- SAR database

- Why know when the first licenses were issued?

- Driver age coefficient

- How to find out the exact date

When the driving experience exceeds 10 calendar years and a person receives a new license, only the year when he started driving is recorded on the card. Two categories of people know the date of issue of the first license with certainty: those who received the certificate during the last ten-year period and those who record all the information.

If a situation arises in which it is necessary to note the date of issue of the first license, then the citizen is faced with a problem. However, modern resources make it possible to find out the date of issue of the first driver's license.

Read this useful article: “How to find out whether a driver’s license has been revoked through the traffic police website.”

Request to the traffic police

This option offers 2 request methods:

- When visiting the traffic police in person;

- Through a request on the website.

With a personal visit, everything is simple: make an appointment by phone or online (section “Service” on the traffic police website) and present your driver’s license to the traffic police officer. He will check their series and number against the internal database and provide information about the date of issue of the first driver's license.

Submitting a request online:

- You must log into the traffic police website.

- Select the “Services” menu and select “Driver Check” in the drop-down window.

- In the form that opens, fill in the details of the current license (series and license number, date of issue).

- After that, click “Request Verification”.

- After processing the request, information about the owner of the license will appear on the screen, as well as the first license issued to him and the traffic police department that issued it.

SAR database

Since the beginning of the 2000s, a non-profit organization has been officially operating in Russia - the community of auto insurers - RCA. The institution was created to control the activities of insurance companies selling compulsory motor liability insurance and comprehensive insurance. The organization's website provides a complete list of all licensed companies, as well as links to official company portals . This is important, since scammers often make copy sites and people, wanting to purchase a policy, fall for their pages.

It is recommended to go to the website of the selected company through the Russian Union of Auto Insurers, this is a guarantee of getting to the official portal.

The union’s website also has a service that allows you to determine the bonus malus coefficient for each driver. This service is designed primarily to provide policyholders with information about clients. Some car owners who often get into accidents believe that by contacting another company, they can get a better price . This is not true; all companies send information about their clients to a common information database.

According to the federal law on compulsory motor liability insurance, RSA is also the authority where you can file a complaint against an insurance company. If the company where the policy was purchased goes bankrupt, the union will also pay for damages.

We recommend that you read the article: “Replacing a driver’s license at the MFC after expiration.”

Is it possible to find out from the driver’s personal data?

It is not possible to find out information about a citizen’s first driver’s license and his driving experience based on his full name. This data is considered the citizen’s personal information, is protected by law and cannot be distributed (protection of confidential information).

Thus, today, obtaining information about the period for issuing the first driver’s license using the number of the current driver’s license is a fairly simple procedure. You are offered a choice of several services and request options that will save your time and allow you to quickly get answers to your questions.

Driver age coefficient

When determining the cost of compulsory motor liability insurance, many indicators play a role. The base price depends on the vehicle, but the reduction and increase coefficients depend on the driver. The lowest price is assigned to experienced car owners who have not been involved in an accident.

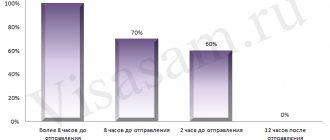

One of the parameters that can increase the amount is the driver’s experience and age. In order for this indicator not to affect the cost, the client must be over 22 years old and have rights for more than 3 years, which means receiving them at 18 or 19 years old.

Let's consider by what factor the price increases if the specified criteria are not met:

- Both indicators were not achieved – 1,8;

- Age over 22 , but driver experience less than 3 years – 1.7 ;

- The situation is the opposite of that indicated above (age up to 22 years, and total driving experience more than 3 years) - 1.6 .

At the moment, a bill is being considered according to which, as you grow older and the number of years of experience increases, the coefficient will become lower. For example, the amount paid for a policy for a forty-year-old driver with 10 years of experience will be multiplied not by one, but by 0.96.

The beginning of your driving experience is the day you purchase the card. Information about whether a person actually drives a car or not is not available in all databases.

When do you need to know the date?

