. No. -

from 0.06%

rate per day

up to 5 million

30 – 1,825 days

Take out a loan

If the client has not repaid either the amount of the debt or the penalty, the MFO will take more serious steps. Either he will transfer the debt to collectors, or he will go to court.

With the help of the court, enforcement proceedings will begin. This means that bailiffs will be able to send a request to banks or directly to your employer. As a result, the debt amount will be written off from the debit account or from the salary card. If the entire amount is not available, the debt will be written off in installments every month after the funds are credited to the account.

Another way for MFOs to get their money back is to sell the debt to collectors. In this case, the collection agency will call the client intrusively. In addition, a note about the change of creditor will appear in the report to the credit history bureau. It will be difficult to get a new loan from a bank or microfinance organization. In addition, information from a credit report can be obtained by a potential employer or landlord, or an insurance company.

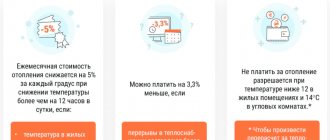

Arrange for deferred payments

Another completely legal way to reduce the financial burden on a debtor is to obtain a deferment on payments or, as it is often called, a credit holiday. In this case, the borrower will also be required to document the reasons for the change in his financial situation. Reasonable ones include, for example, dismissal from work, temporary disability due to illness or the need to care for a sick relative, etc.

Current legislation allows for a deferment in such a situation. Moreover, this rule applies to relationships between clients of both microcredit companies and banking institutions.

Option 1. Borrow money

You can borrow money:

- from friends or relatives;

- from banks or other microfinance organizations;

- at the employer.

Borrow from acquaintances, colleagues, friends to pay off a loan

The best way to do this is with a receipt. This way it will be calmer for both you and the person who is ready to lend. The receipt does not have to be certified by a notary; you can draw it up yourself. What must be in it:

- FULL NAME;

- passport details of the person receiving the money;

- passport details of witnesses to the transfer of money;

- the exact amount and the amount to be returned;

- return period and penalties in case of delay.

The receipt must be written by hand.

Refinancing – combining all loans into one

You can take out a new loan to pay off an old one only if it is a refinancing. Of course, if there are long arrears on loans, it will be very difficult to get new approval from the bank or even from the microfinance organization. But sometimes there are special programs for refinancing loans from microfinance organizations.

Online loan Monetkin Monetkin, Lits. No. 005894

from 0.27% per day

First loan 0%

up to 100 thousand

14 - 168 days

Take out a loan

For example, at Tinkoff Bank you can refinance not only a loan from another bank, but also a microloan issued by an MFO. The main condition is the absence of delays. Refinancing at Tinkoff will significantly reduce the loan burden:

- interest rate from: [email protected] %;

- maximum amount –: [email protected] rubles;

- Account maintenance, information and early repayment are free.

If there are late payments, then the bank will definitely reject the application for refinancing.

Ask your employer to provide a loan for the amount owed

If all financial institutions refuse, but there is official employment, you can ask the employer for help.

You need to conclude a loan agreement at work, which will spell out the detailed terms of the transaction. For example, the employer pays the entire amount of the debt, and then regularly withholds part of the salary for a certain period of time. The optimal retention rate is 30%. This is a profitable deal because this way you can repay your loans early and not overpay due to high interest rates.

Loan secured by CarMoney (Karmani), Persons. No. 005203

from 0.09%

rate per day

up to 1 million

730 - 1,431 days.

Take out a loan

Other ways to find money for repayment

There are less popular, but working ways to pay off debt. If you have no one to borrow money from, you can:

- rent out the collateral property;

- voluntarily sell your property.

The legislation of the Russian Federation allows the collateral property to be rented out. Be it a car or real estate. But it is important that the rental permission is also specified in the agreement with the bank. As a rule, credit institutions allow rent for a period not exceeding the debt repayment period.

Comments: 179

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Tatyana Kurchanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Oksana

10/09/2021 at 04:17 Hello. I'm Oksana. There are microloans for the amount. 100,000. I don’t know how to repay. Please tell me what can be done?

Reply ↓ Olga Pikhotskaya

09.10.2021 at 17:20Oksana, good afternoon. First of all, you need to contact microfinance companies with a request to restructure debt, provide credit holidays or write off accrued interest. Perhaps they can meet you halfway. You can also apply for loan refinancing from Tinkoff Bank. You can apply using this link.

