Inheritance legal relations: basic concepts

All officials and government agencies act on the basis of strict adherence to procedural and documentary regulations established by law. The executors are the notary, courts and registration authorities.

The only variable involved is the court, since dissatisfied people have to turn here only when controversial situations arise. Moreover, even agreements concluded in a voluntary format must be of an official nature, that is, be notarized. The listed standards relate to the period after the opening of the inheritance (the death of the testator).

Basic concepts of legal relations in the distribution of inheritance:

- The subject of legal relations (their essence and purpose).

- Object of legal relations (inherited mass).

- Subjects of legal relations: testator, heirs, as well as other additional persons included depending on the situation.

An important role in inheritance matters is played by the method of dividing the property and money of a deceased citizen. For this purpose, the regulatory framework or a will certified by a notary is also used. A declaration of will drawn up in an unofficial format is not subject to inclusion in a future inheritance case and is not the basis for legal relations.

The exception is wills that are not notarized, but have the same force as legal documents. This specific category includes orders issued in emergency circumstances (life threatening). In some cases, these documents may be certified by persons replacing the notary.

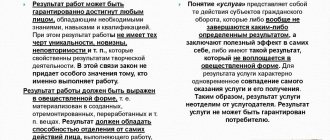

Subject of inheritance relations

In this case, what is meant is not the concept of real or other property, but the essence of legal relations. The subject matter of legal relations lies in the need to make a legal division of the inheritance of a deceased citizen, based on the will he left or the order of heirs represented by relatives.

Features of relationships

The interaction of all persons appearing in the inheritance division occurs within the legal framework. All notarial documents (be it the will itself or a decree on its cancellation, a certificate of inheritance, etc.) are issued on unified state-issued forms. Beneficiaries are forced to enter into legal relations.

Entering into an inheritance implies mandatory confirmation of your desire from a notary. The acquirers cannot simply appropriate the property of the deceased without legal grounds. Both acceptance and refusal of inheritance are confirmed by a corresponding statement. The legislation provides for the actual acceptance of the inheritance, but this will also require further proof in court.

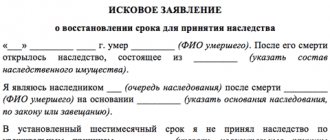

Contact with the courts also follows clear rules. Such legal relations between heirs and judicial authorities are subject to the Code of Civil Procedure of the Russian Federation. To form and file a claim against an inheritance applicant who is dissatisfied with some issue, he should be guided by Articles 131—.

Procedure for entering into inheritance

Now it is clear when inheritance legal relations arise. And their features are not a mystery either. How to enter into an inheritance?

The citizen will have to:

- Wait until the testator dies and the inheritance opens.

- Within six months, write a refusal or accept the inheritance. The corresponding document is drawn up by a notary.

- Wait for the distribution of property and register ownership rights through government agencies.

If there are no disagreements with other heirs, then receiving property by inheritance will not cause any problems.

Grounds for which inheritance legal relations arise

To establish an inheritance case and initiate legal relations between participants, several grounds are required. They all come sequentially. The testator can directly influence the nature of these legal relationships by drawing up a will and, perhaps, directing in it the creation of an estate or the appointment of an executor for the division.

Grounds and stages of entering into legal relations:

- Opening of inheritance (occurs automatically upon the established death of the testator).

- The emergence of the right of inheritance from testamentary or legal claimants.

- Confirmation of this right in an application format at an appointment with a notary.

The inheritance opens only after the death of the owner. Citizens turn to a notary to establish an inheritance case (the notary notifies some applicants himself). At the same time, it is revealed that those wishing to receive their share have a right to claim (if they are included in a will or division of inheritance by law). Then statements are written.

Features of receiving

Inheritance legal relations sometimes cause a lot of trouble. The point is that heirs can be private and singular. In the first case, a person receives full ownership of the property, in the second - partially.

The testator may impose certain obligations in favor of the remaining heirs. For example, provide permanent residence to some recipients of property in inherited housing or pay them monetary compensation in certain amounts. Usually these features are specified in the will. If they are not there, then the property is divided according to the law, taking into account the will of the deceased.

Subjects of inheritance relations

Here we mean all persons appearing in the inheritance case who enter into legal relations. This may be a narrow circle of citizens, consisting of the testator and heirs, or a more expanded one. Witnesses may be present when the will is certified, and the executor appointed by the will will facilitate the division of the inheritance.

Who can be the heir

The successors of a deceased citizen can be both individuals and legal entities. The specific circle is determined based on the presence of a will or without it (in the absence). In the second case, a legal division is connected, based on the order of heirs. Their sequential consideration as applicants is carried out on the basis of family ties with the deceased.

A will allows for the assignment of inheritance rights to any persons at the request of the testator. However, such freedom is limited by the needs of unprotected claimants to the inheritance: the dependents of the deceased are entitled to a mandatory allocation of a share in the inheritance.

Creating a fund after the death of the testator is important if he has a large business. The inheritance fund is called upon to continue conducting this business in the event that a person does not trust his immediate heirs. Thus, he also becomes involved in legal relations.