The main reason why drivers began to wonder about the date of issuance of the first license was the possibility of electronically generating an e-MTPL policy. Previously, when this service was only available in a branch of an insurance company, a year was enough for them and all the paperwork was filled out by the company’s employees. Today, when everyone has the right to fill out an application on their own, the question of the exact issuance of first rights has arisen. The electronic form requires specifying the exact day on which the pedestrian became a driver.

Despite the fact that only the year will be indicated in the finished document, the system will ask you to enter data regarding the day, month and year. It is not possible to skip the column, as the site will throw an error. Specifying an incorrect date will affect the final cost of insurance. This approach was chosen specifically so that those who deserve discounts could take advantage of them.

In practice, those who have already exchanged their licenses are guaranteed to have over ten years of driving experience, which means the coefficient by which the cost of compulsory motor liability insurance is increased will be equal to one.

It is important to know the specific date and month of issue:

- those who received a driver's license less than ten years ago;

- for those who changed their rights due to changes in personal data or loss.

In the second option, this also relates to motorists who have had their license for less than ten years.

The start date of driving license training is counted from the date of issue of the first license. Moreover, it does not matter whether a person is an active driver or not.

Online tracking information

Online today you can get the information we are interested in in two ways:

- Send the corresponding request by email to RSA and wait for a response.

- Try to get information using a special service on the official website of the traffic police.

At the same time, the last option is considered the simplest and most comfortable. After all, the traffic police portal works very quickly, without any glitches. At least, the whole procedure will go much faster than processing an application and searching for information in the RSA.

However, on the official website of the RSA, drivers have the opportunity to obtain information of a different kind. For example, you can check online the KBM, which is a special coefficient used to calculate the cost of compulsory motor liability insurance.

To do this, follow these instructions:

- go to the RSA website and find a section called “OSAGO”;

- Select on the left side “Information for policyholders...”;

- find the section “Information...to determine the KBM”;

- we agree with the processing of our data (this is a standard procedure and it is completely safe);

- fill in all the required fields;

- We wait until the system calculates the exact coefficient.

How to restore KBM

After an accident occurs, the driver’s personal class in the bonus-malus system is lowered by several points, to a maximum of three. This leads to significant overpayments during the next registration of compulsory motor liability insurance. There is only one way to return your rating in the KBM system: accident-free driving. Returning to the previous KBM level will take three times longer, since you can “fall” in the rating by three points at once just for one accident. It is not possible to move up three levels for accident-free driving. The maximum that is possible is a class upgrade of 1 point per year without an accident.

Independent coefficient calculation

In order to protect himself from unlawful actions of the insurance company, a person has the right to independently calculate the coefficient by which the cost of his policy will increase.

To do this, just use the following information:

- up to twenty-two years of age and up to three years of experience, it is equal to one point and eight tenths;

- if the driver is under the above age, and the experience has exceeded three years, then one point six;

- for citizens over twenty-two, but with less than three years of driving experience - one point seven.

For all others, the coefficient is equal to one, that is, age and driving experience do not affect the cost of the insurance policy. If several people fit into OSAGO, then the largest one will be applied. For example, if a parent with serious experience includes his eighteen-year-old child, who has just received his license, in the insurance, then the cost of insurance will be maximum. Determining the date of issue of a driver’s license and where to look for information is described below.

A number of insurance companies offer a policy under which any third party has the right to drive a vehicle. Compulsory motor liability insurance of this type is often more profitable than when introducing a newly hired driver.

What are the pros and cons of this service?

Pros and cons of verification

Pros:

- This is the fastest way to check your license and find out whether the driver is disqualified or not.

- The data is checked directly from the official traffic police databases.

- You don’t need to go anywhere—you can easily check your driver’s license from home, office, or anywhere there is internet access.

- The traffic police website is reliable and does not collect information for transmission to scammers.

Minuses:

- With information about your driver's license, third parties can freely obtain information.

- Sometimes information that is not up to date may be provided.

- Information about the driver himself is very limited.

On what other sites can you find out whether a driver has been disqualified or not?