Reply ↓

09/17/2021 at 08:57

Hello. The situation is this, I found out about debts on microloans, went through the credit bureau, there were 6 agreements, paid 4, 2 remained, paid another one, I checked at the bureau, there are already 4 and all for 2019, it’s possible that agreements are popping up, and how to find out all the possible debts ?

Reply ↓

- Anna Popovich

09.19.2021 at 18:07

Dear Alexander, after 10 days credit institutions are required to transmit new information about the borrower. The transfer period from the moment of occurrence of a certain event is 5 working days. Check with the lender, it is possible that you have paid off the loan debt, but the interest has not yet been repaid to you.

Reply ↓

09.16.2021 at 14:54

Hello. Maybe someone here can tell me. It so happened that being unemployed and having loans, I myself had the mistake of taking out loans for living and paying off loan payments. (I didn’t know about the allowance, and it wouldn’t have been much). In general, now I have 5 loans (total amount with interest 199 thousand) and 3 loans for a total amount (600 thousand). I deliver everything on time, there are no delays.

With a salary of 60 thousand rubles a month, it turns out that I pay almost the entire salary and go into even more debt. This process needs to be slowed down somehow, but I don’t want to spoil CI, so I’ve been paying crazy interest rates for 2 years now, exchanging one loan for another. For good reason, I would just take 1 loan, fortunately CI allows it, but I don’t meet the load, and if I declare more income than it is, a request to the Pension Fund will still reveal the truth. It turns out that I am in a hole from which it seems possible to get out, but the rules of the banks do not allow this. In principle, I am ready even for a high% and 99% that I will give regularly, sometimes even more. But this cannot be conveyed to the robot that checks applications. There is no one to borrow such an amount from, and there is nothing to sell either. I don’t know how to get out... -_-

Reply ↓

- Anna Popovich

09.19.2021 at 17:53

Dear Sergey, we recommend considering the option of refinancing. This way you can reduce the interest rate and collect all the loans and credits together. The best offers can be found at this link.

Reply ↓

03.10.2021 at 22:44

Why do you take out these loans and then complain?????????? Is it really difficult to live within your means?????

Reply ↓

09.16.2021 at 14:13

Tell me, I took out a microloan on a Sberbank card for 2 thousand and 3 thousand and did not pay. Can they withdraw a loan from another bank card, for example Alpha Bank?

Reply ↓

- Anna Popovich

09.19.2021 at 17:54

Dear Alexander, only within the framework of enforcement proceedings.

Reply ↓

09.13.2021 at 21:37

Hello, please tell me, in 2021, I took out a microloan from an express loan company in the amount of 10,000 rubles, to this day there is a fixed amount of debt of 50 thousand, no one called during this time, there were no letters to the court for the return of funds, is it possible Is there any way to avoid paying off this debt due to the expiration of the statute of limitations?

Reply ↓

- Anna Popovich

09/15/2021 at 00:40

Dear Sergey, yes, if the IFC did not go to court, then this debt is no longer subject to collection.

Reply ↓

04.09.2021 at 15:07

Hello, yesterday we took out a microcredit, today we wanted to return the same amount of 90,000 tenge, they called and said that it would not work, we have already sent the money although the money has not yet arrived, is this legal? They tell us you will return it with interest +20000 tenge even though another day has not passed

Reply ↓

- Anna Popovich

09/04/2021 at 20:29

Dear Zhanna, the legislation of the Russian Federation establishes the possibility of refusing a loan within 14 days from the date of its execution, but in this case you will have to return the entire amount and pay interest for this period. We recommend that you contact a lawyer who practices in Kazakhstan, since such legislative nuances may not exist.

Reply ↓

08/31/2021 at 12:53

Hello, tell me what to do correctly. I have goods on credit from MFC, so I have a personal account on the MFC website. On 08/17/21 I entered a card into my personal account for payment. At this time, MFC 20,000 is credited to my card, I didn’t ask for it (according to the time this all happens at 12-09 and 12-10), there is also an SMS with a code that I do not enter, and an agreement for mail and a payment schedule. I started calling the IFC, there was no answer, after 10 minutes of waiting the call was dropped, I wrote an email to cancel the transfer, I didn’t ask, there was no answer. There was already such an attempt on 06/28/21, but there was no card in my personal account where I could send it, and there was also an SMS and a contract, but they responded quickly and everything was resolved. I never got through on the phone that day and didn’t receive an answer, 09/18/21 I return the amount to their account back, but the refund was 19,800. A week later they answer that to completely close I must deposit another 7,000 and that’s it. Explain my actions. Thank you

Reply ↓

- Anna Popovich

02.09.2021 at 17:06

Dear Tanya, ask the IFC for an agreement on the basis of which the funds are transferred to you, only after that can we talk about any actions.