Despite the fact that it is the foundation that receives the inheritance certificate, it is not characterized as its direct recipient. The management positions of the new organization and the persons occupying them are defined, but they receive income from their direct official activities. The heirs in these circumstances are considered beneficiaries receiving dividends from the activities of the fund.

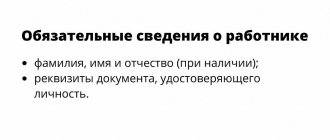

Requirements that a legal successor must meet

The successor must be given the right of inheritance by will or be in one of the inheritance lines by law. In the second case, seven lines are assumed. Closer to the beginning there are immediate relatives and spouses, and towards the end - distant relatives.

The candidate confirms his intentions regarding the inheritance in accordance with his guarantees by filling out an application. During the subsequent waiting period (six months from the opening of the inheritance), he is also obliged to perform a number of actions: assessing the property, paying a fee, obtaining a certificate. To successfully appropriate an inheritance, you must meet the status of a worthy heir.

The assignee is declared unworthy in a lawsuit on the initiative of an interested person (usually from among the other applicants). This is feasible under Article 1117 of the Civil Code. The reasons for awarding this status are evasion of obligations to the testator during his lifetime, depreciation of his last will or violation of the interests of the remaining heirs.

Testator: who could it be?

Any citizen over eighteen years of age has the right to act as a testator if he has registered property (movable and immovable) or monetary resources. There are no maximum age restrictions here.

Any deceased person will be called a testator, regardless of whether he wrote a will or not, as well as the presence or absence of heirs. In the latter case, his property will be recognized as escheat and transferred to the territorial or federal budget. This procedure also fits the definition of inheritance legal relations.

Requirements for the will-maker when writing a will

The main requirement regarding the identity of the testator is his mental and mental capacity, to confirm which the notary may request a medical certificate. Physical inability to express one's thoughts is not a limitation. In this case, a more complex procedure for certification of the will is arranged with the participation of third parties.

Procedurally, the testator is required to generate and submit to the notary’s office the required package of documents for certification. First of all, you need to verify your identity by presenting your passport. The list of other papers includes documents certifying ownership rights and copies of heirs’ passports.

Who or what cannot be included in the list of heirs

In fact, any inherited objects can be included in the text of the will. The notary is not obliged to check the validity of the documentation presented for them and their availability. However, when dividing the inheritance, only property registered in the name of the testator or money stored in his personal bank accounts will be involved.

In the absence of a will, the estate is distributed according to the fact of its discovery. Objects of ownership that were not registered in the name of the former user cannot be included in the inheritance estate. If there is registration, but the title documents for it have been lost, restoration will have to be done by the future owners.

There are no restrictions on the inclusion of heirs in the will. There is a recommendation regarding the inclusion of the mandatory dependency ratio. When dividing an inheritance by law, unscrupulous subjects of legal relations are excluded from inheritance in accordance with Art. 1117 Civil Code. There are no other restrictions identified here either.

About queues

Inheritance legal relations arising as a result of opening an inheritance without a will have many features. The point is that if there is no testamentary document, then citizens will receive property according to the law in order of priority. As we have already said, the closer the blood relationship, the greater the chances of receiving part of the property of the deceased.

First-degree heirs include spouses, children and parents. The second is grandchildren, grandmothers, brothers and sisters. Next come aunts and uncles, nephews, and so on. Usually things don’t go beyond the 3rd degree of priority.

Stepdaughters, stepsons, stepmothers, stepfathers are also subjects of inheritance legal relations, just like fathers-in-law. But they, as a rule, are at the very end of the line of heirs.

Property from the testator is distributed first of all among all applicants of the 1st stage of priority for waiting for property. If there are none, then 2nd, and so on.

Heirs further down the line can receive an inheritance when one of the closer applicants has renounced their right to register the testator's property as a property, and nothing more. That is why the main subjects of legal relations of the inheritance type are close relatives - children, parents, husbands, wives. And only occasionally - grandparents, brothers and sisters and grandchildren.

Objects of inheritance legal relations

Inheritance involves the transfer of the testator's property and money to his legal successors. Transferable positions act as objects of legal relations in inheritance cases. It is worth noting that according to the law, accepting an inheritance with conditions or in partial terms is impossible. A person either fully accepts the share assigned to him or refuses it (possibly to another heir).

Hereditary mass: what is it?

The object of legal relations is a single, inheritable position of a property or monetary nature, or an entire inheritance mass, implying a list of such positions. Sometimes the contents of an inheritance are very difficult to determine (especially without a will). In this case, it is necessary to establish the presence and location of objects of legal relations.

Identification of assets and property can be done independently by contacting the registration authorities (for example, Rosreestr when identifying real estate or the traffic police to search for information about the availability of a car, etc.). In addition, clients can contact a notary to organize his professional request to government agencies or, for example, to banking institutions.

Refusals and shares

You can inherit both shares and the entire property. When inheriting by law, property is divided in equal parts among all heirs of one or another order.

If inheritance occurs by will, then the relevant document must indicate to whom to bequeath what and in what parts. Is there no such record? In this situation, all property is divided in equal proportions among the recipients of the property.

It is impossible to refuse one part of the inheritance and accept another. A similar arrangement is possible if a citizen is simultaneously an heir by law and by will. In this situation, the recipient himself chooses how exactly to enter into the inheritance.