State fee for a driver's license

New driver's license

Driver's license photo requirements

Where and how to get an international driver's license?

There are many sites. All of them offer to obtain more detailed information about the driver using the license number. However, you should be careful when entering your information on them - some sites collect information and provide it to scammers. Before filling out the fields, make sure that the site has a proven reputation and cooperates with the traffic police.

What are the dangers of driving a car without a policy?

Taking out insurance is an important condition for every motorist. The penalty for not having a policy can vary significantly. If there is no policy at all, then the motorist will have to part with an amount equal to 800 rubles. All consequences of an accident fall on the shoulders of the unlucky motorist who forgot to pay for the policy. In the absence of this document and maintenance, the motorist faces a fine of 500 rubles.

ATTENTION !!! Sometimes the driver simply forgot the policy at home. In this case, he must pay a fine of 500 rubles if he does not prove that the policy still exists. To do this, you need to provide the number of an insurance agent who can confirm the availability of the policy. It will help you recover your policy number that was forgotten at home. If there is a duplicate or scan of the insurance, this can also serve as evidence for the inspector.

When the insurance period has expired, it can be called expired. This threatens the driver with a fine of 800 rubles. Sometimes driving a car is done by a motorist who is not included in the insurance policy. For example, a car owner is drunk and transfers control to another person. In this case, the fine will be 800 rubles. Moreover, it will be the car owner who will pay for it.

What changes will happen in 2020

In addition to the appearance of two new categories (Tm - for trams and Tb - for trolleybuses), all subcategories of transport will be required to be indicated. To find out more detailed information about subcategories and special marks, you should study the Federal Law “ On Road Traffic Safety” dated December 10, 1995 N 196-FZ (as amended).

The changes will also affect the procedure for obtaining permission to drive a car, which will depend on its technical features. So, if the traffic police exam is taken in a car with an automatic (automatic transmission) or continuously variable (variator) transmission, the motorist will receive a mark indicating the corresponding restriction . In this case, he will not be able to drive a car with a manual transmission. All restrictions (both general and related to certain types of vehicles) will be in the form of abbreviations consisting of Latin letters.

When replacing a document, an o will appear in paragraph 14, in which it will be noted when the certificate was received for the first time. In case of loss or disappearance of the ID, the o.d. will also appear on the replacement document. This mark does not impose any restrictions. The latest innovation is o - such a record will be received by drivers who have serious health problems and are required to undergo a medical examination more often than others.

What innovations can we expect in the future?

For the bonus-malus system and the calculation of the accident-free experience associated with it, special innovations are planned only in the order of its assignment to the owner. The values of the indicator itself will not change. The fact is that this is a rather old foreign scheme, honed and verified over many decades long before the appearance of compulsory motor liability insurance in the Russian Federation.

But the major reform of the PIC system, planned for a long time - since 2014, has already happened. Now the departments of the State Traffic Safety Inspectorate, the Ministry of Finance, the Central Bank and the RSA are agreeing on the optimal package of changes that will be proposed for approval and implementation.

The degree of radicality of innovations was planned to vary.

Well, as they say, we’ll wait and see, hoping for the best.

When is an insurance policy not important?

There are situations when the presence of compulsory motor liability insurance is not necessary for the driver.

These include:

- Vehicles with a design feature of up to 20 km/h,

- when insuring a risk by another policyholder, which is not prohibited by current legislation,

- if you have an international insurance policy,

- Vehicle intended for military service,

- due to the presence of certain technical characteristics, due to which the car is not subject to the provisions of the Russian Federation law on compulsory insurance,

- when the vehicle is not equipped with wheel propellers.

In other cases, insurance must be issued no later than 10 calendar days from the date of registration of rights to the vehicle.

How to get information about the date of issue of rights in 2021

Today there are several ways to obtain information. Let's look at the most popular of them:

- Submitting a corresponding request to the RSA or the Russian Union of Auto Insurers. At the same time, you can send a request through the official RSA website or a host of other services on the Internet.