Reply ↓

08/30/2021 at 21:18

Hello, in April I took out a microloan of 30,000 rubles, they did not pay it back, now it’s the end of August and they are already demanding 93,000 rubles. Is there any point in suing? Or is everything according to the law on their part?

Reply ↓

- Anna Popovich

08/31/2021 at 02:37

Dear Angela, it makes sense, because the total amount of all payments, taking into account interest, fines, penalties, fees for additional services (for example, insurance) cannot exceed the loan amount by more than 1.5 times.

Reply ↓

08/24/2021 at 02:48

Good evening! I purchased a phone in the Wildberries online store in installments. Approved by MCC bank “Buy, don’t save”. I did not receive any agreement from them, not by email, anywhere, not a payment schedule, not the amount how and when - nothing at all. The order has not yet arrived at the pick-up point, I haven’t picked it up yet, and I immediately have a question: what should I do? I don’t have an agreement that I clicked to sign, no payment schedule, nothing. I only received an SMS from them - after following the link I get to my personal account, where it says - No contracts! The fact is that I am deaf and hearing impaired, so I cannot call them on the phone number provided, and no one can call me, since I will never hear anyone. What to do in such cases? Please tell me. What needs to be done, and is it necessary to pick up this phone from the point of issue, which shows the status as paid?

Reply ↓

- Olga Pikhotskaya

08/24/2021 at 02:53

Natalya, hello. Very often our readers encounter this problem, and they cannot get anything from Wildberries employees. You can read the comments on this page. Try asking your question via the feedback form on the retailer’s website (wildberries.ru/services/kontakty) and write a letter to the Buy Don’t Save MCC at

Reply ↓

Natalya

08/24/2021 at 03:25

Thank you very much! I'll try to do everything as you wrote. Please tell me, should I pick up this order or is it better not to?

Reply ↓

Olga Pikhotskaya

08/24/2021 at 03:34

Please) Read reviews about the lender on the Internet and decide what is best to do. It may make sense to get a loan or credit card with an interest-free period from a bank that you trust, enter into a loan agreement and pay for the phone with the money received. You can also get an installment card. The most popular offers are available on this page. In addition, after a month, check your credit history to make sure that this loan is not hanging on you. You can request a credit report from BKI free of charge 2 times a year.

Reply ↓

08/24/2021 at 03:40

I read everything, understood everything. That is, if I don’t pick up this phone, then the agreement with the Buy Don’t Copy bank will be automatically terminated, and I won’t have to pay them anything? And besides the sample, I didn’t receive any contract and no payment schedule... Therefore, I had doubts about whether to pick up this phone from the pickup point... I wrote two identical letters to the “Buy don’t save” email this afternoon - at least show me the contract and why via their link My personal account is empty and it says - there are no contracts. They don't answer - they are silent. The whole day there have been no answers to two letters from them.. Therefore, I doubt whether I need to pick up the goods, and whether they will cancel this agreement that I signed with buy it, don’t save it, yourself.. I won’t be able to call them and find out something. I can, of course, go tomorrow to their address, st. Pravda no. 8. But is it necessary? If I don’t pick up the phone, will they cancel everything automatically and cancel the agreement with the bank? Sorry, there are a lot of questions..) I am very grateful to you, thank you very much! ) means the contract with the bank is automatically canceled if I don’t pick up the phone? I’d rather use your advice about credit cards and installment cards) but I won’t take this phone. The main thing is that they cancel this agreement...

Reply ↓

- Olga Pikhotskaya

08/24/2021 at 03:48

Natalya, I can’t get an intelligible answer from Wildberries support service. In theory, if the customer does not receive the goods, the transaction is canceled. But you need to monitor your credit history yourself so that you can take timely action if the loan is considered valid.

Reply ↓

Natalya

08/24/2021 at 03:53

I emailed them twice, MKK Buy, don’t save... They don’t answer.. Thank you! You helped me a lot! For the first time real help. Thank you!