- Driver's card . This document is issued in paper form to all drivers. However, more often than not, finding it in a stack of other papers is even more difficult than the information we need. One of the reasons for the lack of value of the document is its non-binding nature for drivers and the absence of fines for its loss.

- Submit a corresponding request directly to the traffic police or on the official website of the State Road Safety Inspectorate.

Each of the methods listed above has its own pros and cons, but all of them are considered quite effective and convenient for obtaining the necessary data.

Driver's card

A personal driver card, or, as it is most often called, a driver’s card, is issued personally to each driver. It contains basic information regarding the driver himself, including:

- exam date;

- date of receipt of rights, etc.

Lawyers recommend that you treat this document with care and carry it with you in your glove compartment, because the card can be used as an additional supporting document.

As our practice shows, drivers with quite a long driving experience, most often, do not know the location of this document at all and believe that there is absolutely no need to restore it, because all the information recorded in it today can be obtained in a short time by other means.

ARTICLE RECOMMENDED FOR YOU:

Fatal accidents: punishment in 2021

Application to the traffic police

Today, drivers can receive most of the services provided by the traffic police electronically using the official website of the inspection. This approach was introduced to relieve specialists from automatic work and minimize queues.

Note

To obtain the necessary data, visit the State Traffic Inspectorate portal located at: https://tt.gibdd.ru

After visiting the site, follow these step-by-step instructions:

- first of all, find the section called “Services” (at the top of the screen);

- now point to the section and select “Check driver” in the window that appears, then left-click;

- fill in all the required fields (date, number, series, etc.) and confirm the operation;

- As soon as the program processes your request, all the necessary information about the driver, court decisions, date and place of issue of the license will appear on the screen.

It is worth noting that it is impossible to verify the data by providing other details. For example, information is not available by entering data from a paper or electronic PTS and last name, because such information is considered confidential and is protected by law.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

In addition, today it is possible to obtain the information in question by contacting the local traffic police department. To do this, it is necessary to draw up a corresponding application in writing, indicating in its content all information about the driver and data from his valid license. At the end of the application you must state a request for information.

The only disadvantage of this method of obtaining data, in addition to wasting time visiting the authority, is the review period, which is sometimes thirty calendar days!

Copies of all necessary papers and documents must be attached to the driver’s application, including a copy of the PTS (if it is in paper form), a copy of the driver’s license and a copy of the identity document.

Obtaining information from RSA

Another popular way to obtain information is to contact the Union of Auto Insurers or RSA. To do this, you should state your desire in writing in free form on a blank sheet of paper, attach copies of all the necessary documents (the contents of such a package of papers can be found on the website) and give it to the employee. In addition, in 2021 there is the possibility of receiving data by email.

As a rule, RSA specialists themselves find all the necessary information , and then send it to you.

ARTICLE RECOMMENDED FOR YOU:

How to challenge the towing of a car for illegal parking

It is worth noting that at the time of writing there is no possibility of obtaining information online on the RSA website. However, the technical department assured us that their programmers are working on adding this feature and it is quite possible that it has already appeared - be sure to check!

RSA recommendations for drivers

If a citizen’s total driving experience is more than three years, he should not look for an opportunity to obtain information about the date he received a driver’s license. That’s why RSA employees recommend first finding out whether this information is really necessary or whether the driver can enter an approximate date.

In addition, RSA recommends not to bother searching for reliable information, entering in the fields as the date the last day of December of the year when the driver received his first license . This way, the system will be able to correctly process the response, and the cost of the policy will not change.

The above method of entering information is considered the simplest and fully complies with the norms of existing legislation.

Why do you need a compulsory motor liability insurance policy?

Compulsory insurance is not a whim of officials, since thanks to it many debt obligations can be avoided in the event of an accident. Considering the congestion of city roads or highways, this precaution does not seem unnecessary at all. If an accident occurs due to the fault of the driver, then a timely issued policy will allow the insurer to compensate for losses incurred in repairing someone else’s car. In this case, the damage will be compensated not only to property, but also to the health status of the victims. Therefore, insurance is mandatory for motorists.

Driver's card

A personal card is given to the motorist. In it you can actually find information about the owner of the car, in particular about where and at what time the exams were taken, and also about the moment of receiving the driver’s license. This card is very useful if you have it on hand.

But the old plan papers were provided in paper form. For this reason, for drivers with very extensive driving experience, they are no longer usable or lost, because this card is not mandatory documentation.

Is the driver at risk of having his state license plate removed if he does not have compulsory motor insurance?

This year, traffic cops do not have the opportunity to remove registration plates. In this case, the car is not sent to the penalty area, but the driver will not be able to get out of the fine. In a very good situation, the inspector may limit himself to a verbal warning, but often an administrative penalty is imposed on the offender.

To avoid material expenses and not get into the most awkward situations, you should issue a policy in a timely manner. The amount of insurance payment has increased significantly this year, but it will be much better than regularly receiving fines for violating traffic rules. Each driver makes the decision to take out a policy independently, but it is always better to know about the consequences in advance.

Punishment for a fake policy

Due to the significant increase in the cost of insurance, many drivers resort to falsifying such a document. An offender caught doing this is unlikely to get away with a large monetary penalty. In this case, the violator may even face criminal prosecution. If forgery of documents is discovered during a stop by a traffic police inspector, the offender may be charged up to 80,000 rubles. If he caused an accident, the fine will become much more substantial. It amounts to up to 120,000 rubles or the driver faces imprisonment for up to 2 years.

Benefits of checking

Driving a vehicle without a permit is fraught with sanctions:

- Traveling without a license (provided that in principle you have one) – 500 rubles. Sometimes traffic police inspectors release violators simply with a warning.

- The driver is deprived of a driver's license and is driving a vehicle - 30 thousand rubles. A traffic inspector can detain a driver for 15 days.

- Admission to drive a vehicle for a driver who has been deprived of his license – 30 thousand rubles.

The service provided by the State Traffic Safety Inspectorate for checking rights against the database is a convenient tool for controlling driving license.

Why do we need information about the issuance of the first document?

Usually only the motorist who was able to obtain it for the first time can remember the date of issue of his first driving license. But he will have to display this information when applying for an insurance policy online. Data on obtaining a license influences the calculation of the total length of service of a motorist, and is an integral part in calculating the cost of an MTPL policy. Such data is not displayed directly on the form itself. Many drivers try to cheat the system by indicating an arbitrary number within the year of issue. This trick does not work, since the system very quickly recognizes the discrepancy between the entered data. This will not allow you to issue an insurance policy.

How to check a driver’s license for free using the traffic police database by last name

The traffic police database, which has been in public use for several years, provides a whole range of information about the status of rights and the presence of penalties. Using this service is easy. To obtain any information, you must know the document number and the date of its issue . When creating the service, it was planned to have such a function as an online service for checking a driver’s license in the traffic police database by last name and date of birth. But to date this function has not been implemented.

Check permissions

Moreover, developers and officials recognized that such driver verification would be a clear violation of confidentiality . In this regard, the further implementation of this option was abandoned. As a result, you can find out whether you have rights in the traffic police database only if you have the number of this document.

In most cases, this is sufficient, since such information is usually requested if:

- hiring for the position of driver is being considered;

- The issue of drawing up a European protocol at the scene of a traffic accident is being resolved.

In both cases, the driver does not refuse to provide his documents for verification.

If a conflict issue arises and it is necessary to find out information about the status of the driver’s license or the amount of his fines, but only his last name is known, then you will have to make a written request to the traffic police . Today, checking a driver's license in the traffic police database by last name is only possible using departmental data that is used by law enforcement officials and that is not available for general use. If in 2021 you are promised to identify the owner of the driver's license online by last name in the traffic police database, then you are most likely dealing with scammers . Although the possibility of a corruption component cannot be ruled out, in Moscow and other cities people with access to databases can check their driver’s licenses by last name. However, it is not recommended to use such services.